If My Portfolio Were A Horse, The Vet Would've Shot It And Then Shot Me For Making Him Look At It 🐎

OVERVIEW

If My Portfolio Were A Horse, The Vet Would’ve Shot It And Then Shot Me For Making Him Look At It 🐎

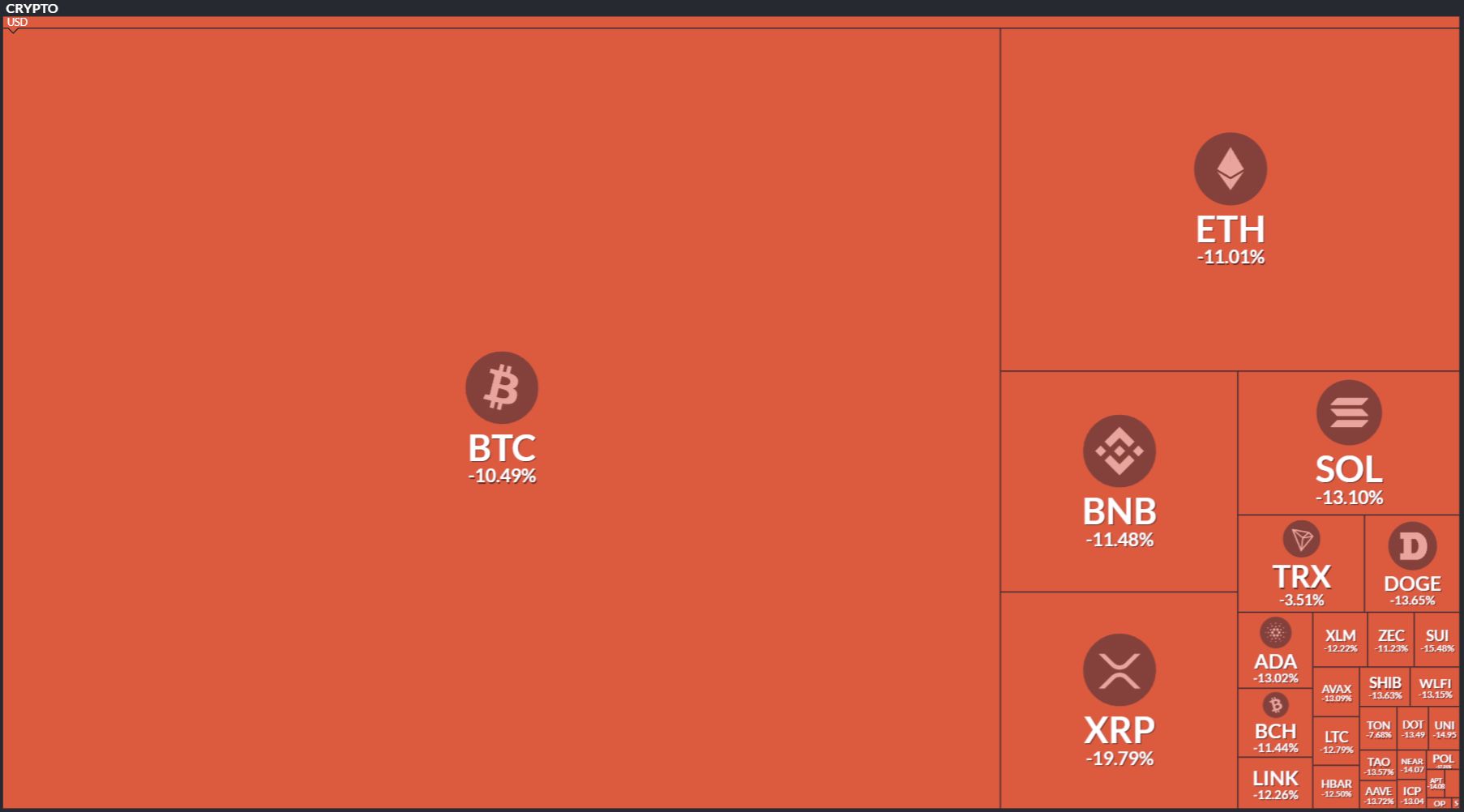

Before we dive in, here’s today’s crypto market heatmap:

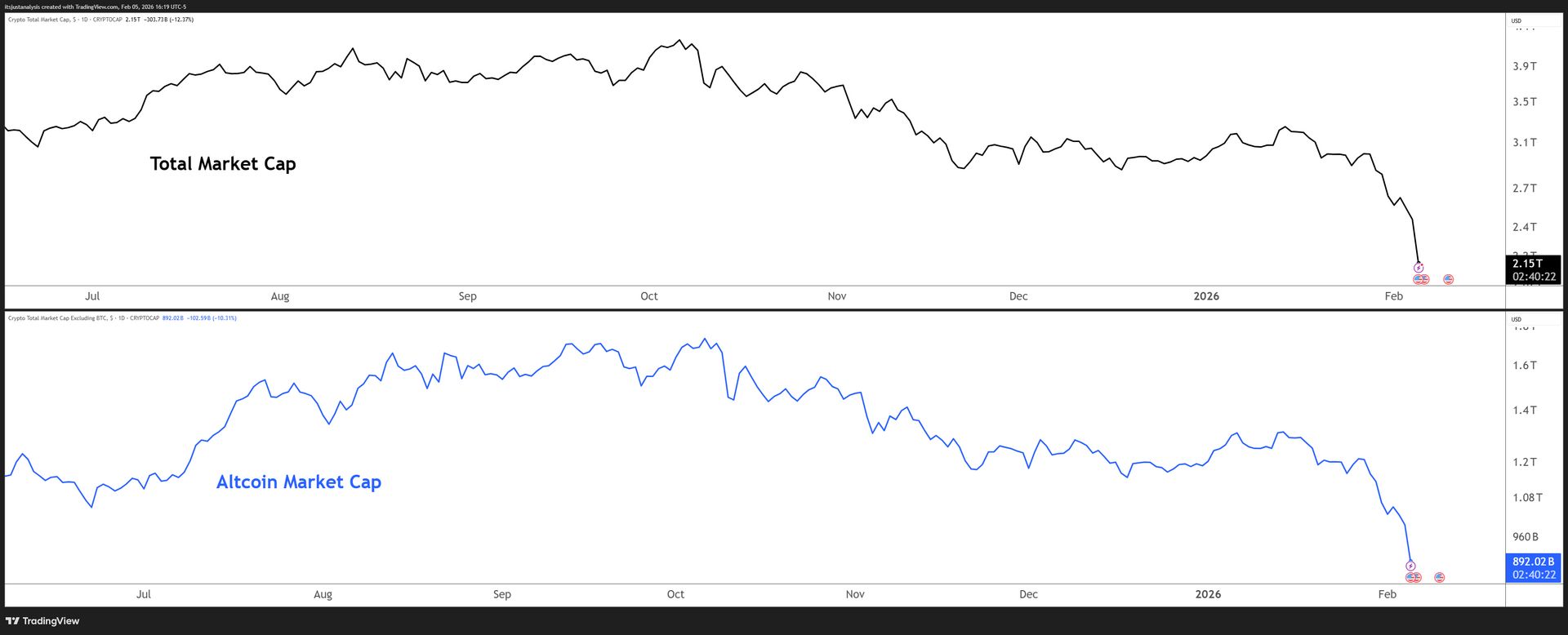

And here’s a look at crypto’s total market and altcoin market cap charts:

ON-CHAIN ANALYSIS

You, Me, & The MVRV 📈

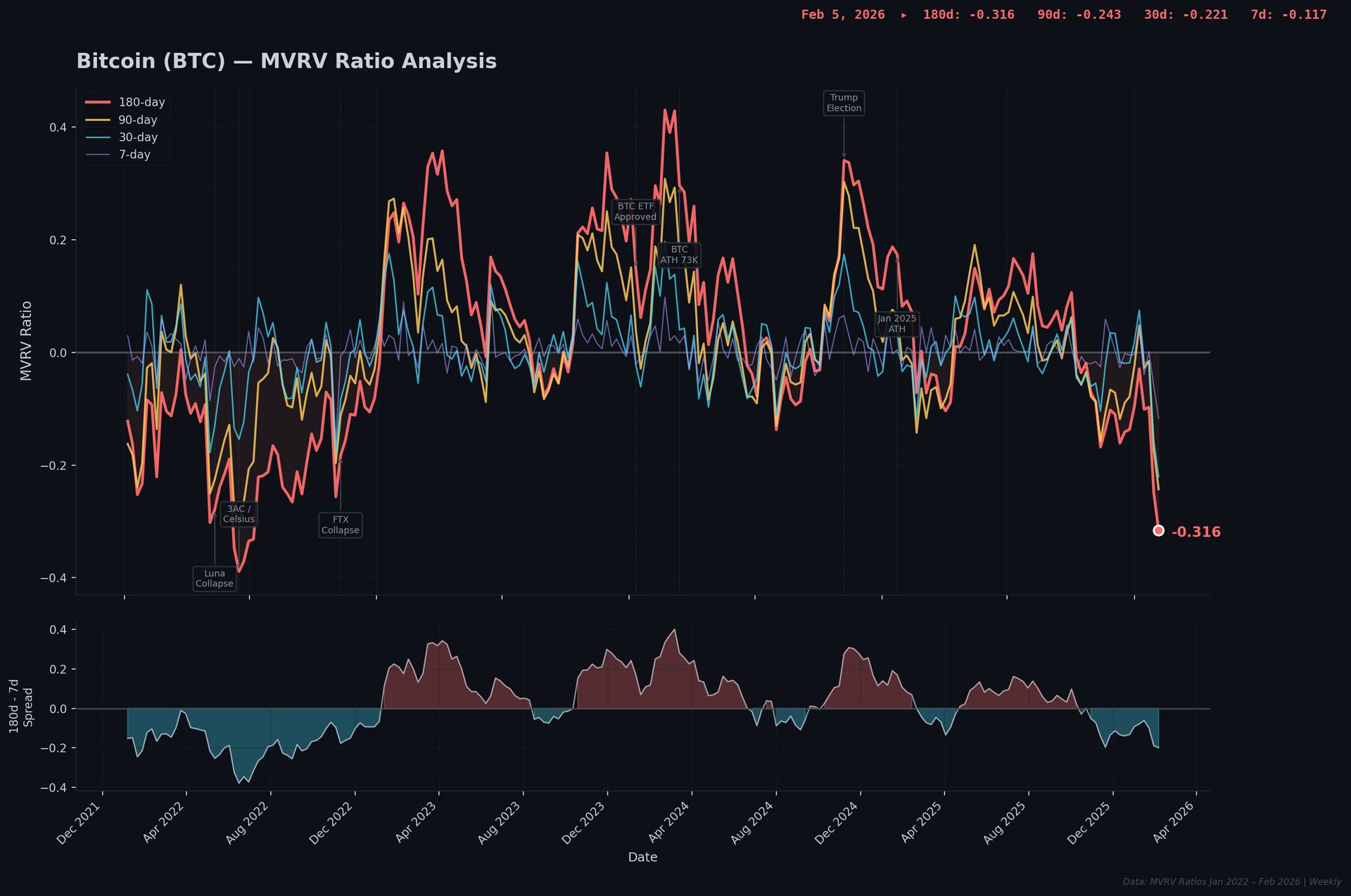

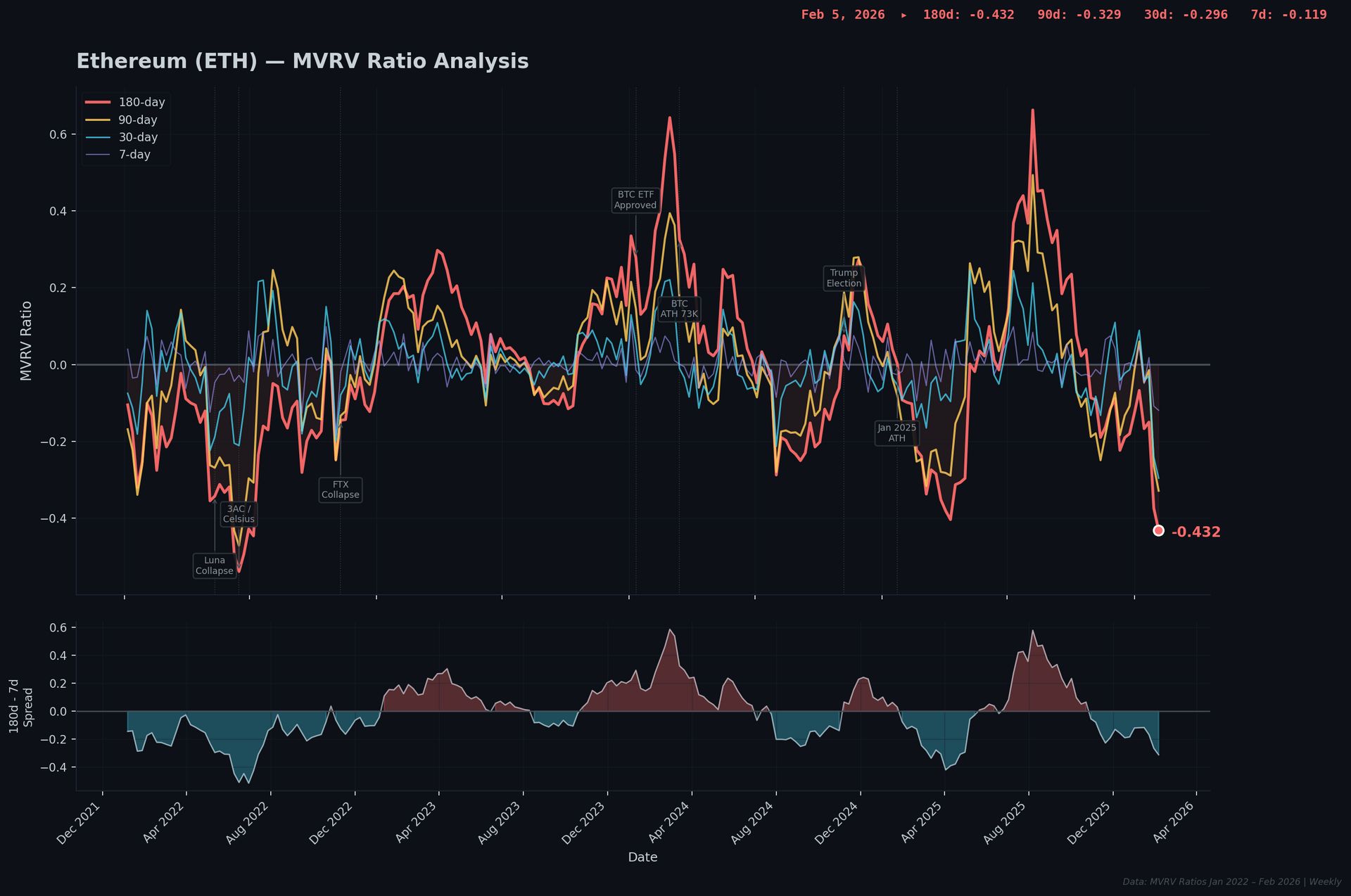

The MVRV ratio – Market Value to Realized Value – tells you whether the average holder at a given timeframe is sitting in profit or agony. 🏥

Positive means they’re up. Negative means they’re underwater. The further negative, the more people are questioning their life choices and “conviction.” We’re examining the 180-day, 90-day, 30-day, and 7-day MVRV for BTC, ETH, ADA, and LINK.

Spoiler: it’s not going well. 😐️

ON-CHAIN ANALYSIS

Bitcoin (BTC): The “Store of Value” That’s Currently Storing Pain 🤕

Bitcoin’s 30-day MVRV of -0.221 is the single worst reading in the entire dataset going back to January 2022. Not “one of the worst” – the worst. 📉

The 180-day sits in the 2.8th percentile, keeping company exclusively with June 2022, when Three Arrows and Celsius were speed-running into bankruptcy and BTC was bleeding from $30K to $17K.

The trap door is the real story here. In early January, the 180-day briefly recovered to -0.029 before cratering nearly 10x deeper in four weeks. The last move this violent was May-June 2022, when Luna turned $60 billion into a punchline.

The historical silver lining: The late 2022 bottom launched a face-ripping rally to +0.330 by March 2023. But all four timeframes are negative simultaneously for the second consecutive week, and the rate of deterioration is the steepest four-week decline in the dataset.

Someone is selling a lot of Bitcoin, and they’re not done. The question is whether you have the stomach – and the solvency – to wait for the bounce. ⌛️

ON-CHAIN ANALYSIS

Ethereum (ETH): Somehow Making Bitcoin Look Dignified 🎩

ETH’s 30-day MVRV of -0.296 is, like Bitcoin’s, the worst reading in the entire dataset. 🤯

But here’s the real insult: six months ago, ETH’s 180-day hit +0.663 – the highest reading out all four tickers we’re looking at today. In four years. It’s now at -0.432. A full swing of over 1.0.

The current 180-day is worse than the Luna collapse (-0.343), worse than FTX (-0.145), and closing in on Three Arrows territory (-0.539 in June 2022). Five weeks into 2026 and ETH’s average 180-day MVRV (-0.220) is already worse than the entire 2022 bear market average (-0.190).

Let that marinate.

ETH’s eternal pattern holds: it overshoots BTC in both directions. Deeper lows in 2022, higher highs in mid-2025, and now deeper lows again. Holding ETH is basically leveraged Bitcoin exposure with extra steps and more disappointment.

The June 2022 depths (-0.539) coincided with ETH around $880 and eventually marked the absolute bottom. Current levels aren’t there yet – which means either this stabilizes, or we’re re-testing the “is Ethereum actually dead?” narrative for the third time this cycle. 🤦

ON-CHAIN ANALYSIS

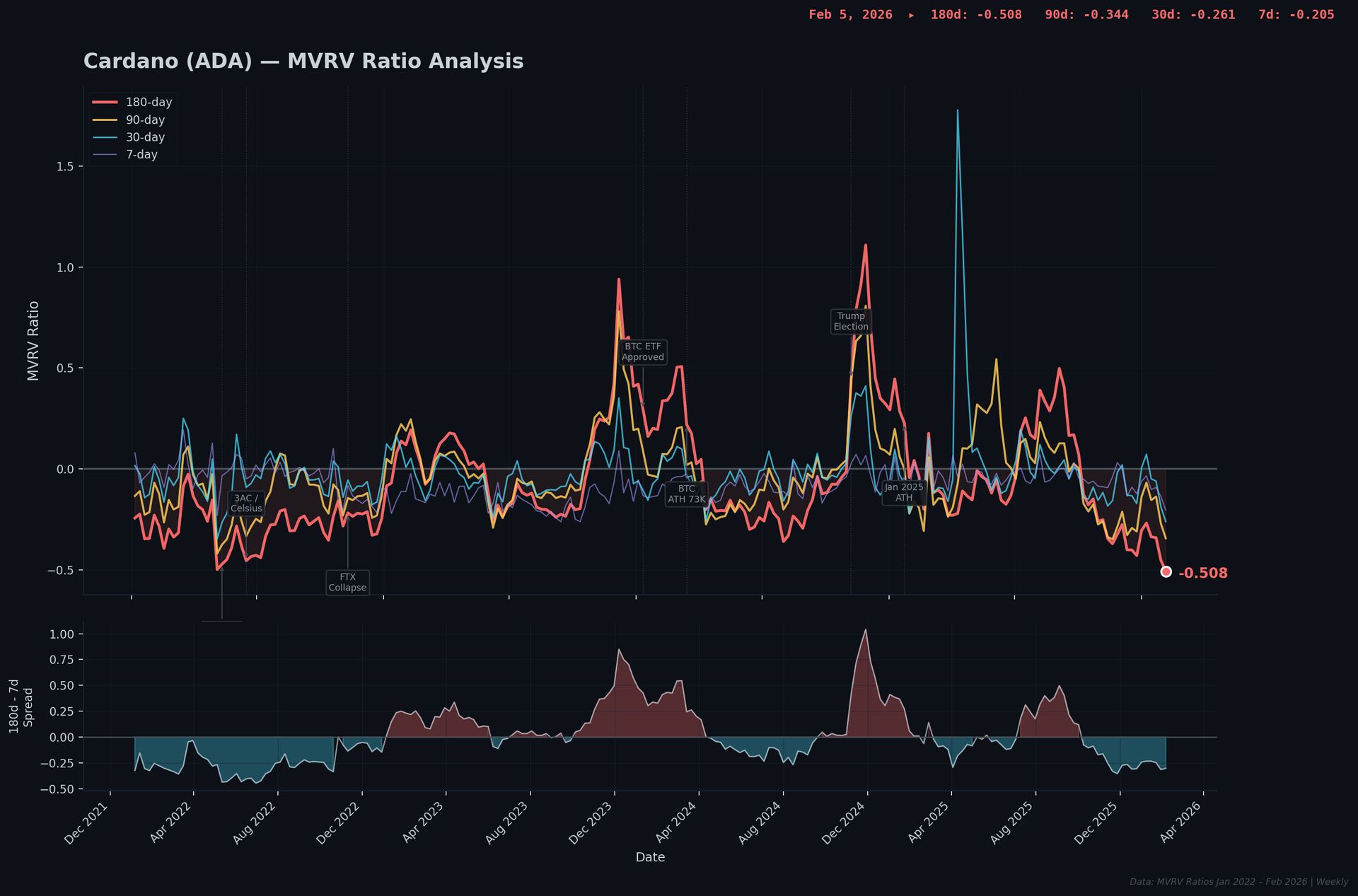

Cardano (ADA): The Gift That Keeps On Taking 🎁

Congratulations to ADA for achieving something truly remarkable: its 180-day MVRV of -0.508 is the worst reading in the entire dataset – out all four tickers and on any timeframe. 😨

And I mean no event in this data set is worse. Not during Luna. Not during FTX. Not during Three Arrows. Right now. Today. The 0.5th percentile. One observation out of 214. Literally unprecedented holder pain.

The 7-day at -0.205 is the real gut punch – people who bought ADA last week are already down 20%. ADA holders have spent 45% of the entire four-year dataset with all four timeframes negative simultaneously.

The hopium angle: ADA rallies harder than anything when it wants to. The problem is it spends 80% of its time making holders wish they’d bought a savings bond instead. Current all-four-negative streak stands at four consecutive weeks, and the 2026 average 180-day (-0.369) already dwarfs the full 2022 bear market average (-0.285).

We’re five weeks in. 😶

ON-CHAIN ANALYSIS

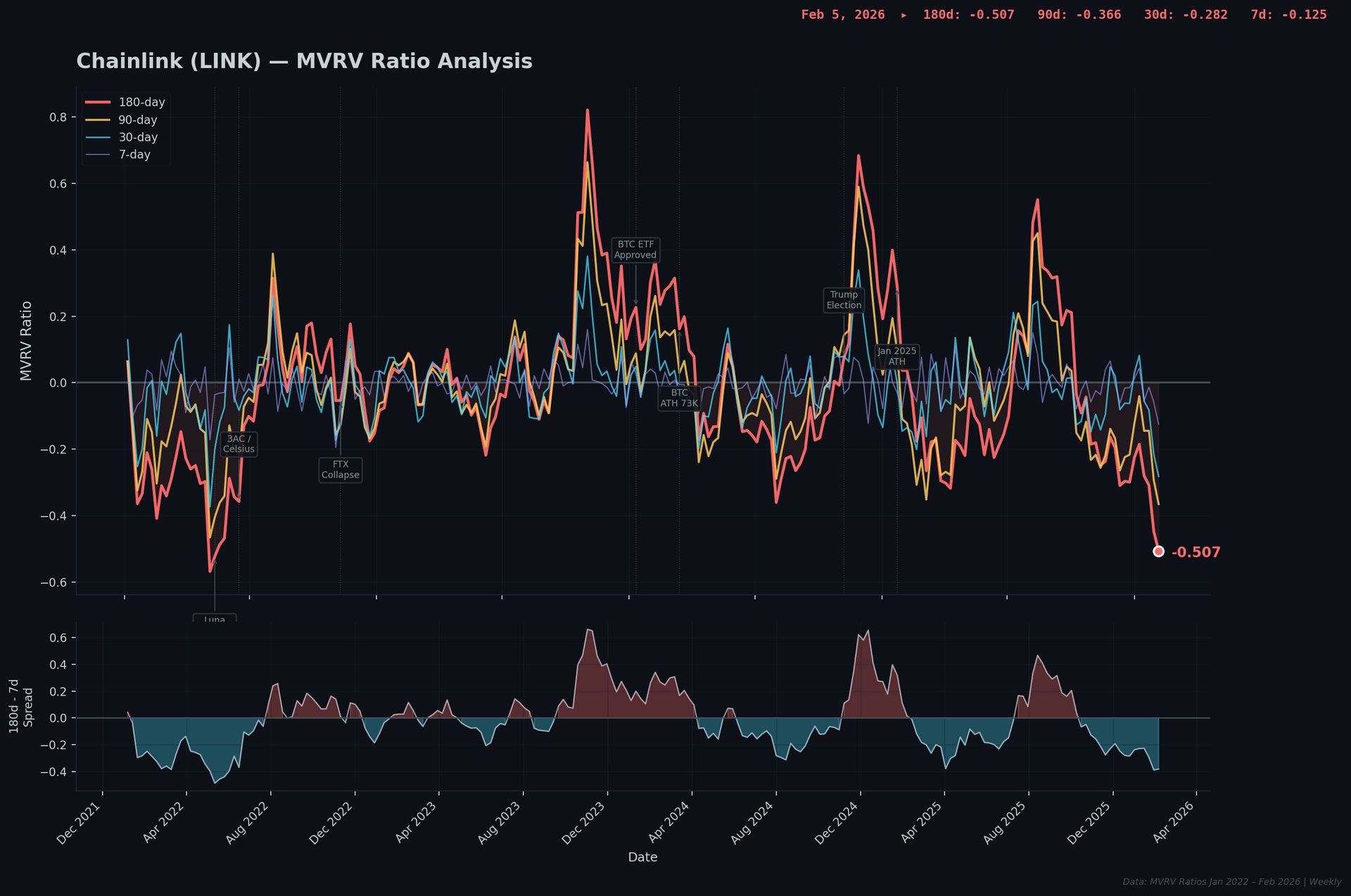

Chainlink (LINK): The Oracle That Couldn’t Predict Its Own Decline 🔮

LINK brought its own body bag. 💀

The 180-day at -0.507 trails only the May 2022 readings (-0.523 and -0.569) when the market was actively on fire. The 90-day and 30-day are both in the bottom 1.5th percentile – MVRV levels previously reserved exclusively for the most catastrophic events of the 2022 bear market.

The tragic backstory: in November 2023, LINK was the MVRV king – 180-day at +0.821, the highest sustained reading of any asset in the dataset. The oracle of DeFi. The one that finally proved the doubters wrong.

Then it spent two years giving every cent back and then some. The four-week collapse from -0.185 (Jan 8) to -0.507 (Feb 5) is the most violent deterioration in LINK’s history.

The closest historical parallel is May-June 2022, where LINK’s 180-day bottomed at -0.569 – only 12% further down from here. Recovery from those lows took roughly 10 months to turn positive. 📆

ETHEREUM

No, Buterin Didn’t Kill L2s, But He Did Pee On Them When They Were Already Dead 🥹

Vitalik doubled down on his prior L2 comments, comparing the slapping of optimistic bridges on generic EVM chains to the DeFi era’s obsession with forking $COMP ( ▼ 15.78% ). Felt like building, was actually just comfortable stagnation.

Twitter tweet

Now, if the market was doing ok, pitchforks would probably be out for Vitalik’s blood. But when you look at just some of the big name Ethereum L2s… well they’re already dead. Or at least deadish.

$OP ( ▼ 15.38% )

Officially the worst fraking named crypto in existance. This pink eye of a chart, at one point, was trading at $4.86 back in March 2024. Fast forward almost two years later and it’s down -96% to $0.19.

Hell, from it’s most recent swing high of $0.37 on January 13 it’s wiped out -50%.

$APT ( ▼ 13.79% )

Here’s another ETH L2 on it’s last death rattle.

From it’s October 2025 high of $5.61, it’s collapsed a stupid amount: -81% to $1.07. I could go on, but I think you get the point: the L2s were dead long before Buterin started poking it with a stick. 💀

LINKS

Links That Don’t Suck 🔗

🤷♂️ Fund Manager Recommends Elon Musk Buyback Tesla Shares To Spark Stock Turnaround

🪙 Why is COIN Stock Falling More Than 8% Today?

🎰 Circle and Polymarket Partner to Strengthen Onchain Financial Markets

🤔 ‘Overwatch 2’ Rebrands to ‘Overwatch’ as New Year-Long Story Arc Launches (Gaming News Roundup)

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋