November 2025 Crypto Crime Scene Report: Detectives Say Every Chart Was Found Face-Down With No Signs Of Struggle 👮

OVERVIEW

November 2025 Crypto Crime Scene Report: Detectives Say Every Chart Was Found Face-Down With No Signs Of Struggle 👮

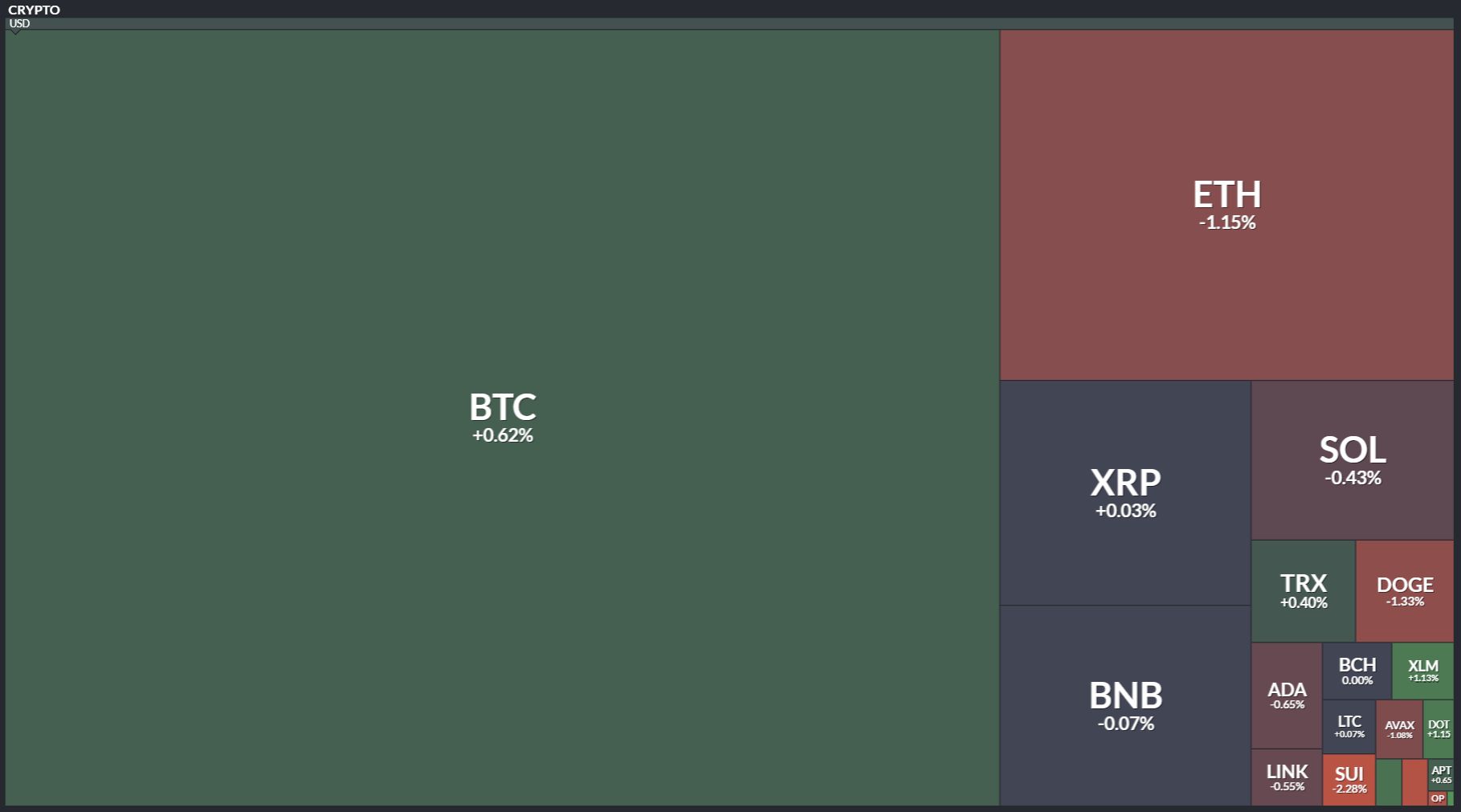

Before we dive in, here’s today’s crypto market heatmap:

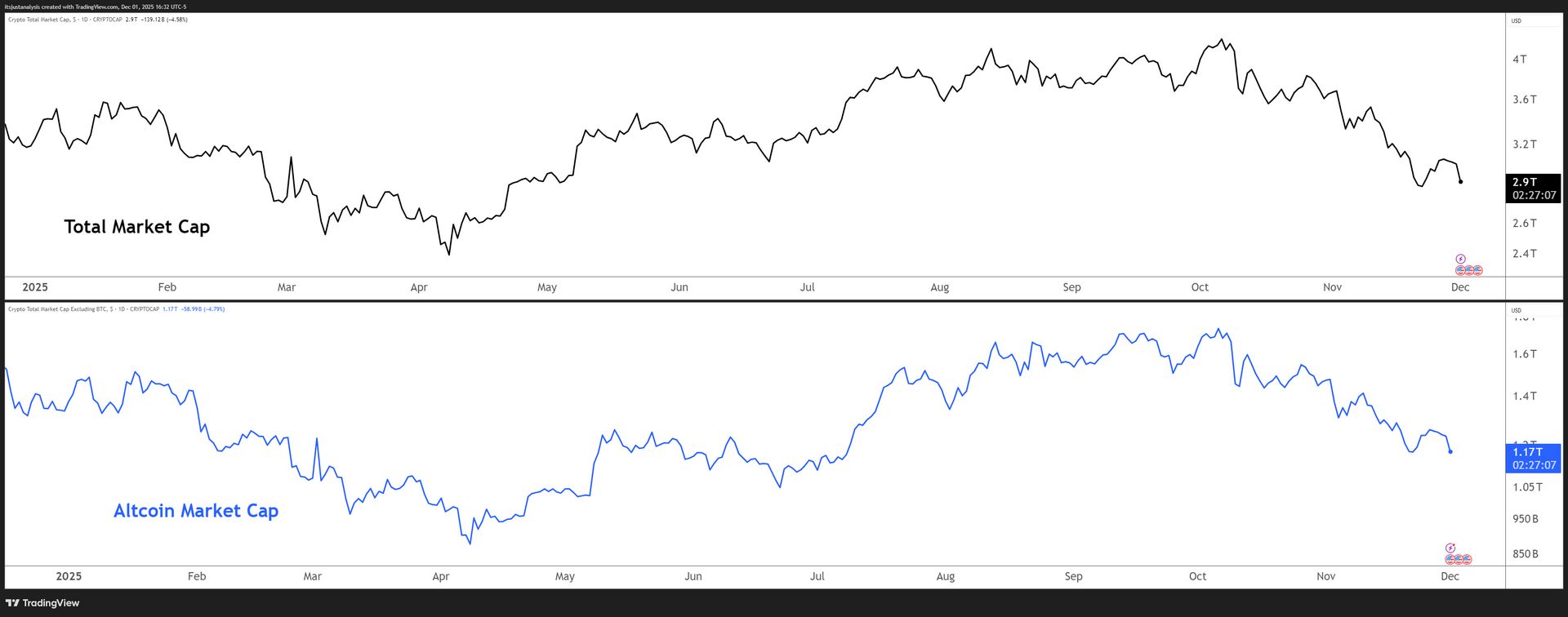

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

November 2025: The Month Crypto Forgot How to Function 😕

November was a coordinated demolition of value across every single major crypto asset class. 💣️

But before we dive into this crime scene of awfulness, here’s the scoreboard based on eight assets I looked at:

The Scoreboard: Everybody Ate Glass

-

Bitcoin: -17.54%

-

Ethereum: -22.25%

-

XRP: -14.11%

-

Cardano: -31.96%

-

Litecoin: -13.70%

-

Chainlink: -24.90%

-

Stellar: -18.66%

-

BNB: -19.58%

No rotations here, just synchronized nuking.

From November 2024 Euphoria to 2025 Disaster

Twelve months earlier, everything was vertical. Stellar did +466%. XRP did +283%. ADA did +215%. You know, the kind of numbers that make people post victory laps.

2025 reversed all of it with surgical cruelty. But like, The Saw movies style surgery. 🪚

Year-over-year swings:

-

Stellar: +466% to -18.66%

-

XRP: +282% to -14.11%

-

Cardano: +215% to -31.96%

-

Chainlink: +66% to -24.90% ☢️

The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

ON-CHAIN ANALYSIS

November 2025 Liquidation Statistics: Bulls Got Obliterated 😵

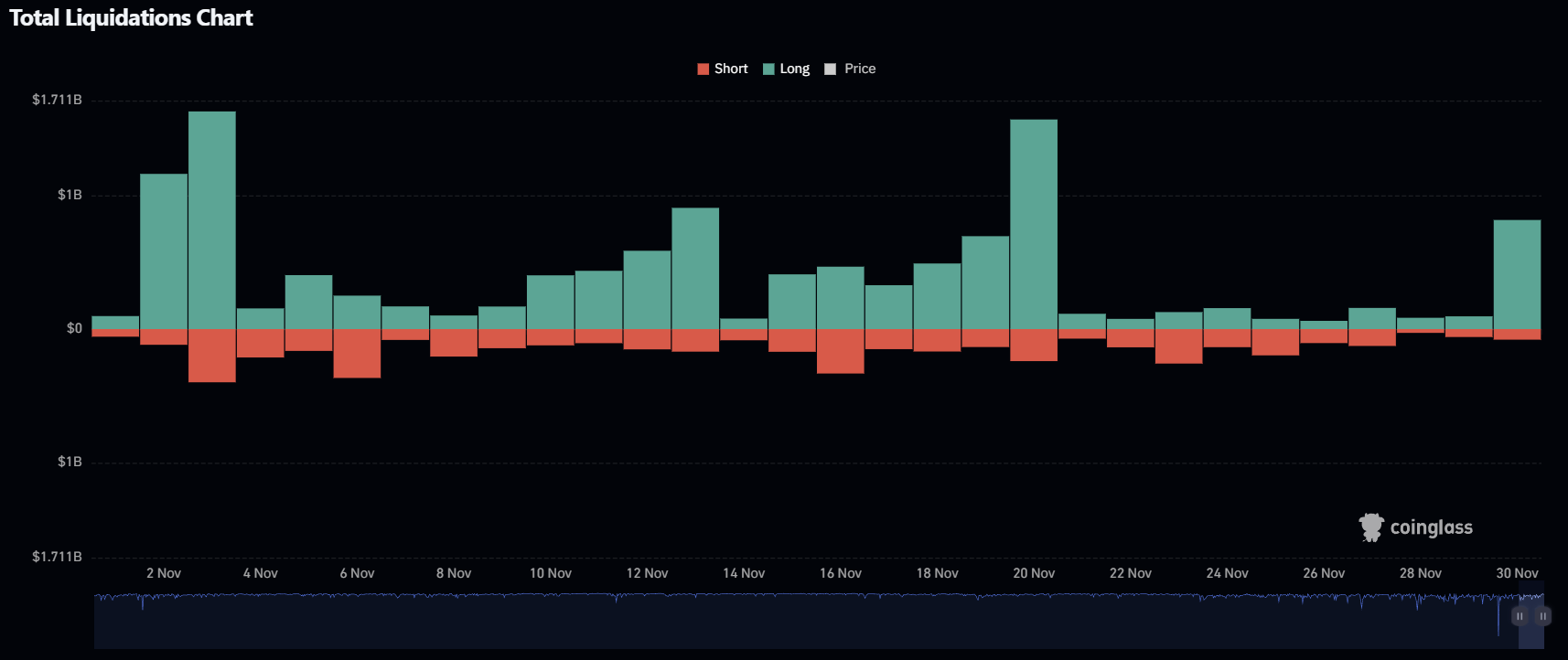

November 2025 Liquidations, Daily – Click to enlarge.

Total Liquidations: $17.04 billion

-

Long Liquidations: $12.28 billion

-

Short Liquidations: $4.77 billion

Bulls Took 72% of the Pain

-

Longs: 72.0% of all liquidations

-

Shorts: 28.0% of all liquidations

-

Long/Short Ratio: 2.57:1 – For every $1 of short liquidations, $2.57 in longs got wiped out

Daily Averages

-

Average daily liquidations: $568.1 million

-

Average long liquidations: $409.2 million/day

-

Average short liquidations: $158.9 million/day

-

-

Median daily liquidations: $328.31 million (the big events heavily skewed the average upward)

Weekly Pattern Analysis

-

Week 1 (Nov 1-3): $3.13 billion liquidated – The month’s bloodiest start, with Nov 2-3 delivering a savage 1-2 punch to overleveraged longs.

-

Week 2 (Nov 4-10): $2.47 billion – Continued pain but more distributed, and that’s being generous.

-

Week 3 (Nov 11-17): $4.17 billion – The worst week, with steady bleeding of long positions.

-

Week 4 (Nov 18-24): $3.33 billion – Nov 19-20 spike punished late entries.

-

Week 5 (Nov 25-30): $3.94 billion – The Nov 30 finale ($816.6M) closed the month with emphasis.

The ‘Efficiency’ of Destruction

Liquidation concentration: The top 3 liquidation days (Nov 3, Nov 30, Nov 20) represented $4.15 billion or 24.4% of the month’s total carnage compressed into just 3 days (10% of the month).

Long bias persistence: Only 4 days out of 30 saw shorts take more damage than longs (Nov 8, 22, 25, 28).

November 2025 was a grinding, choppy month that ate overleveraged bulls for breakfast, lunch, and dinner. The 2.57:1 long/short liquidation ratio tells you everything you need to know about who was wrong and who paid for it. 😐️

TECHNICAL ANALYSIS

Asset Autopsies For November 😷

Bitcoin: “Safe Haven” Was a Joke

-

-17.54% | $109,603 to $90,374

-

3rd worst November ever

-

Worst monthly loss since February 2025, but if it wasn’t for Feb 2025, it would have been the worst since June 2022.

BTC erased $19,228, the largest November dollar wipe in its history. 🤯

Ethereum: The L1 Implosion

-

-22.25% | $3,848 to $2,992

-

2nd worst November ever

-

February’s -32.20% damage? All undone.

-

Down 19.21% YoY

ETH put nine months of recovery into a shredder. 😵

Cardano: The Bloodbath

-

-31.96% | $0.61 to $0.41

-

2nd worst November in ADA’s history

-

Down 61.55% YoY, the worst YoY result of the bunch.

-

October (-24.54%) + November (-31.96%) = two-month beating of -48%

I can’t even think up an analogy of how bad one of my favs is doing. 💀

Chainlink: The Oracle Implosion

-

-24.90% | $17.24 to $12.95

-

2nd worst November ever

-

February’s -41.11% carnage? Gone and back again.

-

Down 31.81% YoY

DeFi’s data backbone snapped. 😱

XRP: The Least Bad

-

-14.11% | $2.51 to $2.16

-

5th worst November

-

One of only two assets up YoY (+10.60%)

Not really winning, just losing slower. 🤒

Litecoin: The Forgotten Soldier

-

-13.70% | $95.40 to $82.36

-

3rd worst November on record

-

Massive 35.14% intra-month swing

-

Down 19.77% YoY

I mean, it’s really not that bad compared to everyone else. 🤷

Stellar: The 466% Hangover

-

-18.66% | $0.30 to $0.25

-

YoY collapse: -52.60%

-

Performance swing: -485pp

This was like a North Korean rocket test, went up, and then crashed. 👇️

BNB: The Centralized Outlier

-

-19.58% | $1,089 to $876

-

Still up 33.93% YoY despite the beating

BNB survived 2024-2025 better than most. “Better” is relative. 😶

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🌩️ ASI Cloud Logs Six Billion Tokens And Launches Accelerator, With AiMo On Board

Cudos’ November ASI Cloud update reports more than six billion inference tokens processed and over a thousand active users. They’ve launched the ASI Accelerator, a wallet‑based program offering GPU credits, mentorship and ecosystem support to AI startups, and welcomed AiMo Network as its first cohort member. On top of that, privacy‑first Cocoon AI is scaling with distributed, renewable‑powered GPUs. Cudos.

🔒 Secret Network Deploys A Confidential Solidity-Writing AI Inside SecretVM

ChainGPT’s Solidity-LLM now runs inside SecretVM’s encrypted enclave, letting devs generate and audit smart contracts privately. The AI never sees unencrypted source code, and node operators never see anything at all. It’s the first real example (maybe) of “AI-powered development without leaking your entire business plan.” Secret Network.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🏦 Quant Reminds Banks They Can’t Wing Tokenised Deposits Forever

Tokenised deposits won’t scale unless everyone stops acting like their private sandbox is the center of the universe. Quant basically says “great experiments, kids, now pick a standard so the adults can build real infrastructure.” Without it, we get fragmented finance that makes CeFi look organized – which is kind of where we’re at already. Quant.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🎵 Decentraland Music Festival 2025 Goes Full Twitch-Core

Well, here’s another attempt to prove it==the metaverse still has a pulse. The festival runs Dec 3-6 and is basically a four-day flex for stream-native musicians who don’t need a label to go viral. Decentraland is turning every land parcel into a stage so creators can farm engagement like they’re speed-running culture. Decentraland.

🎨 Tezos Art Community Reflects On Berlin’s High‑Energy Gathering

A post‑mortem on “Art on Tezos: Berlin” notes how the art scene thrived across four days of exhibitions, panels and parties. The event brought together artists, curators, supporters, the Tezos Foundation and TriliTech in a “trifecta” collaboration. Attendees left feeling relieved, renewed and reassured about Tezos’ place in the art world… until they noticed the price action. Tezos.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

🛠️ Injective’s iBuild Lets You Spin Up a DEX By Typing Like You’re Ordering a Pizza

This is actually kind of cool. iBuild is an AI no-code tool that turns prompts into real dApps, because apparently “learn Solidity” was scaring off customers. You connect a wallet, buy some INJ credits, and the AI handles the engineering while you pretend you’re a founder. Injective Protocol.

🛡️ Curve’s Llamalend Turns Liquidations Into Slow Motion Instead Of Sudden Death

Here’s some risk management for people who don’t want to get deleted by a two-second wick.Liquidation protection replaces hard liquidation prices with a “liquidation range” that gradually adjusts collateral during volatility. Borrowers get breathing room instead of instant removal from the gene pool. Curve Finance.

NEWS IN THREE SENTENCES

Protocol News 🏦

📊 Casper Taps Allium To Turn Its On-Chain Data Into Something Humans Can Read

Casper is piping network analytics into real dashboards so builders and institutions stop guessing what’s happening on-chain. Allium handles the data plumbing while Casper gets to brag about transparency. Casper Network.

📜 Turing Space Joins IOTA To Bring Credentials On‑Chain And Wreck Paperwork

Turing Space has joined the IOTA Business Innovation Program to build a platform for digital identity and credential verification. The team plans to issue credentials at global scale (from World Health Organization volunteers to renewable‑energy certificates) while claiming an 80 % cut in verification time and a 50 % drop in cost. The magic lies in IOTA’s fee‑less decentralized ID framework, notarization tools, and “gas station” features. Iota.

🪙 Band Protocol’s Oracles Live On Monad – Fast Feeds For Fast Chains

Band Protocol’s price oracles went live on Monad mainnet from day one, offering rapid data feeds for DeFi. The initial feeds cover USDC, USDT, SOL, ETH and WBTC, and they’re built on decentralized aggregation and quick updates. Band.

LINKS

Links That Don’t Suck 🔗

🤔 Towns Turns Group Chats Into Money-Making Hubs

🎰 Kalshi taps Solana to tokenize betting contracts: Report

First Chainlink ETF set to begin trading on Tuesday as exchange signs off on Grayscale’s LINK fund

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋