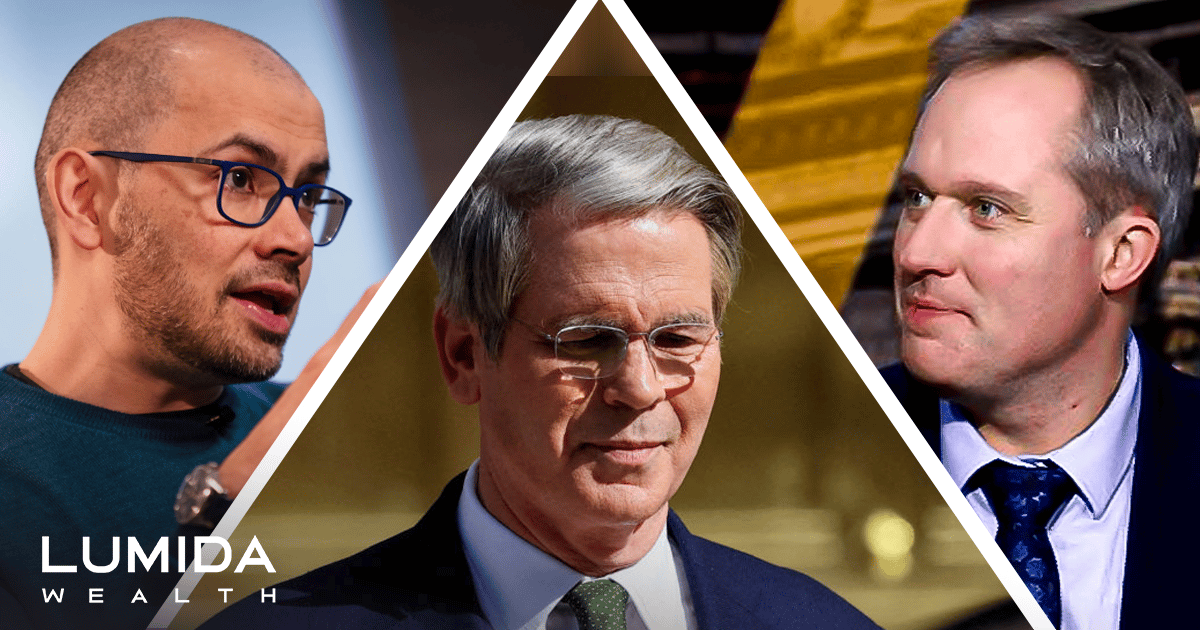

The Bessent Pivot. Inflate, Default, or Build?

Here’s a preview of what we’ll cover this week:

-

Macro: Performance Chase (Cont), No Spending Problem?, Crypto for Safety, AI for Speed

-

Market: Earnings Season Highlights

-

AI: AI Disrupts Commencement, Google’s Veo 3, Engineering Biology, AGI Deadline Compression

Lumida in Spotlight

Buffett Bows Out, Trump Deals In: Tariffs, Trade Wars, AI Upheavel

Catch the full breakdown on our latest broadcast — listen here on Youtube. Or look up, Lumida Non-Consensus Investing on Spotify or Apple.

We discuss:

-

AI Connection vs. Human Connection

-

Regulation in the aftermath of Chevron

-

Trump 1.0 vs. Trump 2.0 on Middle East Policy

Ram on the Deep Podcast with David Seaman

Bitcoin’s above $100K.

Ram Ahluwalia joins David Seaman’s Deep Podcast to break down:

-

Why Bitcoin is at $110,000

-

The inconsistency and flip in Bessent’s policy

Coindesk. TokenPost.

All spotlighting our views on Bitcoin and the U.S. credit downgrade.

We said the downgrade means nothing long-term.

Macro

Hey folks, we will keep posting light due to Memorial Day weekend.

My plan this weekend is to take our kids to the New York Children’s Museum or the Planetarium.

I strongly believe in the age of AI, the next generation of kids who have critical thinking skills and creativity, will have the edge.

I recommend listening to my quarterly chat with my friend Angelo Robles. Angelo and I get together and have a far ranging chat on geopolitics, AI, policy and what all of this means for markets.

Catch the full breakdown on our latest broadcast — listen here on Youtube. Or look up, Lumida Non-Consensus Investing on Spotify or Apple.

Google AI

Google dropped a signficiant set of accountments around AI.

We continue to believe Google is the only name in Mag 7 not priced for AI… and yet they are leading on Agentic AI. Don’t forget driverless cars as well.

Google is our largest stock market position.

Check out these capabilities from Google’s VEO3.

Lumida will share our own Lumida AI Avatar this week.

Bond Yields

Moody’s downgraded US debt…

There are a lot of folks expecting a 5% yield.

It is highly consensus.

But, real interest rates are high.

That means bond investors are earning attractive yield – and in a disinflationary environment.

Also, if growth slows, bonds should benefit.

Real time tax returns show slowing of income growth.

Short interest in bonds is also extremely high.

Mortgage rates are very high.

Backlogs of homes are building. Hard to see mortgage rates going higher.

The boat is tilted too much to one side on a crowded ‘yield steepening’ idea.

Technically, the last few days look like panic selling of bonds.

The cure for high prices is high prices.

The cure for high rates is high rates.

Cyclicals tech and discretionary are stating to give way to other ideas such as healthcare.

I mentioned there are plenty of names in healthcare with attractive free cashflow yield.

Take a look at Medtronic. Medtronic reported strong results and the stock dropped after earnings. We think owning this name in the healthcare space, along with Kidney Dialysis leader Da Vita makes a lot of sense.

Both buybacks and FCF yield and valuation are attractive.

Medtronic for example is around 10-year low forward PE valuations:

And, the stock is near its trendline.

This isn’t a go-go growth stock. But it is benefitting from the secular ‘Aging Demographic’ trends and steady accumulation. It’s not hard to imagine a 10 to 20% price improvement here looking out 12 months or more.

Relatedly, we continue to believe that the healthcare sector is highly oversold and presents strong bargains — especially in a world where consumer real-incomes are slowing. (Just take a look at popular retail stocks like Ross Stores getting shellacked).

Take a look at healthcare valuations over history:

Buying healthcare stocks today is akin to buying banking stocks in the Spring ‘23 banking crisis.

We have a mid to high teens allocation to the sector which is an overweight vs the S&P 500.

When we look at the various charts and positioning, these names have multiple characteristics of a bottoming process.

Really, medical devices as a theme are once again attractive.

When an entire theme is attractive – esp one linked to a long term secular trend – I get interested.

Kidney Dialysis leader, Da Vita, which happens to be a Buffett stock is another idea we like.

The valuation is good.

Notice the valuation across many names is attractive. That means the attractive pricing is not due to idiosyncratic company issues — the entire sector is in correction and on sale.

Da Vita may be better than Med Tronic in some respects. It has a ~17% free cashflow yield and it is plowing all of that back into buybacks. That’s strong capital allocation.

The risk with both of these names is healthcare policy risk. We think those risks are behind us and discounted in the stocks rather that in front of us.

What gives us conviction in healthcare is that we see bargains aplenty matched with attractive technical entries. Take a look at medicare advantage insurer Centene which services federal workers for example. It’s also cheap and at the lower end of its range.

It’s a buffet out there.

We continue to believe United Health is especially mispriced.

Zooming out, it looks like this week was a ‘breather’ week for market.

Indices are holding at the right levels.

Lumida Deals

It’s unfortunate the SEC marketing rule means we cannot preview any deal.

We have to share them after they close.

We are closing on our lates deal and it is over-subscribed.

If you want access them in the future, fill out this form.

And if you’re ready to become a Lumida client — reach out to Marc (marc@lumida.com).

We don’t work with everyone. We guide those who are ready to go deeper — and build wealth in this new regime.

Will share more next week.

Note – our deals to date:

1) CoreWeave Deal 1: $7 Bn valuation (now $45 Bn+)

2) Brad Jacobs QXO at $9.14. Now at $16+ stock in less than 1 year

3) CoreWeave Deal 2: $23 Bn valuation. Up 100% since IPO.

4) We will share more later.

This deal is as as asymmetric as the QXO deal – meaning we don’t see real chances of principal risk, and skewed upside opportunity. More to come.@d

No Spending Problem?

Bessent on Wall Street Week suggsted the rise in long-term yields is not related to the $3 Tn in surprise additional deficit spending from Congress.

He believes the sudden jump rates is a coincidence.

My view and the market view: the simplest explanation for higher bond yields :

Greater borrowing needs to attract $3 Tn in capital. That happens via higher rates.

Remember, Bessent also wants to get the mortgage rates down.

It’s at record highs over the last few years.

How does Bessent square his explanation ‘Markets are pricing in higher growth’ with his explanation for higher rates?

Has the policy goal to lower mortgage rates – a very good objective for Main Street – changed? (No.)

Will higher fiscal spending lower mortgage rates? Not at all.

It crowds out capital to fund other assets.

Said another way, this is Bessent spin.

Bessent should have said:

‘Congress is spending like a group of drunken sailors.

We have a spending problem not a revenue problem.’

That was Bessent’s old message. He has flipped.

Now increased deficit spending is good.

Like the Boy Who Cried Wolf, the more you spin the less markets trust you.

And, isn’t that why markets rallied after the futures sell off following the 50% tariff recommendation on Europe?

Markets are seeing thru this.

Policy makers are gradually eroding their credibility.

That’s why Bitcoin is at $110,000.

I do have concern that the Trump admin is over-using Bessent to spin policy.

Markets see thru that and it gradually causes an erosion in credibility for when you really need it.

Notable to see that Elon Musk has said he is getting back to Tesla and xAI and will not contribute significantly to the next election cycle.

Elon and Bessent had quite an argument in the White House…even though presumably they are both on the side of lower tariff barriers. Would love to understand more what that dispute centered around.

Earnings Season Highlights

Toll Brothers (TOL), released this week on May 21, 2025.

The earnings offer a glimpse into the luxury homebuilding sector, showing how the company is navigating tariff challenges and a shifting housing market.

We think it’s still a bit early to call a bottom in housing stocks.

The Trump admin focus on privating Fannie Mae and Freddie Mac will reduce the outstanding debt. That will be a great IPO, and we’d consider buying it at the right valuation.

But, it will likely raise not lower mortgage rates. Private or semi-private companies will need to focus on the profit motive rather than a public policy imperative.

Housing is a key sector of the economy, so we want to look at how this sector is doing regularly.

Overall, we continue to see backlogs build and softness in building supply materials firms which are reporting year-over-year declines in net income.

We remain on the sidelines here. Perhaps in late 3Q it could be time to buy when rates are presumable lower.

AI

AI Disrupts Commencement

An AI is reading the names of graduates here.

The irony is so thick.

Wonder how many of these graduates are entering the workforce with a degree that will get destroyed by the AI displacement cheese grater?

Many of these grads— engineers, writers, marketers — face a job market where AI tools are coming online faster than most people are prepared for.

Some will get shredded or see their job as scanning human barcoders.

Others – entrepreneurs with a strong work ethic and creativity – will wield the machine.

Only Fans (poised for AI Disruption?)

Engineering Biology

AGI Deadline Compression

Stay tuned, stay informed, and as always, stay ahead.

Not subscribed yet? Don’t miss out on future insights—subscribe to the newsletter now!

For real-time updates, follow us on:

X | Telegram | Youtube | TikTok | News | Ram’s X

As Featured In