Watching My Portfolio Like A Hospice Nurse On A Double Shift 😶

OVERVIEW

Watching My Portfolio Like A Hospice Nurse On A Double Shift 😶

Before we dive in, here’s today’s crypto market heatmap:

And here’s a look at crypto’s total market and altcoin market cap charts:

NEWS

Everyone Else Is Posting Liquidation Screenshots; Ondo’s Posting Bullish AF Press Releases 🤯

$ONDO ( ▲ 1.87% ) must have a trader working in their PR department because nothing says “wait for the best time” like when the aggregate crypto market looks like day three roadkill in 105-degree, 100% humidity.

PR El Numero Uno

This is the biggen. Ondo Global Markets is now live in MetaMask. Eligible (effing non-U.S.) mobile users can access 200+ tokenized assets – Tesla, NVIDIA, Apple, Microsoft, Amazon, ETFs (QQQ, IWM), and commodity plays (silver, gold, copper, rare earths) – directly in the wallet.

Minting/burning runs 24/5; transfers run 24/7. For millions of MetaMask users watching portfolios implode, there’s now a one-click path to tokenized TradFi without opening a brokerage account.

Second Salvo: SEC Registration Filed

While everyone else prays the SEC doesn’t knock, Ondo walked up and rang the doorbell.

They filed a confidential registration statement for Ondo Global Markets – voluntarily adopting “gold standard” securities disclosure. Once effective, they’d be the first transferable tokenized stock issuer subject to SEC reporting requirements.

The stack includes an SEC-registered transfer agent, broker-dealer, investment adviser, and ATS. Most crypto projects treat regulation like a disease. Ondo’s treating it like a moat.

Round 3: Ondo Perps

Perpetual futures on U.S. stocks, ETFs, and commodities. Up to 20x leverage. Available 24/7 globally (again, because US regulators are still better at telling individuals what they can and can’t do with their own money, non-U.S.).

But the badassery here is this: tokenized securities as collateral – not just stablecoins. Post your tokenized Tesla to collateralize an NVIDIA perp. Spot and perps on one platform with cross-collateralization.

The Digestif: Ondo Global Listing

A service for wallets, exchanges, and blockchains to offer tokenized U.S. stock IPOs on listing day across Ethereum, Solana, and BNB Chain.

They proved the concept with BitGo’s IPO – tokenized on day one. Now it’s productized. Or is it productimized. Or producederized. Anyway.

Well done Ondo, well done. 👏

STONKTWITS

LATEST STOCKTWITS VIDEO & PODCAST DROPS 🎙️

🪙 Cryptotwits Podcast – Hyperliquid + Gold $5,000 + Zero Inflows = What’s Next?

🏪 Retail Edge – Hood Down 30%: Dip Buy or Changing of the Guard? Plus MSFT Cheap, GME Back, and China Fear

⚖️ True Odds – Super Bowl Is Set: Seahawks vs Patriots (Plus Mag7 Earnings Rapid-Fire + Elon Trillionaire Bet)

🏄️ Boardroom Exclusive – Virtuix’s Competitive Advantage Explained by CEO Jan Goetgeluk (Virtuix IPO)

🎤 The Howard Lindzon Show – Long Degeneracy: Why Robinhood, Coinbase, and Platforms Will Keep Winning | The Howard Lindzon Show

TECHNICAL ANALYSIS

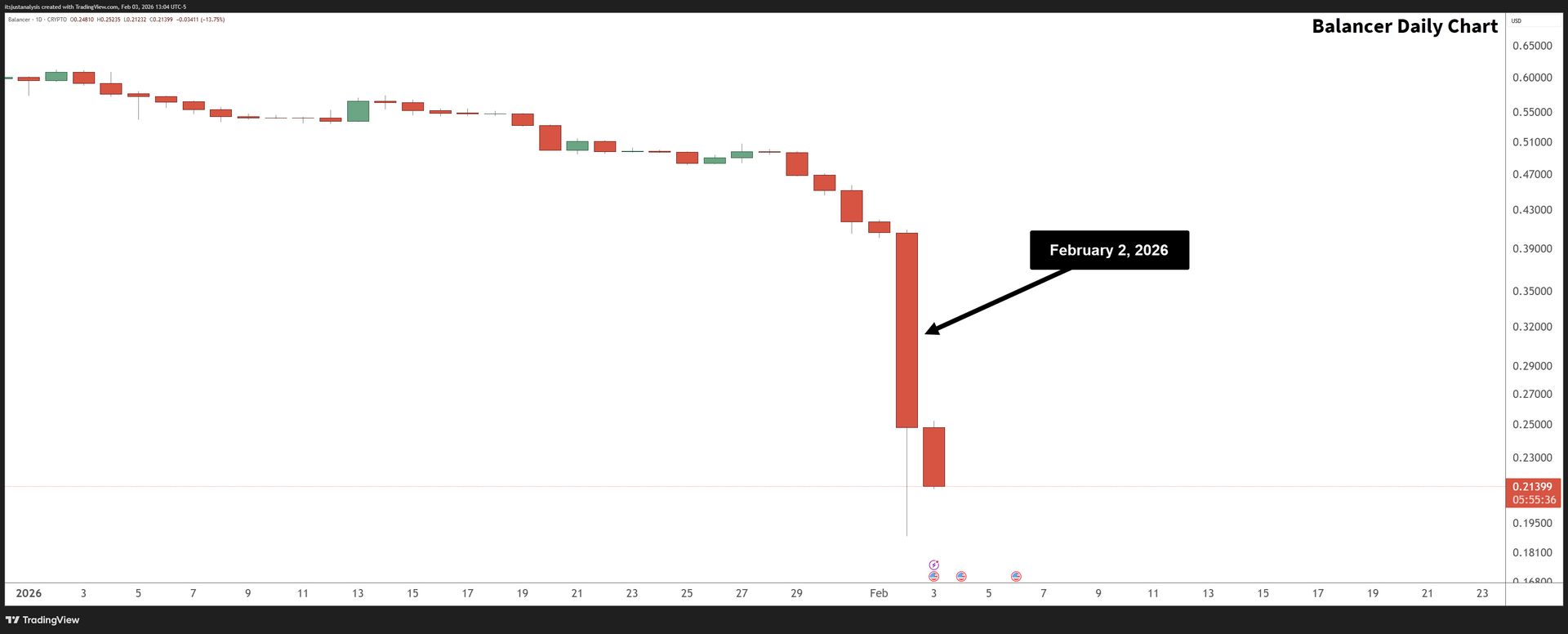

BAL Hits Rock Bottom – And It Wasn’t Even a Hack This Time 😱

Balancer’s $BAL ( ▼ 11.47% ) token cratered nearly -54% yesterday, dropping from $0.4088 to an all-time low of $0.1884. I admit, when I saw this on my watchlist, my brain immediately wen to: oh. great. another DeFi sploit.

But it wasn’t an exploit – it was a liquidation cascade triggered by a single whale getting blown out of leveraged positions.

The Culprit: humpy.eth

The whale behind the carnage is humpy.eth – the same actor who gamed Balancer’s vote-escrow tokenomics during the 2022 “veBAL Wars.” This time, humpy.eth was using BAL as collateral on $AAVE ( ▼ 1.82% ) and Venus. According to Chaos Labs:

-

humpy.eth held the majority of BAL exposure across lending markets

-

When BTC fell below $80K then $75K, these positions got margin called

-

Liquidations occurred over a 2-hour window

-

The BAL market on Aave contracted by 95% post-liquidation

Timeline

-

November 3, 2025 – $128M Balancer V2 exploit drains funds across multiple chains. TVL drops 46%.

-

Late January 2026 – Broader crypto selloff begins. BTC falls below $80K.

-

January 30-31, 2026 – Mass liquidations of humpy.eth’s BAL positions triggered.

-

February 1, 2026 – Rosen Law Firm announces class action investigation.

-

February 2, 2026 – BAL hits ATL of ~$0.18.

-

February 3, 2026 – BAL trading around $0.21.

Balancer’s Response

Twitter tweet

So, no new hack. Just a whale with oversized leverage getting margin called during a market downturn, and thin liquidity amplifying the damage. Protocol functions fine. Token’s down 99.7% from its $75.

Yes, Balancers ATH is $75. Not a typo. I triple checked. 🤦

NEWS IN THREE SENTENCES

AI, Stablecoins, & Privacy News 🕵️

🤖 Sui Wants to Be the Blockchain Where AI Does Stuff

Sui published a manifesto on “agentic execution” – infrastructure that lets AI agents act autonomously with shared state, portable permissions, atomic workflows, and verifiable outcomes. Sui says that today’s internet assumes humans click buttons and fix mistakes, but AI agents operating at machine speed need execution that settles cleanly without manual intervention. Sui.

NEWS IN THREE SENTENCES

Real World Asset Tokenization (RWA) News 🪙

🏦 DigiShares Brings Institutional RWA Tokenization to Injective via Valereum

DigiShares is integrating its white-label tokenization platform with Injective through a collaboration with Valereum, connecting 200 asset issuers across 40+ countries to a blockchain actually built for financial applications. The setup includes Valereum Markets’ El Salvador license for secondary trading. They’re also aligning around ERC-7943 for interoperability, which means tokenized assets will work across chains instead of getting stuck wherever they were minted. Injective Protocol.

NEWS IN THREE SENTENCES

Metaverse, NFT, & Gaming News 🎮️

🎲 Decentraland Wants You to Show Up Every Friday and Play Games Together

Play With Friends Fridays is a six-week series of organized gaming sessions in Decentraland, running every Friday at 2pm UTC with rotating multiplayer games designed for social players, not sweaty competitors. The lineup includes parkour, fashion runways, retro arcades, and something called Waffle Battle that sounds exactly as ridiculous as it is. Decentraland.

🐧 0x Becomes the Exclusive Swap Engine for Abstract, the Pudgy Penguins Chain

Abstract partnered with 0x as its exclusive DEX aggregator, meaning all swaps through the Abstract Portal route through 0x’s professional-grade infrastructure. The Pudgy Penguins brand already has Walmart distribution and billions of GIF views, so they’re not exactly manufacturing relevance from scratch. 0x.

🎮 Enjin Launches a Year-Long Quest Where Your NFTs Do Something

Enjin’s Multiverse Quest “Essence of the Elements” kicks off February today (Feb 3rd) with Fire Season, rewarding players with Magma Blobs infused with up to 50,000 ENJ and a shot at rare Degens through weighted draws. Connect one wallet, play across multiple games, earn Essence points capped at 180 per game to keep things fair. Oh, but there’s a big no no on combining wallets later, so pick one and commit. Enjin.

NEWS IN THREE SENTENCES

DeFi, DEX, & Lending News 🏦

📊 72% of DeFi Users Are Bullish, According to People Who Use DeFi

A 1inch-led survey of 8,163 DeFi users found 72% are optimistic about 2026, with U.S. respondents even higher at 82%. Veterans (my wife would say financial self harmers, but Veterans sounds better) with 6+ years hit 73%, while newcomers under one year sit at 62%. The biggest frustration is still gas fees at 26.8%, followed by security risks – so basically the same complaints as always, just with more optimism. 1inch.

🎯 Uniswap’s Continuous Clearing Auctions Get Their Own Tab

Starting February 2nd, the Uniswap Web App shows ongoing and upcoming Continuous Clearing Auctions under an Auctions tab, so you can bid on tokens before they’re widely tradable. CCA already proved itself when Aztec raised $60 million from 17,000 bidders with zero detected sniping or manipulation. Token teams no longer need bespoke frontends; the interface handles discovery, bidding, and liquidity bootstrapping. Uniswap.

NEWS IN THREE SENTENCES

Protocol News 🏦

⏸️ Story Delays All Token Unlocks by Six Months Because “Long-Term Alignment”

Story’s Board approved a six-month delay on all locked $IP ( ▼ 0.0% ) token unlocks, pushing the original February 13th date to August 13th, 2026. No changes to total supply or allocations – just a longer wait for team, investor, and insider tokens to hit circulation. Story Protocol.

🔮 Jupiter Buys Its Way Into Prediction Markets and Polymarket Tags Along

Jupiter secured $35 million from ParaFi Capital and announced it’s bringing Polymarket to Solana for the first time. The deal settles entirely in JupUSD at spot price with an extended token lockup, which is a fancy way of saying ParaFi is committed. Jupiter.

🌐 MultiversX Ships Google’s Universal Commerce Protocol Before Anyone Else

MultiversX became the first L1 to integrate Google’s Universal Commerce Protocol via MCP, meaning AI agents on Claude, Gemini, or ChatGPT can now query balances, transfer tokens, and execute transactions without human intervention. The MCP server gives agents structured tools instead of letting them hallucinate API calls – critical when real money is at stake. MultiversX.

LINKS

Links That Don’t Suck 🔗

🇺🇸 US Government Shutdown Ends As House Approves Funding Bill: Report

🤔 What Is Weighing PayPal Down? Gary Black Points To This Limitation

🚗 Tesla Continues To Rejig Lineup In Run Up To Vehicle Autonomy

🤖 Stellantis’ new robot does in 90 minutes what would take a human weeks

🏰 Man uses $10 in lottery winnings to score $100,000 jackpot

Get In Touch 📬

Email me, Jonathan Morgan, feedback; I’d love to hear from you. 📧

Follow me on Stocktwits 🫂 And Sponsor this newsletter 😎

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds positions in AVAX, ADA, PUDGY, WLC, IMX, XTZ, NEAR, HBAR, ALGO, INJ, LTC, LINK, ZEC, XLM, and FET. 📋