✍️ Maverick Charts – Macro & More – October 2023 Edition #12

Dear all,

with October ‘closing the books’ soon, your monthly Top 20 Macro & More charts from around the world + 5 Bonus! Before that, from the legend Charlie Munger:

“You don’t have to be brilliant, only a little bit wiser than the other guys, on average, for a long, long time.” = persistence and consistency wins over > occasional brilliance

-

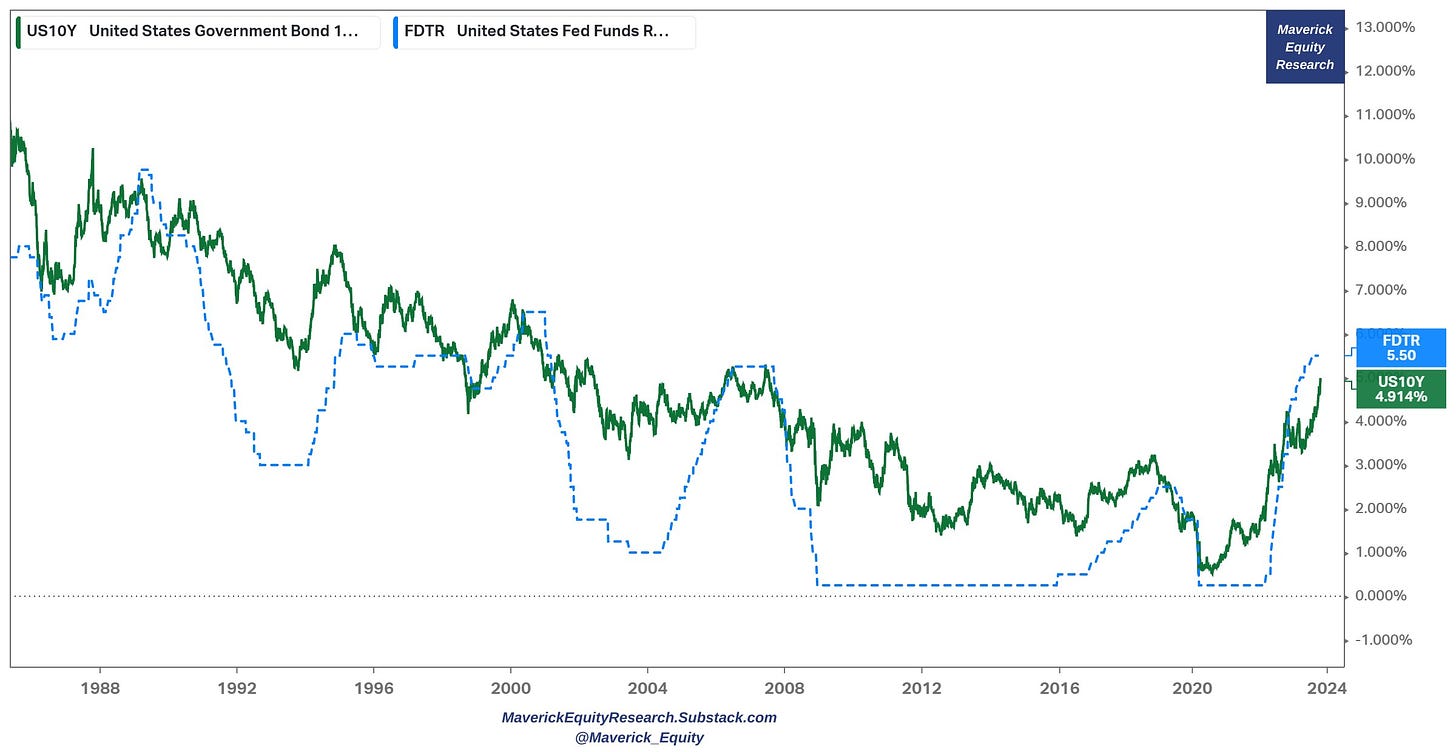

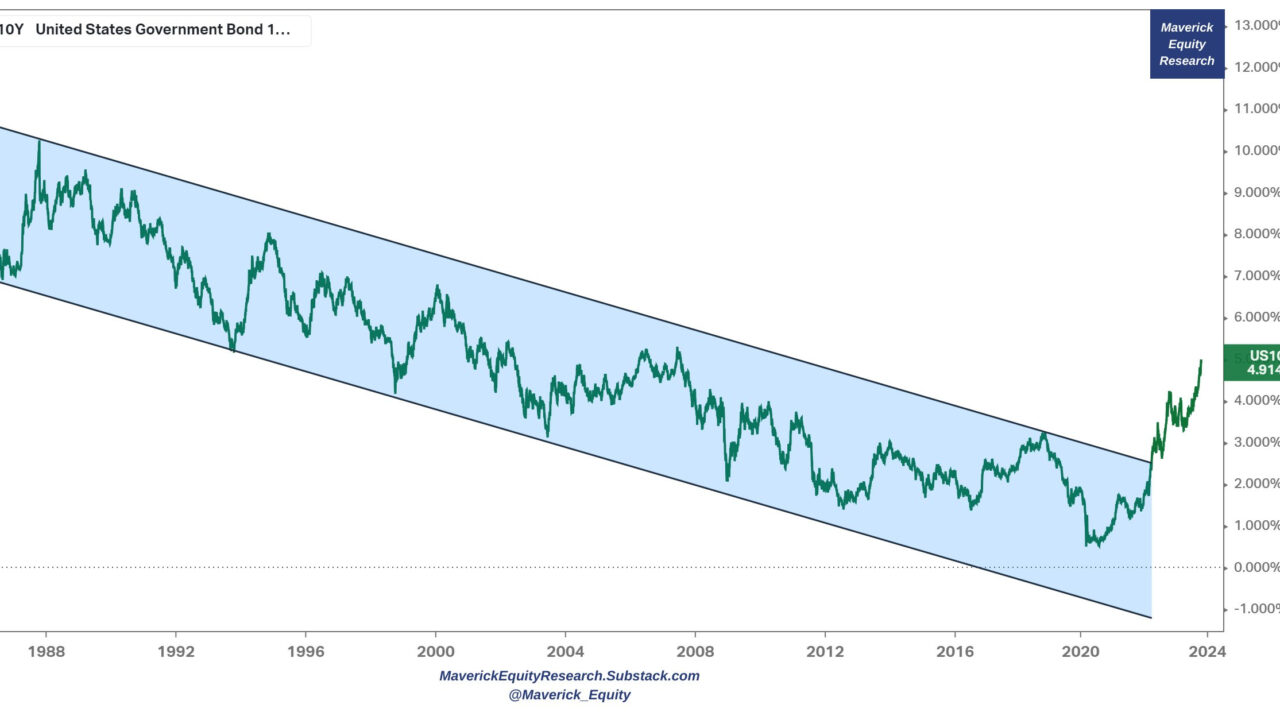

Can the 10-year US yield go to 6% or higher?

👉 5.5% is quite likely, how? See how the 10-year (green) often meets, kisses and even surpasses the FED funds rate (dashed blue)

👉 6%, less likely but possible? yes … If it goes to 6-7%, would be a great opportunity to lock-in some risk free yield … especially hunting for a good Yield to Maturity (YTM) across the treasuries curve … even at this levels goodies are to be found …

N.B. working now on a comprehensive piece about ‘Investing in Bonds’, stay tuned…

-

After trending down for decades, channel is broken big since the mid of 2022

-

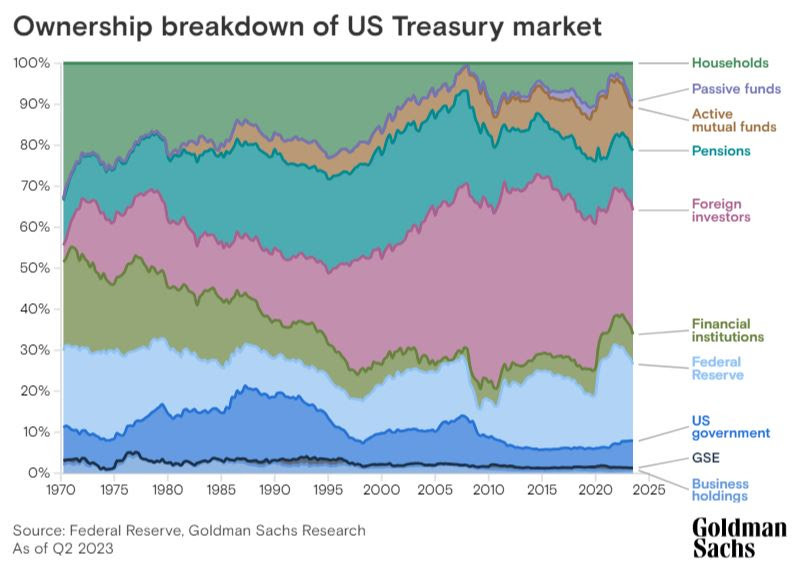

Who owns the US treasuries market by the way? Some key notes:

👉 the big share of foreign investors since the 2010s

👉 households owning more and more though note a fact quite unknown: in this bucket also hedge funds are included … which is strange if you ask me, can’t find a rationale for that yet … if you do, please let me know

👉 the FED and active mutual funds lowering their holdings lately

-

Foreign investors holdings side note that:

👉 China has been lowering their holdings since the mid 2010s

👉 which is the lowest level since 2009

-

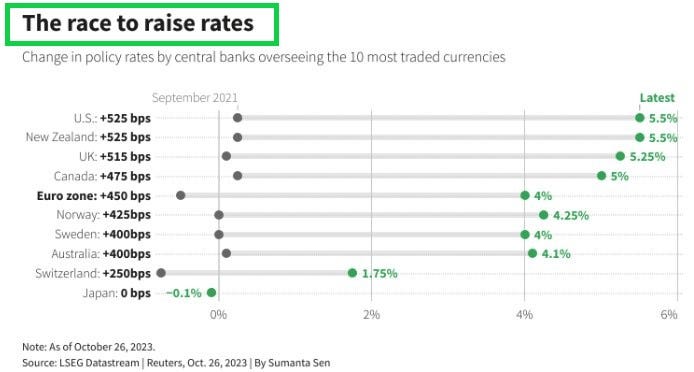

The Race to Raise Interest Rates since 2021 across the world in 1 chart:

👉 one of the fastest hiking cycle in decades – ‘ no wonder bro’ ‘, just check inflation

👉 ‘any good thing with this bro’?’ Yes, cash/bonds pay nowadays, even in real terms

-

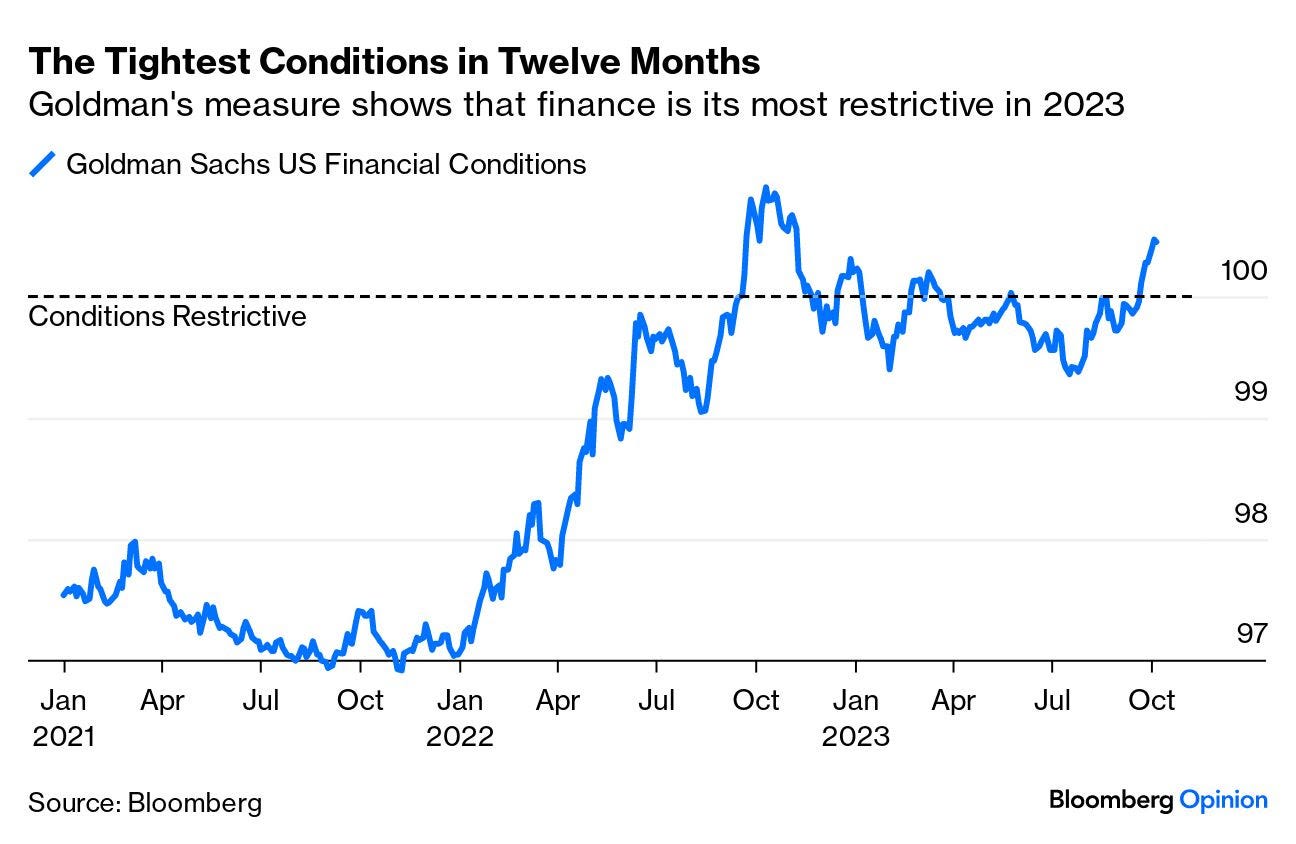

Tight conditions indeed financing wise:

👉 Financial Conditions are in ‘restrictive conditions’ territory as GS model shows

-

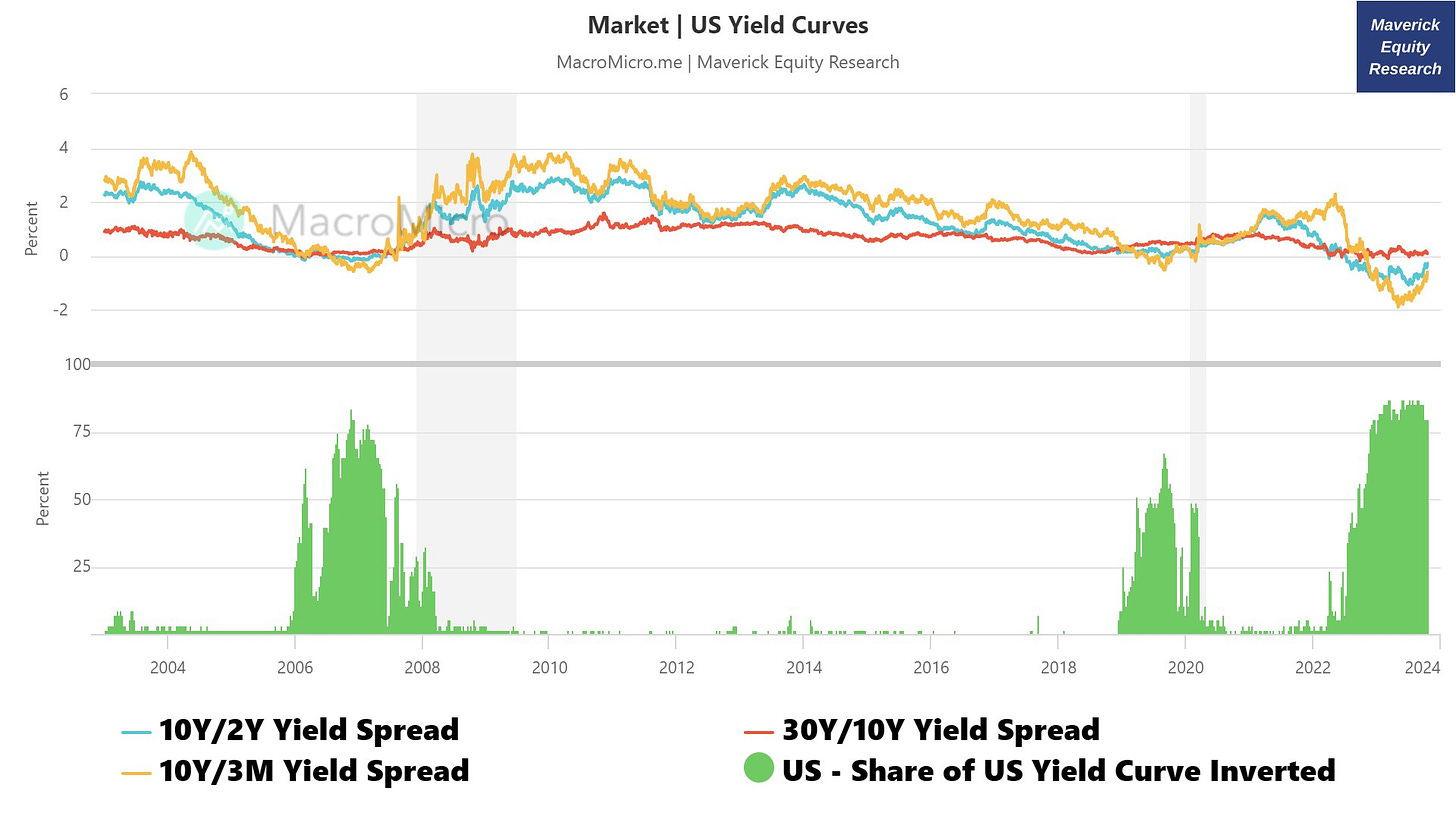

US Yield Curve: % Share of the Yield Curve Inverted

👉 70% now, previously 74%

👉 Key bond yield spreads: 30y/10y, 10y/2y, 10y/3m

-

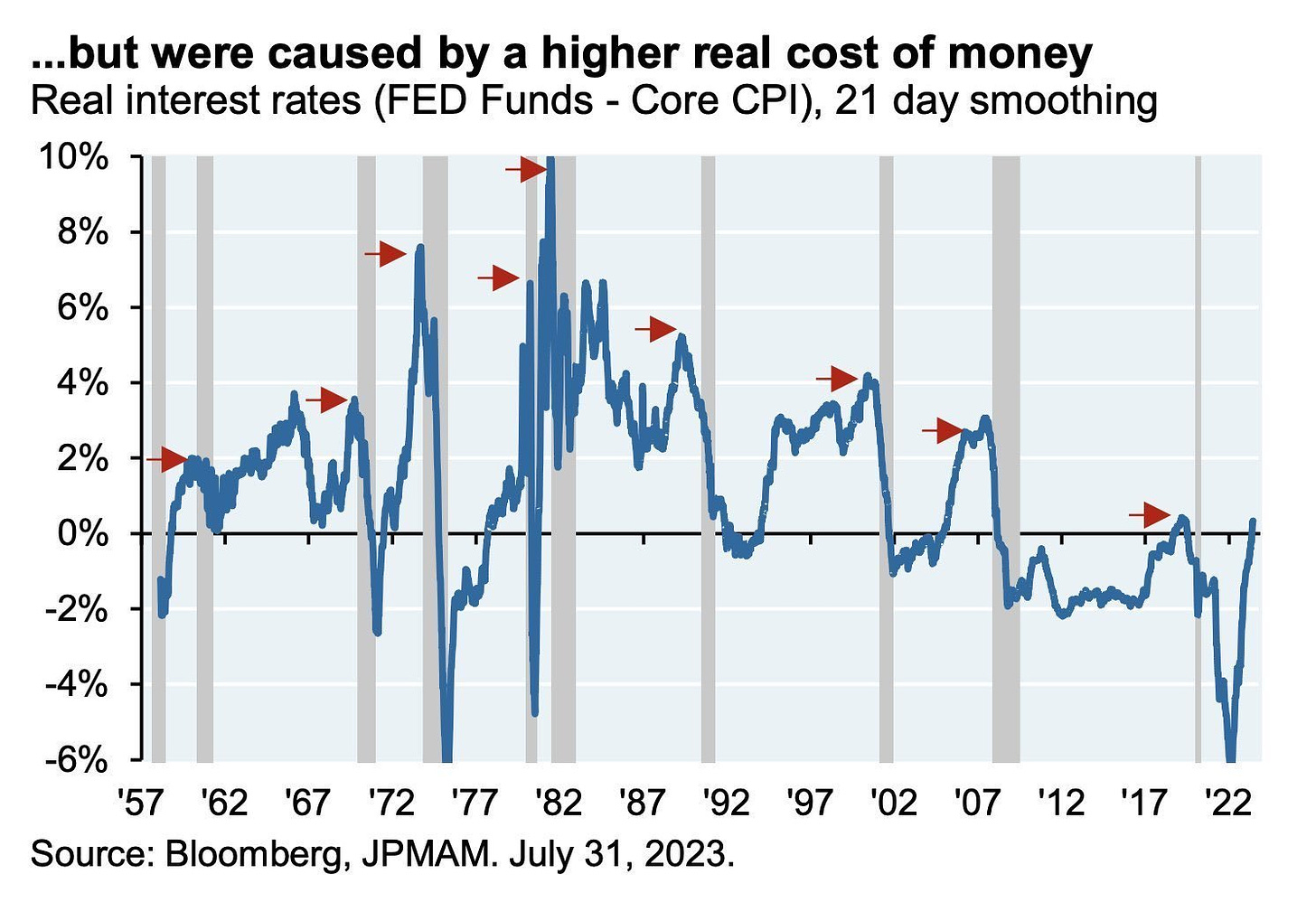

Note how yield curve inversions did precede recessions, yet let this one sink in:

👉 they were caused by a higher real cost of money (FED funds – Core CPI)

👉 which ain’t high these days, right?

-

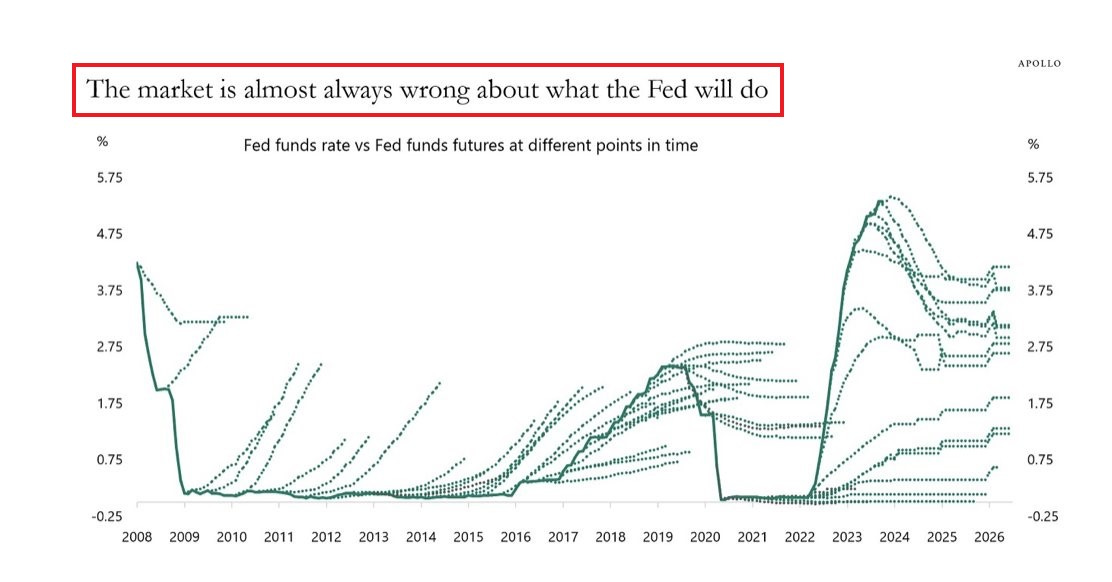

The FED vs The Market on interest rates direction:

👉 across time and especially nowadays, I saw a lot of people (no name calling here) be it more or less qualified to bash the FED, but what what the market as a whole thinking they are ahead of the curve and know what FED will do going forward?

👉 well, guess what, the market overall is almost always wrong about the direction …

👉 take-away: we need to think in terms of probabilistic outcomes, and not in terms of deterministic ones … various scenarios and reaction to it …

-

Which begs the question, what is the market thinking currently?

👉 via various Taylor rules done by DB, we get a current interest rate path that is LOWER than what is implied currently by the market

-

Real Rates matter way more as nominal rates are just / ‘just’ nominal:

👉 here we see the 10-year real rate at 2.4% and how historically it hurts parts of the economy and/or investment themes

👉 I would see it as opportunity to get paid in real terms for low risk bond allocations and also a way to clean-up excesses in the economy (bad business models & frauds holding hostage both financial resources and human capital)

-

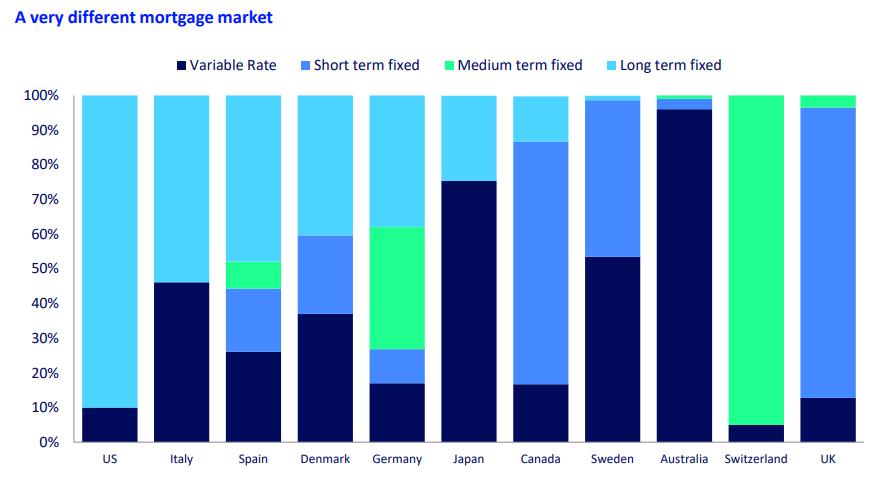

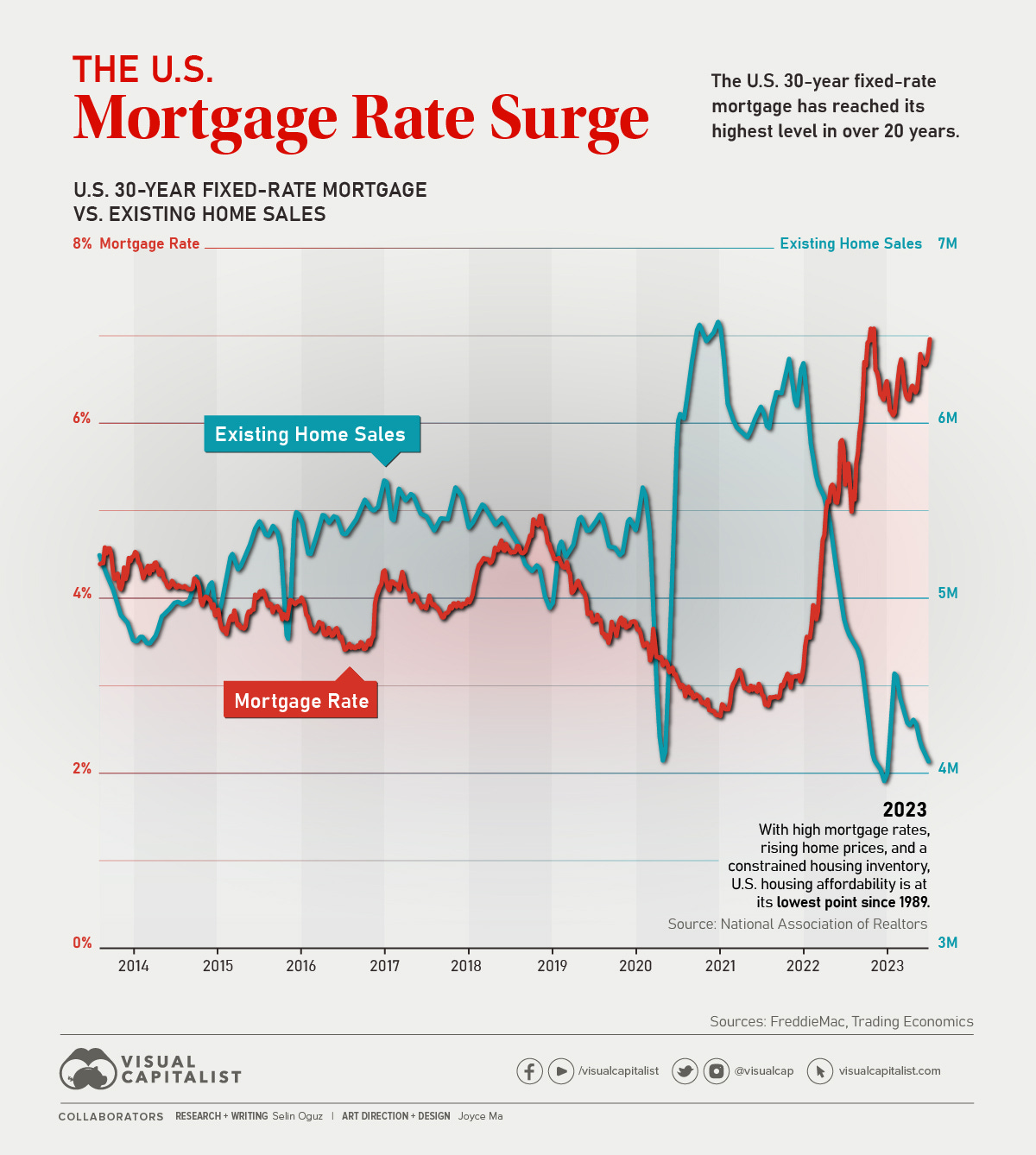

Not all real estate/mortgage markets are created & are equal at any point in time:

👉 Given high interest rates, a natural focus is on the mortgage market and below the distribution of the types of mortgages in the system in various DM countries

👉 US has a big chunk of mortgages with fixed interest rates on the short term which should cool-off a bit the constant doom & gloom headlines with ‘mortgage rates at record levels’ etc …

👉 on cutting rates across the world, one can also say that by looking at this the FED is likely not the first one to blink and cut rates

-

Sure, high mortgage rates are not good for people planning to take a mortgage for a home, but you know, when rates were low, we had the issue of ‘punishing the savers’ … I guess, one cannot make everybody happy and nor the economy 😉

P.S. on mortgages with distribution by interest rates and more, check my earlier take ✍️ The State of the US Economy in 35 Charts in case you missed it

-

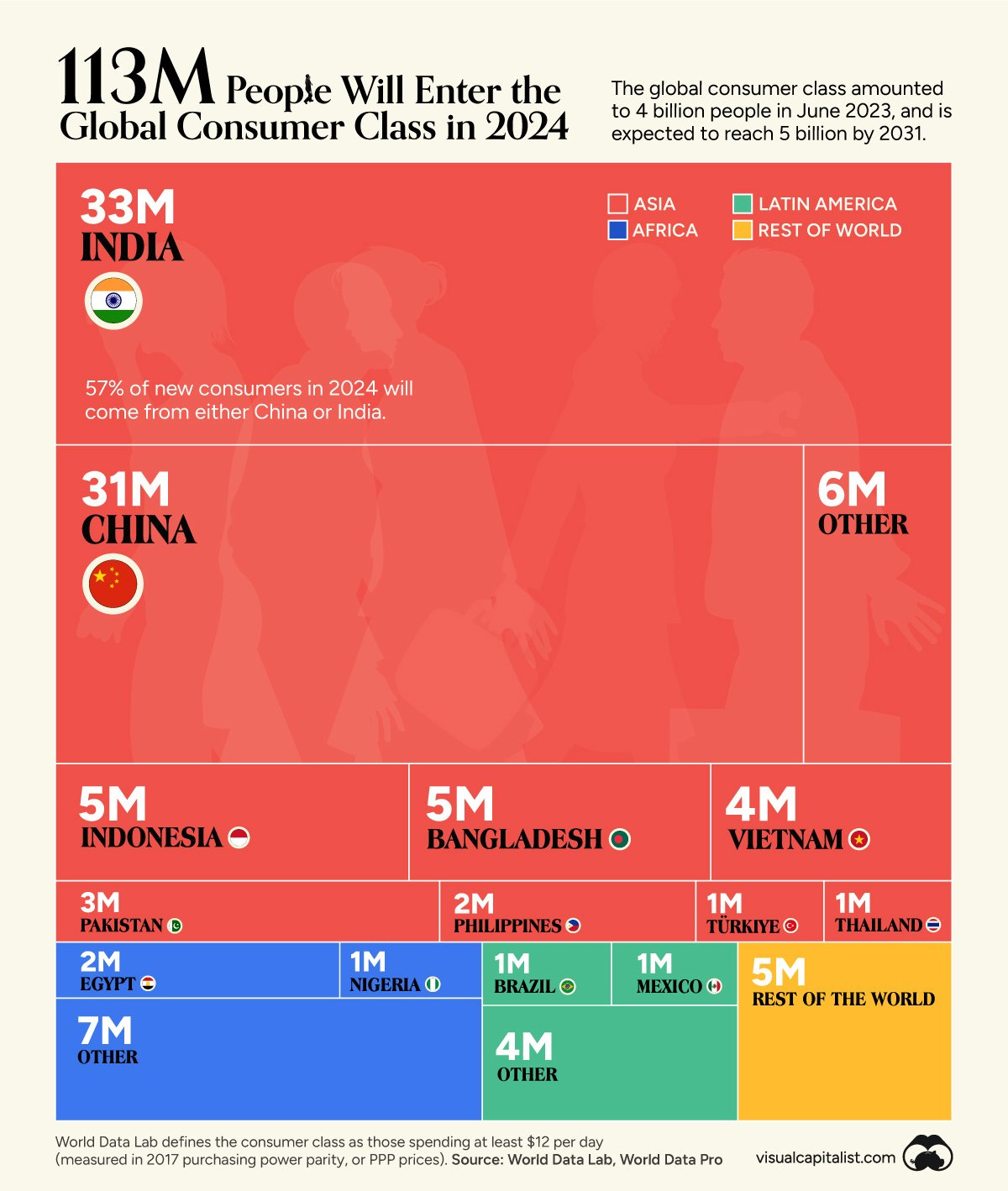

113 Million People Will Join the Global Middle Class in 2024

👉 defined by the World Data Lab as someone who spends at least $12 per day (measured in 2017 purchasing power parity), these individuals are typically rising up in developing regions like Asia and Africa.

-

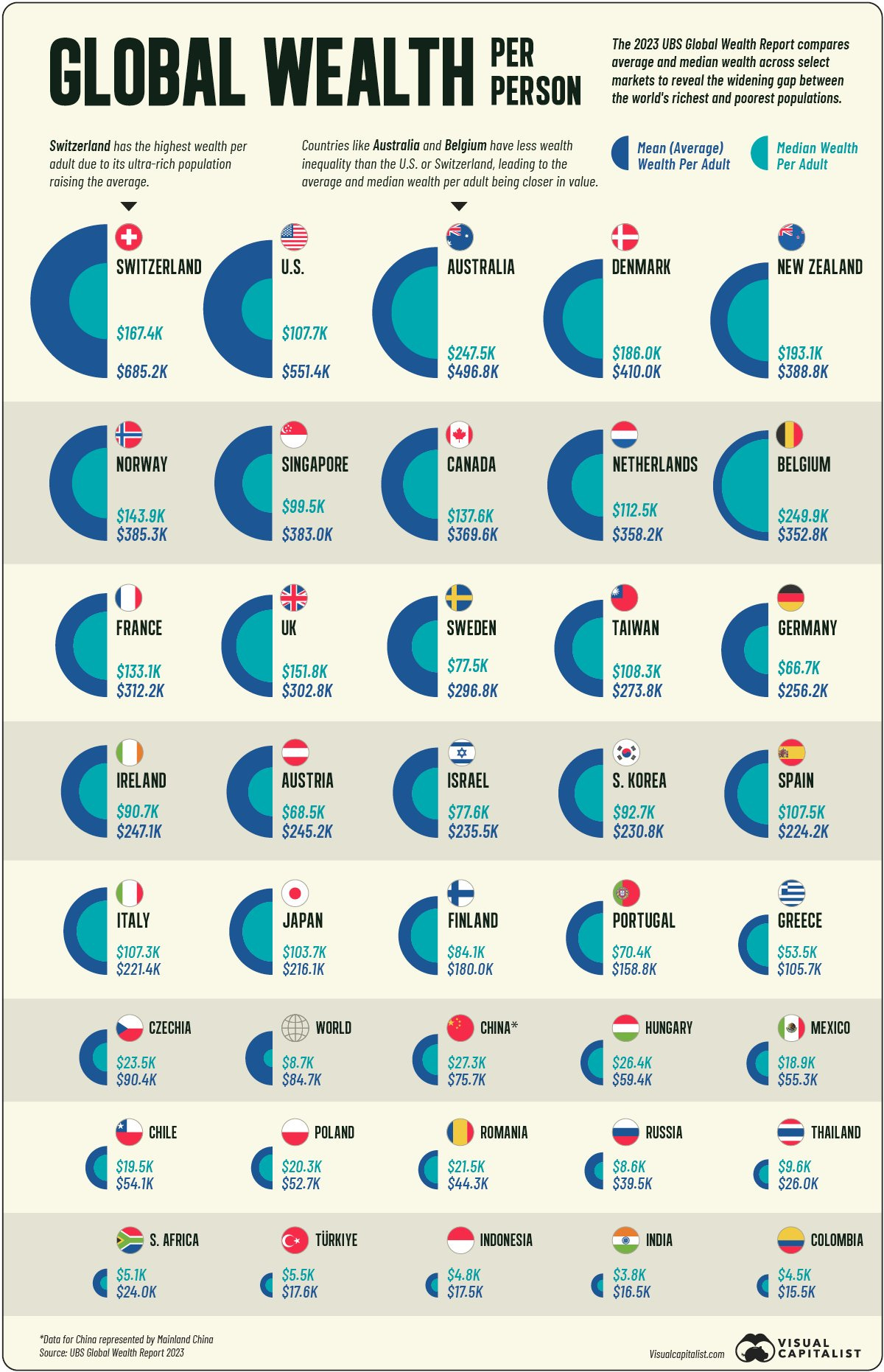

Visualizing the Top Countries by Wealth per Person

👉 check both the mean/average & median values … tells quite something …

-

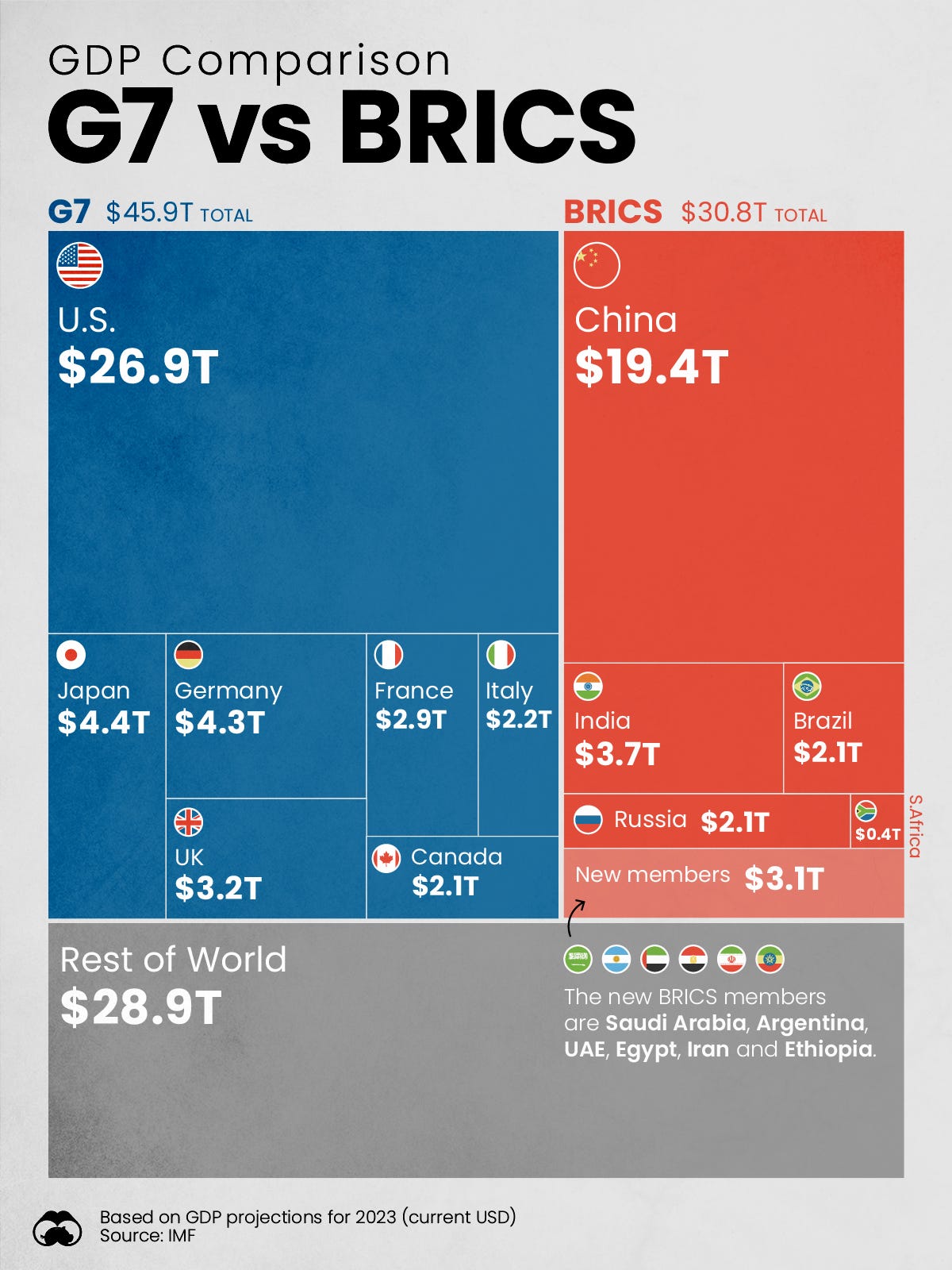

Comparing the GDP of BRICS and the G7 Countries

-

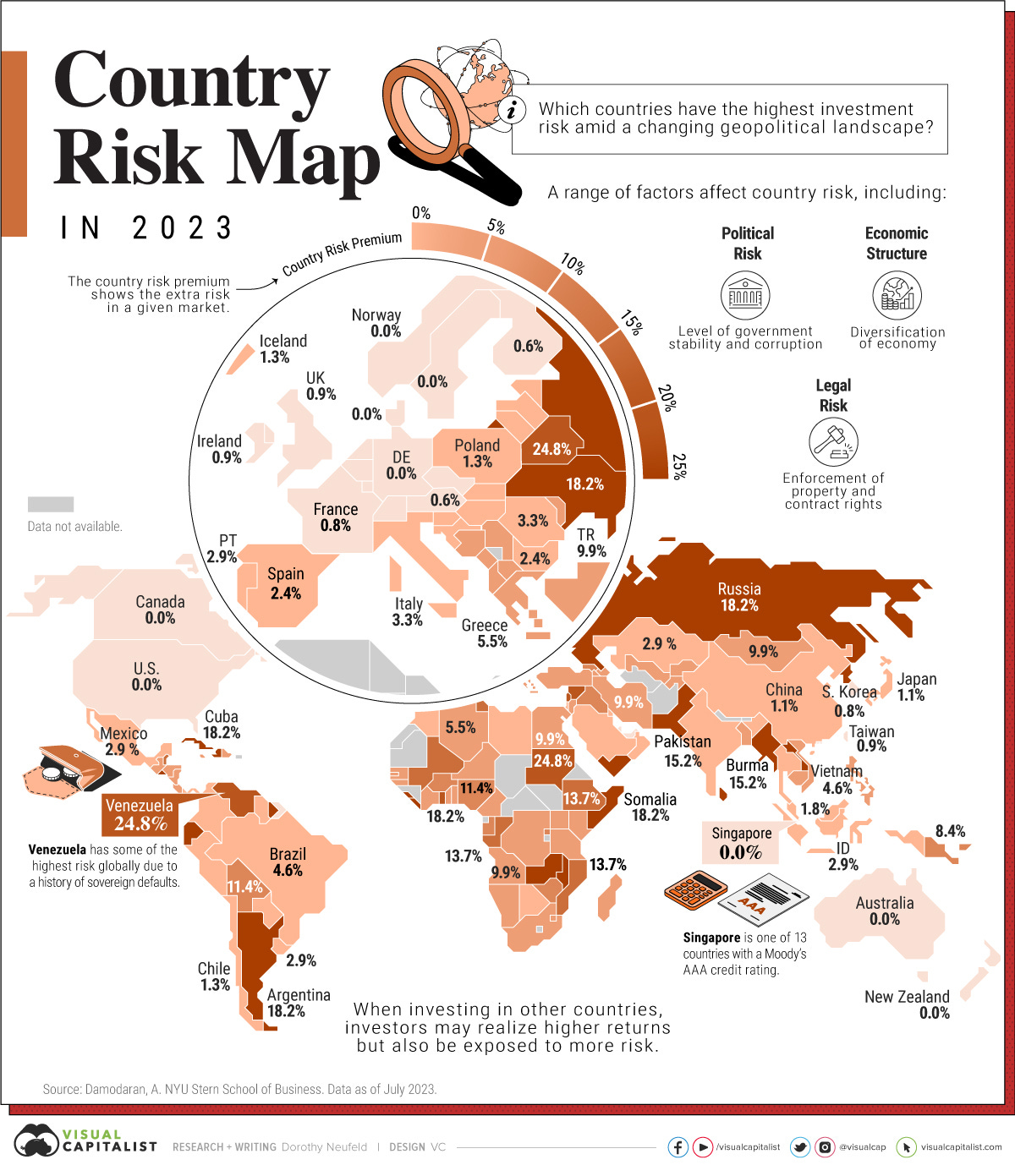

Which Countries Have the Highest Investment Risk in 2023?

👉 Investment risk is defined here via the big 3:

Political risk: Type of regime, corruption, level of conflict

Legal risk: Property rights protections, contract rights

Economic risk: Diversification of economy

👉 higher returns ‘require’ higher risk in general … with the exception of deep research via spotting asymmetries: human behavior can be emotional and create chaos but in investing also big opportunities …

-

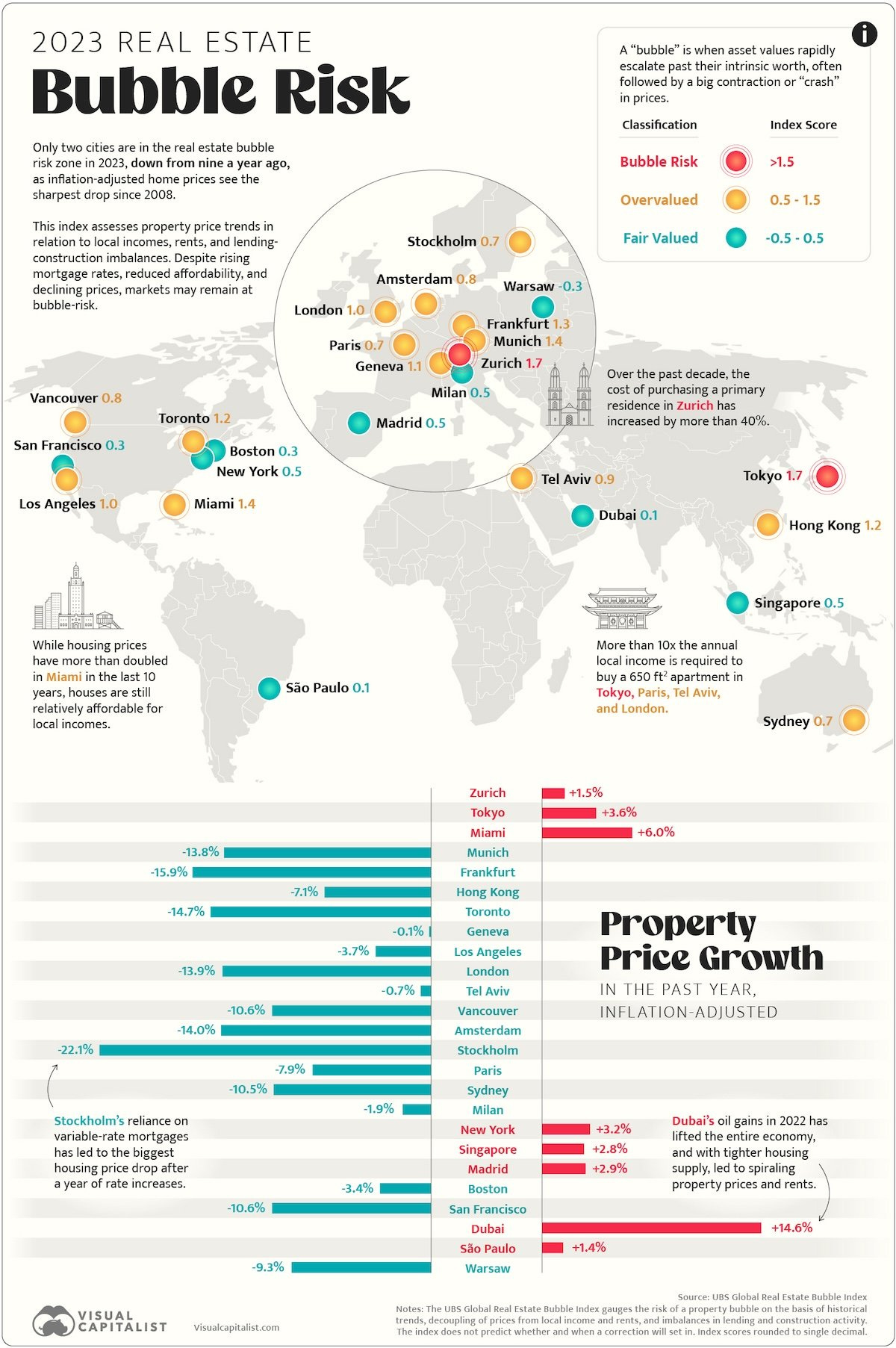

The Cities With the Most Bubble Risk in Their Property Markets

👉 Zurich, Tokyo, Miami, Munich and Frankfurt top 5

-

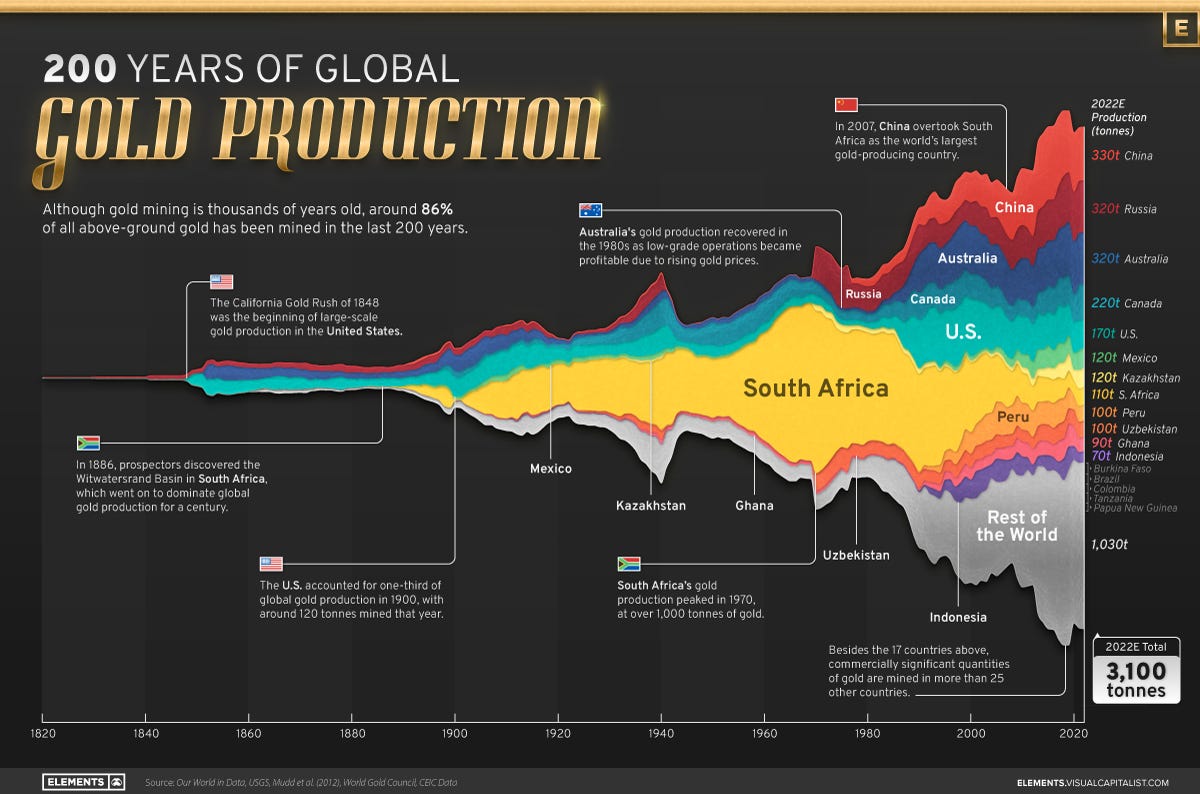

200 years of Global Gold Production (supply) in one chart:

👉 2022 estimates are for 3,100 tones

👉 China the biggest producer as it overtook South Africa in 2007; Russia, Australia, Canada and US follow in the top 5

👉 Gold mining has been around for thousands of years, but note that 86% of all above-ground gold has been mined in just the last 200 years – Let that sink in!

-

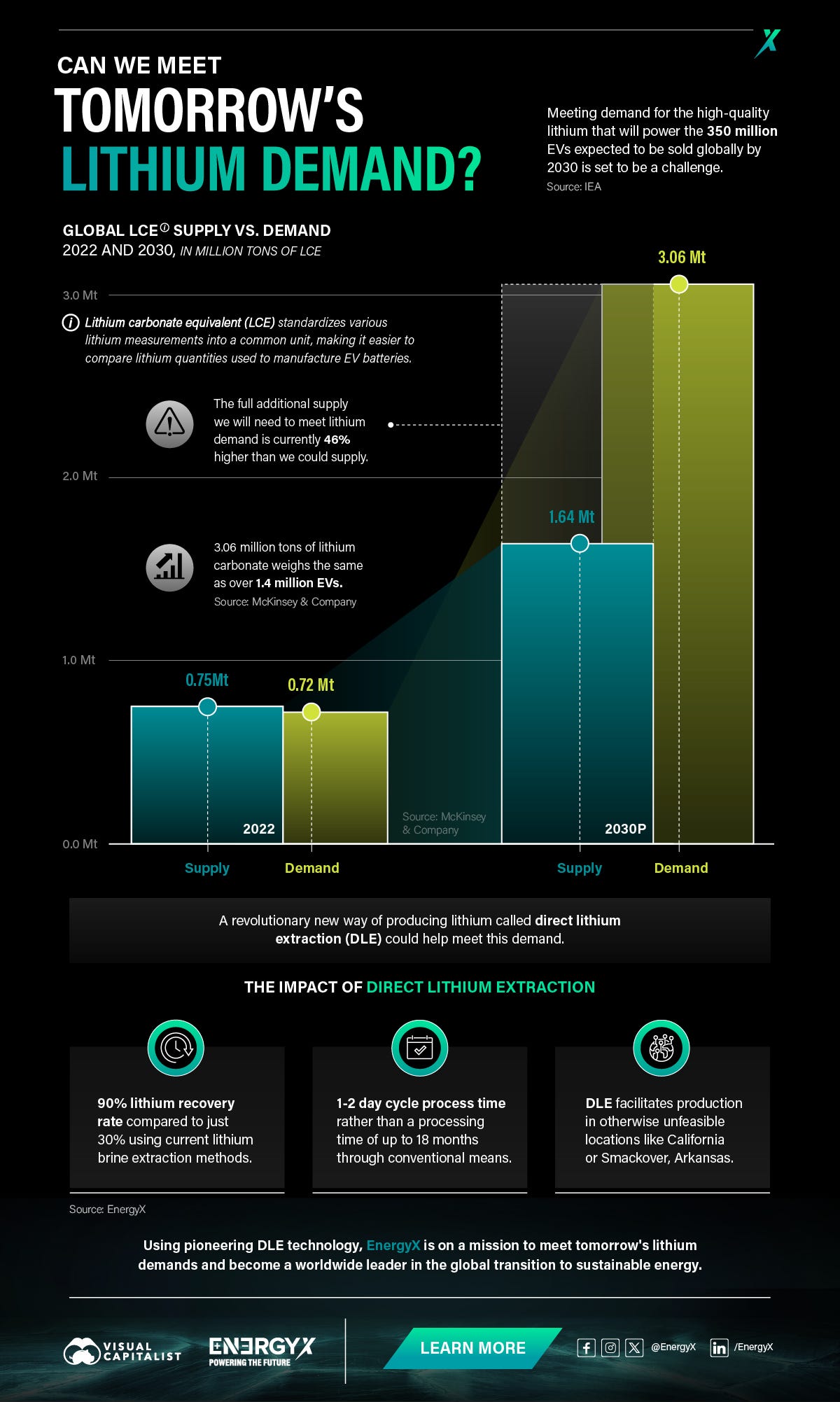

The Lithium Rush: Can We Meet Tomorrow’s Lithium Demand?

👉 Without action, by 2030, there won’t be enough lithium to meet the combined demands of the clean energy transition and the UN’s sustainable development goals.

👉 However, advances in DLE by pioneering companies like EnergyX could help meet the demand and ensure the transition to a more sustainable future

5 Bonus charts:

-

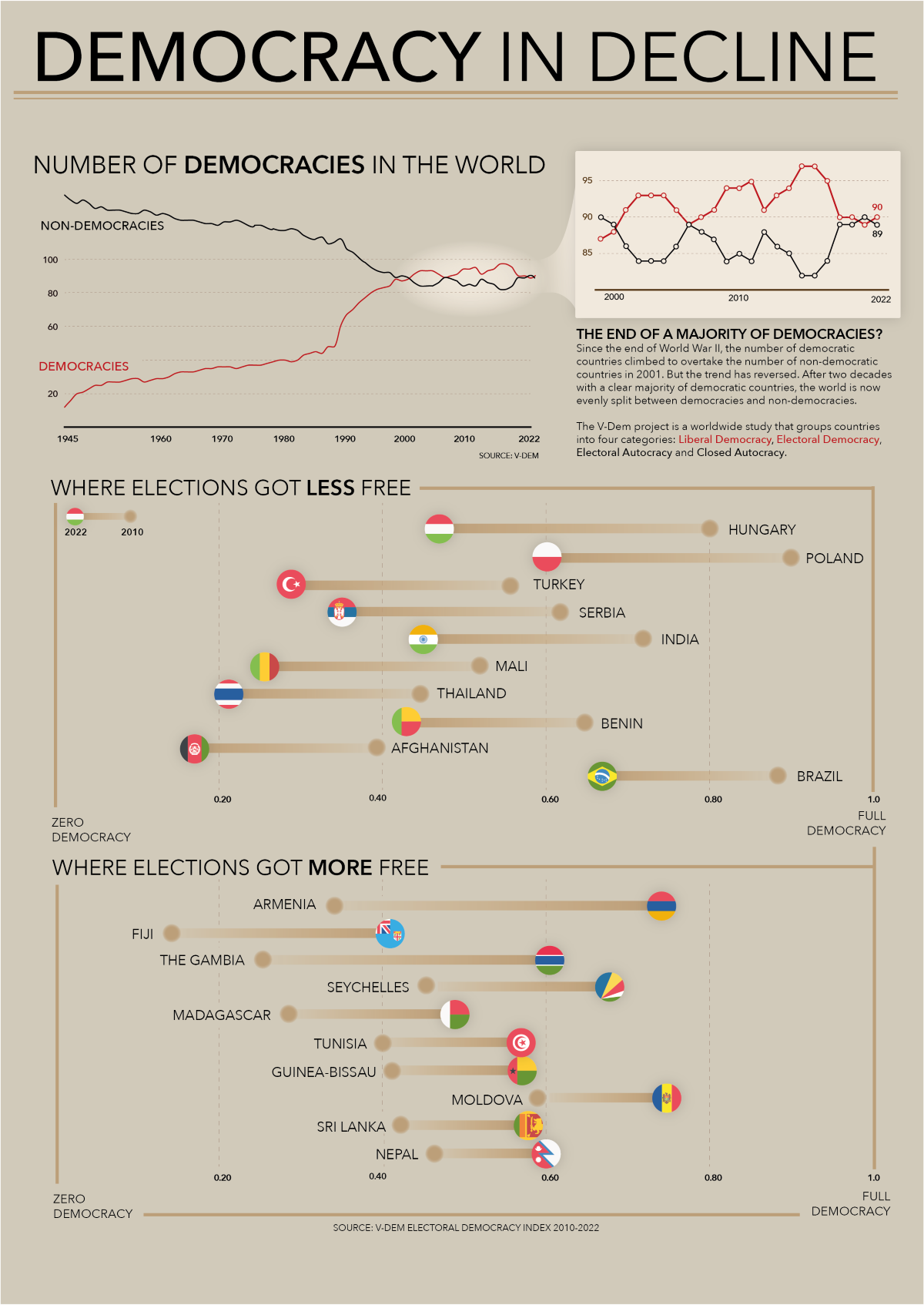

The Number and the evolution of Democracies Globally

👉 since the end of WW2, the number of democracies overtook the non-democracies

👉 after 2 decades with e clear democracies majority, the world is not evenly split

👉 note the countries where elections got LESS free and MORE free

-

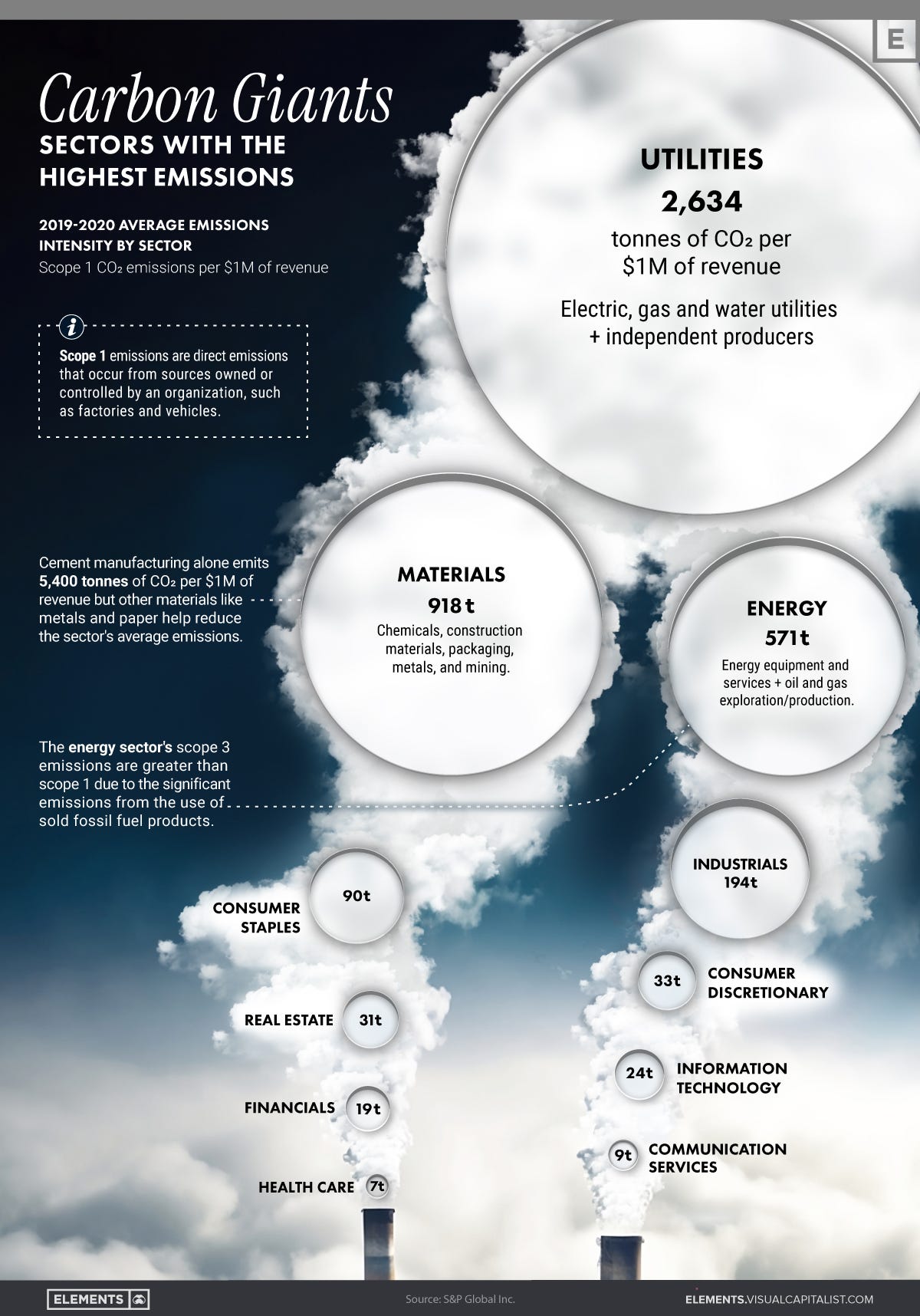

The Most Carbon-Intensive Sectors in the World

👉 utilities, materials, energy, industrials and consumer staples with the biggest carbon footprint

👉 I guess we can’t have our cake and eat it … but for sure a lot can be done by each of us regular folks (food, energy waste etc) and big corporates & governments

-

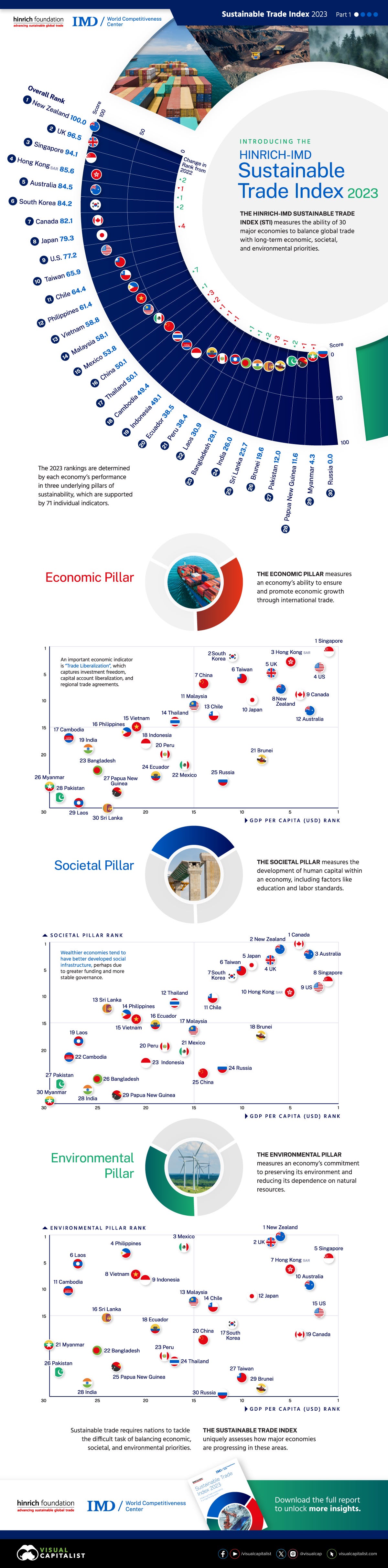

Ranked: The World’s Most Sustainable Economies in 2023

👉 New Zealand, UK, Singapore, Hong Kong and Australia leading the pack

-

All of the World’s Exports by Country in One Chart

👉 China, US, Germany, Netherlands and Japan the top 5

-

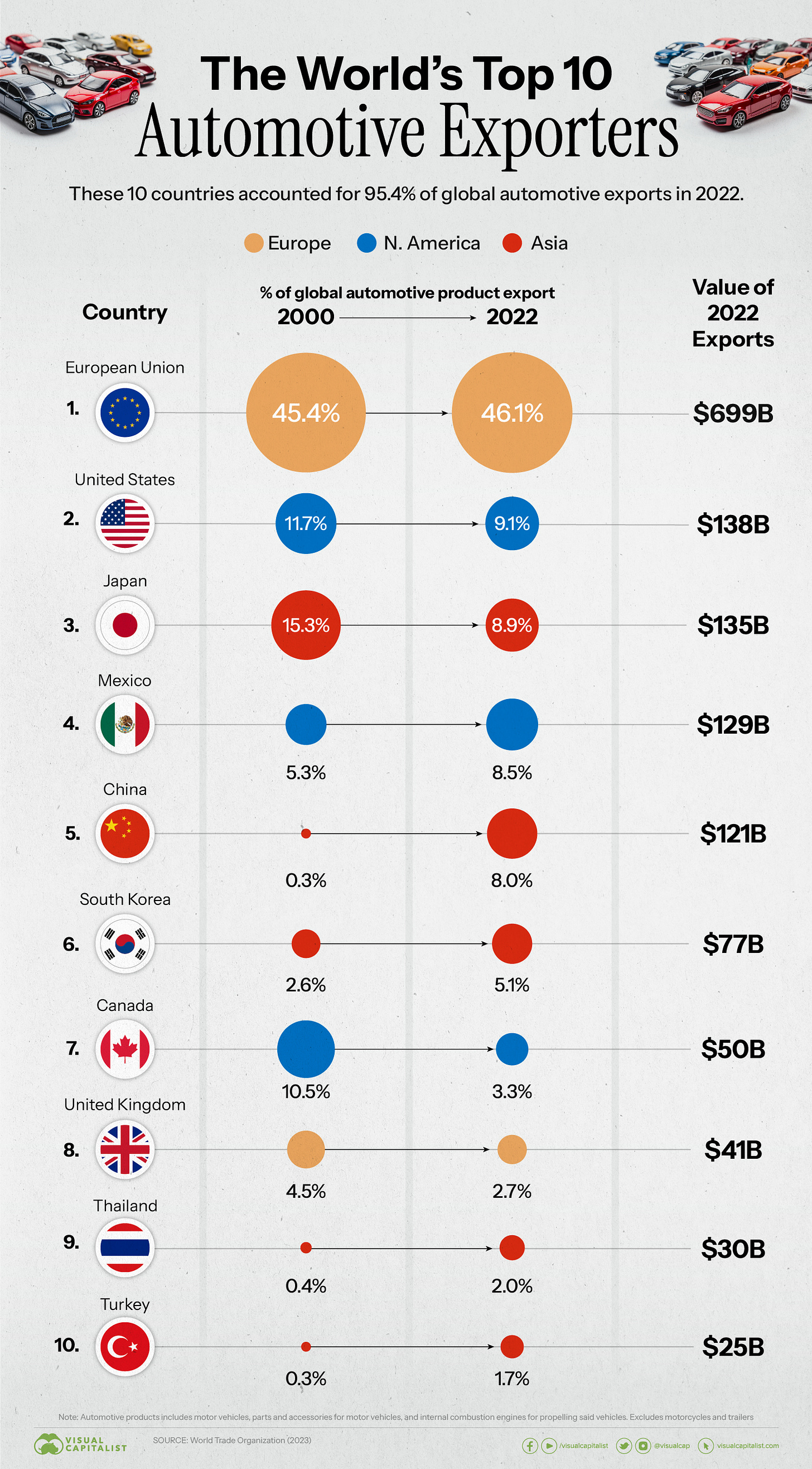

And now top 10 Automotive exporters which account for 95.4% of the global pie

Research is NOT behind a paywall & NO pesky ads. What would be appreciated? Just sharing it around with like-minded people & hitting the ❤️ button. Thank you!

That’s all for October. Have a great next week & next month!

Mav 👋 🤝