Great Year For Layoffs

CLOSING BELL

Great Year For Layoffs

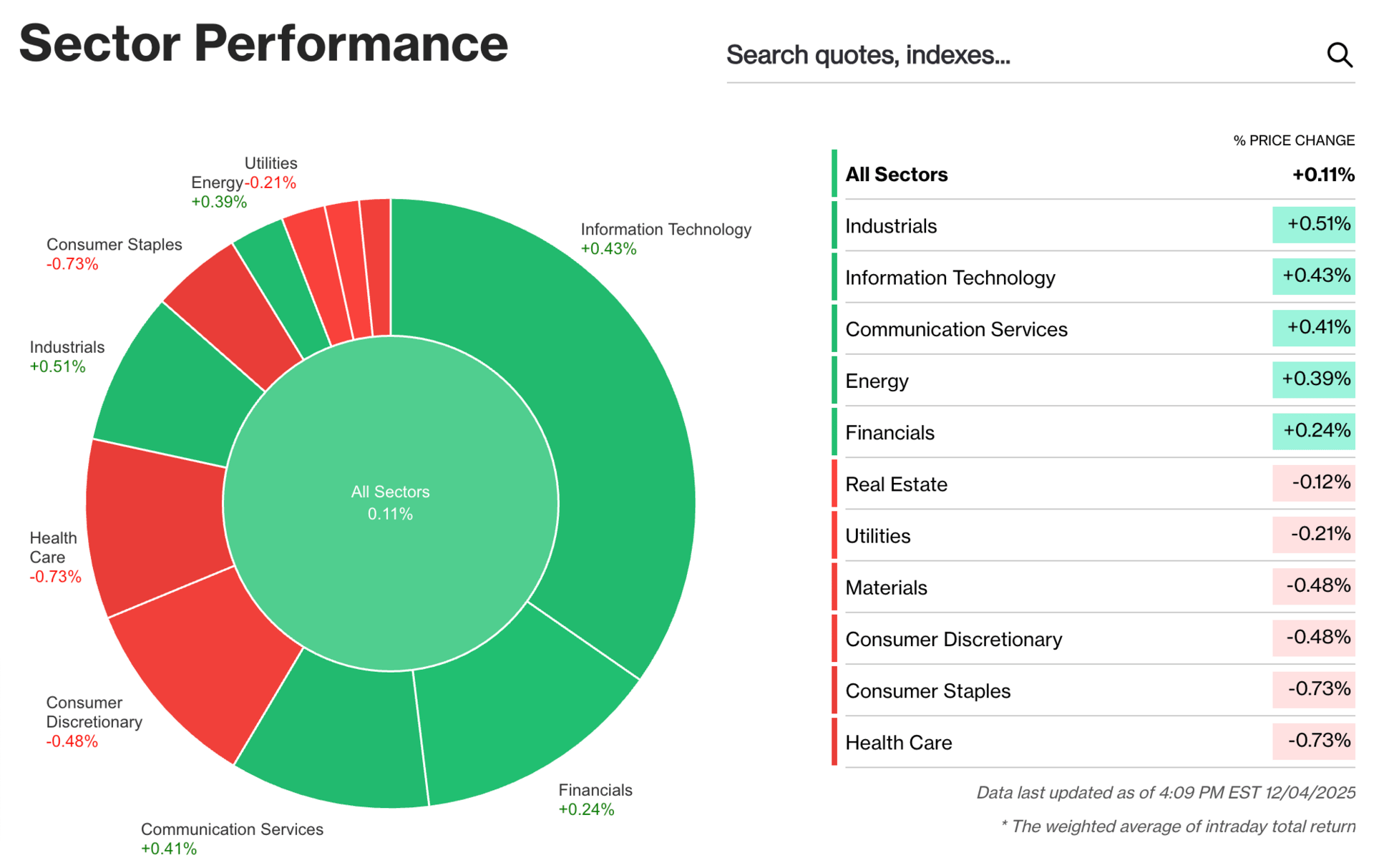

The market closed higher Thursday, but only barely. The S&P 500 came within 100 points of an all-time high, finally seeming to get November out of its system.

Prices were not rebounding for all the right reasons. The most recent labor market data on Thursday showed jobless claims were at a three-year low, matching the three-year ADP low net additions from Wednesday. A third report from a professional placement firm, Challenger Gray & Christmas, found November had the highest layoffs since 2022, at 71,231. 2025 has so far seen the most layoffs since the 2020 pandemic, the report said.

All eyes are on the Fed, but bond traders are increasingly showing concern Trump’s incoming pick, whether it be Kevin Hassett or otherwise, will cut too quickly (or not quickly enough, depending on your point of view). Tomorrow is the last macro release before the FOMC likely cuts rates, and it’s a three-month-old inflation report from September. 🥾

Bitcoin paired gains, treasury yields rose, and Meta stock climbed after Zuck chucked out spending plans for his failure of a metaverse. Turns out, no one wanted to live inside Ready Player One like Zuck thought back when he changed his company name and went full 3-D. People just wanted to stop quarantining. 👀

$SPY ( ▲ 0.1% ) $QQQ ( ▲ 0.32% ) $IWM ( ▼ 0.49% ) $DIA ( ▲ 0.14% )

STOCKS

🌕️ After-Market Earnings Show Mixed Results Across Sectors

ChargePoint Holdings Inc $CHPT ( ▲ 26.88% ) was climbing in the post market, the EV charging network operator reported a narrower than expected adjusted loss of $2.23/share, worse than the -$1.31 consensus estimate, but revenue came in at $105.67 million. Chief Rick Wilmer said it was a return to growth and expects up to $110M revenue in the coming quarter.

DocuSign $DOCU ( ▼ 6.65% ) was falling 6% in the post-market. The e-signature firm handily beat expectations, announcing adjusted earnings of $1 per share, topping the $0.91 consensus estimate. Revenue of $818M beat estimates too, but the forward-looking guidance was not enough for investors.

SentinelOne $S ( ▼ 12.02% ), the cybersecurity AI platform, was dropping 8% after hours. Its forecasts for revenue came in below estimates, and it announced its CFO was stepping down.

Ulta Beauty Inc $ULTA ( ▲ 14.09% ) crushed Wall Street’s expectations for its fiscal third quarter and significantly raised its full-year guidance, driven by strong consumer demand across all beauty categories.

In the pre-market, retail came in on top. Kroger Co. $KR ( ▲ 0.16% ) beat analyst estimates on profitability, reporting adjusted EPS of $1.05 per share, narrowly topping the $1.04 consensus estimate. Total sales were $33.9 billion, below estimates.

Dollar General Corp. $DG ( ▲ 6.09% ) significantly beat analyst expectations on profit, posting a diluted EPS of $1.28 per share, easily surpassing the $0.92 consensus estimate. Revenue of $10.65 billion also beat the $10.61 billion forecast, driven by a 2.5% increase in same-store sales and improved gross margins.

SPONSORED

Make Every Ad Dollar Work Harder

Great measurement is pointless if you don’t act on it.

BlueAlpha is the AI Action System for Marketing, built to turn noisy data into weekly, campaign-level moves your team can actually take. Not dashboards. Not stale reports. Actions.

Every week, BlueAlpha delivers transparent, trusted recommendations your team can approve in minutes. Reallocate. Scale. Cap. Pause. All backed by Bayesian MMMs, causal tests, and explainable AI from the team that built Tesla’s growth systems.

Brands like beehiiv, MUBI, and Klover, use BlueAlpha to cut waste, compound ROI, and grow faster.

See measurable lift in under a month. See how an action system changes everything.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MAJOR DEAL

Warner Bros Buyout Pitch Deals Are In ✅

It’s the second round of Warner Bros pitches, and all through the week, giant media conglomerates were stirring, and here’s a sneak peek:

Investors saw bids from Paramount Skydance, Comcast, and Netflix for WBD’s huge library of fan-favorite IPs like Harry Potter, Superman, and even Scooby-Doo.

The bidding war started when Paramount, fresh off an enormous merger of its own, finally approved by the deal supporting Trump Admin, made a bid for Warner Bros Discovery in September. WBD is planning to segment out its streaming service HBO Max from its cable and movie properties.

Doug Creutz, media analyst at TD Cowen, said David Ellison (to media what his dad Larry Ellison is to software) and the new leaders at $PSKY ( ▼ 7.39% ) knew they needed big franchises if they wanted to stay competitive in media. Paramount’s biggest icon is 63yo Tom Cruise in Mission Impossible, and the next best brand is Star Trek. Not exactly the universally known icons like Star Wars, Marvel, or Game of Thrones. (No offense Trekkies.)

This week was the second round of bidding, and Paramount wants the whole pie and is willing to pay $25/share, or around $62B, according to Media Play News. Netflix wants the streaming side of things and is still offering up a massive $70B+ bid. Comcast is after the same streaming + studios segment as Netflix, and could offer $27-$28/share for it. We’ll see which way the deal develops and watch for regulatory oversight that might affect the outcome. $WBD ( ▲ 2.14% ) is sitting at about $24 a share in the Post market Thursday.

Late Thursday, Paramount complained Netflix would be a hard sell with regulators, because it is a popular streaming service the world over.

IN PARTNERSHIP WITH

The Real AI Play? The Developers Who Own the Land and the Power

AI demand is overwhelming the electricity grid, and interconnection queues have become a multi-year choke point. Hyperscalers know it—which is why the real winners will be the developers who control both the land and the energy beneath it.

Meet New Era Energy & Digital (Nasdaq: NUAI). In one of the fastest-growing data-center corridors in the country, Permian-based NUAI is building powered land and powered shells with integrated natural-gas generation engineered for true speed-to-power.

Texas-born, raised, and based — $NUAI ( ▼ 5.31% ) is the power behind the next digital wave.

This advertisement is for informational purposes only. New Era Energy & Digital, Inc. accepts no responsibility for any actions or decisions made based on the information presented in this advertisement. Do Your Own Research (#DYOR).

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞️

-

UiPath stock surged 24% after reporting its first GAAP profitable Q3 and raising its full-year guidance.

-

Capricor Therapeutics‘s red-hot rally has Wall Street and retail hooked.

-

USAR stock gained 24% after its acquired unit struck a rare earth deal with Arnold Magnetic Technologies.

-

Tom Lee predicted Ethereum will outperform Bitcoin.

-

Waymo is now operating fully driverless vehicles in Houston and Dallas.

-

Goldman Sachs warned copper’s recent record run may fizzle, citing a lack of current supply-demand tightness.

-

C3.ai stock rose as the US government chose its agentic AI platform for a nationwide health data overhaul.

-

21Shares launched the first leveraged SUI ETF on Nasdaq after SEC approval.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Factory Orders (10:00 AM), Michigan Consumer Sentiment (10:00 AM), PCE Price Index (10:00 AM), Personal Spending (10:00 AM), Consumer Credit (3:00 PM).📊

Pre-Market Earnings: Imperial Petroleum Inc ($IMPP), MoneyHero Ltd ($MNY), and Victoria`s Secret & Co ($VSCO).🛏️

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

📈 This week, save over 80% on MarketSurge—get 2 months of unlimited access for only $59.95*

😨 Market Doubts Hassett Can Deliver at Fed, PGIM’s Peters Says

🚣 “Impermissible”: Congress fumes over Hegseth’s Venezuela strike secrecy

🎥 Bids for WBD are in. Here’s what Paramount, Comcast and Netflix could do with the assets

💋 A ‘K-shaped’ economy has investors on edge. BofA says it may hold up.

📺️ Meta has prioritized ‘novel utility’ of AI chatbots over Metaverse

👀 Suspect arrested in January 2021 D.C. pipe bomb case

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍