The Weekend Rip: Jan 25

The Weekend Rip

Happy Weekend!

Major stock indices finished mixed in a volatile, short week as investors grappled with a “Greenland-induced” trade war scare and a significant plunge in Intel shares. While markets initially tumbled after President Trump threatened fresh 10% tariffs on eight European allies to pressure a sale of Greenland, equities recovered mid-week when he signaled a de-escalation at Davos. However, the week ended on a cautious note with the S&P 500 suffering its second straight weekly loss, as gold surged toward $5,000 and silver topped $100 amid persistent geopolitical uncertainty and Intel’s 17% post-earnings slide.

Let’s recap and prep you for the week ahead. 📝

◀️ On Monday, the market was closed for Martin Luther King Jr. Day.

Tuesday 📉: Major indices tumbled over 2% as Trump ignited a global trade war by threatening eight European allies with fresh 10% tariffs to force the sale of Greenland, wiping out $750 billion in market value. While safe-havens gold and silver hit fresh record highs, Netflix shares fluctuated after-hours following a Q4 beat of 325 million subscribers and an all-cash pivot for its $83 billion Warner Bros. Discovery acquisition.

Wednesday 🌮: Markets staged a “Taco Turn-around” as major indices roared back after Trump signaled a de-escalation in trade tensions at Davos, postponing European tariffs and opting for a non-military “framework plan” for Greenland. While equities rebounded, Netflix fell to a 52-week low on a cautious 2026 outlook, chips climbed higher, and Apple joined the AI rally by announcing a massive Siri overhaul into a conversational chatbot.

Thursday 🌎️ : Markets closed higher as a “concept of a plan” for Greenland eased trade war fears, with Trump and NATO discussing mineral rights and missile defense instead of aggressive tariffs. While Q3 GDP was revised up to a robust 4.4%, Intel shares slipped after-hours on a weak Q1 outlook despite a Q4 beat, as the chipmaker struggles to keep supply abreast of “insatiable” AI demand. The highlight of the day was the official sign-off on the TikTok US spinoff, a historic deal led by Oracle and Silver Lake that secures the app’s future in America by retraining its algorithm on domestic data

Friday 🏔️: Major indexes finished mixed as the S&P 500 secured its first back-to-back weekly loss since June, largely weighed down by Intel’s 17% plunge following a weak quarterly outlook. While blue chips limped, safe-haven commodities soared to historic levels with gold nearing $5,000 an ounce and silver breaking the $100 mark for the first time.

Saturday: This week’s Stocktwits Top 25 showed performance vs. the indexes. ICE agents tackled, shot and killed a nurse on the streets of Minnesota. A blizzard swept the United States.

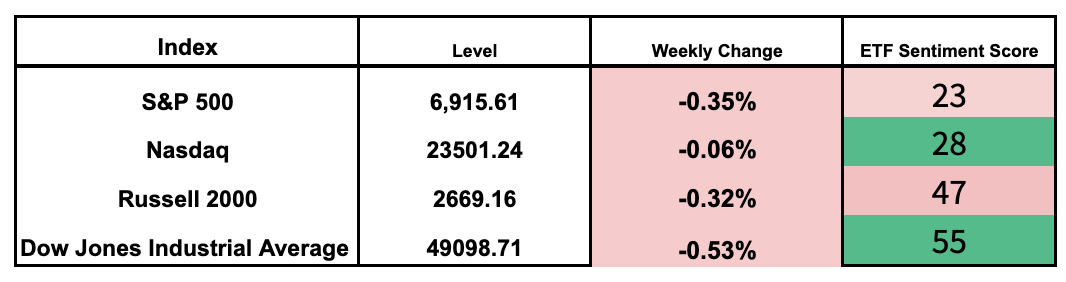

Here are the closing prices:

SPONSORED

Hiring in 8 countries shouldn’t require 8 different processes

This guide from Deel breaks down how to build one global hiring system. You’ll learn about assessment frameworks that scale, how to do headcount planning across regions, and even intake processes that work everywhere. As HR pros know, hiring in one country is hard enough. So let this free global hiring guide give you the tools you need to avoid global hiring headaches.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what’s going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data. There are so many earnings, there is no way to fit them all in our regular format.

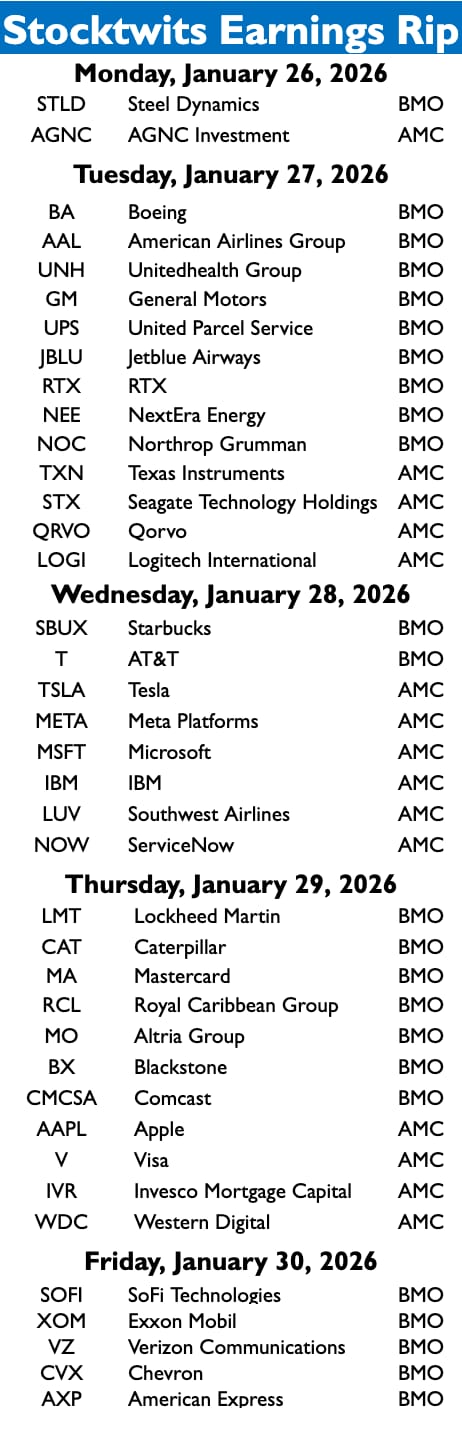

Earnings This Week

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

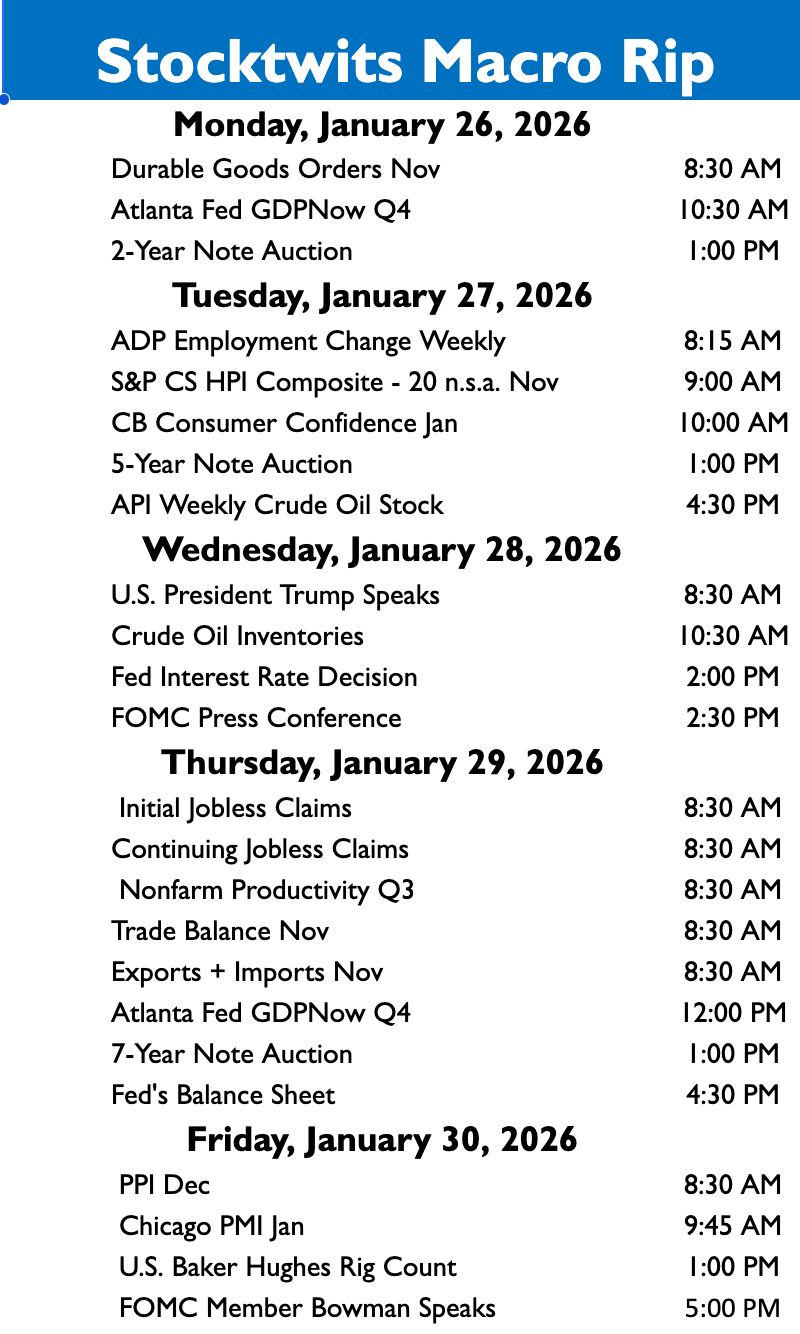

Economic Calendar

In addition to the above, check out this week’s complete list of economic releases.

Links That Don’t Suck 🌐

🆘 Want to learn proven strategies for picking top stocks? Join IBD’s free online workshop on 2/7 *

Who was Alex Pretti, the intensive care nurse shot dead in Minneapolis?

⛴️ Trump threatens 100% tariffs on Canada over China deal; Carney reiterates Canada commitment to USMCA

🚘️ Auto executives are hoping for the best and planning for the worst in 2026

✈️ Flight disruptions from massive winter storm will linger Monday

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Want to see some change? Email Kevin Travers your feedback; follow him on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋