The 100-Week Moving Average Is Holding. That's the Good News. That's Also All the News. 📰

OVERVIEW

The 100-Week Moving Average Is Holding. That’s the Good News. That’s Also All the News. 📰

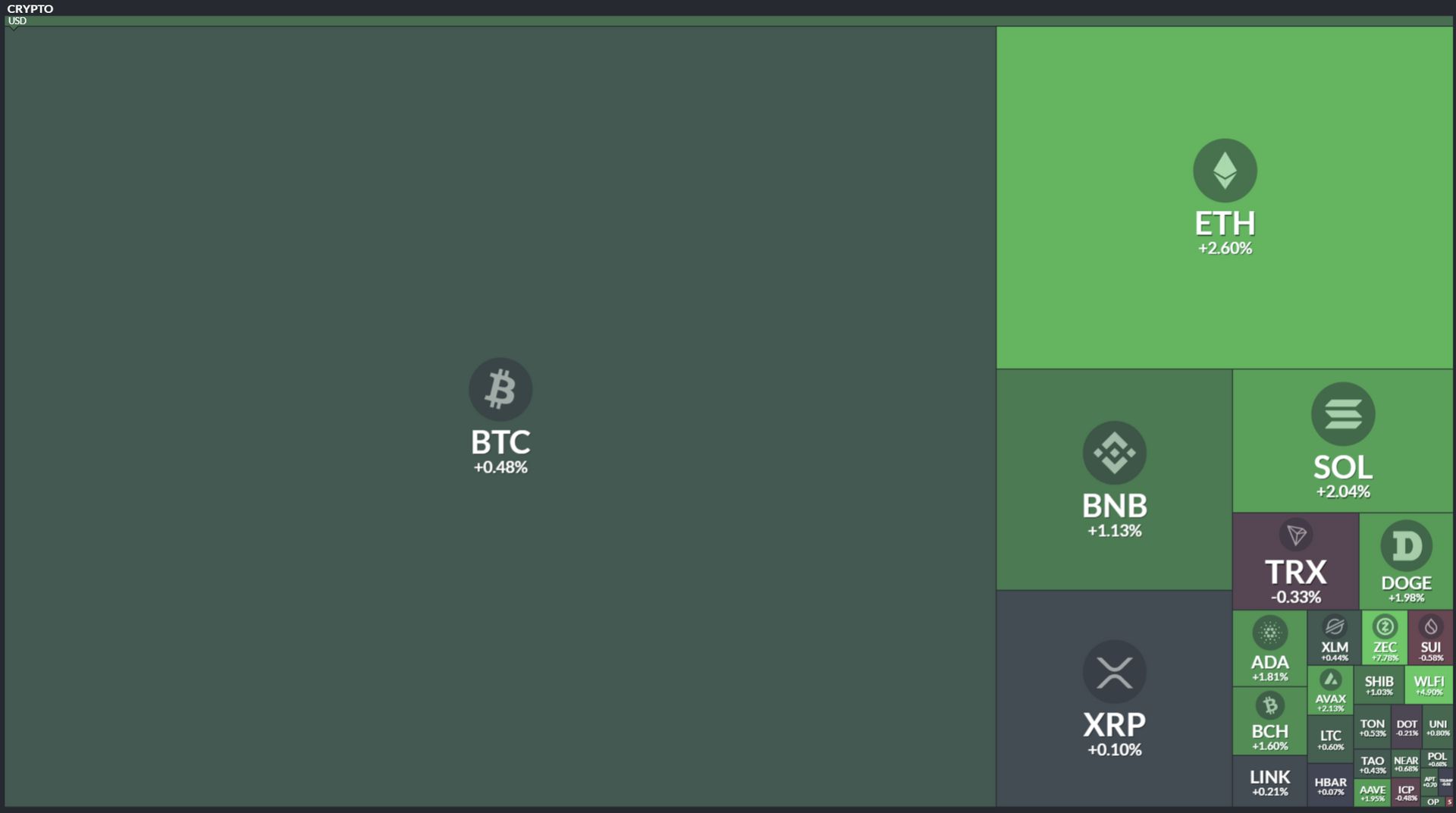

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

TECHNICAL ANALYSIS

HOOOOOOOOOLLLLLLLDDDDDDD 🛑

The chart below is the weekly Total Market Cap weekly chart. And that blue moving average is the 100 Week Moving Average. I guess I also wrote it on there. Three times. Anyway. 😶

That moving average is looking more like Apollo Creed during the tail end of the expedition match with Ivan Drago than, well, Rocky’s fight with Ivan Drago. Makes me nervous as hell. 🧱

TECHNICAL ANALYSIS

Bottom Dwellers 😱

Let’s look at some of the higher market cap altcoins that look, well, like home ground and mixed sausage. But the kind that you forgot to put in the fridge and had to leave for a week. 🦨

Avalanche

We’re going to look at this train wreck with a little more detail here later on in the newsletter, but here’s what’s happening.

It looks horrible, but there’s a possibility that the pain might be ending. If the weekly can close above the 161.8% Fibonacci extension ($11.86) and if the Detrended Price Oscillator crosses and closes above the zero line, then AVAX could get a strong relief rally. 👍️

Ondo Finance

It’s gotta be near criminal how cheap Ondo is here relative to it’s activity, use, and growth. Absolutely stupidly criminal. But deal seekers are going to pounce hard on $ONDO ( ▲ 1.06% ) once retail catches on.

This is very similar to what we looked at with Avalanche. A close at or above $0.3347 would keep ONDO above the 100% Fibonacci extension and could provide enough of a boost to put the DPO above the zero line, triggering a nice jump higher. 🦘

STOCKTWITS

Executive Interview: Plus AI CEO on Autonomous Trucking 🚛

More Stonktwits video content! 👇️

NEWS

VanEck’s AVAX ETF Arrives To A Frosty Reception: Zero Inflows On Day One 🥶

VanEck officially launched $VAVX ( ▼ 0.44% ) on Monday, making it the first and only U.S.-listed spot $AVAX ( ▲ 2.27% ) ETF. Historic moment for the ecosystem. Regulatory milestone. All that jazz. 😶

One problem: nobody showed up.

The fund posted roughly $330,000 in trading volume on day one with zero net inflows. The NAV closed around $2.41 million – essentially the seed capital sitting there wondering where its friends went. For context, Bitcoin spot ETFs saw billions pour in during their opening weeks. VAVX got the financial equivalent of tumbleweeds blowing through an empty barn. Or drifting snow. Or something.

I’m running out of creativity for snow related themes because I’m in West Michigan and school has been canceled almost every day this month because fook this fooking snow and ice and yuck. Anyway.

To be fair, VanEck’s waiving sponsor fees until February 28 (or $500M AUM, whichever comes first – spoiler: it’ll be February 28), and the fund does include a staking component that could generate yield.

AVAX itself is trading around $12, down 65ish% over the past year and sitting roughly 92% below its 2021 all-time high. The token’s been stuck in a deep freeze long before this ETF showed up.

Grayscale and Bitwise have competing AVAX products in the pipeline, so there’ll be more competition for the same pool of institutional apathy soon enough. Yay. 🥳

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🆔 Internet Identity 2.0 Hits NNS Dapp – No More Anchor Numbers, Finally

Starting Monday, the NNS dapp login switches to the new Internet Identity 2.0 interface at id.ai, which means discoverable passkeys and no more memorizing anchor numbers like it’s 2019. Your neurons and assets stay exactly where they are; you just get a one-time upgrade flow and a mobile-ready UI. Try it now at id.ai if you’re impatient. Internet Computer.

🤖 ENS Wants to Be the DMV for AI Agents – But, Like, Decentralized

As AI agents start transacting onchain, someone has to answer “who is this bot and can I trust it?” ENS is positioning itself as the universal naming layer for agents – portable, open, human-readable identities that work across wallets, chains, and agent frameworks. Standards like ERC-8004 and x402 are already building on this assumption, so ENS might accidentally become agent infrastructure without even trying. Ethereum Naming Service.

🔐 Celestia’s Private Blockspace: Keep Your Data Secret But Still Provably Available

Celestia launched Private Blockspace using verifiable encryption – publish encrypted state, prove it’s available and correct, reveal nothing about the contents. Perp exchanges, institutional rails, and data marketplaces can now keep positions and balances confidential without pushing trust back onto operators. Hibachi is already live with it for a perps exchange where users might actually be able to recover funds from encrypted state. Celestia.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🔗 Chainlink’s Says They’re the Only Interoperability Stack That Does Everything

Chainlink dropped a manifesto explaining why tokenization can’t scale without end-to-end interoperability – cross-chain transfers, existing system integration, compliance, privacy, and orchestration all in one platform. They’ve got Swift, UBS, DTCC, and Euroclear running pilots, which is the institutional equivalent of flexing. Chainlink.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🔥 Avalanche’s Retro9000 Now Rewards Apps Based on How Much AVAX They Burn

The C-Chain Round of Retro9000 flips the script – instead of wallet-based voting, grants now go to projects ranked by actual AVAX burned through gas fees. Top 40 on the leaderboard at round’s end get paid, and new projects get score multipliers so they’re not competing against entrenched players from day one. Referrers can earn up to $3K in AVAX per project. Avalanche.

🎁 Gatta Wants to Fix Loyalty Programs by Making Them Private and Bot-Proof

Gatta is building a ZK-powered loyalty system where brands can reward real behavior without tracking, bribery, or airdrop farmers gaming the system. Verifiable credentials prove you’re eligible without exposing who you are or what you did. First version launches this month on Horizen, targeting 100 Web3 brands and eventually AI agents that manage your rewards automatically. Horizon.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

📉 Curve Smooths crvUSD Borrow Rates So You Stop Panicking

Curve DAO approved a monetary policy update that smooths crvUSD borrow rates using an EMA on PegKeeper debt, so rates stop spiking every time the peg defense kicks in. PegKeepers still do their job in real time – rates just take the scenic route now instead of jerking around like a coke up day trader. The baseline rate got bumped to compensate. Curve Finance.

🌉 Stellar’s CEO: Blockchain Won’t Kill Swift, They’ll Just Learn to Coexist

Denelle Dixon’s Davos take: the “disrupt legacy finance” narrative was always wrong – blockchain extends what existing systems do rather than replacing them. Swift connects 11,000 institutions across 200 countries. The future is code-based and committee-based systems bridging together, not one eating the other. Stellar.

🗳️ DAO Voting Is Broken Because Everyone Can See How You Vote

Transparent on-chain voting sounds great until you realize bribers can verify you cast the vote they paid for and whales can pressure smaller holders just by moving first. Zero-knowledge proofs let voters prove eligibility and correctness without revealing their choice, which MakerDAO tested with measurably more independent voting patterns. DeXe’s simpler approach: just hide individual votes until the proposal closes – same effect, less cryptographic ceremony. DeXe.

NEWS IN THREE SENTENCES

Protocol News 🏦

⚠️ Neo Drops a Hotfix and a Hard Fork, Upgrade or Resync Everything

Neo-CLI v3.9.2 is live on TestNet and hits MainNet February 3rd – if you don’t upgrade before then, enjoy resyncing your entire node from scratch. Hard fork heights are block 12,960,000 for TestNet and 8,800,000 for MainNet, and no, you can’t reuse your old config.json. Update your plugins too or don’t complain when things break. Neo.

🗳️ Synthetix Election Season: Four Seats, Your Vote, Governance Theater Continues

Four of seven Spartan Council seats are up for grabs, and SNX stakers in the 420 pool get to pick who signs off on treasury transactions and governance proposals. Nominations close January 25th, voting runs January 26-30 on Snapshot, and you’ll need your SNX staked before ballots open. Synthetix.

📊 Nansen Now Tracks Sui

Nansen officially integrated Sui, giving builders, institutions, and degens real-time visibility into asset flows, wallet behavior, and who’s actually using what. Dedicated dashboards are live today with Token God Mode and wallet profiling rolling out in phases. Smart money tracking on Sui is now a thing. Sui.

LINKS

Links That Don’t Suck 🔗

😨 $7 Billion Exits Binance In A Week, Raising Near-Term Volatility Risks

💳️ Crypto Bill Momentum Builds After Swipe-Fee Proposal Is Shelved

😡 Chinese National Gets 46 Months in Prison for $37 Million Crypto Scam Targeting Americans

🏯 Crypto-Focused Japanese Banking Subsidiary Applies for U.S. Banking License: FT

🌭 Oscar Mayer’s Wienermobile race is coming back to the Indy 500

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋