We Crossed the Rubicon Last Week in the Bond Market

Last week seemed like it lit a fire under folks regarding their lack of appreciation for the current and expected US govt fiscal situation. Growing deficits for as far as the eye can see. Treasury comes out and reminds the market how much borrowing needs to occur in 2H23 and we are not even in recession yet. Fitch reminds markets that the US fiscal situation continues to deteriorate. Ackman and Gross remind markets that there is money to be made shorting USTs. It seems like perhaps we have crossed the rubicon here. Tremors in the bond market were felt last week. Seems like early days still.

So where do we go next. Unfortunately, there really is only one way to fix the deficit situation in the current dysfunctional political environment in DC. There is no appetite for cuts to entitlements or defense spending, the only two line items that can really make any difference on the spending side. There is no appetite for raising taxes on corporations or the wealthy despite ample room to do so. So that only leaves the interest expense item for the US govt which is basically driven by the interest rate policy of the Fed.

The Fed is rapidly getting to a point where it may be forced to lower interest rates to save the US government’s deficit situation (fiscal dominance) but to do so at a point before the inflation dragon has been slayed. Cutting rates prematurely to save the govt is going to lead to a significant devaluation of the US$ vs real assets and re-ignite an inflationary reality again. However, continuing to hike and hold interest rates at high levels will only make the US government’s fiscal situation that much worse.

There is another potential way out of this but no one is going to like to hear it. It involves allowing the market do the job for the Fed to get them to a point where they can justify cutting rates. This involves a significant deterioration in risk asset prices to help break this inflationary heat and gives the Fed cover to cut rates again, but to do so from a point where there actions are less likely to re-stoke inflation. The Fed is going to have to let this episode of bond market weakness exacerbate from here, destroying some more regional banks and over-levered overseas US$ borrowers along the way. Inflation expectations are already creeping back higher again on the combination of the above Treasury supply situation and recent belief by the Fed of the “golden path” to an “immaculate disinflation.” The bond market is sniffing out a reality of the Fed going too soft on tightening now. Headline inflation expectations are rising again on back of gasoline’s rally. June CPI print was an interim low with July moving higher and August likely higher again.

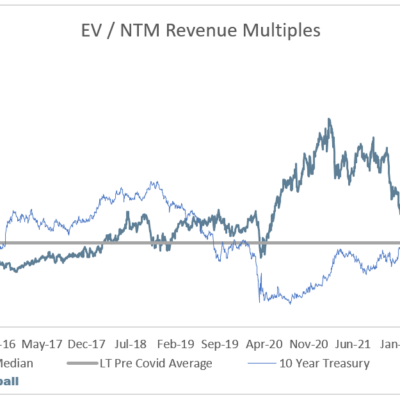

This back-up in yields is going to continue and will hit equity multiples and credit spreads at a rapidly accelerating pace over the coming months which seasonally (Aug-Oct) often portend a nasty risk taking environment. Given currently historic valuations, as risk premiums and term premiums rise, it’s not going to take a lot to topple this whole thing over. The Fed needs to let it happen, break the back of inflation while the real economy probably doesn’t suffer a cataclysmic fall. Main street gets a small victory as real wages rise, asset prices have been reset lower and we move on to the next phase of the cycle.

Important Disclaimer: This blog is for educational purposes only. I am not a financial advisor and nothing I post is investment advice. The securities I discuss are considered highly risky so do your own due diligence.