AI: AI 'breaking the internet' concerns way overdone. RTZ #751

The Bigger Picture, Sunday June 15, 2025

There is a growing outcry that AI will soon lead to a ‘broken internet’. A ‘Pearls clutching’ time indeed.

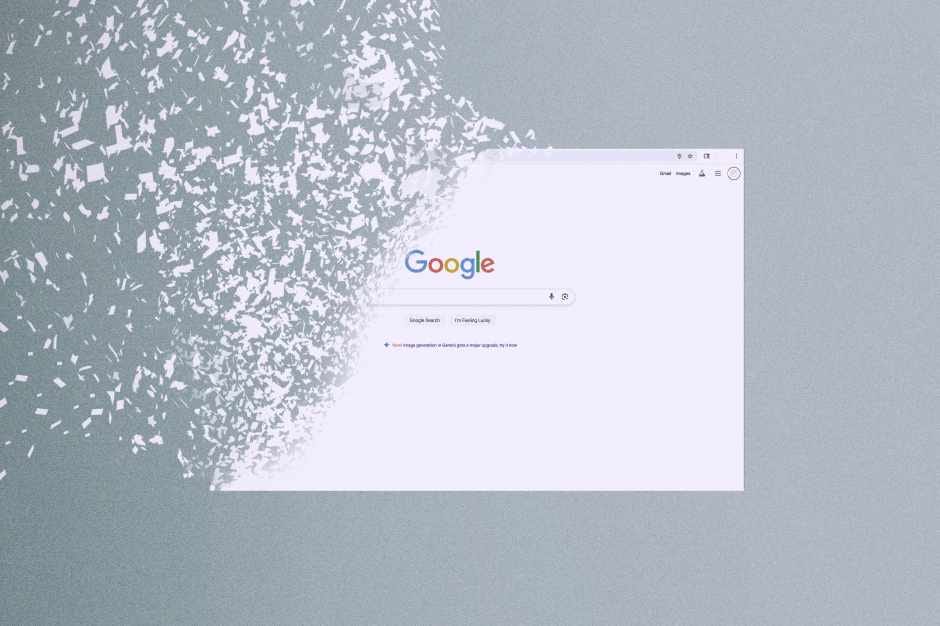

I’ve discussed in detail the rapidly building concerns that AI will increasingly ‘break’ the internet as we know it. By that they mean that the SEO (search engine optimized) financial ecosystem of the web, which especially benefits the online ad behemoths Google/Alphabet and Meta. And that somehow is a ‘bad’ thing in this AI Tech Wave, not a net good thing, as I contend in the longer term. Tech Waves have a habit of changing prevailing business models, generally for the better. Especially for mainstream users. That is The Bigger Picture I’d like to unpack this Sunday.

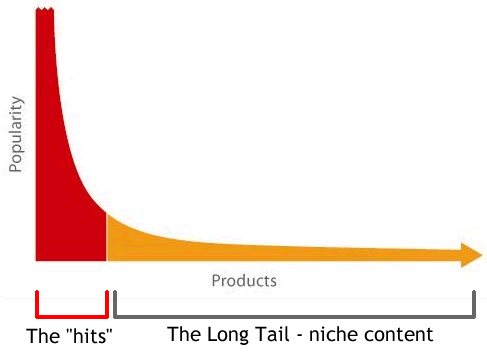

The main concern is that the current Internet/web is being severely jostled by AI summarization of billions of daily user queries and prompts. So that is reducing the traffic from the Googles to uncounted web sites, particularly online news and ‘magazine’ purveyors’, and the far ‘longer tail’ of websites on the internet. Both on desktops and smartphones. And that is a jostling of orders worth billions in interim traffic and dollars.

Two recent publications outline this set of concerns this week, and both worth full reads.

First up is the WSJ’s “News Sites Are Getting Crushed by Google’s New AI Tools”:

“Chatbots are replacing Google’s traditional search, devastating traffic for some publishers”

“Chatbots are replacing Google searches, reducing traffic to news sites like HuffPost and the Washington Post.”

“Business Insider cut staff due to traffic drops; Atlantic CEO expects Google traffic to approach zero.”

“Publishers are focusing on direct reader connections to boost business.”

And they start it off with a bang:

“The AI armageddon is here for online news publishers.”

“Chatbots are replacing Google searches, eliminating the need to click on blue links and tanking referrals to news sites. As a result, traffic that publishers relied on for years is plummeting.”

“Traffic from organic search to HuffPost’s desktop and mobile websites fell by just over half in the past three years, and by nearly that much at the Washington Post, according to digital market data firm Similarweb.”

“Business Insider cut about 21% of its staff last month, a move CEO Barbara Peng said was aimed at helping the publication “endure extreme traffic drops outside of our control.” Organic search traffic to its websites declined by 55% between April 2022 and April 2025, according to data from Similarweb.”

“At a companywide meeting earlier this year, Nicholas Thompson, chief executive of the Atlantic, said the publication should assume traffic from Google would drop toward zero and the company needed to evolve its business model.”Google’s introduction last year of AI Overviews, which summarize search results at the top of the page, dented traffic to features like vacation guides and health tips, as well as to product review sites. Its U.S. rollout last month of AI Mode, an effort to compete directly with the likes of ChatGPT, is expected to deliver a stronger blow. AI Mode responds to user queries in a chatbot-style conversation, with far fewer links.”

Here is the key quote worth highlighting:

“Google is shifting from being a search engine to an answer engine,” Thompson said in an interview with The Wall Street Journal. “We have to develop new strategies.”

Again, across the ‘longest of tails’ of internet content.

The key thing here is that this quest by Google to ‘organize the world’s information and make it universally accessible and useful’, over two decades ago had always implictly set this destination for Answers rather than Search.

I remember vividly as the head of Goldman Sachs’ Internet Equities Research, analyzing dozens of internet ‘Search’ companies from Yahoo! to Alta Vista, and many, many in between (Excite anyone?). We ended up taking Yahoo! and Inktomi public even.

But it wasn’t until Google was invented in 1998 after a feverish set of ‘Pagerank’ algorithms by Larry Page and Sergey Brin at Stanford, that the true quest for internet search even got started.

Of course in those intervening years from both periods above, the internet/web and grown exponentially from a few hundred web sites that could be organized in an index by Yahoo! to millions of web sites globally. And the internet back then was only a few hundred million users, mostly in the US and Europe.

A similar set of concerns emerged in 2012 when Facebook had its IPO, and the stock retreated 50% as it was right in the midst of the transition from the internet on desktops to the internet on smartphones. And the prevalent concern was the markedly lower advertising real estate on desktop vs smartphones and the jostling to come on the ad revenue economics on Facebook and others.

That concern proved wrong in hindsight.

Fast forward to 2025, with four plus billion of eight billion souls GLOBALLY querying the internet everyday, first with “Search” and now for “Answers” with AIs, that the comfortable arrangement of businesses to date are getting jostled.

Barron’s continues on the WSJ theme above with the dramatic “Google Search Is Fading. The Whole Internet Is At Risk”.

For the record, I don’t think either statement is true, but here is their argument:

“The lifeblood of the internet is drying up. What the decline of search means for users, companies, and stocks.”

“Roughly one in five visits to the world’s top internet sites begin on search engines, according to data from analytics firm Semrush. At Wikipedia, search generates 63% of global visits. For travel site Tripadvisor, it’s 58%; for local review site Yelp, it’s 51%.”

“But internet search traffic has been falling for much of the past year as web surfers experiment with artificial-intelligence-powered search from OpenAI’s ChatGPT and AI start-up Perplexity AI. So far, referrals from AI search engines have replaced about 10% of the traditional search losses, according to Similarweb data.”

The piece goes on to try and make its best case for concern for Google, the internet, and the web economy as we know it. But it doesn’t take a beat to look at the larger forest for the trees.

It’s still worth reading in full to get the scope and depth of the arguments against Google, and the current internet economy. I make a case for Google actually doing well longer term in a number of pieces on this substack.

For a video version of this debate, watch this interaction between Google CEO Sundar Pichai, and the relentless questions by the Verge Editor in chief Nilay Patel, from the 21 to the around 25 minute mark. Sundar in my view makes the broader, longer term ‘glass more than half full argument’ for the internet ahead.

I’m also on record saying (30 minutes to 31:15 mark) on my ‘AI Ramblings’ AI: RTZ podcast with my Gen Z nephew Neal Makwana that we are in the earliest stages of a massively, more positive state of the internet.

That this short-term reality will make way for a FAR BIGGER internet and web ecosystem, both in terms of billions more in interactions, and bigger TAMs (total addressable markets). The market has not had enough time to adjust for the changes underway, and the accelerating ones ahead.

The same web sites are being threatened by a change from Search to Answers, will likely benefit from far greater quests of answers beyond the basic Search. All made possible by Google, Meta, Amazon, TikTok and many others with machine learning and other technologies that preceded Generative AI. And now with full on AI at Scale.

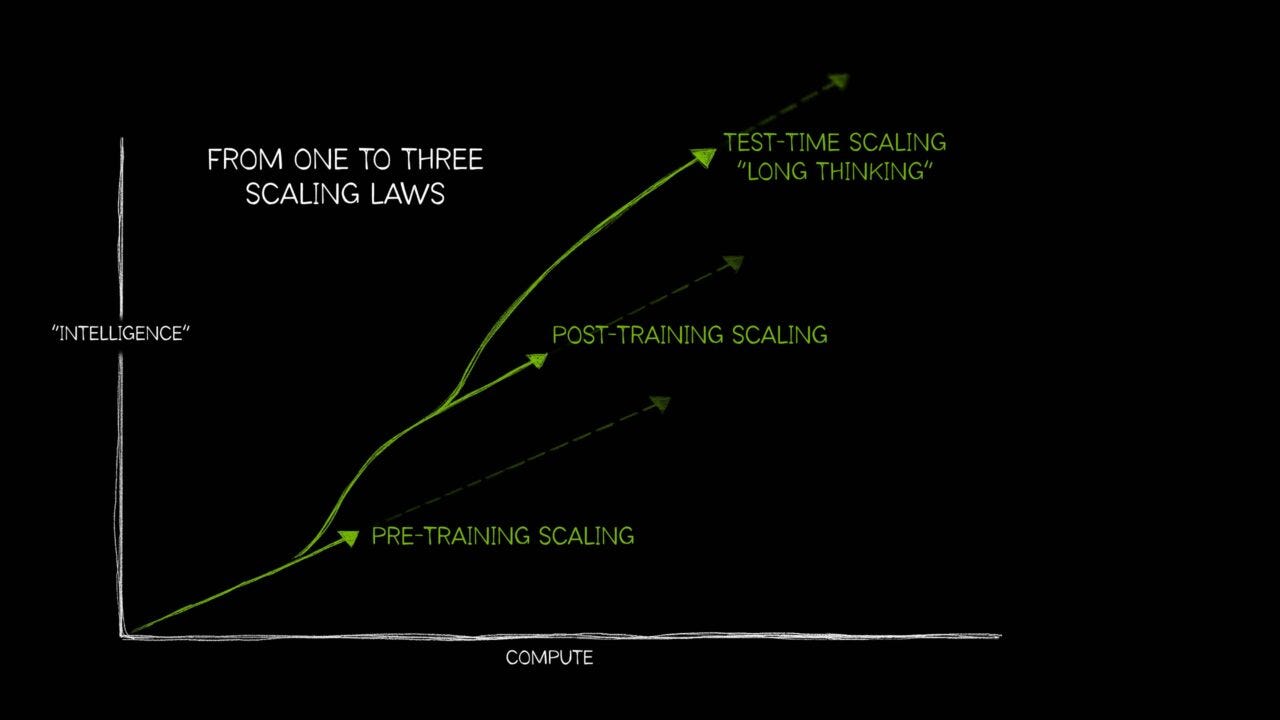

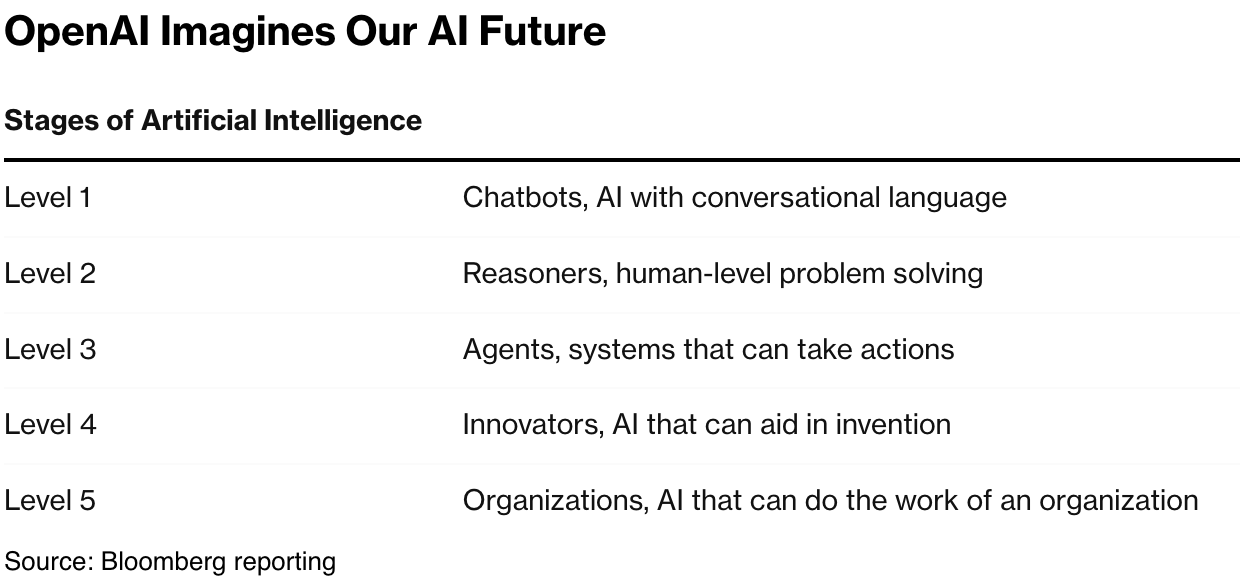

And we go from AI chatbots to AI Reasoning, Agents and beyond.

As we go from a few billion people searching for answers daily (10 billion a day on Google alone), to tens of billions of AI Agents searching for answers for their users, both ACTIVELY and PASSIVELY, we’re likely to see a mainstream expansion of the financial opportunities for even the longest of tails of content on the internet.

And the underlying will revolve around the three pillars of online monetization over the past few decades, Ads, Transactions, and Subscriptions.

Yes, we may use cooler underlying mechanisms like Stripe and/or Stablecoins, but the overall economic mechanisms will be familiar. And used in novel, market expanding ways for the AI innovations to come.

So a lot more pearls to clutch for all.

Including the AI pirates turning into naval commanders soon.

That is The Bigger Picture in this AI Tech Wave, worth noting this Sunday.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)