Stock Market Goes Nuclear (Again)

CLOSING BELL

Stock Market Goes Nuclear (Again)

$SPY ( ▲ 0.66% ) $QQQ ( ▲ 1.0% ) $IWM ( ▲ 0.76% ) $DIA ( ▲ 0.51% )

Source: Tenor

Despite the Santa Claus rally missing us for the third straight year, U.S. and global stocks closed the week at new all-time highs, fueled by optimism over rate cuts, AI industry news, and expanding market breadth. 🎉

In today’s newsletter, we cover Meta’s latest nuclear energy deal, the disappointing December jobs report and revisions, the Supreme Court punting its tariff view to next week, and more from a busy day on Wall Street. 👇️

STOCKS

Meta’s Latest Deal Sparks Nuclear Energy Rally ☢️

With CES in focus this week, AI, chips, and infrastructure were all top of mind for investors. Nuclear energy stocks have taken a breather since October, but were beginning to slowly catch a bid again … until today’s news reignited the fire. 🔥

Meta announced major nuclear energy deals with Oklo, TerraPower, and Vistra, which will provide up to 6.6 GW of carbon-free power for Meta’s AI data centers. It provides the tech giant with diversified power sources and additional future scale.

For Oklo, this means it can advance its plans for a 1.2 GW nuclear campus in Ohio, with potential power as early as 2030. For TerraPower, the agreement will allow it to develop up to 8 advanced Natrium reactors that support 2.8 GW of power and storage. And Vista’s long-term purchase agreements for over 2.1 GW at its existing plants lock in demand from one of the AI space’s top players. 🤝

This, combined with geopolitical talks over Greenland “joining” the U.S. in some form, boosted nuclear energy and “rare earth” stocks as a group this week. It also reiterated that energy is the problem every tech company is trying to solve right now. ⚡️

And if you don’t believe Meta, just look at OpenAI and SoftBank investing $1 billion in SB Energy to build more AI data centers powered by renewable energy.

We’ll see how far this rally goes, but for now, it’s clear that buyers have recharged their batteries and once again have this space at the top of their radars. 🧭

TECHNICAL ANALYSIS

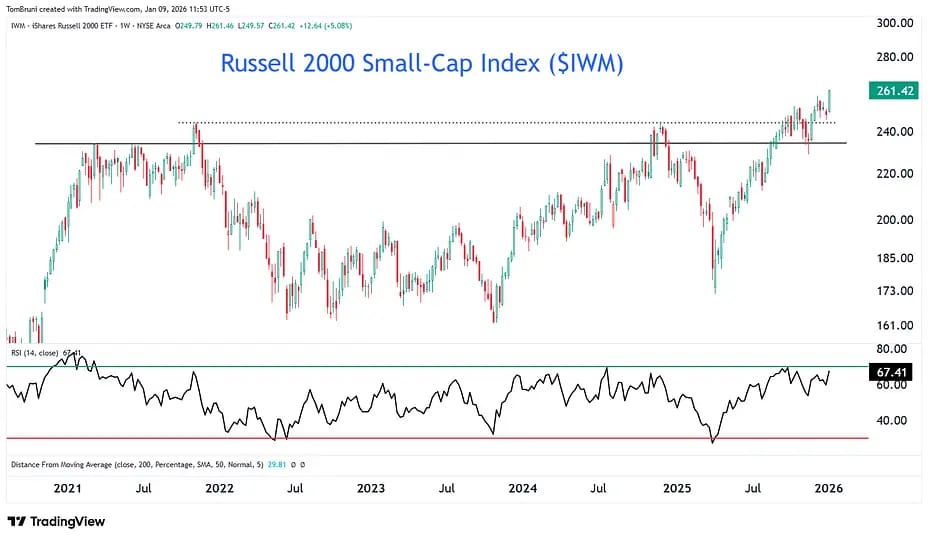

Small-Caps Surge AS Market Breadth Expands 💸

For the last four years, small-caps have frustrated investors with their underperformance and lack of direction, but with this week’s close at all-time highs, analysts say any doubt about the Russell 2000’s trend has been eliminated. 👍️

Heading into 2026, analysts hoped the expanding market breadth we saw last year would continue. After all, more stocks going up is better than fewer. Now, with the Russell 2000, S&P Mid-Cap 400, and equal-weight S&P 500 all breaking out to new highs, analysts view it as clear support for the next leg of this bull market.

Source: TradingView

Stocktwits traders are discussing opportunities across sectors, particularly in healthcare, industrials, and financials, the largest components of the Russell 2000 index. With the large-cap versions of those sector indexes already making new highs, investors are looking for their small and mid-cap peers to join the party. 🥳

POLICY

Supreme Court Delays Its Tariff Decision 🗓️

The market was ready to hear the Supreme Court’s decision on the legality of Trump’s tariffs today at 10:00 am ET; however, it declined to comment just yet. Instead, it pushed the expected delivery to next Wednesday, January 14th. 🐌

Prediction markets like Polymarket indicate a roughly 75% probability that the Supreme Court will rule against the administration and eliminate or limit the tariffs. Regardless, the policy uncertainty did not seem to impact the market much; instead, it hit individual stocks like Nike, On Holdings, etc., which are most exposed.

Meanwhile, Trump’s latest push to make housing more affordable is pumping residential real estate brokerage stocks and related industries. U.S. mortgage rates dipped below 6% amid his $200 billion mortgage bond push, making investors feel more optimistic about the housing market’s prospects in 2026.

Opendoor surged nearly 20% alongside Rocket Mortgage, Compass, and others benefiting from a potential increase in real estate transactions. Homebuilders were also well bid, despite selling off initially on the initial ban of institutional investors. And investment firms like Blackstone and Invitation Homes clawed back more of their initial losses today. 🏘️

ECONOMY

2025 Job Market Recap Raises Some Eyebrows 🧐

The December jobs report helped raise the market’s rate-cut odds by being soft, but not recessionary. Roughly 50k new jobs were added vs. 70k expected, and the unemployment rate ticked down to 4.4%. October and November job creation was revised downward by 76k collectively, adding to the overall weakness.

We’re in a “bad news is good news” environment for the market right now, as long as it doesn’t get “too bad.” Where that line is and when it will start to matter is anyone’s guess, but for now, the market is just excited about earlier rate cuts.

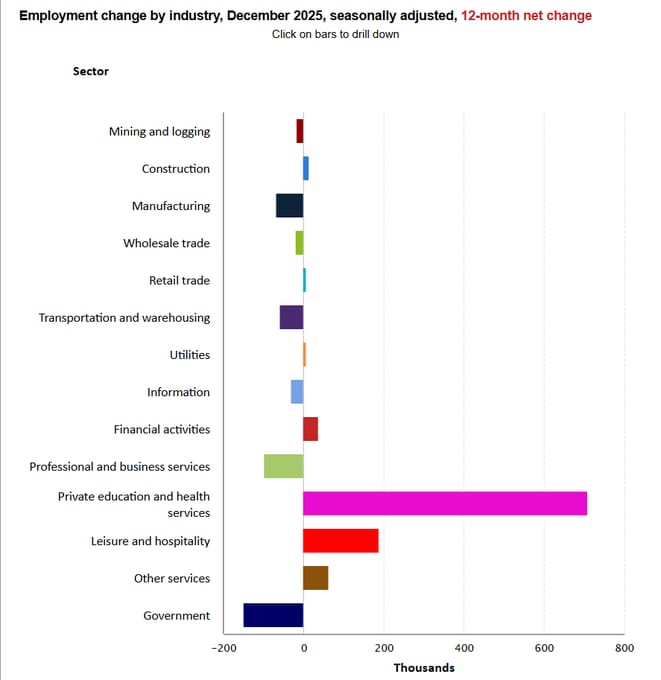

One chart that did make the rounds came from Heather Long, Chief Economist at Navy Federal Credit Union. The figures showed that the healthcare and social assistance sectors were the only ones to add a material number of jobs, while key areas like manufacturing, transportation, and professional services shrank. 🤯

Source: Heather Long on X

Companies are doing “more with less,” choosing to slow hiring but not increase layoffs or separations unnecessarily. So while there’s minimal job growth, the labor market remains relatively tight despite its weakening trend. And that’s good enough for stock market bulls (for the time being). 📉

POPS & DROPS

Top Stocktwits News Stories 🗞️

-

Merck is set to acquire Revolution Medicines for $30 billion.

-

Ondas Holdings prices $1 billion stock and warrant offering.

-

Applied Digital’s post-earnings rally was fueled by analyst upgrades.

-

Big oil will invest $100 billion+ to rebuild Venezuelan infrastructure.

-

Lockheed Martin was upgraded by Truist on its 2026 growth prospects.

-

Carvana could have 70% more upside, according to Morgan Stanley.

-

Costco closed out a strong week after its December sales data report.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Recap CES & The Top Market Themes With “Retail Edge” 🎧️

Links That Don’t Suck 🌐

🤖 Elon Musk’s xAI to build $20 billion data center in Mississippi

💰️ The venture firm that ate Silicon Valley just raised another $15 billion

⛏️ Glencore shares pop 10% as firm restarts mega-merger talks with Rio Tinto

🌡️ China inflation hits near three-year high in December as full-year CPI misses target

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in $OPEN, $NVO, $BMNR, $ASST, $ORBS, $SGOV, $HTZ, $MSOS, $LYFT, $SLV, $GRAB, and $BABA. 📋