The Weekend Rip: Aug 17, 2025

The Weekend Rip

Happy Weekend!

Markets swung between record highs and tariff jitters last week, with inflation data, chip diplomacy, and geopolitical drama all in play. Nvidia and AMD struck a 15% China chip tax deal, CPI came in steady, and rate cut hopes surged midweek before hotter PPI data and looming 300% semiconductor tariffs cooled sentiment. Trump invited Putin onto U.S. soil, where they met briefly, but then canceled further plans with no ceasefire in sight. As we head into next week, watch for Fed commentary, retail earnings, and fallout from the chip tariff threat. 📉

Let’s recap and prep you for the week ahead. 📝

◀️ Markets dipped slightly on Monday as investors braced for Tuesday’s CPI release and digested a flurry of trade and earnings news. Nvidia and AMD struck a deal with the White House to pay 15% of China’s chip sales revenue in exchange for export clearance, a move seen as better than losing the market entirely, but one that sparked debate over precedent. Trump confirmed gold will not be tariffed after a confusing Customs ruling briefly sent futures to record highs. Earnings were mixed: BigBear.ai missed badly, Kodak warned of debt trouble, and Monday.com and C3.ai both plunged post-report, while SoundHound surged and Ford boosted its EV investment to $5B.

🌏️ Markets rallied Tuesday with the S&P 500 and Nasdaq both closing at record highs, fueled by steady July inflation data and surging airline stocks. Core inflation ticked up slightly, but overall CPI held at 2.7% year-over-year, reinforcing expectations for a Fed rate cut in September. Airline fares jumped 4% in July, sending United, Delta, and American Airlines up over 9% each. Tech led gains with Nvidia hitting a fresh record after announcing resumed AI chip sales to China. Perplexity AI made headlines with a $34.5B all-cash bid for Google Chrome, aiming to acquire its massive user base amid looming antitrust rulings, though experts view the bid as more symbolic than serious. Meanwhile, Cava Group disappointed investors with Q2 revenue of $278M and sharply slowed same-store sales growth, cutting its full-year forecast and sending shares down over 20% after hours. Despite the miss, Cava opened 16 new stores and remains on track for 1,000 locations by 2032.

⚡️ Markets climbed Wednesday as rate cut hopes sent the S&P 500 and Nasdaq to back-to-back record highs, while the Dow surged over 450 points, nearing its own all-time high. Treasury Secretary Scott Bessent called for up to 150 basis points in cuts, intensifying speculation of a jumbo September move. Bullish, the Peter Thiel-backed crypto exchange and owner of CoinDesk, soared 180% intraday on its NYSE debut, ending with a $12B market cap after multiple volatility halts. Cathie Wood’s Ark Invest scooped up 2.5M shares, signaling strong institutional interest. Apple revealed plans for a 2027 launch of a tabletop robot with a motorized iPad-like screen and redesigned Siri, part of its AI comeback strategy. Amazon expanded its same-day grocery delivery to over 1,000 cities, aiming for 2,300 by year-end, offering free delivery on $25+ orders for Prime members and intensifying competition with Walmart, Instacart, and DoorDash.

🐂 Markets were mixed Thursday as hotter-than-expected PPI inflation data rattled rate cut expectations, with wholesale prices jumping 0.9% month-over-month—the largest surge in three years—driven by tariffs and supply chain pressures. Despite this, futures still priced in a 92.6% chance of a 25bps cut in September, though odds of a 50bps move dropped to zero. Intel shares spiked nearly 8% after Bloomberg reported the Trump administration may take a stake to support its chip manufacturing, part of a broader push to secure U.S. semiconductor dominance. Berkshire Hathaway revealed a $1.6B stake in UnitedHealth, sending $UNH up nearly 10% despite its 50% YTD decline amid rising medical costs, medicare cuts, and DOJ probes. Elsewhere, Deere fell 7% post-earnings on weak ag fundamentals and tariff pressures, while crypto retreated with Bitcoin dropping below $118K. Retail sales rose 0.5% in July, and geopolitical eyes turned to Trump’s scheduled meeting with Putin in Alaska.

😢 Markets fell Friday as the White House floated semiconductor tariffs in the 200–300% range, sparking fears across tech and dragging sentiment lower. Consumer confidence dipped for the first time in four months, while solar stocks surged on fresh tax credit guidance that extended eligibility for new projects. Trump met with Putin in Alaska to discuss a potential Ukraine ceasefire, flanked by Rubio, Lutnick, and Bessent. Berkshire’s UnitedHealth stake helped lift the Dow, which closed just shy of a record. Meanwhile, Bitcoin cooled to $121K, Intel rose on renewed stake rumors, and Opendoor jumped 9% on CEO exit and activist buzz. The Alaskan summit ended shortly after it began, with no ceasefire or success to speak of. Instead, the president said the world should focus on a full peace agreement to end the war.

🤩 This week’s Stocktwits Top 25 showed momentum performance vs. the indexes.

Here are the closing prices:

|

S&P 500 |

6,449 |

+0.94% |

|

Nasdaq |

21,622 |

+0.81% |

|

Russell 2000 |

2,286 |

+3.07% |

|

Dow Jones |

44,946 |

+1.74% |

SPONSORED

Data Just Made Palantir Worth $250B

Palantir just rocketed to $250 billion by helping companies extract value from user data.

The big data gold rush is here, but the company that stands to profit the most may not be Palantir…

A new disruption to smartphones gives users a share in the data profits, already facilitating +$325M in earnings and generating +$75M in revenue.

With 32,481% revenue growth, this company is gearing up for a potential Nasdaq listing (stock ticker: $MODE), and pre-IPO shares are available at only $0.30/share.

It’s a $1 trillion industry, and their disruptive EarnPhone is now being distributed by Walmart and Best Buy.

⚠️ The window to invest at $0.30/share is closing — act now.

Invest in the Mode Pre-IPO Today

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what’s going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Earnings This Week

Earnings season is underway, with over 177 stocks reporting this week.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

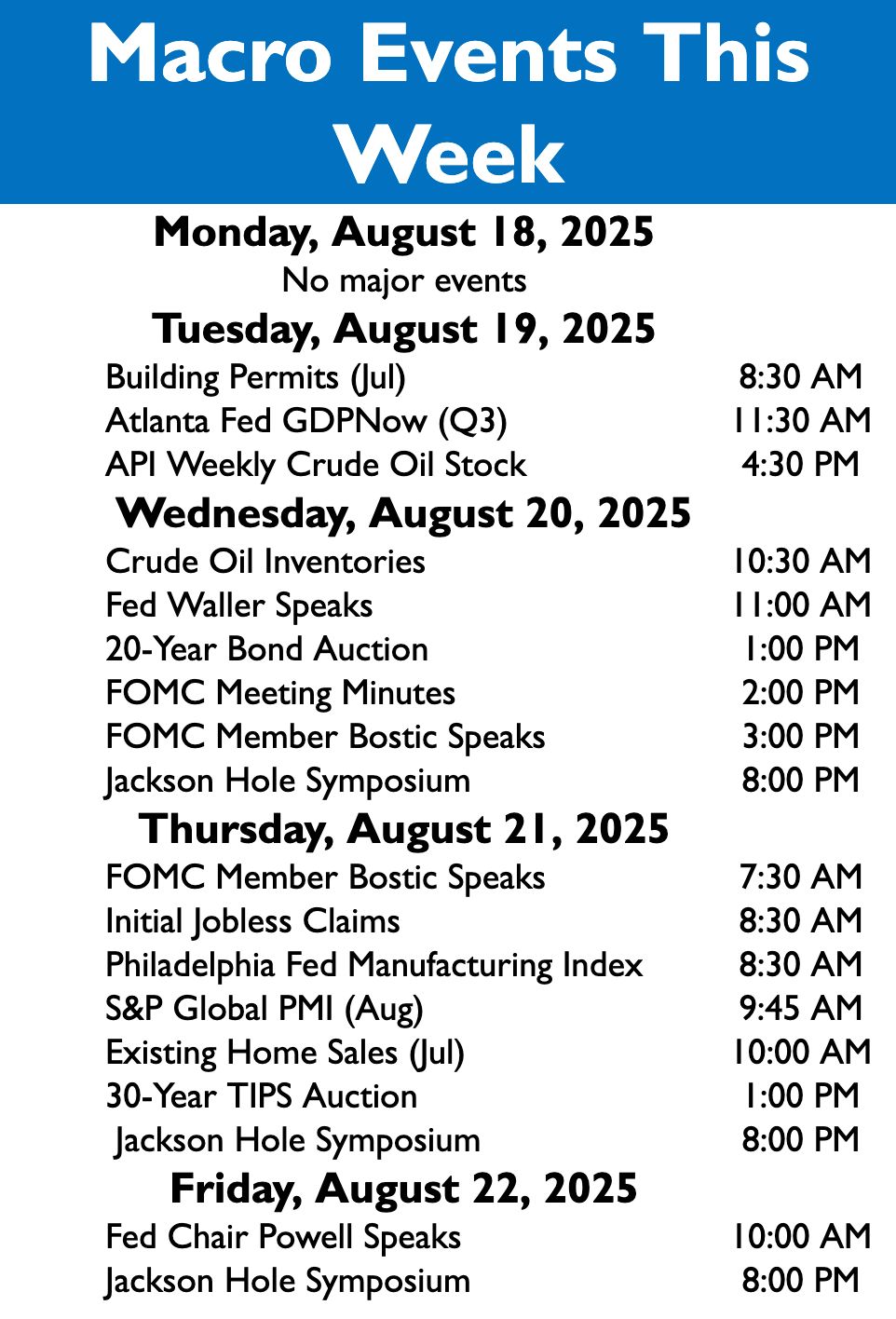

Economic Calendar

It’s a busy week of economic data, with investors focused on FOMC minutes and Fed Speak at the Jackson Hole Summit.

In addition to the above, check out this week’s complete list of economic releases.

Links That Don’t Suck 🌐

🆘 Make smarter investing decisions all summer long with IBD Digital—try 3 months for just $30*

🏘️ Florida’s housing market was once red-hot. Now it’s one of the coldest in the country.

⚠️ European leaders to join Ukraine’s Zelenskyy for meeting with Trump

🪴 ‘The risk that’s on our doorstep’: July inflation data has economists on edge

🛍️ America starts to feel the squeeze: What we know about tariffs and inflation

🚶♂️ Powell’s Jackson Hole speech, Walmart earnings: What to watch this week

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Kevin Travers) your feedback; follow me on Stocktwits. I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋