The Week in Charts (5/20/24)

View the video of this post here.

Could your money be working harder for you? Make sure you’re on the right path to reach your goals by getting a second look on your portfolio and financial plan. Creative Planning is proud to provide comprehensive wealth management services to clients in all 50 states and abroad. So whether you’re in California, Texas, Kansas, Florida or any of the states in between, there’s an advisor near you!

The most important charts and themes in markets and investing…

1) Inflation Isn’t Going Away

The bad news? Inflation in the US isn’t going away. For the 37th consecutive month, CPI came in above 3%. That’s the longest period of high inflation since the late 1980s to early 1990s.

The good news? Core CPI (which excludes food and energy) continues to trend lower. The 3.6% increase over the past year was the smallest since April 2021.

The biggest factor driving core prices lower continues to be the all-important Shelter component. Shelter CPI has now moved down on a YoY basis for 13 straight months, from a peak of 8.2% in March 2023 (highest since 1982) to 5.5% today. Given its long lag vs. real-time rental price data (which is down 0.8% YoY), a continued move lower is expected which should lead to a continued decline in core inflation.

While overall inflation remains elevated, we’re in a much better place today than June 2022 when CPI peaked at 9.1%. With the exception of Transportation, all of the major CPI components have a lower rate of inflation today.

Why is Transportation moving in the wrong direction? Skyrocketing auto insurance rates continue to be a major contributing factor, up 23% in the past year. That’s the biggest 1-year spike since 1976.

Outside of CPI, we saw upward inflation trends in two other major reports:

- US Producer Prices increased 2.2% over the last year, the highest PPI reading since April 2023.

- US Import Prices increased 1% over the last year, the biggest YoY increase since December 2022.

2) Why the Fed Needs to Hold the Line

The war against inflation is far from over. Jerome Powell acknowledged as much in a recent speech, saying “we’ll need to be patient and let restrictive policy do its work. I do think it’s really a question of keeping policy rates at the current rate for longer than had been thought.”

This is a big shift from his dovish rhetoric late last year. And as a result, we’ve seen a huge shift in markets.

Entering the year, the bond market was pricing in 6 to 7 Fed rate cuts in 2024 with the first one starting in March. Today, the expectation is for just 1 to 2 rate cuts with the first cut not coming until September.

Whether that September cut actually happens will depend on the data between now and then. The Cleveland Fed is forecasting another 3.4% CPI reading for May, which is unlikely to change anyone’s mind one way or another.

The Fed continues to say that they need to see more progress towards their 2% inflation target before cutting rates. But with each passing month, the gap between actual inflation and a 2% inflation trendline continues to widen. We’ll likely see CPI move back to 2% at some point, but that won’t erase the above-average cumulative inflation we’ve all experienced since 2020.

3) Record Balance Sheet Drawdown

The Fed’s balance sheet is now 18.5% lower than its April 2022 peak. That’s the largest drawdown on record, surpassing previous large drawdowns in 2009 and 2019. Those drawdowns would abruptly end with a return to Quantitative Easing (QE), and the Fed’s balance sheet would hit new highs in both cases less than a year later.

That seems unlikely today with inflation still a concern and Quantitative Tightening (QT) continuing for now, albeit at a slower pace starting in June ($60 billion/month vs. $95 billion/month currently). But with the Fed’s powers stronger than ever, rest assured they will be quick to use them when the next “crisis” emerges. Which means that it’s only a matter of time before QE returns.

4) Racing Back to New Highs

Remember the 6% correction back in April?

Well, that’s officially over with the S&P 500 racing back to new highs last week. The S&P 500 hit its 23rd all-time high of the year, crossing above 5,300 for the first time.

The Dow also hit a new record high, crossing above 40,000 for the first time.

When will the Dow hit 80,000?

That depends on its rate of return going forward, which is impossible to predict.

Here’s how long it took for the Dow to double the last few times…

- Dow 20,000 to 40,000 (Jan 2017 – May 2024): 7 years

- Dow 10,000 to 20,000 (Mar 1999 – Jan 2017): 17 years

- Dow 5,000 to 10,000 (Nov 1995 – Mar 1999): 3 years

- Dow 2,500 to 5,000 (Jul 1987 – Nov 1995): 8 years

4) Roaring Kitty Returns

The meme stock mania returned last week in spectacular fashion.

All it took was this tweet from “Roaring Kitty” (real name: Keith Gill) which meme stock acolytes interpreted as a signal to buy. Why? Because it’s showing a gamer leaning forward in his chair, which apparently means that he’s “getting serious.”

If that sounds crazy, this will sound absolutely insane: at their peak levels last Tuesday, GameStop ($GME) was up 271% on the week and AMC Entertainment ($AMC) was up 308%.

How is that possible?

The power psychology, FOMO, and herd behavior.

While Roaring Kitty disappeared back in 2021, membership in the Reddit message board (r/WallStreetBets) from which he used to post has continued to grow…

And Roaring Kitty’s own influence has grown as well, with 27 million views of the gamer tweet and his follower count rising in the past week from 460,000 to over 1.3 million.

But as we saw in 2021, a meme can only take a stock so far before the fundamental reality sets in. And this time, the party didn’t last very long. The tide abruptly turned last Wednesday and both GameStop and AMC would decline over 60% from their peak levels to Friday’s close.

Interestingly, while volatility in meme stock world was sky-high, that didn’t translate whatsoever into the broader market. The Volatility Index ($VIX) ended the week at 11.99, its lowest close since November 2019.

5) The Metal With a PhD in Economics?

Copper prices ended last week at their highest level in history, rising 34% over the last 3 months.

Often referred to as Dr. Copper, rising prices are said to be a bullish indicator for the markets and the economy while falling prices are considered a bad omen.

But is this actually the case?

The data doesn’t support it. The S&P 500 has shown strong gains irrespective of the direction of Copper and the US economy has generated real growth in years when Copper has been down and up (see video discussion here).

6) Will the China Reversal Stick?

The MSCI China ETF ($MCHI) is now outperforming the S&P 500 ETF ($SPY) on the year after rallying over 30% from its low in January.

Is this just a dead cat bounce or something more?

That remains to be seen, but with a weighting of over 25% in the major Emerging Market indices, strength in China would go a long way to reversing EM’s decade-long underperformance relative to US equities.

7) The Walmart “Bubble?”

Walmart reported earnings last week with big beats on both Revenue (+6% YoY) and Net Income (+205% YoY).

Its stock jumped to an all-time high after the report and is outpacing the S&P 500 on the year with a gain of 23%.

Walmart, not known for attracting high-end shoppers, has benefitted from the sustained period of high inflation by attracting more affluent customers to its stores. Former Walmart CEO Bill Simon said this has created a “bubble” at Walmart, warning that once inflation abates these high income shoppers will leave in search of higher levels of service.

While Walmart sales have been strong, we continue to see signs of consumer weakness across the broad retail spectrum.

US Retail Sales increased 2.7% over the last year but after adjusting for higher prices they actually fell 0.7%. Both of these numbers are well below the historical averages of +4.7% nominal growth and +2.0% real growth.

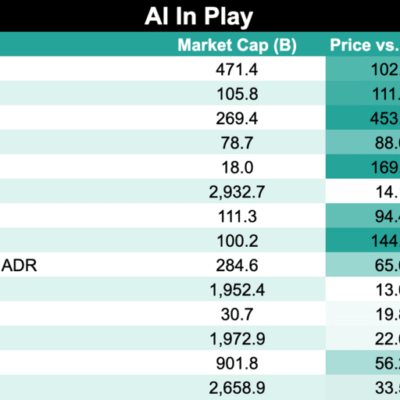

8) Booming … Utilities?

Here’s something you don’t often see: 3 out of the top 5 stocks in the S&P 500 this year are in the typically boring Utilities industry (Vistra, Constellation, and NRG).

With a gain of 15% the S&P 500 Utilities sector is actually outpacing the S&P 500 Tech sector (+10%) on the year.

The narrative behind the move: surging demand for electricity. Where from? You guessed it: powering the AI revolution. Goldman Sachs is forecasting a 15% annual increase in data center power demand over the next 7 years, with data centers making up 8% of total US power demand in 2030 (up from 3% today).

Some are comparing the current period to the boom in electricity generation during the 1960s and 1970s which stemmed from the wide adoption of air conditioning.

9) A Few Interesting Stats…

a) Grade Inflation: the typical GPA of a high-school graduate rose from 2.7 in 1990 to 3.1 in 2019. Why? Pressure from parents and administrators, as well as the heightened competitiveness of college admissions.

b) Americans are expected to spend $449 billion this year on home renovations and repairs, down from a record $481 billion spent in 2023. That would be the first annual decline in spending since 2009.

c) The US goods deficit with China is at its lowest level since 2010, down 34% from the peak deficit in 2018.

d) The best performing stocks in the S&P 500 over the last 5, 10, 15 and 20 years.

e) The highest and lowest price to sales ratios in the S&P 500…

And that’s all for this week. Have a great week!

-Charlie

If we can help guide you on your road to wealth, reach out.

Disclaimer: All information provided is for educational purposes only and does not constitute investment, legal or tax advice, or an offer to buy or sell any security. Read our full disclosures here.

The post The Week in Charts (5/20/24) appeared first on Charlie Bilello’s Blog.