AI: AI Data Centers Growing Globally in Financing Needs. RTZ #777

We’ve covered the growth of AI Cloud companies beyond Amazon AWS, Microsoft Azure, Google and Oracle Cloud (in that order of size) beyond NeoClouds before here on AI: RTZ. They’re led by companies like CoreWeave (with Nvidia, OpenAI et al as equity partners), and others, all growing fast to help LLM AI hyperscalers and cloud companies build AI Data Centers with a trillion or more capex investments over the next few years in this AI Tech Wave.

With Mag 7s like the companies above and others like Meta and Tesla/xAI joining the AI Data Center ‘Table Stakes’ in the tens of billions of dollars (plus billions more to Power them), it’s no wonder that the industry is adding debt to finance these buildouts in addition to equity. Venture backed, or public funds backed. Even cashflow rich companies like Meta are jumping in to raise more debt for their AI data center buildouts.

So it’s useful to update ourselves mid-year 2025, on the current neocloud building and funding landscape on both parts of the balance sheet, equity and debt, and whether it’s public or private.

The Information lays out this Neoclouds and debt raising in “Chip-Backed Borrowing Boom Propels AI Computing Startups”:

“Companies have used their high-powered chips to get more than $20 billion in loans.”

“AI computing startups are borrowing to meet huge demand.”

• “Private lenders, flush with cash, are increasingly willing to lend against AI chips.”

• “Debt adds risk if growth slows or chips lose value more quickly than expected”“Several startups offering computing power for artificial intelligence are embracing the “borrow big to grow fast” strategy pioneered by CoreWeave, loading up on debt backed by their stocks of high-powered chips.”

“For instance, London-based cloud startup Fluidstack has gotten approval from Macquarie and other lenders to borrow more than $10 billion leveraging its holdings of Nvidia AI chips, or graphics processing units, as collateral, said people familiar with the company’s financing.”

Given the sums involved, it’s increasingly important to add debt to the picture, despite current interest rates.

“The strategy could help meet AI’s insatiable demand for computing power but adds billions in debt to a relatively young and unprofitable industry. By boosting competition, the startups could drive down prices, making it harder for them to pay back their loans, which now tally more than $20 billion.”

“Fluidstack’s sum exceeds the amount CoreWeave raised in GPU-backed debt before the cloud company’s public listing earlier this year. CoreWeave pioneered the use of AI chips as debt collateral, raising a total of $9.9 billion to purchase chips it leases to customers like OpenAI.”

These new NeoClouds are growing rapidly globally, rivaling companies like CoreWeave in the US, which had a very successful IPO in recent months.

“Fluidstack is drawing on the capital from lenders as needed, and it’s possible it won’t borrow the full amount, said one person close to the company. Fluidstack said in April it had struck a GPU-based financing deal with Macquarie, but the size of its borrowing and the involvement of other lenders haven’t been previously reported.”

“The eight-year-old startup, which rents chip access to AI companies, has also talked to Goldman Sachs and JPMorgan Chase about potential debt arrangements, said one person familiar with the discussions. The banks did not have a comment.”

And they’re able to raise these sums, despite their relatively nascent revenue numbers to date. Especially overseas.

“The company generated just $65 million in revenue last year, according to a person familiar with its finances. It was able to borrow so much in part because private debt funds are flush with cash and looking for high returns. Private credit has grown roughly tenfold in the past decade to more than $2 trillion, according to McKinsey.”

“Private credit funds like the industry’s fast growth and the predictability of customer contracts. Fluidstack, which began in 2017 as a small provider of basic computing services, is expected to have more than $400 million in sales this year, said one person familiar with its finances. It counts France’s Mistral AI and Germany’s Black Forest Labs as customers, and in February it struck a deal with the French government to build a data center that will draw about 1 gigawatt of power.”

And its attracting a broader array of finance companies besides the industry stalwarts like Blackstone and others.

“A growing number of private credit firms such as Blue Owl Capital are willing to make loans backed by AI chips, anticipating that the hardware will retain its value for several years.”

“We are at the dawn of massive-scale GPU financing needs,” said Kurt Tenenbaum, senior managing director at Blue Owl, where he has overseen deals with companies like DoorDash and SpaceX. Tenenbaum estimated 75% of the money spent on building AI cloud businesses will go toward purchasing GPUs.”

Key to the whole picture of course Nvidia, with its AI GPU chips and infrastructure, as the global ‘global standard’.

“A key issue for lenders is how long the Nvidia chips will retain their value. Are they like a car, which depreciates quickly, or a building, which has a longer useful life? CoreWeave has estimated the chips have a useful life of six years, longer than some competitors and industry analysts believe is the case. Nvidia has in recent years shortened its development cycle for releasing new AI chips, posing the risk that the chips will quickly become obsolete.”

For now, the debt markets are pretty accommodative.

“Investors have demanded interest rates reaching into the teens—more than a large swath of the high-yield bond market demands—and strong guarantees to make up for the risks of these loans. Lenders to CoreWeave took comfort in the company’s contract with Microsoft, which pledged to spend $10 billion with the cloud company by the end of the decade.”

“The giant cloud computing providers such as Alphabet, Amazon and Microsoft have typically financed their growth through their huge cash flow. CoreWeave’s GPU-backed debt facilities, anchored by Blackstone and Magnetar Capital, carried interest rates of 10.5% and 14.1% at the end of last year.”

But the newcomers like CoreWeave have had to be more creative.

“CoreWeave’s debt scared away some investors from its initial public offering, but the stock has soared about 300% since. Investors, mainly fast trading individuals, embraced the stock as a leveraged bet on a fast-growing industry. CoreWeave’s success has taken away some of the stigma of heavy borrowing, which is an unusual practice in the tech industry.”

“The company has since sought out cheaper sources of funding that don’t require it to pledge GPUs as collateral. In May, it raised $2 billion in an upsized high-yield bond offering at an interest rate of 9.25%, partially to repay its outstanding debt.”

And they’re using their robust public stock valuations to beef up their capabilities while the going is good.

“CoreWeave’s $9 billion acquisition, announced Monday, of data center operator Core Scientific was in part another effort to lower its borrowing costs. Because Core Scientific owns its data centers rather than renting computing capacity, the deal will allow CoreWeave to tap infrastructure financing sources, which typically offer lower interest rates than chip-based lenders.”

And the others are following a similar playbook.

“Fluidstack CEO Gary Wu said borrowing against the company’s chips made sense because Fluidstack needed a lot of capital and didn’t want to sell too much equity. “As you explore the other options, they’re hard to scale,” Wu said. Fluidstack has also raised venture capital and is building software services for customers renting its chips. It has considered raising additional financing to build data centers housing its chips but has not taken that route yet, Wu said.”

Again, Nvidia’s chips are the key collateral.

“While Nvidia’s chips are the gold standard in AI, some companies are trying to borrow against less widely used chips made by Advanced Micro Devices. TensorWave, a cloud startup renting access to AI processors from AMD, is actively seeking to raise debt backed by those chips, said co-founder Piotr Tomasik.”

And it’s widening beyond Nvidia as well.

“That deal would be one of the first backed by AMD chips. TensorWave in May raised $100 million in venture funding led by Magnetar and AMD Ventures and said it was building a cluster of 8,000 AMD chips.”

“Other cloud startups are avoiding GPU-backed debt and looking to cheaper sources of financing. Nebius, a publicly traded company renting GPU access to AI startups, recently raised $1 billion in convertible debt at interest rates of 2% and 3% to build data centers and buy more chips. The company has told investors it plans to become profitable on the basis of earnings before interest and taxes in the next couple of years.”

The whole piece is worth reading for more details, but it’s a good update on the fast growing technical and financial imperatives of the AI data center business, from a bottoms up perspective.

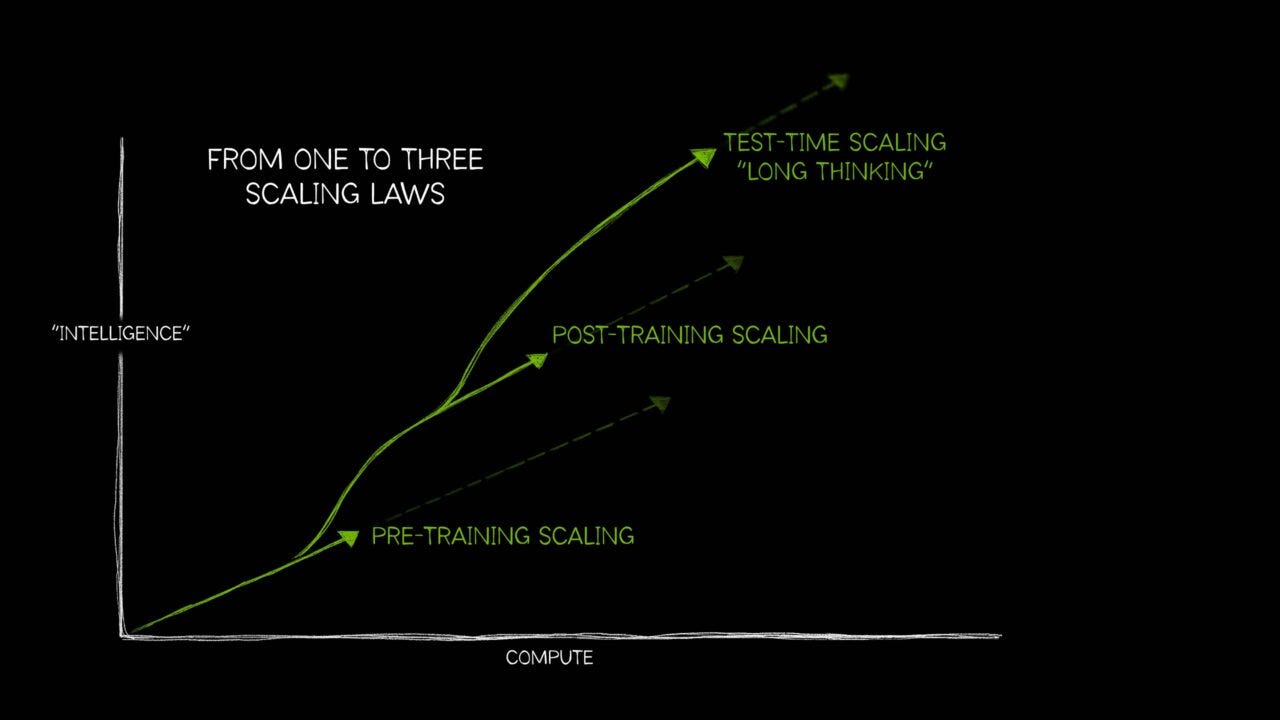

And a critical one at this AI Tech Wave for AI companies large and small. Because for now, without the mainframe scale of investments in AI Compute at Scale, there is no production of AI ‘intelligence tokens’ at Scale in the chart above.

Thus no AI Applications and Services in Box 6 above of the AI Tech Stack, for the higher margin rewards of this technology stack buildout.

So debt or equity, in unprecedented amounts, is a reality for the industry and investors, for the foreseeable future. Globally. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)