Powell Needs to Stop Gaslighting Markets About Financial Conditions

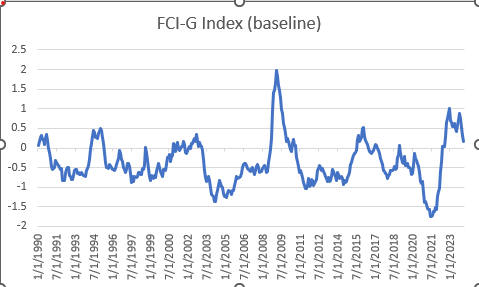

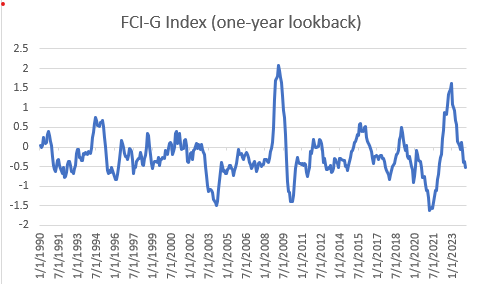

The Federal Reserve has introduced its own version of a Financial Conditions Index which they publish monthly (just released on 3/22 through February) that “can be used to gauge broad financial conditions and assess how these conditions are related to future economic growth. Higher figures denote tighter financial conditions, lower figures denote looser financial conditions. The baseline index measures how financial conditions affect the economy with a lag of up to three years and an alternative index allows lags of at most one year.

Fed President Logan mentioned earlier in the year in a speech (https://www.dallasfed.org/news/speeches/logan/2024/lkl240106) where she expressed concerns about loosening financial conditions making the Fed’s job more difficult to bring inflation back down to 2% specifically these indicators as being two of the four indicators that she looks out (the others being the Chicago Fed Financial Conditions Index and the Goldman Sachs Financial Conditions Index).

As a result, I think it is fair to suggest that these Fed indices (charts below) are the Fed’s main indicators to show whether or not financial conditions are restrictive and to what degree these financial conditions are impacting the economy, either assisting or detracting the Fed’s ability to achieve its inflation target.

With the February data just released, we can now see that the Fed’s two main indicators of financial conditions have shown a drastic loosening of financial conditions since last summer with the series using a 1-yr lookback suggesting that financial conditions are no longer restrictive (negative numbers) and getting increasingly less restrictive

Source: https://www.federalreserve.gov/econres/notes/feds-notes/a-new-index-to-measure-us-financial-conditions-20230630.html

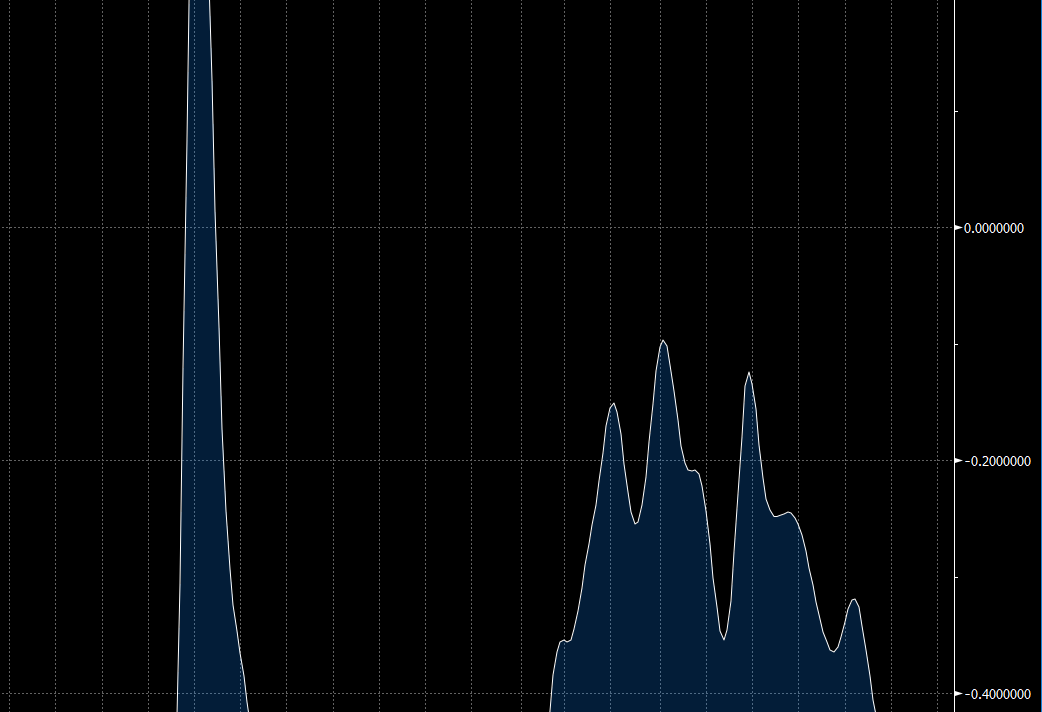

The Chicago Fed indicator (also below) of financial conditions is suggesting that conditions are as loose as they have been before the tightening cycle even began.

Source: Bloomberg

When asked about financial conditions at the press conference, Chairman Powell said that they are still restrictive and providing some pressure on growth and on inflation. He either doesn’t get to see the Fed’s own data or he is lying because the data clearly shows that not only are financial conditions not restrictive, but they are probably accommodative at this point.

The reason this is important is that the loosening of financial conditions filters quickly through to the real economy, supporting growth (especially in interest rate sectors) as well as into inflation and inflation expectations. Animal spirits re-ignited by a Fed Chairman that doesn’t believe financial conditions are loose is only going to further threaten to de-anchor inflation expectations which have already been moving higher for months as well as lead to a re-acceleration of actual core and headline inflation in the coming months. He is drastically increasingly the likelihood of a second wave of inflation and for inflation to become an election issue.

As I have been discussing, until and unless the Fed acknowledges that it’s policy is not restrictive enough to bring down inflation towards 2% in a timely manner, and thus needs to do more tightening and/or more aggressive QT, financial markets are going to continue to rally inflation related assets (gold / oil / commodities / BTC / stocks) until the point at which the Fed becomes uncomfortable that inflation expectations are no longer well anchored and that their next interest rate move could actually be a rate hike. Introducing volatility into the interest rate market is the first step toward showing that the Fed is serious about achieving this mandate.

There are 9 Fed members that are looking for 2 cuts or less in 2024 with 3 voters (Bostic, Bowman and Barkin) that are likely looking for zero or 1 cut. I suspect Waller (author of the “What’s the Rush” speech and Mester (also both voters) are at 2 cuts. That means there are 5 voters who currently would not be supporting the start of a rate cutting regime given this inflation background unless the labor market showed sign of imminent and significant deceleration, something that really is not expected at this point.

I don’t believe Powell is going to look to start a rate cutting campaign without unanimous consent in an election year otherwise he would run the risk of this decision being seen as highly political. So I think there is a lot of wood to chop for him to convince the rest of the committee to get going in supporting a rate cut. Powell’s dovish performance may have been his effort to try to put some pressure on other Fed members to get onboard but the gaslighting from this press conference about financial conditions still being restrictive is ridiculous, even when looking at the Fed’s own indicators. We need a Federal Reserve and a Fed Chair that are serious about bringing inflation back to 2% and what we saw last week ain’t gonna get us there. Markets will continue to move in a disturbing direction for the Fed, threatening to de-anchor inflation expectations, until they course correct.

My positioning biases: Long: Gold/BTC/Oil, Short: Small Caps, Short: Duration USTs

Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do your own due diligence.