Clouded Judgement 12.29.23 – Year End Review

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

2023 Top Performers

In 2023, there were 14 cloud software companies that were up 100%+ this year (in the index I track of ~80 total)! Only 20 traded down on the year, and the median year-to-date performance of the basket of companies was +40! Below you can see the top performers from 2023.

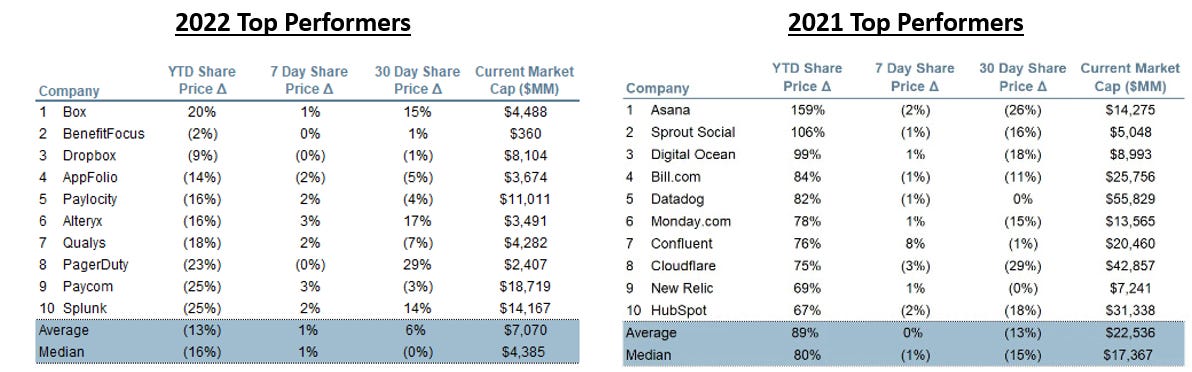

And below are the top performers from 2022 and 2021

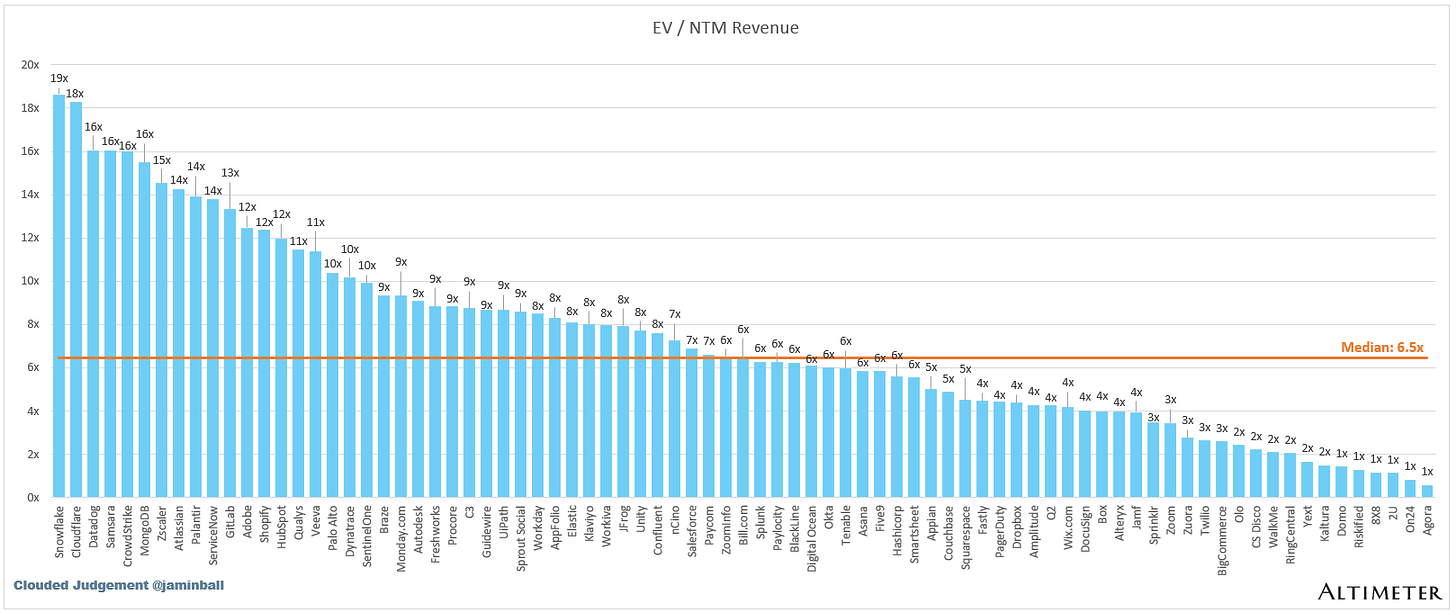

Top 10 EV / NTM Revenue Multiples

This year, only 1 company had a top 10 multiple for every day of the year – Snowflake. Cloudflare and Datadog were close, but weren’t in the top 10 for 100% of the days (they were in the top ten 99.6% and 99.2%, respectively)

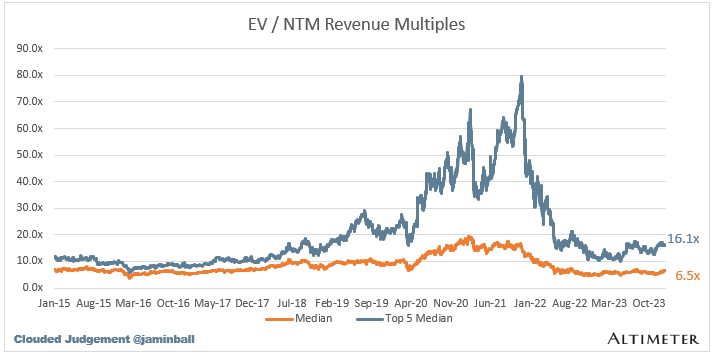

And below you can see who ended up in the top 10 at the end of 2022 and 2021. From the end of 2022, the highest multiple companies (ie the top 10) have seen ~50% multiple expansion (16.1x vs 10.7x)! And the overall basket has seen ~25% multiple expansion (6.5x vs 5.2x). If we rewind the clock back a few years and look at the year end top 10 for 2020, 2021, 2022 and now 2023, there are 4 companies that find themselves on every year end list: Snowflake, Cloudflare, Datadog, and Zscaler.

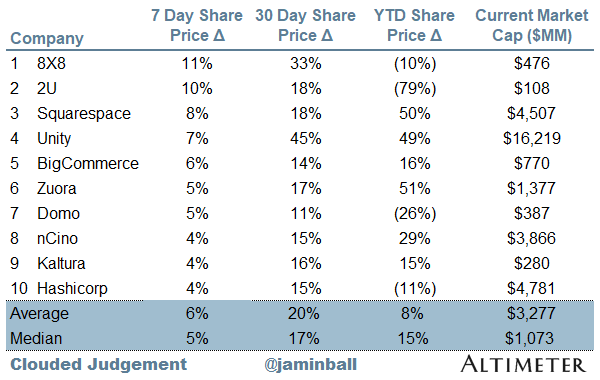

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue – in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt – cash) / NTM revenue.

Overall Stats:

-

Overall Median: 6.5x

-

Top 5 Median: 16.12x

-

10Y: 3.8%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

-

High Growth Median: 16.0x

-

Mid Growth Median: 9.1x

-

Low Growth Median: 4.3x

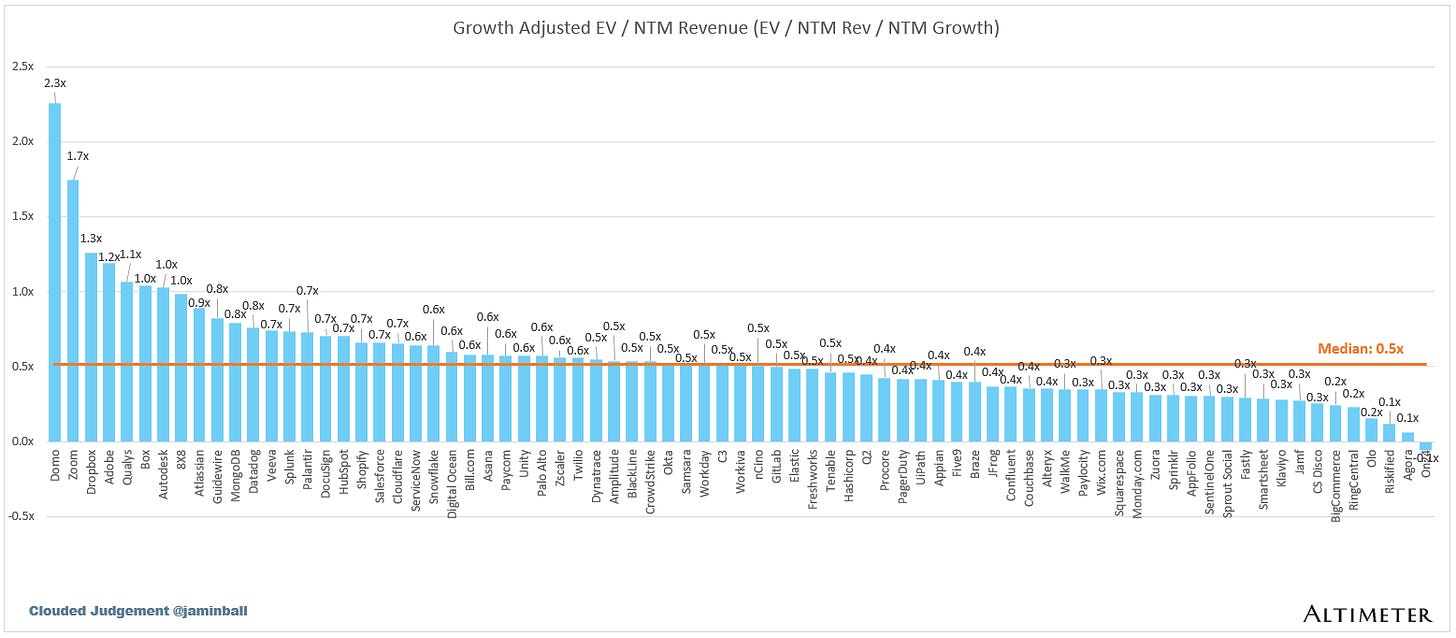

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

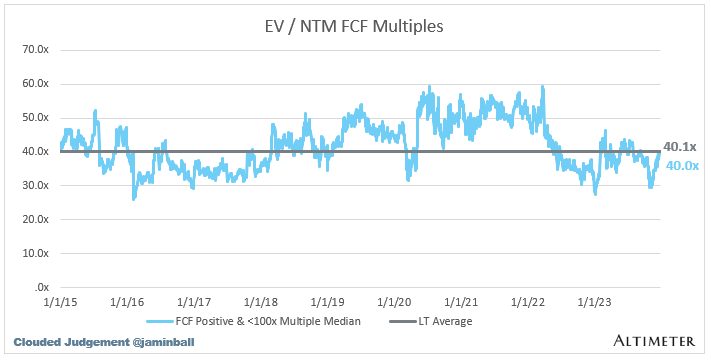

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

-

Median NTM growth rate: 14%

-

Median LTM growth rate: 20%

-

Median Gross Margin: 75%

-

Median Operating Margin (13%)

-

Median FCF Margin: 8%

-

Median Net Retention: 112%

-

Median CAC Payback: 39 months

-

Median S&M % Revenue: 43%

-

Median R&D % Revenue: 26%

-

Median G&A % Revenue: 17%

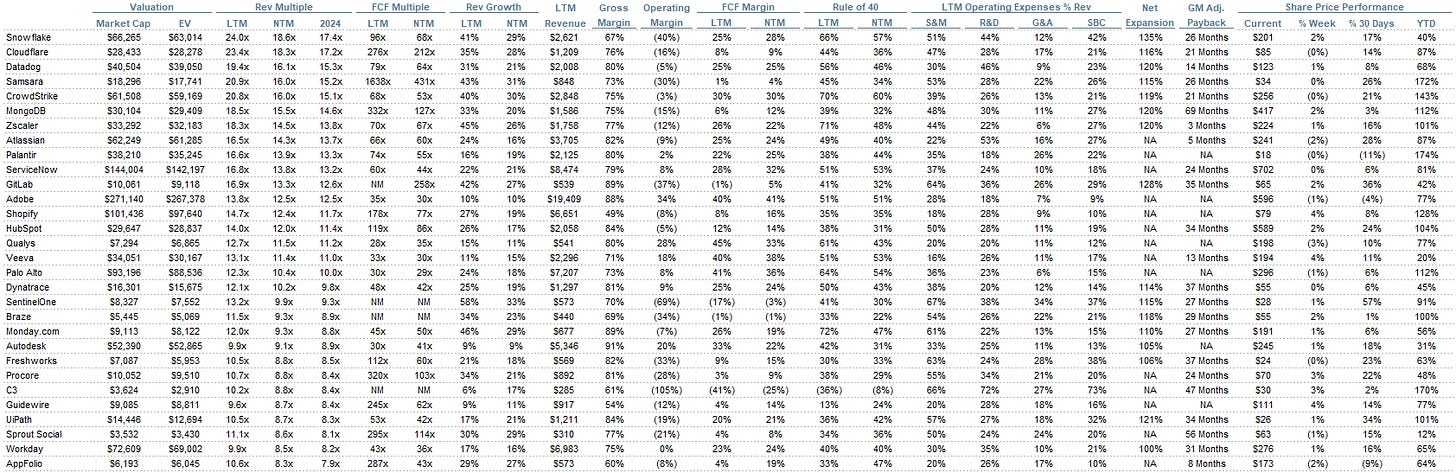

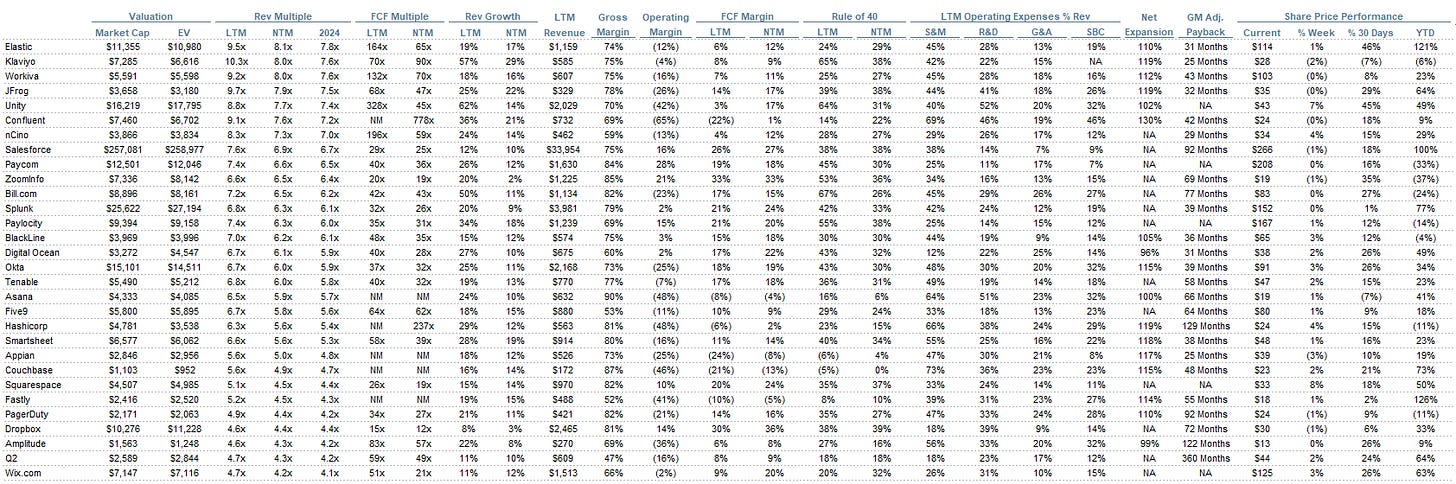

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations – Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP (“Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.