Black Friday Sales Confound Recession Fears; More Stock Picks

Here’s a preview of what we’ll cover this week:

-

Macro: No Support For Doomers; Consumers Are Confident; Amazon’s Nightmare

-

Markets: The Bullish Trigger; Every Day Up…; Our Energy Pick for the AI Power Decade; Top Trade in Managed Care; Our Bet in Biotech; OpenAI Needs To Raise At $1Tr; Investment Tip: When Bubbles Burst

-

Lumida Curations: AI Will Define This Generation; The Market Just Hit Reset; Protein is the Breakfast Metabolic Hack

Happy Thanksgiving.

I’m deeply grateful for the privilege to serve as a steward of your capital.

Investing is an act of Trust.

That trust is earned slowly and tested often, and we never take it for granted.

To invest on someone’s behalf is to shoulder the volatility, and carry the emotional load of markets so you don’t have to.

It’s a duty we embrace.

Our job is to stay steady when the world feels unsteady, to make disciplined decisions when the noise is loudest, and to protect your ability to pursue what matters most:

family, purpose, and the freedom to choose your path.

This year reminded me that challenges arrive with a kind of quiet purpose.

There’s a wisdom that only reveals itself through tension.

I’m grateful for those experiences because they carve out the resilience and perspective that ease alone could never teach.

I’m thankful for clients and followers who challenge our thinking.

Curiosity keeps us honest.

It reminds us that markets don’t reward ego — they reward learning.

Every cycle gives us new data, new puzzles, and new opportunities to refine our process.

Wealth is a tool for possibility.

Our duty is to protect and expand those possibilities so you can stay focused on building a meaningful life.

That responsibility is a privilege — and we treat it as such.

Wishing you and your families clarity, rest, and a moment to appreciate the progress — visible and invisible — that brought you here.

Thank you for trusting us with work that truly matters.

I did a stream from my FSD on Thanksgiving night. Watch it here.

Keep More Of Your Capital Gains

Every spring, investors write one of their biggest checks of the year to the IRS.

However, you can save your taxes and contribute to economic and social welfare instead.

Actions taken today can mitigate income tax owed to the IRS in the spring.

The solution is Solar Investment Tax Credit (ITC). It allows investors to offset federal taxes by financing qualified solar projects.

In practical terms, an investor with a $100,000 tax bill could put roughly $60,000 into a qualified solar project and reduce their income tax liability by 40% to 45% if you live in a high-tax state.

Corporates have been doing this for years; in 2024 alone, more than $20 billion in solar credits were traded, up four-fold from the year before.

We have a limited capacity on this opportunity; so if you have a substantial tax bill, now is the time to act.

Click here to know more about this and other tax mitigation opportunities. You can also book a free consultation call here, and learn how Lumida can help you save taxes.

Macro

No Support For Doomers

This past Sunday, I did a podcast highlighting how there is significant value in stocks due to a pullback driven by the Fed hawkish cut and our “no recession” call. Watch the Non-consensus investing podcast on Youtube here.

(The fact that one has to make such a call and that it is amazingly non-consensus tells you we are nowhere near a market top.)

The economy is growing, and this week’s data releases continue to prove it.

-

Black Friday sales hit a record $11.8Bn, up ~10% annually.

-

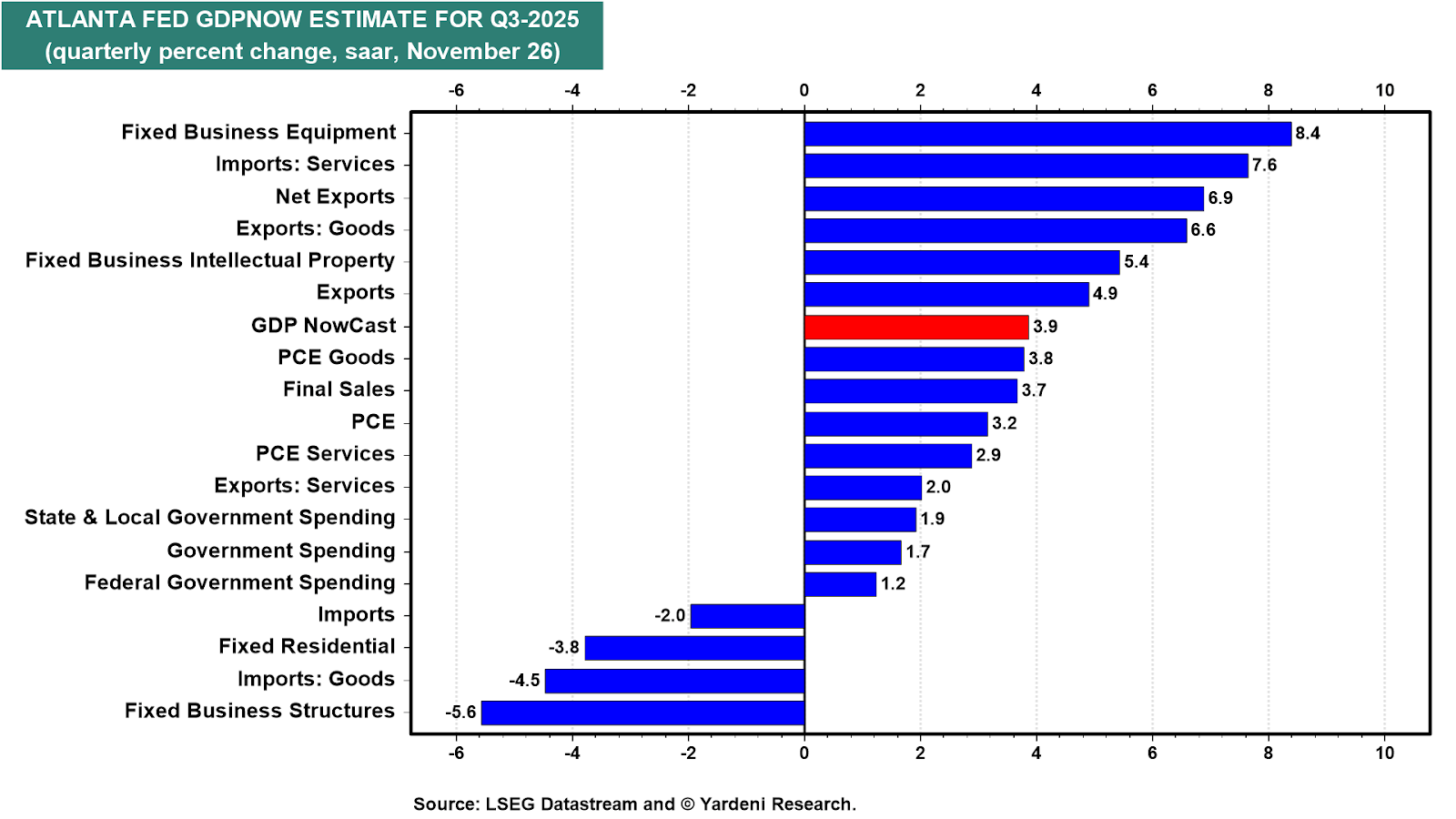

Q2 GDP growth was revised higher to 3.8%, with Q3 now tracking around 3.9%.

-

Initial jobless claims also came in lower than expectations, consistent with the “low-fire-low-hire” environment.

To sum it up, we have a growing economy with spending consumers and confident businesses.

Take a step back. We have a boomer led economy. Boomers have record household balance sheets. Corporate and individual real incomes are up. We have transfer payments and robust federal spending. We have a services economy driven by healthcare. We have a massive capex boom adding 1% to GDP. (Swings in manufacturing just don’t matter).

It is very difficult to derail an economic boom given the above conditions.

Why are people still fearing a recession?

Some other data points…

Commercial real estate is showing signs of bottoming in various hard hit markets like Austin or San Francisco.

I will do my best to tell you when you should be concerned. Now is not that time.

Consumers Are Confident

Like Druckenmiller, our primary datasource for understanding the health of the real economy is studying the US consumer thru earnings transcripts.

We discussed banks in October, now we have data on retailers.

Headline: The US consumer is strong and spending.

Management teams across retailers describe shoppers as “choiceful,” “value-seeking,” and “engaged”.

Target’s CCO Richard Gomez captures the mood: “Guests are choiceful, stretching budgets and prioritizing value. They’re spending where it matters most.” (Note: Target’s numbers look dreary and we think the stock should be avoided.)

Costco’s CFO Gary Millerchip echoes that “members are spending towards necessities and remain very choiceful in their spending on discretionary items.” (Costco remains over-valued and is now going thru multiple compression).

Dollar Tree notes that “customers are seeking value and convenience more than ever.” (Dollar Tree’s numbers are impressive, we want to buy on the next pull back.)

The spending pattern beneath that language is a reordered wallet, not a shrinking one.

Retailers have also shown optimism around consumers’ health, and guided towards a strong holiday season.

Walmart, Ross Stores, and Dollar tree also raised their guidance encouraged by the strong business momentum.

Walmart’s numbers and product innovation – including e-commerce – is very impressive. The multiple is now higher than Amazon and by more than a few turns (37x vs. 30x).

Amazon’s Nightmare: Walmart’s E-Commerce

Walmart is scaling e-commerce as a profit engine, and markets are beginning to feel the difference.

John Rainey (CFO, WMT): “our business model continues to evolve with operating income increasingly influenced by improved e-commerce economics.”

Walmart had a remarkable 28% e-commerce growth, its seventh straight quarter above 20%, driven by pickup, delivery and ad monetization.

Fulfillment speed is closing what used to be an Amazon-only moat:

“Approximately 35% of store-fulfilled orders were expedited or delivered in under three hours,” with sales through fast channels up nearly 70%.

Combine that with market-share gains in grocery and general merchandise, and the readthrough is clear:

Walmart is building Amazon’s flywheel on top of a value-anchored consumer base and a physical network Amazon doesn’t have.

It is hurting Amazon’s share, and is one of the reasons why Amazon’s lagging.

Amazon is also ceding capture of cloud market share growth to Google and Microsoft on the margin.

We aren’t in the ‘buy Amazon’ club because of this two prong flank attack given Amazon’s current valuation vs its peer group. Especially when you can buy Microsoft just off the 200 Day Moving Average.

Markets

The Bullish Trigger

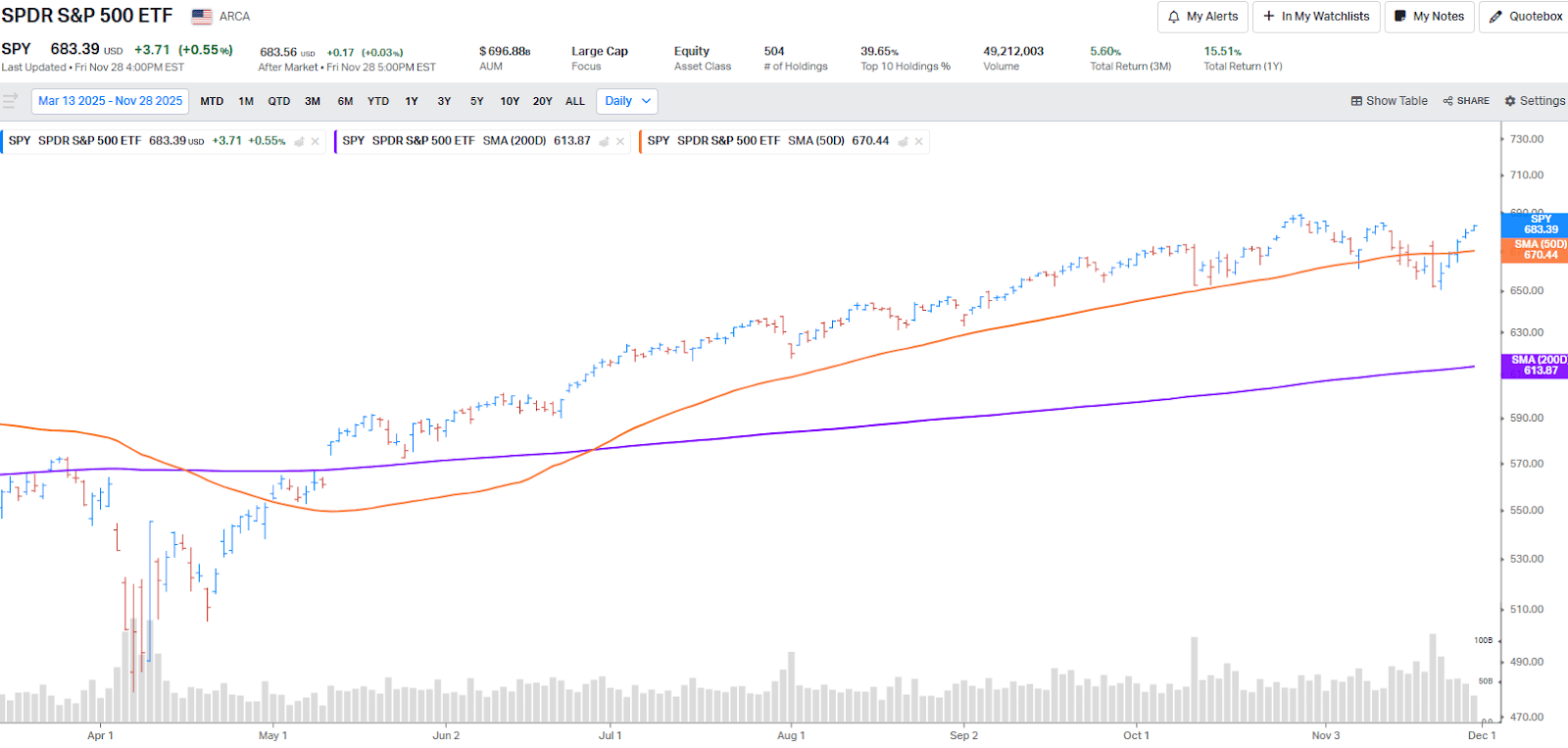

Last week, we saw SPY drop below its 50D, but it recovered with 4 consecutive green days and 70% of NYSE issues rising.

This is one of the strongest Thanksgivings in the market history books.

A lot of capital exited the market these last few weeks and are now falling over themselves to get back in.

That’s why we have this string of gains.

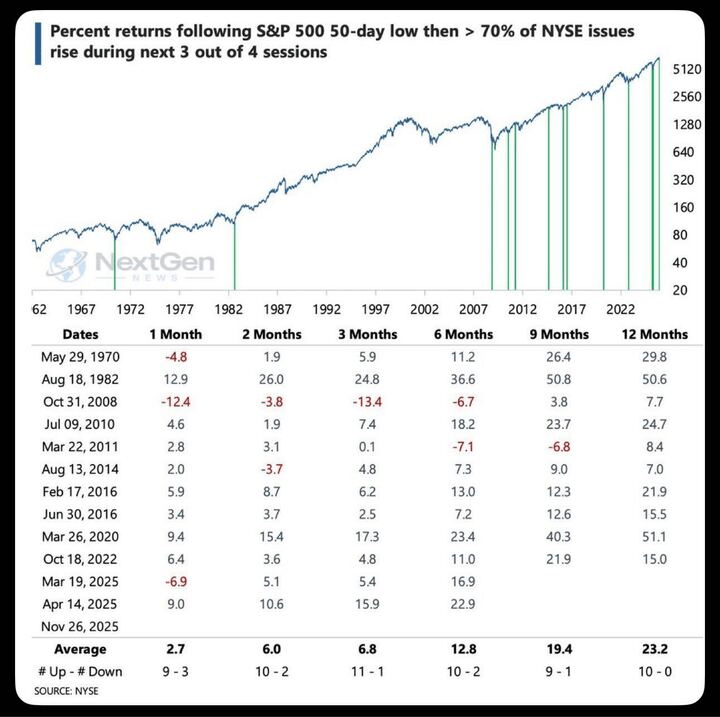

This triggered a bullish signal.

Over the past 50 years, this pattern has coincided with powerful forward returns:

+12.8% at 6 months, +23.2% at 12 months, with a 10/10 positive hit rate over one-year periods.

With the economy expanding, businesses growing, and consumers confident, we might see markets play out similar to what the indicator implies.

EVERY DAY UP…

We see many names and themes doing well now thru year end.

A short and shallow pullback early this week given tactical overbought conditions would be expected. After that, best to deploy if you are not fully invested.

The best businesses in the world went on sale, and we were quick to scoop them.

We see this across a variety of names. That last time we saw the best businesses in the world on sale was November 2023. They’ve now returned to reasonable valuations.

On the broad indices, I expect we’ll get to All Time Highs on or before year end.

Rate cut probabilities are close to 90%

However, If the Fed does not cut, then the rally might stumble.

It’s rare to find a variety of quality businesses on sale at the same time.

When that happens, it’s best to scoop them up.

Our Energy Pick for the AI Power Decade

Natural gas is becoming the most important feedstock for U.S. computing power – the sector is experiencing demand like never before.

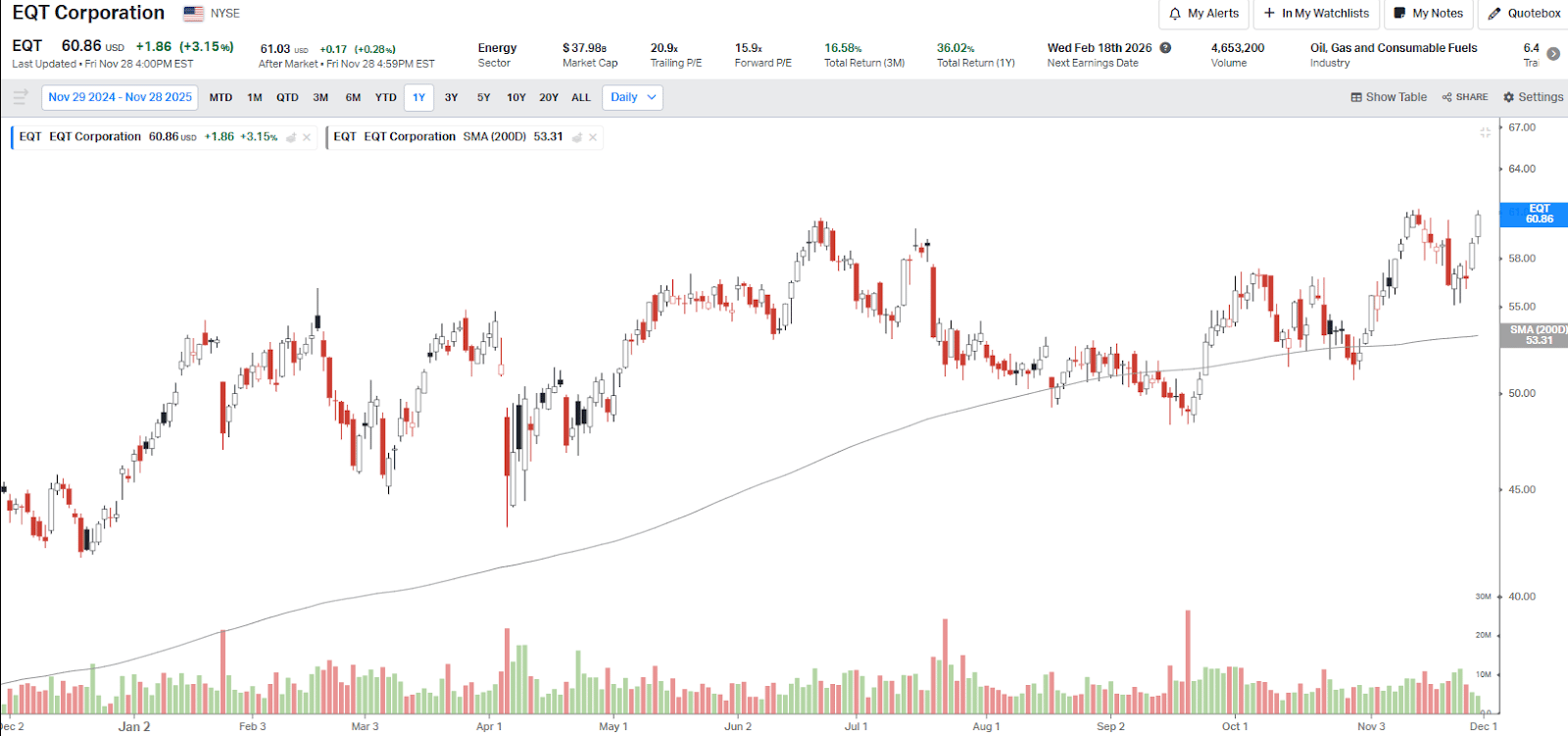

This week, we initiated a position in EQT Corporation (ticker: EQT).

(The stock is up 7% since we wrote about it on X last week, so maybe you wait for a pullback.)

EQT is the second largest natural gas producer in North America and has midstream pipelines. EQT has 20 year datacenter contracts – this is a neat way to bet on datacenters at a much more reasonable valuation.

Tn EQT’s own words, demand from the region is already “greater than what we can currently provide.”

At the same time, EQT has also signed LNG contracts with Sempra, NextDecade Rio Grande, and Commonwealth to build export optionality.

From a numbers perspective, the engine is humming:

EQT’s revenues and Net income increased by ~30% YoY – it had record low per-unit costs in Q3, and generated over ~$2.3B in free cash flow over the last four quarters, taking FCF yield to 7%.

Olympus Energy, acquired mid-year, was integrated in 34 days, the fastest operational onboarding in company history. This shows the execution culture.

The most important risk is commodity price sensitivity:

Even with long-term contracts, EQT’s earnings still move with Henry Hub natural gas pricing, and a prolonged gas oversupply could compress margins and delay capital returns.

EQT also has over $8Bn in debt, so a decline in cash flows could hurt their ability to cover repayments.

Top Trade in Managed Care

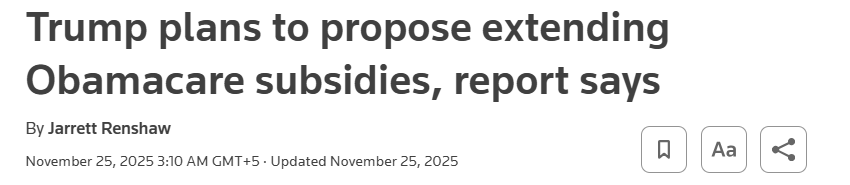

Healthcare stocks were back in business this week thanks to reports around ACA subsidies extension.

We bought Molina Healthcare (MOH) this week because the stars are aligning:

The political risk around subsidies is fading, valuation is depressed, and the long-term structural runway remains intact.

Politicians will continue to make the irresponsible decision and spend, spend, spend. And Molina Health is already priced for spending cuts, despite a mismatch in political rhetoric.

Molina is a leading managed care organization that provides healthcare services primarily through government-sponsored programs. It operates in 19 states and serves approximately 5.7 million members.

Molina had been priced for disaster, losing over 50% in the last 1 year.

It now trades at roughly 8× 2Y Fwd P/E, which is amongst the lowest levels in its 3Y History.

It’s hard for us to imagine this business trading at 8x PE in two years. Shouldn’t it price at least at 12x PE? That would imply a 50% return over the next two years.

And healthcare stocks have rallied sharply, the backdrop is solid.

The company delivers a high return on equity (~20%) and has leaned into aggressive buybacks.

Shareholder yield is now at 20% – among the highest in the sector. The market is acting as if this is going to get cut in half. That’s hard for us to imagine.

The core Medicaid book remains disciplined; the company is continuing to secure state wins, including a new Medicaid contract in Florida that is expected to bring substantial premium volume over time.

The bear case is that Molina saw a significant spike in Medical loss ratios, jumping to ~93% from 89% an year earlier. Now, this is true for plenty of other insurers that have subsequently rallied off of the May lows.

Management has also cut full-year EPS guidance for the third time, from an initial ~$22 to about $14 now. We think the worst is priced in.

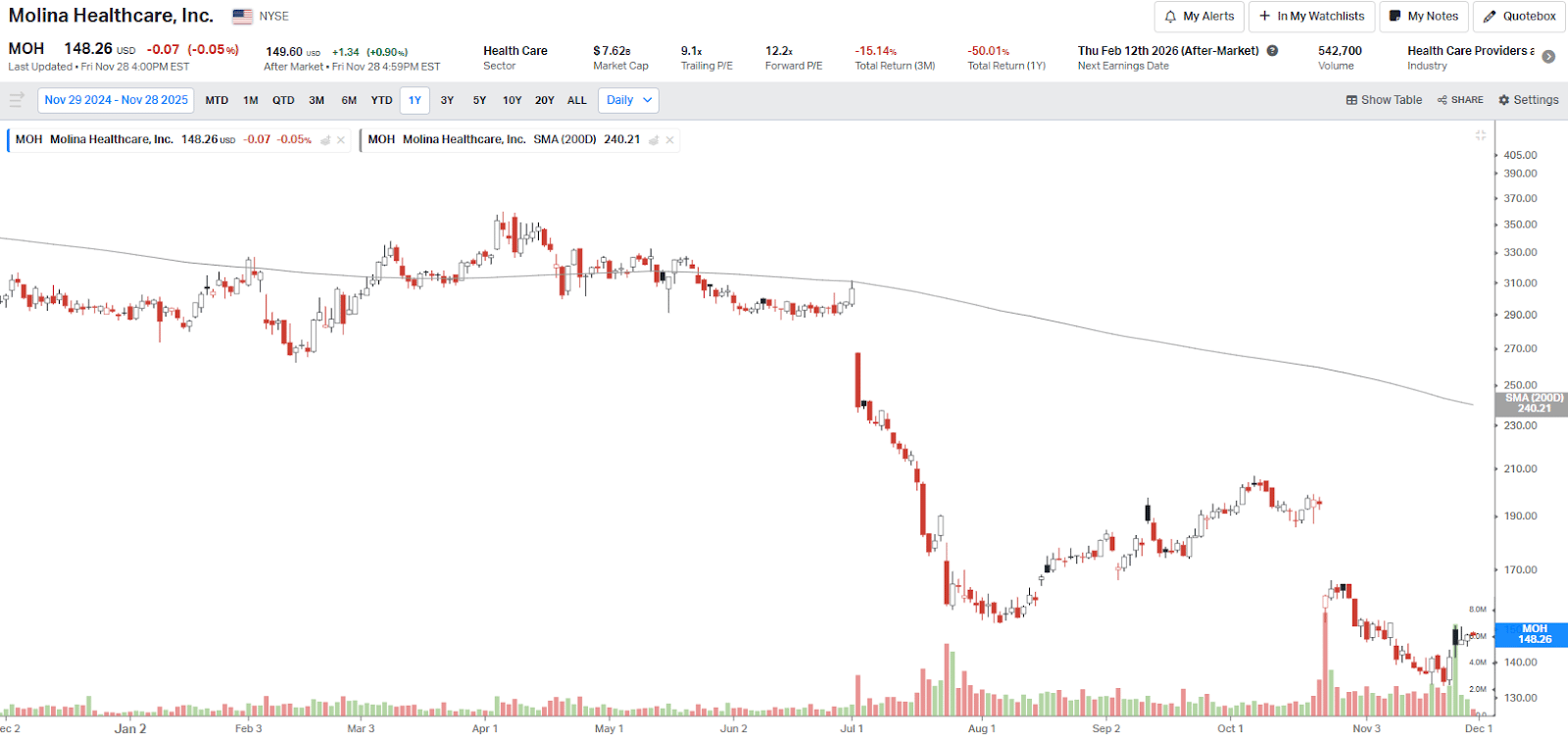

We see a number of hedge funds scooping up the name in the recent 13Fs.

They all bought way too early. The stock continued to drop. We think now is a reasonable time to buy. (It’s satisfying when the other hedge funds did the work and you can get in at a better price. 🙂

We are getting in at about a 25% lesser price than the hedge funds.

We like being on the same side of the table, just at a meaningfully better entry point.

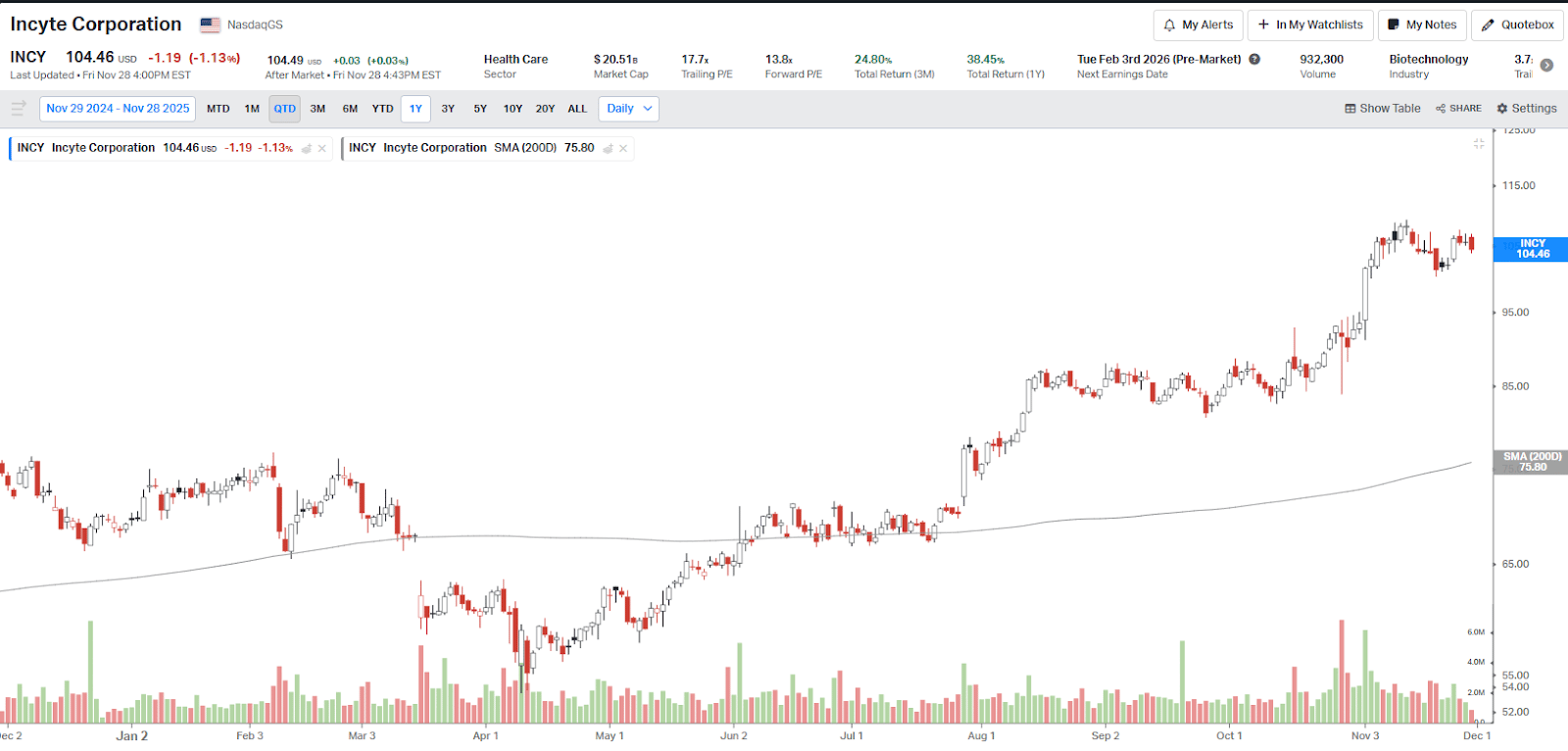

Incyte (INCY): Our Bet in Biotech

INCY presented a good opportunity this week, and we took it.

Incyte sits at the intersection of proven drug economics and pipeline-driven upside.

The business started its story around Jakafi – the dominant JAK inhibitor for myelofibrosis and polycythemia vera. It continues to be Incyte’s cash-engine at scale, and has funded the company’s pipeline for a decade.

But Incyte isn’t a one-drug story anymore.

Over the last two years, INCY has built a second growth pillar in immunology and dermatology.

Opzelura, a topical formulation with expanding label reach, is emerging as the next flagship asset, with revenue up ~35% YoY last quarter.

Beyond it, the company is stacking multiple new oncology and rare-disease products: Minjuvi/Monjuvi +33.6% YoY, Iclusig +26.4% YoY, Pemazyre +10.1% YoY, and even smaller assets like Zynyz are inflecting off a tiny base (+3167% YoY).

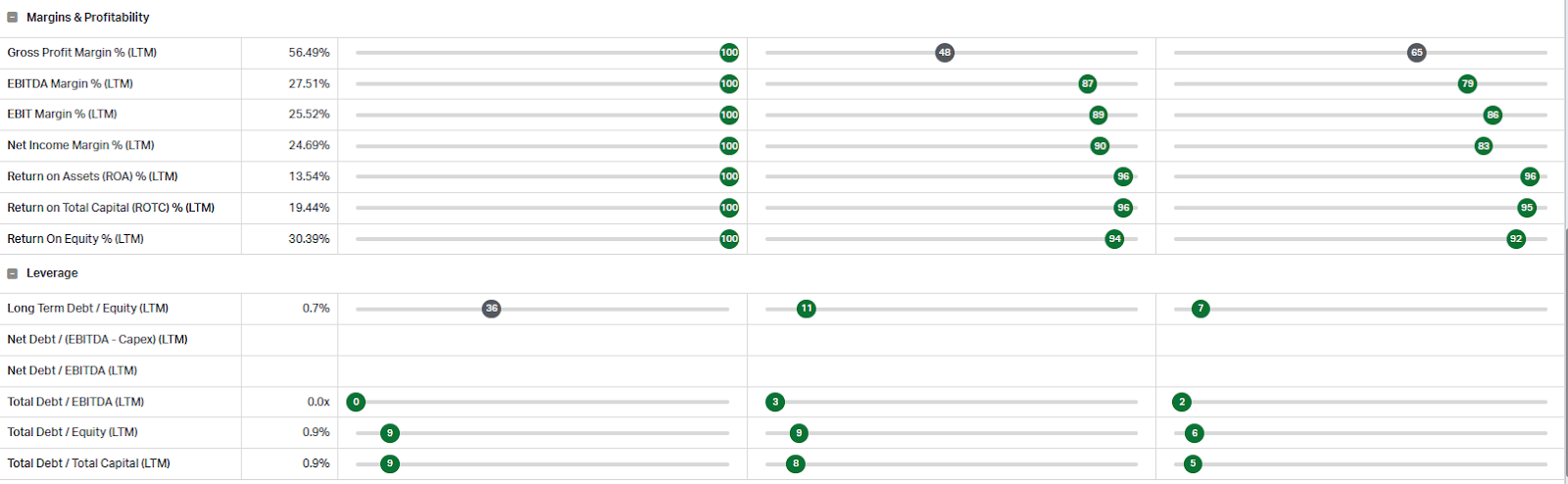

Moreover, you rarely find a biotech with this level of balance-sheet quality:

~56%+ gross margins, ~25% EBIT margin, ~30% ROE, strong free cash flow, and effectively no debt.

The business funds R&D internally, returns capital through buybacks, and isn’t dependent on capital markets to survive.

Valuation is not stretched either: ~13.8x forward P/E and ~6–7% FCF yield, putting it mid-pack for healthcare but with better profitability than most peers.

The overhang, and the reason this isn’t priced like a growth compounder, is clear: Jakafi loses exclusivity around 2028.

Everything between now and then is a race to diversify revenue and prove that Opzelura + the oncology pipeline can absorb the earnings gap.

Management has shown strong execution, and we believe markets aren’t pricing INCY for its potential (YET!).

Note: Biotech investing is extremely difficult. We would not allocate more than 1 to 2% to the name.

AI Adoption is Driving Mainstream Productivity Growth

AI implementation is now the norm across industries. Companies are reporting efficiency gains, cost take-out, and dollar-linked ROI from AI rollouts.

Banks and insurers are the furthest along.

JP Morgan CFO Jeremy Barnum said AI is already improving “fraud resolution times and analyst throughput”. This represents a “structural efficiency unlock rather than a cyclical benefit.”

Insurance is echoing similar efficiencies.

Progressive CEO Tricia Griffith noted that AI-supported claims handling is “materially improving adjudication speed while reducing manual intervention,” enabling volume growth without equal headcount growth.

Retail and logistics are embracing AI far faster than consensus assumes.

Walmart CEO Doug McMillon said AI-driven inventory and replenishment tools are helping reduce stockouts, improve accuracy, and enhance e-commerce flow.

Target CIO Brett Craig highlighted that AI-led routing is reducing logistics miles and increasing routing efficiency, translating directly into cost-per-unit gains.

Healthcare, historically slow to adopt technology, is now discovering throughput leverage.

UnitedHealth COO Dirk McMahon stated that automation is “removing manual claims friction and speeding intake workflows,” allowing more throughput without additional labor.

Healthcare is 18% of the U.S. GDP, even marginal productivity gains here ripple through inflation, wages, and national cost curves.

Overall, this enterprise adoption of AI will only drive the demand higher, and help the AI productivity growth story continue.

We have previously written how AI is driving returns for hyperscalers – Read it here.

OpenAI Doom Loop? OpenAI Needs To Raise At $1Tr

HSBC estimates that OpenAI could need $207 billion in financing by 2030 to meet all of its compute capacity commitments.

If OpenAI needs $200 Bn+ in funding, here are their choices:

1) Cash from Operations (CFO): $12 Bn going to [ $50 to $100Bn if you are bullish ]

Not enough, and that’s assuming pure margin.

2) Cash from Debt Financing:

They would need a debt to equity structure like CoreWeave, except CRWV can defend its liabilities with term revenue contracts but OpenAI cannot.

3) Cash from Equity Financing aka Shareholder Dilution.

OpenAI needs to raise at a $1 Tn valuation.

The stock would be down 30% to 40% easy in the last two weeks if it was publicly traded.

FOMO is the enemy of returns. Size is the enemy of returns. Capex is the enemy of returns.

Lumida Curations

AI Will Define This Generation

Sundar Pichai says Those who learn to harness AI will shape the future, unlocking new creative and economic opportunity.

The Market Just Hit Reset

After fear-driven volatility and a VIX spike, conditions now resemble the start of a rally not the end of one.

Protein is the Breakfast Metabolic Hack

A high-protein morning switches on satiety and calorie control, while sugar sends appetite in the opposite direction.

Meme

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.