Recording Records

Presented by

CLOSING BELL

Recording Records

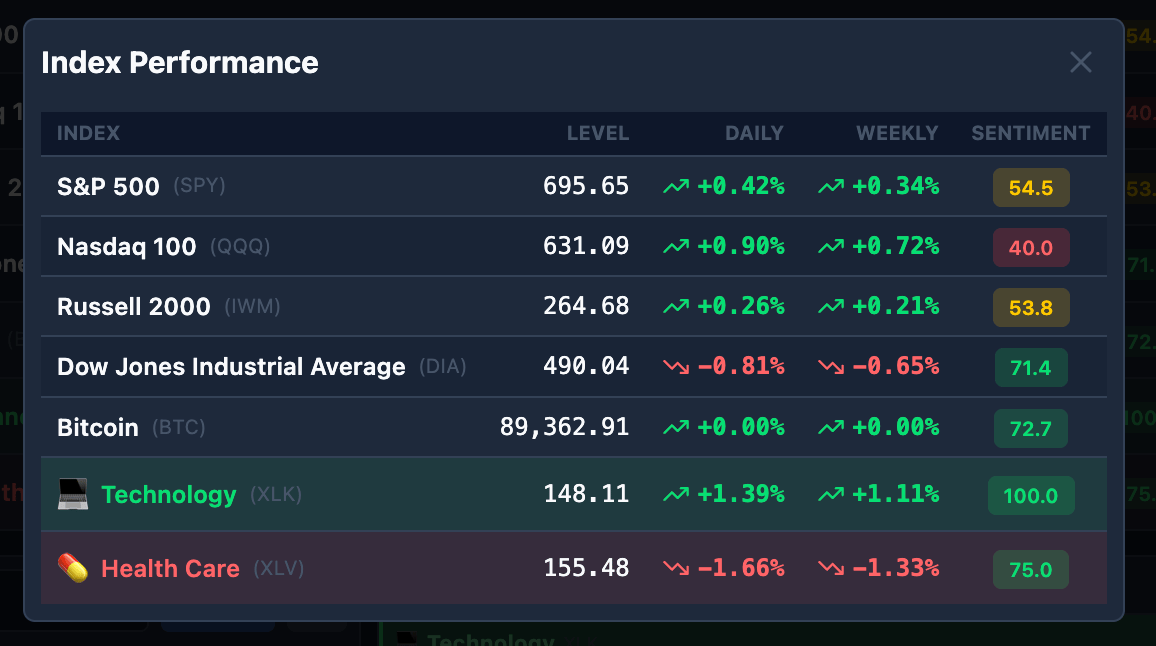

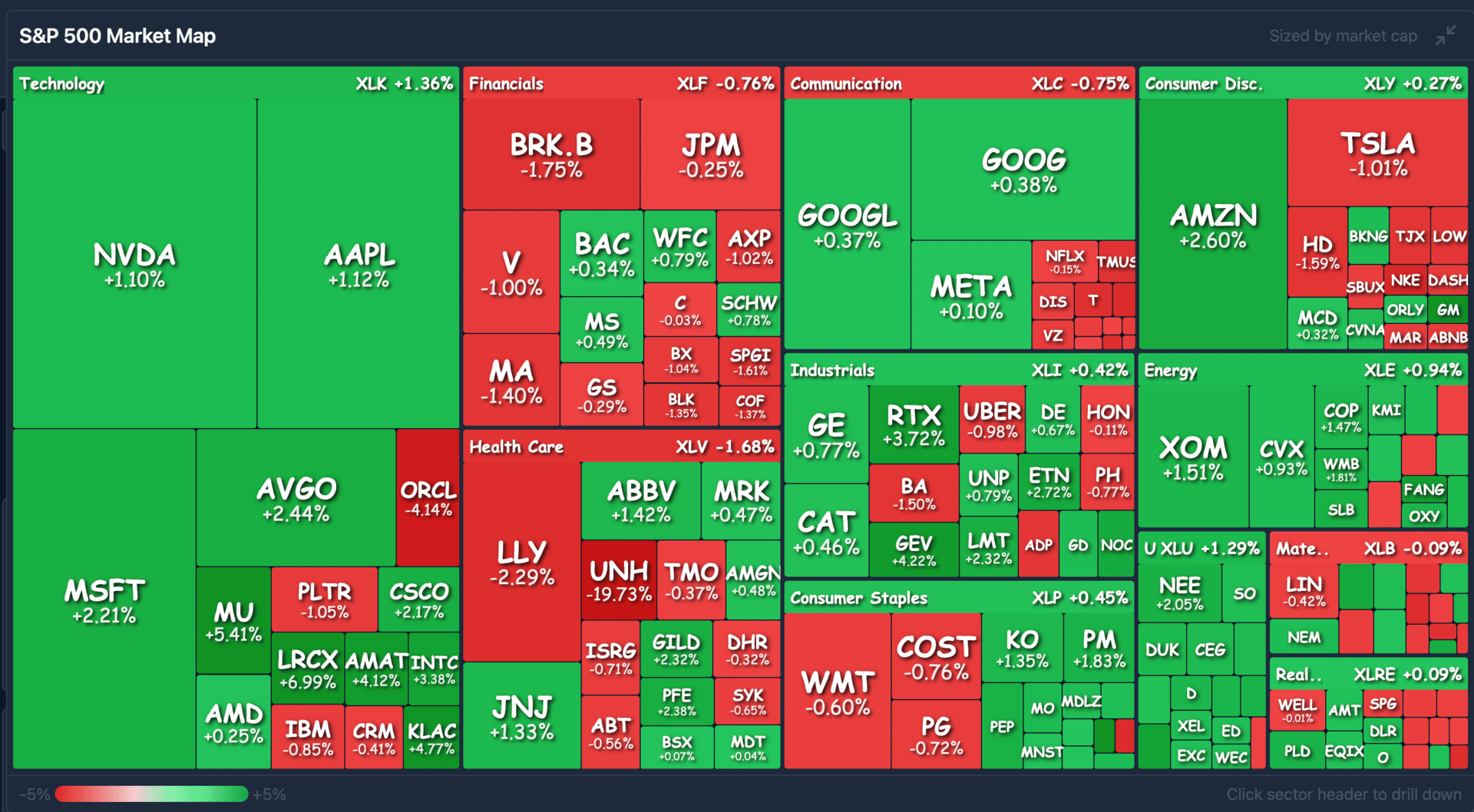

Happy Tuesday! The Dow is at $49,000 and the S&P 500 is knocking on the 7,000 door as the bulls continue to charge, the S&P 500 and Nasdaq 100 hitting records. While gold and silver fell slightly, the dollar fell a lot, the USD index dropping 1.2% in the steepest four-day fall since last April. US consumer confidence from the Conference Board fell to its lowest since 2014.

The blizzard of events is not over yet. Airlines are cutting more flights this week, bringing the total to nearly 20,000 missed connections following the blizzard, and the radar shows more snow is coming Saturday.

The FOMC is due to decide on the target Federal Funds rate tomorrow, and nearly everyone thinks it will be a no-change meeting.

UnitedHealth is seeing a total bloodbath. The stock fell 19% after missing earnings and forecasting a revenue decline for 2026. The White House cut to next year’s Medicare spending increase also hit the entire sector, with Humana, Molina, and CVS all cratering over 10%.

The president is continuing his country wide tour, speaking in Iowa tonight on affordability to ague his first-year goals are achieved. It’s a midterm tour, but all anyone can think about is how expensive everything is, the dangerous ice this winter on U.S. streets, and the files the Fed has not fully released yet.

The government might partially shut down this weekend, the Senate now divided over a funding bill after the violence Saturday.

AFTER THE BELL

📂 Tech Earnings Recap: Chips, Storage, & Security

📟 Industrial Headwinds Persist: Texas Instruments reported mixed results for Q4 2025, narrowly missing expectations as industrial and automotive markets continue to navigate a cyclical downturn. The stock was climbing more than 8% post market.

-

The Numbers: Adjusted EPS of $1.27 missed the $1.29 estimate, while revenue of $4.42 billion fell slightly short of the $4.45 billion forecast.

-

Bright Spot: Despite the broad miss, the data center market was a standout, posting 70% year-over-year growth.

-

2026 Outlook: Midpoint revenue guidance for Q1 2026 was set at $4.5 billion, which actually exceeded analyst estimates and signaled a potential bottoming in the chip cycle.

💿 AI Demand Drives Record Margins: Seagate crushed Q2 2026 estimates, fueled by the massive infrastructure ramp-up for generative AI. The stock jumped more than 6% in the aftermarket.

-

The Beat: The company reported an adjusted EPS of $3.11, significantly higher than the $2.83 analyst consensus. Revenue hit $2.83 billion, topping the $2.74 billion estimate.

-

Mass Capacity: CEO Dave Mosley noted that performance was driven by the “durability of data center demand” and the ongoing transition to HAMR-based Mozaic high-capacity drives.

-

Guidance: Seagate issued a robust Q3 outlook, projecting EPS between $3.20 and $3.60, far above the $2.96 Street estimate.

SPONSORED BY VIRTUIX

Walk Around in AI-Generated Worlds: $VTIX Debuts on Nasdaq with 138% Growth

The wait is over: Virtuix ($VTIX) officially began trading on the Nasdaq!

Virtuix’s omni-directional treadmills let you move in 360 degrees inside AI-generated environments, whether fictional game worlds or photorealistic replicas of the real world.

$VTIX is ready to scale:

Explosive Growth: 138% YoY revenue growth as the “Peloton for Gamers” ships to homes, with production capacity in place for $100M annual revenues.

Defense: Beyond the living room, Virtuix launched “Virtual Terrain Walk” for U.S. military mission planning.

Access to Capital: $50M raised from high-profile investors including Mark Cuban.

“We’re only getting started,” said Jan Goetgeluk, Virtuix’s founder and CEO. “In a world where AI can rapidly generate photorealistic environments, we let you walk around inside those worlds.”

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MOVING NEWS

📂 Morning Earnings Briefing: Massive Beats & Strategic Shifts

✈️ Boeing $BA ( ▼ 0.78% ): Boeing reported its highest quarterly revenue since 2018 at $23.9 billion—a massive 57% year-over-year jump.

-

The EPS Surprise: Core earnings hit $9.92, crushing the forecasted loss of $0.45. This was primarily driven by an $11.83 gain from the divestiture of its Digital Aviation Solutions business.

-

Operational Wins: The company delivered 600 commercial airplanes in 2025, with production of the 737 MAX stabilizing at 42 per month.

📦 UPS $UPS ( ▼ 3.0% ) : UPS exceeded analyst expectations with an adjusted EPS of $2.38 on $24.4 billion in revenue.

-

Volume vs. Price: While domestic volume declined, revenue per piece grew 8.3%, showcasing the company’s ability to maintain “revenue quality” amidst a shrinking parcel market.

-

The Inflection Point: Management signaled that 2026 will be a recovery year, projecting sales of $89.7 billion—well above 2025 levels—as it completes its Amazon “glide-down”.

🛡️ Raytheon $RTX ( ▼ 1.14% ) : Raytheon shares neared 52-week highs after a “beat-and-raise” quarter fueled by global defense demand.

-

The Big Numbers: Adjusted EPS of $1.55 beat the $1.47 forecast, while organic sales grew 14%.

-

Fortified Backlog: The company ended the year with a record $268 billion backlog, supported by a 23% year-over-year increase in new awards.

TRENDING STOCKS

Stocktwits Top Trending

-

$RDW ( ▼ 6.34% ) : Redwire skyrocketed nearly 30% following its selection for the Missile Defense Agency’s (MDA) $151 billion SHIELD Golden Dome contract.

-

$GRI ( ▼ 21.81% ) : GRI Bio is seeing a pullback as traders take profits following recent speculative momentum in the biotech sector.

-

$IREN ( ▲ 5.05% ) : IREN is ripping higher as it successfully pivots from pure-play Bitcoin mining to high-performance AI data center infrastructure.

Today’s Pops and Drops

-

$GLW ( ▼ 4.93% ) : Corning hit record highs after announcing a $6 billion optical fiber deal with Meta for AI data centers.

-

$SYY ( ▼ 0.74% ) : Sysco surged after crushing Q4 profit estimates and raising its full-year 2026 earnings guidance.

-

$GM ( ▼ 1.42% ) : General Motors jumped on a massive profit beat and a confident 2026 outlook supported by new buyback plans.

-

$HUM ( ▼ 7.45% ) : Humana is the hardest hit in the managed care crash, reeling from the flat 2027 Medicare Advantage payment proposal.

-

$ELV ( ▲ 6.15% ) : Elevance Health is sliding as the industry re-evaluates profit margins under the new government rate projections.

ST Media

Top Stocktwits News Stories 🗞️

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

🏦 Federal Reserve Prepared to “Stand Pat” Amid Political Storm

The Federal Reserve is widely expected to maintain the current benchmark interest rate this Wednesday, shifting into a “wait-and-see” posture following last year’s series of cuts.

Markets price in a near 0% chance of a rate move this week, with futures traders eyeing June and December for the only potential cuts of 2026.

Policymakers are opting for “patience” to allow previous easing to circulate, though the meeting is overshadowed by a DOJ subpoena and a looming successor nomination from the White House.

While the Fed seeks to signal a dovish bias and continued confidence in disinflation, Chair Powell faces a high-stakes press conference where he must defend central bank independence against unprecedented political pressure.

☀️ Pre-Market Earnings: Major Expectations

-

$T (AT&T): traders are weighing high debt and wireline declines against growth in mid-band 5G and satellite initiatives.

-

$ASML (ASML Holding): High expectations, the market is betting on strong momentum in EUV technology and AI-driven memory demand.

-

Also watch $GLW, $GD, $GEV, $DHR, $ELV, $ADP, $PGR, $APH. ☀️

🌙 After-Market Earnings: The Heavy Hitters

-

$TSLA (Tesla): Sentiment is cautious following weak Q4 deliveries of 418k units; analysts expect an EPS of $0.45 (down over 50% from 2022 levels) amid rising competition.

-

$META (Meta): Expected to deliver a strong $8.21 EPS on $58.45 billion in revenue; investors are laser-focused on 2026 AI spending guidance, with projections ranging from $153B–$160B.

-

$MSFT (Microsoft): Forecasted EPS of $3.92 on $80.28 billion in revenue; the key will be whether Azure AI Services growth can justify a massive capex ramp toward $98.8 billion this fiscal year.

-

$IBM (IBM): Consensus sits at $4.33 EPS (up 10.5%); while hybrid cloud and AI traction are solid, the market remains wary of premium valuations and stiff competition from AWS/Azure.

-

Also watch for $LUV, $NOW, and dozens more.

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

📈Want to learn proven strategies for picking top stocks? Join IBD’s free online workshop on 2/7*

🤑 Financier Ross Stevens Makes $100M ‘Extremely Innovative’ Gift to US Olympians

😨 India, EU reach landmark trade deal, tariffs to be slashed on most goods

🏠️ House Democrats to Trump: Fire DHS chief Noem or they’ll start impeachment proceedings against her

💰️The government is barreling toward a partial shutdown over DHS funding. Here’s what to expect

📦️ UPS cutting 30,000 jobs, closing 24 facilities in 2026

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋