2 to 100 Club (06-20-2024)

From the Desk of Steve Strazza @Sstrazza

Welcome to The 2 to 100 Club.

As most of you know, we use various bottom-up tools and scans to complement our top-down approach.

It’s really been working for us!

One way we’re doing this is by identifying the strongest growth stocks as they climb the market-cap ladder from small- to mid- to large- and, ultimately, to mega-cap status (over $200B).

Once they graduate from small-cap to mid-cap status (over $2B), they come on our radar. Likewise, when they surpass the roughly $30B mark, they roll off our list.

But the scan doesn’t just end there.

We only want to look at the strongest growth industries in the market, as that is typically where these potential 50-baggers come from.

Some of the best performers in recent decades – stocks like Priceline, Amazon, Netflix, Salesforce, and myriad others – would have been on this list at some point during their journey to becoming the market behemoths they are today.

When you look at the stocks in our table, you’ll notice we’re only focused on Technology and Growth industry groups such as Software, Semiconductors, Online Retail, Solar, etc.

Then, like any good technician, we filter the list down to those closest to new highs.

This allows the cream of these strong groups to rise to the top and helps streamline our mission to identify technical breakouts in the top-performing stocks.

We made some changes to this scan a while back. Instead of all-time highs, we’re sorting by 52-week highs.

With the severe drawdowns endured by so many growth stocks since last year, all-time highs just aren’t a reality for most of the names on this list right now.

Using 52-week highs will open the door for more stocks and give us more options for finding the best setups.

Here is this week’s list:

*Click to enlarge view

Now let’s dive in and discuss some of our favorite long setups!

Premium Members can log in to access our 2 to 100 Club Trade Ideas. Please login or start your risk-free 30-day trial today.

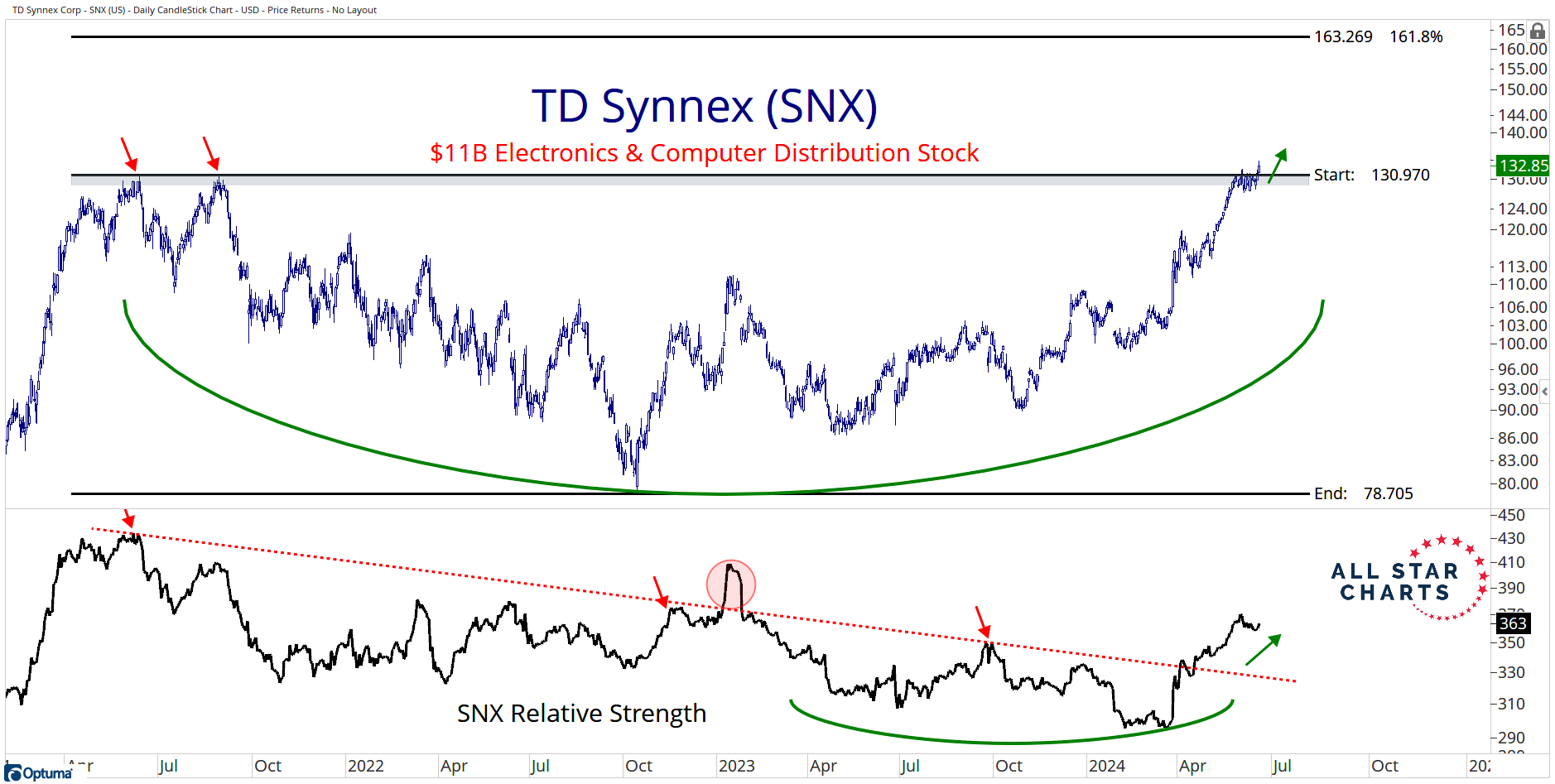

Our first setup today is a $11B company that operates as a distributor and solutions aggregator for the information technology ecosystem. Here is TD Synnex $SNX:

TD Synnex has emerged higher from a three-year consolidation pattern to fresh all-time highs.

This level has acted as resistance over the past few years, making it a great place to define our risk. If SNX can stick the landing above its prior cycle highs from 2021, we’re buyers looking for a fresh leg up.

On a relative basis, SNX has recently broken out from a 3-year downtrend versus the broader market. We expect the stock to continue outperforming if it is above those old highs on absolute terms.

If SNX is above 131, we want to own it with a target of 163 over the next 2-4 months.

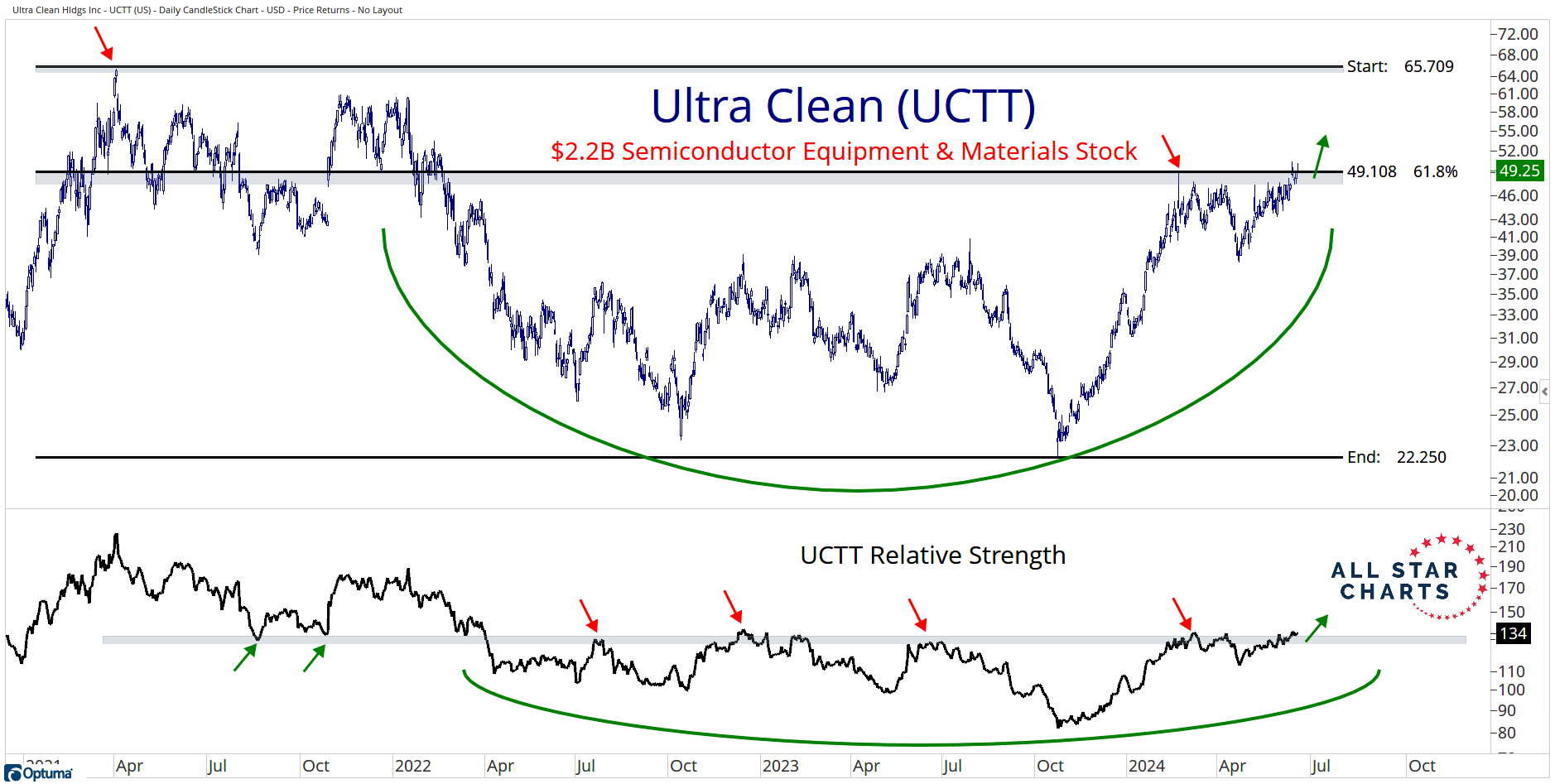

Our last setup is a $2.2B company that develops and supplies critical subsystems, components and parts, and ultra-high purity cleaning and analytical services for the semiconductor industry. Here is Ultra Clean $UCTT:

UCTT is trading at fresh 52-week highs. The stock is challenging a critical level of interest at the 61.8% retracement after carving out a 2.5-year bearish-to-bullish reversal pattern.

A decisive breakout would confirm the resolution of this multi-year rounding bottom. With the path of least resistance pointing up for UCTT, we want to be long on a breakout above the 61.8% retracement.

On a relative basis, UCTT looks poised to resolve higher from a similar basing pattern versus its peers. If we’re above 49 on absolute terms, we expect the stock to keep outperforming its peers over longer timeframes.

We want to own UCTT if it’s above 49, with a target of 66 over the next 3-6 months.

That’s the latest scoop on our 2 to 100 Club.

We hope you enjoyed it! Thanks for reading, and please reach out to us with any questions.

Good fishing.

The post 2 to 100 Club (06-20-2024) appeared first on All Star Charts.