Bleak December? Nevermore

Presented by

CLOSING BELL

Bleak December? Nevermore

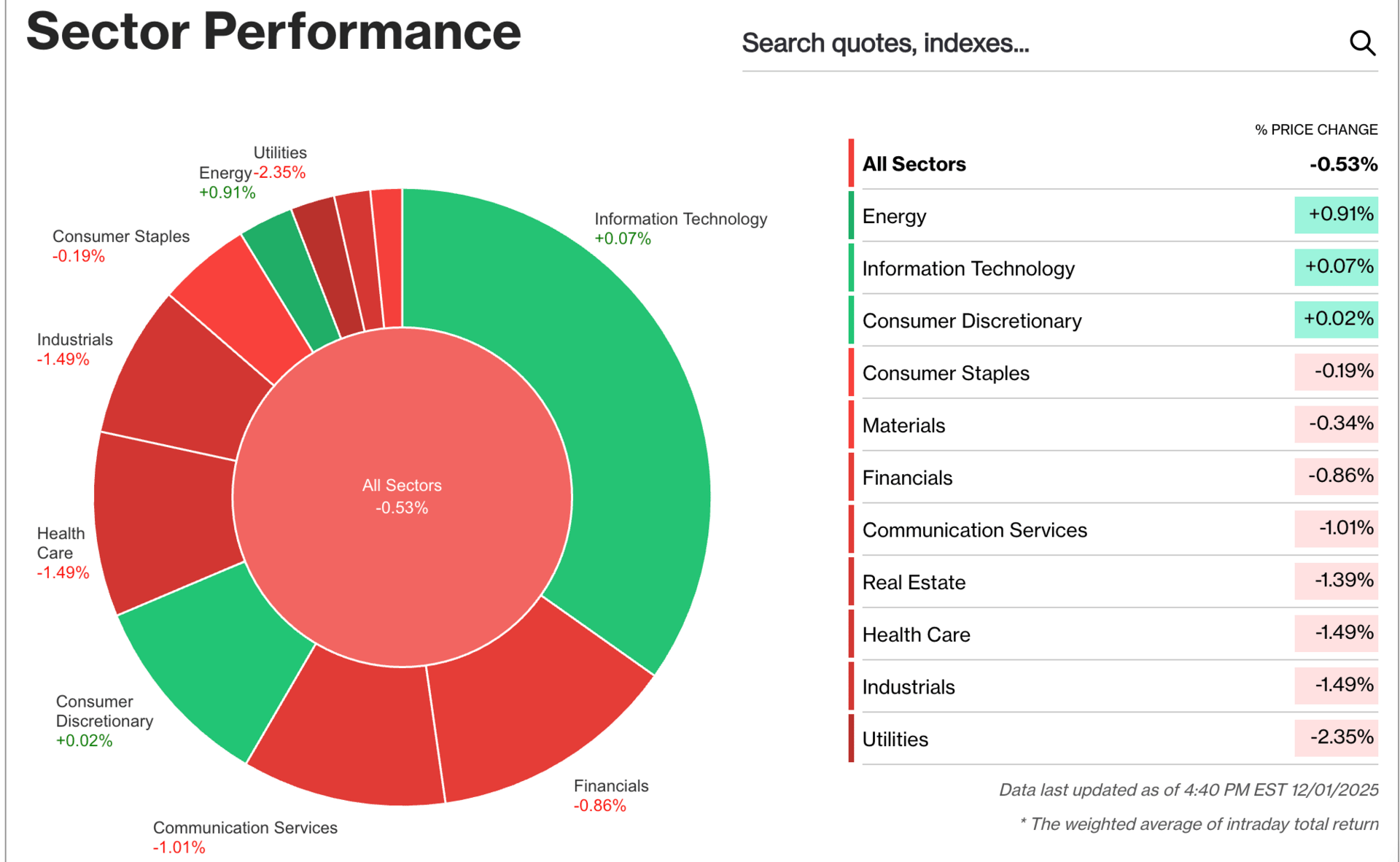

The market slid Monday, Americans coming back from the Football, Turkey, and Christmas shopping marathon weekend that capped November with a red start to December.

Thanksgiving’s short week rally was spurred on by Fed rate cut speeches, but this week comes the PCE from September, the last major macro data that will tell the FOMC how the economy was performing… three months ago. Manufacturing, measured by the Purchasing Managers Index Monday, showed a ninth month of contraction. President Trump has made up his mind on the next Fed chair, but so far won’t share who it is. After last week, Kevin Hasset was called a frontrunner by the press.

The Japanese central bank sent ripples through the Forex market on Monday after a bank governor talked about monetary policy, sending Government bond yields high and the Nikkei 225 down.

Black Friday sales climbed, speaking of macro, up about 4.1% according to Mastercard numbers, and online sales climbed 10%the day after Thanksgiving.

Silver hit fresh highs, Gold ended November in the green for the fourth month in a row, but Bitcoin fell back hard, again, dropping 4% for the day at the time of writing. Nvidia was falling after another spending splurge on a chip designer. Apple hit a fresh high, though. 🍎

$SPY ( ▼ 0.46% ) $QQQ ( ▼ 0.34% ) $IWM ( ▼ 1.26% ) $DIA ( ▼ 0.81% )

AFTER THE BELL

Winners In The Post Market: Data Center Service Providers

Earnings season is not over till the fat lady sings. Monday’s reports, the first for the last month of Q3’s expected results, came in with some heavy-hitting movers after the bell.

$MDB ( ▼ 1.05% ) popped 15% after the bell on earnings, after MongoDB gave some a pretty healthy Q3 2026 quarter report, and boosted its incoming fourth quarter guidance. The database maker beat revenue estimates by 6% at $628M, up 19% from last year. It raised its Q4 goals to $655M-$670M, nearly $50M above midpoint estimates.

Credo Technology Group $CRDO ( ▼ 3.64% ) was also climbing 16% in the post-market. It’s a data center connectivity provider and posted a profit of $82M and $0.44/share, compared to a net loss last year. It’s a great time to be in the giant electrical cable business, according to Chief Bill Brennan, who said they see coming Q3 revenue above $336M, way above the street’s $248M.

Adding to news in the post-market, Netflix added to the Warner Bros $WBD ( ▼ 0.54% ) buyout timeline with a mostly cash bid submission in the second auction round.

Bank of America Global Research said in a note that Netflix would be “killing three birds with one stone,” with a WBD buyout, competing with recently merged $PSKY ( ▼ 1.94% ) and $CMCSA ( ▼ 0.41% ) at the top of the bidding pile. 🎥

SPONSORED

A message for QQQ shareholders

Have you received emails or calls from our third-party proxy solicitor, Sodali? These are not spam—they’re here to help you participate in an important proxy vote for QQQ.

You can help shape the future of Invesco QQQ by voting on a proposed upgrade from its current trust structure to a more flexible, open-ended ETF. This change aims to deliver greater value to you, including:

-

Lower costs: Expense ratio reduced from 0.20% to 0.18%

-

Greater transparency: Enhanced reporting and oversight

-

No tax impact: The change will not trigger any tax consequences

-

Same investment objective: QQQ will continue to track the Nasdaq-100® Index

Rest assured, QQQ will continue to track the Nasdaq-100® Index and its operations will be managed by the same trusted team.

The deadline to vote is December 4th. Call 800-886-4839 for help.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

BUBBLE NEWS

Nvidia Buys Stake In Company It Does Business With ⭕️

Nvidia said Monday it bought $2B worth of Synopsys $SNPS ( ▲ 4.85% ) stock. It’s yet another strategic partner stake buy from the chip giant, hoping to offer up cash to help the silicon design and software supplier build more apps.

It’s the latest Nvidia purchase of a current partner, yet another deal that looks nearly round enough to be circular.

“Our partnership with Synopsys harnesses the power of NVIDIA accelerated computing and AI to reimagine engineering and design — empowering engineers to invent the extraordinary products that will shape our future,” founder and CEO Jensen Huang said in a release.

It wasn’t the only AI name that made purchases on Cyber Monday. OpenAI said it bought a stake in Thrive Holdings. And get this: Thirve is a recently created subsidiary of Thrive Capital, a VC firm led by one of the Kushners, and a major investor in OpenAI. Now that is circular enough to roll away. 🛞

HISTORY NEWS

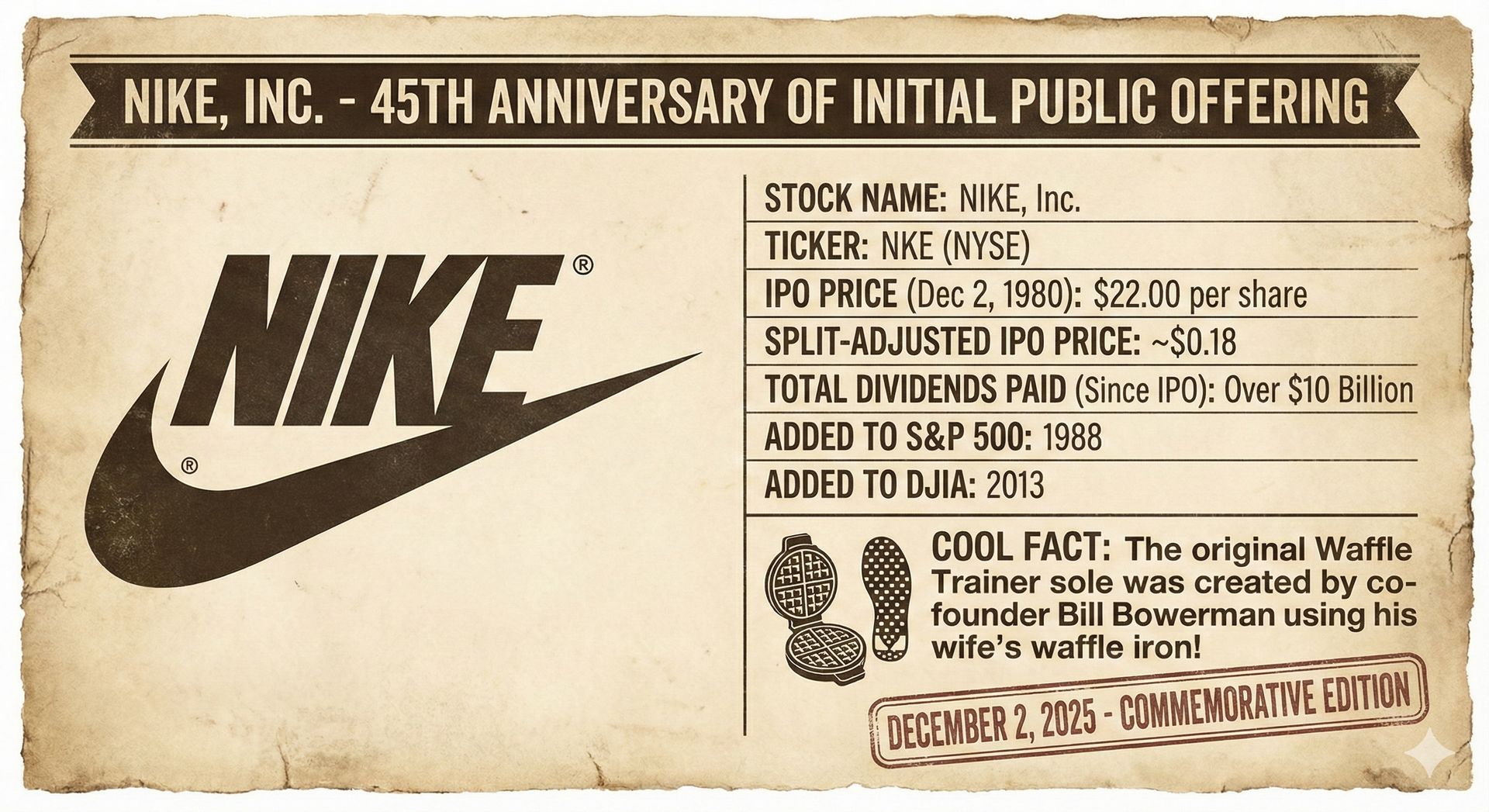

Nike Meets 45 Year IPO Anniversary Tues, Dec 2nd

IN PARTNERSHIP WITH

7 Mistakes People Make When Choosing a Financial Advisor

Interested in finding a financial advisor? SmartAsset’s no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞️

-

Peter Schiff said Bitcoin turns valuable energy into nothing.

-

Michael Burry said Elon Musk’s Tesla stock is “ridiculously overvalued.”

-

Dan Ives updated his AI 30 list, removing SoundHound, ServiceNow, and Salesforce.

-

Goldman Sachs acquired Innovator Capital Management for $2 billion to strengthen its ETF portfolio.

-

Barrick Mining gained today after considering IPO for its North American Gold Mines

-

MicroStrategy announced a $1.44 billion reserve as its Bitcoin holdings hit 650,000.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

YOU DECIDE

So What Is The Poverty Line?

On Friday, I reviewed the drama on Fintwitter last week, the question of the $140k poverty line proposed by Michael Green, Strategist and Portfolio Manager for Simplify Asset Management. Green wrote a deliberately shocking Substack post last week, arguing that the actual ‘poverty line’ in the U.S., if calculated by counting the costs paid by average families with two adults and two children, was much closer to $140,000 than official estimates.

Others argued against his claim, and Monday Green wrote further about his wish to re-examine how we measure hard economic times. On Friday, I decided to pose the question to the Daily Rip audience, as it was clear that top substack economists couldn’t figure out whether times are tough right now in the U.S.

Here are the results:

What is the bare minimum for a 4-person Family?

🟨🟨🟨🟨🟨⬜️ $160k+ (130)

🟨🟨🟨⬜️⬜️⬜️ $140k (83)

🟨🟨🟨🟨🟨⬜️ $120k (136)

🟨🟨🟨🟨🟨⬜️ $100k (124)

🟩🟩🟩🟩🟩🟩 $90k (145)

🟨⬜️⬜️⬜️⬜️⬜️ $30k+ (48) 666 Votes

The current leading dollar average is $90k, but today I’m sending a new, more evenly weighted poll question below, and I’ll be back with the results this Friday.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: FOMC Member Bowman Speaks (10:00 AM), JOLTS Job Openings (10:00 AM), API Weekly Crude Oil Stock (4:30 PM). 📊

Pre-Market Earnings: Castor Maritime Inc ($CTRM), and Anavex Life Sciences Corporation ($AVXL). 🛏️

After-Market Earnings:

P.S. You can listen to all of these earnings calls on Stocktwits.

Crowdstrike Holdings Inc $CRWD ( ▼ 0.99% ) : The cybersecurity leader is expected to report adjusted earnings of $0.94 per share and revenue of $1.2 billion for its fiscal fourth quarter, with investors closely watching for guidance for fiscal 2026.

Marvell Technology Inc $MRVL ( ▲ 1.9% ) : Wall Street forecasts that the chipmaker will post adjusted EPS of $0.75 on revenue of $2.06 billion for the third fiscal quarter, with focus placed on custom AI accelerator growth and demand from the data center segment.

Okta Inc $OKTA ( ▲ 0.39% ) : The identity management firm is projected to announce adjusted earnings of $0.76 per share, representing a double-digit increase year-over-year, while revenue is estimated to reach $730 million for the third quarter.

Links That Don’t Suck 🌐

🎩 Bitcoin’s worst day since March

⛴️ Is the US preparing for war with Venezuela?

👀 Trump reportedly gave Maduro ultimatum to relinquish power in Venezuela

😨 OpenAI takes stake in Thrive Holdings to help accelerate enterprise AI adoption

💉 Eli Lilly cuts cash prices of Zepbound weight loss drug vials on direct-to-consumer site

Get In Touch 📬

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍