Hedge Funds Go Defensive; Lumida vs. Robinhood

Here’s a preview of what we’ll cover this week:

-

Macro: Walmart Stays Constructive On Economy; Trump Wants Tariffs

-

Markets: Midterm Risk; Software Is Value?; Antero Resources: The Energy Play; CLAUDE: Sovereign AI Is Here; Robinhood Ventures

-

Lumida Curations: White House Shifts to Section 122; AI as Your Life Operating System; Compute Is the Catalyst

Spotlight

I did a Lumida Non-consensus investing podcast this week, titled ‘Hedge Fund 13F Deep Dive’.

We discuss hedge funds’ latest moves, thematic rotation, and where the next opportunity lies.

You can watch the podcast here.

(The marketing team really needs to update that 10 years old photo of me, geez! 🙂

Is AI a Bubble?

We had Michael Parekh this week on our podcast to answer the hottest question of this decade — ‘Is AI a bubble?’.

Michael is one of my favorite analysts in the space. Glad to call him a friend.

We discuss the valuations of hyperscalers, the reality of future returns, and whether the expectations are overoptimistic.

Watch it here.

Why do most managers lag the S&P 500?

One word: trends.

Humans don’t buy stocks.

They buy stories.

AI.

3D printing.

Genomics.

Crypto.

A trend is ‘story diffusion’ over time.

Phase 1: Non-Consensus, Hated

Every major trend starts out uncomfortable.

In 2023, consensus said Nvidia was a bubble.

The S&P was headed for recession.

China was ‘uninvestable’.

Crypto was a ‘scam.’

Mag 7 stocks are a bubble.

That’s the early phase of a powerful move:

Low ownership. High skepticism.

Strong upside reflexivity.

Phase 2: Momentum

The story spreads. Price confirms the narrative.

More allocators pile in. Career risk flips.

You no longer look reckless owning it.

You look reckless not owning it.

That’s when diffusion accelerates.

Phase 3: Late Momentum

Everyone is in.

Valuation stops mattering.

Quality names detach from gravity.

Think of “can’t lose” stocks trading at 40–50x earnings.

The safety of the crowd feels rational.

Phase 4: Break

The trend rolls over.

At first, investors buy the dip — because that worked in Phase 2 and 3.

But this time it doesn’t.

They add.

They lever.

They rationalize.

Then comes recognition.

The story no longer explains the price action.

That’s when fear replaces comfort.

Most managers lag because they:

Underweight Phase 1 (too uncomfortable)

Chase Phase 3 (too comfortable)

Overstay Phase 4 (too hopeful)

Alpha lives in understanding where you are in the diffusion cycle.

Trends don’t end because the story sounds wrong.

They end because everyone already believes it.

Should You Buy The Dip?

The old guard of high beta is done.

Duolingo is down 60% in the last 6 months.

Robinhood is down 30% from the highs even as the S&P 500 is near record highs.

SoFi has hit its highs and it has also rolled over.

Bitcoin is well off the highs.

Palantir is not near highs.

Quantum stocks are toast.

The vast majority of crowd favorite names that worked in 2023 to 2024 are in a bear market.

Retail sentiment drove these stocks beyond their actual valuations, but reality is striking now.

These crowded stock holdings are drifting back to earth, and are taking investors’ portfolios with them.

The best performing ideas are those that are ignored and under-owned: oil field services, pharma stocks, midstream energy, select staples, and international, small cap value.

I see no reason why that trend won’t continue.

The under-performance of the QQQ vs the S&P and vs the Dow (in that order) is akin to a pinata getting smashed — the capital from the most crowded categories is flowing into its twin opposite.

The problem: retail investors made money in those categories, and now their instinct is to buy the dip because they feel they “know” the category.

Even worse, they are doing it with leverage. This means the losses are proliferated.

It is time to pivot to high-quality, value-oriented, cash generating assets – a theme we have been flagging since the start of 2026, and hedge fund filings second.

When to Buy the Dip?

Buying the dip has not worked recently. Our recent buy of Coupang and Software stocks are examples of that.

The market will always give you feedback… It’s important to listen to it. We have highly consistent processes. So, when we see that, we treat it as a form of signal.

I created a simple algorithm that helps us know when to Buy the Dip.

You can see it on this chart below.

Buying the dip strategy has absolutely crushed the S&P.

It works.

However, in corrections or bear markets, this strategy gets destroyed.

When the equity curve line is red, the strategy return under-performs the S&P.

When the equity curve line is green, the strategy return beats the S&P.

My thought is to use this as a Regime Indicator potentially in two ways:

(1) When the equity curve line is red, avoid or short high beta.

(2) When the equity curve line is green, own beta. Buy dips, run bull market strategies.

I haven’t really seen anyone talk about how to use backtests, and the performance of backtests, to give insight into the current market regime.

I think it makes a lot of sense…

…and you’re seeing a lot of accounts blow up that could have avoided that with this handy indicator.

Lastly, this is the type of strategy I want to bake into the Lumida Invest app.

Imagine having an AI that beats the S&P 500 in your pocket.

Still need to test it more, but quite promising isn’t it?

We are hiring a few more quants so we can stay on offense.?

Lumida is Scaling. Join Us Now And Own The Future Of Investing.

I have some exciting news to share.

Lumida is building the future of wealth management.

It’s time to move beyond Robinhood’s gamified “Trade, Trade, Trade” model.

It’s hurt investors and their own data shows it.

(See this tweet from James Chanos on Robinhood’s retail investors – they have barely gained despite S&P 500 producing double digits gains in last few years).

The way we look at it, apps like Robinhood, E*Trade, and WeBull are primarily geared to “reward” you for trading.

They make money on the backend, getting paid for order flow every time you make a move.

We are investors, and we only do well if you succeed.

Join our investor community and be part of our growth. We will launch an equity crowdfunding. This is the waitlist.

You’ll see our strong revenue growth (with third party audited financials) soon to follow.

Our strategy is to grow with our community. The community and social media has helped us grow. We’d like you, our valued community, to be a part of that as we seek to disrupt the trillion dollar wealth management industry.

AI Avatars are coming…

13F Analysis

13F filings came out this week. we have these automatically updated in the Lumida Invest app.

You can sort to see which manager performed the best or worst.

Our AI also scans all 13F holdings to look for a setup validated by the trader agent.

Our LLM agent also does a fundamental bull bear case.

So, all bases for informed investments are covered.

Consider testing the Lumida Invest app, sign up here.

Animal Spirits Are Being De-Risked

Back in Nov, when the S&P 500 sank from its then all-time high of 7,000, we wrote markets were moving towards quality and away from animal spirits.

The Q4 13F filings second the move.

We are seeing systematic de-risking in the “animal spirits” bucket.

Capital is rotating away from high-risk, hype-driven names and toward underowned, value-oriented sectors.

Renaissance Technologies is the clearest signal.

A few quarters ago, they were long animal spirits names such as Reddit, Palantir, Hims, GameStop.

These names traded on narrative velocity and retail participation.

That exposure has now been sold down.

Renaissance does not trade stories. It trades momentum.

When momentum works, they lean in. When it turns parabolic or starts fading, they exit without hesitation.

The same pattern shows up across other quantitative managers.

Quant firm Voloridge reduced Robinhood and SoFi.

Citadel cut exposure to MicroStrategy and Coinbase.

These hedge funds stepping away from animal spirits shows a broader de-risking taking place.

The funny thing is we’ve done the exact same thing – and we did it not know other sophisticated hedge funds were doing the same.

That makes us feel smart, I guess. We want to make sure we’re swimming in the same currents as the best hedge fund investors in the world. No, not Bill Ackman, I mean the quant funds!

It doesn’t mean they are always right – but, they usually are – and we should test our view of the world against theirs constantly.

The Dow outrunning the QQQ exemplifies this move away from animal spirits.

We have been moving away from Animal spirits and into quality stocks since last Nov, and it has paid back well.

Leaning Away From Mag 7

The 13F filings show a consistent pattern: hedge funds reduced exposure to the Mag 7 complex.

Meta was the most common exit.

Renaissance and Druck sold Meta completely. Two Sigma trimmed their Meta position.

Meta was a compelling story thanks to its advertising engine. However, the issue is capital intensity.

Meta’s capex has ramped materially to over $100B expected in 2026.

This elevated capex means Meta is burning cash today for a possible return in the future.

Markets don’t like sitting through these periods of uncertainty, and this is why the stock continues to under perform.

We also exited our position in Meta in the week after earnings.

Google also saw cuts – Multiple hedge funds, including Renaissance, and Paul Tudor, trimmed their positions.

Over the past year, Google moved from trading near 20x forward earnings to closer to 30x. That re-rating was driven by a shift from “lagging in AI” to “AI leadership.”

At 30x forward earnings, the debate changes.

Investors are no longer only paying for a cash-flow compounder trading at a reasonable valuation.

They are paying for future AI monetization (which the market is discounting heavily now).

More and more, these Mag 7 companies are transitioning from cashflow rich, capital light models to debt heavy and capex intensive models with the prospect of heightened regulation from state, federal, and EU.

Mag 7 names are starting to look like utility companies.

Take a look at this chart.

The days of $1 Tn in S&P buybacks fuelled by the hyperscalars are behind us.

It’s important to recognize these shifts quickly, as they happen, rather than wait to respond.

This heavy spending might eventually cause the returns to shrink.

We aren’t buyers of capex payers here (although we have a tactical weight on Amazon).

Surprisingly, despite it being on the other side of capex spend, Nvidia also saw outflows.

We are also of the view that Capex Receivers may be at risk as well.

The Blue Owl news means financing for Datacenters in the debt market is drying up.

Capex payers, like OpenAI and Anthropic, have a capital markets dependancy.

It’s inevitable that datacenter slowdown will impact capex receivers.

Besides, aren’t capex receivers also a crowded concept?

Hedge Funds are going for Dividend and Defensives

The rotation away from crowded growth has not gone into cash.

It has gone into cash generators.

The 13Fs show hedge funds moving up the quality curve and into cash-flow certainty.

Dividend payers and defensives keep showing up as incremental adds.

Point72 added utilities exposure, including names like Ameren (AEE) and Black Hills (BKH).

Voloridge added AT&T (T) and reduced exposure to higher beta financial-technology names.

Overall, across the quant cohort, we keep seeing the same preference: higher quality businesses, more dividend support, less sensitivity to risk appetite.

We flagged this shift last week on how dividend paying stocks were outperforming the markets, while non-dividend stocks were lagging.

The 13Fs confirmed the move.

Utilities sit at the intersection of defensives and dividends.

They offer yield support, earnings visibility, and benefit from structural AI demand. And, Hedge funds noticed this.

Most hedge funds bought utility names during Q4.

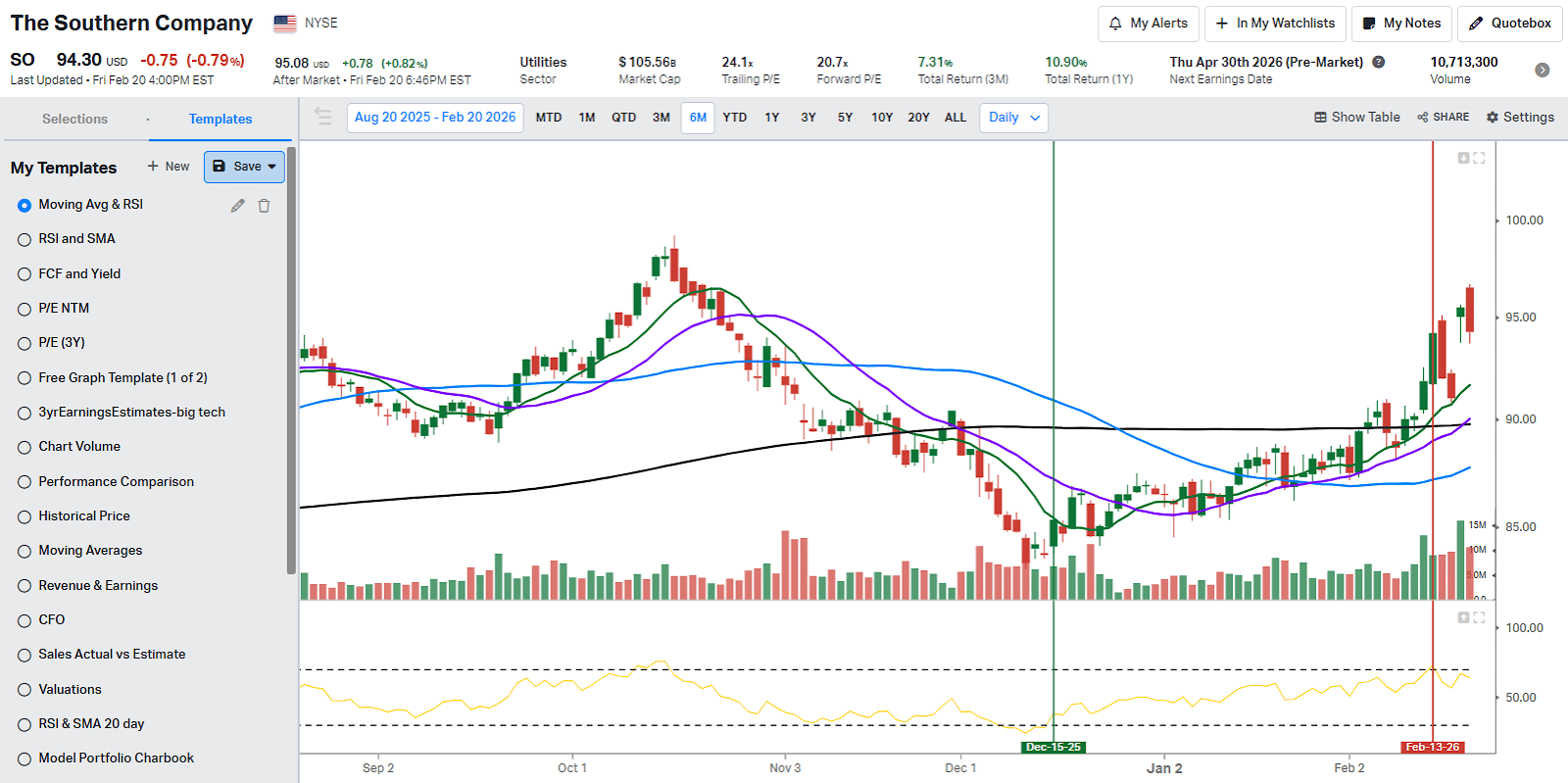

Southern Energy is one of our picks in utilities – we bought it at lows in Dec.

Southern energy is a leading utility provider based in the Southeastern United States, serving approximately 9 million customers.

They have a growing natural gas distribution segment, and are strategically positioned to benefit from rising energy demands, particularly due to investments in data centers.

Southern Company reported an impressive 11% YoY growth in electric sales to data centers in the latest quarter.

They have a robust pipeline of industrial projects totaling over 50 gigawatts.

Dan Tucker, CFO, stated, “Data centers are a focal point of our growth strategy, indicating strong future electricity consumption.”

Southern Energy also has an attract dividend yield of 3.4% which is higher than the industry average.

We sold SO after the rally on Feb 13, taking the gains. The stock continued its move upwards post our sale. We highlighted in green and red vertical lines below so you can see our buy and sell point for education purposes.

However, the technicals don’t look compelling right now for a re-entry.

Both Staples and Utlities have run-up quite a bit on increased anxiety in the market.

Macro

Walmart Stays Constructive On Economy

Walmart reported earnings this week with revenue up 4.9% (constant currency) and adjusted operating income up 10.5%.

Management’s tone was constructive on demand, with the key message that consumers are spending.

John Furner (CEO) said “spending continues to be resilient.”

Walmart sits at the center of everyday spend. When they describe resilience, it reflects real basket behavior.

Higher-income households are driving the demand.

Furner: “the majority of our share gains came from households making more than $100,000.”

Lower-income stress is present, but it has not broken demand.

Furner: “For households earning below $50,000… wallets are stretched… paycheck to paycheck.”

That is a real pressure point.

But it coexists with continued purchasing activity.

This supports a “two-speed” consumer: higher-income remains healthy; lower-income remains constrained; aggregate spend holds up.

Disinflation is a tailwind.

John David Rainey (CFO) said like-for-like inflation is running “a little bit above 1%.”

That helps real purchasing power. It also reduces the probability of a broad demand shock.

The consumer does not need wage acceleration to keep spending if inflation stays contained.

Management’s macro posture remained constructive with optimism reflected in guidance.

Rainey: “we are… constructive on the economy.”

They have guided towards 4% midpoint growth in revenues, and 7% in EPS.

Walmart earnings confirm our thesis on a stable and growing economy.

As a stock investment, we would still avoid Walmart. It trades at a P/E NTM of 45.1x and a PEG over 3.5.

Investors’ recent defensive positioning drove a rally in the stock, but we believe it is overpriced. And, we have better opportunities.

Trump Wants Tariffs

On Friday, the Supreme Court struck down Trump’s tariffs, stating he overstepped his power.

Trump did exactly what markets expected him to do.

He reinstated a blanket 10% global tariff as the replacement. Then he upped that to 15%.

If a U.S. importer was paying ~20% to bring goods out of a country and now pays 10%, that is a direct margin release.

Importers can take it as profit, or pass it through as price cuts to defend unit volumes.

Either way, demand elasticity improves when the tariff wedge shrinks.

Vietnam is a spotlight.

They export over ~$143B, 30% of their GDP to the USA (their largest export country).

Most of the exports are consumer items and electronics. So, the price sensitivity is usually high.

Lower tariffs improves relative competitiveness for Vietnamese products in US markets.

It also makes Vietnamese products more lucrative for importers, since lower tariffs give more headroom for pricing flexibility and profits.

If this tariff reset holds, we believe Vietnam is poised to do good here.

Markets

Midterm Election Risk

2026 is a midterm election year.

History says volatility rises and returns compress during these years.

Also, we believe the botched handling of the Epstein files creates material risk that Trump will lose the mid-terms.

Trump is directly linked to many themes – AI, nuclear, rare earth materials, space, crypto, energy, financial deregulation, and more. An unwind of the ‘Trump Bump’ should cause volatility as we get closer to the summer.

Since 1945, the S&P 500 has averaged roughly +9.3% annually.

In midterm years, that drops to about +3%.

More important than the average return is the path.

Midterm years also have a higher likeliness for a sharp drawdown in first half of the year.

The average peak to drawdown in midterm years is roughly -17% compared to ~13.7% in regular years.

Half of the 20%+ intra-year drawdowns since 1945 occurred in midterm years.

We are seeing a similar tape play out this year.

SPY has traded in its narrowest range since 1966, and has practically stayed in the same 6,900 region for the last four months.

However, within the index, we are seeing rotation from high growth sectors to value and cash oriented companies.

This shows investors are positioning defensively.

We have been making a similar move in our portfolio by adding bond proxies.

CMCSA is an example. We wrote about it back in Dec, and the stock has rallied nicely from its lows.

We have been taking the gains, and exiting a chunk of our position after the ~35% move.

But, we still think it has legs as it ties to various factors that are doing well.

You can read our thesis here.

Software Is Value?

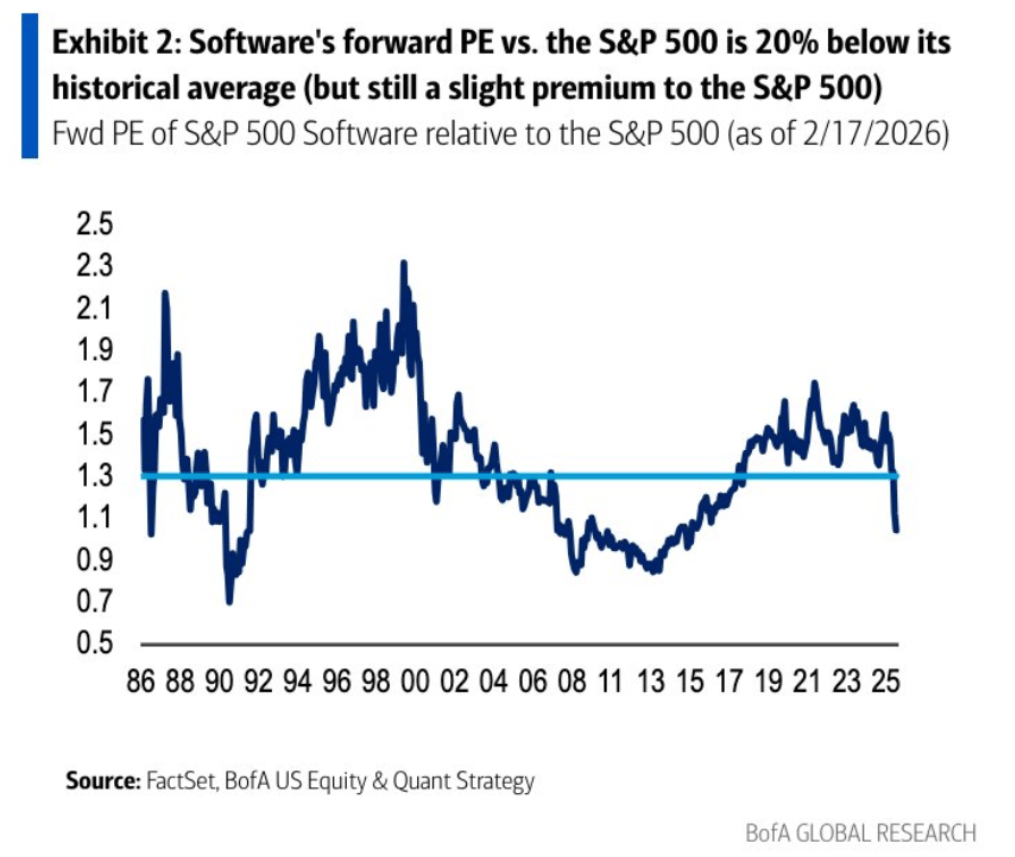

Software’s forward P/E relative to the S&P 500 is now ~20% below its historical average premium.

IGV now trades at a lower forward multiple than consumer discretionary and roughly in line with industrials.

We are seeing the worst of the AI scare priced into software.

The IGV ETF has lost roughly ~35% of valuation premium over the last year.

Multiples have compressed hard, but earnings haven’t.

Q4 software earnings have kept pace with expectations, and broadly, we saw no signs of fundamental deterioration.

That said, the “AI Apocalype” is still in motion. It has spread to cybersecurity stocks, a subset of SaaS, and hurt names like Crowdstrike and Palo Alto Networks. (We were short both going into earnings and remain short as a partial hedge against our other software longs which sport cheaper valuations and farther along the bubble decompression.)

It’s also true that the AI Apocalypse story is not real.

The market priced in an “AI apocalypse” scenario: legacy software disrupted overnight, customers canceling contracts, entire categories obsoleted.

That framing misunderstands enterprise software.

AI implementation is not flipping a switch.

Large companies run embedded workflows across CRM, ERP, HR, finance, logistics, and compliance systems.

Replacing that infrastructure requires retraining users, migrating data, rebuilding integrations, and reconfiguring internal controls.

That creates inertia.

Users have switching costs not just in dollars, but in learning curves and operational risk. Enterprises do not rip out mission-critical systems because a new AI model demos well.

AI will get implemented. But it will likely be integrated into existing platforms rather than replacing them wholesale.

We are already seeing this.

Software providers are embedding AI inside their primary offerings.

AI becomes a feature enhancement: better pricing, automation, productivity gains, cost reduction.

The provider improves ARPU and stickiness rather than losing customers.

That dynamic supports incumbents more than the market initially assumed.

We discussed Hubspot’s earnings in our last newsletter, and they tell us exactly what happens to software after SAAS. Read here.

This is what makes markets complex.

As my friend and hedge fund manager Neal Berger says, “Would you rather be right or rather be rich?”.

I believe the AI Apocalypse story is wrong… but, I’m not going to back up the truck here until I see the market start to shift.

Antero Resources: The Energy Play

The 13Fs show hedge funds are reallocating toward energy exposure, with a clear bias toward cash-flowing U.S. domestic barrels.

Hedge funds are positioning for a power-constrained economy where AI, and LNG exports act as structural demand drivers.

Antero resources was a popular feature across the 13Fs.

We also bought it recently, alongside AQR, Point72, Paul Tudor and other hedge funds.

AR is a U.S. Oil + natural gas producer in Appalachia (Marcellus/Utica) with leverage to LNG and power demand.

The setup is simple: the market wants free cash flow, inventory quality, and cost discipline — and it wants it at a reasonable multiple.

AR screens that way.

At ~10.9x forward P/E, AR is priced like a commodity stock.

But, LNG exports and data centers are acting as credible growth levers to drive sharp demand for years to come.

The company generated >$750M of free cash flow in 2025, used it to reduce debt by ~$300M, and still repurchased ~$136M of stock (2% of MCap).

The fundamental business is also solid.

Revenues grew 20% in Q4 with improvements in production, and better oil prices.

EBIT also increased 4x from last year, indicating the operating leverage.

Management guides an increase in production from 3.4 Bcfe/d in 2025 to about 4.1 Bcfe/d in 2026, with optional growth toward 4.5 Bcfe/d in 2027.

It will support strong capital efficiency and margin expansion.

AR has also hedged ~50% of 2026 volumes at reasonably higher price, which reduces left-tail risk while keeping upside if gas tightens.

They also extended their runway via the HG Energy acquisition (adding ~385k net acres and 400+ drilling locations), which is how you compound inventory without blowing up the balance sheet.

The risk is similar to other energy producers. If oil prices decrease sharply, it might hurt revenues and earnings.

Execution of HG energy also needs to be on point to ensure cost synergies are realized.

However, at a ~10x P/E multiple, most of the risk is already priced in.

Technically, we believe this is in a bull market. Wait for a good entry, don’t think it’s this Monday or Tuesday.

Typically there is equity index weakness immediately after quarterly options expiration that lasts about 2 days or so.

CLAUDE: Sovereign AI Is Here

The WSJ reports that the Pentagon Used Anthropic’s Claude to arrest Maduro.

LLMs are moving from ‘enterprise SaaS’ to statecraft.

Consider that Pete Hegseth wants to increase Defense spending by 50% to $1.5 Tn.

How much of this is going towards AI?

The single most important datapoint to underwrite datacenter capex is this:

What % of the backlog and future demand is represented by the U.S. Government?

Whichever sovereign achieves “omniscient and omnipresent” battlefield awareness has an extraordinary competitive advantage.

The Department of Defense is price insensitive.

They can afford to pay for a massive capex build out as compared to more frugal S&P 500 CFOs.

Note: The FY 2026 Pentagon budget has ~$14 Bn ear marked for AI spending.

That’s not a big number.

But, that number doesn’t include classified line items.

And, the Pentagon still can’t account for a trillion dollars in spending on failed audit tests.

A lot of this ‘Is Datacenter Capex a bubble?’ question rides on how much of the $1 Tn revenue projections is linked to the U.S. government.

This might be the single most important question to underwrite ‘Is AI a bubble?’

Robinhood Ventures

1) Databricks is SaaS. Its private mark is absurdly high vs public comps.

I passed on Databricks multiple times.

2) They are offering Ramp.

Ramp’s competitor, Brex, was just bought at $5 Bn by Capital One. That’s 50% lower than their price in 2021.

These are direct comps. Ramp will have the same issue.

3) Stripe just raised at $130 Bn

But, every payments company in the world is in a bear market – including darlings like Adyen.

4) Robinhood’s first pre-IPO deal Figma is down 80%

Contrast this to Lumida

1) Our first deal Coreweave is up multiples

Everyone made money.

2) Another deal, Brad Jacobs QXO, also made money

3) We are investing in Defense Tech – front-running the Pentagon…

Fundamentally, the difference is this:

Robinhood is a broker. They are pushing products.

We are investors. We want to make money.

Lumida Curations

White House Shifts to Section 122

After the Supreme Court blocked Trump’s reciprocal tariffs under IEEPA, the administration is pivoting to Section 122 authority to impose a 10% global tariff—aiming to offset lost revenue and keep 2026 tariff collections largely intact.

AI as Your Life Operating System

Alexandr Wang describes personal super intelligence as an AI extension of you—understanding your goals, tracking progress, and proactively managing health, work, and daily tasks so you can focus on what matters most.

Compute Is the Catalyst

AI training compute has grown nearly a trillion-fold in 15 years—with another ~1000x expected soon—driving models that already outperform most humans at coding and accelerating the redefinition of machine intelligence.

Meme

Not Subscribed Yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X | Lumida Health | Lumida Tax

As Featured In

Disclaimer: Lumida Wealth Management LLC (‘Lumida”) is located in New York, NY, and is an SEC registered investment adviser. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Lumida only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. Any direct communication by Lumida with a prospective client will be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

The information in this material has been obtained from sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated in this material are accurate and that the forecasts, opinions and expectations contained herein are fair and reasonable, Lumida, Inc. and Lumida Wealth Management LLC (collectively Lumida) make no representations or warranties whatsoever the completeness or accuracy of the material provided, except with respect to any disclosures relative to Lumida. Accordingly, no reliance should be placed on the accuracy, fairness or completeness of the information contained in this material. Any data discrepancies in this material could be the result of different calculations and/or adjustments. Lumida accepts no liability whatsoever for any loss arising from any use of this material or its contents, and neither Lumida nor any of its respective directors, officers or employees, shall be in any way responsible for the contents hereof, apart from the liabilities and responsibilities that may be imposed on them by the relevant regulatory authority in the jurisdiction in question, or the regulatory regime thereunder. Opinions,forecasts or projections contained in this material represent Lumida’s current opinions or judgment as of the day of the material only and are therefore subject to change without notice. Periodic updates may be provided on companies/industries based on company-specific developments or announcements, market conditions or any other publicly available information. There can be no assurance that future results or events will be consistent with any such opinions, forecasts or projections, which represent only one possible outcome. Furthermore, such opinions, forecasts or projections are subject to certain risks, uncertainties and assumptions that have not been verified, and future actual results or events could differ materially. The value of, or income from, any investments referred to in this material may fluctuate and/or be affected by changes in exchange rates. All pricing is indicative as of the close of market for the securities discussed, unless otherwise stated. Past performance is not indicative of future results. Accordingly, investors may receive back less than originally invested. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this material must make their own independent decisions regarding any securities or financial instruments mentioned herein and should seek advice from such independent financial, legal, tax or other adviser as they deem necessary. Lumida may trade as a principal on the basis of its views and research, and it may also engage in transactions for its own account or for its clients’ accounts in a manner inconsistent with the views taken in this material, and Lumida is under no obligation to ensure that such other communication is brought to the attention of any recipient of this material. Others within Lumida may take views that are inconsistent with those taken in this material. Employees of Lumida not involved in the preparation of this material may have investments in the financial instruments or securities (or derivatives of such financial instruments or securities) mentioned in this material and may trade them in ways different from those discussed in this material. This material is not an advertisement for or marketing of any issuer, its products or services, or its securities in any jurisdiction.