The Altcoin Index Is Green Today, Which Means We're Only Down 40% Instead of 42% 🤦

OVERVIEW

The Altcoin Index Is Green Today, Which Means We’re Only Down 40% Instead of 42% 🤦

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

Source: TradingView

NEWS

Hedera Just Became McLaren’s Official Web3 Partner 🏎️

Formula 1 partnerships in crypto have a… let’s call it “mixed” track record. So when another blockchain announces they’re slapping a logo on a race car, the default reaction is usually skepticism. 🤔

But this one’s different. $HBAR ( ▼ 0.04% ) just locked in a multi-year deal with McLaren Racing – not as some tertiary “innovation partner” buried in the fine print, but as an Official Partner with branding on the F1 car, driver suits, and both Arrow McLaren IndyCar Chevrolets.

What They’re Doing

The partnership kicks off with digital collectibles – free-to-claim drops during F1 Grand Prix weekends. Arrow McLaren IndyCar collectibles return for the 2026 season. The collectibles will include “unique experiences, prizes and incentives,” which is marketing-speak for “we’re figuring out the utility as we go, but we’re committed to making it worth your time.”

McLaren’s Discord becomes the hub for both crypto-native fans and normies who just want closer access to the team.

More importantly for McLaren: Hedera is governed by a council of blue-chip institutions (Google, IBM, Boeing, etc.), which makes the compliance and brand-safety conversation with sponsors a lot easier than “we’re partnering with a network founded by an anonymous cartoon character.”

Congrats to the Hedera team. 👏

CRYPTOTWITS

New Cryptotwits Podcast Episode! 📺️

NEWS

Nope. Didn’t See That Happening. SKALE Just Landed the PGA TOUR ⛳️

Well, file this one under “announcements I didn’t have on my 2026 bingo card.” 😱

$SKL ( ▼ 2.54% ) just announced a partnership with the PGA TOUR, NODE Foundation, and Solis Interactive to build a mobile golf game called PGA TOUR RISE. On blockchain. With actual digital asset ownership.

Huh?

PGA TOUR RISE is a free-to-play mobile game launching with minigames first, full release planned for 2026. It’s not a golf simulator – it’s more of a strategy/empire-building setup where you’re developing courses, managing resources, and trading gear.

Think less Tiger Woods PGA Tour, more Anno 1800 or Banished but not Civilization because I don’t think you make armies of John Daly on a hex grid to attack competing Golf World stores in another market.

Anyway, all in-game items get minted as digital assets on SKALE, so players actually own their clubs, apparel, and whatever else they accumulate.

First Major App on SKALE’s Base Deployment

Here’s the part that probably matters most for the crypto-native crowd: PGA TOUR RISE will be the first major application deployed to SKALE on Base. So SKALE’s gas-free execution layer is now plugging into Coinbase’s L2 ecosystem.

Base’s Luca Curran called it “a phenomenal way for SKALE to introduce themselves to the Base community,” which is corporate-speak for “we’re happy to have the traffic.”

What The Market Thinks: Not Much

StockTwits sentiment sits at 50 – dead neutral (which, compared to the rest of the market, is pretty good) – with high message volume (65). People are talking, but nobody’s convinced of anything. The chatter spike from the announcement generated noise but not a whole lot of conviction.

And the price action?SKL gave back every penny it gained off this news. Six days ago, it printed its lowest daily close in the token’s history. Yesterday’s close was the second lowest ever.

Fundamentals and price action are living in completely different universes right now. 🌏️

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

STOCKTWITS

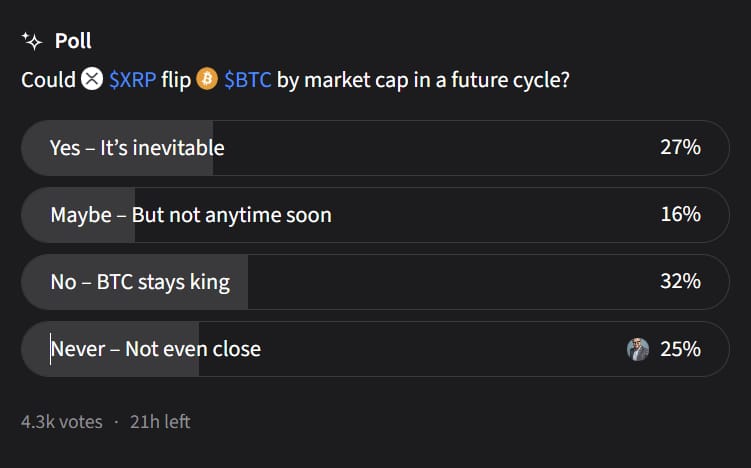

Take This Poll: Could XRP Flip BTC In A Future Cycle? 👇️

Not gonna lie, the current results surprised me. 🤯

Less than a day left! 📆

NEWS

Circle’s Building An Empire. The Stock Price Says Who Cares. 😐️

$CRCL ( ▼ 3.67% )’s playing a bigger game than most people realize. The market just isn’t paying attention yet. 🧠

Easier USDC For You And Me

First, they’ve rolled out a crosschain forwarding service baked directly into CCTP that eliminates the operational nightmare of multichain USDC transfers. The service already powers $HYPE ( ▲ 28.55% )’s one-click USDC deposits from any CCTP-enabled chain to their orderbook DEX.

The fee gets deducted from the minted USDC on the destination chain, so users don’t need to hold gas tokens anywhere. They’re claiming 50-200% reduction in transfer times by removing the attestation-fetching bottleneck.

Circling The RWA Wagons

Second, and this is the more interesting play: Circle Contracts and their Arc L1. This is full-stack RWA tokenization infrastructure. Developers can spin up ERC-20 contracts using pre-audited templates without writing Solidity, mint tokens through Circle Wallets, and monitor on-chain activity via webhooks.

Oh, and Arc runs on USDC for gas fees, not some volatile native token. That’s a deliberate design choice that makes cost modeling predictable for institutions building tokenized asset systems.

In a nutshell, Circle wants to be the main highway for institutional crypto, not just the stablecoin issuer. USDC, EURC, and USYC become the settlement rails. Arc becomes the execution environment. CCTP plus forwarding becomes the interoperability layer. A vertically integrated stack that competes with the “assemble your own infrastructure from twelve different protocols” approach most teams are stuck with.

Meanwhile, CRCL trades nearly flat to its June 5, 2025 IPO open of $69, down roughly -77% from its July all-time high. StockTwits sentiment sits at 31 (bearish) on normal message volume.

This is one of those classic disconnects: company ships infrastructure that could define how institutions tokenize real-world assets, market shrugs. The stock price says nobody cares, but the product roadmap says Circle’s betting they will. 👍️

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

💱 Flow’s Stablecoin Got a Glow-Up

Flow is swapping out USDF for PYUSD0, both backed 1:1 by PayPal USD, but the new one uses LayerZero’s OFT standard. Your USDF is fine, but you’ll need to migrate it yourself through a swap portal, stableswap pool, or Stargate bridge – dealer’s choice. Do nothing and watch your stablecoin slowly become that gift card you forgot in a drawer. Flow.

🦑 Kraken Finally Notices Algorand Exists, Adds USDC Support

USDC on Algorand is now live on Kraken, giving customers access to near-instant, low-cost digital dollar transactions – you know, the thing Algorand has been doing this whole time. Kraken will run an Algorand node and receive a delegation of ALGO that earns zero rewards, which is a very fancy way of saying “we’re helping but not profiting.” Algorand.

🏛️ Alchemy Pay Collects Another State License Like Pokémon Badges

Alchemy Pay just secured its 14th U.S. Money Transmitter License – this time Nebraska – because you need a permission slip from every state to move money in America. They’re also working on an RWA platform, their own stablecoin, and Alchemy Chain, a stablecoin-focused L1 with a testnet launching soon. Global licenses now include Australia, Korea, Switzerland, and a Hong Kong SFC license through strategic investment, so compliance bingo is going well. Alchemy Pay.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🐾 Filecoin’s CloudPaws NFTs Are Basically LinkedIn Badges

CloudPaws is a 100-piece NFT collection for developers, storage providers, and contributors building on Filecoin Onchain Cloud – not for trading, just for ecosystem identity and collaboration access. Holders get priority for testing programs, bootcamps, partner integrations with FNS and Filfox, and offline event perks. Batch 1 minting opened January 15th; batch 2 follows a bootcamp for newcomers. Filecoin.

🎬 Decentraland Wants You to Watch Documentaries With Internet Strangers

Decentraland is hosting weekly watch parties every Wednesday at 2pm and 8pm UTC, screening curated documentaries inside a virtual theatre with live text chat. The six-week lineup includes films about AI, climate change, play, and obsessive artists – basically a film festival for people who want to feel things. Decentraland.

NEWS IN THREE SENTENCES

Protocol News 🏦

🔧 Tellor’s Mainnet Upgrade Is Basically a Bug Squash With Extra Steps

Tellor is upgrading to v6.1.1 on January 29th, tightening validation on reported data and fixing that annoying hex decoding issue where it choked on 0x prefixes. They also moved the daemons package to a separate repo because it needed its own apartment. Tellor.

🇪🇪 Tezos Hits Upgrade #20 Like It’s Collecting Stamps

Tezos just activated its 20th protocol upgrade – Tallinn – cutting block time to 6 seconds and achieving finality in 12. Once 50% of bakers switch to tz4 addresses, all bakers will attest every block for stronger security and leaner consensus. They also added an Address Indexing Registry that cuts storage footprint by up to 100x. Tezos.

🗄️ Sia’s December Update: Boring Infrastructure Work

Sia shipped reliability fixes across the stack – tighter uploads, QUIC bandwidth monitoring, S3 multipart upload support, and a fix for that potential deadlock during downloads nobody asked about. The Grants Program is also getting stricter in 2026 with monthly milestones, architecture overviews, and security best practices now required. Sia.

⭐ Astar Admits Ecosystem Hype Without Products Is Just Noise

Astar’s 2026 strategy pivots hard from “let’s grow the ecosystem” to “let’s build things people actually use,” launching Astar Stack – a product suite including Astar Fi for DeFi access and Astar Guard for risk monitoring. Tokenomics 3.0 and revised dApp Staking are coming Q1, with Burndrop still progressing in parallel whenever regulatory stars align. Astar.

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋