AI: AI Agents & Ecommerce, the next AI business tussle. RTZ #897

As I’ve discussed in earlier pieces, there’s a big transition coming as AI moves from chatbots to AI Agents and Reasoning on the AI Tech Wave roadmap to AGI as proposed by OpenAI and others.

AI Agents seem simple and attractive as the next layer of value for mainstream billions. Smart AI software that represents the individual memories, interests and tastes of mainstream users to do things for them on the internet, with their best interests in mind. One of those core ‘AI things to do’ is online shopping.

Sounds simple, but there are complex issues underneath in terms of providing these services to end users while ALSO accommodating the business models of the various layers of LLM AI and online shopping/ecommerce companies. The recent OpenAI/Walmart partnership around ChatGPT and ecommerce is a timely case in point.

And this is a complex set of negotiations and litigation in some cases that we will see the industry navigate over the coming couple of years and beyond.

There are two recent events that highlight this coming AI Agents/Ecommerce business tussles.

The first is a tussle between Amazon and AI Chatbot/Agents/Browser provider Perplexity, a company I’ve discussed in detail before.

The Information lays it out well in “Perplexity Takes On Amazon”:

“Cue the violins. Perplexity on Tuesday accused Amazon of bullying it by demanding that the AI startup no longer allow its users to send their AI assistants to Amazon to buy stuff. The startup, which is an expert at public relations theatrics, published a long blog post entitled “Bullying Is Not Innovation,” in which it claimed to be “fighting for the rights of users” who are demanding the right to buy stuff through AI agents. I’d love to see a protest march of Perplexity users who feel aggrieved by this state of affairs.”

“Don’t get me wrong. While websites have long had the right to block bots that attempt to crawl them, it’s also not unheard of for big tech firms to seek to stymie potentially disruptive tactics by newcomers. An AI agent—which in theory can take action on behalf of users, like browsing Amazon’s marketplace and buying stuff—would certainly qualify as a disruptive newcomer. Amazon generates tens of billions a year selling ad space on its marketplace, a highly profitable revenue stream that will diminish if people start using agents to shop rather than browsing themselves. So Perplexity may be right about Amazon’s possible motivation.”

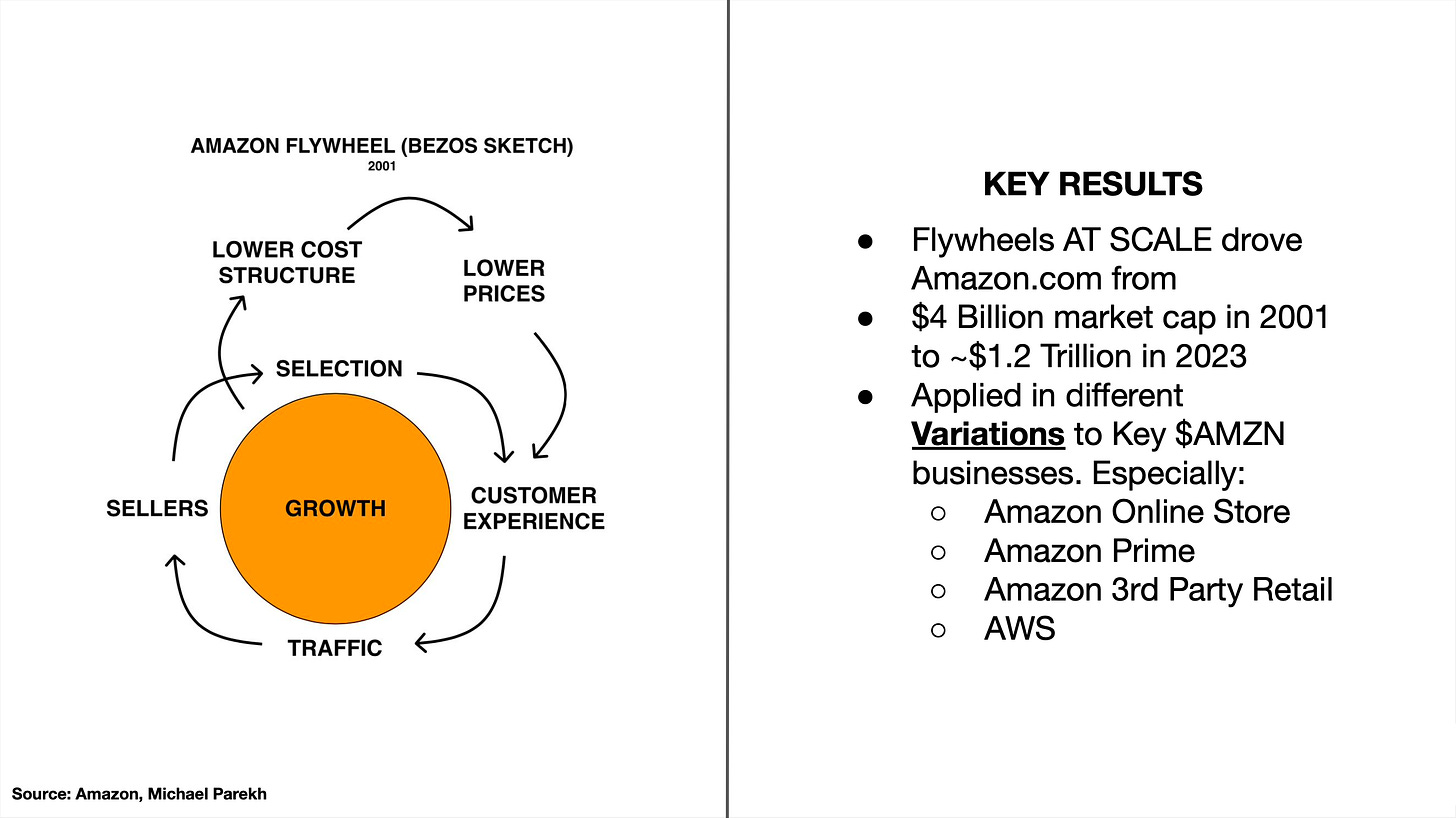

Indeed, Amazon has an extraordinary business catering to millions of third party retailers to sell things through its infrastructure. I’ve outlined this ‘Amazon Flywheel’ accomplishment here.

Now the shoe is on the other foot with AI:

“Amazon didn’t help itself with its weak response. It said Perplexity should respect Amazon’s wishes that its shopping agent avoid Amazon’s marketplace, to “ensure a positive customer experience.” Amazon CEO Andy Jassy was more convincing on the company’s earnings call last week, when he detailed what was wrong with outside AI agents offering to buy stuff for people. “There’s no personalization, there’s no shopping history, the delivery estimates are frequently wrong, the prices are often wrong,” he said. That sounds believable, given the hit-and-miss nature of AI chatbots generally. (These consumer reviews suggest Perplexity’s agent shopping service leaves something to be desired.)”

“But is this a reason for Amazon to block Perplexity? It’s possible Amazon is worried shoppers will blame it for screwups on their order, rather than holding Perplexity responsible. Jassy also said last week that Amazon will find “ways to partner” with outside agents. Amazon is presumably trying to control how agents evolve, at least on its own marketplace (see our story on this subject from July and a more recent story on Perplexity’s commerce effort).”

“This situation has echoes of the battle underway in enterprise software, as companies like Salesforce push back against the attempts of newer AI search tools like Glean to connect to their apps. AI is turning the established order in tech upside down. It’s understandable that newcomers like Perplexity want to claim victim status, but things are never as simple as they seem.”

The irony here is Amazon’s own history over two decades ago when it was ‘just’ a purveyor of a growing array of goods via its own website and introduced ‘1-Click’ Shopping and got a business patent and Amazon also secured a trademark for it. Other ecommerce companies contested it vigorously as an enroachment on their ability to servce customers directly and offer the same capability.

The broader issue here is echoed again with a recent agreement between OpenAI and Walmart, to integrate some Walmart shopping into ChatGPT. OpenAI plans on expanding aggressively into ecommerce via its chatbot and other applications, with integrated ‘instant payments’.

Again, the Information outlines that situation well in “OpenAI’s Commerce and Apps Efforts Divide Consumer Firms”:

“In October, Thumbtack, a firm that helps people book home services professionals, agreed to make its app available through ChatGPT, as have a number of commerce firms eager to reach the chatbot’s 800 million weekly users. But Marco Zappacosta, Thumbtack’s CEO, isn’t worried that ChatGPT will replace his own app.”

“Booking a car on Uber is incredibly efficient as a user experience. Right now, it’s still clunkier to do that through a chat interface. Ditto ordering your groceries through Instacart, or dinner through DoorDash, or hiring a plumber through Thumbtack,” said Zappacosta, adding that he expects the user interface to improve as AI agents become more widely adopted. Still, the ChatGPT connection ensures that Thumbtack is “in the conversation,” he said.

This is a dynamic of ‘re-aligning incentive’ with AI AIgents and ecommerce, I’ve discussed in detail before.

“Zappacosta represents one side of a divide among merchants and consumer brands over the wisdom of partnering with OpenAI’s ChatGPT. The opposing view is held by a number of other companies who worry that partnering with ChatGPT could undercut their existing business.”

“As OpenAI sets about turning ChatGPT into a place where people can buy goods, book travel and order meals, in addition to accessing information, partnering with apps that specialize in those services is key. But first, it has to persuade those firms that ChatGPT isn’t a threat.”

A tough long road, but OpenAI has made some progress to date:

“On the shopping side, OpenAI has won over Etsy and Walmart. But executives at other companies, including apparel retailer Everlane and home furnishing firm Brooklinen, say they are holding off on partnering with OpenAI. They say it isn’t clear how brands will be able to identify shoppers making purchases via AI agents or know if they’ve made a purchase from the brand before.”

The crux of the matter of course is customer data and direct relationships.

“That information allows a merchant to follow up with a shopper with targeted discounts or other forms of marketing to entice them to shop again, which is something OpenAI frowns upon. OpenAI says it “asks” merchants using its checkout feature to not enroll shoppers from ChatGPT in marketing or loyalty email programs.”

“Adding a middleman could hurt retailers in other longer-term ways, like cutting into the ad revenue they earn when customers visit their websites.”

And investment analysts are noting and weighing in on the issues:

“While Etsy’s early relationship with ChatGPT is a demand opportunity, we are concerned what it could mean for Etsy’s onsite advertising business that generates a majority of the company’s EBIT [earnings before interest and taxes]. If consumers are converting at higher rates, what happens to an advertising business that monetizes on a cost-per-click basis?” said a report last week from MoffettNathanson.”

“Data on what people are buying is a merchant’s “most precious asset,” said independent research analyst Andrew Lipsman. “And if you start providing that information…to platforms, you are allowing the platforms to disintermediate you. It is very easy for them once they have all this purchase data—that they currently lack—to be able to go directly to advertisers and sell inventory based on the same data.”

And of course companies like Amazon have large, deep interests to protect:

“Protecting advertising revenue is imperative for e-commerce giants like Amazon, which has so far refrained from partnering with any AI companies and has blocked several AI agents from accessing its site. Perplexity on Tuesday said Amazon was demanding it block its AI assistants from making Amazon purchases on behalf of users. Perplexity accused Amazon of trying to “eliminate user rights so that it can sell more ads.”

“An OpenAI spokesperson said ChatGPT isn’t intended to be a replacement for other ways users shop online, and its commerce features share customer information with merchants so that they can process payments and fulfill orders. The spokesperson said that the apps feature allows companies to reach new users directly in ChatGPT while keeping their app features and user relationships intact.”

OpenAI of course is eager to diversify its own business beyond AI chatbots.

“Free vs. Paid”

“Much is at stake for OpenAI. Most of ChatGPT’s audience use its free tier rather than paying to subscribe. OpenAI has previously told investors that it will bring in $110 billion in revenue from businesses making money off those nonpaying users between 2026 and 2030, which could include revenue related to shopping queries and transactions as well as advertising.”

And OpenAI is quick to offer ‘instant shopping’ on its services:

“OpenAI in late September launched Instant Checkout, which adds a Buy button to certain products that appear in its search results and allows users to make purchases without having to leave the chat window to go to another site. ChatGPT takes a small cut of each transaction done through its site.”

“A week after making the Instant Checkout announcement, OpenAI announced that it was integrating outside apps such as Zillow, Expedia and Uber into ChatGPT so people could search for details on a house they want to buy, book travel or call up an Uber without leaving the AI chatbot.”

And retailers of course want to understand the broader consequences here:

“Some retailers who are holding off on selling through ChatGPT say they need to better understand what types of AI search queries their products show up in response to and what kinds of shoppers are searching for their brand on sites like ChatGPT and Perplexity.”

“Even if brands or retailers don’t want to participate in Instant Checkout, they can still share their product data with OpenAI to boost the likelihood their items are featured in shopping search results, and shoppers will be directed to outside sites to complete their purchase.”

The whole piece is worth reading in detail for additional details around the core issues.

At a high level, this issue of AI Agents vs Online Retailers is analogous to the other major tussle between LLM AI companies and content/copyright owners under ‘Fair Use’ differences.

Both these transitions will take a while to negotiate, with lots of ebbs and flows in between. Not to mention a fair bit of litigation and deal-making along the way. Just like in tech waves prior to this AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)