Amazon Beat This Losing Streak After 20 Years

Presented by

CLOSING BELL

Amazon Beat Its Losing Streak After 20 Years

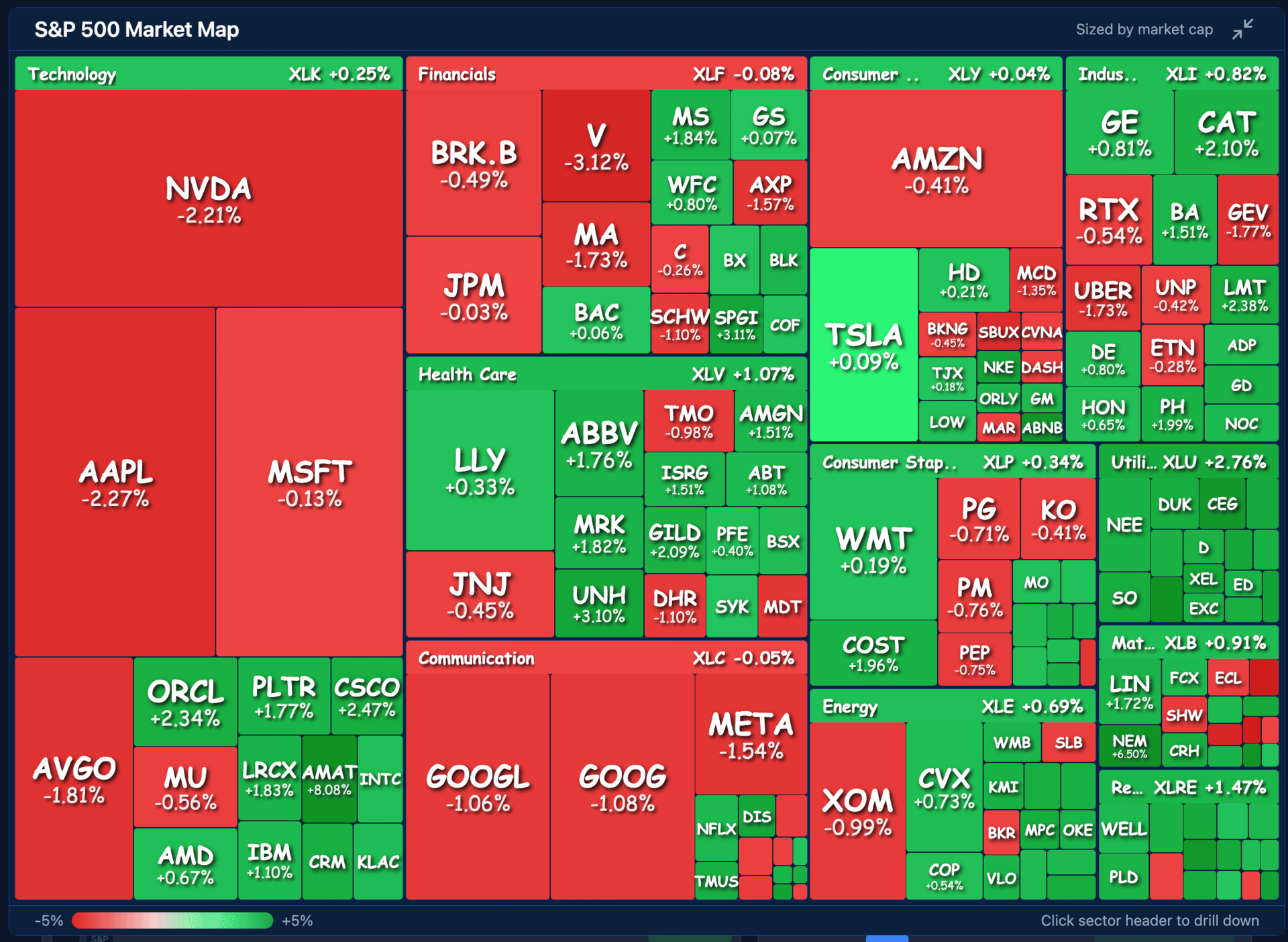

The market was a wild ride Friday, up then down then up, ending in a photo finish in the green. Many names in the software, crypto, and even trucking rebounded, though for the week all indexes ended in the red.

The entire Mag 7 fell aside from Tesla, . Amazon fell for its ninth straight session, its worst losing streak since 2006.

The macro news for the day helped a bit, showing CPI data that did not increase as much as feared, just 2.4% overall, and 2.5% for core prices excluding food and energy. That mixed with the better labor numbers (though abysmal backward revisions) showed the economy may be on track to fight inflation.

Don’t get too excited, because the Fed seems set to hold rates till June as these conditions continue to improve. The WSJ reported that several categories of consumer goods saw increases due to a pass through of tariff costs, like a 16% climb in ground beef prices. At least fuel and electricity prices fell back some.

Financials were hit today by a UBS analysis of levered loans in the private credit markets that may be up next on the AI ‘replacing everything sell off’ chopping block.

EARNINGS

Amazon Capex Angst Triggers Historic Losing Streak 📦

Investors are fleeing $AMZN ( ▼ 0.41% ) as the e-commerce giant enters its ninth consecutive day of losses, marking its longest slump since 2006. The selloff has erased roughly $463 billion in market value as the street grapples with a massive surge in infrastructure spending.

The primary catalyst for the 18% slide is a record $200 billion capital expenditure forecast for 2026, a massive leap from the $131 billion spent in 2025. This aggressive ramp into data centers, custom chips like Trainium, and the Project Kuiper satellite constellation has caused free cash flow to plummet 71% year-over-year to $11.2 billion, sparking fears of a “quixotic” spending race against Big Tech peers.

Management maintains a bullish outlook, but one week into that outlook and the stock is hurt bad. While the market remains wary of the near-term cash drain, the company is doubling down on its custom silicon strategy to bypass industry bottlenecks, expecting nearly all Trainium 3 supply to be committed by mid-2026.

EARNINGS

A Tale of Two Earnings

The social commerce platform Pinterest saw shares crater 21% after posting a rare revenue miss Thursday. That alongside a disappointing forward guidance sent shares into the gutter. While user engagement reached record highs, cautious spending from large retailers weighed heavily on the top line.

-

-$0.54 EPS vs. -$0.81 forecast, $1.32B revenue vs. $1.33B forecast, $951M – $971M. Q1 guidance vs. $981.3M estimate

The decelerating revenue trend over the past three quarters triggered a wave of analyst downgrades and price target cuts from firms like Evercore ISI and BofA.

It came down to tariffs that made it much harder for Pinterest’s largest retail advertisers to sell their viral products. Despite a record 619 million monthly active users, the platform is also struggling against AI-driven competition from Alphabet and OpenAI, which analysts fear may signal the end of its margin expansion cycle.

In contrast, Applied Materials, and its positive earnings reaction showed AI data centers that are damaging business models like Pinterest are making other companies small fortunes.

The semiconductor equipment giant $AMAT ( ▲ 8.08% ) surged Friday after delivering a double beat fueled by the relentless global build-out of AI data centers. Robust demand for advanced wafer fab equipment continues to offset lingering headwinds from China trade restrictions.

-

$2.38 EPS vs. $2.20 forecast, $7.01B revenue vs. $6.89B forecast.

The Why: AMAT called out “unprecedented demand” for energy-efficient chips and advanced packaging required for the next generation of AI processors. CEO Gary Dickerson highlighted the company’s leadership in gate-all-around transistors and high-bandwidth memory stacking, which are becoming critical bottlenecks for AI hardware manufacturers.

The Outlook provided a massive boost, the company forecasting Q2 revenue of $7.65 billion, far exceeding the $7.01 billion analyst target. With shares already up 26% year-to-date, the positive outlook suggests a multi-year growth engine as global AI infrastructure spending enters a new, more aggressive phase.

CRYPTO STOCKS

Digital Assets Rebound Ignites Risk Asset Rally

The digital asset ecosystem saw a massive wave of buying pressure as $BTC surged +5.18% to reclaim $69k, as many hope the bottom is in. The move came after CPI came in with less inflation than experts expected to see.

The rebound acted as a high-velocity catalyst for sector proxies: $MSTR ( ▲ 8.85% ) climbed due to its role as a high-beta corporate Bitcoin treasury, while $HOOD ( ▲ 6.82% ) gained as retail trading participation and crypto-notional volumes began to scale.

Coinbase shares jumped $COIN ( ▲ 16.47% ) following back-to-back upgrades from Bank of America and Goldman Sachs, with analysts raising price targets to $340. This came despite a report Thursday that showed 19.2% revenue decline, and a loss of nearly $700M.

SPONSORED BY KRAKEN

Grow Your Portfolio with Kraken 🐙

Ready to make your assets work harder for you? Kraken is offering a limited-time 3% match on all cash and crypto deposits from February 10th through March 9th. Whether you are moving over Bitcoin or funding with fiat, Kraken adds an extra 3% on top to give your balance an immediate boost.

As one of the world’s longest-standing exchanges, Kraken combines security with an intuitive interface, making it the premier choice for both seasoned pros and crypto newcomers. Don’t leave money on the table—secure your bonus and start trading with more today.

Kraken Disclosure: This post contains affiliate links, which means I may receive a commission at no cost to you if you make a purchase through a link.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TRENDING STOCKS

Market Movers

-

$DXCM ( ▲ 7.59% ) DexCom: Increased on high volume as the medical device sector sees renewed interest following recent clinical data and positive long-term guidance for continuous glucose monitors.

-

$AKAM ( ▲ 6.84% ) Akamai Technologies: Rallied after reporting strong performance in its security and cloud computing segments, outpacing delivery growth.

-

$MOH ( ▲ 6.82% ) Molina Healthcare: Gained as the managed care space stabilized following clarified regulatory reimbursement rates and better-than-expected medical cost ratios.

-

$NRG ( ▲ 6.52% ) NRG Energy: Rose driven by increased power demand forecasts tied to the expansion of regional data centers and energy grid modernization.

-

$VRTX ( ▲ 5.69% ) Vertex Pharmaceuticals: Gained as the biotech major prepares for multiple clinical trial milestones in the first half of 2026 for its pain and autoimmune pipelines.

Losers

-

$STZ ( ▼ 8.04% ) Constellation Brands: Plunged after slashing its fiscal 2026 outlook, citing a 6% decline in organic net sales and decelerating beer buy rates, particularly among Hispanic consumers.

-

$NCLH ( ▼ 7.57% ) Norwegian Cruise Line: Declined as part of a broader sell-off in travel and leisure names amid concerns that persistent inflation is finally crimping high-end discretionary travel budgets.

-

$NVR ( ▼ 7.27% ) NVR Inc: Dropped as the homebuilding sector reacted to a hawkish Federal Reserve stance and rising yields, which have dampened new mortgage applications.

-

$EXPE ( ▼ 6.41% ) Expedia Group: Fell following mixed results that indicated pricing pressure in the online travel agency space and rising customer acquisition costs.

-

$V ( ▼ 3.12% ) Visa Inc: Slipped lower alongside other payment processors as investors worry that the slowdown in high-end consumer spending reported by retailers will impact transaction volumes.

ST MEDIA

Top Stocktwits Stories 🗞️

Instagram post

Instagram post

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

Links That Don’t Suck 🌐

📈 Join IBD Live and watch experts analyze the market in real time–and save $400 for a limited time*

🤑 CPI Report: Annual Inflation Rate Comes In At 2.4% In January, Below Wall Street Expectations

Dubai’s DP World replaces CEO after Epstein links emerge

🏠️ Venezuela oil sales top $1 billion, funds won’t go to Qatar account anymore, Energy secretary says

📺️ Here’s the inflation breakdown for January 2026 — in one chart

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The content is to be used for informational and entertainment purposes only and the service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published on the service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋