Davos, Despots, Demands

CLOSING BELL

Davos, Despots, Demands

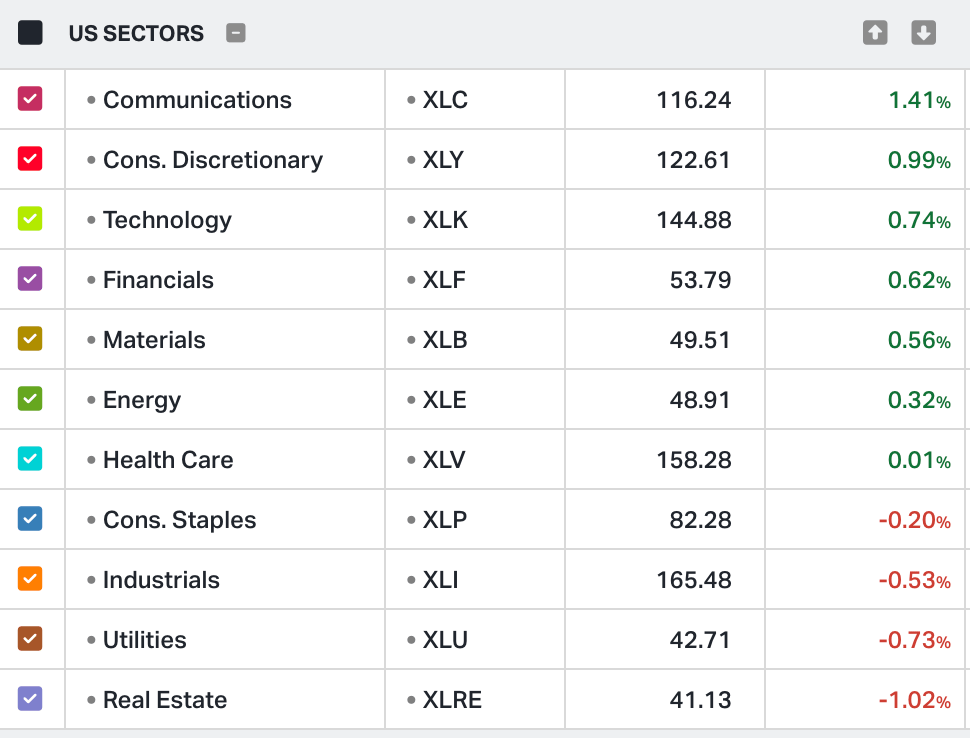

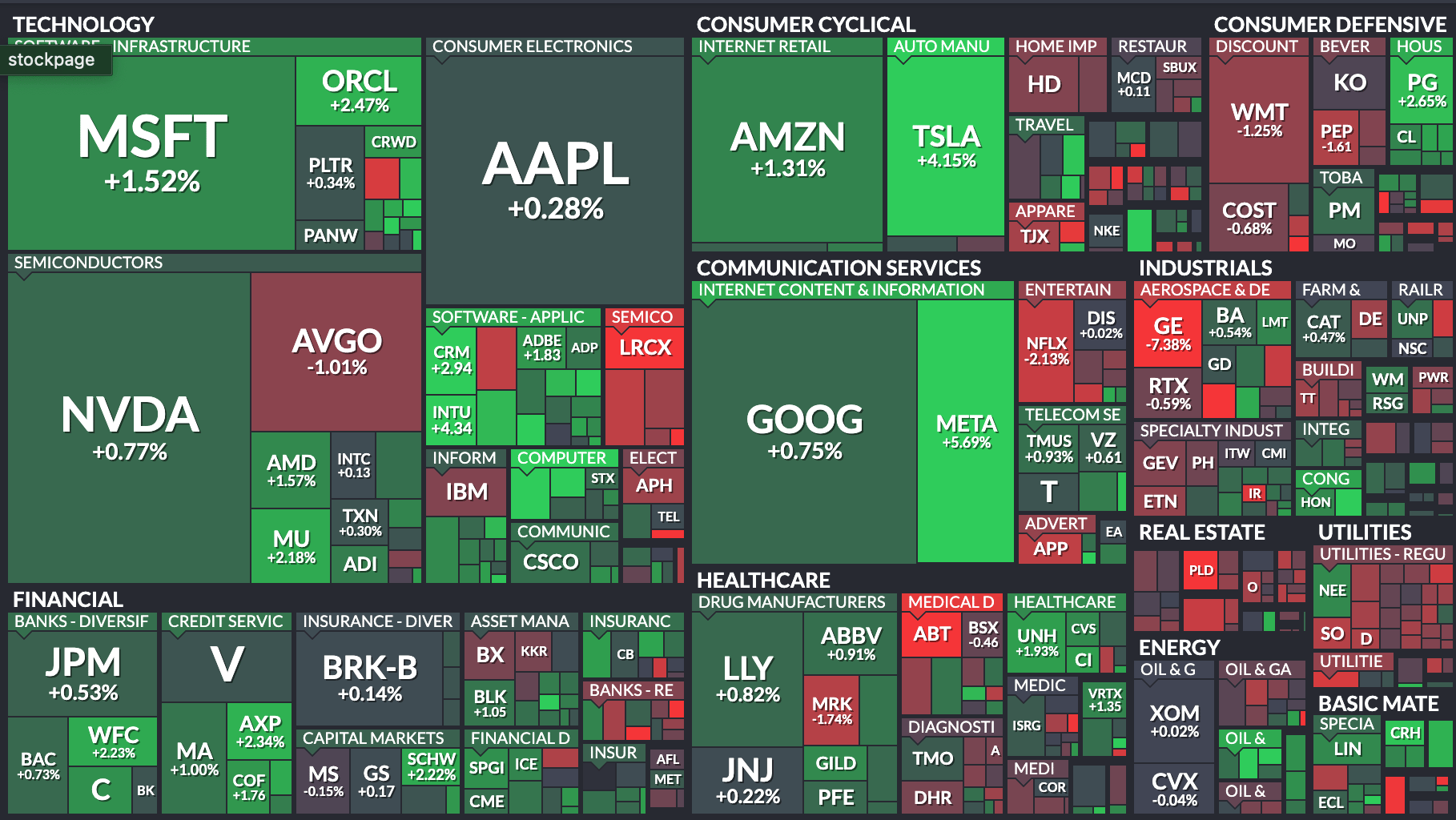

$SPY ( ▲ 0.52% ) $QQQ ( ▲ 0.73% ) $IWM ( ▲ 0.75% ) $DIA ( ▲ 0.59% )

Markets closed higher Thursday, a crucial day for ‘same as usual’ data. While earnings rolled in from heavy hitters across every sector, the private jet herd kept conferencing at Davos. Prices stayed green as more rumors about the Greenland framework worked their way to investors. Bloomberg reported the president and NATO Sec. Gen. Mark Rutte discussed stationing U.S. missiles and organizing mineral rights instead of threatening each other.

Greenland and Denmark said they hadn’t been at those talks, but Dutch Prime Minister Mette Frederiksen said she was open to more NATO and U.S. military bases in the far far north. After all, there are treaties going back to the 1950s that enable the U.S. to build defenses, but Uncle Sam has to ask first. The EU is now back on track to ratify a U.S. trade deal.

Back home, macro is still looking at inflation, hiring, and the layout of the FOMC this year. Q3 GDP was revised up to 4.4%, the strongest growth in two years, fueled by a surge in exports and AI business investment. While the labor market remains in a “low-hiring, low-firing” state with 200,000 weekly jobless claims, inflation remains stubbornly sticky, with the Fed’s preferred PCE gauge holding at 2.8% year-over-year. The BEA dropped the somewhat ‘stale’ Oct. and Nov. numbers, averaging out readings to make up for PCE data points delayed during the shutdown.

It looks like the chance of a rate cut, based on this hot running but immobile market, is slim to zilch next week.

In earnings, Intel rised to meet Q4 expectations but fell on the forward looking Q1 numbers. After a nearly 50%+ year so far, it’ll take some great numbers to keep the stock going, and the part Govt. owned chip maker said it has plenty of demand, but it can’t keep up with supply.

RIP: Intel’s Q1, Tiktok’s Chinese ownership, and more.

AFTER THE BELL

Chips and Cards and Future Tech 💾 💳️

Intel $INTC ( ▲ 0.13% ) was falling in late trading despite a non-GAAP EPS beat of $0.15 (vs. $0.08 estimate). While revenue of $13.7 billion slightly topped expectations, the market is punishing the stock for a weak Q1 2026 outlook, with projected revenue of $11.7B–$12.7B and a non-GAAP EPS of $0.00. Intel’s Q4 revenue declined 4% from last year, but still did better than expected.

CEO Lip-Bu Tan said that demand is strong, but internal execution was not up to standards yet: they could not meet expectations with supply. 💾

Investors are increasingly skeptical of the “January rally” as the company continues to navigate supply shortages and heavy losses in its foundry division. The market loves an underdog, and Intel has been running the underdog race for years, but optimism is sending its stock price higher while margins fall.

Intuitive Surgical $ISRG is the evening’s big winner, surging over 5% after blowing past expectations with an adjusted EPS of $2.53 (crushing the $2.27 consensus) and revenue of $2.87 billion. The rally is driven by a staggering 18% jump in worldwide procedures, signaling that hospital demand for the new da Vinci 5 systems is far outstripping the “moderated growth” fears that had recently weighed on the stock. 🤖

Capital One $COF ( ▲ 1.76% ) Shares fell 2.5% as the bank officially confirmed in its filing that it will acquire Brex’s rewards business for $5.15 billion. While the strategic move aims to capture higher-spending corporate clients, the high price tag combined with a cautious outlook on credit card interest rate caps is creating a “sell the news” reaction. 💳

SPONSORED

Global HR shouldn’t require five tools per country

Your company going global shouldn’t mean endless headaches. Deel’s free guide shows you how to unify payroll, onboarding, and compliance across every country you operate in. No more juggling separate systems for the US, Europe, and APAC. No more Slack messages filling gaps. Just one consolidated approach that scales.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MERGER NEWS

TikTok Deal Is Finally Closing 🤳

The long-awaited resolution to the TikTok saga has finally arrived, as the U.S. and China officially signed off on a spinoff deal to keep the app operating in America. The deal, which effectively ends years of national security disputes, is set to close this week, likely on Friday, January 23, 2026.

The TikTok US Spinoff Structure

-

Oracle: Takes a 15% stake and will serve as the “trusted technology provider,” hosting all U.S. user data and managing the “rebuilt” recommendation algorithm.

-

ByteDance: Retains a minority 19.9% stake but will have no control over U.S. operations, data protection, or content moderation.

-

The Investor Consortium: Silver Lake and Abu Dhabi-based MGX each take 15% stakes, with the remaining ownership split among existing ByteDance investors like Susquehanna, Dragoneer, and Michael Dell’s family office.

-

The Algorithm: In a major concession, Oracle will license and retrain the algorithm from scratch using exclusively U.S. data to ensure the feed is free from foreign influence.

-

Governance: The new entity, TikTok USDS Joint Venture LLC, will be governed by a seven-member board, a majority of whom must be American citizens. 🌍️

TRENDING STOCKS

Stocktwits Watchlist & Hot Stocks

-

$TMC ( ▲ 1.84% ) : Shares jumped as the company submitted a consolidated application to NOAA for deep-seabed mining permits in the Pacific. 🌊

-

$SXTP ( ▲ 152.0% ) : The stock skyrocketed over 150% after securing a distribution deal with Runway Health for its malaria-prevention drug, ARAKODA. 💊

-

$NAMM ( ▲ 83.63% ) : Momentum continues for this penny stock leader, which gained another 94% today on retail volume and gold mining expansion plans. ⛏️

-

$IBRX ( ▲ 6.07% ) : Engagement remains high as investors track final enrollment milestones for its pivotal QUILT-2.005 bladder cancer study. 📈

-

$CRML ( ▲ 20.89% ) : Trending heavily as one of the world’s largest rare-earth deposits, fueled by President Trump’s “Greenland” strategic resource push. 🇬🇱

-

$GME ( ▲ 6.69% ) : Retail interest remains white-hot after CEO Ryan Cohen’s open-market purchase of close to 1M shares. 🎮

-

$BTGO ( 0.0% ) : Recently IPO’d crypto infrastructure firm climbed today after its NYSE debut.

POPS & DROPS

Top Stocktwits News Stories 🗞️

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

EARLY BIRD

Thursday Pre-Market Highlights

GE Aerospace $GE ( ▼ 7.38% ) Shares are falling big time after a “beat-and-raise” quarter. Driven by a 24% surge in commercial engine services, the company also issued bullish 2026 guidance, projecting an adjusted EPS of $7.25 at the midpoint. ✈️

Freeport-McMoRan $FCX ( ▼ 2.86% ) : The mining giant delivered a strong beat with an adjusted EPS of $0.47 on $5.63 billion in revenue, far exceeding Wall Street’s expectations. ⛏️

Procter & Gamble $PG ( ▲ 2.65% ) reported a mixed quarter, beating on core EPS at $1.88 but slightly missing revenue targets at $22.21 billion. 🧼

Mobileye $MBLY ( ▼ 3.4% ) shares fell after reporting a significant earnings miss of $0.06 adjusted EPS, well below the $0.24 analyst consensus. 🚗

Links That Don’t Suck 🌐

📈 Want to learn proven strategies for picking top stocks? Join IBD’s free online workshop on 2/7*

🤑 Software sell-off sparked by AI sets stage for potential big year of M&A, investors say

🥇 Gold hovers near record highs as Goldman Sachs lifts year-end forecast to $5,400

💰️ Consumer spending remained strong during the holiday season despite elevated prices

👀 SpaceX lines up four Wall Street banks for potential IPO, FT reports

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: S&P Global PMI (Mfg + Services) (9:45 AM), Michigan Consumer Sentiment (10:00 AM), Baker Hughes Rig Count (1:00 PM). 📊

Pre-Market Earnings: $SLB, $ERIC, $BAH. ☀️

P.S. You can listen to all of these earnings calls on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋