PayPal Just Dug Visa's And Mastercard's Grave 💀

OVERVIEW

Banks Wanted Toll Booths, PayPal Brought A Wrecking Ball 💀

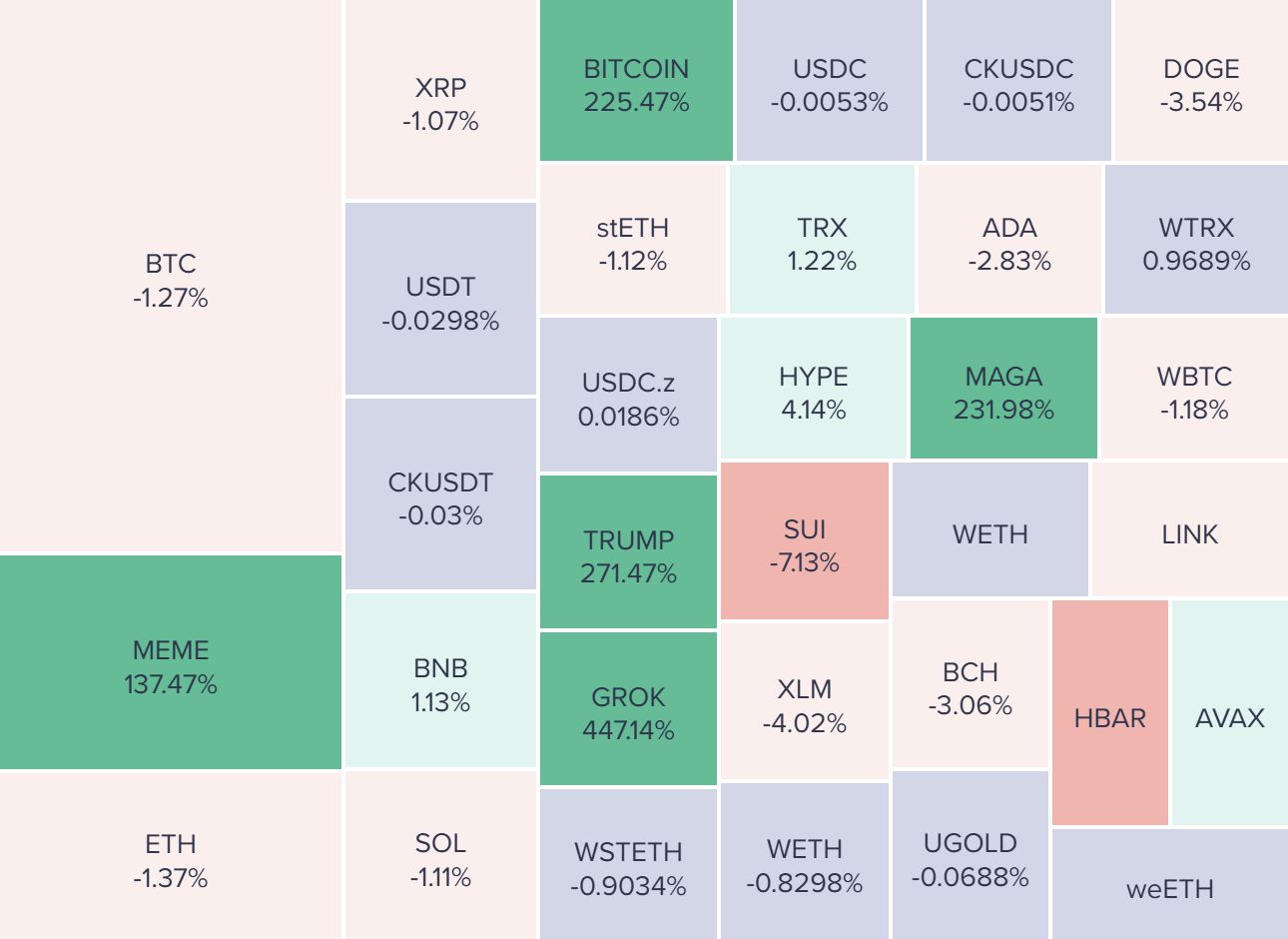

Before we dive in, here’s today’s crypto market heatmap:

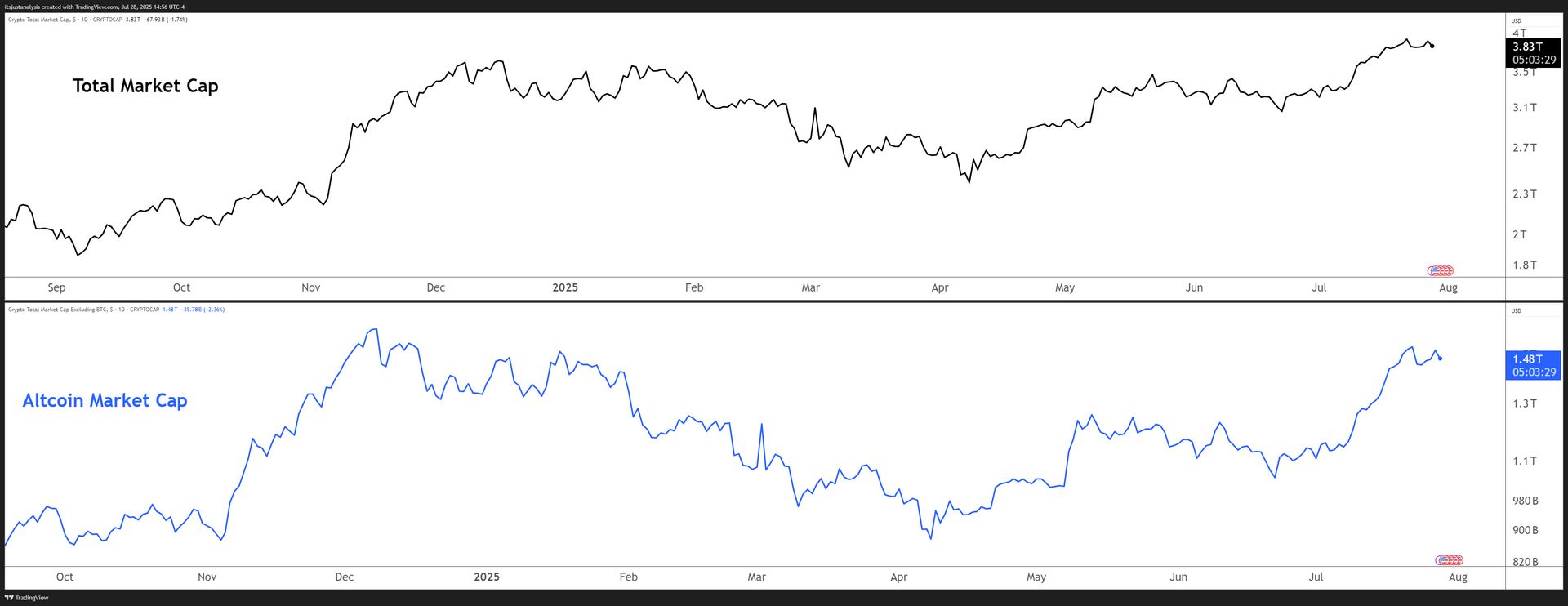

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

PayPal Says ‘Hold My PYUSD’ and Breaks the Global Payments Game 💣

PayPal just tossed a grenade into the bloated corpse of legacy banking fees and walked away like a boss. 💣️

Their new “Pay with Crypto” feature slashes cross-border transaction costs by up to 90% and opens the floodgates to a $3 trillion crypto market, all while making it easier for merchants to grab payments from over 650 million crypto users. 📉

No more twelve-step international wire transfers. No more bending the knee to Visa or Mastercard just to accept money from overseas. Merchants in the U.S. can now accept BTC, ETH, SOL, USDC, and nearly 100 other coins through wallets like MetaMask, Coinbase, Binance, Phantom, and Exodus – with stablecoin conversions, near-instant settlement, and a flat 0.99% fee.

Oh, and its not just a checkout gimmick. It’s a full-stack payments overhaul:

-

Merchants can hold PYUSD and earn 4% interest.

-

Freelancers can get paid instantly in crypto without begging Stripe to behave.

-

PayPal is syncing with Fiserv to blast stablecoin rails worldwide.

And if you didn’t know, they launched “PayPal World” last week, uniting five of the world’s biggest digital wallets into one open platform. Basically, they’re building the SWIFT killer everyone’s been yelling for, minus the crusty compliance headaches. 💥

SPONSOR

C2 Blockchain Inc. Becomes the First Public Company to Add DOG Coin to Its Treasury

C2 Blockchain Inc. (OTC: $CBLO) has made history as the first publicly traded company to add DOG Coin ($DOG)—the leading Bitcoin-native meme token—to its corporate treasury. With over 95 million DOG coins now held in reserve, CBLO is bridging digital culture and institutional finance. DOG combines the viral energy of memes with the security of Bitcoin, offering long-term upside and community power. This move positions CBLO as a forward-thinking digital asset company, leading a new era of treasury diversification rooted in Web3 and Bitcoin innovation.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Disclaimer: This communication is for informational purposes only and does not constitute an offer to sell or a solicitation to buy any securities. Investing in securities or cryptocurrencies involves risk. Past performance is not indicative of future results.

NEWS

Tron Inc. Waves A $1 Billion Tin Cup 🍵

Tron Inc. (née SRM Entertainment) swapped plush‑toy pandas for Justin Sun’s blockchain dream, flipped its Nasdaq ticker to TRON on July 17. 📆

Now they wants permission to hawk up to $1 billion in every security known to man: common, preferred, debt, warrants, Cheez‑It crumbs, you name it.

The S‑3 filing shouts “flexibility,” but the fine print whispers the real plan: use other people’s cash to buy even more TRX on top of the 365 million tokens already sitting in its Hong Kong‑custodied “Treasury Wallet.”

Why It Reeks 🦨

-

Family Affair. That $100 million June PIPE? Paid entirely in TRX by a vehicle owned by Justin Sun’s dad, Weike Sun, who naturally became board chair the next morning.

-

No Adults in the Room. Compare the guest lists:

-

Bitcoin & Ether: BlackRock, Fidelity, Cantor Fitz drop nine‑figure checks and brand equity.

-

Tether (USDT): Cantor Fitzgerald manages its $130 billion bond pile. Same crew.

-

Tron: a reverse‑merged plushie souvenir shop, Sun Sr., and a trust company most folks can’t spell.

-

-

Dilution Carnival. Shelf lets management print shares faster than Sun tweets, while the Series B warrants already lurking at $0.50 could hand Dad 90 %+ of the float if shareholders ever nod off.

-

Reg‑Risk Piñata. TRX is literally named in an existing SEC lawsuit as a maybe‑security; Tron Inc. concedes a classification flip would nuke the model. (Buried in risk factors, of course.) ☢️

High‑Level Take 🔢

Tron’s pitch boils down to: “Buy our stock so we can buy our token and maybe stake it on DeFi for yield.” Great if TRX moons – catastrophic if Justin’s next pet project face‑plants.

Tron Inc. looks less like MicroStrategy and more like a family‑office piggy bank wearing a public‑company costume. Traders chasing a quick hype pop might scalp the ticker, but anyone hunting real institutional validation should note how the room empties when Sun walks in.

TRX could still rip on retail FOMO – just know the only deep pockets here are literally just Justin and Justin’s dad. 👖

NEWS

South Florida Crypto Launderer Plots Finger‑Chopping Ransom To Cover $3M Debt 😐️

Shlomo Haim Akuka, 30, dug himself a $3 million USDT hole with a Brazilian creditor and figured the quickest way out was straight‑up horror. 😱

FBI affidavits say he asked undercover agents – posing as cocaine traffickers – to kidnap the debtor, his fiancée, or his kids and slice off fingers until the balance sheet looked pretty.

Debt, Drugs, and Dumb Choices 🤦

-

June 10 – First meet‑up in a Hollywood restaurant. Akuka flips $30k cash to USDT for a cool 5 % fee.

-

June 10‑July 23 – Four more laundering sessions push the total near $200k.

-

July 17 – Plot twist: Akuka floats a kidnapping, offers 20% of the haul as payment, and recommends “remove a hand” for motivation.

-

July 23 – Doubles down in front of two undercover cops, deciding daughters are “easier” hostages and fingers are fair game.

All while bragging he’s a “professional” with bank accounts sprinkled across big‑name banks. Sure, pal.

Agents bag Akuka on July 25 before the sequel goes full Saw. He’s now staring at decades for money‑laundering and conspiracy. That $10k “up‑front fee” he waved around? Might cover a few ramen packs on commissary – if he’s lucky. 🍜

SPONSOR

🚨 New on Stocktwits: Sentiment meets $SPY

The Stocktwits Sentiment Index now includes a live $SPY overlay. You can track real-time retail sentiment and market price in one clean chart, perfect for spotting moments where the community is early…or euphoric.

-

Sentiment surges while $SPY lags? That’s conviction.

-

Price pops as sentiment fades? That’s hesitation.

-

Both run hot? That’s FOMO.

Get a clearer read on the market, powered by what the community is truly feeling.

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

💳 Alchemy Pay Adds Fiat Ramp for Ondo’s USDY on Solana

Users in 173 countries can buy tokenized US-Treasury-backed USDY with Visa, Apple Pay, bank transfer, etc. Alchemy’s 300+ payment rails + 50 fiat currencies service non-US investors seeking compliant yield. USDY offers 24/7 liquidity, real collateral, fast Solana settlement. Alchemy Pay.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🏦 WLFI and Vaulta Fuse USD1 into Web3 Banking

Vaulta’s assets join WLFI’s macro reserve as USD1 slides into Vaulta’s compliance-heavy rails. Target perks include on-chain payments, tokenized RWAs, and stable liquidity minus the banker bureaucracy. Campaign slogans aside, the balances are verifiable. Vaulta.

📊 Chainlink Puts Mutual Funds On-Chain After 250 Years

CCIP, ACE, and friends now stream live NAVs and atomic settlements for giants like BlackRock, Franklin, and UBS. Real-time registers kill T+4 drudgery while digital cash erases settlement risk. If your fund still prints PDFs, enjoy the museum fees. Chainlink.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🤖 Youmio Picks Avalanche for Agent-Native L1

Centralized AI silos just lost the exclusivity game. The chain gives every AI agent a wallet, skills, and on-chain memory, all running at Avalanche speed. Launchpad Mios evolve across games while a single token tracks their hive-mind antics. Avalanche.

🎮 ROM Golden Age Scores 2 Million Sign-Ups Before Launch

Two days of CRYSTAL drops vanished in six minutes, juicing hype for the August 12 rollout across 170 countries. PLAY holders already flipped tokens for CRYSTAL to fund guardian summons and gear crafting. WeMix.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending Protocol News 🏦

📈 Aave V4 Brings Risk-Based Borrow Rates

Spoke markets can set collateral-specific “Risk Premiums” → safer borrowers pay less, riskier more. Improves capital efficiency, aligns TradFi credit logic, and boosts DAO revenue via higher premiums = more protocol fees. Aave.

🔄 NEAR Backs Everclear to Unify Cross-Chain Liquidity

Everclear plugs into NEAR Intents to clear and net stablecoins at near-zero cost while moving up to $5 million per shot. The goal is billions in monthly volume and an end to bridge spaghetti. Fragmented pools just got scheduled for demolition. NEAR.

🔒 Algorand × Hex Trust: Institutional Staking in Safekeeping

Extended custody deal now includes direct access to Algorand staking pools via Hex Trust’s licensed infrastructure. Institutions can stake, earn, and govern without handling keys, reinforcing Algorand’s Pure PoS decentralization. Algorand.

LINKS

Links That Don’t Suck 🔗

😶 Breaking: US SEC delays decision on Grayscale Solana ETF

🤯 BNB overtakes Nike in market cap and could reach $900 before weekend

🔥 AVAX on fire: Traders target $140 as Avalanche DeFi heats up

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Email me (Jonathan Morgan) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in ADA, IMX, COPI, MIN, AGIX, ALGO, ZEC, XLM, and NEAR. 📋