Asymmetric Market Update™️ #31

Macro

The Cuban Missile Crisis lasted just thirteen days.

Thirteen days when the world genuinely teetered on the edge of nuclear war. Markets froze, leaders scrambled, and people braced for catastrophe. And then, almost as quickly as it began, the threat dissolved. Cooler heads prevailed. Life moved on, and the markets soon followed.

The first half of 2025 has packed what feels like an entire decade of geopolitical shocks, foreign policy events, market reversals, liquidity shifts, and asset class rotations into just six months. In Q1, it looked like the wheels were falling off. In Q2, the market shrugged, bought the dip, and ripped back to all-time highs.

Now, we’re left asking: did we live through a cycle that usually takes years?

“There are decades where nothing happens, and there are weeks where decades happen.”

– Vladimir Lenin

A relief rally has erased the panic of early Q2’s tariff-induced tantrum, pushing equity indices back to record highs as sidelined investors rush to re-enter the market. In fact, May 2025 was the S&P 500’s strongest May of this century, and June extended those gains – the S&P ground its way back to all-time highs by quarter-end. This marks a stunning 25%+ surge off the April lows, reversing the tariff-driven correction.

Market sentiment flipped from fear to optimism almost overnight: the CNN Fear & Greed index, which plunged into extreme fear in April, has rebounded into bullish territory (mid-60s out of 100, indicating “Greed”).

Volatility (VIX) also collapsed, which closed above 60 during the trade scare, and has fallen back to the mid-teens – a sign that investors see calmer waters ahead.

Several catalysts converged in June to fuel this face-ripping rally:

1) US-China Trade Truce

A tentative trade agreement restored a fragile peace in the tariff war, removing a major tail risk. Negotiators put “meat on the bones” of a deal that freezes U.S. tariffs at 55% on Chinese imports (China retains 10% on U.S. goods) – steep but far better than the feared escalation to triple-digit tariff rates. Crucially, China agreed to lift export restrictions on rare earth minerals and resume issuing Chinese student visas, addressing key pain points. This de-escalation, which occurred before the July 8th soft deadline, delivered exactly the “optical tariff relief” we anticipated, shifting the narrative from trade panic to progress.

2) Cooling Inflation & Steady Data

Price pressures have been less sticky than feared (as we expected)– inflation came in cooler than expected and remains moderate. Meanwhile, growth is holding up: the labor market remains solid, consumer spending is steady, albeit cooling, and corporate earnings have not slowed significantly. The Atlanta Fed’s GDPNow tracker even flipped from predicting a Q1 contraction to ~3% GDP growth for Q2, underscoring real momentum in the economy. In short, the hard data never confirmed the recessionary fears from earlier in the year, and now even soft data (surveys, sentiment) is finally catching up and improving.

3) Fiscal Stimulus Optimism

The Trump administration doubled down on its pro-growth agenda with the “One, Big, Beautiful Bill”, a massive $4.5 trillion tax and spending package. President Trump insists that “growth will offset deficits,” and markets are inclined to agree. The Senate moved forward on this fiscal plan heading into July, which investors interpreted as a fresh stimulus that could boost economic growth in the second half of 2025, boding well for risk assets. The mere prospect of large-scale tax cuts/infrastructure spending has been a bullish macro catalyst, lifting cyclicals and “reflation trade” assets. In tandem with the trade truce, this fiscal push signaled that policymakers are determined to extend the economic expansion, another clear positive for risk assets.

4) Offside Positioning & Inflows

Perhaps the biggest fuel for the rally has been the human and algorithmic scramble to catch up.

We entered May/June with many investors badly offside – hedge funds, CTAs, and pension funds had de-risked amid the Q1 turmoil, leaving plenty of dry powder on the sidelines. This topic was discussed in detail in our previous Market Updates.

As the news improved, those players rushed back in, creating a powerful flow of funds into equities. For example, trend-following CTAs had to cover shorts and flip long; they bought an estimated $103 billion of global equities in May alone, pushing their U.S. equity exposure from a net short position to $17.5 billion net long by early June. Hedge funds also ramped up exposure aggressively, especially in the beaten-down tech sector. This rapid accumulation of technology in a decade came as managers realized they were underexposed to the market’s leaders. At the same time, corporations continued to devour their own shares through record buybacks, adding a structural bid to the market.

And retail investors kept coming. The GameStop psyche lives on – the instinct to fade Wall Street’s fear, buy the dip, and keep pressing risk when the pros are offside. Once again, Main Street beat Wall Street to the punch.

In short, a wave of mechanical and discretionary inflows flooded into equities through late Q2, lifting prices.

5) Under-positioned “Pain Trade”

Ironically, the very skepticism that drove many investors to the sidelines is now making the rally more robust. Even after weeks of inflows, positioning remains relatively moderate. Hedge fund gross leverage is in the 99th percentile of history, but that’s mostly due to rising asset values, while true net exposure only just climbed back above 50% (about neutral).

As we discussed last month, many funds are still underweight the year’s big winners. Hedge fund exposure to the “Magnificent 7” mega-cap stocks continues to decline even as those stocks roar higher. This creates a two-sided dynamic: on the way up, the market leaders can continue to climb “under their own power” (since few investors are fully long, there’s little profit-taking); and eventually, the performance pain of missing out forces more funds to chase the rally and re-risk their portfolios. It’s a classic “hated” rally – disliked by many but all the more durable for it. As we noted last month, it’s hard to break something that no one’s leaning on. Indeed, that adage is playing out: despite stretched valuations (P/E is a meme) and improved sentiment, the market’s resilience has been impressive because so few were fully invested. Every minor dip finds sidelined buyers who feel compelled to put cash to work.

The Israel-Iran Oil Shock: A Blip, Not a Regime Shift

In early June, markets briefly panicked as conflict between Israel and Iran escalated. Oil prices spiked. Inflation fears resurfaced. But the whole thing unwound just as quickly. Regarding oil prices, zoom out…

The oil rally was a short squeeze, not a structural move. The market realized there were no material supply disruptions, and oil retraced. Inflation expectations barely budged. This was a headline-driven dislocation (sound familiar?), not the beginning of a new inflationary spiral.

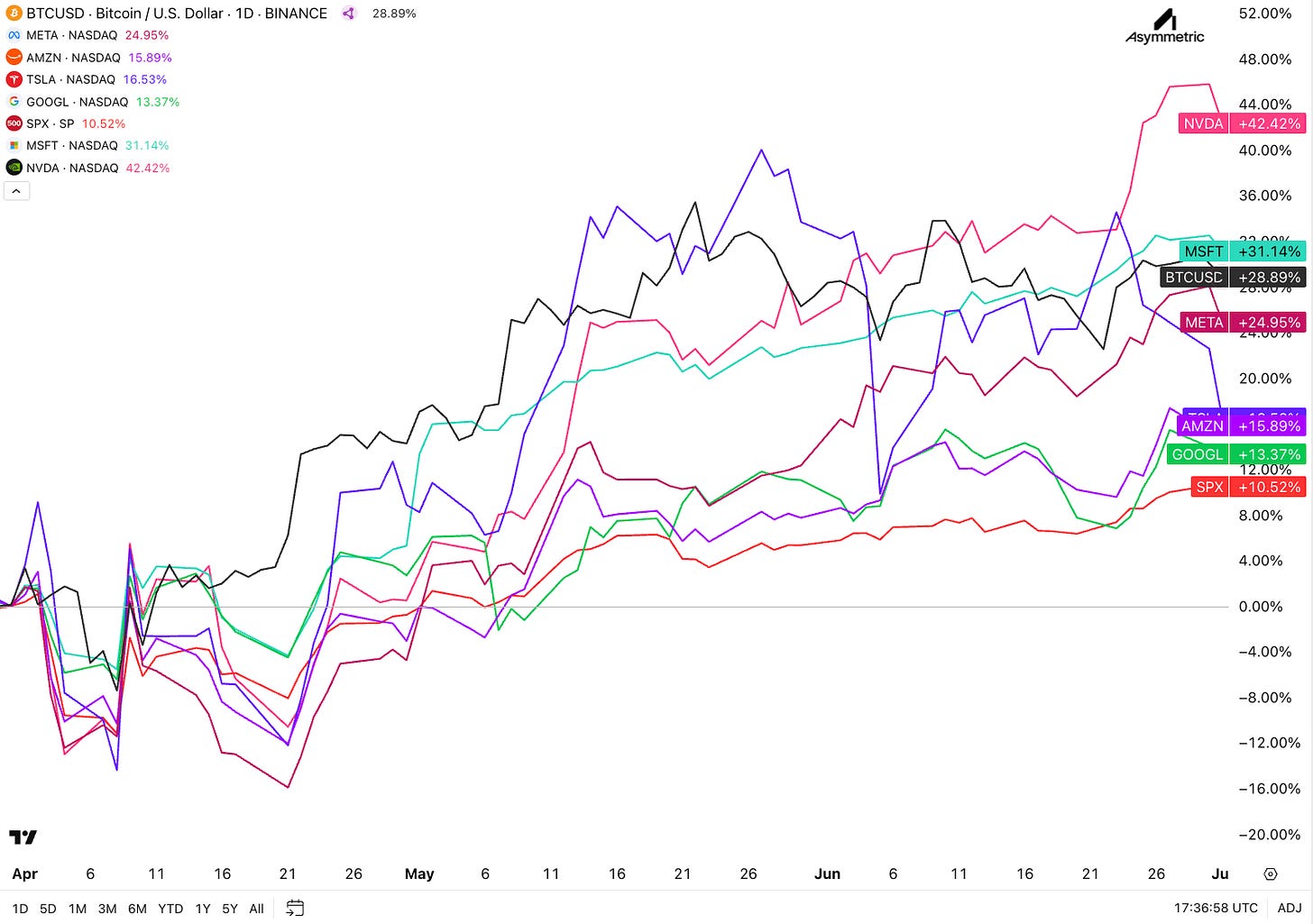

All told the second quarter of 2025 has been a historic reversal of fortune from the chaos of Q1. The S&P 500 is up roughly 10% for the quarter (wiping out Q1’s losses and then some), and the Nasdaq is up even more as growth stocks and Bitcoin rebounded sharply.

Importantly, this surge has been broad-based, extending beyond just Big Tech. Although tech and growth led the charge (aided by AI hype and still-strong earnings), we also saw a recovery in cyclicals, small caps, and crypto (more on that below). Consumer sentiment has begun to recover from deep pessimism, and fund managers’ cash levels are decreasing as FOMO sets in. Market sentiment has shifted from doom to boom.

That said, after such a rapid run-up, some near-term turbulence is to be expected. By late June, we observed some profit-taking and hedging ahead of the quarter-end. In particular, pension funds rebalanced their booming equity portfolios – Goldman estimated that approximately $28 billion of U.S. equities were set to be sold for the June quarter-end rebalance (in the 90th percentile of quarterly flows).

This forced selling hit the market in the final days of June (one reason we had a few soft sessions mid-week). However, that flow is now behind us. With the calendar turning, pensions and other rebalancers have completed their mechanical selling, removing a temporary overhang. We expect buyback activity and active investor buying to resume dominance heading into July as trade deals get finalized.

Looking forward, many want this to be a bull trap. After a 20%+ index gain in just 2–3 months, a breather would be both natural and healthy. Evercore ISI noted that after explosive “earnings season rallies” like those seen in Q1, the following month typically experiences choppy consolidation and a ~19% average spike in the VIX as volatility normalizes.

Stretched sentiment is another caution flag: the AAII bull-bear survey has flipped to its most bullish bias in over a year, and the Fear/Greed index, at around 65, is well off the extreme fear lows (though not yet euphoric).

Valuations, too, are becoming harder to ignore, with the S&P now back near ~20× forward earnings and the Magnificent 7 trading at hefty premiums after their rebound.

In short, the easy money from the April panic lows has been made.

Purely on a risk/reward basis, the entry point today is less attractive than it was earlier this year.

However, none of these factors imply a major top; they merely indicate the likelihood of normal volatility returning. Crucially, the bull case remains supported by positioning and policy. We expect to see a high above 6900 for the S&P 500, with Bitcoin moving towards $150k before year-end.

As described, investors are not maxed out long – far from it – and any positive surprises could force another round of catch-up buying. We still see underweight exposure across equities and crypto that needs to be rebalanced.

Additionally, corporate buybacks (while temporarily in blackout for earnings season) will resume and continue providing a bid.

And policymakers, both fiscal and monetary, are now tilting dovish (or at least less hawkish), which creates a favorable backdrop (see below).

The bottom line: this rally still has legs, albeit with more volatility and “two-way” action than the straight-up trajectory of the past month.

Policy & Rates: Fed Patience, Liquidity on the Rise

Markets have a short memory. For many, the Cuban Missile Crisis was quickly forgotten about. The same will happen with tariffs as they fade away from the front page.

If the first half of 2025 was all about trade policy dominating headlines, the back half of the year may be driven by monetary policy. So, where does the Federal Reserve stand after this tumultuous quarter?

In short, caught between improving economic data and uncertain inflation risks from tariffs, which we do not think is doubtful, as the “direction of travel is clear.” Lower.

The Fed held a key meeting in mid-June and, as expected, chose to keep the policy rate unchanged at 4.25–4.50%. Fed Chair Jerome Powell has adopted a cautious stance: with growth still okay and inflation not far from the target, the Fed doesn’t see an urgent need to cut rates yet. Powell testified to Congress that he was in “no rush” to ease policy while the fallout from the trade dispute was still unfolding.

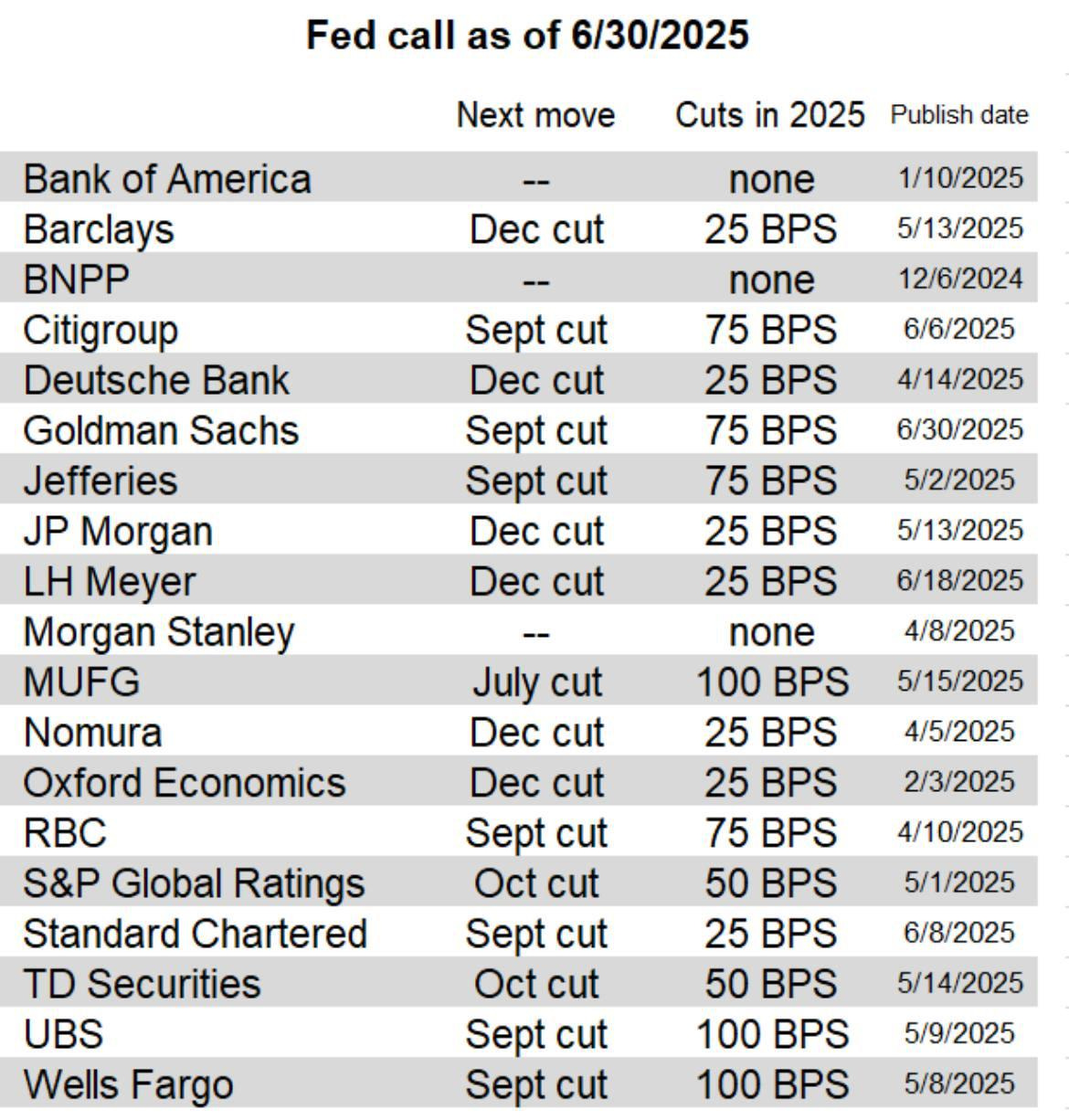

Importantly, the Fed is closely monitoring tariffs. Powell noted that the new tariffs could boost inflation over the summer as import prices adjust. If that happens, it might delay rate cuts; however, this is not our base case, as we still believe cuts are forthcoming this summer…as do most of the banks.

Powell explicitly stated that he would not endorse a cut as soon as the July FOMC meeting – essentially pushing back against market doves – and would rather wait to see if tariff-related price increases actually materialize in the June/July data. We believe there are higher-than-market expectations for a rate cut in July.

From the Fed’s perspective, any inflation bump might be “short-lived,” but they need a few more months of clarity. The message from the Fed is simple: policy is on hold for now, but the Fed is not unwilling to cut later this year if conditions warrant.

The market has adjusted to this guidance. Whereas a month or two ago, futures were pricing in as many as four rate cuts in 2025 (a reflection of the Q1 growth scare), investors have pared back those bets. Currently, the consensus expects two quarter-point cuts by year-end (likely starting in September or Q4).

In effect, the Fed and the market are converging: some modest easing is expected later in 2025, but no sudden slashing of rates unless the economy turns sharply downward or the financial system shows signs of stress. This relatively slower trajectory of rate cuts has nudged bond yields up from their spring lows – the 10-year Treasury yield is back around 4.25% after dipping under 4% during the worst of the tariff panic. The yield curve remains inverted (short rates at ~4.36% vs. 10-year rates at 4.34%), but slightly less so than it was a few months ago.

It’s a sign that recession odds, as implied by bonds, have decreased somewhat now that a trade meltdown seems off the table.

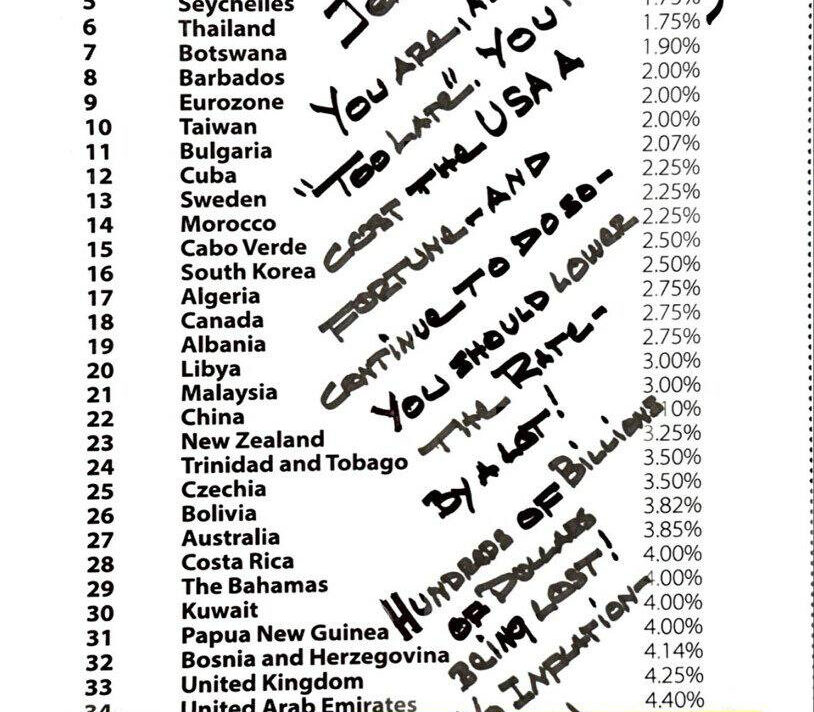

Despite Powell’s cautious tone, it’s worth noting that pressure on the Fed to ease is building. President Trump has been publicly browbeating the Fed to cut rates much faster. He argues (on Truth Social and in press remarks) that with other central banks easing, the Fed is holding U.S. growth back – going so far as to say rates should be “2–3 percentage points lower” and personally insulting Powell as “very dumb” and “hardheaded” for not cutting.

While the Fed insists it doesn’t answer to politics, the reality is that they likely won’t want to over-tighten.

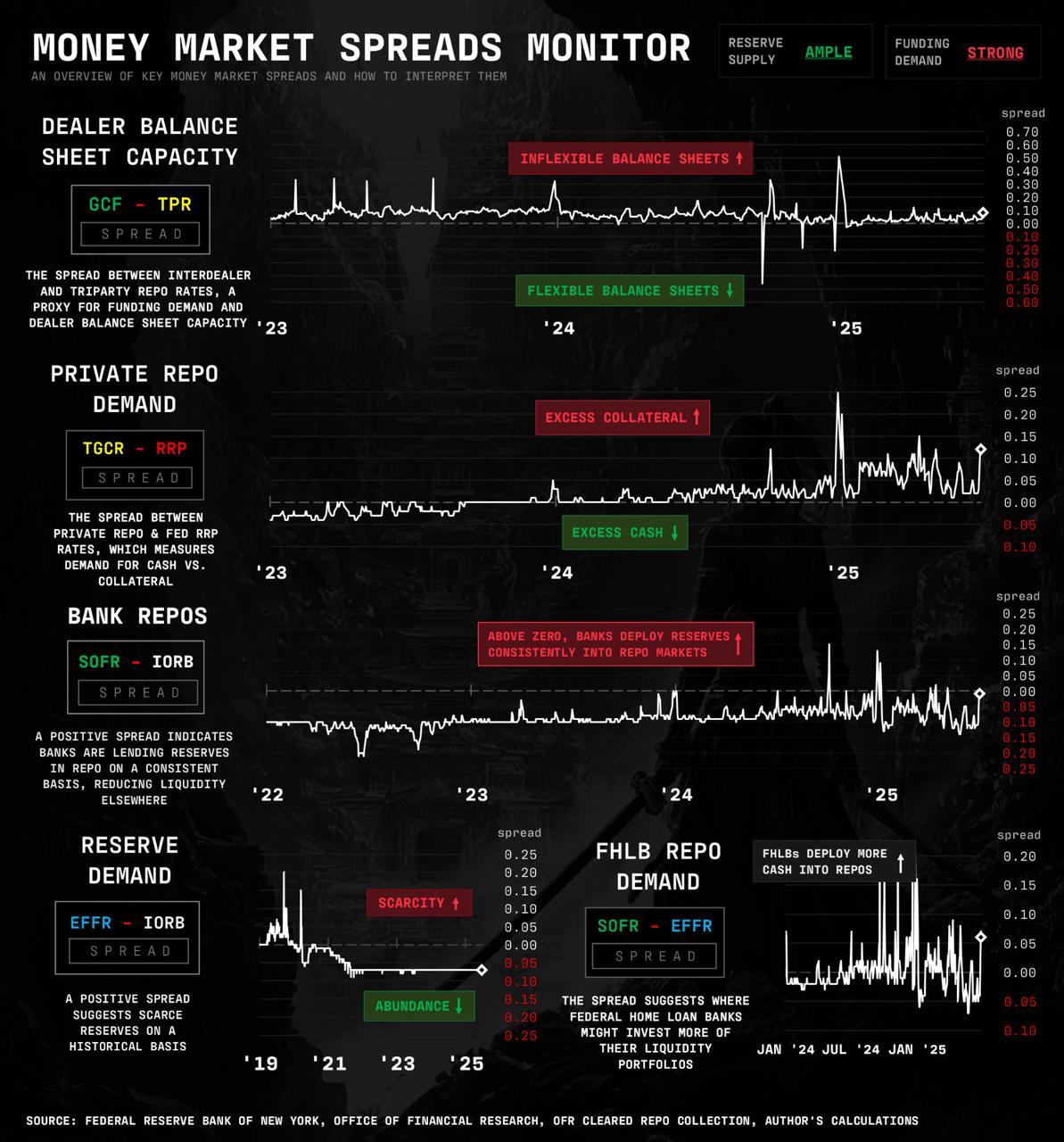

It’s telling that the Fed has already shifted its stance on liquidity. As we discussed previously, the Fed is ending quantitative tightening (QT) earlier than initially planned and has even hinted at backdoor ways to inject liquidity if needed (non-QE-QE).

Moreover, banking regulators have eased certain rules (for example, adjusting bank capital ratios and leverage requirements) to encourage lending. These steps amount to a subtle re-loosening of financial conditions after two years of tightening.

Behind the scenes, money markets are quietly loosening. Dealer balance sheets are flexible, banks are lending reserves into repo markets, and Federal Home Loan Banks (FHLBs), the government-sponsored entities that serve as critical short-term lenders to the banking system, are deploying more cash into repos. Liquidity is sneaking back in.

This chart tracks key money market spreads and liquidity flows. The signal is clear: the system is shifting from tight to loose. The reserve supply remains ample, funding demand is rising, and cash is being increasingly deployed, creating a perfect backdrop for stealth QE.

In practical terms, liquidity is making a comeback. Money supply contraction has stabilized, and bank lending, which wobbled during the spring uncertainty, is firming again now that credit fears have subsided. Real interest rates (inflation-adjusted yields) remain somewhat restrictive, but are likely to have peaked. If inflation stays mild and nominal yields hover in this range, real rates will gradually decline. And if the Fed does begin cutting by fall, which is our base case, we could see a meaningful decline in short-term rates by year-end. The Fed’s forecasts (the “dot plot”) now project about 50 bps of cuts by December, which would bring the Fed funds rate closer to ~3.75–4.0%.

This has two important implications:

Risk assets can breathe easier. A Fed on hold (and soon to ease) reduces the pressure on discount rates for equities. It also lowers the odds of a policy mistake-induced recession, which we see as a greater risk, and this is why we believe the Fed should cut in July. The fact that financial conditions have eased in recent weeks (helped by a weaker dollar and tightening credit spreads) is reflected in the rally we’ve seen. As one example, high-yield credit spreads narrowed back toward pre-tariff levels, and equity valuations expanded as investors grew confident the Fed “has their back” again.

The U.S. dollar and rates may become less dominant market drivers. With the Fed on pause/cutting (soon) and growth improving, the dollar index has softened (down from its highs), and capital is flowing out of safe havens into riskier bets. Emerging market equities and currencies have perked up alongside crypto, indicating a broader risk-on rotation as the specter of ever-tightening policy fades.

Of course, we’re not in full-blown stimulus mode, at least not yet.

In the U.S., pairing monetary easing with the aforementioned fiscal expansion (if Trump’s mega tax bill passes) would be a recipe for higher growth and higher deficits.

That raises longer-term questions (e.g., upward pressure on long-term yields, debt sustainability), but in the near term, it likely means even more liquidity sloshing around. The Treasury will issue more debt to fund spending, and the Fed may indirectly accommodate this. Indeed, some investors (like Arthur Hayes) speculate that the Fed could even resume outright QE if needed to absorb new Treasury supply, especially if foreign buyers balk at financing Trump’s widening deficits.

The dreaded “double tightening” (both fiscal and monetary tightening) has flipped to a “double easing” outlook for late 2025. Trade uncertainty is fading, the White House is priming the fiscal pumps, and the Fed is leaning dovish again. This sea change in policy stance is a big reason we remain constructive on risk assets, even after the big rally. Liquidity is the lifeblood of markets, and it’s starting to flow more freely. We are mindful of inflation and yield risks (we’ll be watching oil prices, wage data, etc.), but for now, the policy mix is favoring investors.

As the saying goes, “Don’t fight the Fed,” – and the Fed is no longer fighting us.

If the first half taught us anything, markets can compress decades into weeks. Sometimes, like in the Cuban Missile Crisis, what feels like the end of the world is just a moment. Panic can be brief. Resolutions can arrive faster than we’re prepared to believe.

Crypto

The Crypto Rally Few Are Actually Enjoying

The biggest rallies are always the loneliest. And this one belongs to Bitcoin.

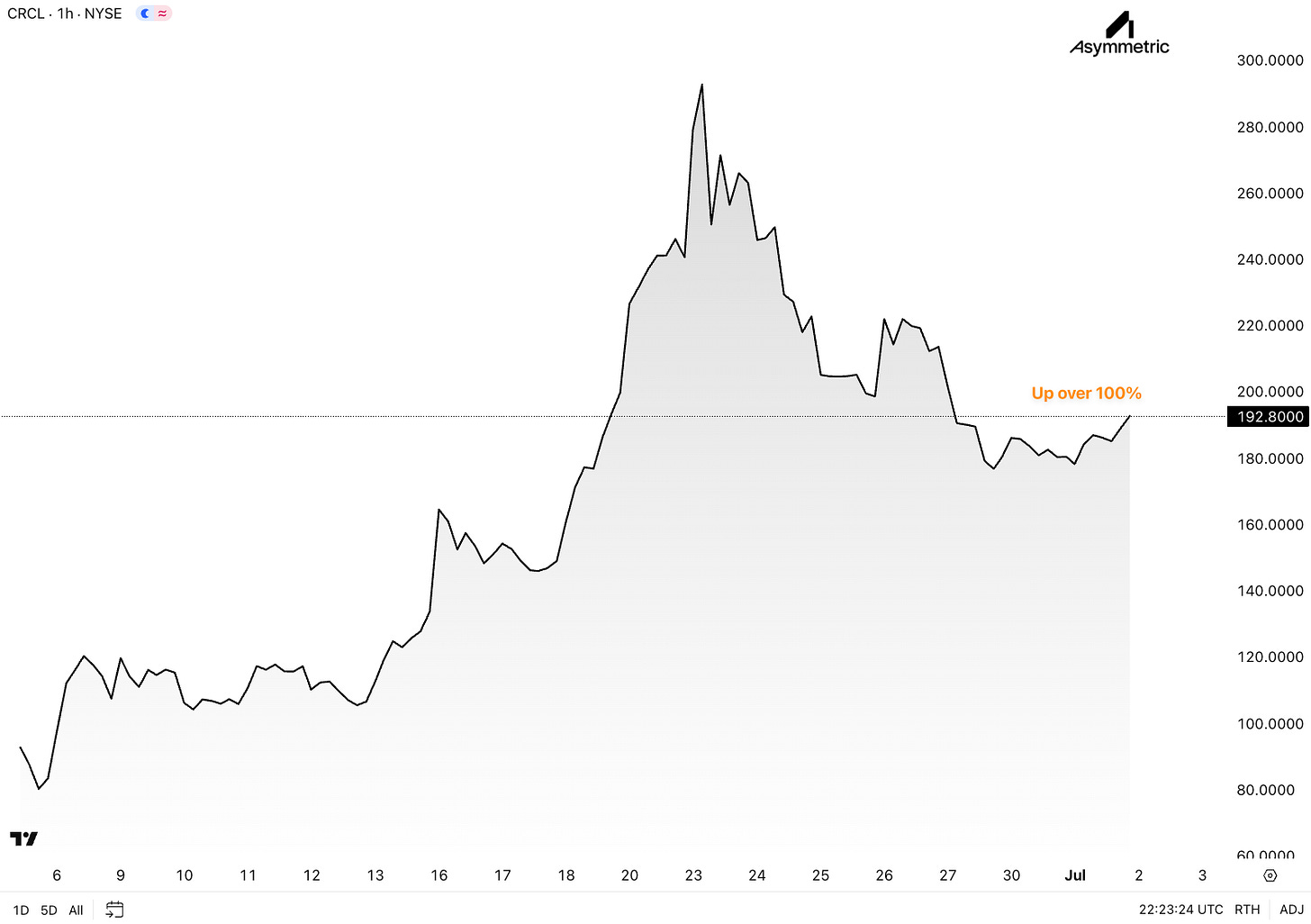

Bitcoin’s surge back above $108,000, paired with Circle IPO, has reignited Wall Street and Silicon Valley’s interest in crypto.

What’s the killer app of crypto? Stablecoins. And now, thanks to regulatory clarity and the success of the Circle IPO, stablecoins have experienced significant growth, drawing institutional capital deeper into the crypto ecosystem. Circle’s IPO green-lighted Multi-Family Offices, Endowments, and Pensions for more crypto exposure, validated the thesis that real businesses with crypto-native rails can scale, exit, and provide traditional M&A and IPO pathways that don’t rely on token launches.

It signaled to Wall Street and Silicon Valley alike: this space is investable again. And just like that, the same people who said crypto was dead are now back at the cap table.

But this isn’t the broad-based crypto rally of prior cycles. It’s concentrated.

There’s nothing worse than watching a rally you don’t participate in. That’s what this crypto market feels like right now. Bitcoin’s ripping, but most people aren’t enjoying it.

Diversification = Diworsification

With Bitcoin cruising past $ 100,000, most investors expected altcoins to explode and their favorite memecoins from 2023 to 100x.

What did they get instead? Down another 50%-75%.

Only a handful of assets are moving in tandem with Bitcoin.

BTC’s dominance is surging, now above 65%, a level we haven’t seen since 2021.

The price is now within striking distance of its all-time highs, up ~50% from Q2 lows. Meanwhile, most major altcoins, such as Ethereum and Solana, remain 40–60% below their peaks.

The Altcoin Season Index has been stuck in the low-20s for months, firmly in “Bitcoin Season” territory. Historically, anything under 25 means very few altcoins are outperforming Bitcoin.

That’s exactly what we’re seeing: capital is concentrating on BTC (and, to a far lesser extent, a few blue-chip alts with strong narrative tailwinds like $HYPE) while everything else drifts.

Diversification has diluted returns in this cycle. Concentration has compounded them.

This level of outperformance by a few assets is nothing new.

We’ve seen this movie before.

Remember FAANG? Facebook (now Meta), Amazon, Apple, Netflix, and Google (now Alphabet). They dominated equity returns from 2013 to 2021.

Or how about the “Magnificent 7” — the small chip company led by Jensen Huang, Nvidia, plus Apple, Microsoft, Alphabet, Amazon, Meta, and Tesla?

The outperformance was so extreme that allocators fired their active managers. Why pay for stock pickers when seven names are doing all the work?

Now, look at crypto.

What’s the point of a liquid crypto hedge fund? To beat the market.

What’s the benchmark? Bitcoin.

So what do hedge funds need to do to keep LPs happy? Outperform Bitcoin.

Unless a crypto hedge fund has been mostly long on spot BTC and HYPE, it has probably underperformed year-to-date.

That makes for some not-so-fun LP calls. Why pay for stock pickers when a few publicly traded, easy-to-buy names are doing all the work?

So, why has Bitcoin been attracting the bulk of flows?

Several factors are driving this “flight to quality” – where investors are piling into Bitcoin (and, to a lesser extent, a few other large caps) while leaving the rest of the crypto market behind:

1) The long-awaited wave of institutional money is finally materializing, and it’s overwhelmingly focused on Bitcoin.

Crypto investment funds have now logged 11 consecutive weeks of net inflows, totaling approximately $16.9 billion since mid-April.

Notably, Bitcoin accounted for roughly 83% of those inflows, whereas most smaller altcoin-focused funds experienced either trivial inflows or outflows.

Okay, so Bitcoin flows are crushing L1 governance tokens. But what about physical gold? Digital gold’s big brother is always part of the conversation, right?

Over a recent five-week span, U.S. Bitcoin ETFs attracted more than $9 billion of new capital, while gold-backed ETFs saw $2.8 billion of outflows in the same period.

Probably nothing.

Additionally, the major ETF issuers are actively promoting the BTC ETFs. Can we blame them? Absolutely not. It is an incredible business for them.

One of the most noteworthy, and perhaps the most discussed, aspects of ETFs is that most of these buyers are long-term investors. Think asset managers, hedge funds, endowments, pensions, etc.

While the media have emphasized this, and we tend to be contrarian, we do agree that these flows are stickier.

After the Circle IPO (an Asymmetric investment), we were receiving texts and calls from money managers in traditional finance (tradFi) asking about how to gain exposure for themselves and their clients.

The same ones who said crypto was a scam six months ago now want a 5-10% allocation.

2) The macroeconomic backdrop has been tailor-made for Bitcoin’s narrative.

Trump’s aggressive deficit spending, fiscal expansion, and tolerance for higher inflation are the perfect macro setup for Bitcoin.

Bitcoin is the bid in the reflation trade. The bid that doesn’t close at 4 p.m.

The U.S. dollar has weakened. The Fed is on pause. Liquidity is coming back.

When inflation runs hot, and policymakers don’t care, investors need hard assets.

Bitcoin has finally earned that seat next to gold.

3) Bitcoin has been de-risked.

Bitcoin has won the regulatory game.

The SEC has greenlit Bitcoin ETFs. U.S. banks can custody crypto.

Bitcoin is generally classified as a commodity, rather than a security.

And the stablecoin market? Thanks to bipartisan bills like the STABLE Act and the GENIUS Act, it finally has real rules.

This has unlocked massive institutional flows. Funds that were previously sidelined due to compliance risk are now buying size.

Meanwhile, most altcoins remain in a regulatory gray zone, with some being borderline unregistered securities, and nobody wants to be caught holding the “governance token” bag.

Flows confirm the bifurcation:

Year-to-date, Bitcoin fund inflows have dwarfed all other assets. Ethereum’s inflows are a fraction. Solana? Barely a blip. However, Solana is likely to see more interest now with ETFs going live and more treasury companies coming online.

“When in doubt, buy Bitcoin” has been the mantra.

All in all, this has led to outsized outperformance by Bitcoin, which we expect to continue as Bitcoin dominance continues to climb towards 70%.

Concentrate to Compound

As investors, the market is always right, and we must heed what it is telling us.

In 2023 and 2024, the market was telling us that it didn’t want any more crypto venture investments, as seen by the struggles in raising capital from existing LPs.

Now, the market is telling us that it wants liquid exposure but wants to be concentrated in Bitcoin, Circle, Hyperliquid, Solana, and maybe a few others. Consider the Bitcoin treasury companies. They are being launched at a pace that feels like every other day.

The combination of Bitcoin (the asset) and Solana (the infrastructure) as a “barbell” investment pair will likely remain effective in the long term. But moving forward, the weight is shifting. The anchor is heavier towards Bitcoin.

VC

Building Bridges to the Real World

The crypto VC landscape churns with a quiet intensity, funneling capital into innovations that aim to tether blockchain technology to tangible, real-world outcomes. Gone are the days of unchecked speculation; today’s VCs are investing in tokenized real-world assets, yield-generating DeFi infrastructure, and cross-chain connectivity solutions, signaling a sector that has matured in both ambition and discipline. Amid macroeconomic headwinds and evolving regulatory frameworks, these themes reflect a market focused on functionality, interoperability, and measurable impact.

Tokenizing the Tangible

Tokenized RWAs—including U.S. Treasuries, real estate, and corporate credit—are increasingly favored by VCs seeking to bring traditional finance into the crypto fold. As of June 2025, the RWA market is valued at $24 billion, representing a 380% increase from three years ago. Treasury-backed tokens account for $6.9 billion of that, with Ondo Finance leading the charge through its $1.1 billion in tokenized U.S. Treasuries and partnerships with BlackRock’s BUIDL.

Standard Chartered projects that tokenized assets could reach $30 trillion by 2034. Just this past week, Robinhood’s CEO announced its intent to get into the RWA scene – quite heavily, too. While regulatory fragmentation and valuation uncertainty remain obstacles, the sector’s momentum is unmistakable. This marks a clear departure from the speculative cycles of 2021–2022, where hype often outpaced utility.

DeFi’s Next Chapter

DeFi remains a magnet for VC activity, with $4.9 billion in crypto venture deals in Q1 2025. This includes major investments in platforms focused on liquidity solutions and sustainable yield. EigenLayer, which raised $70 million in June, exemplifies the growing demand for restaking protocols. Platforms like Hyperliquid and Aerodrome are also gaining traction as decentralized alternatives to centralized exchanges.

Still, challenges persist. Despite lofty valuations, most leading DeFi protocols generate less than $1 million in monthly recurring revenue, raising long-term sustainability concerns.

Cross-Chain Connectivity: Linking Liquidity

Fragmented liquidity remains one of the most significant friction points in crypto. VCs have responded by doubling down on cross-chain infrastructure, with projects like LayerZero and Axelar drawing significant capital.

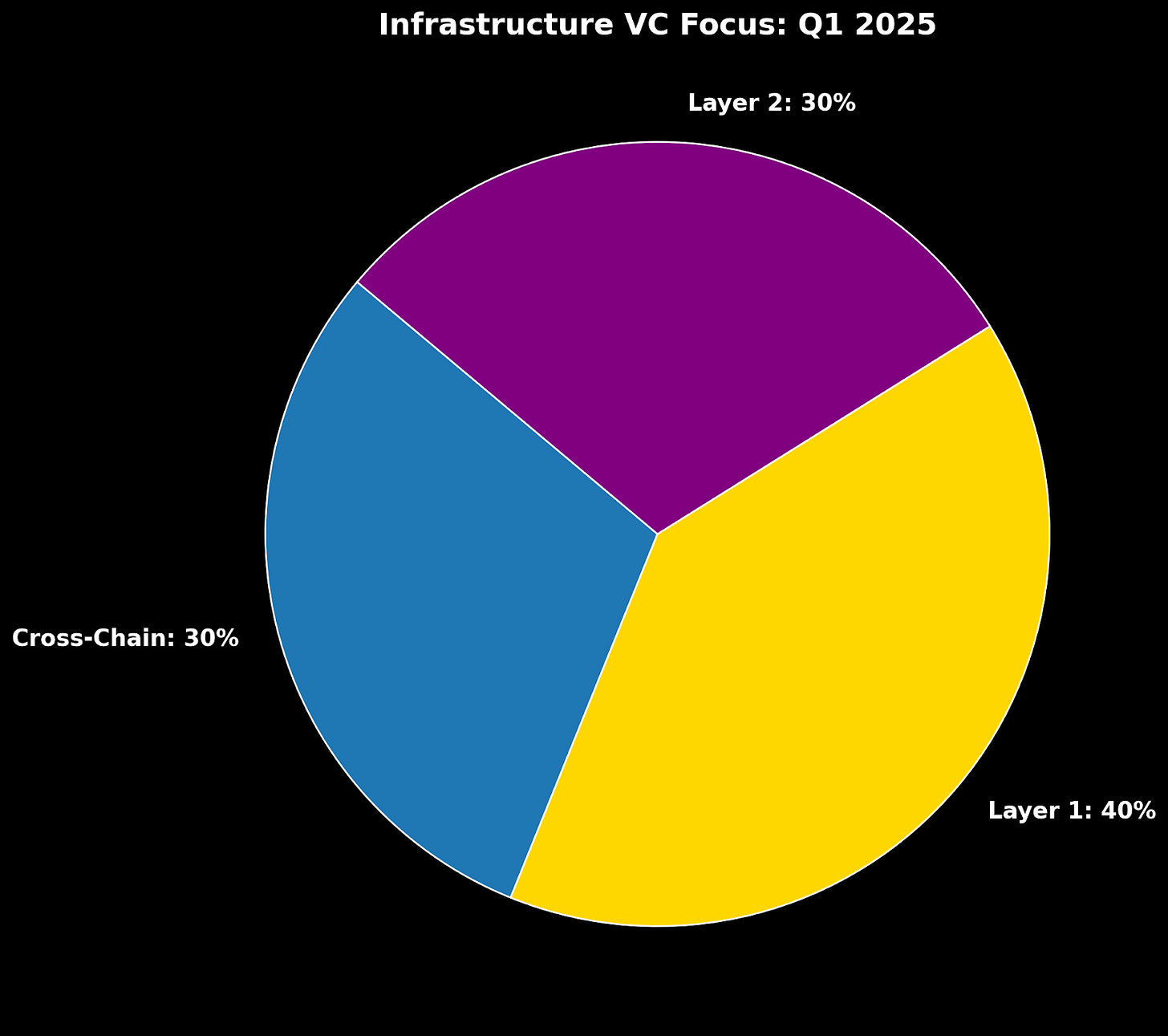

In Q1 2025, approximately 30% of infrastructure-focused VC funding targeted cross-chain startups. Yet, risks remain: more than $2 billion has been lost to bridge exploits since 2020, including the infamous Ronin hack. As with previous waves of interoperability efforts, security and trust are foundational.

Macro Headwinds and Market Discipline

Wider macro conditions are applying new pressure. U.S. GDP contracted by 0.3% in Q1 2025, the first decline in over two years. Still, the Atlanta Fed’s GDPNow model forecasts a 3.4% rebound in Q2. This tightening environment has increased scrutiny on early-stage ventures, demanding clearer product-market fit and real-world traction.

From Hype to Utility

In mid-2025, crypto VC appears driven by pragmatism. With $4.9 billion deployed in Q1, capital continues to flow—but only toward ideas grounded in utility, security, and scalability. Tokenization, restaking, and interoperability are no longer speculative trends; they are now established realities. They are the foundation of a more disciplined and interconnected ecosystem.

If the current trajectory holds, crypto will look less like an experiment in permissionless finance and more like a core pillar of global financial infrastructure.

Bitcoin DeFi

The Evolving Bitcoin DeFi Ecosystem

We’re starting to see eggs hatch in the Bitcoin ecosystem. After nearly two years of heavy capital deployment into foundational infrastructure — including scaling solutions, staking mechanisms, interoperability layers, and wallets — that groundwork is beginning to pay off. The once-quiet build phase is giving way to visible traction, with mainnet launches, cross-chain integrations, and centralized exchange support accelerating the shift toward a more robust Bitcoin-native DeFi stack.

Recent developments:

-

Botanix Launches Mainnet: Asymmetric Portfolio company Botanix, a Bitcoin L2 goes live with a 16-node federation, promising five-second block times, low fees and Bitcoin-native DeFi. Link

-

Xverse (Leading Bitcoin Wallet) Goes Live on Starknet: BTCfi on Starknet is enabled through bridges for native Bitcoin assets and a unified user experience within the same mobile UI. Link

-

Zeus Network Launches btcSOL: The launch enables Solana stakers to receive zBTC (a Bitcoin wrapper on Solana) instead of the typical SOL rewards they would receive. Link

-

Citrea Solves ZK Proof within one Bitcoin Block: Citrea’s latest breakthrough enables ZK proof verification within a single Bitcoin block, advancing the path to ZK rollups on Bitcoin. Link

-

Wallet of Satoshi Launches on Sparks: Enabling Bitcoin PayFi using Sparks with self-custody. Link

Bitcoin L2s

Bitcoin L2s are moving from theory to production. What began as exploratory research and testnets is now evolving into live, permissionless infrastructure. With Botanix launching its mainnet on June 30, we’re marking a major milestone in the maturation of Bitcoin’s L2 and DeFi ecosystem.

At the core of Botanix is the Spiderchain — a delegated proof-of-stake system built entirely on Bitcoin multisig. Validators stake BTC into on-chain multisig wallets that rotate based on stake weight and block proposals. These validators produce EVM-compatible blocks and relay commitments to the Bitcoin chain, enabling optimistic finality and cryptoeconomic security rooted in Bitcoin itself. The validator set is open and permissionless, and the use of native Bitcoin scripts (not wrapped tokens or alternate consensus) ensures the system can function trustlessly. This model resembles the rollup security approach pioneered in Ethereum — but rebuilt for Bitcoin, with a Bitcoin-first ethos.

Botanix’s mainnet now supports validator onboarding, BTC staking, and bridging. The team is focused on expanding ecosystem infrastructure, from explorers and wallets to DeFi primitives and dev tooling. Early integrations and grants are already underway, and the first native dApps are expected to launch in the coming weeks. As the Spiderchain grows, it can scale to support an increasingly complex onchain economy — without needing wrapped assets or third-party bridges. We’re excited to see Botanix evolve into a foundational piece of the Bitcoin DeFi stack, offering builders a credible alternative to Ethereum or Cosmos while keeping Bitcoin at the center of the trust model.

Asymmetric is proud to announce our investment in Botanix. We’re excited to support the growth of their expansive ecosystem and see Bitcoin gain strong economic incentives and yield generation as a natural byproduct of this activity.

Source: Botanix

Metaprotocols

Last month’s newsletter highlighted Alkanes, which we view as one of the most interesting metaprotocols emerging on Bitcoin today. It enables programmatic fungible tokens through indexer logic, offering a more expressive and modular framework compared to earlier standards like BRC-20 or Runes. We’re closely tracking the progress from the creators and paying attention to developer velocity around the protocol. While activity appears to have cooled slightly since its initial launch, we are “monitoring the situation”. We are curious to see how new and existing teams will experiment with and build on top of this evolving primitive.

Source: Dune

And with that… I think it’s worth reflecting on just how far we’ve come. Just as we’ve watched Bitcoin’s application layer come alive through Ordinals, BRC-20, Runes, and now Alkanes, it’s worth remembering that Ethereum went through a similar evolution. In the early days of Ethereum, there were no standards—just raw smart contracts with isolated logic. Tokens existed, but they weren’t interoperable. Every dApp had its own way of tracking balances, transfers, and permissions. It wasn’t until the introduction of ERC-20 that a common standard emerged, giving rise to the ICO boom and enabling DeFi to exist through shared assumptions about how tokens behave.

Then came ERC-721, which did for NFTs what ERC-20 did for tokens. Before ERC-721, NFTs existed in concept — like CryptoPunks — but lacked a standardized interface. You couldn’t move them between marketplaces, wallets didn’t know how to display them, and developers had to reinvent the wheel every time they wanted to build with them. Once the standard was adopted, an entire universe of NFT infrastructure, marketplaces, games, and tooling was unlocked. The protocol became legible — interpretable not just by indexers and dApps, but by the entire ecosystem.

This history reminds us that it wasn’t raw programmability alone that made Ethereum thrive — it was the creation of metaprotocols, shared languages, and standards that allowed network effects to compound. Bitcoin is now entering that same phase, with its own metaprotocols bringing structure, legibility, and composability to an ecosystem that was once considered too rigid for such experimentation. Just as ERC-20 and ERC-721 breathed life into Ethereum, protocols like Runes and Alkanes are beginning to do the same for Bitcoin. Things could get very exciting here extremely quickly.

Bitcoin Staking

A key theme for June has been the resilience of Babylon’s staking ecosystem in the face of compressing yields. The current APY on Babylon sits around 0.39%, reflecting a natural decline as early high-yield incentives taper. Yet, what’s notable is that Babylon has not seen a significant drop in total value locked (TVL). This suggests that participants are beginning to see Bitcoin restaking not just as a yield play, but as a core primitive for new financial infrastructure.

One driving force behind this stability is the growing adoption of Liquid Staking Tokens (LSTs) as a wrapper for Bitcoin across EVM environments. LSTs issued through Babylon are becoming a common format for composability and integration — enabling staked Bitcoin to be rehypothecated, used in DeFi, or pledged as collateral across protocols without sacrificing native yield.

Bitcoin LSTs are now being integrated into structured products and yield strategies, including borrow/lending markets and collateralized positions — marking a key step forward in making Bitcoin productive across the broader DeFi landscape.

Lombard’s LBTC continues to be the most dominant LST operator with over 18,000 BTC and they have recently signed an exclusivity agreement with Katana (a yield oriented DeFi chain incubated by Polygon and GSR), to have Lombard be the only version of BTC available on that chain.

Source: BitcoinEcoTK

dApps

We view borrow-lending as one of the most significant long-term opportunities for Bitcoin. As Bitcoin continues to evolve from a passive store of value into an active layer of internet capital, the ability to borrow against BTC or use it as pristine collateral unlocks entirely new financial primitives — from leverage and liquidity access to structured products and real-world integrations. Native borrow-lending markets are essential infrastructure for a mature Bitcoin economy, enabling users to stay long BTC while accessing dollars, yield, or risk management tools without ever leaving the asset. This foundational layer will power everything from DeFi apps to institutional finance, and we believe it’s still early. For this reason we continue to be excited about Liquidium (Asymmetric PortCo) building an omni-chain lending dApp.

Liquidium is making fantastic progress and most recently announced a working demo which had a lender borrow USDT on Ethereum, directly against their Bitcoin on L1, and pay back this loan, which resulted in a successful cross-chain loan repayment.

Source: X

Omni-chain abstraction continues to be a recurring theme, and one which enables builders to create seamless interoperable UX. Notably, Circle Gateway is particularly interesting in this context — it enables a unified, chain-agnostic USDC balance that can be instantly accessed across multiple blockchains, making it a powerful unlock for borrow-lending against BTC. By eliminating the need to pre-fund liquidity pools on each individual chain, Bitcoin lending platforms can offer seamless, low-latency loans with USDC that’s available wherever demand arises — whether on Ethereum, Solana, or emerging Bitcoin-aligned ecosystems. This dramatically improves capital efficiency, reduces friction for users, and enables real-time margin management, making BTC-backed lending markets faster, more scalable, and responsive to liquidity needs across the crypto economy.

Team Updates

-

Joe was featured on Kyle Chasse’s Youtube episode “Wall Street Is KILLING Altcoins (They’re Buying THIS Now)”

All Market Updates

Please let us know if you have any questions or comments.

As always, thank you for your support.

– Asymmetric