🏆15 Quality stocks

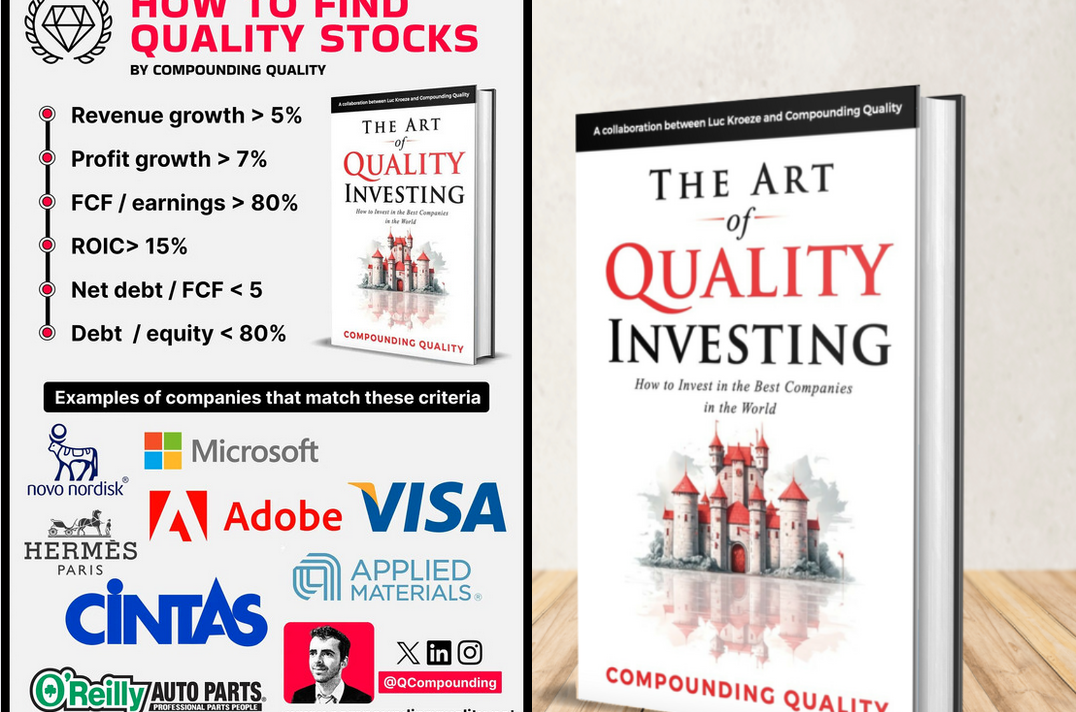

The launch of The Art of Quality Investing was a huge success.

Several thousands of copies were sold already.

You missed it? Order the book here:

🏆15 Quality stocks

In the book, Luc and I talk about the criteria you can use to find Quality Stocks.

When you screen for companies matching these criteria, you’ll find a lot of wonderful companies.

You can also enter these criteria yourself in Finchat.

Here are 15 quality stocks that stood out to me:

1. Adobe

Adobe is a true compounding machine active in computer software products and technologies. Adobe’s products allow users to express and use information across all print and electronic media.

-

Net Debt/FCF: Net cash

-

FCF Margin: 37.0%

-

ROIC: 28.1%

-

LT Growth Estimate: 13.4%

-

FCF Yield: 3.8%

2. Arista Networks

Arista Networks provides cloud networking solutions for large data centers, emphasizing scalability and programmability to enhance agility and efficiency.

-

Net Debt/FCF: Net cash

-

FCF Margin: 32.7%

-

ROIC: 50.8%

-

LT Growth Estimate: 19.4%

-

FCF Yield: 2.6%

Source: Finchat

3. Cintas

Cintas provides tailored business services including uniform rental, facility maintenance, and safety products, ensuring workplace professionalism and safety across various industries.

-

Net Debt/FCF: 1.5x

-

FCF Margin: 15.5%

-

ROIC: 37.9%

-

LT Growth Estimate: 12.4%

-

FCF Yield: 2.2%

4. Evolution AB

Evolution AB is a leading provider of live casino solutions, offering immersive online gaming platforms with professional dealers to replicate real-world casino experiences.

-

Net Debt/FCF: Net Cash

-

FCF Margin: 53.5%

-

ROIC: 32.6%

-

LT Growth Estimate: 14.6%

-

FCF Yield: 4.6%

Source: Finchat

5. Fortinet

Fortinet offers comprehensive cybersecurity solutions including firewalls, endpoint security, and threat detection, safeguarding organizations against evolving cyber threats.

-

Net Debt/FCF: Net cash

-

FCF Margin: 29.7%

-

ROIC: 49.0%

-

LT Growth Estimate: 14.9%

-

FCF Yield: 3.5%

6. Hermès

Hermès is well-known for its luxury fashion, leather goods, and accessories, emphasizing artisanal craftsmanship and timeless elegance.

-

Net Debt/FCF: Net cash

-

FCF Margin: 28.9%

-

ROIC: 86.3%

-

LT Growth Estimate: 10.98%

-

FCF Yield: 1.8%

7. IDEXX

IDEXX develops innovative diagnostic products for veterinary care and livestock industries, empowering professionals with accurate insights to enhance animal health.

-

Net Debt/FCF: 0.4x

-

FCF Margin: 21.3%

-

ROIC: 122.2%

-

LT Growth Estimate: 12.0%

-

FCF Yield: 2.1%

8. Lululemon Athletica

Lululemon designs high-quality, yoga-inspired activewear, promoting active lifestyles and community engagement through versatile apparel.

-

Net Debt/FCF: Net cash

-

FCF Margin: 13.1%

-

ROIC: 45.4%

-

LT Growth Estimate: 12.3%

-

FCF Yield: 3.5%

9. Meta Platforms

Meta Platforms provides social networking platforms and digital advertising solutions, connecting billions of users and businesses worldwide.

-

Net Debt/FCF: Net cash

-

FCF Margin: 30.0%

-

ROIC: 24.9%

-

LT Growth Estimate: 22.4%

-

FCF Yield: 3.7%

Source: Finchat

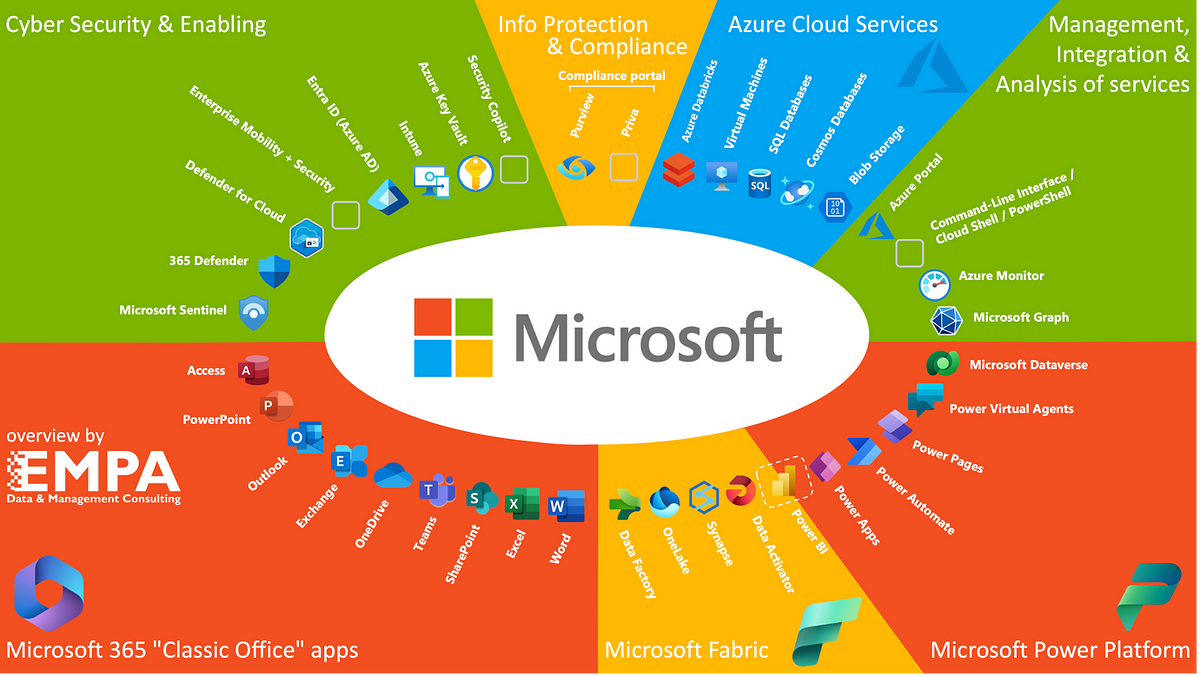

10. Microsoft

Microsoft offers a wide range of software, hardware, and cloud computing services, empowering individuals and organizations with innovative technology solutions.

-

Net Debt/FCF: Net cash

-

FCF Margin: 25.8%

-

ROIC: 52.0%

-

LT Growth Estimate: 16.3%

-

FCF Yield: 2.1%

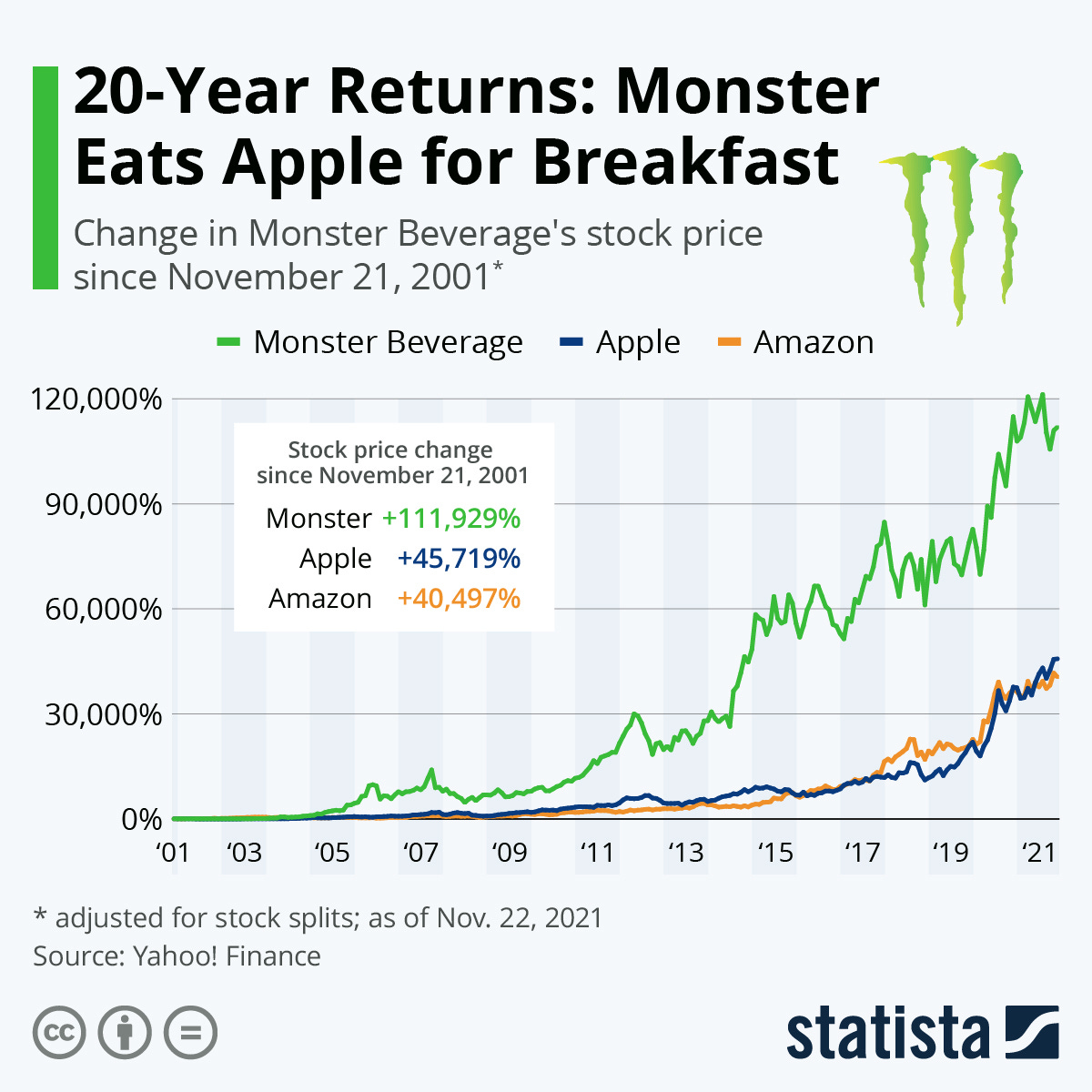

11. Monster Beverage

Monster Beverage produces energy drinks for active consumers seeking performance enhancement and vitality.

-

Net Debt/FCF: Net cash

-

FCF Margin: 21.6%

-

ROIC: 34.7%

-

LT Growth Estimate: 14.2%

-

FCF Yield: 3.1%

Source: Statista

12. MSCI

MSCI delivers investment decision support tools and ESG research, empowering investors with actionable insights and sustainable investment strategies.

-

Net Debt/FCF: 3.7x

-

FCF Margin: 41.3%

-

ROIC: 72.3%

-

LT Growth Estimate: 13.1%

-

FCF Yield: 2.9%

Source: Finchat

13. Novo Nordisk

Novo Nordisk specializes in diabetes care and other chronic conditions, developing innovative treatments to improve patient outcomes.

-

Net Debt/FCF: Net cash

-

FCF Margin: 23.0%

-

ROIC: 69.8%

-

LT Growth Estimate: 19.7%

-

FCF Yield: 2.2%

14. O’Reilly Automotive

O’Reilly Automotive is a leading retailer of automotive parts and accessories, providing expert service and product availability for professionals and DIY enthusiasts.

-

Net Debt/FCF: 3.0x

-

FCF Margin: 12.4%

-

ROIC: 43.5%

-

LT Growth Estimate: 11.5%

-

FCF Yield: 3.3%

15. Visa

Visa facilitates secure electronic payments and financial services globally, driving economic growth and financial inclusion through seamless transactions.

-

Net Debt/FCF: Net cash

-

FCF Margin: 54.4%

-

ROIC: 20.8%

-

LT Growth Estimate: 13.3%

-

FCF Yield: 3.6%

Source: Finchat

Overview

Here’s an overview of all the companies mentioned:

The Art of Quality Investing

These 15 companies were based on the Quality Criteria used in the book.

Do you want to learn more? Grab your book copy here:

Happy Compounding!

Pieter

PS On Friday I’ll give a free webinar about quality investing. You can join here.

Used sources

-

Interactive Brokers: Portfolio data and executing all transactions

-

Finchat: Financial data