Shutdown Here But Markets Flying

Presented by

CLOSING BELL

Shutdown Here But Markets Flying

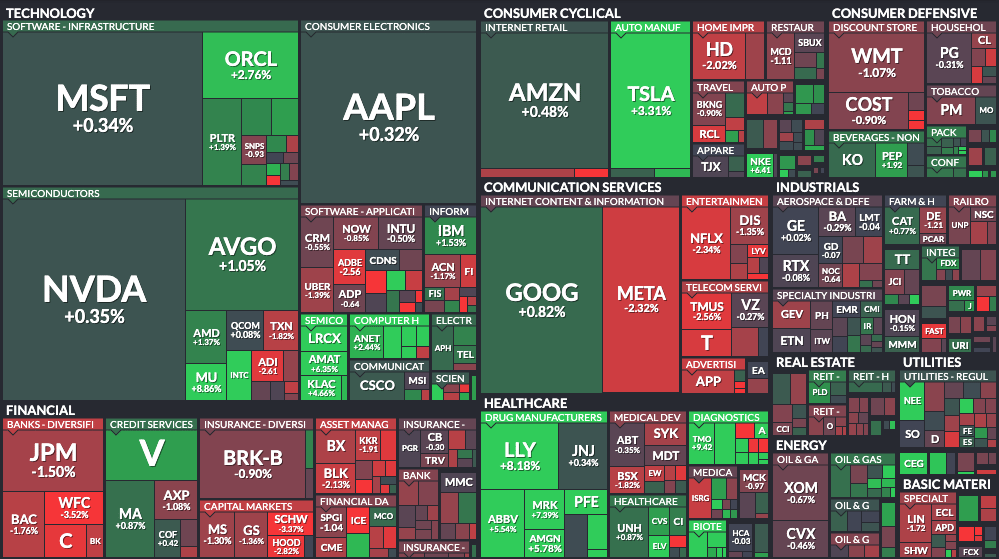

The market climbed Wednesday, after starting the day lower, after the Government shutdown overnight in the U.S. The last partial shutdown took 35 days, but the market rose 10% in that time. The Dow, S&P 500, and Nasdaq 100 hit record closing highs, the S&P breaking 6,700 for the first time.

Analysts at Fitch said the shutdown is not bad news for the roaring market, according to WSJ. Pharma stocks, climbing on tariff clarity that the Pfizer deal brought to the industry, helped push stocks higher. Merck, Biogen, Amgen were leading the market up.

Jobs numbers from ADP, some of the only up-to-date numbers investors will get while the Fed stays closed, showed a shocking -32k private jobs in Sep, when they expected at least +42k. The SCOTUS let Gov. Lisa Cook keep her job, until January, in a win for Fed Independence. 👀

Today’s RIP: Reddit losing AI chat war, Plug and Fermi climb with green energy, and more. 📰

4 of 11 sectors closed green. Health care $XLV ( ▲ 3.09% ) lead, communications $XLC ( ▼ 1.4% ) lagged.

$SPY ( ▲ 0.34% ) $QQQ ( ▲ 0.48% ) $IWM ( ▲ 0.22% ) $DIA ( ▲ 0.11% )

STOCKS

OpenAI Stops Prioritizing Reddit Answer Machine ❔

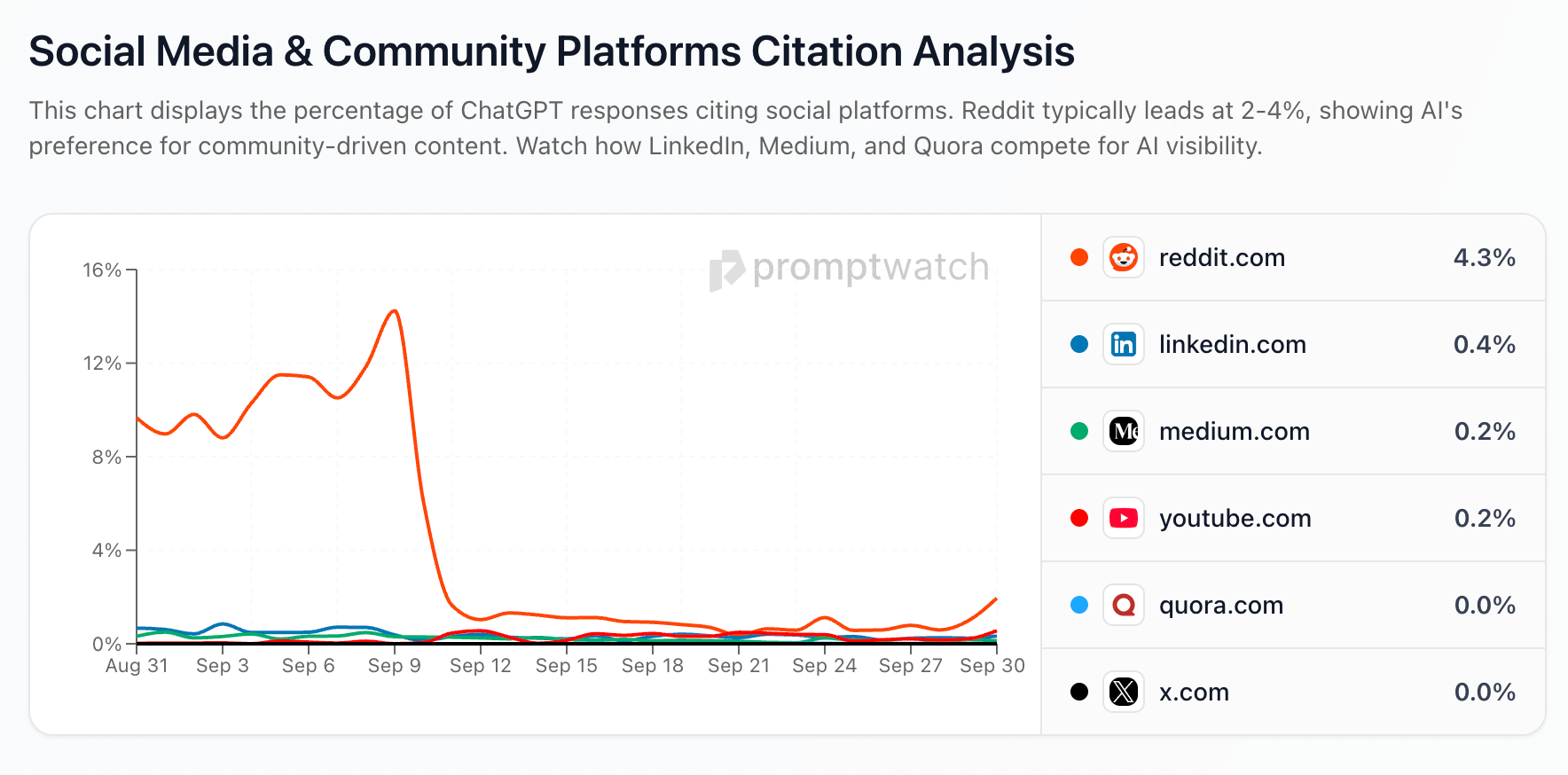

Searching “question/problem reddit” is usually a sure-fire way to get a Google result answered by actual humans about whatever problem or question you have. Reddit knew this, and planned to sell this crowd-sourced Q and A data to large language model companies to answer questions from customers. Just a couple of months after the firm went public, it looks like that plan may need to change.

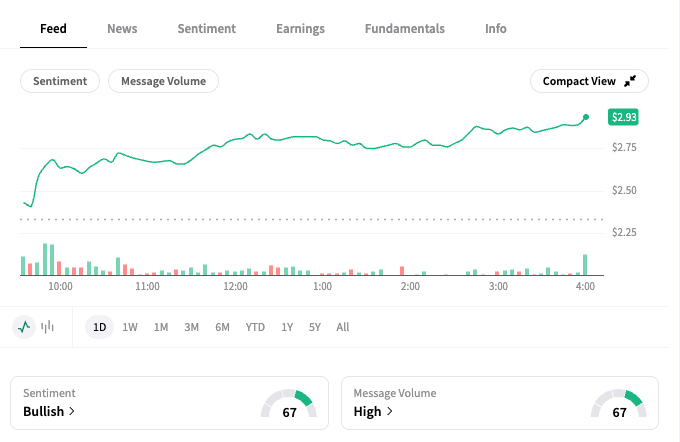

Reddit shares $RDDT ( ▼ 11.91% ) fell Wednesday after overnight social posts started to question how much the social media site expects to make selling its user data to LLM companies like OpenAI.

According to data from marketing sites like PromptWatch, the share of answers on ChatGPT that cite Reddit is down big time, from a September high of 14% to now just 4%.

Investors were worried. Reddit pulled in $35M in its first reported quarter from ‘other revenue’, which includes selling data for searches like this. Although just a small piece of the $535 million revenue pie, it could be enough of an issue to hurt the bottom line. The company only went public in April, and said it may never reach profitability, but so far it’s looking good, with nearly $90M in Q2 net income.

The firm lost nearly $500M last year, usually due to one of two quarters of massive spending.

SPONSORED

AI Boom Fuels Demand – Galaxy’s Helios Powers the Next Wave

The AI rally is reshaping markets and supercharging demand for compute and power.

Galaxy Digital’s (Nasdaq: GLXY) latest research shows U.S. data center consumption is on track to triple by 2028, as hyperscalers and AI labs race to secure capacity.

That’s where Galaxy’s flagship West Texas data center campus, Helios, comes in.

With 800MW approved and 2.7GW under study, Helios is poised to be one of the largest single-site campuses in the world – purpose-built to handle the massive power and connectivity requirements of next-gen AI workloads. As efficiency gains accelerate adoption, the need for scalable, energy-rich infrastructure has never been greater.

Galaxy, a global leader in digital assets and datacenter infrastructure, is ready to meet the moment and help power the AI economy.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

INDUSTRY NEWS

Plug Power Surges With Green Energy, Femi Climbs On IPO 🌿

Plug Power shares climbed $PLUG ( ▲ 25.75% ) Wednesday, after the battery and electric company shipped a 10-megawatt hydrogen array to Portuguese company Galp.

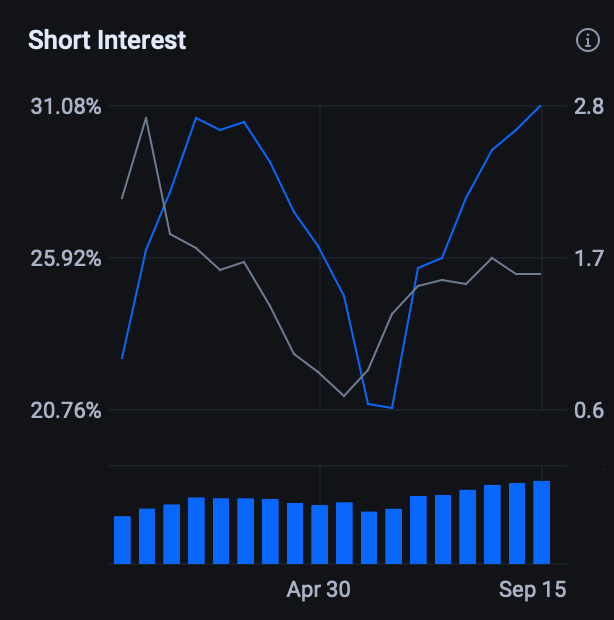

The green tech makes hydrogen gas to make electricity, but more importantly, marks a win for the heavily shorted stock.

More than 30% of shares at PLUG are being shorted

Europe remains a critical market for the New York-based company. In Q2, global electrolyzer activity, including over 230MW of GenEco projects, added $45 million to Plug’s revenue, with major investment decisions hoped for in 2026.

The Street expects 2025 sales of $710M, but analysts don’t see operating profit for the next four years.

Fermi $FRMI ( ▲ 54.91% ) helped push the hydrogen narrative on Wednesday, flying on the stocks first day as a listed company. The company was not even around 10 months ago, according to Barrons, but now the company is trying to build a massive 5,000+acre data center on the Texas Tech campus.

Fermi says the project will combine natural gas, nuclear reactors, solar panels, and batteries to produce five times the electricity of the Hoover Dam. Sounds ambitious, but the company was co-founded by Toby Neugebauer, former founder of failed anti-woke fintech bank GloriFI, and Rick Perry, former Texas Governor and Secretary of the U.S. Energy Department in Trump 1.0. Perry resigned after allegedly setting up the infamous phone call with Ukraine that nearly got Trump impeached. 😅

The company sold more than $600 million in equity, structured as a REIT, but is unlikely to pay out dividends for years: work has yet to truly begin at the 9-square-mile energy plant, according to Barron’s. The type of reactor they want to build typically takes 15 years to come online. ⚡️

POPS & DROPS

Top Stocktwits News Stories 🗞️

-

Ford climbed as CEO pushed $30K EV strategy.

-

Bitcoin jumped to $116K, lifting crypto stocks.

-

Upstart climbed 3% after BTIG revised delinquency estimates.

-

Plug Power jumped 24% after shipping a major fuel cell.

-

Illumina climbed 8% after launch of new data business.

-

Fermi surged 60% on Nasdaq IPO debut.

-

General Motors rose after Q3 U.S. auto sales jumped 7.7%.

-

MSTR rallied 5% after exempltion from Bitcoin gains tax.

-

Helix debuted OpenAI as first on-chain pre-IPO.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Being A CMT Just Got Even Better On Stocktwits

Stocktwits and the CMT Association are teaming up to elevate the visibility of CMT charterholders across global financial markets.

How to qualify + claim your perks:

If you’re a CMT Charterholder or Candidate, opt in here to unlock:

-

🏅 CMT Badge on your Stocktwits profile

-

📈 Dedicated CMT Stream for real-time commentary and analysis

-

🔍 1 Year of Stocktwits Edge (advanced data + sentiment tools)

-

🎨 Chart Art Features in the daily community TA newsletter

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Continuing, Initial Jobless Claims (8:30 AM), Factory Orders MoM (10:00 AM), Fed’s Balance Sheet (4:30 PM) 📊 * might be different under Gov. Shutdown.

Pre-Market Earnings: AngioDynamics ($ANGO). 🛏️

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

🤖 FTC accuses Zillow of paying $100 million to ‘dismantle’ Redfin

📺️ Government shutdown live updates: Stalemate to last at least three days

😨 Hollywood is not taking kindly to the AI-generated actress Tilly Norwood

🎩 Government shutdown takes hold with mass layoffs looming and no end in sight

🏠️ With Friday’s jobs report in question, ADP shows private payrolls fell by 32,000 in September

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋