How Much Is Too Much

Presented by

CLOSING BELL

How Much Is Too Much

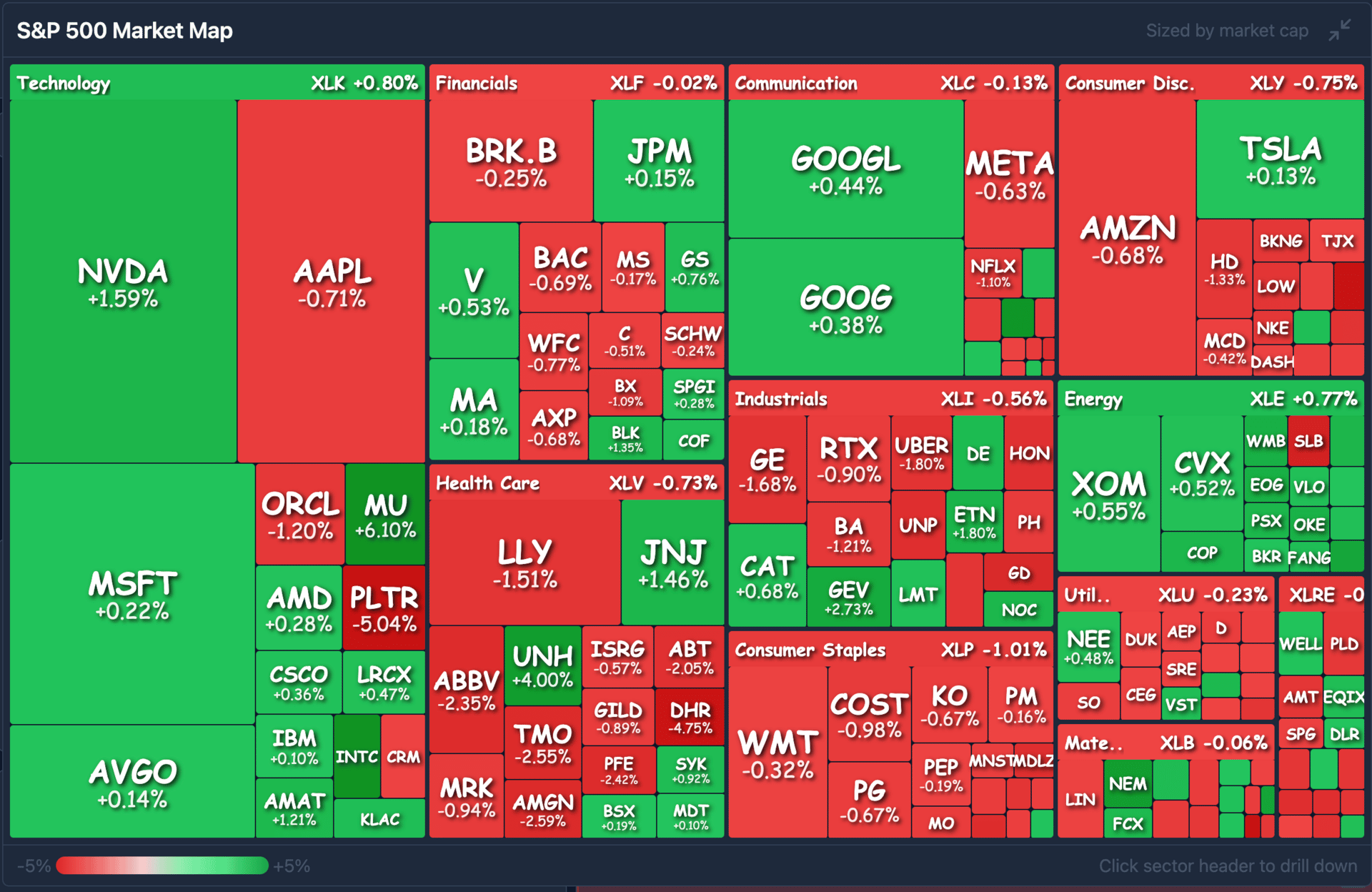

Happy Wednesday, the Fed kept rates in place, as everyone expected, and the market shrugged. Already at record highs, prices will only change watching earnings and AI infrastructure deals, and for the most part the first ofthe Mag 7 did their part to keep the report beats rolling.

It was the first no-change FOMC meeting since the summer, Gold and Silver both climbing to fresh highs: even Bitcoin was up on the news that rates are not going anywhere. Gold hit its best single day since March 2009. That month marked the Great Recession bottom in stock prices. 🤔

Stocks were overall not changing drastically after the S&P 500 and Nasdaq hit records to start the day. ARML reported a record surge in chip-making machine orders, but the stock fell as the market priced in the ‘yet another semi stock saying it broke records again’ tune. The market viciously pulled apart the first of the Mag 7 reports after the bell, for any scrap of operating margin gain, and punished even a smidgen of loss.

New table because no one liked my small graphic:

|

Index |

Ticker |

Level |

Daily |

Weekly |

|---|---|---|---|---|

|

S&P 500 |

$SPY |

695.42 |

🔴 -0.01% |

🔴 -0.01% |

|

Nasdaq 100 |

$QQQ |

633.22 |

🟢 +0.33% |

🟢 +0.26% |

|

Russell 2000 |

$IWM |

263.30 |

🔴 -0.54% |

🔴 -0.43% |

|

Dow |

$DIA |

490.13 |

🟢 +0.01% |

🟢 +0.01% |

|

Bitcoin |

$BTC |

89,108 |

🟢 +0.00% |

🟢 +0.00% |

|

Technology |

$XLK |

149.23 |

🟢 +0.80% |

🟢 +0.64% |

|

Consumer Staples |

$XLP |

82.32 |

🔴 -1.01% |

🔴 -0.81% |

AFTER THE BELL

Two Bangs and a Miss: Big Three Start Mag 7’s Reporting Season 💪

🚗 Tesla $TSLA ( ▼ 0.39% ) Margin Pressure Overshadows Delivery Miss

Tesla reported its first annual revenue decline ever, sales falling for three out of four quarters in the past year, and a 30% drop in Q4 revenue to $24.9B. Still, the company is looking toward the future, and said it was halting production on the Model S and Model X to use the California factory space to start building robots. 🤖

Tesla also said it would invest $2B in Chief Musk’s XAI startup. The stock was up about 1.5% after hours. Musk said he still expects to build a cyber cab company, with a two seat autonomous flagship coming in April.

-

The Numbers: Reported an increase in Gross Margin to 20.1%.

-

The Catalyst: Volume weakness stems from cooling EV demand and increased competition in the Chinese market, leading to inventory digestion.

-

The Outlook: Guidance remains cautious for the first half of 2026 as the company pivots toward its next-gen platform and AI integration.

📱 Meta $META ( ▲ 9.35% ) Efficiency Gains vs. Massive AI Capex Ramp

Meta showed a resounding Q4 beat Wednesday, with stronger-than-expected sales guidance to look forward to. Investors are weighing a potential earnings beat against a staggering 2026 AI capital expenditure forecast.

-

The Numbers: Revenue growth of 22% year-over-year fueled by high ad-tier conversion and Reels monetization.

-

The Catalyst: Operating leverage is improving, but the market is fixated on the more than $130 billion AI spending guide for infrastructure. 😟

In 2025, Meta spent half as much. -

The Outlook: Forward guidance hinges on the ability to prove that Llama integration is driving tangible top-line growth to offset the massive capex.

💻 Microsoft $MSFT ( ▲ 0.22% ) Azure Scaling to Justify $99B Spend

Microsoft rounded out the big three with a resounding miss. Well, the software and OpenAI owning giant beat all expectations, but that included the capital expenditures estimate. MSFT sees a light operating margin because it’s spending nearly $40B a quarter on AI.

The narrative centers on whether cloud growth can keep pace with an unprecedented investment in AI infrastructure. It looks like growth in margins ticked down, and so did the stock, falling 7% in the post-market.

-

The Numbers: Azure revenue grew 39%, compared to the past quarter’s 40% growth.

-

The Outlook: Guidance suggests continued double-digit growth, but the “tape” is sensitive to any deceleration in AI-driven cloud contributions.

SPONSORED BY iHERB

The Logistics of Longevity

In the world of investing, asset management is key. The same rules apply to your health.

While general marketplaces rely on unverified third-party sellers, iHerb – the specialty store for health and wellness – treats its inventory differently. We buy directly from manufacturers and store every product in temperature-controlled fulfillment centers to ensure potency and authenticity.

Now, that standard is scaling up: iHerb has officially acquired Vitacost, uniting two respected, industry titans to dominate the global wellness market.

Always Authentic: Direct sourcing, no mystery resellers.

Fully Transparent: Expiration dates listed on every page.

Global Reach: Serving 180 countries.

Don’t settle for mystery supplements. Invest in a source you can trust.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

🏦 Federal Reserve Says ‘No Change’, Powell Signals “Meeting-by-Meeting” Data Dependence

The Federal Reserve held the benchmark interest rate steady at 3.50% – 3.75%, pausing after three consecutive cuts to assess economic resilience. It was a 10-2 vote to hold was in line with expectations, though Governors Christopher Waller and Stephen Miran dissented in favor of a 25-basis-point cut.

The approved statement that dropped at 2 PM ET showed a change in tune from the past three statements: no longer was there a line celebrating the decreasing risk to the labor market in the U.S. economy.

Chair Powell, in his afternoon press conference cited a “clearly improved” outlook and a stabilizing labor market with 4.4% unemployment, reducing the immediate urgency for further easing. He did not comment on his plans to stay at the Fed after his tenyear as its chair end this spring.

Policy remains in a “wait-and-see” mode; Powell emphasized no pre-set path for future meetings, while markets now look toward June for a potential next move.

TRENDING STOCKS

Market Movers Wednesday

-

$INTC (11.04%): The stock rebounded sharply following reports that Nvidia and Apple are in talks to utilize Intel’s foundry services for future chip production, including next-gen GPUs. Sentiment was further bolstered by CFO David Zinsner’s recent purchase of 5,882 shares at approximately $42.50.

-

$ASML (-2.72%): Despite reporting record Q4 net sales of €9.7 billion and net bookings of €13.2 billion, shares pulled back during the session. Management issued a bullish €34 billion–€39 billion revenue guide for 2026 but sparked supply concerns by noting EUV capacity remains extremely tight.

-

$RR (-10.61%): Richtech Robotics plummeted after announcing a $38.7 million private placement of 8.5 million shares. The dilutive financing completely offset Tuesday’s rally fueled by an “agentic AI” collaboration with Microsoft to upgrade the ADAM robot.

Biggest Movers

-

$STX (19.14%): The stock skyrocketed after a massive Q2 beat with EPS of $3.11 vs. $2.77 expected and record gross margins of 42.2%. Multiple analysts, including Cantor Fitzgerald and Rosenblatt, raised price targets to $500, citing the structural shift toward mass-capacity AI storage.

-

$BNAI (17.01%): Momentum continued following a $2 million AI pilot deal at Nelson Mandela University. The micro-cap is seeing extreme retail interest as it penetrates high-barrier regulated industries with its AI compliance platform.

-

$TXN (9.94%): Gains accelerated as the analog chipmaker benefited from a rotation back into industrial and automotive semiconductors following improved sector-wide guidance.

-

$APH (-12.21%): Experienced a sharp sell-off following a downward revision in full-year guidance, as the company cited slowing demand in certain communications and automotive end-markets.

-

$AXON (-9.89%): The TASER maker fell as investors reacted to persistent margin compression caused by U.S. tariffs and high R&D spending, despite reporting record top-line revenue.

-

$PLTR (-5.04%): Pulled back from recent highs as traders took profits following a parabolic run-up, with the stock facing technical resistance at its previous 52-week peak.

ST MEDIA

Top Stocktwits News Stories 🗞️

LIVE FROM THE NYSE:

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Initial Jobless Claims 8:30 AM ET, Atlanta Fed GDPNow 12:00 PM ET, 7-Year Note Auction 1:00 PM ET 📊

Pre-Market Earnings: $NOK, $LMT, $CAT, $MA, $RCL, $MO, $BX, $CMCSA, $HON, $DB, $VLO, $STM, $TMO, $SNY, $NDAQ, $SAP, $LHX, $TSCO, $TAK, $SHW, $PHM, $IP, $NSC. ☀️

After-Market Earnings:

$AAPL ( ▲ 0.2% ) : Wall Street expects a record-breaking quarter with revenue projected at $138.5 billion and EPS of $2.67. Key focus remains on the “iPhone 17 supercycle,” which is forecasted to drive hardware revenue past $78 billion, alongside high-margin Services growth expected to hit $30 billion.

$V ( ▲ 0.53% ) : Analysts anticipate EPS of $3.14 on revenue of $10.7 billion, representing a 14.2% year-over-year bottom-line jump. Sentiment is focused on cross-border transaction volume and management commentary regarding regulatory pressure from the proposed 10% credit card interest rate cap.

Also watch for $WDC, $KLAC, $SYK, $WY, $RMD. 🌙

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

📈 Jersey Mike’s Subs plans IPO with Morgan Stanley, JPMorgan

🤑 Tesla to invest $2 billion in xAI, Elon Musk’s OpenAI competitor

😨 Democrats lay out immigration enforcement demands to avert shutdown

🛢️ Oil Hits Fresh Four-Month High as Trump Warns Iran to Make Deal

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The content is to be used for informational and entertainment purposes only and the service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published on the service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋