Is Inflation Even Real?

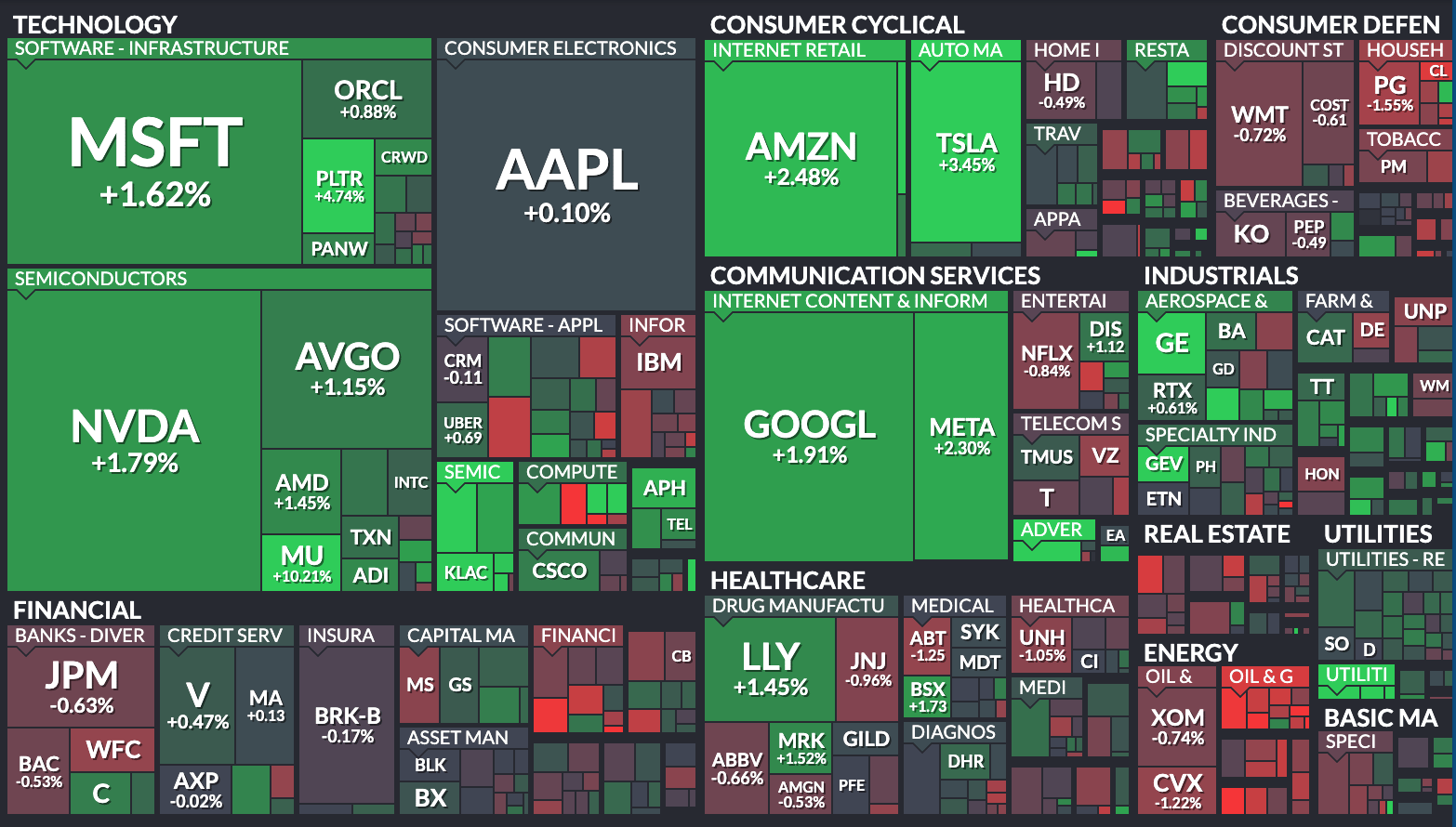

CLOSING BELL

Is CPI Even Real?

$SPY ( ▲ 0.76% ) $QQQ ( ▲ 1.45% ) $IWM ( ▲ 0.6% ) $DIA ( ▲ 0.15% )

The market climbed Thursday, rebounding after four down sessions in a row after inflation data looked pretty good. In tech, Micron computer RAM bookings were still sending the stock flying after Wednesday’s release, pulling up the Nasdaq.

Technically, the inflation report was incomplete; the Consumer Price Index from November showed prices climbed just 2.7% from last year, the Fed said, way lower than estimates for 3.1%.

Normally such a drastic cut in the rate prices are changing would freak markets out, WSJ reported, but the data is from during the shutdown, and no one is taking it 100% seriously. Labor Department workers warned collection issues may have pushed the numbers lower, and hey, even if the data is made up, less inflation is good, right?

“I think you largely just put this one to the side,” UBS Economist Alan Detmeister told WSJ. “Maybe this report gives a minor downward sign for overall inflation, but the vast, vast majority of this is just noise and should be ignored.”

Ask yourself, “Did prices fall recently?”

In other news, Trump’s speech last night was mostly skippable, besides the $1,776 he is mailing military members, for one reason or another. It might be to win over hearts and minds, especially after some $14B in estimated paychecks were lost during the shutdown and are still finding their way back into servicemembers’s hands. 🫡

AFTER THE BELL

Clothing, Shipping, and Housing Stocks Show

Nike $NKE ( ▼ 0.09% ) Nike’s second-quarter results painted a picture of a “beat” on paper that was quickly overshadowed by some ugly details as shares tumbled 10% in after-hours trading.

While the sportswear giant surpassed expectations with earnings of $0.53 per share on $12.4 billion in revenue, underlying metrics stunk. Gross margins fell to 40%, largely driven by the crushing impact of higher North American tariffs and elevated promotional activity. This resulted in a 32% drop in net income, proving that even a top-line beat couldn’t protect the bottom line from the rising costs of global trade and a costly brand turnaround.

The report also highlighted a stark divide in Nike’s sales channels, showing a 14% collapse in digital sales and a staggering 30% revenue drop for the Converse brand.

FedEx $FDX ( ▲ 1.74% ) the global package-moving bellwether, delivered a Q2 double-beat, reporting adjusted EPS of $4.82 against the $4.12 estimate and revenue of $23.47 billion, which surpassed the $22.78 billion consensus. The standout metric was a 149% year-over-year surge in free cash flow to $2.3 billion, proving that the company’s “DRIVE” cost-cutting program is driving success. 🚒

Management expressed confidence in the current trajectory by raising its full-year revenue growth outlook to 5.5% and boosting its EPS guidance to $18.40.

KB Home $KBH ( ▼ 0.3% ) : After Lennar’s rough start to the week, KB Home shares declined following its fourth-quarter report as investors weighed a current-quarter earnings beat against a softening outlook for 2026. The builder delivered adjusted EPS of $1.92 on revenue of $1.69 billion, both topping analyst estimates, but the underlying data revealed a 7% drop in average selling prices to $465,600 and a 9% decline in home deliveries.

The primary source of pressure on the stock is the 2026 guidance, which signals a continued retreat in both top-line growth and profitability. 🏘️

SPONSORED

Shoppers are adding to cart for the holidays

Peak streaming time continues after Black Friday on Roku, with the weekend after Thanksgiving and the weeks leading up to Christmas seeing record hours of viewing. Roku Ads Manager makes it simple to launch last-minute campaigns targeting viewers who are ready to shop during the holidays. Use first-party audience insights, segment by demographics, and advertise next to the premium ad-supported content your customers are streaming this holiday season.

Read the guide to get your CTV campaign live in time for the holiday rush.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TRUMP NEWS

DJT Is Literally Going Nuclear ⚛️

Trump Media & Technology Group $DJT ( ▲ 41.93% ) said Thursday it reached a merger agreement with advanced fusion developer TAE Technologies in an all-stock deal valued at over $6 billion. The social media company said it is shifting to generating a new type of buzz, literally. ⚡️

As part of the deal, TMTG will provide $200 million in immediate cash to fund development, with a goal of breaking ground on the world’s first utility-scale fusion plant, a 50-megawatt facility, in 2026. The move sent DJT shares soaring over 31%, as investors collectively said, “Big if true.”

-

Equity Split: Shareholders of both companies will own approximately 50% of the combined entity upon the expected mid-2026 close.

-

Strategic Capital: TMTG is committing up to $300 million in total cash (including $200M at signing) to accelerate the construction of the “Da Vinci” prototype power plant.

-

AI Connection: The merger explicitly targets the massive power demands of the AI revolution, with management arguing that fusion dominance is required to maintain U.S. competitiveness in high-performance computing.

Economist and gold lover Peter Schiff wasn’t so sure this was a great idea. Schiff argued on X that the company has morphed from a social media platform into a Bitcoin treasury and now a fusion venture, suggesting the “constant reinvention” highlights a lack of core operating focus.

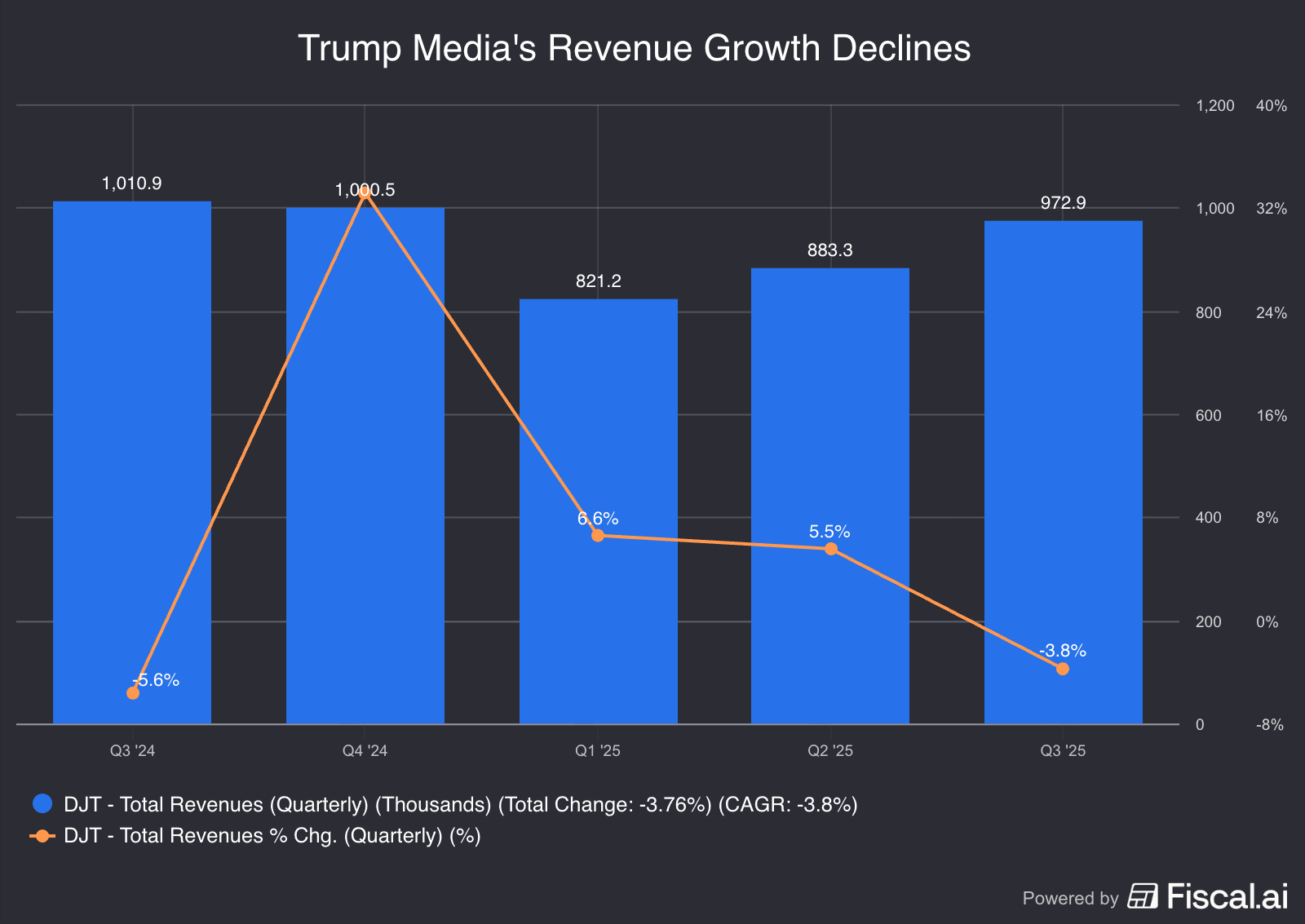

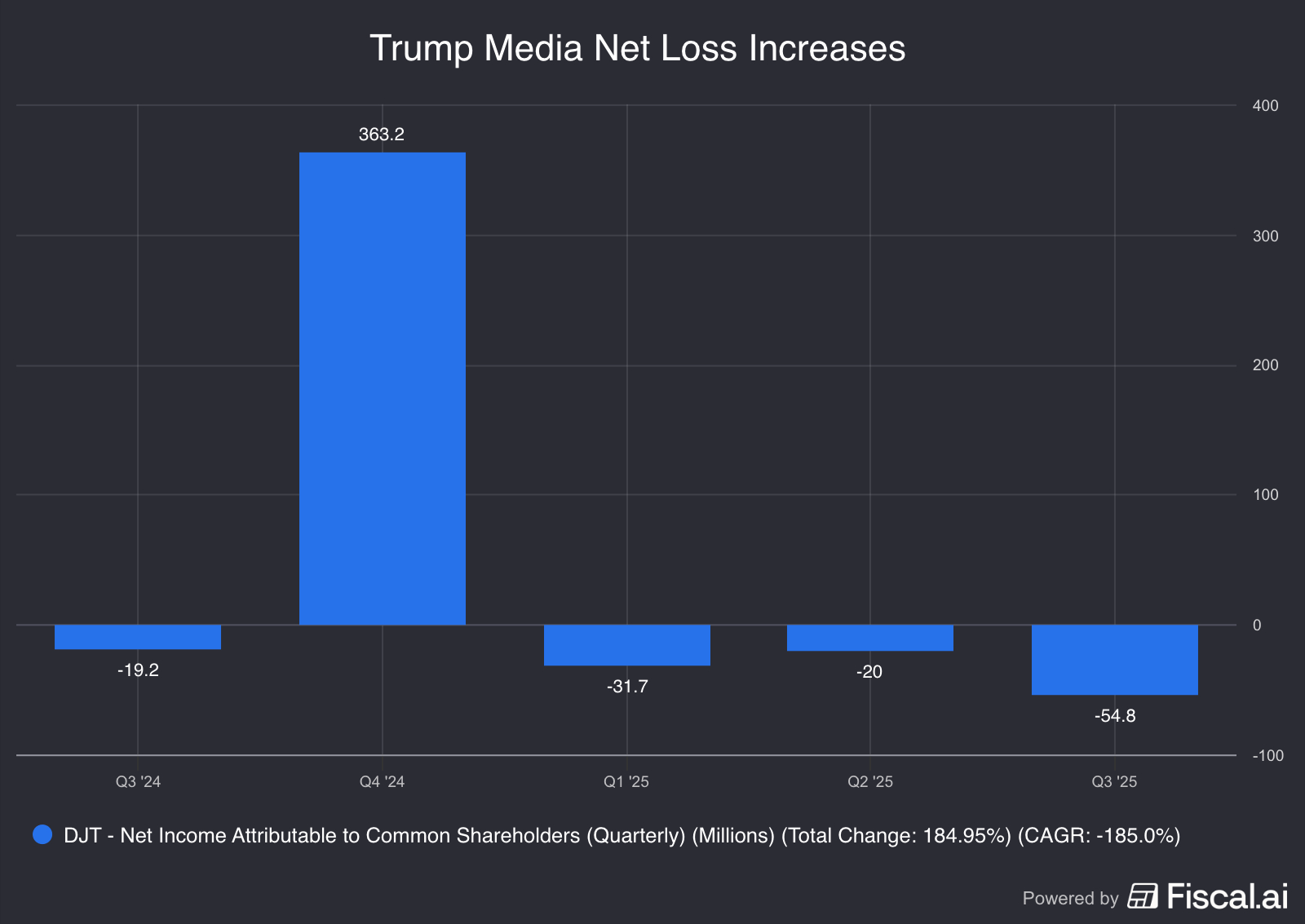

Skiff may have a point. Matt Levine, Bloomberg Opinion writer, pointed out DJT is not really a profitable company. It pulls in about $4M a year, on par with a Substack newsletter, but spends upwards of $100M a year. It paid its CEO $47M in 2024.

In fact, as Fiscal.ai graphs show, it was DJTs worst trading year on record, with a nearly 70% share price slump. While Truth Social saw peak engagement during the 2024 election, stagnating revenue and rising losses in 2025 have forced the company to pivot toward speculative sectors like crypto and, most recently, nuclear fusion. What’s next, flying cars?

Despite the criticism, retail sentiment on Stocktwits jumped to “bullish”

POPS & DROPS

Top Stocktwits News Stories 🗞️

-

Athira Pharma shares rose 70% following positive clinical trial developments.

-

Bitcoin analysts predict a range-bound finish instead of a rally.

-

Weedcoin rose 150% this week on Trump reclassification talk.

-

Sable Offshore soared following a favorable court ruling on pipeline operations.

-

Micron climbed after earnings, validating AI demand while others lagged.

-

XPeng outperformed Tesla this year to take the EV trophy.

-

Inspire Medical tumbled as Wall Street flagged a Medicare coding shift.

-

FuelCell Energy soared 35% after beating Q4 revenue estimates.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Howard Lindzon Exposes the Casino Economy Nobody Wants to Talk About

WHAT’S ON DECK

Tomorrow’s Top Things 📋

-

PCE Price Index (8:30 AM): Expected at 2.7% YoY, this is the Fed’s preferred inflation gauge and will determine if the recent hawkish shift in bond yields is justified.

-

Existing Home Sales (10:00 AM): Markets expect 4.15M units as investors watch to see if the housing market can find a floor despite mortgage rates remaining above 6%.

-

Michigan Consumer Survey (10:00 AM): This final December reading will be scrutinized for “inflation expectations,” which the Fed views as a critical anchor for long-term price stability.

-

Atlanta Fed GDPNow (12:00 PM)

☀️ Pre-Market Earnings: Travel, Payrolls, and Staples

-

Carnival $CCL: Investors are looking for record 2026 bookings to prove that the cruise industry’s post-pandemic momentum can withstand a slowing economy.

-

Paychex $PAYX: As a small-business bellwether, its results will signal whether the cooling labor market is finally hitting the service sector’s hiring plans.

-

Conagra Brands $CAG: Analysts will watch for signs of “consumer trading down” to see if inflation is forcing shoppers away from premium packaged food brands.

-

Winnebago $WGO: Reporting as a “canary in the coal mine” for high-ticket discretionary spending, its results will show if luxury consumers are finally pulling back.

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

📈 Something big may be coming to town—check out IBD’s guide to the Santa Claus Rally*

Police probing whether suspect is tied to MIT killing; person of interest identified

🏠️ CPI inflation print draws caution from economists: ‘It’s hard to take this data seriously.’

💰️ The Trump Family Business Empire Is Growing. We Mapped Out 268 Pieces of It.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋