Weekend Update Unlocked

The following is a sampling of Cannabis Confidential content—random paragraph grabs, charts and notes, interesting happenings and other stuff— from last week.

You can click the title to access any article; most stock stuff and analysis is behind the paywall and you can access a free trial by clicking below; thanks for your support.

Walley World

U.S. canna awaits it’s adventure.

March 25, 2024

There’s no way to know just how long the process will take for the DEA to being it’s proposed rulemaking process for cannabis in response to the H.H.S recommendation—it could happen in days, weeks, months, or even years.

However, the politics involved in rescheduling indicate that the decision will likely be made in the next few months, not years. President Biden campaigned on reform and he’ll likely want to highlight rescheduling when courting voters in 2024.

Bank Street

A new poll from the American Bankers Association (ABA) shows that roughly three out of five Americans support allowing marijuana industry access to the banking system—a finding that comes amid a renewed push for reform among congressional leaders.

“Americans have made it clear that Congress should resolve the ongoing conflict between state and federal law on cannabis banking issues by passing legislation that will enhance public safety, tax collection and transparency,” -ABA Prez Rob Nichols

Grün

German cannabis possession and home cultivation will be decriminalized on April 1st after the law passed the final hurdle in the Bundesrat. Adults over the age of 18 will be allowed to possess 25 grams of canna and grow up to three plants at home.

From July 1, non-commercial canna clubs can supply up to 500 members with a maximum monthly quantity of 50 grams per member.

“The fight was worth it, please use the new option responsibly.” Karl Lauterbach

Game Time Decisions

Cannaland followed an all-too-familiar script early on with a brief smile to the upside followed by air pockets lower for most U.S. names. Canopy, after trading almost $9-half in the pre-market, fell as low as $6.33 less than fifteen minutes into our week.

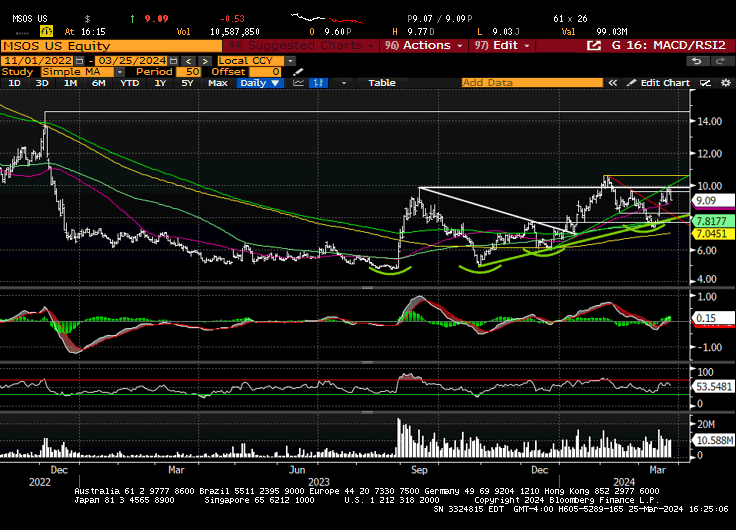

MSOS was trading at session lows ($9.19, -4.5%) when the latest FUD hit the tape. You recall the last FUD—’friction at the DEA’—knocked MSOS 8% lower ($8.10 → $7.48). S.A.M was behind the last hit job and they were behind this one too.

The headline screamed, “House GOP Committee Urges Opposition To Canna Banking Bill, Saying ‘Gateway Drug’ Causes ‘Violence, Depression And Suicide,’ but as we know, the 252-page scientific review by U.S. govt health agencies doesn’t concur.

My first thought, similar to the first FUD, was ’we gotta be close’ but as optimism and cannabis legislation have restraining orders on each other, I won’t mention that Sen. Schumer prolly wouldn’t put his name on this like this unless he felt good about it.

The afternoon saw a few feeble rally attempts before the space landed lower with a thud. I suppose we can’t feign shock as last Wednesday we offered, regarding the rumblings of potential DEA movement into the congressional recess…

I don’t know if that process lurches forward as Congress heads home but if it does, it would be a weekly threepeat following SOTU + the WH—if not, those with battered and abused canna bull syndrome will likely exhale on the other side of the weekend.

I’ll note that while no thuds are good thuds, some thuds are better than other thuds and this particular thud didn’t damage what continues to be a stellar technical set-up, albeit one that remains super-duper-catalyst-dependent.

Narcos

U.S. Govt attempts a historic pivot.

March 26, 2024

When Vice President Kamala Harris looked up from her prepared remarks in the White House’s Roosevelt Room a few weeks ago to make sure the reporters could hear her, she spoke with purpose: “Nobody should have to go to jail for smoking weed.”

Harris’ cannabis reform roundtable was a genuine reminder of just how far the politics have shifted for the onetime prosecutor who was raised during The War on Drugs.

As President Biden seeks much-needed support from young voters, his administration is making a big bet that cannabis policy could help him cross that chasm.

U.S. Propaganda

Reefer Madness was a 1936 film that helped shape negative cannabis stereotypes for decades and laid cover for the weaponization of the plant as a racist immigration tool; it’s a stigma that we’re still fighting to unwind.

Adaptation

Regulated marijuana sales in the United States are expected to exceed $31 billion this year. The forecasted amount is an increase of $2.6 billion from 2023, representing a growth rate of 9.14% year over year.

The positive trend comes despite the fact that canna sales have been suppressed due to the post-pandemic shifts in consumer behavior, higher interest rates and persistent delays in state-led markets (cough New York).

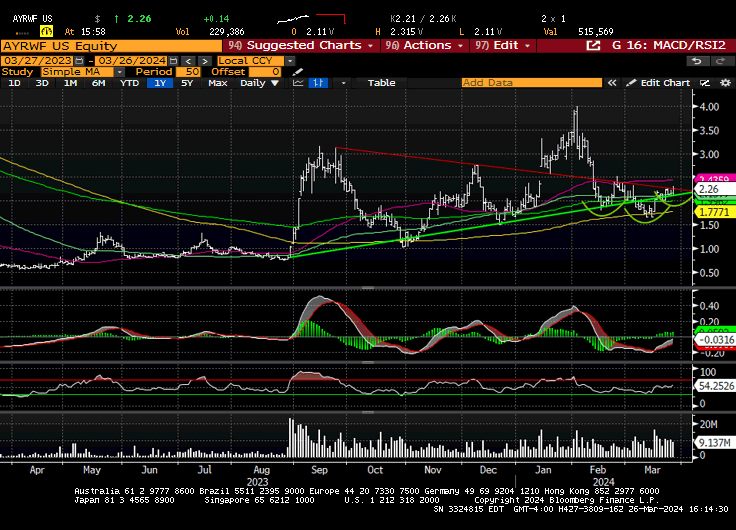

Chart of the Day: AYR Wellness

Freddy Benson Gomes on the Canadian tax stuff (flashed a few weeks ago)

Canada. While the probability of a reform this year is uncertain (the 2024 federal budget will be presented on April 16), it’s increasingly likely that some reform will occur over the mid-term.

This scenario creates an asymmetric investment opportunity: even assuming a low probability for excise reform this year, the upside is immense especially for certain small and mid-cap LPs such as Decibel and Village Farms.

Excelsior Equities on Village Farms ($VFF)

Reducing the tax to 10% ad valorem would see Village Farms’ excise taxes decline 75%, net Canadian canna revs increase 40-50%, and EBITDA increase by over 200%. Perhaps the market is finally starting to do the math on this.

Despite the increase in stock price, Village Farms remains significantly undervalued vs. our $2.00/share price target (which is a blend of $1.75 assuming no change in excise taxes and $4.20 if the excise tax is reduced to 10% and the company keeps only half the savings).

Who’s Schumin’ Who?

The canna crowd is tired of talk.

March 27, 2024

Federal agencies have been funded through September and the congressional must-pass agenda is whittling down. Senate Majority Leader Chuck Schumer now wants to pivot to the slate of bipartisan legislation that he first laid out last summer.

Schumer told Punchbowl News that among other projects, he wants to take a swing at banking reform, echoing a years-long commitment to a commonsense bill that would loosen restrictions for the cannabis industry + promote a safer working environment.

The Senate Banking Committee has already cleared the SAFER Banking Act so it could potentially see floor action at any time. The legislation, designed to help state-legal canna businesses access the banking system, has been hung-up on the Hill for years.

Pining for Democracy

A strong majority of voters, including more than 60% of Republicans that were polled, support congressional legislation to protect states’ rights to set their own canna laws, according to a new survey across three states.

“With almost all 50 states adopting some form of cannabis reform, it is time to pass legislation like the STATES Act, to ensure each state has the right to determine for itself the best approach to cannabis within its borders.” -Rep. Dave Joyce (R-OH)

The Green Party

Eighty-eight percent of Americans say that marijuana ought to be legal for either medical or adult use, according to nationwide polling compiled by Pew Research.

The results are consistent with those of prior Pew polls finding that only about 10% of US adults support a blanket policy of cannabis criminalization.

“Elected officials who refuse to take action to end cannabis criminalization do so at their own political peril.”

Youngkin Bumpkin

With a bill sitting on his desk that would legalize the retail sale of canna in Virginia, Gov. Glenn Youngkin (R) said recently that people “must be smoking something” if they think he’s going to sign it into law.

While Youngkin hasn’t committed to vetoing the bill, he’s been hawkish on creating a legal retail framework, seemingly content on letting the illicit market proliferate. Still, if he doesn’t sign or veto the legislation by April 8th, it will automatically become law.

note: that fucker actually put politics above people and vetoed the bill Friday night.

Humpback

We hiked to the hump this morning amid a Cannaland renaissance, of sorts.

U.S. canna ETF MSOS is high up on the YTD sector performance leaderboards with Q1 almost finut, having held it’s own with heavyweight champs like bitcoin and the semis.

Canadian LPs, triggered by their potential 280E-esque event + the specter of a 420-friendly EU, have recaptured the imagination of vol junkies and day-traders alike and in the process, shining yet another light on the emergence of our left-for-dead space.

Through the lens of looking forward, not back—while carrying the mistakes made as lessons learned—we can almost hear the steady drumbeat of canna news that should persist into the November election.

IDK if all of these homies hit but some if not most will, we think; in no particular order:

1. DEA ruling (SIII; either via proposed or final rule).

2. Garland Memo (will explain how S3 + state-legal (still federally illegal) ops coexist).

3. SAFER Banking (part of the perceived pre-election agenda; contingent on Congress).

4. Florida (tune in Monday at 4PM).

5. Pennsylvania (Kim Rivers: ‘legislation should pass this summer for Jan 1st launch’).

6. Ohio (particulars on when this particularly MSO-friendly state will launch adult-use).

7. Virginia adult-use retail is finally greenlit.

8. UN/ Germany + Implications for EU (flagged yesterday)

Speculation is building that b/w the UN Commission on Narcotic Drugs recognizing ‘Harm Reduction’ in a historic first (70%+ of the Commission’s 53 members voted against Russia’s & China’s opposition) + the buried lede in Germany (willingness to send phase 2/ commercialization to EU for review), the readthrough is that the U.N will be onsides for the next phase of the global cannabis evolution.

9. Other states (WI HA SD NH NE KY NC SC) ahead of fundamental acceleration in ‘25.

All of this is in the context of the U.S operators having already optimized the snot out of their respective businesses after hunkering down through this nuclear winter. An even playing field, complete with functioning capital markets + real exchange listings, will facilitate a long-overdue consolidation and fuel future performance.

Bloomberg Intelligence on the European cannabis opportunity:

Germany Cannabis Legalization May Ignite $248 Billion EU Market

As Europe’s largest medical-cannabis market, Germany’s March 22 vote that legalized the drug for “personal use” effective on April 1 could soon open up a vast European market for producers like Tilray and Curaleaf. Assuming that the country’s two-stage plan is adopted, commercial sales might start as early as late 2024, we believe. Curaleaf estimates that full legalization could create a $248 billion market opportunity, which we think is possible. 👀 (03/22/24)

Rubicon Organics Results + Call Notes

Canadian premium cannabis leader shares results.

March 28, 2024

Whether Check

Florida is at the doorstep of an adult-use vote.

March 28, 2024

Three Texas A&M women’s basketball players were arrested early yesterday morning.

Maliyah Johnson, 21, Kayla Green, 22, and Kyndall Hunter, 21 were arrested by police officers after Johnson admitted there was marijuana in the vehicle and a search found a clear small plastic baggie with cannabis inside.

AG Ken Paxton said, “I’ll not stand by as cities run by pro-crime extremists deliberately violate Texas law and promote the use of illicit drugs that harm our communities.” VP Kamala Harris doesn’t agree, so we’ll soon find out who’s got all hat and no cattle.

Gracias Javi Peña

A Drug Enforcement Administration (DEA) official said the agency wants to “correct misperceptions” that its drug scheduling review process is done in a “shroud of secrecy” as it works to reach a final decision on possibly reclassifying cannabis.

He also said it sometimes takes up to six months for the DEA to complete its analysis of health officials’ recommendations—which is just about how long it’s been since the agency began its current cannabis assessment. 👀

Sunshine?

The big news in Cannaland today was no news, as in the Florida Supreme Court did not issue an opinion. The deadline for their proposed ruling is Monday at midnight and if we don’t hear anything, adult-use cannabis will be on the November ballot.

^ update: the FL S.C. will issue their opinion at 4PM ET on Monday, April, 1st.

Random Thought

$CGC did a 10-1 reverse split in Dec. so mentally moving the decimal one integer to the left helps put the recent move in the proper perspective. The stock didn’t just run from $2.80 to $10; it effectively ran from .28 to $1.00 which is still snazzy, just different.

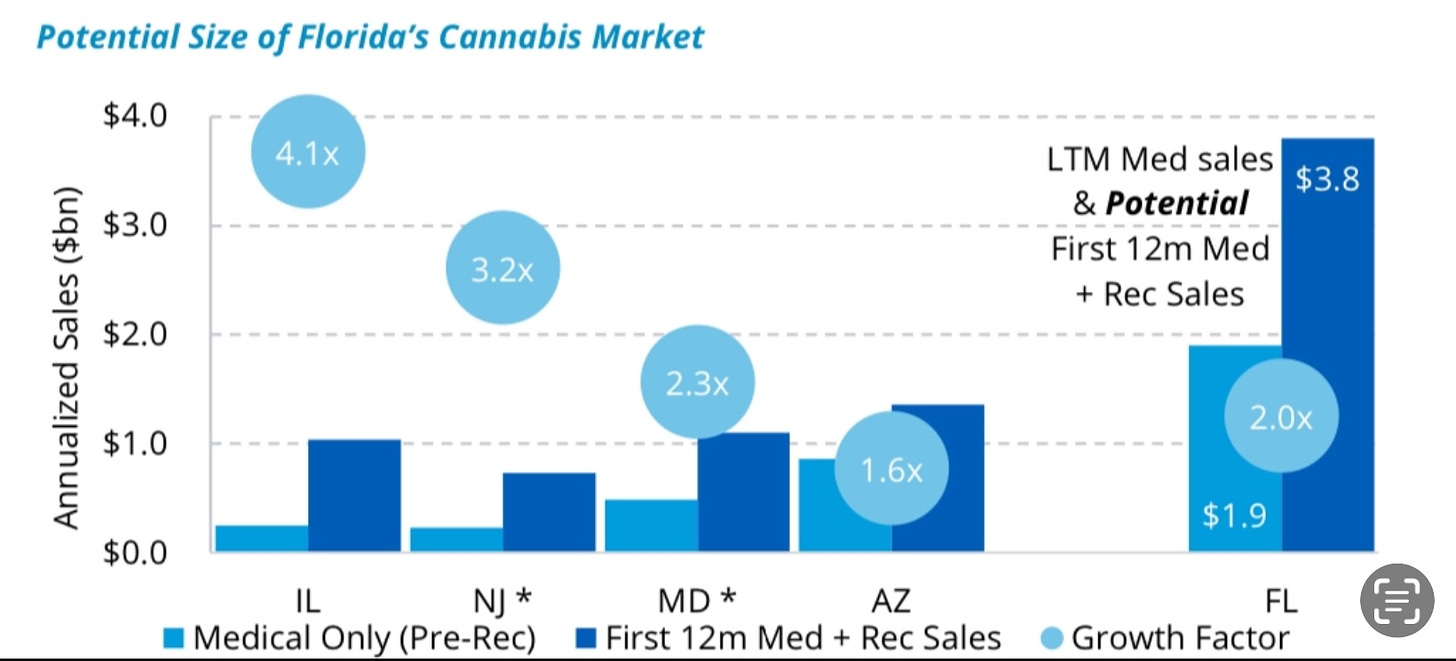

ATB on Florida Cannabis Opportunity:

Florida is the 3rd most populated state (22.2mm) and already has a strong medical canna program with sales of $1.86bn in ‘23 ($1.74bn 2022), which tends to indicate a smoother start to adult-use sales if and once legalized. Although we expect to see pricing pressures leading up to the A-U launch and the partial cannibalization of medical sales, if Florida experiences similar growth step-ups seen in the conversion of other states, the market could generate roughly $3.8bn in the first 12 months of sales (making it the 2nd largest cannabis market in the US, behind California).

Enjoy your weekend, stay safe and please enjoy responsibly.

If you’d like to help Mission [Green] change federal cannabis policies, please click here.

CB1 has positions in / advises some of the companies mentioned and nothing contained herein should be considered advice.