Risk Is Tiptoeing Back In While Volatility Checks The Door Locks 🥷

OVERVIEW

Risk Is Tiptoeing Back In While Volatility Checks The Door Locks 🥷

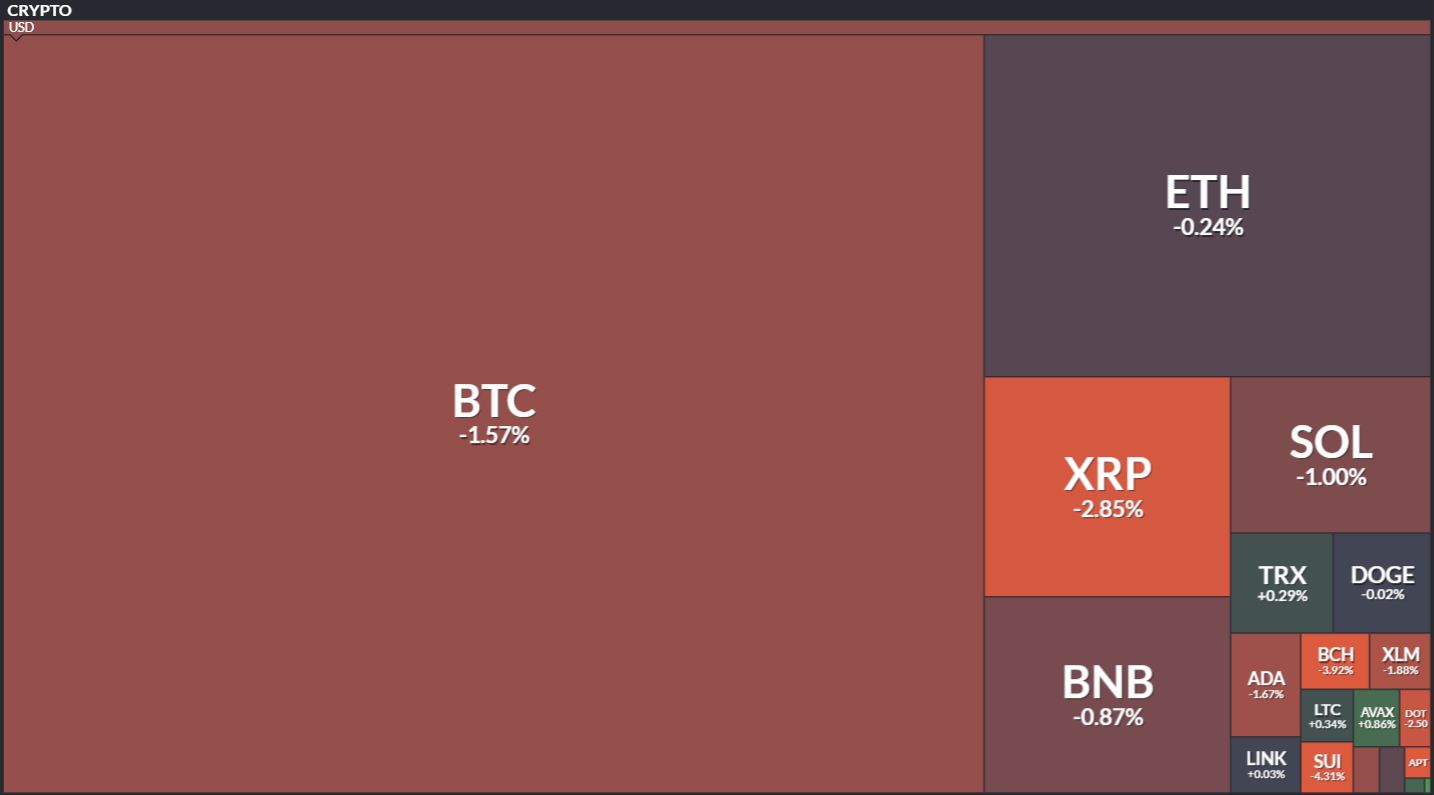

Before we dive in, here’s today’s crypto market heatmap:

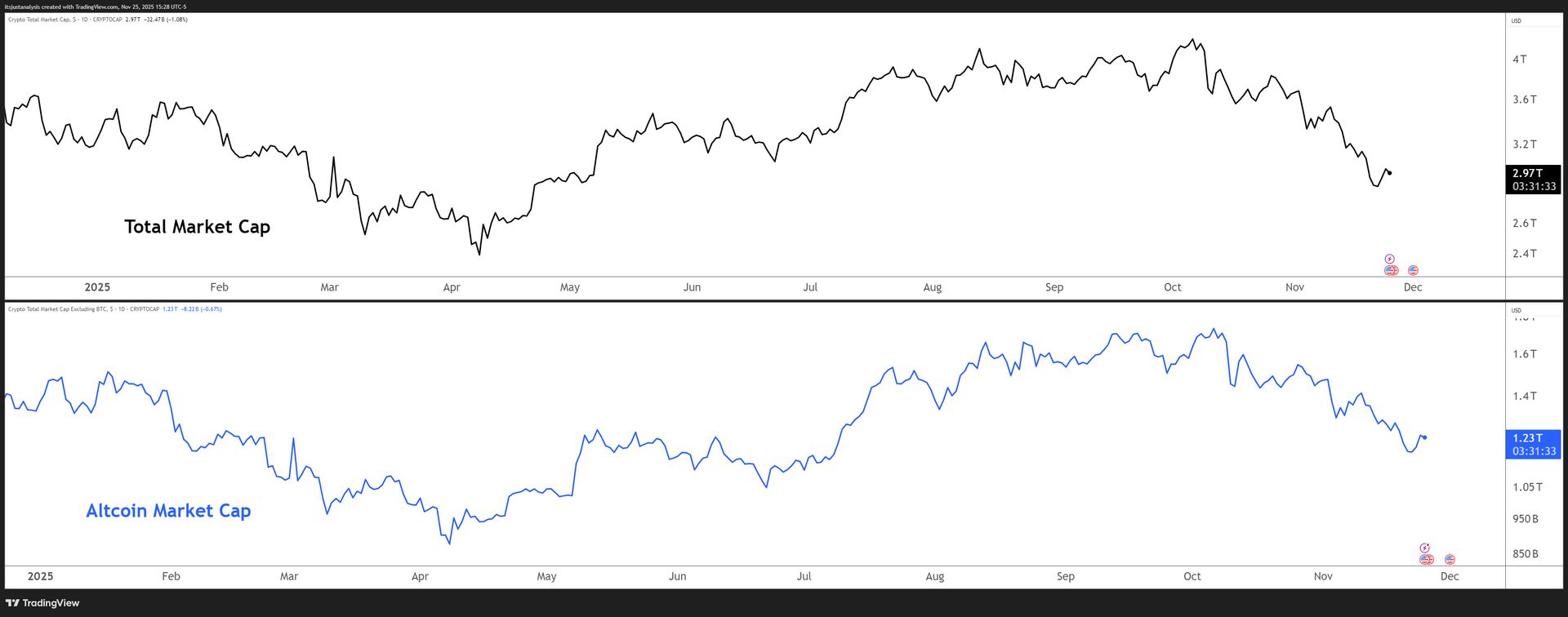

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Polymarket Just Got the CFTC Green Light 🚦

Fun fact in case you forgot: Polymarket is Stocktwits’ official prediction market partner. 🤯

Another fun fact: Polymarket got CFTC approval for an Amended Order of Designation, which means they can operate in the United States as a fully regulated exchange but with intermediated access through FCMs (futures commission merchants) and traditional market infrastructure.

Polymarket has been operating offshore since 2022 after their first encounter with the CFTC. They blocked U.S. IP addresses and built their reputation internationally. During the 2024 election cycle, they processed billions in prediction market volume while Americans could only watch from the sidelines through VPNs and screenshots.

Now they’re coming back – not through some regulatory loophole, but by doing the actual boring compliance work. Surveillance systems. Self-regulatory obligations. Part-16 reporting. The full bureaucratic nightmare that separates legitimate exchanges from offshore casinos.

But You Gotta Do It Through An FCM

The intermediated model is key. U.S. users won’t trade directly on Polymarket – they’ll go through regulated FCMs who handle custody, compliance, and reporting.

That’s how you get institutional participation. That’s how you get real liquidity. That’s how prediction markets become more than just a crypto curiosity.

And the infrastructure is now in place for Americans to legally bet on election outcomes, economic indicators, or what words a CEO may or may not say during a quarterly investor call (oh hai Coinbase). That’s not nothing. 🧠

TECHNICAL ANALYSIS

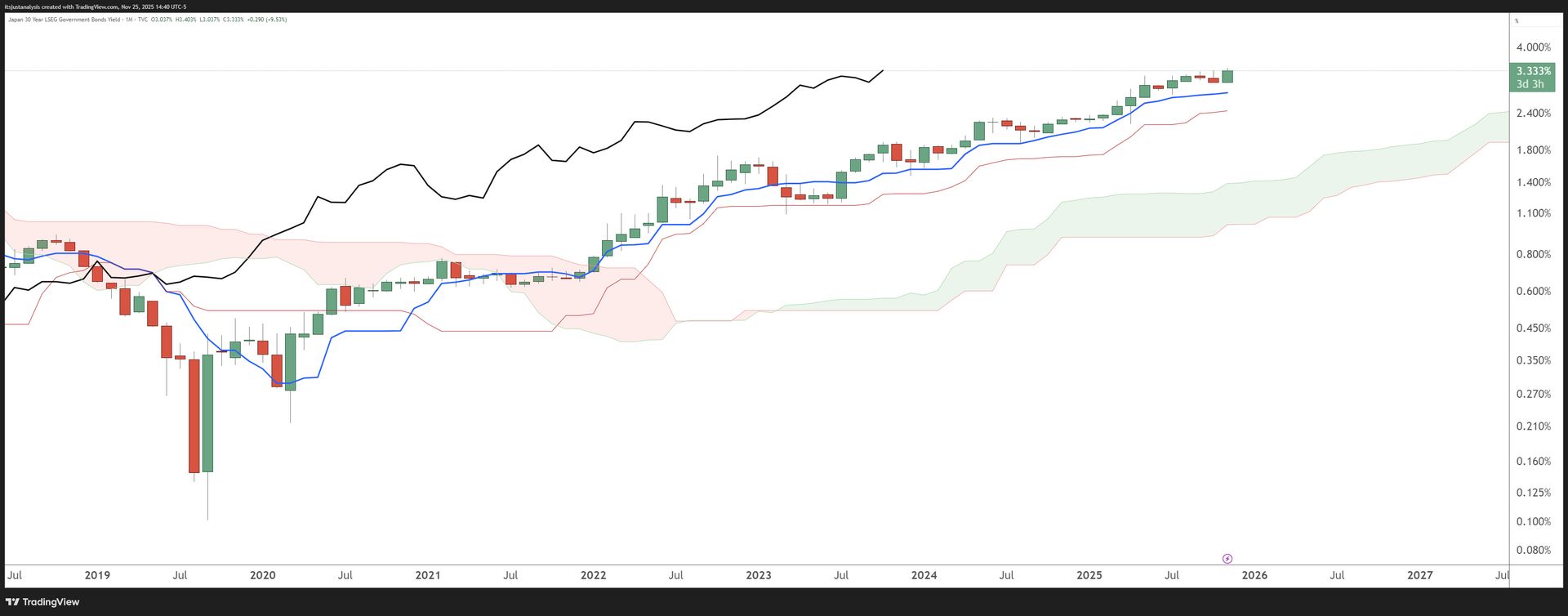

Well, This Is A Scary Ass Chart 😱

This is a chart that should scare the pee out of people. 😐️

Japan 30 Year Bond Yield

You might have heard some people talking about the Japanese Yen or their bonds. In crypto, it’s not something we usually worry about – but when the Yen starts to do crazy shit, it can fook up things on a global scale.

The Yen matters because it’s been the world’s discount funding source for decades. When Japan kept rates at or near zero forever, global investors borrowed Yen cheaply and sprayed that leverage into everything from US stocks to EM bonds to crypto.

So the Yen isn’t just “another currency.” It’s the grease that keeps things greased. When it strengthens or when Japanese yields jump, the entire machinery of global carry trades shakes.

Flows reverse. Liquidity thins out. Assets that never asked to be part of the drama suddenly get dragged into it. And how could this be affecting crypto?

Let’s look. 🔎

-

Carry trades unwind and liquidity vanishes – A stronger Yen or rising JGB yields force leveraged tourists to deleverage. When they unwind, they sell the most liquid stuff first. That includes BTC. Alts get smacked for sport.

-

Global risk appetite tightens – Crypto thrives on excess liquidity and people feeling a bit too confident. Higher Japanese yields drain global liquidity.

-

Funding rates and perp markets get jumpy – Yen volatility bleeds into broader FX volatility, which hits cross-asset leverage. That spills over into crypto perps.

-

Less “easy money” for the marginal buyer – When bond yields compete with BTC’s “store of value” pitch, some TradFi allocators quietly rotate into guaranteed yield instead of digital hope.

-

Stronger Yen sometimes lines up with global risk-off – When Yen spikes, it usually means macro stress. Crypto doesn’t exactly shine when the macro crowd grabs canned goods and cash.

-

Alts feel the hit way harder than BTC – Higher global yields compress valuations in anything long-duration or speculative. Alts fall right into that bucket.

-

Volatility returns at the worst possible times – Rising Yen volatility often arrives like an uninvited guest. Crypto traders notice when cross-asset vols blow out, and they pull back on leverage accordingly.

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

-

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

-

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

-

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.

NEWS

Texas Buys IBIT 🤯

It’s official:

Twitter tweet

But really only $5 million on the 20th according to the Texas Blockchain Council President:

Twitter tweet

The state’s using the ETF as a placeholder while they finalize the RFP process for self-custody infrastructure. That’s the smart way to get in on the dip – get the exposure now, build the operational framework properly, transition to direct custody when you’re ready.

No rush, no mistakes, no security incidents that end political careers. Also, this allocation comes from existing reserves or alternative funding sources, not tax revenue.

It includes donation mechanisms, multi-year hold requirements, and annual audit mandates. Not as big of a deal as a State hodling the ‘real’ thing, but it’s a start. 💁♂️

NEWS

Kraken Just Trojan-Horsed Real DeFi Into Consumer Banking 🦑

Forget the debit card. Everyone’s going to write about the 1% cashback and multi-asset spending because normies understand those things. 💳️

But the actual story here is that Kraken just built regulatory-compliant rails to plug average consumers directly into DeFi lending protocols – and they’re hiding it behind a Mastercard logo.

The Real Play: Vaults

Buried in the press release: “Vaults” connecting users to “independently audited lending protocols” offering 10%+ APY. Kraken isn’t running some internal yield program where they take deposits and promise you 3% while making 15% themselves.

They’ve built an interface layer that connects consumer accounts – with all the regulatory compliance and banking infrastructure – to actual DeFi protocols operating on-chain.

For years, the DeFi adoption problem has been: How do you get normal people to use protocols that require managing seed phrases, understanding gas fees, and evaluating smart contract risk?

You don’t. You build a regulated intermediary that handles the complexity while keeping the economic benefits.

Traditional banks give you 0.5% on savings while lending it out at 8-20%. That spread is how they buy skyscrapers. DeFi protocols cut out that middleman – borrowers and lenders interact directly. If institutional borrowers need liquidity at 10%, lenders can capture most of that instead of the 0.5% crumbs.

The catch has always been accessibility. Kraken’s bet: What if we do all that infrastructure work and just let people click a button?

Let’s see if this catches on. 👀

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🕶️ Axelar Opens Registration For Zypherpunk, A Privacy Hackathon For Builders

Axelar kicked off signups for Zypherpunk, a competition focused on cross-chain privacy primitives, encrypted messaging, and secure agent workflows. Developers compete by building privacy-preserving apps that actually work at scale. Axelar.

🤖 Fetch.ai Declares The Age Of Agents Officially Here

Fetch.ai published a manifesto-style update explaining how autonomous agents will drive search, execution, payments, and coordination. The pitch is that agents become the default interfaces for digital tasks. Fetch.ai.

🧠 AkashML Launches Managed AI Inference On The Decentralized Supercloud

Akash introduced managed inference services so teams can deploy AI models without touching centralized cloud providers. It offers GPU access, autoscaling, and pay-as-you-go pricing directly on decentralized infra. It’s basically AI hosting that doesn’t live inside a single corporation. Akash Network.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🎨 Metis Blends AI Agents And Onchain Creativity With Its Generative Art Initiative

A gentle reminder that even bots can make pretty pictures. Metis introduced a program that lets AI agents co-create art alongside humans and mint pieces onchain. The project explores how AI can participate in creative economies without feeling like a soulless add-on. Metis.

🎮 Immutable Teases Expansions As Web3 Gaming Momentum Ramps Up

Immutable continues rolling out infra updates, partnerships, and onboarding funnels for studios building fully onchain games. The message is that 2026 will be the year onchain gaming hits mainstream pipelines. They’re trying to become the Unreal Engine of Web3. Immutable.

🦃 Gala Games Announces TownStar Thanksgiving Sale With Seasonal Upgrades And New Items

Black Friday for farm sim gamers? Gala is rolling out a Thanksgiving sale with limited items, boosts, and discounts inside TownStar. It’s targeted at bringing players back before Season resets kick in. Gala Games.

NEWS IN THREE SENTENCES

Protocol News 🏦

🧱 Kaspa Unveils Programmability Mosaic And Previews Smart Contract Foundations

Kaspa rolled out its “Programmability Mosaic,” outlining how future contracts, primitives, and VM layers will land on its DAG-based network. The system introduces modular execution so apps can run fast and securely without slowing the chain. Kaspa.

🔍 Tezos Launches Wallet Checkup To Help Users Audit Security Before It’s Too Late

Tezos rolled out a wallet diagnostic tool that identifies outdated apps, unsafe settings, and risky signing habits. It’s meant to prevent the “I didn’t know” disasters that wipe people out. Blockchain equivalent of a yearly health exam, minus the awkward small talk and cupping of balls. Tezos.

🏷️ Casper Adds Tradable CSPR Names So Wallets Finally Get Real Identities

Casper users can now buy, trade, and manage CSPR Names directly on the official marketplace. The upgrade gives wallets readable identities instead of random hex strings. Casper Network.

LINKS

Links That Don’t Suck 🔗

🏒 CNBC’s official NHL team valuations 2025: Here’s how the 32 franchises stack up

👀 Custody shuffle continues as 87,464 more Bitcoin leaves institution-tagged wallets in 24 hours

📈 Monad surges after token launch – here is why early investors are celebrating big gains

🏦 America’s fifth-largest bank US Bancorp tests stablecoin on Stellar

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋