✍️ The S&P 500 Report: Performance, Profitability & Special Metrics – #Ed 3

Dear all,

welcome to the 3rd edition of the S&P 500 Report, a unique & comprehensive report via data driven research & visually appealing charts that simply tell 10,000 words. A perfect time for another S&P 500 deep dive now that the Q2 2023 earnings are over.

N.B. This S&P 500 coverage focuses on Performance, Profitability & Special Metrics. Valuation lens will be covered in the dedicated ‘Valuation’ section, prior edition here: ‘Maverick Valuations #2 – USA: Dow Jones, Nasdaq 100 & the mighty S&P 500’

Structured in 6 parts + bonus charts & designed to have a natural flow:

📊 Performance Ins & Outs

📊 Earnings, Profitability, Flows, Value & Growth

📊 The 11 Sectors Performance Breakdown

📊 Sentiment, Seasonality, Volatility

📊 Technical Analysis: Short Term & Long Term

📊 Special & Alternative Metrics

👍 Bonus Charts 👍

📊 Performance Ins & Outs

👉 Bears Make Headlines & Lose Money, Bulls Make Money!

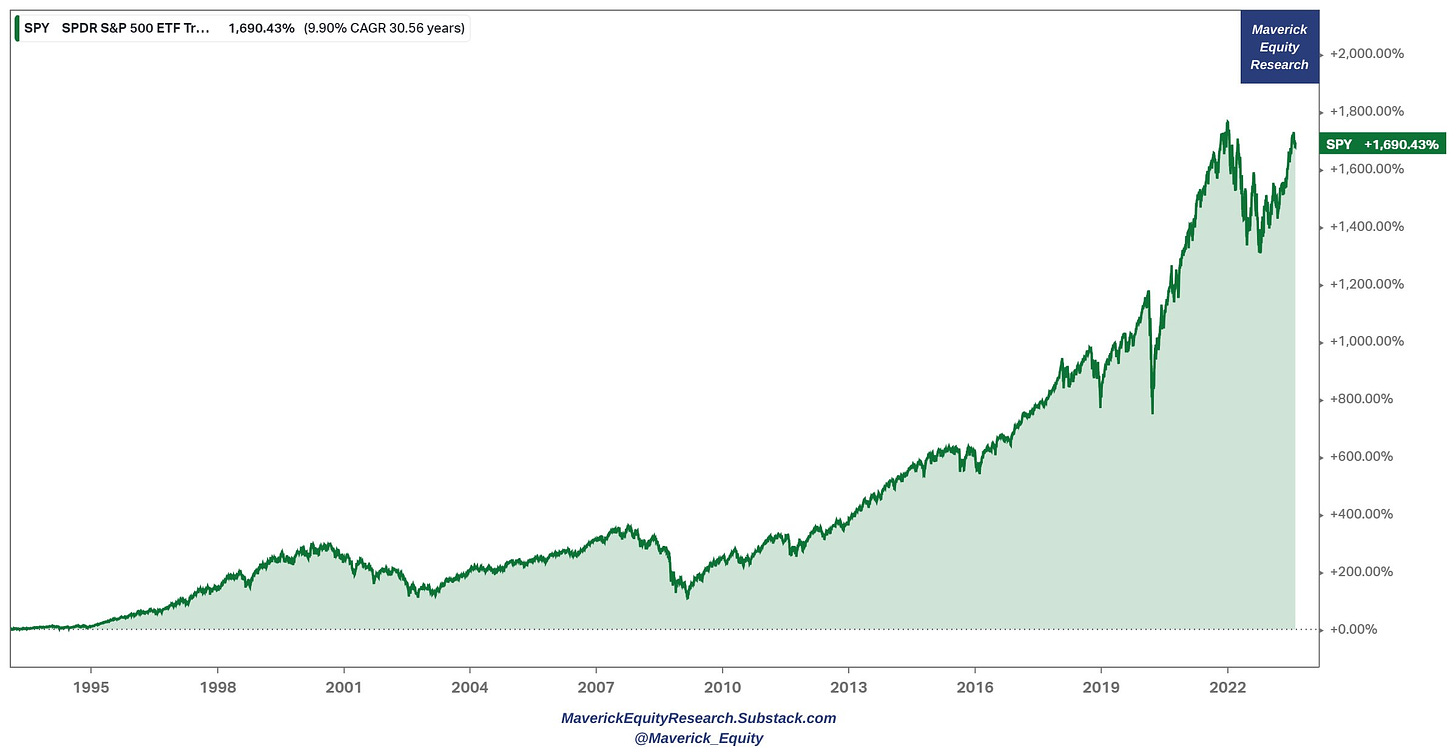

S&P 500 last 30 years: +1,700% return with 10% CAGR … compounding surely works …

👉 Since 2020 we had many outliers: a pandemic, ramping inflation & interest rates (from 0% to 5.5%), an energy crisis, some banks that went bust (Credit Suisse in Europe, SVB & FRC in USA), a worldwide bottled supply chain & a war in Europe.

A key question now: how did the S&P 500 do despite all that?

-

+43.23% = 10.11% CAGR to investors = very very good given the recent context!

-

Recall “The first rule of compounding: never interrupt it unnecessarily.” Munger

-

for that not to happen, one should have a solid plan, a good broker that does not charge them very high fees, and consider taxes when optimising own investments

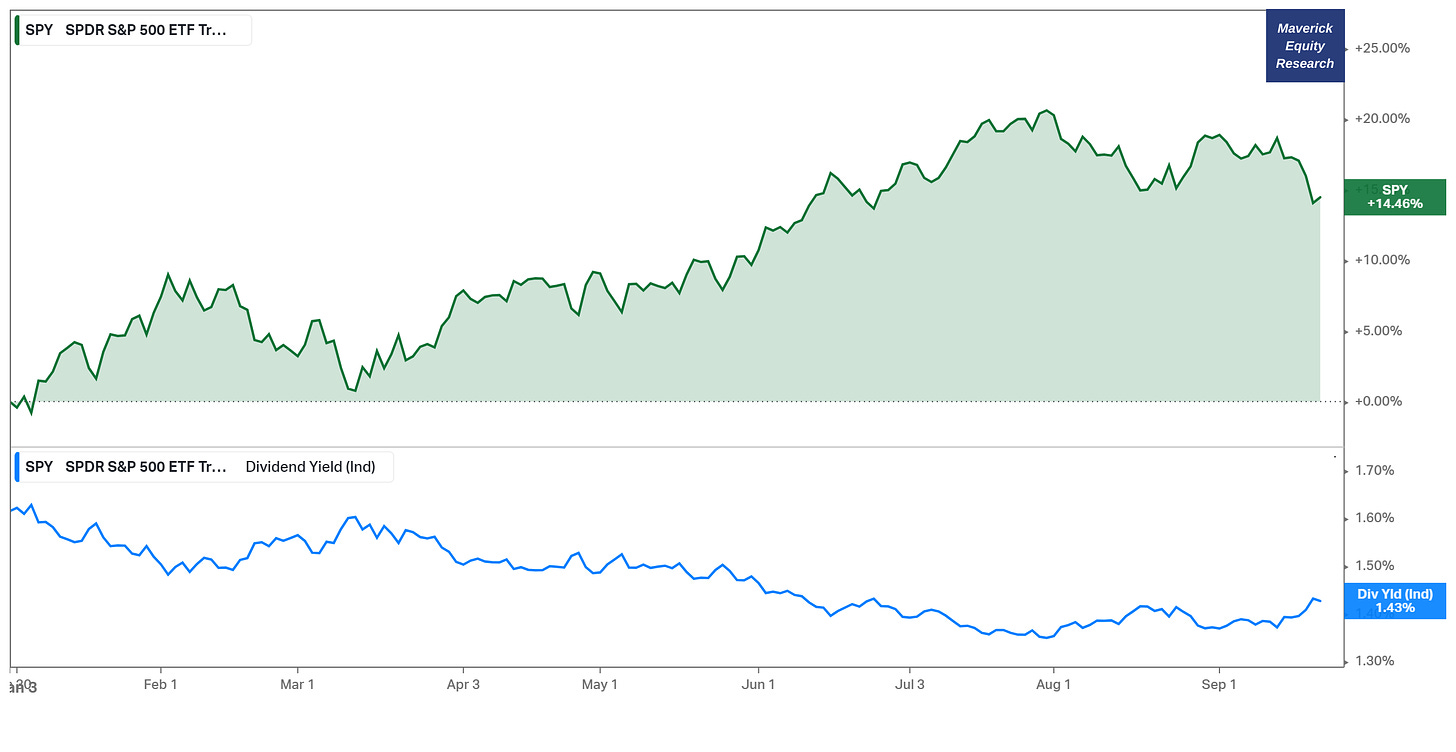

👉 2023 performance now: a great 14.46% with a dividend yield of 1.43%

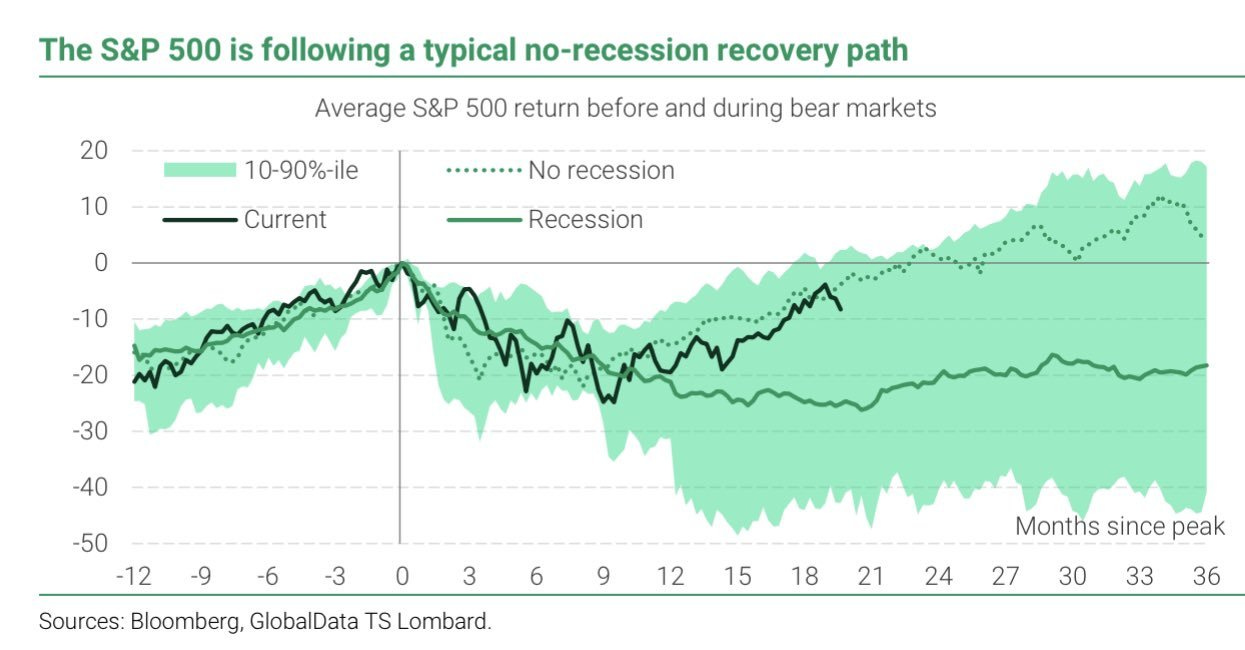

👉 Key note #1: after we had the 2022 bear market (biggest since the 2007-2009 GFC), it follows the typical no-recession recovery path currently

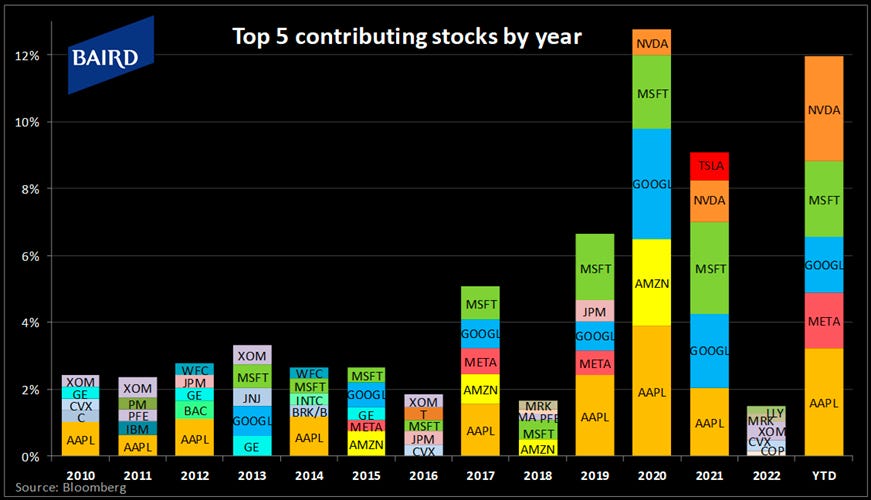

👉 Key note #2: 14.46% return is concentrated in a few names or more distributed?

-

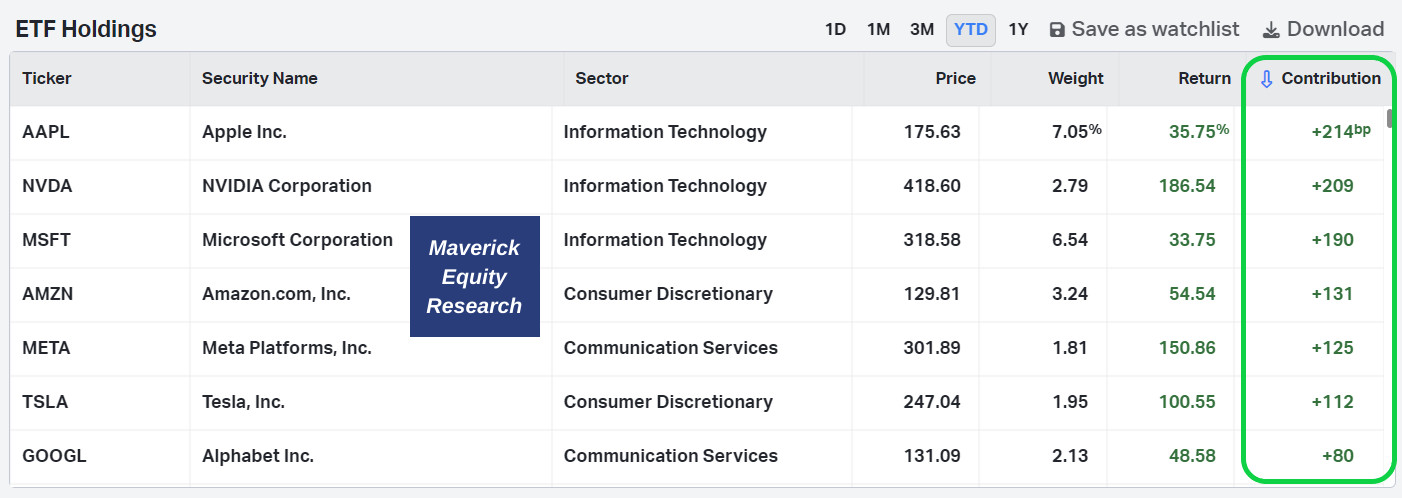

2023 % returns & the holdings weightings

-

return attribution analysis tells us exactly that 10.61% (1061 b.p basis points) are due to just 7 stocks, the M7 (Magnificent Seven) tech stocks: Apple, Nvidia, Microsoft, Amazon, Meta/Facebook, Tesla & Google/Alphabet.

-

hence, 73.37% (10.61/14.46) of the 2023 performance is due to the M7 tech stocks

Let that sink in! And bring the sink if you feel like 😉

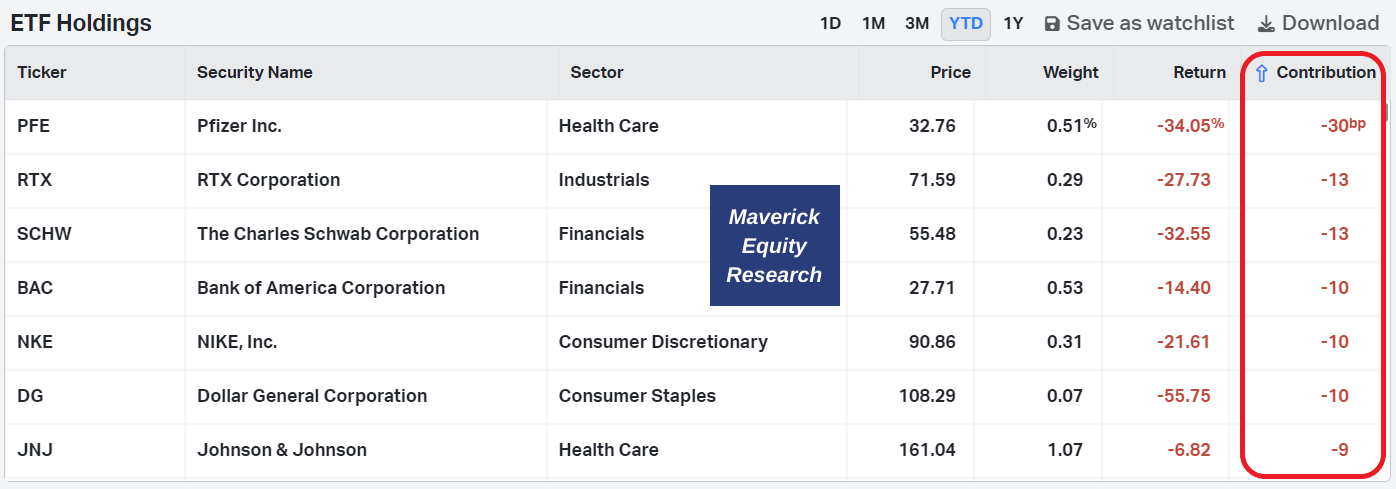

The laggards are the following 7 stocks: their weight is small in the index, but note that most of the individual returns are materially negative in 2023: Pfizer, Schwab, Bank of America, Nike, Dolla General and J&J as household names

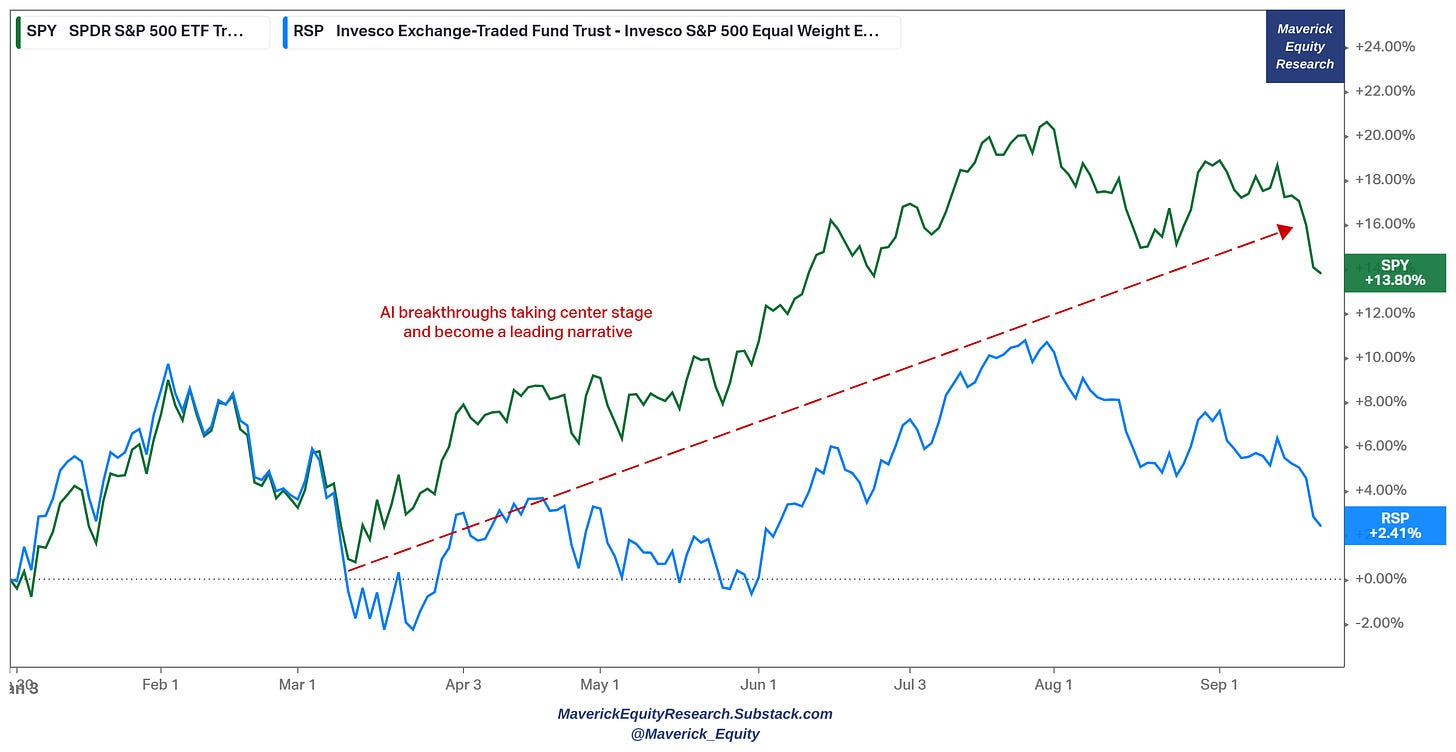

The major M7 stocks positive contribution is also showcased via the returns of the weighted (SPY) VS equal weighted (RSP)! The weighted SPY outperforming big time!

-

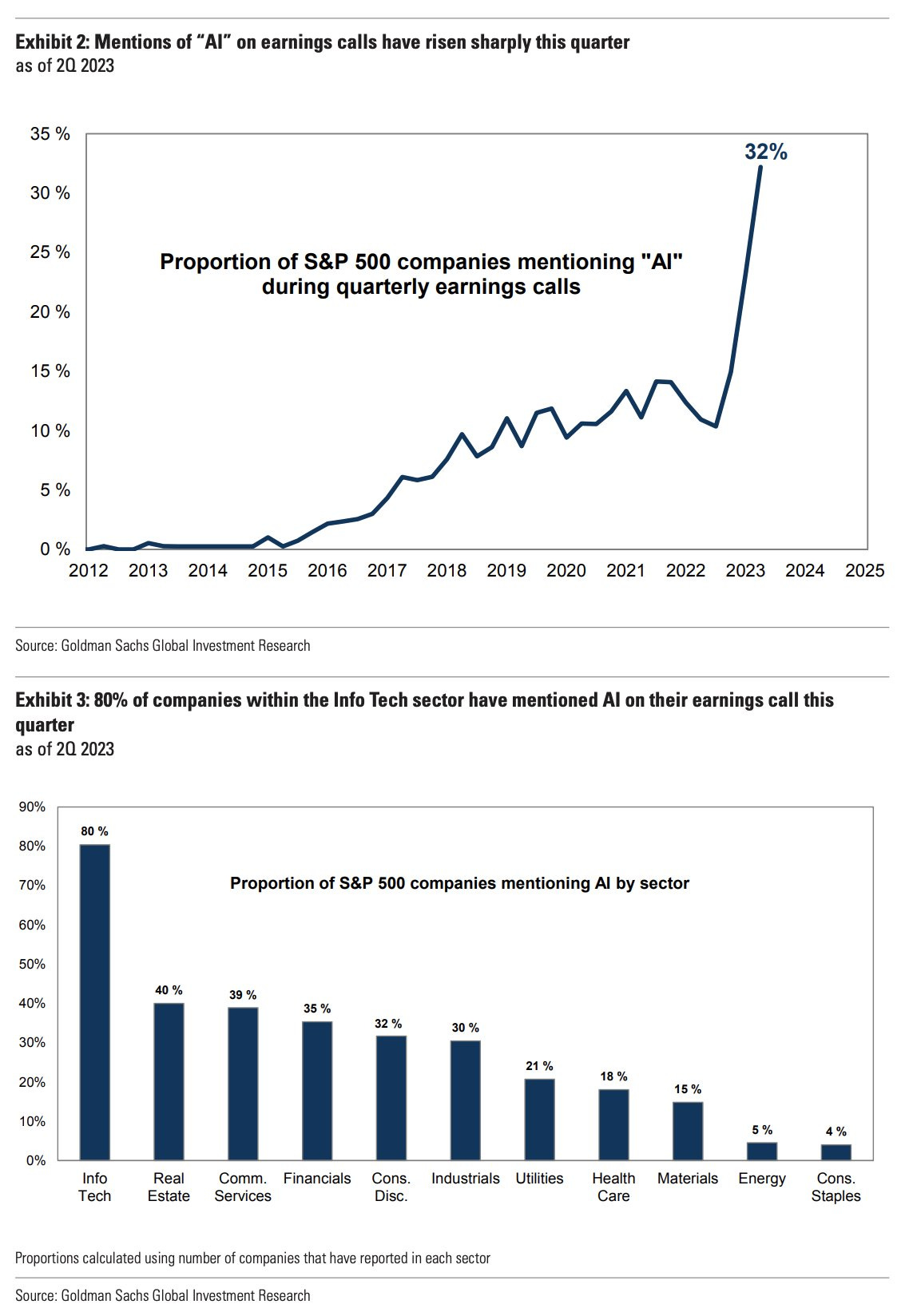

note that it started in March when the recent AI breakthroughs & narrative took over completely the center stage

-

I am quite certain that there will be big AI winners in the next 5-20 years, though also certain that many will pump their AI capabilities and real world use cases, hence hype is almost a given, hence down the road many will naturally deflate…

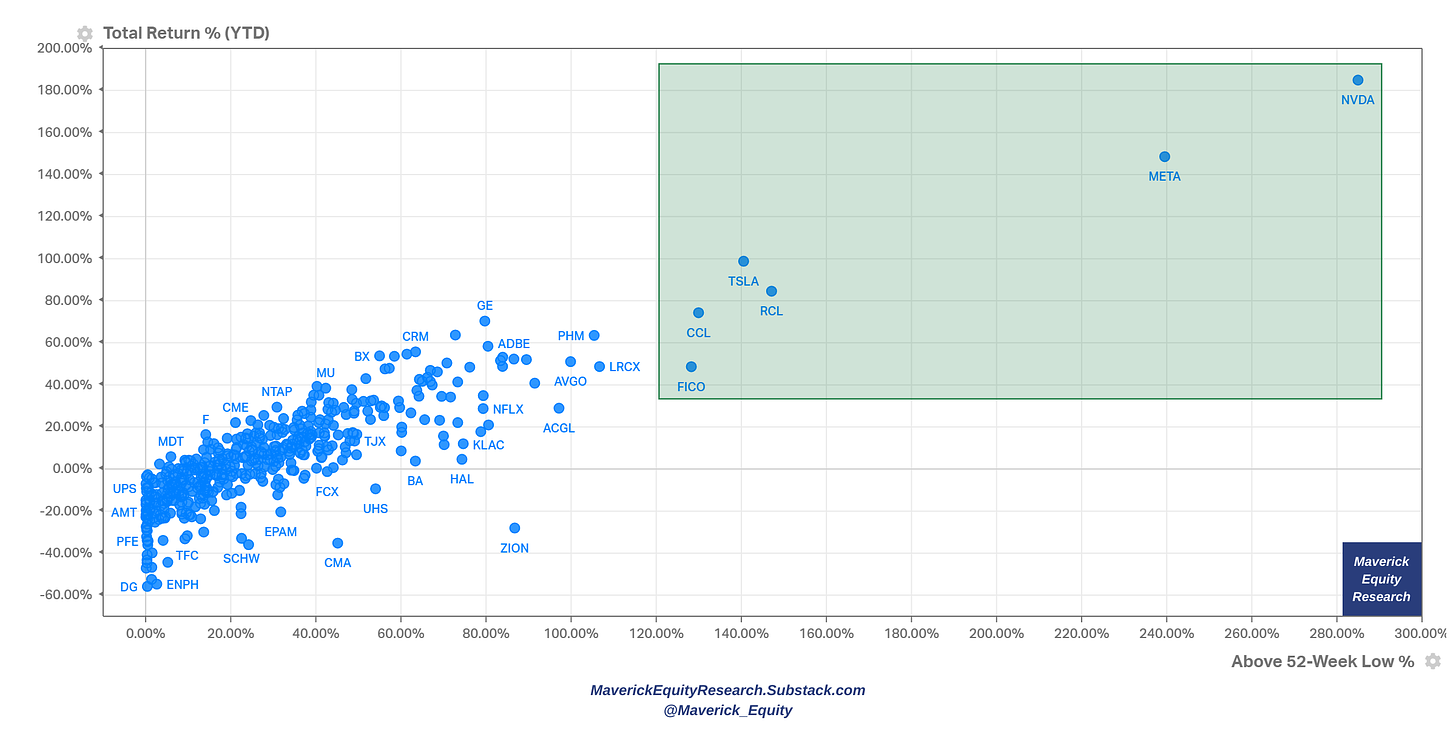

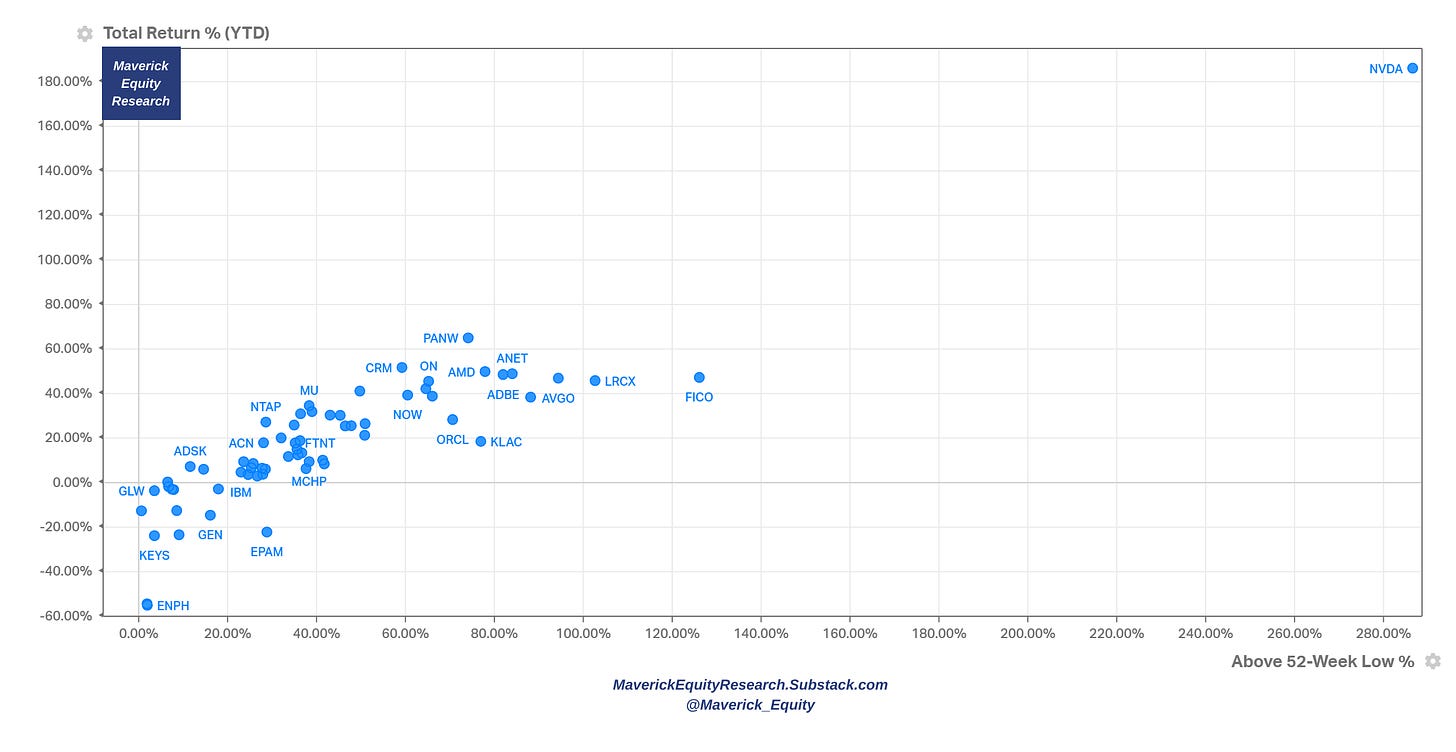

👉 now let’s ignore weighting and switch to the S&P 500 unweighted components via the following 2D chart: 2023 % returns & Above 52-Week Low %: Nvidia the mega outlier after the recent AI driven parabolic run, followed by Meta & Tesla

Complementary by single names in the 11 sectors and 24 industries, size = market cap

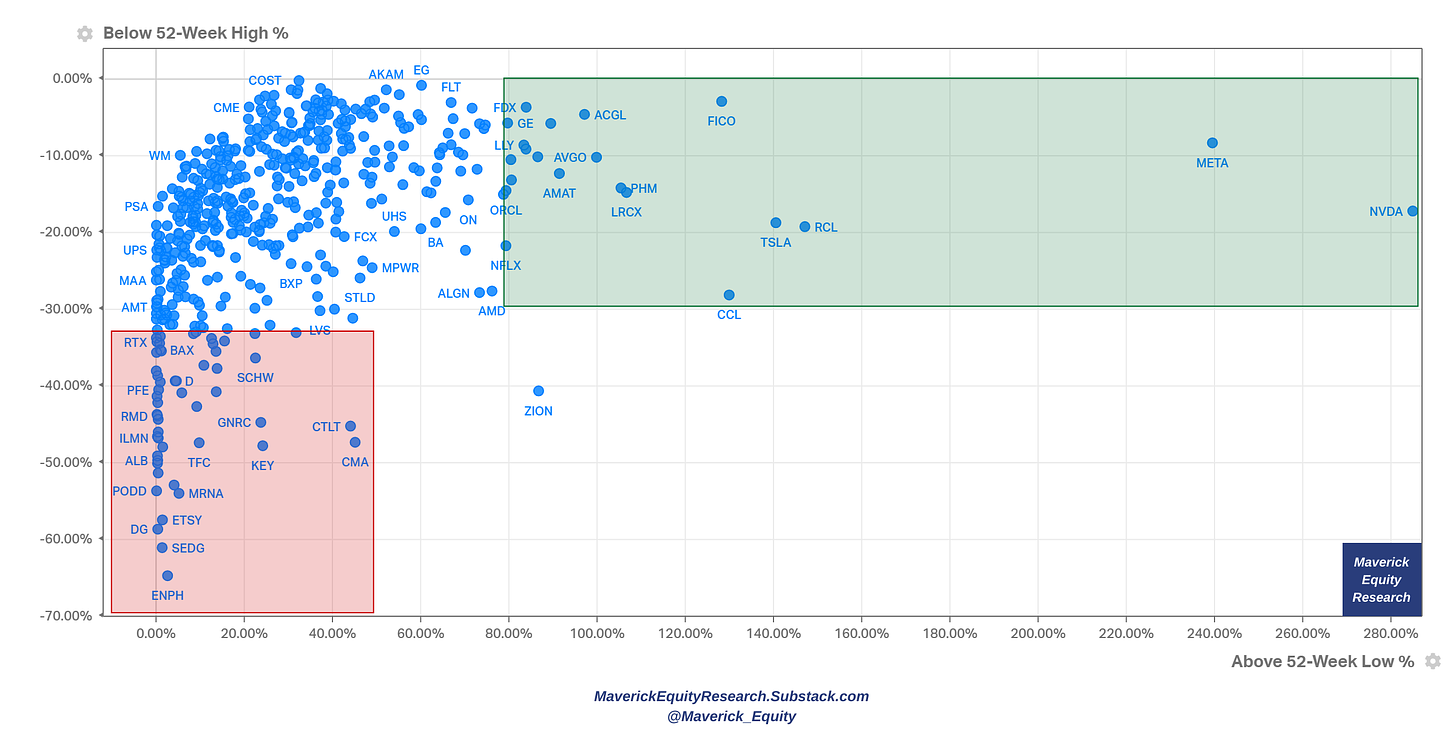

👉 continuing smoothly with the S&P 500 stocks above their 52-week lows & below their 52-week highs as my quick way to see both positive & negative momentum

-

if you see some of your names in one of the extremes, it’s interesting to relate to the other close clusters, peers or market overall and derive insight from there

📊 Earnings, Profitability, Flows, Value & Growth

👉 2023 Q2 earnings season:

-

revenue growth +0.5% going against the most anticipated recession ever talks

-

earnings growth -2.8% which is expected to be back positive in Q3 and taking off starting with Q4 … that is rather too optimistic in my view, but still I see expect decent positive developments earnings wise

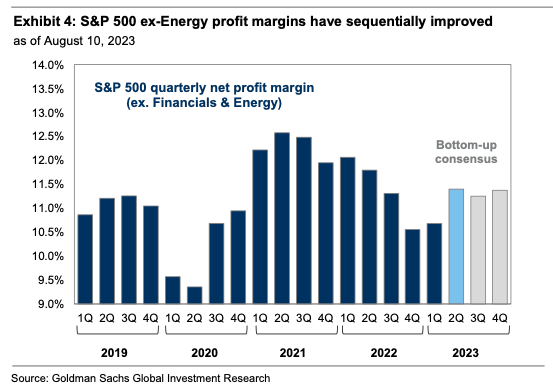

👉 Profitability:

S&P 500 Net Profit Margins (ex-Financials & Energy) sequentially improving lately

S&P 500 EPS (earnings per share) forward 12-month & price

-

back to earth & more aligned after the FED (and fiscal policy) induced parabolic run once the Covid outbreak

-

when stock prices go way above earnings/EPS consider getting cautious …

-

fundamentals matter always sooner or later. In the end it is all about earnings I heard on the street …

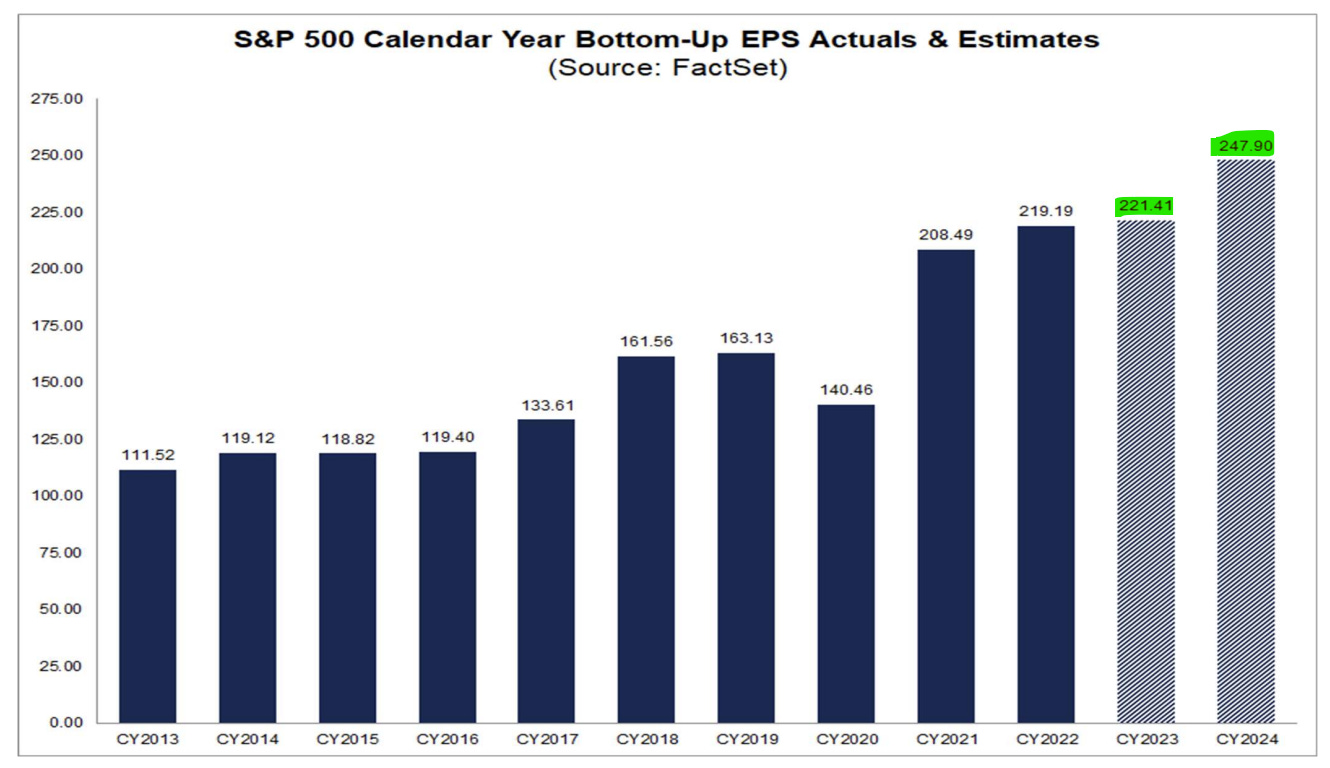

Complementary, the S&P 500 EPS Actuals & Estimates via consensus bottom-up:

-

221 for 2023 & 247 for 2023. No earnings recession on the horizon …

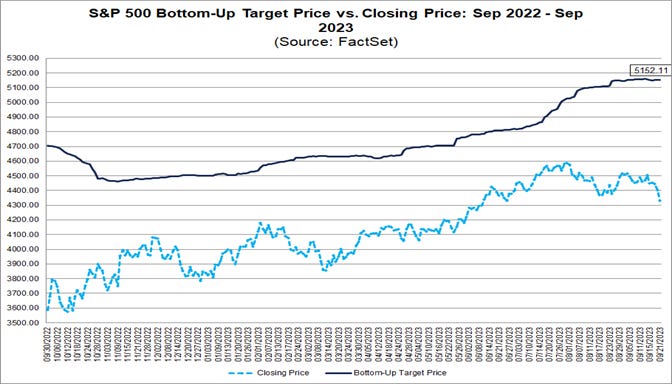

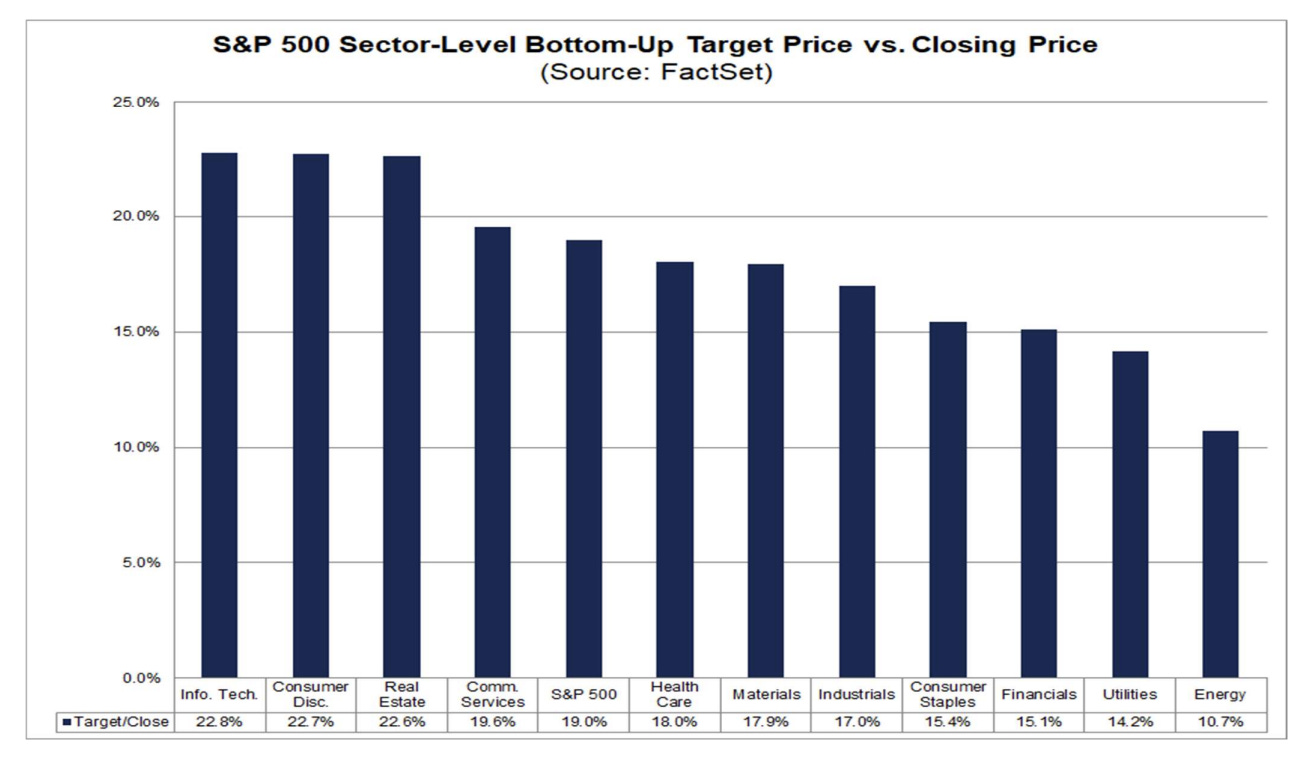

👉 Industry analysts median forecast +19.0% return in the next 12 months

-

imo likely too optimistic, I target for less & would be surely happy with less as well

Side personal note here, in investing (but not only):

-

better to have less expectations than high ones, if results are higher than it’s just a very nice and welcomed surprise

-

key to be realistic: would be great another 19% to compound on top of the 14.46% this year, but it will be tough with high interest rates which are seen now as they will be ‘higher for longer’ among other reasons

-

as you might have noticed, true and genuine research aims to stay grounded and withing what’s realistically possible: this is not a ‘trading room’, not a place where people are lured in for ‘multi-baggers’ ‘generational wealth’ ‘10-100x your money’ and get rich quick schemes … plenty of scams and places like that out there…

👉 S&P 500 (SPY) monthly financial flows (green/red) & total return (blue) since 2020:

-

2020 Covid crash: -$28.5bn in February, +$13.3bn with the March sharp rebound

-

2022 bear market: +$25.6bn in Dec 2021 right at the top, -$30.5bn in Jan 2022 to start the bear market and even bigger than the Covid crash, hence big outflows outliers are a good metric to watch for

-

2023: +$18bn in May as this time it was NOT sell in May and go away because they were bigger even than the October +$14.5bn local bottom which told us there is another leg higher in the 2023 rebound

Going forward, I do not expect extreme outflows nor inflows which are to be watched as reasoned above, while I aim for positive inflows in December for a Christmas rally.

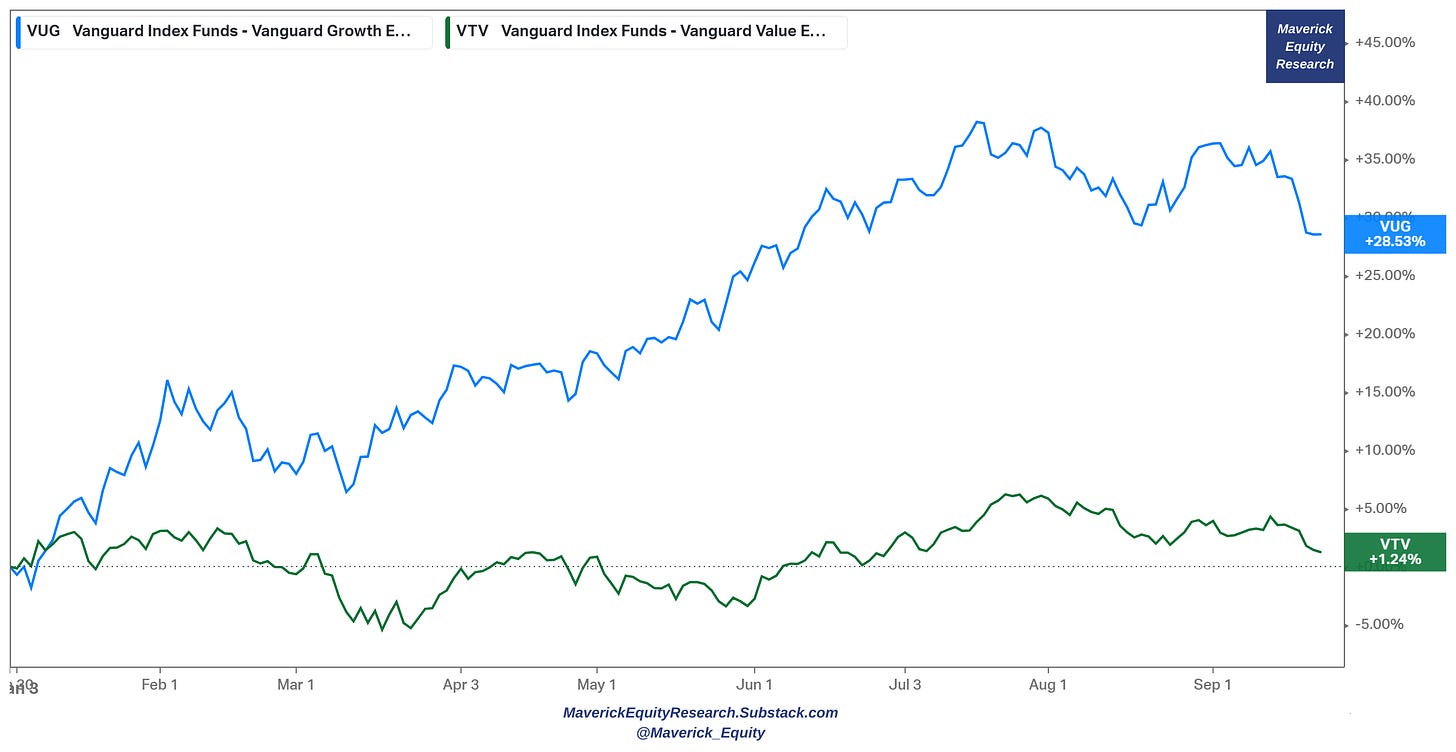

👉 Value & Growth via the investing styles lens:

-

VUG growth (blue) +28.53% rally while VTV value (green) with just +1.24%

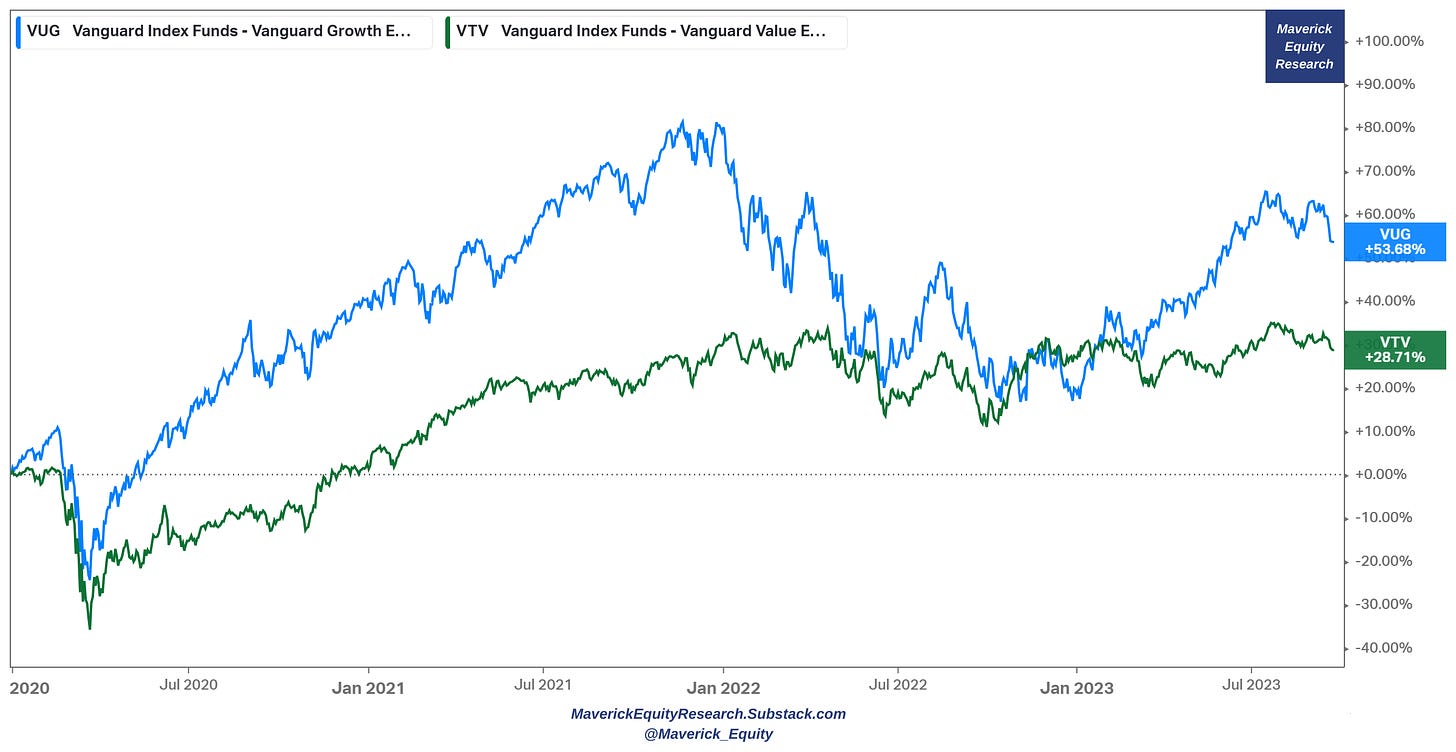

3-year timeframe: we see how value VTV value (green) did match VTG growth (VUG) for a good part of the 2022 bear market, now Growth is back big via the AI driven run!

More nuance via factors: growth (IWF) leading & momentum (MTUM) lagging in 2023

📊 The 11 Sectors Performance Breakdown

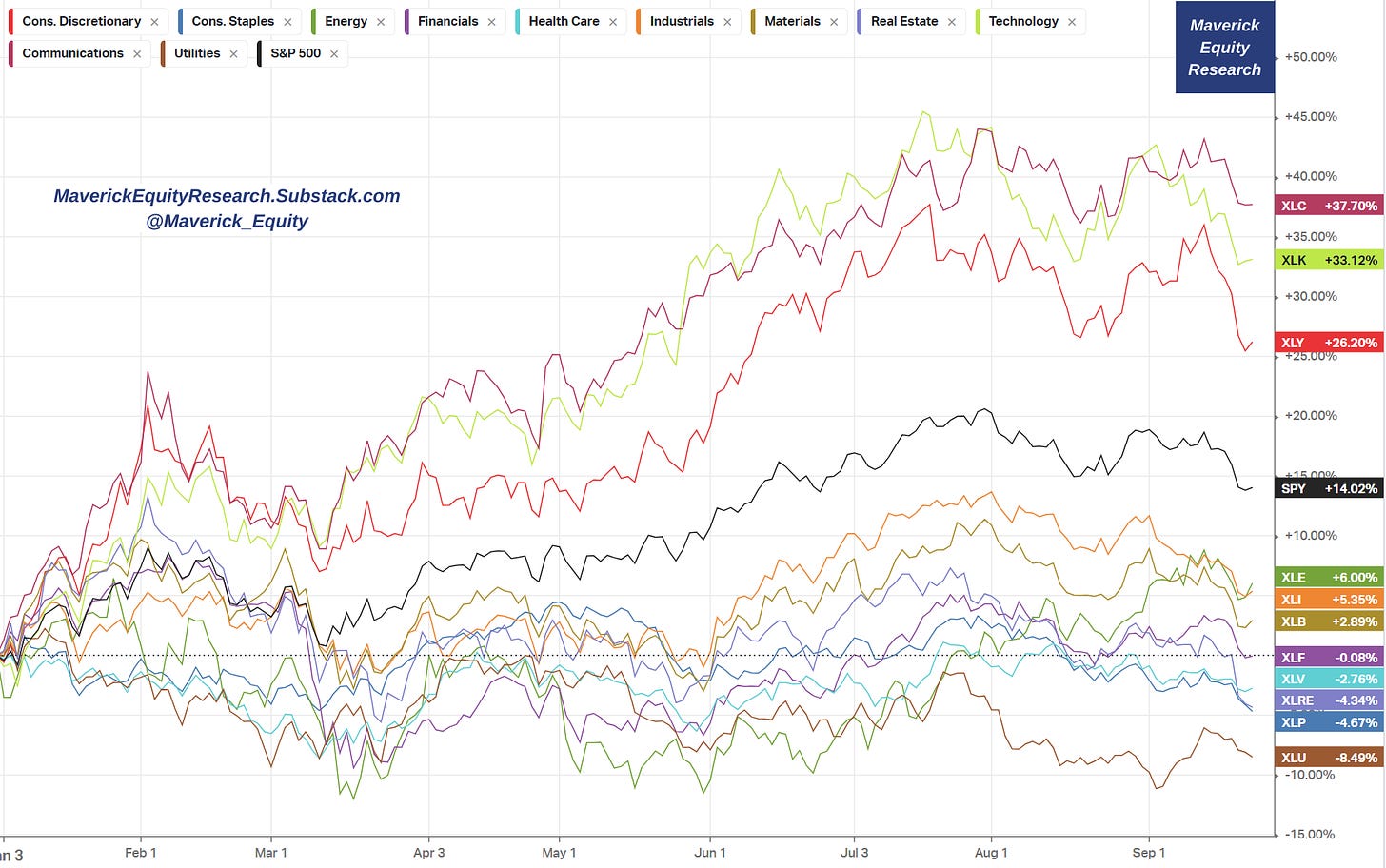

👉 2023 performance of the 11 Sectors that shape the S&P 500:

-

XLC (Communications) & XLK (Tech) & XLY (Consumer Discretionary) leading

-

46% huge spread between the Top & Bottom sectors which is very rare to see: XLC (Communications) + 37.7% while Utilities (XLU) -8.49%

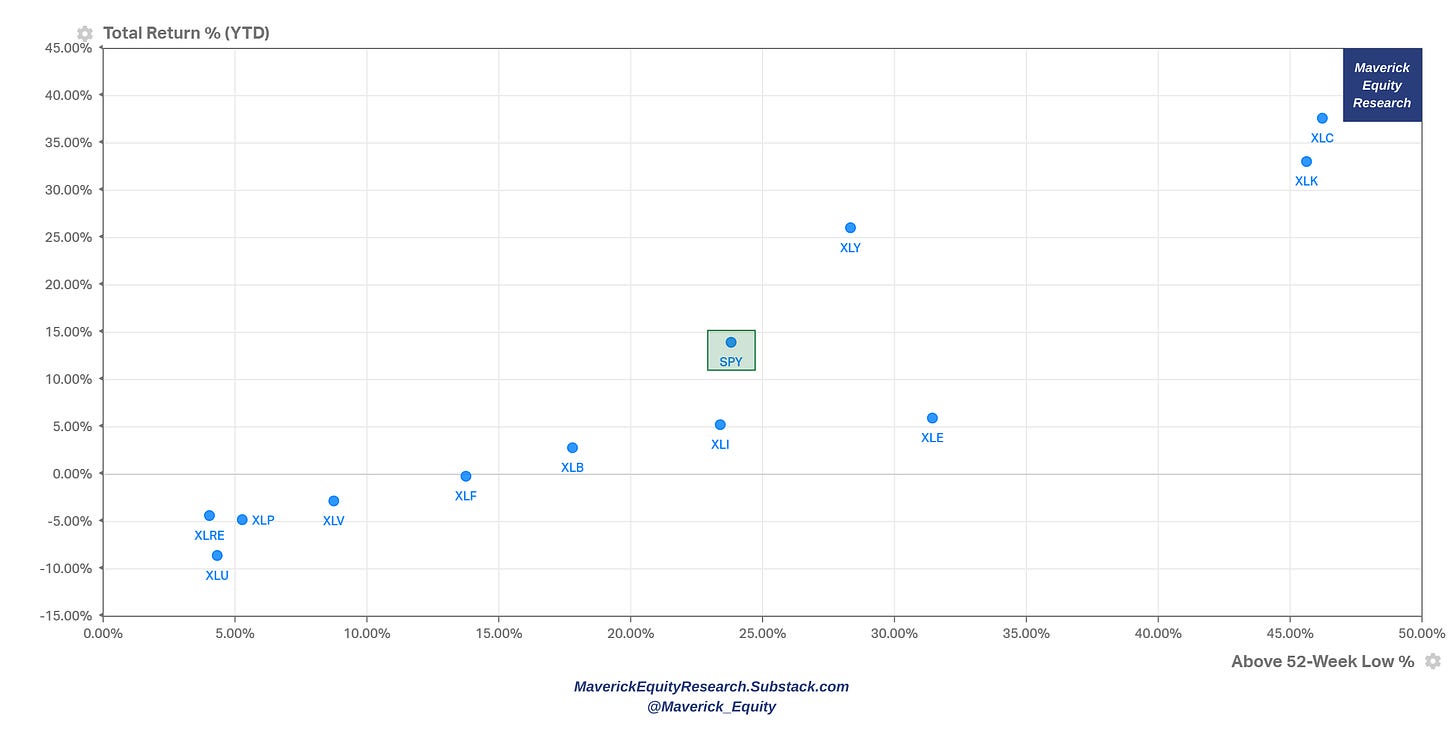

👉 The 11 Sectors + S&P500 itself (SPY) with 2023 % returns & Above 52-Week Low % for an extra dimension and same key message:

-

XLK, KLC & XLY also with the momentum from their 52-week lows

-

note, energy is bouncing back also from the 52-week lows

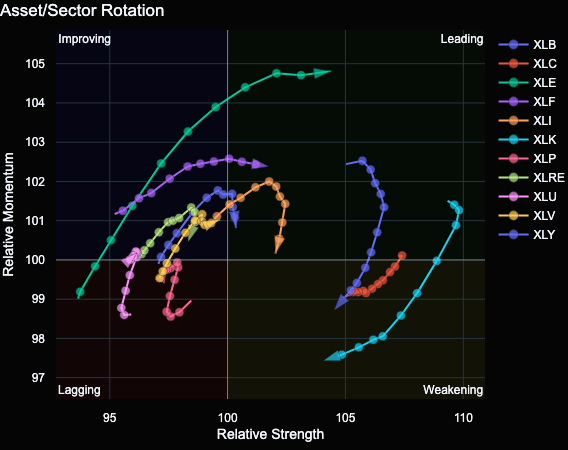

👉 Sectors rotation graph for relative strength & momentum dimensions:

-

Energy (XLE) leading while note the weaking Tech (XLK)

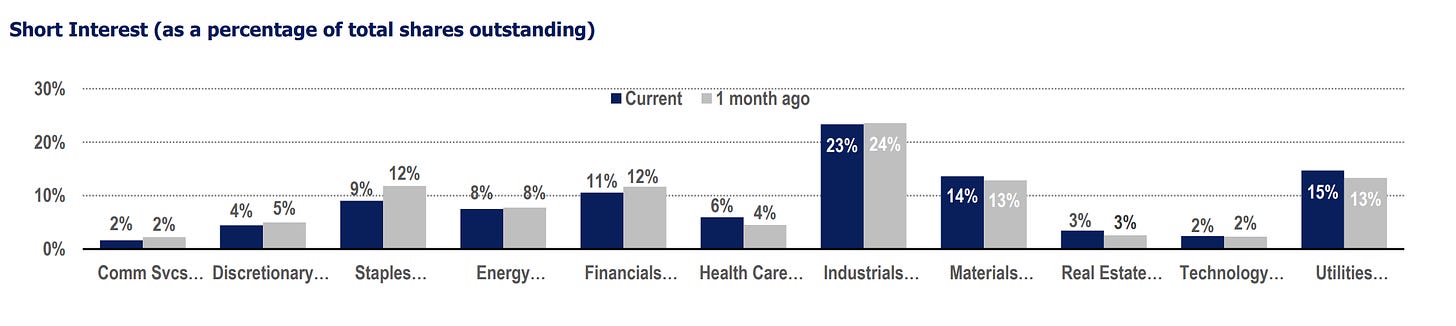

👉 Short Interest breakdown for the 11 sectors: Industrials (XLI) the most shorted, Tech (XLK) and Communication Services (XLC) the least

👉 Industry analysts 12 month median forecast / target price for the 11 sectors:

-

Tech (XLK) the most optimistic while Energy (XLE) the least

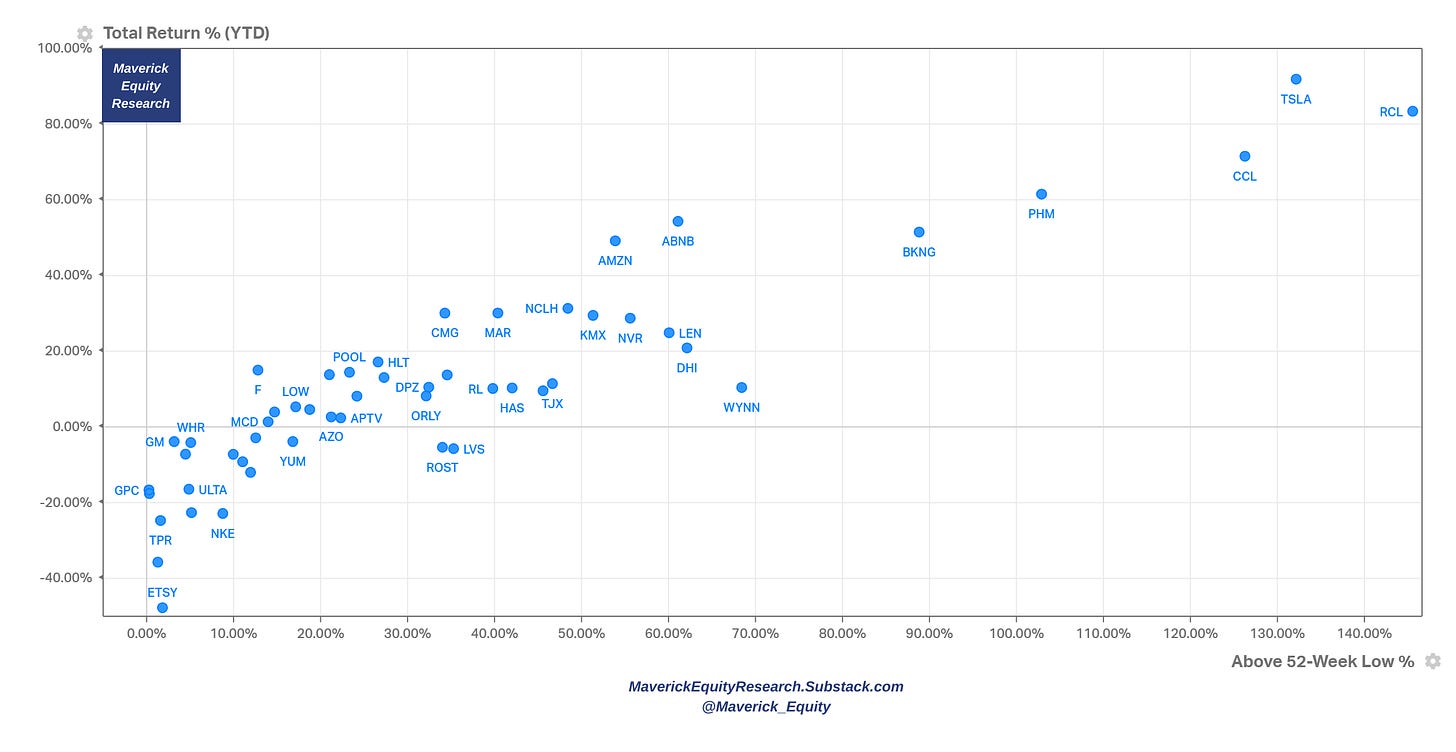

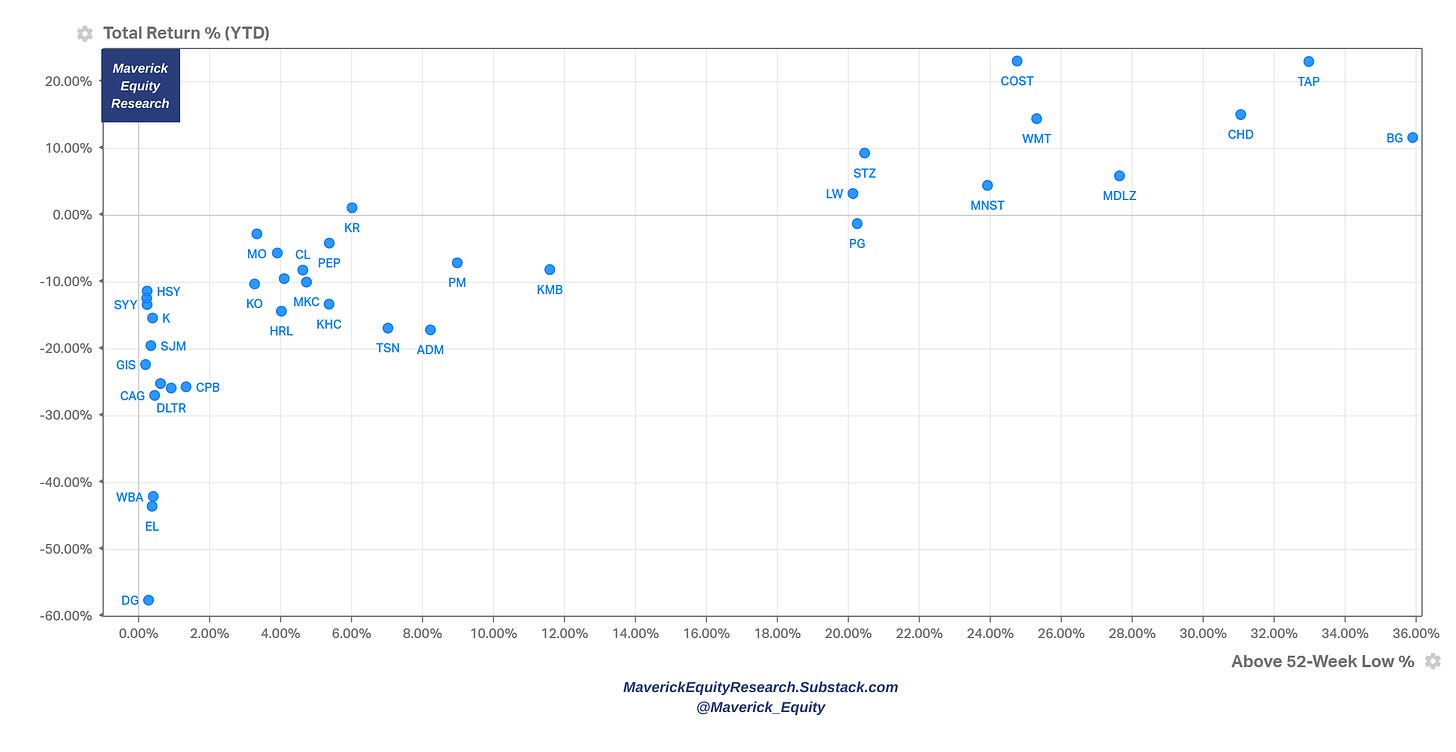

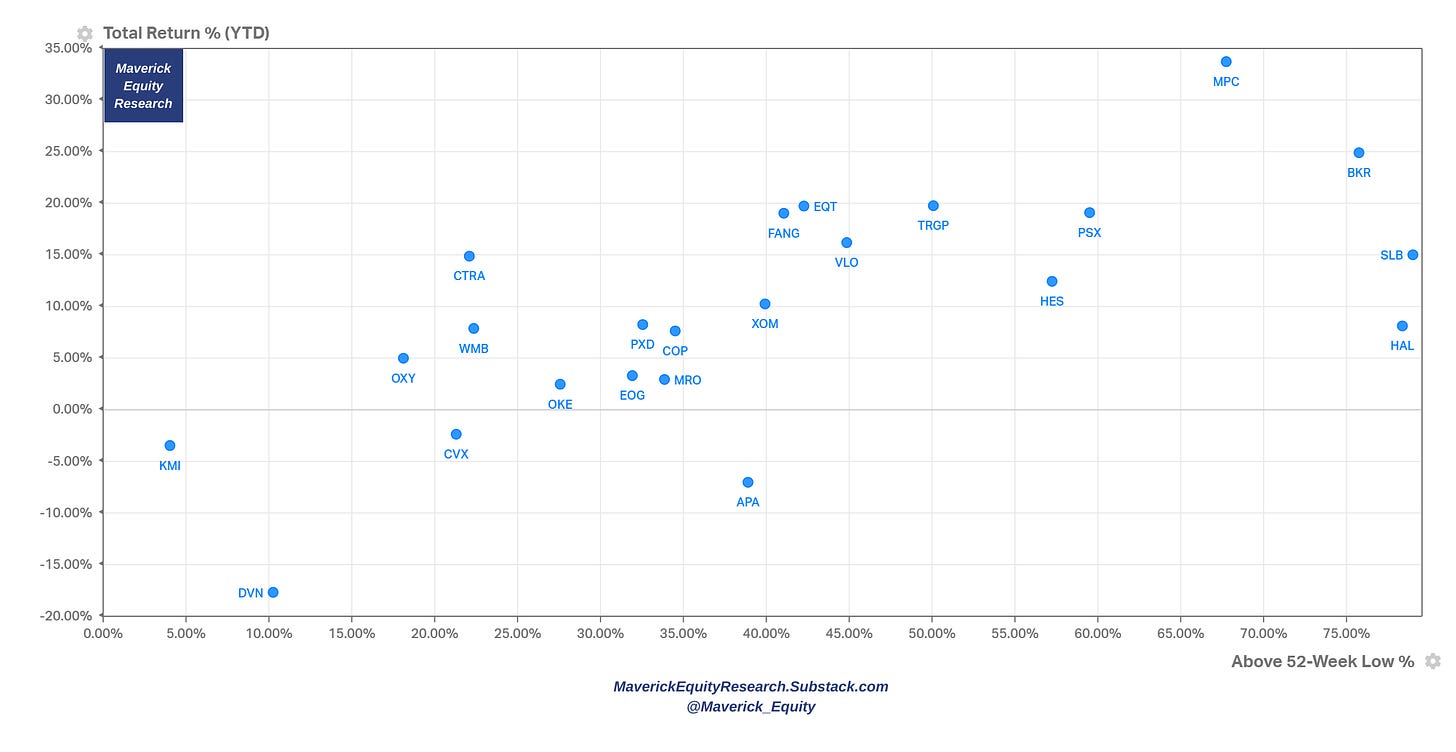

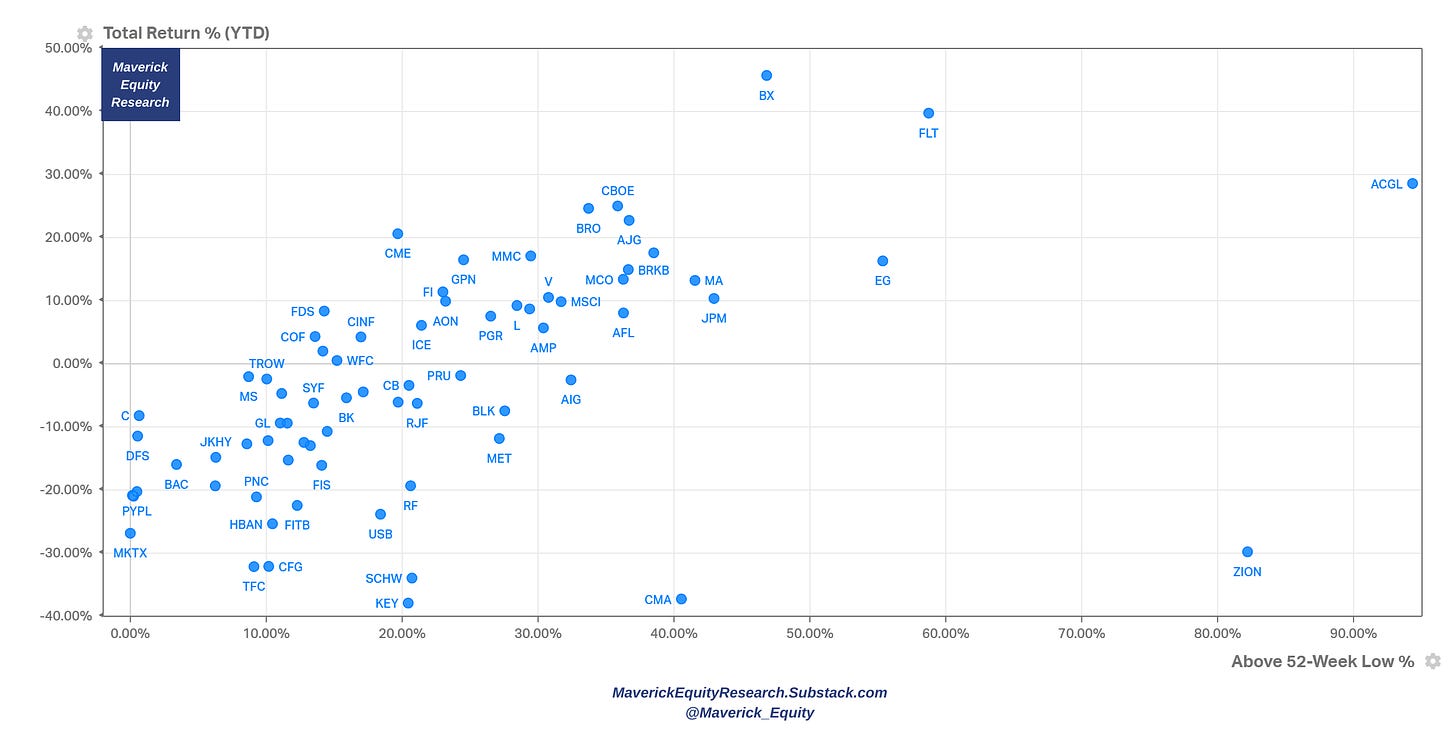

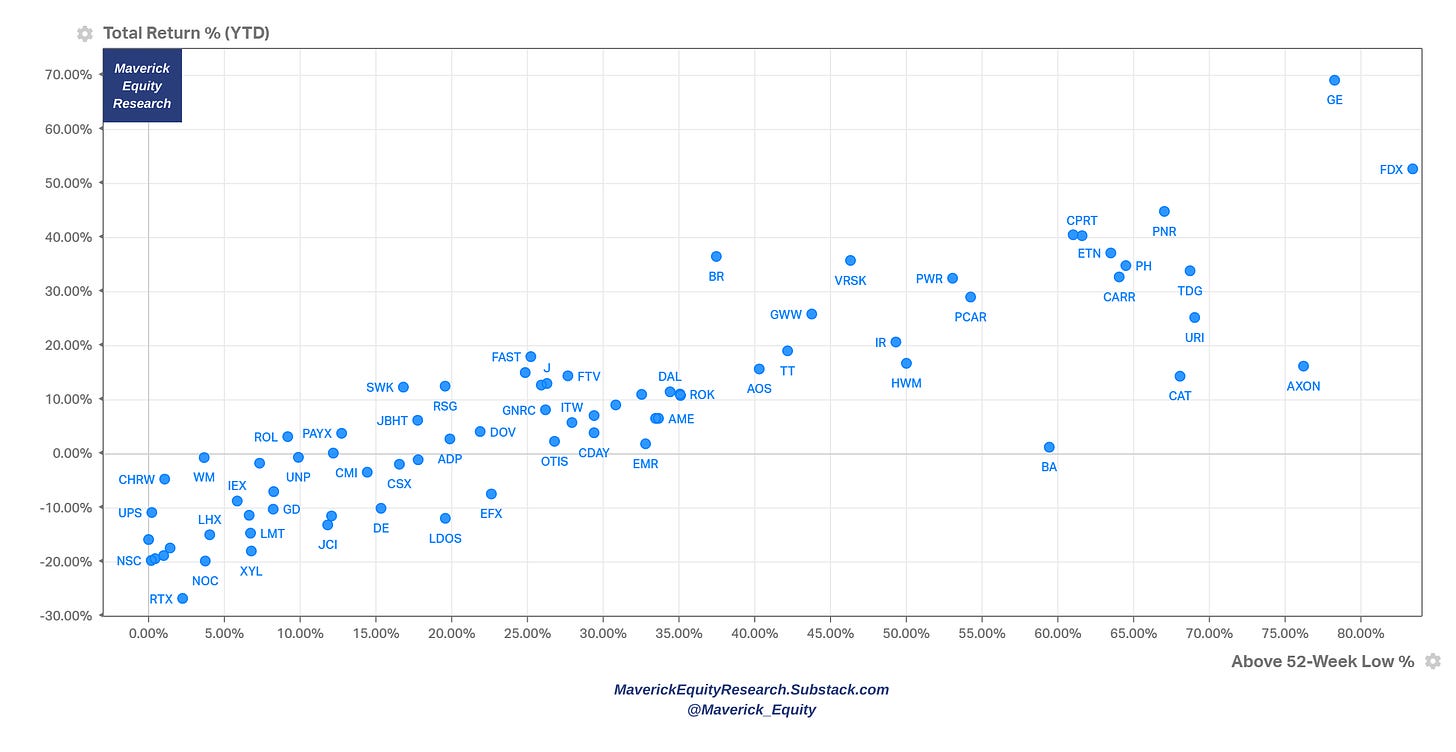

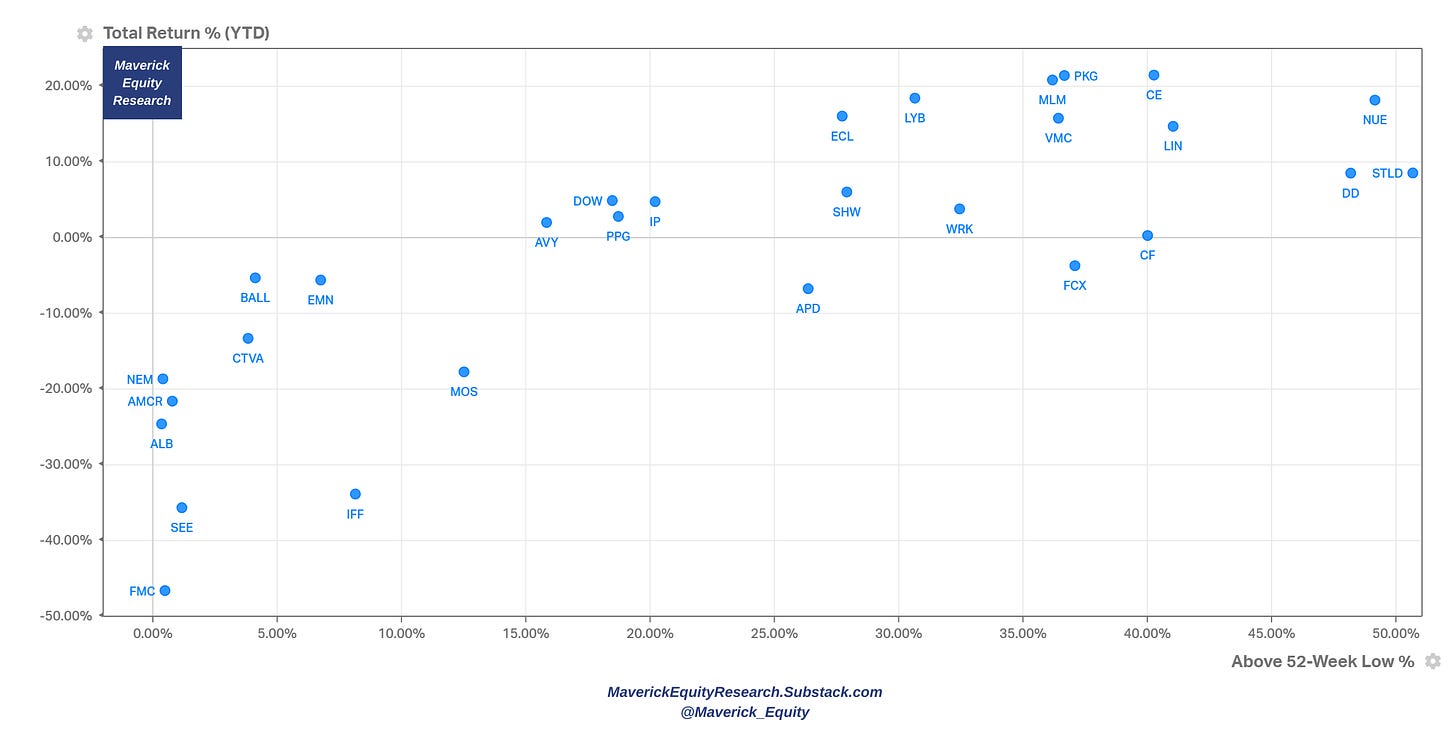

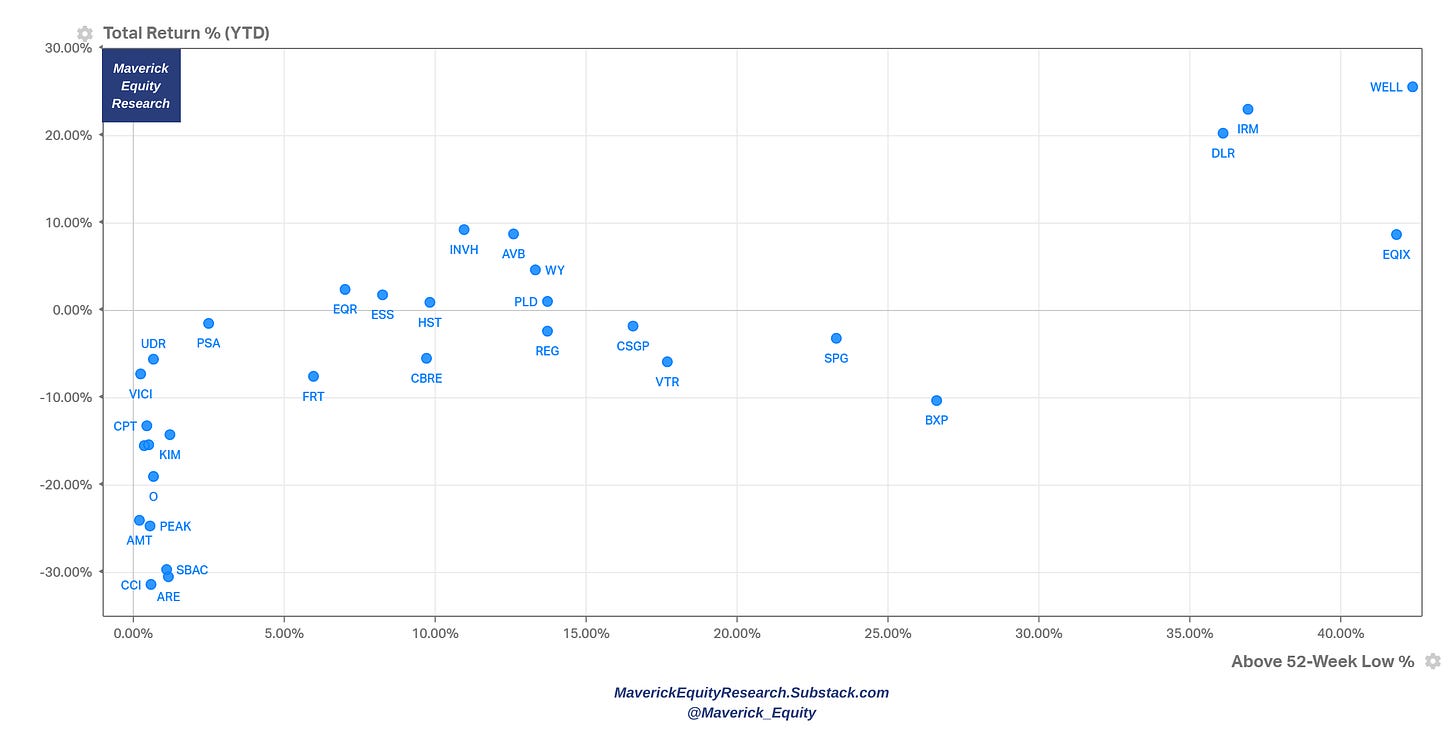

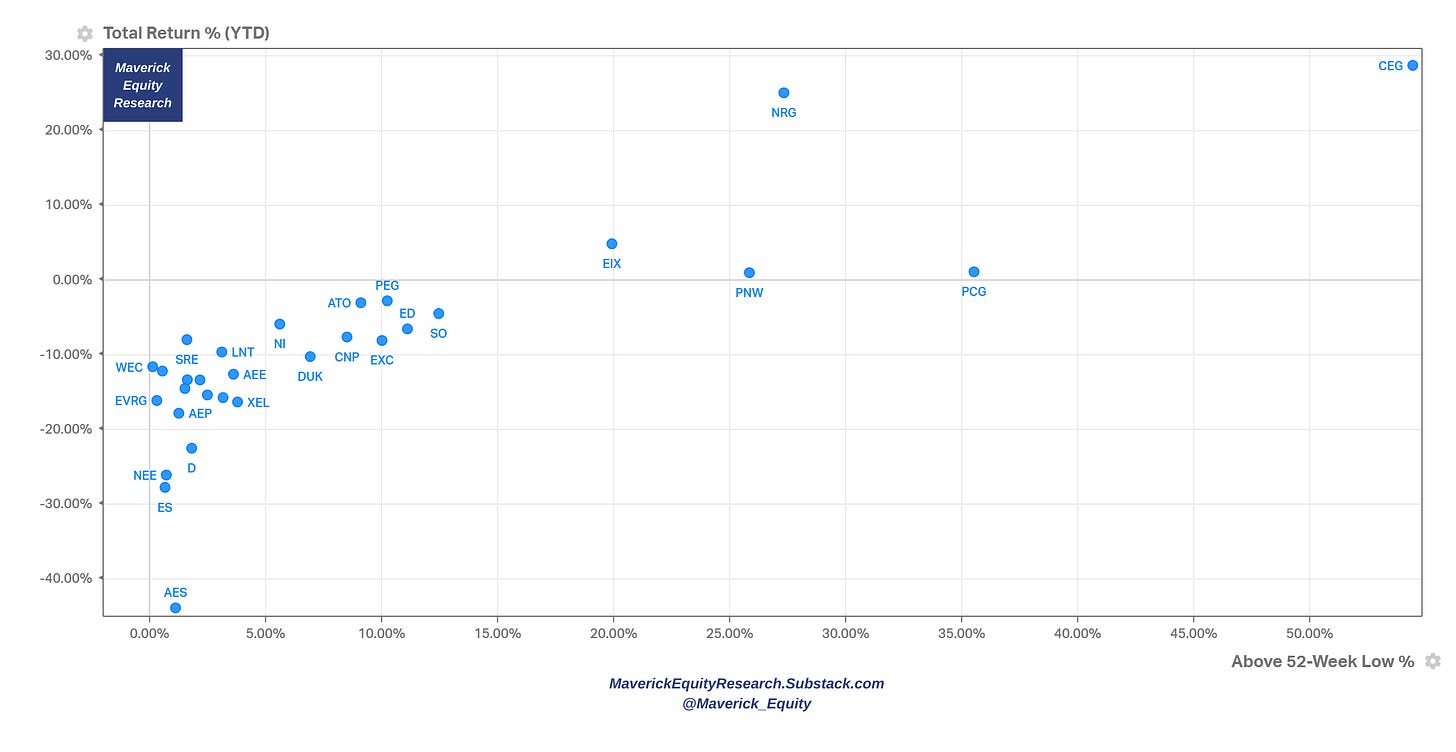

👉And now let’s zoom into the Price/Performance of the 11 sectors via scatterplots: 2023 % returns & above 52-week low % returns. General use cases for this visuals? Check for outliers, market leaders & laggards, positive/negative momentum, relative strength and/or likely un/warranted cheap or expensive stocks:

-

XLY – Consumer Discretionary: Tesla (TSLA) & the cruisers Royal Caribbean (RCL) and Carnival (CCL) rocking the boat …

-

XLP – Consumer Staples: Dollar General the big story on the negative side, Costco (COST), Walmart (WMT) & Mondelez (MDLZ) keep bringing the goodies…

-

XLE – Energy: most energy names making a nice comeback …

-

XLF – Financials: a mixed bag as pretty much most of the times, PayPal (PYPL) continuing the slide in 2023 while Arch Capital Group (ACGL) +30% in 2023 and almost 2x since the 52-week low

-

XLV – Health Care: many names down this year while West Pharmaceutical Services (WST) the big outlier on the positive side

-

XLI – Industrials: General Electric (GE) and FedEx (FDX) the big rebounders …

-

XLB – Basic Materials: many names rebounding nicely from the 52-week low … infrastructure needs and demand anyone? …

-

XLRE – Real Estate: Welltower (WELL) the outlier in this space …

-

XLK – Technology: Nvidia (NVDA) the big outlier, AI AI AI …

-

XLC – Communications: META/Facebook with a mega rebound, currently in the MetaVerse … with the CEO planning and training to fight Musk in the ring ;). Google (GOOG) & Netflix (NFLX) not chilling anymore with a nice rebound also …

-

XLU – Utilities: Constellation Energy Corporation (CEG) a big outlier …

📊 Sentiment, Seasonality, Volatility

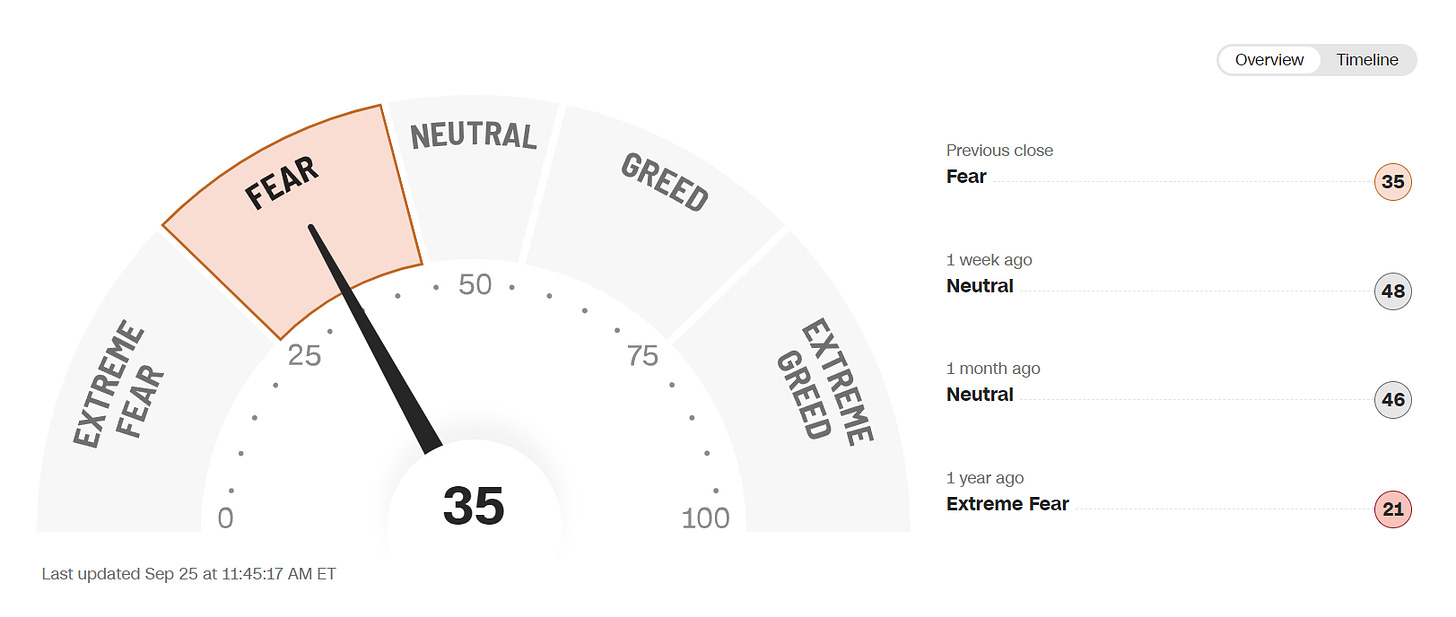

👉 Sentiment: retail investors, institutional & mixed/composite indices

-

After the 2022 bear market, retail investor sentiment is picking up materially

-

BofA fund manager survey: despite global growth expectations being more pessimistic with net 53% expecting a weaker economy over the next 12 months, there is optimism for the stock market which is likely driven by likely interest rates cuts as priced in currently by the market

-

The Fear & Greed index shows Fear at 35, materially less than the Neutral 46 from 1 month ago, while note that 1 year ago in the 2022 bear market we were at the 21 Extreme Fear level

-

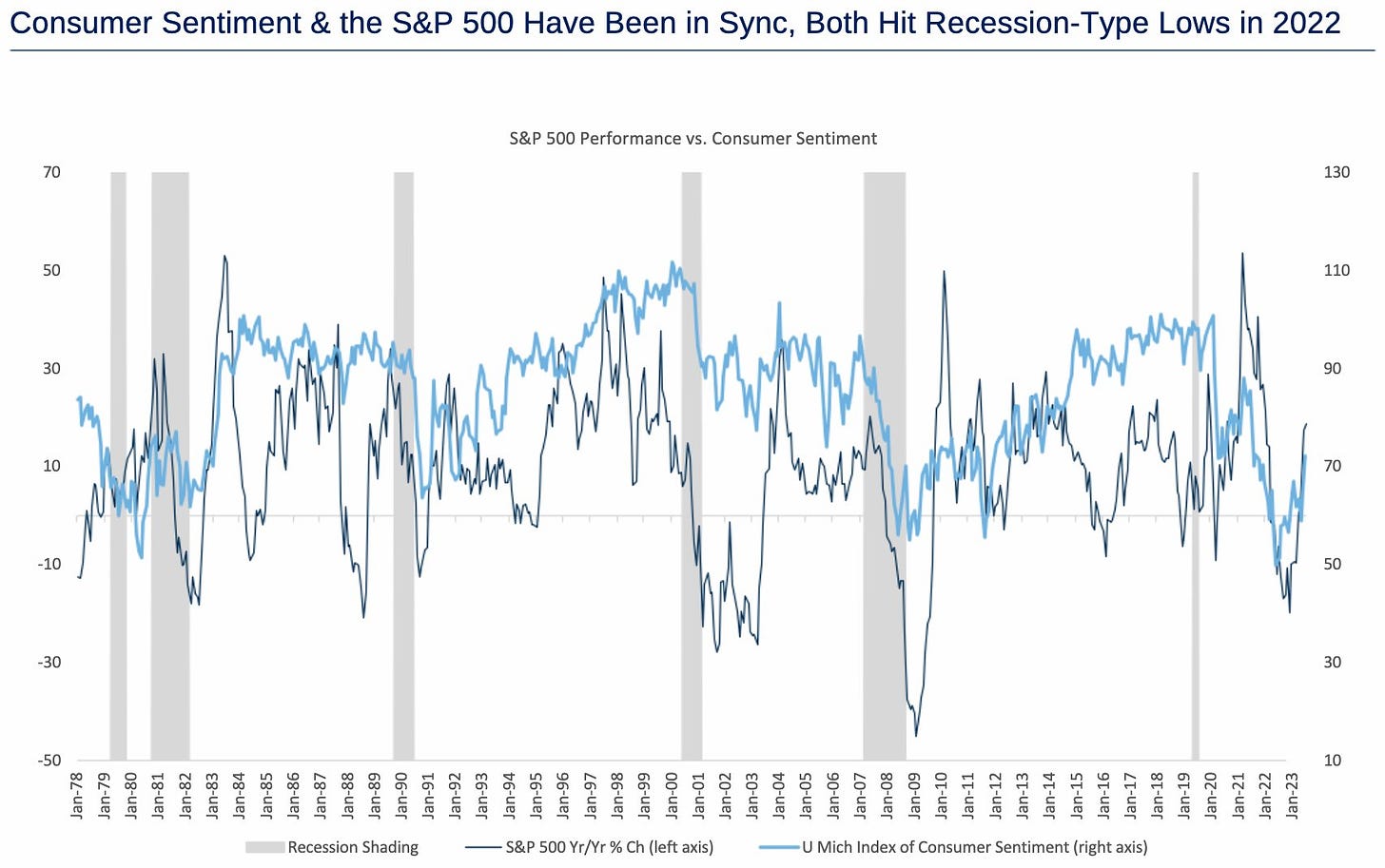

Consumer Sentiment and the S&P 500 dance together: after the 2022 bear market (biggest since 2007-2009 GFC), recovering more and more

-

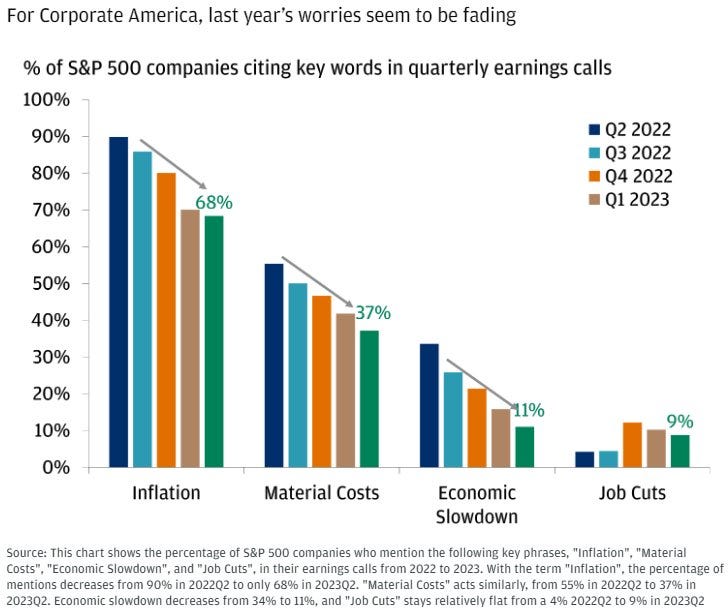

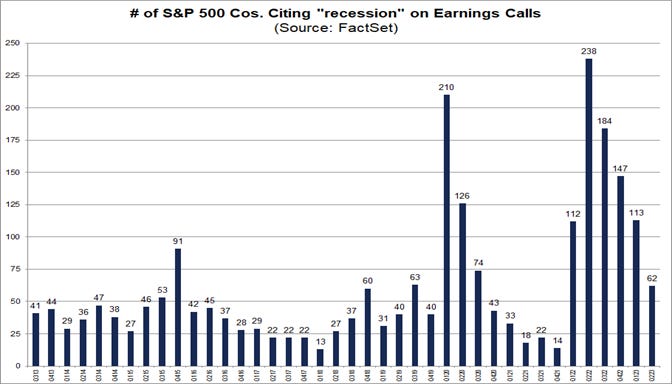

S&P 500 companies themselves via earnings calls narrative

2022 worries are fading for Corporate America

And the ‘R’ word: fewer & fewer citing ‘recession’ for the 4th straight quarter

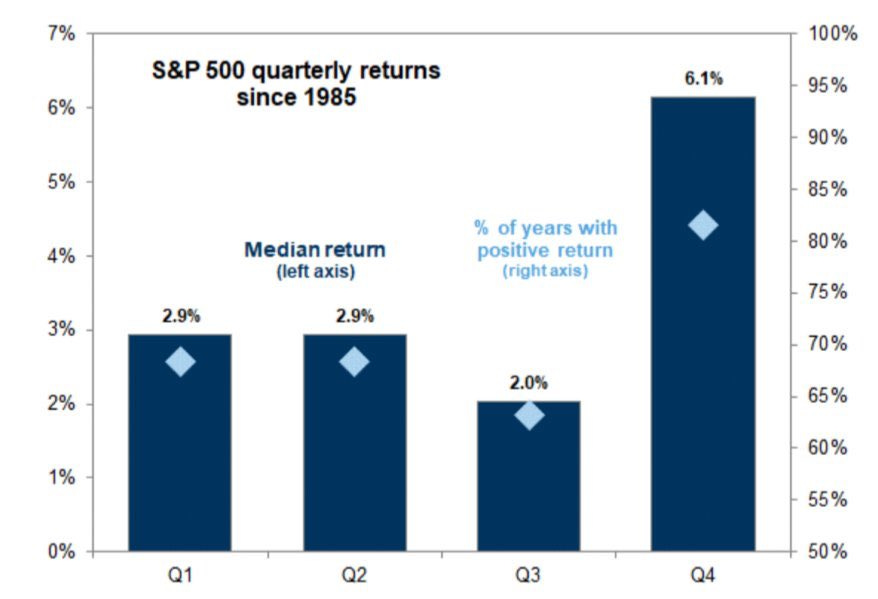

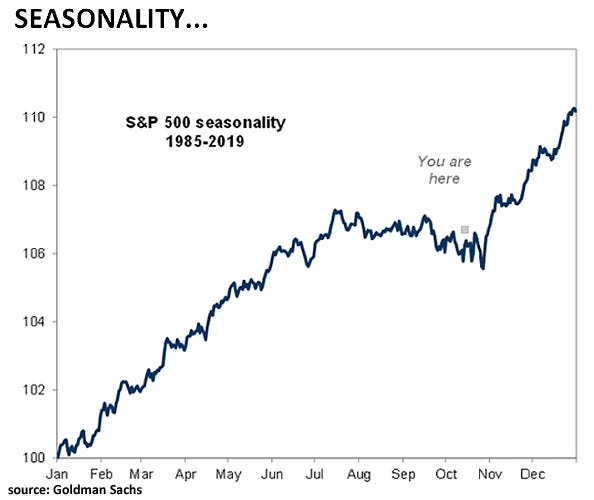

👉 Seasonality tells us we are behind the next move higher

-

Quarterly wise, since 1985 we have a 6.1% return in Q4; personally, I expect less given we already had a great year this year

-

Daily/Monthly wise, it points out up as well

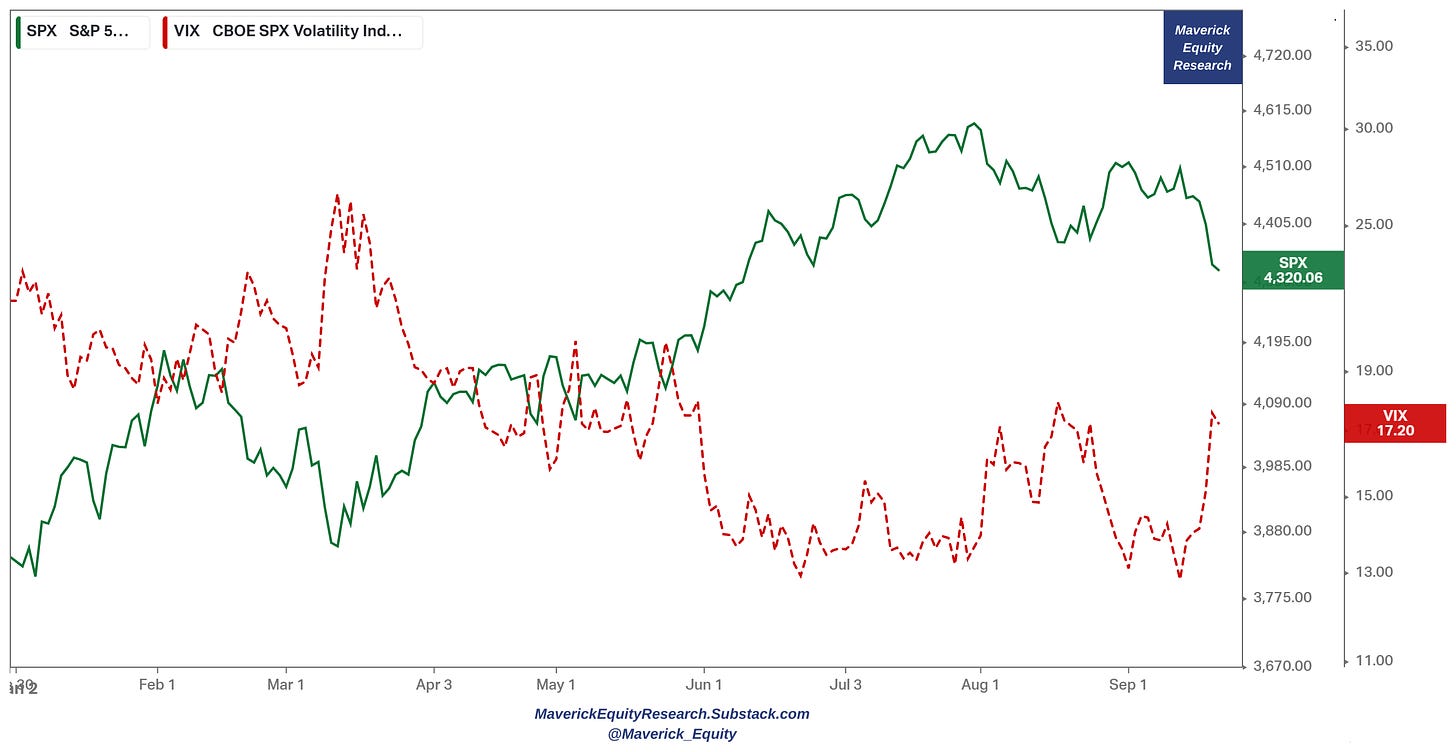

👉 Volatility wise:

-

2023 stock market rally caused VIX (indicator of market uncertainty) to fall since June to its lowest level in more than 3 years (since January 2020)

-

recent spike to 17.2 as we cooled off a bit, but still below 19.6 average since 1990

📊 Technical Analysis: Short Term & Long Term

Short Term:

-

once we broke out of the major resistance level (red) & the 200-day MA, we did exit the 2022 bear market and headed up nicely via the trending channel

-

channel resistance level broken recently with the next support at the 200-day MA

-

however, the RSI at 34 is signalling oversold conditions as it signalled also before local bottoms, hence pointing to a likely bounce back going into the year end

Complementary with an even shorter time frame, specifically from July 2022:

-

trendline (black line) from the October 2022 lows is the support level

-

tested for the 2nd time recently, only to bounce back from in the recent days which was also signalled by the RSI that reached oversold territories

-

hence, still a support level and in case broken, the 200-day MA is the next one

-

the 50-day MA (blue) is the resistance level here should the 2023 rally continue

Long Term:

-

after the recent drop still above the 50 & 100-week moving averages which are now support levels going forward

-

RSI in oversold territory at the 33 level which often signals a bounce back

📊 Special & Alternative Metrics

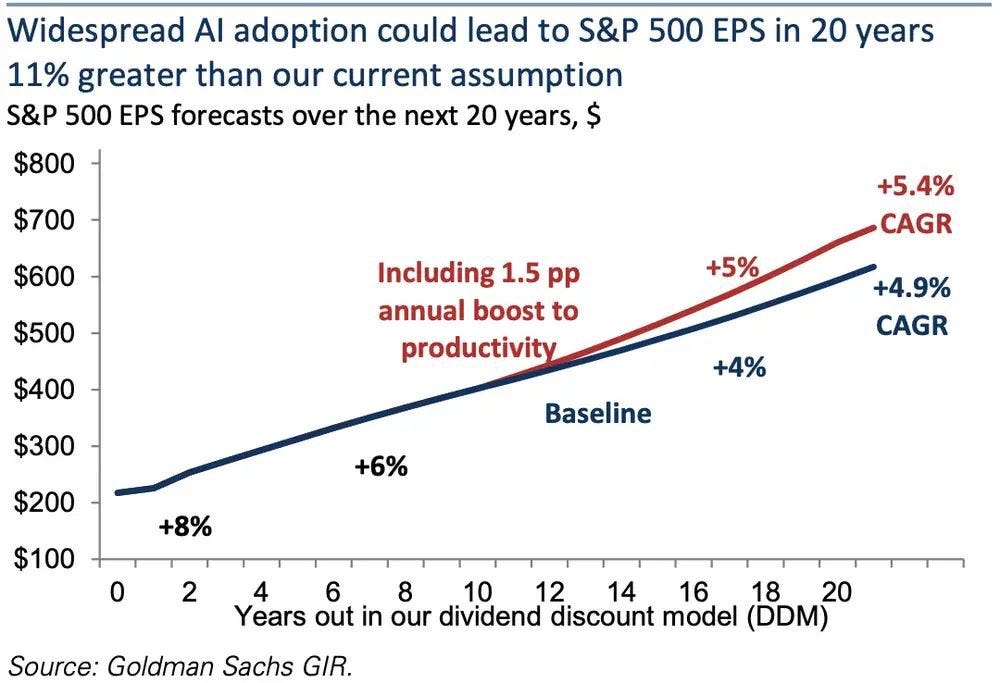

👉 S&P 500 EPS to be boosted for the next 20 years by +0.5% in annual growth driven by widespread AI adoption (0.5% seems not a lot, but CAGR aka compounded)

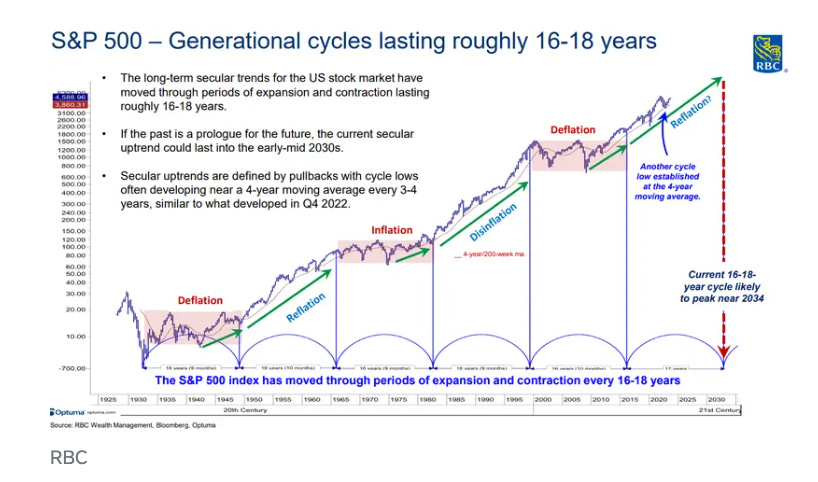

👉 S&P 500 set to triple to 14,000 by 2034 via the generational cycles:

-

current 16-18 year cycle likely to peak around 2023

-

3x might sound ridiculously high? It is highish but not something bombastic and that is because: a) reaching 14,000 would imply around 11% annualised returns which is not that uncommon b) not too long ago in 2010 the S&P 500 was at 1,000

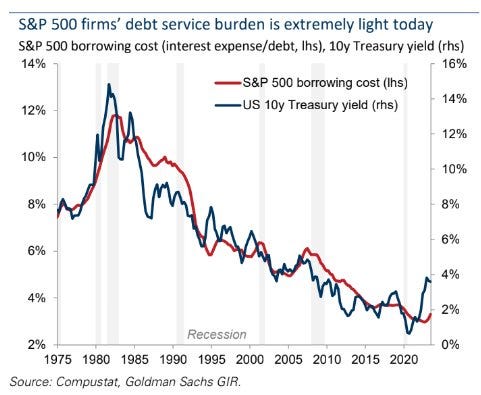

👉 How is the S&P 500 dealing with the high & fast rising rates environment?

-

debt service burden is extremely light

-

strong Corporate America is also a reason for why the most anticipated recession did not happen

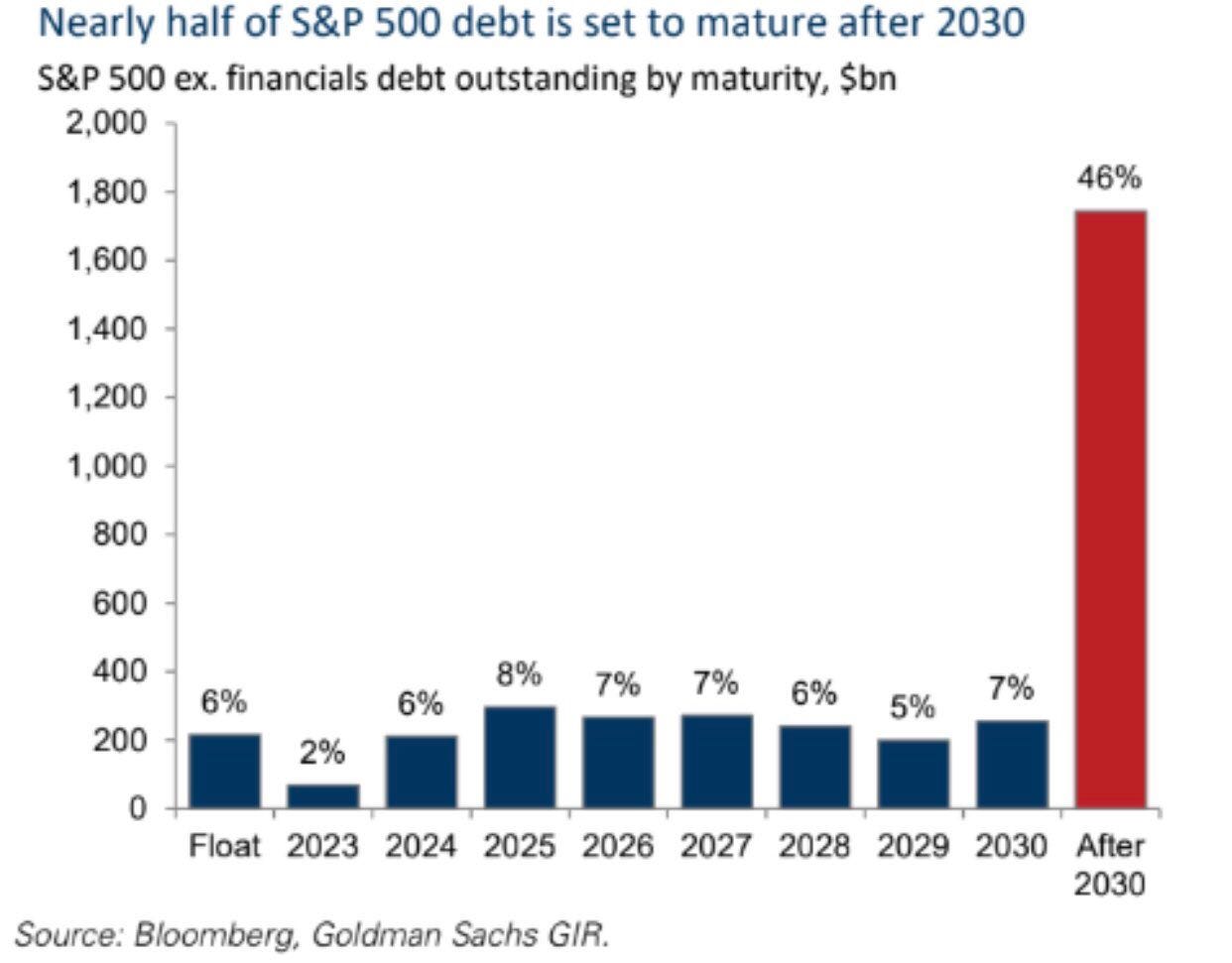

Complementary angle to answer, ‘how comes rates are not impacting S&P 500?’

-

almost half of the S&P 500 is set to mature AFTER 2030

-

hence, rate hikes have had not much of an impact on their interest expense so far

-

also, many of the S&P 500 companies have big pricing power etc

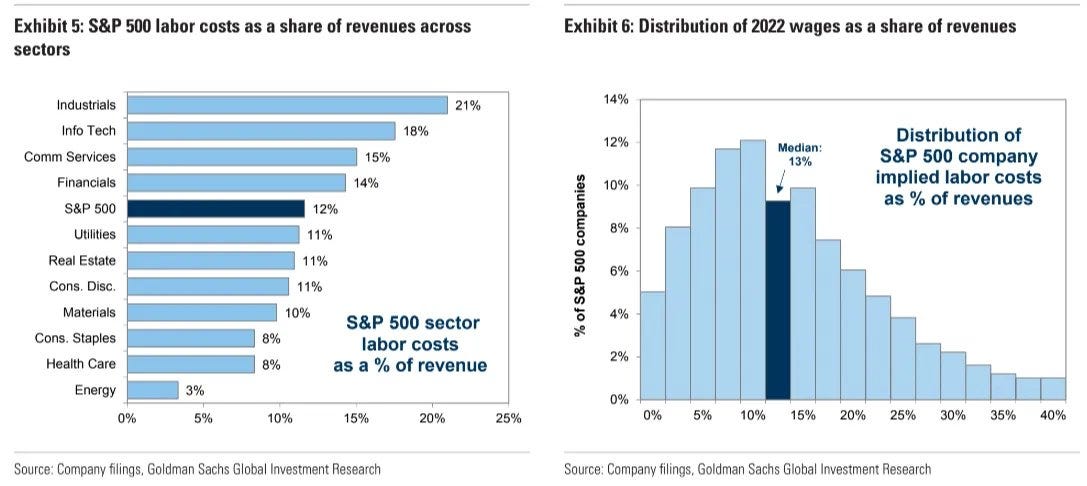

S&P 500 labour costs across the 11 sectors:

-

At the aggregate S&P 500 index level, labour costs equal 12% of revenues

-

At the stock level, they equate to 13% of revenues for the median constituent

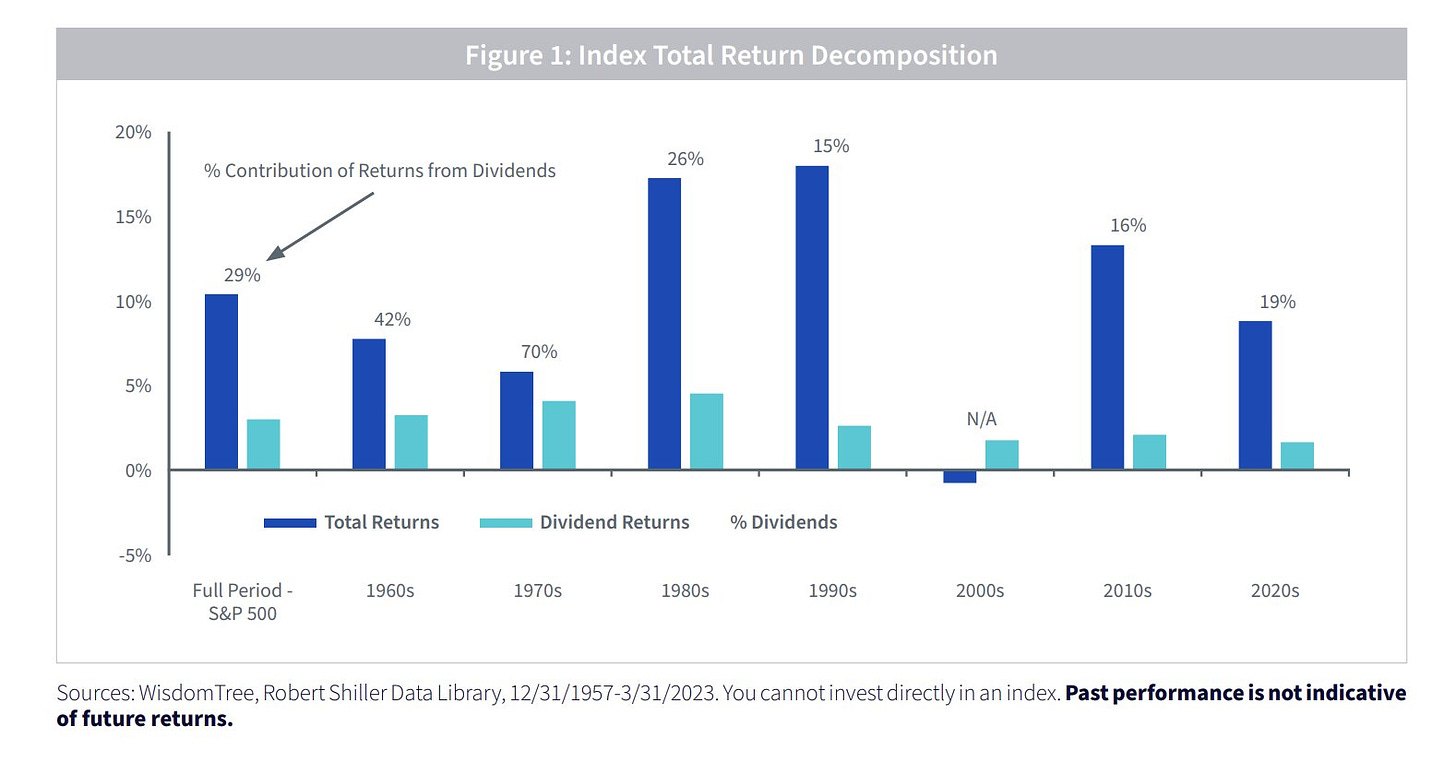

👉 The Power of Dividends in the S&P 500:

Dividends contributed almost 30% to the 10.4% annual total returns of the S&P 500 over the long run. Some further key notes:

-

In the 1970s, a decade characterized by high inflation and weak economic growth, dividends made up 70% of total returns

-

The 1990s—the decade of the dot-com bubble—had the lowest contribution from dividends of just 15%

-

The 2000s was the only decade with negative total returns: the dividend returns of nearly 2% provided a cushion to offset negative price returns driven by the bursting of the dot-com bubble and the Global Financial Crisis

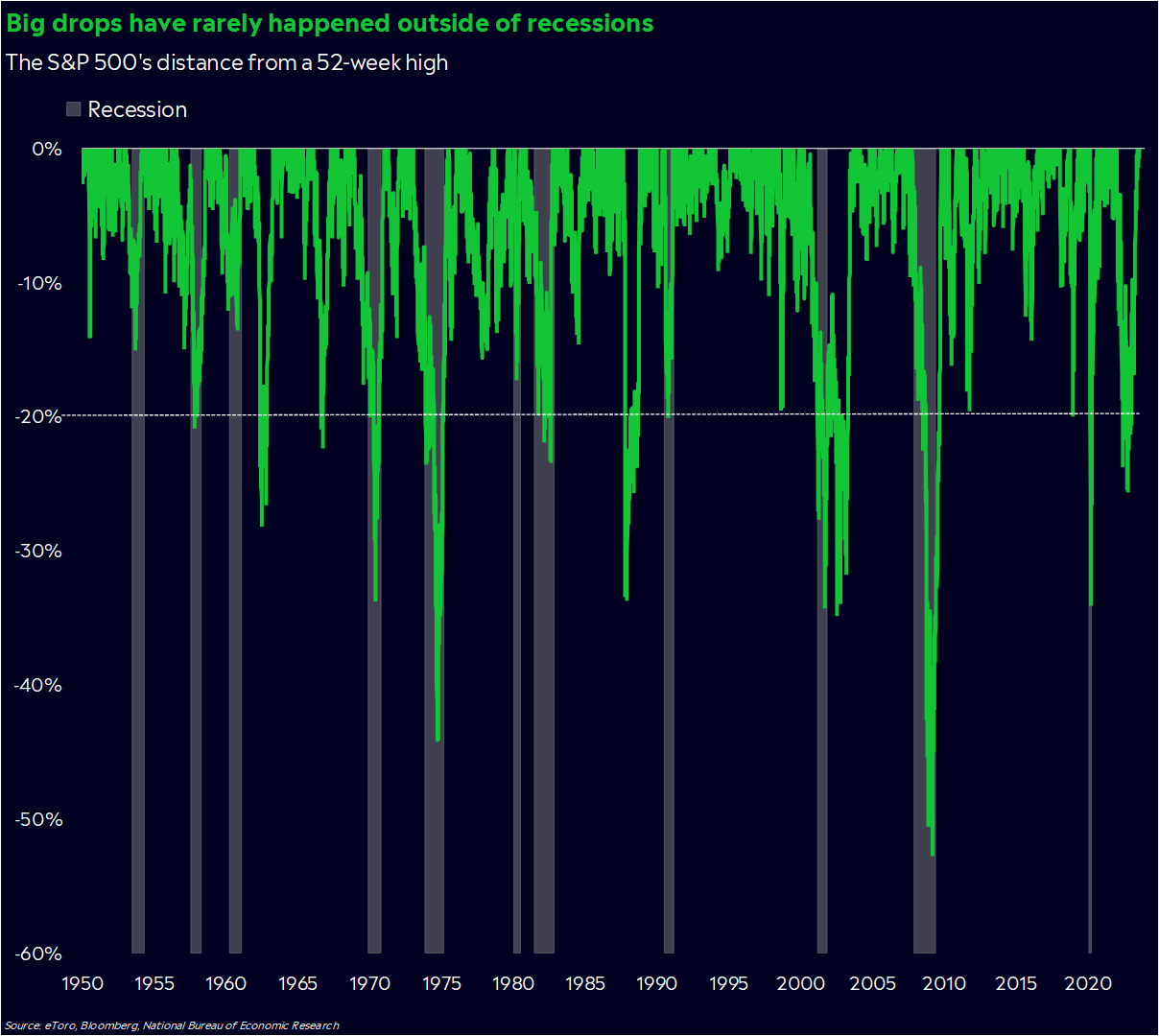

S&P 500 distance from a 52-week high (green) and recession periods (grey):

-

20% drops (grey horizontal line) do not happen often outside of recessions

👍 Bonus Charts 👍

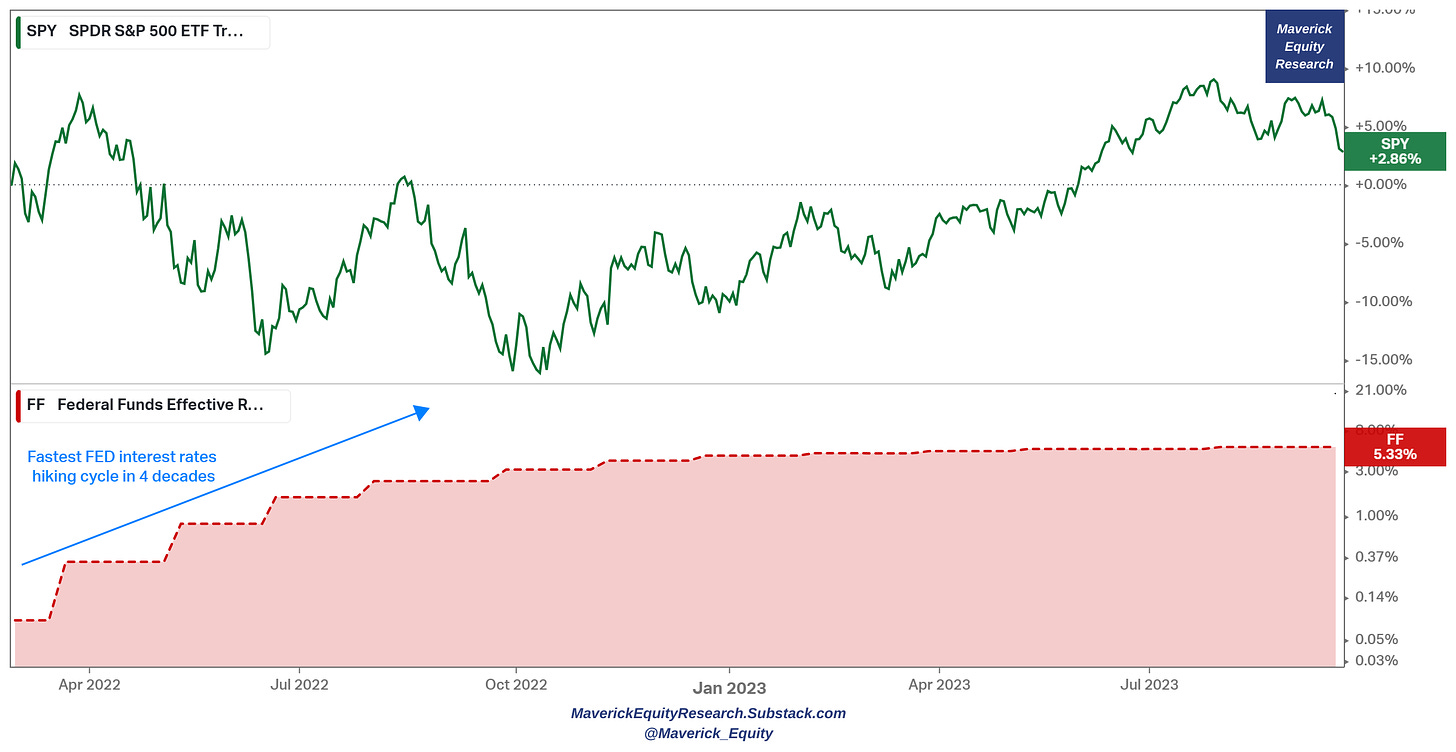

👉 interest rates a main talking point, S&P 500 (green) & US FED interest rates (red):

-

we went from 0% to 5%+ interest rates in no time = 2022 FED with the fastest interest rates hiking cycle in 4 decades, yet despite that outlier, stocks still +2.86%

-

stocks as a (natural) hedge to interest rates! Not the first time, nor the last …

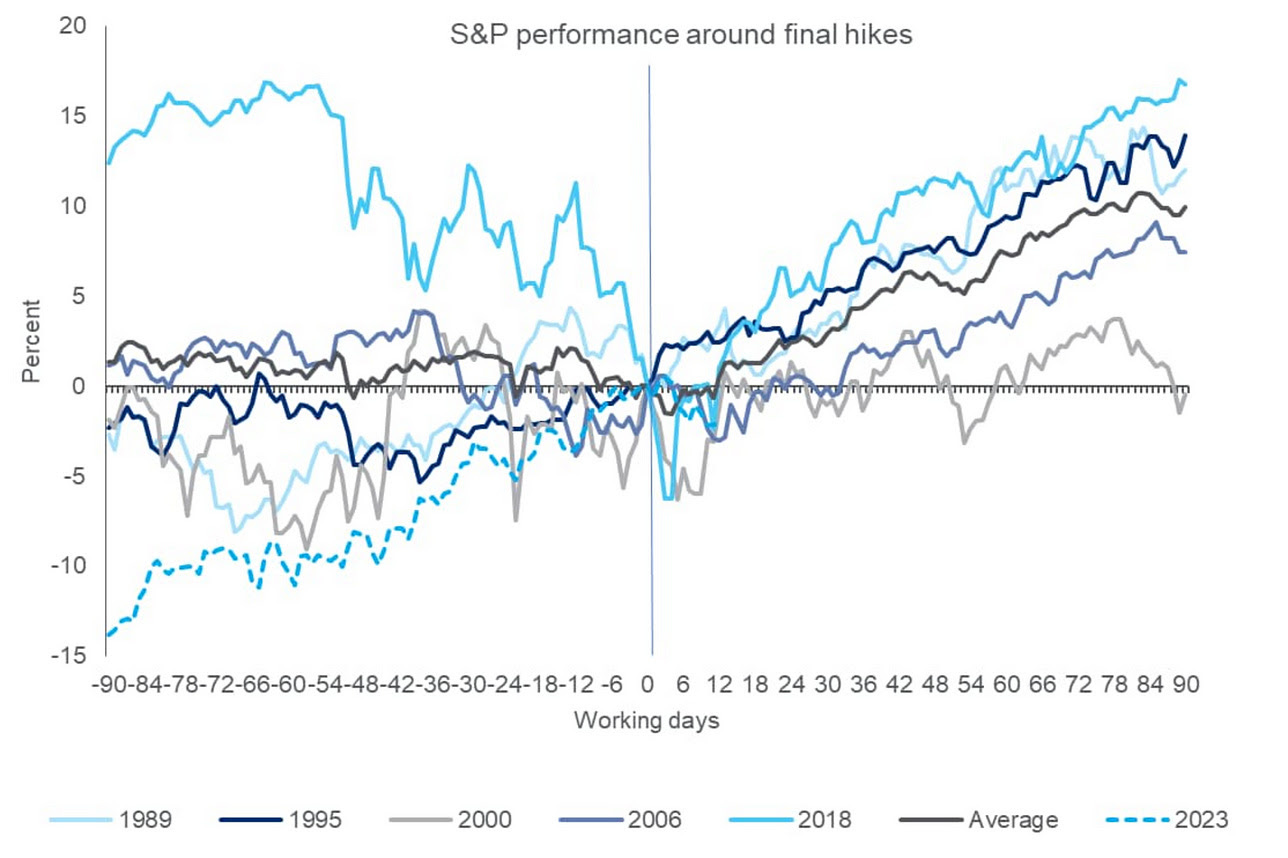

👉 How does the S&P 500 perform around final interest rate hikes which we should have sooner rather than later? There you go:

👉 ‘AI’ mentions on earnings call rose sharply in the most recent quarter

👉 Top 5 stocks contribution by year since 2010:

-

Apple running the show

-

Big Tech domination present in the last years

This research is NOT behind a paywall & there are NO pesky ads floating around.

Did you enjoy this extensive research by finding it interesting, saving you time & getting valuable insights? Now some of you asked how can one support me which is really kind of you 🤗. Therefore, it would be great & highly appreciated if you would support an independent investment researcher for the ‘Maverick-esque’ ongoing & future research. A donation or a tip to support my work can be done via the following:

Twitter thread on this research piece can be found here.

Thank you & have a great day!

Mav