The Gladys Knight Strategy for Fed Policy Making

I think Powell’s performance at the press conference earlier this week shows his continued love for the 1970s music of his youth. Gladys Knight and the Pips classic song “All I Need is Time” comes to mind when I think of the Fed’s operating strategy of continuously trying to “buy time” as they search to achieve their dual mandate of maximum employment and price stability while keeping their primary mandate of ensuring smooth US Treasury market functioning always at the top of their mind.

As a result of this operating principle, the Fed is continuously conscious of the current levels of volatility and uncertainty regarding how market participants price their ability to reach these goals.

This backdrop forces the Fed to act in ways which dial up or dial down the level of volatility in markets in order to give them more time to achieve their mandates. When volatility gets too high and threatens their financial stability mandate or may cause a sizable deflationary bust or push us closer to an employment correction, the Fed steps in with both actions and words to dampen volatility back down again to make sure we don’t fall off the ledge. This is the “Fed Put” dynamic that everyone knows and expects and we often spend time searching for that point when markets are on the ropes and volatility is rising.

On the flip side, there is the expected dynamic of the Fed having to re-introduce volatility into a market when volatility is too low. This is a little less known because we have been in a low inflation world for a long time post Volcker leading up to Covid where inflation was never a concern. However, now that we are back to an above 2% inflation environment, when volatility gets too low and threatens to re-ignite animal spirits, unanchor inflation expectations and lead to inflation reacceleration, the Fed usually comes in to introduce volatility again to prevent inflation expectations from becoming unanchored. I guess you could say this is the “Fed Call” level.

There have been various times over the last few years where the Fed acted in this way of re-introducing volatility back into the narrative. The Jackson Hole speech in August 2022 very much comes to mind as does Powell’s hawkish testimony to Congress in March 2023 right at the dawn of the regional banking crisis issues. Financial conditions too loose and inflationary expectations rising too high needed to be smacked back down to reality and they were.

I truly believed we were at that point again at 1:59pm on Wednesday right ahead of the Fed’s March meeting. I thought they were going to come in and deliver a dot plot and press conference which would raise interest rate volatility again in order to smack down the market’s animal spirits which continue to build after several months in a row of loosening financial conditions had brought inflation expectations and actual inflation back up again.

According to various financial conditions metrics that the Fed itself publishes, financial conditions are no longer restrictive and may be looser now than when they actually started the tightening cycle.

Here is the Chicago Fed’s Financial Conditions Index which shows financial conditions today are looser than they have been since before the tightening cycle began in early 2022.

Source: https://www.chicagofed.org/research/data/nfci/current-data

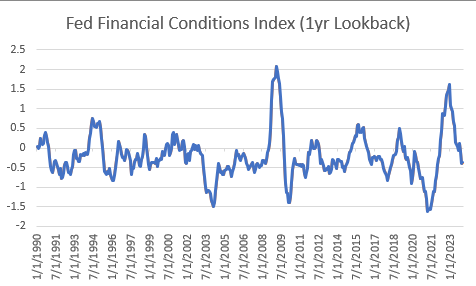

Here is the Fed’s other proprietary measure of financial conditions indexes (updated only through January 2024 data but assume it will show more loosening in February). Positive figures are financial conditions restrictive and negatively impacting growth. Negative figures (like now) are the opposite.

Source: https://www.federalreserve.gov/econres/notes/feds-notes/a-new-index-to-measure-us-financial-conditions-20230630.html

Despite what has been clear loosening of financial conditions over the last several months which are clearly having a positive impact on both growth and inflation (which the Fed upgraded in their most recent Summary of Economic Projections this week), Powell decided to tell the market that financial conditions are still restrictive, are in fact still dampening growth and are not a concern for the achievement of their 2% inflation goal. His words run counter to the data. Frankly, he’s lying.

Even though the dot plot was more hawkish in its totality than folks were thinking it could be (with the mean dot rising for 2024/25/26 and the neutral rate, all suggesting less rate cutting was coming), Powell came on stage and decided against this hawkish posture. While I am still not really sure why he chose this path, if one believes, as I am increasingly doing, that the Fed’s only true mandate is the smooth functioning of the US Treasury markets (which I discussed in the post yesterday), then this strategy makes a lot more sense.

While he may not speaking for the entirety of the committee given there were still 9 members that felt only 2 rate cuts should be coming in 2024, Powell did feel it was necessary to deliver a volatility reducing message at the press conference yesterday. His words slammed the MOVE index back to multi-quarter lows, last seen before the tightening cycle began.

Source: Bloomberg

As I discussed in yesterday’s post, I think the reason for this dovish outlook from Powell occurred because deep down he (along with Yellen) are very concerned about what they saw in the September/October yield spike and term premium expansion period. There is growing concern in DC about the size of the US Government’s growing deficits and ever rising debt situation. There must be a growing concern about fiscal dominance in a dysfunctional DC that cannot raise taxes and cannot lower spending to improve the deficits so the Fed knows the only way deficits can be reduced is if they cut rates. And if this rate cutting regime leads to higher tax receipts from asset price appreciation in a higher inflation environment, that helps the deficit out as well.

The Fed is the only entity with a real lever to lower the deficit through its interest rate policy and so Powell, whose primary mandate is to ensure smooth market functioning for USTs and financial stability, is more inclined to deliver that cutting cycle to Biden and Yellen in an election year than not.

To me, this reality suggests that we aren’t going to return inflation to a 2% environment any time soon and this is why I want to be short US$ against real assets and short USTs overall. While the US$ can rally against other fiat currencies that have central banks who are more willing to cut sooner to address growth concerns (we have already seen the SNB, Mexico, Brazil cutting rates to address their growth concerns), the US$ and USTs should continue to underperform real assets over time until/unless the Fed changes course about how much forward inflation that are going to allow to help the US Government’s fiscal position out.

As long as inflation doesn’t rise too much and the public isn’t moving toward an “Arab Spring,” they probably feel comfortable with this cutting agenda. However, at some point, if the public gets wind of the gaslighting and starts to act differently amidst an ever increasing inflationary backdrop, things are going to be a lot different and the Fed is likely going to regret the path that it has chosen.

My positioning biases: Long: Gold/BTC/Oil, Short: Small Caps, Short: Duration USTs

Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do your own due diligence.