Why the Fed is Trapped in a Box?

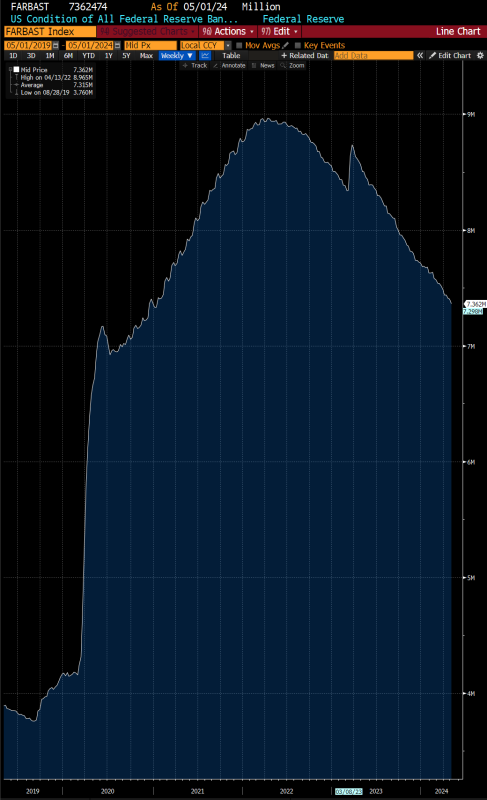

I think one of the major reasons why the Fed has found itself in a box here where both raising rates and cutting rates may make it more difficult to achieve their dual mandate is because of the way they have dealt with the reduction of their balance sheet via quantitative tightening.

The idea of a passive runoff of maturities in a slow, methodical, like watching paint dry passive way has kept too much liquidity in the system which has made it harder to achieve the last mile on inflation returning to 2%.

They would have been better off using the balance sheet more aggressively to tighten financial conditions at the beginning of the tightening cycle. The Fed was quick to add to the balance sheet, buying trillions of assets during QE period post Covid but has been slowplaying the “QT,” working down the balance sheet passively so as not to disrupt financial markets.

Source: Bloomberg

The Fed has elevated the primacy of their mandate to ensure smooth UST market functioning five times in the last 5 years (September 2019 repo crisis, March 2020, October 2022 (UK Gilt crisis), March 2023 (SVB bank run), October 2023 (term premiums / yields rising). That has kept too much liquidity in the system which has meant lower risk premiums, more muted term premiums, ignited animal spirits, and unanchored inflation expectations, all making it more difficult to slay inflation.

If the Fed would have engaged in actual QT and the selling of assets rather than just rolling off maturities, they would have been more successful in quickly returning inflation to 2% rather than looking to accomplish that feat in more than 5 years like the path we are on now. They should have actually done this more aggressive balance sheet reduction before they even started their rate hiking campaign as higher interest rates this cycle has only been even more stimulus because households and corporations locked in low borrowing costs during Covid while the US government has had to borrow more expensively. This has sent out interest rate “stimmys” to the wealth and powerful cashed up companies, keeping consumption and inflation more elevated than in prior tightening cycles.

The Fed would have been better off enacting “LIFO” monetary policy whereby you cuts rates to zero and then you do QE when things are bad and then when it’s time to exit, you do QT first and then you raise rates after in order to achieve your target. They completely screwed this up and are still screwing this up by announcing they are beginning to taper QT here again to make sure banks are going to not have a liquidity issue sometime in the future.

The Fed has been wrong every step of the way during the tightening cycle and will continue to be wrong and will likely not be able to create the conditions to bring inflation back down to 2% on a sustainable basis with these massive fiscal deficits at 6%+ of GDP and debt to GDP levels at greater than 120%. It seems like the US is just going to inflate the debts away and this is a policy that is being endorse at the highest levels of the Fed and Administration. The question is whether we do this slowly or rapidly. The jury is still out on whether Powell will be Burns or Volcker 2.0. Most signs suggest he is Burns.