Weekend Update Unlocked

The following is a sampling of Cannabis Confidential content—random paragraph grabs, charts and notes, interesting happenings and other stuff— from last week.

You can click the title to access any article; most of the insight and analysis is behind the paywall and you can access 33% off an annual subscription today only by clicking on the button below; thanks for your support!

Tears for Fears

Weekend FUD spooks the space.

March 11th, 2024

In the fourteen months since the last failed attempt at meaningful federal cannabis reform, weed stocks have tanked, investments have dried up, sales have stagnated and spending on growth has withered.

The industry is now placing its hope in the government agency that’s responsible for much of its misery in the first place: the Drug Enforcement Administration.

Spotlight

We fired up our turrets this morning to find MSOS trading 4% lower on a weekend WSJ article that cited a former DEA official and an anonymous source (from…?) who said that the DEA has concerns regarding the move to Schedule III.

While this story felt like a plant by an anti-cannabis group and it is the type of thing we’re bound to see when a decision is approaching, FUD (fear, uncertainty, doubt) is a powerful toxin for a sector that has been repeatedly punk’d by politicians.

We have several thoughts, including these: the DEA is an agency within DOJ, the DOJ reports to POTUS and President Biden just reaffirmed cannabis on the biggest stage in the world, prompting BI to lay 80% odds it gets rescheduled in the next few months.

Lest we forget, we have a 252-page confession by the U.S. government that outlined the medical benefits, as well as a limited adverse effect profile, which is binding, so it really doesn’t matter if “some within the DEA” think that more research is necessary.

[note: “potency concerns” are a tell re: fingerprints are on the WSJ article], as was this:

Further, per the WSJ article, the HHS contacted the Office of Legal Council (OLC) for their legal opinion. OLC opinions on the interpretation of law are binding too, so if that query was regarding the legality of SIII under the UN Treaty, as some suspect, then the DEA will have no choice but to propose moving cannabis to Schedule III.

It’s probably worth noting that the head of the OLC, much like AG Merrick Garland, is a Biden appointee so even if we don’t know the timing of the DEA—and timing is everything—we know that everyone answers to someone who answers to POTUS.

I’ll also share this legal opinion from a pal of mine who’s close to the situation:

The DEA is OK with this…as you know, people often rely on their legal counsel as shield from liability, so it’s entirely possible if DEA requested a legal opinion from OLC, it’s likely for the purpose of insulating them from liability or challenges that will inevitably arise from their decision, whether it be a Final Order or a Proposed Rule.

But Wait, There’s More

Away from SIII, there’s SAFER Banking, which has bicameral and bipartisan momo, although we don’t blame investors for being dubious after so many false starts and empty promises. Expectations are low for good reason, but any movement would trigger an outsized reaction given sentiment and the (now lack of) positioning.

There’s also Garland and his Memo, Florida and the Supreme Court (we’ll know w/in three weeks if it’ll make the ballot), Pennsylvania (Kim: passage in July, live in January) and Virginia (Youngkin may DK retail sales after his stadium funding fell through).

Dust in the Wind

U.S. canna awaits federal reform.

March 12th, 2024.

Virginia’s 60-day General Assembly session adjourned without the state’s Republican governor signing into law a bill legalizing adult-use cannabis sales but that’s likely because the Democratic-controlled GA hadn’t formally send Gov. Youngkin the bill.

But it’s also because the Democratic opposition to a Youngkin pet project—a publicly financed basketball and hockey arena in a Washington DC suburb—has ended hopes of bipartisan cooperation on other issues, including recreational cannabis sales.

Salient observations from our pal Sammy J, posted early this afternoon:

A reminder of just how illiquid the sector is, especially when there’s no fast money buying reform headlines, and how there’s no real price discovery in any of this volatility: The entire basket of underlyings traded US$11.5M notional today. Arb & algo selling into no bid.

The idea that the market is “telling” us something about reform timing when the entire flush this week has been on <1% of the sector's MC is simply ridiculous. The market isn't telling us a thing, other than what we already know: it’s deficient and awaiting material change.

The reason most jump to the conclusion that the market is telling us something or pricing in “news” is because that is how efficient markets tend to work. This is NOT an efficient market. This is private equity, marked daily, with a call option on reform as its only driver.

Cannabist Earnings + Call Notes

AYR Wellness Earnings + Call Notes

Village Farms Earnings + Call Notes

Cresco Labs Earnings + Call Notes

Jushi Earnings + Call Notes

March 13th, 2024

Rise Above

U.S. canna plans begin to emerge into the election.

March 13th, 2024

U.S. Vice President Kamala Harris on Friday plans to gather rapper Fat Joe and several people pardoned by the Biden administration for marijuana-related convictions for a White House public discussion about criminal justice reform.

The meeting comes as Harris, a Democrat, is tasked with convincing people of color and young voters to give President Joe Biden and her a second term amid fears that voters dissatisfied with sluggish policy reforms may sit out November’s election.

Advocates and stakeholders are hoping that the recent emergence of cannabis on the national stage, including the recent mention at the State of the Union, began a steady drumbeat of positive headlines that will include federal reform, SAFER Banking + DOJ guidance before ballots are cast.

Mass Pardons

Massachusetts Gov. Maura Healey plans to announce that she’s following the lead of President Joe Biden and issuing pardons to those convicted of simple possession of cannabis at the state level.

The move could touch the lives of tens of thousands of Massachusetts residents with simple possession convictions on their records. Details of the plan were announced at a news conference today.

Crack of Dawn

The second half of earnings arrived in force this morning, headlined by AYR Wellness, Cresco, Cannabis and Village Farms.

Cresco beat across the board, AYR has the highest relative exposure of any MSO to adult-use flippage in Ohio, Florida and Pennsylvania, Cannabist was dank (but super-oversold + set to benefit from federal reform) and Village continues to position itself as the low-cost global producer.

Importantly, we can add Cresco and AYR Wellness to the list of U.S. canna companies that are taking a more active stance against the silly 280E tax-treatment. Each of the situations is unique in their own way, of course, but they are all opaque.

Feels to us like most operators kitchen-sinked Q423 to set the table for the new year but we won’t see the benefits of that until the quarters to come. TerrAscend reports tomorrow afternoon, which’ll complete this earnings cycle save a few stragglers.

It was a solid reporting season given the incredibly difficult status quo but as we saw with the T1s, the market hasn’t been rewarding those efforts given the singular horse-blinder focus on federal reform.

White House Smoke Signals

Biden bets on Green.

March 14th, 2024.

The DEA has been conducting a review of the HHS recommendation but has yet to issue an opinion, though one is expected this spring according to two sources with knowledge, per NBC News.

X-Men

The Biden administration’s top health official is defending his recommendation to reschedule cannabis against criticism from a Republican senator, noting that many states have “moved much farther than the federal government” on the issue.

“There’s been a lot of science that’s been collected over the years on cannabis. We have far more information now’” HHS Secretary Xavier Becerra, citing the 252-page

confessionanalysis the HHS provided the DEA to support its recommendation.

Set them Free

A coalition of 36 members of Congress are calling on the President to grant clemency to all Americans currently in federal prison over non-violent cannabis convictions by commuting their sentences—and they noted that the pardons he’s issued to date for simple possession cases did not release a single person from incarceration.

“Until the day Congress sends you a marijuana reform bill to sign, you have a unique ability to lead on criminal justice reform and provide immediate relief to thousands of Americans.”

Village Farms will be the big winner in the cannabis sector, Beacon says

We have long noted that there will ultimately be only a handful of “winners” in the C$6 billion industry. It is beyond a doubt that VFF will not only be one of them, but the largest.

Trading at just 7x our FY24 EBITDA forecast and likely less than 2x upon tax reform with a strong balance sheet, we continue to believe the risk-return is exceptional.”

Between the Bells

I was reminded of a joke I heard long ago a few hours into today’s session:

‘My wife told me I was a bad lover; I said, “how can you tell in thirty seconds?”‘

MSOS was up/down 2% depending on when you happened to look at the screens—but how can we really tell with < $10M notional having traded in the ETF at the time?

Such is purgatory life in an environment where U.S. cannabis stocks can’t be custodied and when the few who can are waiting on actual reform before getting involved.

The tetherball continued into the afternoon, probing newfound triple-lindy support four times by my count, as we were left to wonder how much we should read into the numerous breadcrumbs that’ve been left behind by this obvious political agenda.

The more I watched today’s price action, the more convinced I became that the same handful of holders are moving the same names back-and-forth between ’em. When I say that we need some fresh faces and new places (to list), I ain’t joking.

Alas, that wasn’t today’s business as MSOS closed flat to the penny on $34M notional, which wasn’t exciting but it did keep it on the righteous side of triple-lindy support.

So we’ve got that going for us.

TerrAscend Earnings + Call Notes

March 14th, 2024

The Tides of March

U.S. canna looks to flip the script.

March 15th, 2024.

Vice President Kamala Harris says the Drug Enforcement Administration (DEA) must reschedule marijuana “as quickly as possible,” calling it “absurd” and “patently unfair” that cannabis is still classified in the same category as heroin.

“I cannot emphasize enough that they need to get to it as quickly as possible and we need to have a resolution based on their findings and their assessment—but this issue is stark when one considers the fact that on the schedule currently, marijuana is considered as dangerous as heroin and more dangerous than fentanyl which is absurd, not to mention patently unfair.”

Banana Split

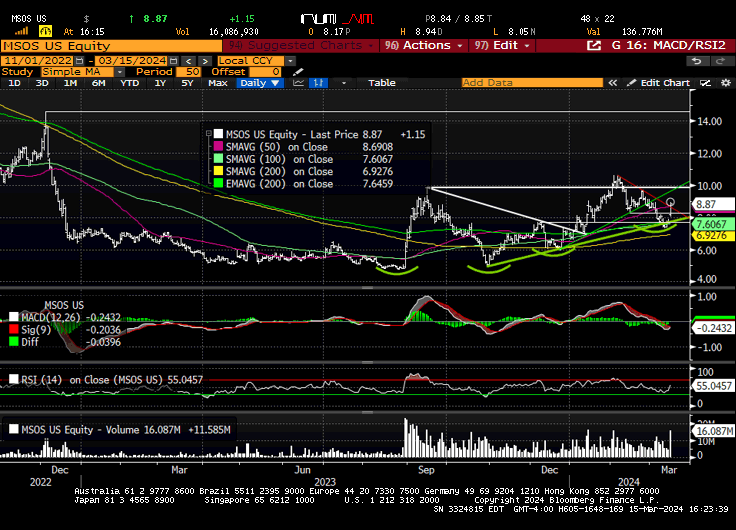

The broader market legged lower today, taking a respite from it’s risk-on ways, which could only mean one thing: Cannaland would make a stand. U.S. cannabis ETF MSOS was active early/often as a combination of factors triggered a 15% gain.

C21 buys Deep Roots in a deal valued at $3.5 million

^ we’re involved C21 (Board etc.) but it’s not about that; Sonny and the CXXIF team deserve all the credit for grinding through terrible operating conditions to pay off $30M+ of debt with FCF and shifting into growth mode via accretive acquisitions.

Wall Street

The ETF traded as high as $8.89 (+12%) out of the gate as call buyers poured in—some front month and a shit-ton of April paper—which set off a piñata party in the underlying stocks as dealers attempted to hedge with volumes otherwise absent.

The early action was gappy and trappy as traders looked to unload bags and rotate exposure into the gap higher—remember, the same handful of folks are trading the same handful of names outside the ETF—with some potentially looking to diversify from the ‘safe names’ given the better tone across most U.S. canna earnings reports.

Midmorning, we saw a monster MSOS option trade print…

Customer sold 22k MSOS mar24 8 calls to buy 11k apr24 9 calls pays 26c, and buys 6k MSOS 28mar 7 puts

…that created 1.5M shares of MSOS for sale which would under normal circumstances trigger another trap door but that didn’t happen, at least not today…

…or at least not before the historic livestream from The White House at 1:25 PM ET:

…which we believe was more about a steady drumbeat of positive cannabis headlines into the election than it is overt gaslighting, not that we expect anyone to believe us/ them until we move from triple-lindy support through the tricky-trifecta of catalysts.

After an unfashionably late start, the prepared remarks were brief but consistent with what we shared above: The White House intends to ride canna all the way to a second term and if they pull up lame, on any level, they’ll have green eggs on their face.

The money shot was here:

“We have directed the HHS and the Department of Justice to reassess how marijuana is classified under the federal drug scheduling and I cannot emphasize enough that they need to get to it as quickly as possible and we need to have a resolution based on their findings and their assessment—but this issue is stark when one considers the fact that on the schedule currently, marijuana is considered as dangerous as heroin and more dangerous than fentanyl which is absurd, not to mention patently unfair.

So, I’m sure DEA is working as quickly as possible and will continue to do so and we look forward to the product of their work.”

Volumes continued to pour into MSOS—the NYSE big dog with it’s 28 U.S. canna tails—as it retested session highs, which was also the downtrend from the Feb. 6 YTD high.

^ ‘tis but a scratch, albeit a 31% five-week scratch, if you’re new to these parts.

The end product? A powerful technical response the put the bulls on the field and the bears on their heels as we look forward to the DEA decision, SAFER Banking and the Garland Memo, which’ll let us know how it all fits together.

After that, I need a nap.

To Lay Me Down 🎶

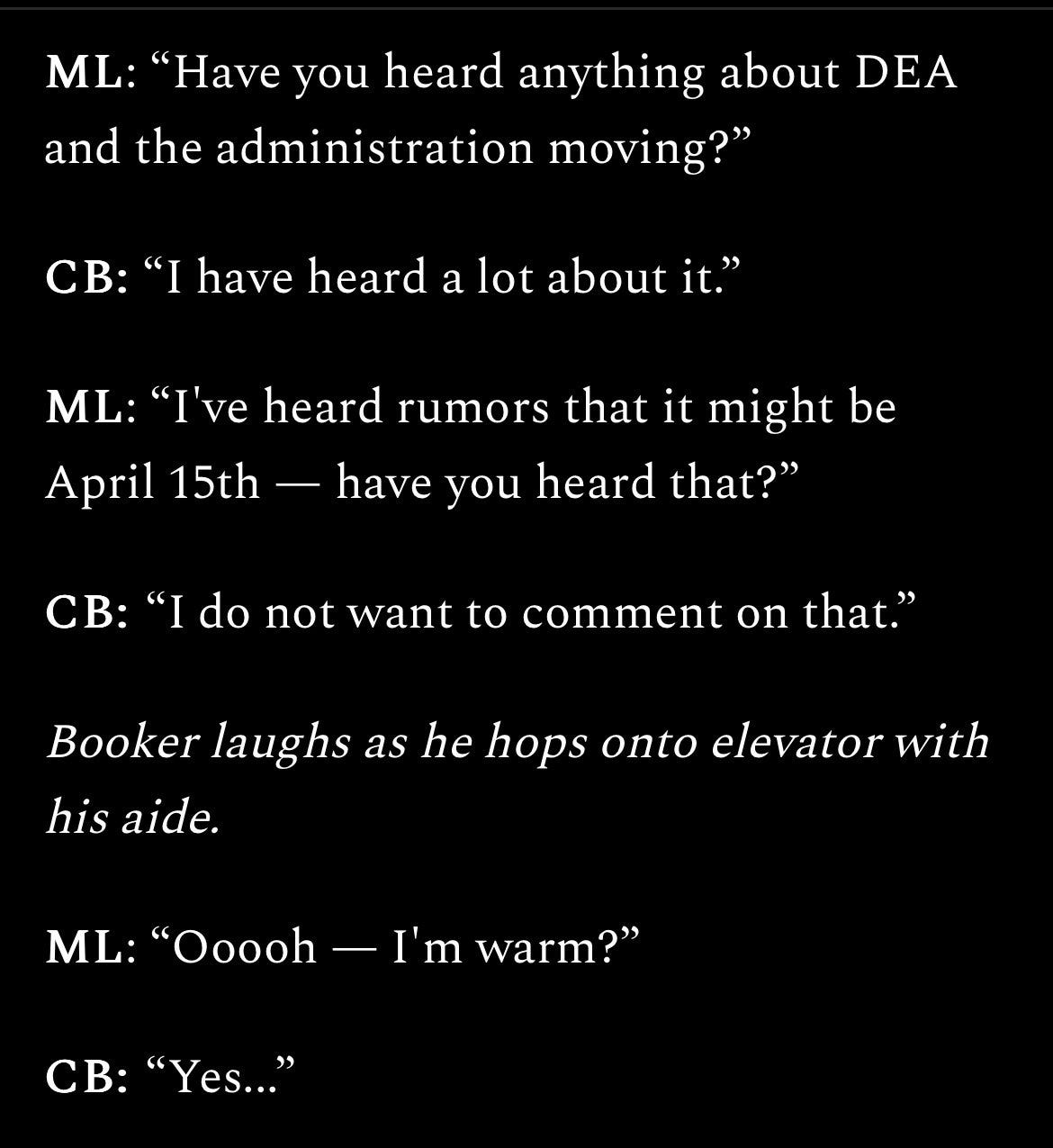

Cory Booker on DEA rescheduling marijuana soon: “I have heard a lot about it”

Take 20% off the Benzinga Cannabis Conference on April 16th-17th at the Diplomat Beach Resort in Hollywood, Florida by using ‘WELDON20′ as your discount code.

Enjoy your weekend, stay safe and please enjoy responsibly.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.