Dow Runs To Start Tech+Fed Week

Presented by

CLOSING BELL

Dow Runs To Start Tech+Fed Week

The market climbed Monday, all eyes on tech reports to come, and the FOMC decision that already feels decided. Gold sold off as traders watched a cooling trade battle between China and the U.S., with groundwork laid over the weekend ahead of Thursday’s meeting between Presidents Xi and Trump.

Rare earths fell after news that Beijing would delay its export licensing plans while negotiations continue. Trump raised tariffs on Canada because he didn’t like a Canadian ad over the weekend.

Qualcomm was the hero of the day, announcing competitor AI chips with a 2027 launch date, sending the stock roaring.

After the bell, Nextera and Google made a splash with a new nuclear power plant deal out in Iowa, reviving an old power plant there that’s expected to turn on by 2029. 👀

Today’s RIP: Qualcomm said it’s making AI chips too, after the bell reports, tech week previews, and more. 📰

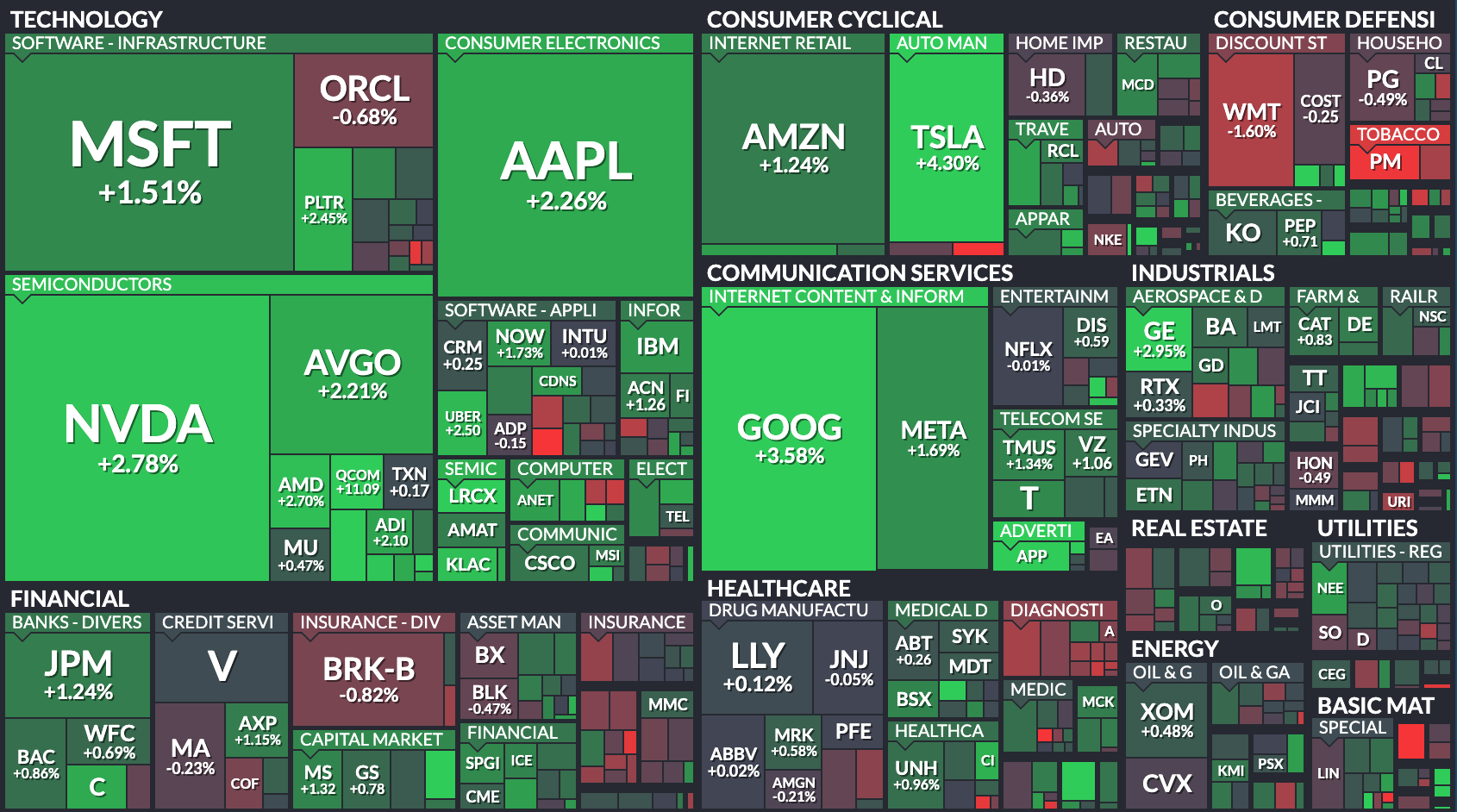

10 of 11 sectors closed green. Tech $XLK ( ▲ 1.85% ) lead and materials $XLB ( ▼ 0.05% ) lagged.

$SPY ( ▲ 1.18% ) $QQQ ( ▲ 1.78% ) $IWM ( ▲ 0.35% ) $DIA ( ▲ 0.67% )

AFTER THE BELL

Biggest Movers On After The Bell Results

A day of records as the S&P 500 closed above 6,800 for the first time ended with another round of earnings. If you want previews of stocks reporting tomorrow, skim down below, but stay here for some movers after the bell:

Confluent $CFLT ( ▼ 3.16% ) was climbing 9%, beating sales expectations, the b2b data streaming company showing a 19% bump in sales from last year to $298M. The stock was gaining despite a low next quarter revenue guidance, but traders did not seem to mind after hours.

Whirlpool $WHR ( ▲ 0.16% ) was falling slightly, the hot tub company pulling in sales in Q3 that beat estimates, up about 1% year over year to $4.03B. Operating margins fell to 5.1%, from 6.6%, and free cash flow fell $52M.

Avis Budget $CAR ( ▼ 1.17% ) was up 5%. The car rental company said revenue was up 1.1%, beating estiamtes at $3.52B. Profit climbed to $10.11/share, 27.9% higher than the street expected.

$BBBY ( ▲ 0.35% ) was slightly falling, but beat an estimated loss with a slightly smaller 19C/share loss. The company skipped reporting specific forward-looking guidance, and instead, Executive Marcus Lemonis said they expect Bed Bath & Beyond to turn revenue positive in 2026.

IN PARTNERSHIP WITH POLYMARKET

Trade the Outcome, Not Just the Stock Price.

Polymarket, the world’s largest prediction market, has rolled out Earnings Markets. You can now place a simple Yes/No trade on specific outcomes:

-

Will GOOGL beat EPS?

-

Will NVDA mention China?

Profit directly from your conviction on an earnings beat, regardless of the immediate stock movement.

Why trade Earnings Markets?

-

Simple: Clear Yes/No outcomes.

-

Focused: Isolate the specific event you care about.

-

Flexible: Tight control for entry, hedging, or exit strategy.

Upcoming markets include GOOGL, AMZN, MSFT, and more. Built for how traders actually trade.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TRENDING TODAY

AI Semiconductors Stealing the Show… Still 🧑🎤

Qualcomm rose was the fortunate son Monday after unveiling AI chips to rival AMD and Nvidia. Qualcomm, known for its mobile and ‘internet of things’ chipsets, is now planning new AI datacenter chipsets. With 72 of its incoming A1200 or A1250 chips in a server rack, Qualcom $QCOM ( ▲ 11.09% ) hopes to become a real player in the high-flying AI world.

85% of Qualcomm’s revenue comes from its QCT chip businesses, largely for smartphones, which brought in $30B last year. $ARM ( ▲ 4.65% ), the company that develops some of Qualcomm’s chips, climbed on the news. The first customer to use the new chips is a Saudi Arabian AI startup called Humain, according to Bloomberg. Even a small break into the $500B AI semiconductor market could make big changes to Qualcomm’s revenue structure, according to Bloomberg Intelligence analysts.

Qualcomm has been somewhat left behind in the AI semiconductor boom. Compared to the rest of the semiconductor world, Qualcomm was only gaining 10% this year, compared to a 40% climb in $SOX ( 0.0% ).

It wasn’t the only news in the Semi space. $AMD ( ▲ 2.67% ) was up again after its Friday Oracle news. AMD was up Monday after a team-up with the U.S. Energy Department to build supercomputers at the Oak Ridge National Laboratory in Tennessee. Tech companies like $HPE ( ▲ 2.89% ) and $ORCL ( ▼ 0.68% ) were also mentioned in the news, coming together under a $1B investment pile to advance nuclear and quantum tech. A real who’s who buzzword of a press release.

$GOOG ( ▲ 3.62% ) and its brother $GOOGL ( ▲ 3.6% ) were up, trending higher on Stocktwits before this week’s earnings report.

Strive $ASST ( ▲ 49.09% ) was up big time, climbing 46% after investing Mike Alfred said he bought 1M shares in a twitter post. Alfred is on the board of Iren, and is the previous CEO of Digital Assets Data.

The Vivek Ramswamy (remember him?) co-founded company entered public markets in September through a merger with Asset Entities, and publicly listed company Smeler Scientific $SMLR ( ▲ 31.22% ) with the goal of becoming a Bitcoin treasury company. It bought True North Inc. for an unlisted price, and as of September, holds about 10,000+ Bitcoins.

PARTNER MESSAGE

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors’ portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset’s no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞️

-

Cadence Bank rose 5% after Huntington $7.4B all-stock acquisition.

-

Beyond Meat plunged after Mizuho cut its price target.

-

Gold miners retreated as bullion slipped on U.S.-China trade progress.

-

Critical minerals stocks fell as U.S.-China trade deal optimism grew.

-

Albemarle fell 8.6% after selling majority stake in Ketjen to KPS.

-

Keurig Dr Pepper rose 7% after unveiling $7B financing for JDE Peet’s deal.

-

Dyne Therapeutics rose 40% after Novartis acquired rival Avidity.

-

Intellia Therapeutics fell 43% after pausing two late-stage trials.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PREVIEWS

Earnings Coming Tomorrow, Here’s What To Look For 🔍️

Sofi $SOFI ( ▲ 3.41% ) was climbing, trending before its report coming Tuesday. Here are Street estimates based according to Yahoo Finance for top names reporting Tuesday:

Sofi earnings per share: $0.08, representing 80% year-over-year growth. Revenue: $890.8 million, indicating a 29.2% year-over-year increase.

Visa Average EPS estimate: $2.97, based on a consensus of 29 analysts. Revenue average estimate: $10.62 billion, based on a consensus of 27 analysts.

JetBlue average EPS estimate is a loss of $0.42, based on the consensus of 14 analysts. Rev estimate: $2.32 billion, representing a 3.3% year-over-year decline.

Paypal average EPS estimate: $1.20. Average Revenue estimate: $8.23 billion.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: CB Consumer Confidence (10:00 AM), 7-Year Note Auction (1:00 PM), API Weekly Crude Oil Stock (4:30 PM) 📊

Pre-Market Earnings: PayPal Holdings ($PYPL), SoFi Techs ($SOFI), UnitedHealth Group ($UNH), Royal Caribbean Gr ($RCL), United Parcel Service ($UPS), and JetBlue Airways ($JBLU). 🛏️

After-Market Earnings: Visa ($V), ContextLogic ($LOGC), Enphase Energy ($ENPH), and Electronic Arts ($EA). 🌕️

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

📺️ Argentina’s Markets Surge as Milei Win Eases Fear of a Crisis

🎩 Fed expected to cut rates again, even as officials fly blind without data

😨 Amazon to announce largest layoffs in company history, source says

⛈️ Hurricane Melissa is now the strongest storm on the planet this year

🍔 Could halt in SNAP benefits, paychecks pressure lawmakers to strike shutdown deal?

Get In Touch 📬

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍