Animal Spirits are Testing the Fed's Patience. Will Powell Smack Them on Wednesday?

The Fed/Treasury pivot in late Oct/Early November on a minor growth scare drove all yields lower for the rest of 2023 but that significant loosening of financial conditions has driven inflation breakeven yields and actual inflation higher again. We have basically round tripped back to the September period and since then, we have seen actual GDP come in higher, forward GDP estimates revised higher, the labor market has remained firm and inflation readings to start 2024 have come in hotter than expected.

2-year inflation breakeven yields are making near 6 month highs, heading back to the zone last seen around the September Fed meeting when the majority of Fed members were still expecting to raise rates another time in 2023.

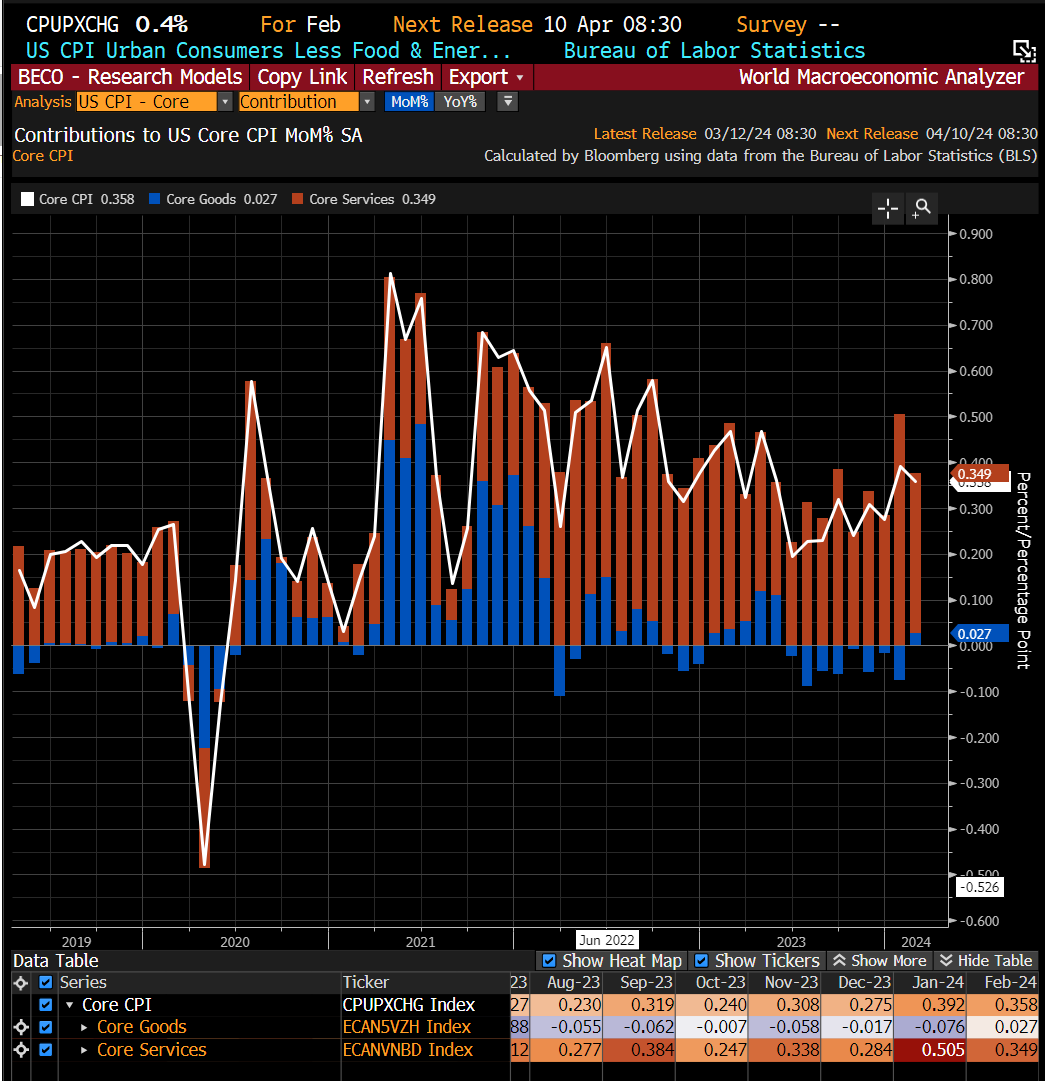

Core CPI monthly inflation readings bottomed in 4Q23 and continue to show re-acceleration. The 3-month annualized Sticky CPI according to the Atlanta Fed is up to 5% yoy now. We will get the February core PCE figures later this month but the trend is in place there as well. We are not getting closer to 2% like folks believed we were to end 2023.

Retail gasoline prices in the US have finally gone positive yoy in 2024 vs 2023. Seasonally, we should expect to see these higher gasoline prices last for another few weeks but could keep going all the way through Memorial day peak demand.

A re-acceleration of headline inflationary pressures from higher gasoline prices really would put the nail in the coffin for the Fed’s loosening intentions this year. Even though they look primarily at core inflation, a move higher in gasoline is going to force them to hold off longer and the longer they hold off before cutting, the less likely they are to commence the cutting cycle this year because we start to get closer to the election.

Why did the Fed not deliver the last rate hike in 2023? Why is everyone so convinced they are going to deliver the 3 rate cuts they said were coming for 2024? This Fed has shown that it can change its mind when the data changes. Well, the data has changed again here and the Fed needs to lean in and prevent inflation expectations from running hotter again into the seasonal stronger gasoline/housing demand period that is coming up.

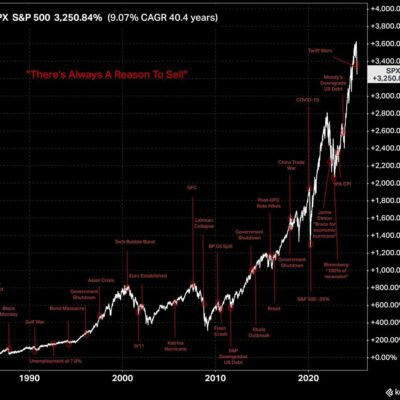

Risk asset markets will continue to rally until the point at which the Fed gets uncomfortable that inflation expectations and actual inflation are running away from them again. There are clear signs to start the year that this is already under way after the significant loosening of financial conditions we have seen since last November.

The Fed has the opportunity to address this on Wednesday but if they don’t, and choose to ignore it, they will surely have to address it in an even larger way later as inflation assets (oil, gold, BTC, stocks, etc) push even higher and risk de-anchoring inflation expectations even more. And that will only become more difficult in an election year.

They need to raise the odds that their next move could actually be a hike. They should be lowering the cuts in the Dot plot for both 2024 and 2025 as well as raising the neutral rate. Introducing volatility into the rates market is the pathway to tightening financial conditions that will slow down the animal spirits and re-anchor inflation expectations.

This seems easier to deal with at this meeting but we need to trade the Fed we have, not the Fed we want.

My positioning biases: Long Gold/BTC/Oil, Short Small Caps, Short Duration USTs

Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do your own due diligence.