AI: Celebrating Early AI Calls here on Google & Amazon. RTZ #893

The Bigger Picture, November 2, 2025

As am investment analyst over decades of tech cycles, it’s great when early calls on ‘Underdogs’ come to pass. That’s the AI Bigger Picture I’d like to discuss this Sunday.

Even though AI: Reset to Zero is not focused on market calls, it does feel good to have early AI calls made here two years ago on Google and Amazon, validated in the public markets this week. As I summarized yesterday, five of the ‘Mag 7s’ yesterday reported strong earnings results for their respective quarters. And even though Meta saw a downdraft of over 10% post results, most of them were flat to up.

In particular, the markets like Google and Amazon’s Cloud results in particular, sending Amazon up over 10%. On Google with Gemini AI and Amazon with its AI opportunities with AWS, in these pages as being the under-dogs in this AI Tech Wave over two years ago. The markets now see the AI tail winds for both. So Bigger Picture I’d particularly like to discuss this Sunday, is the next Mag 7 that is similarly under-appreciated.

But first, please indulge me with the victory laps. Am a human analyst after all.

I’d highlighted Google and Amazon as AI underdogs on August 2, 2023, and August 3, 2023 respectively. Both meaningfully below current levels. And not viewed as AI favorites by a long shot.

The markets this week sent both stocks up on conviction around Google/Alphabet turning AI into a big opportunity from a big potential liability. And Amazon is being viewed as being the biggest Cloud winner with AWS, particularly due to its momentum with Anthropic Claude models in Gigawatt AI data centers being in big demand by business customers.

On Google, my takeaway two years ago came down to this:

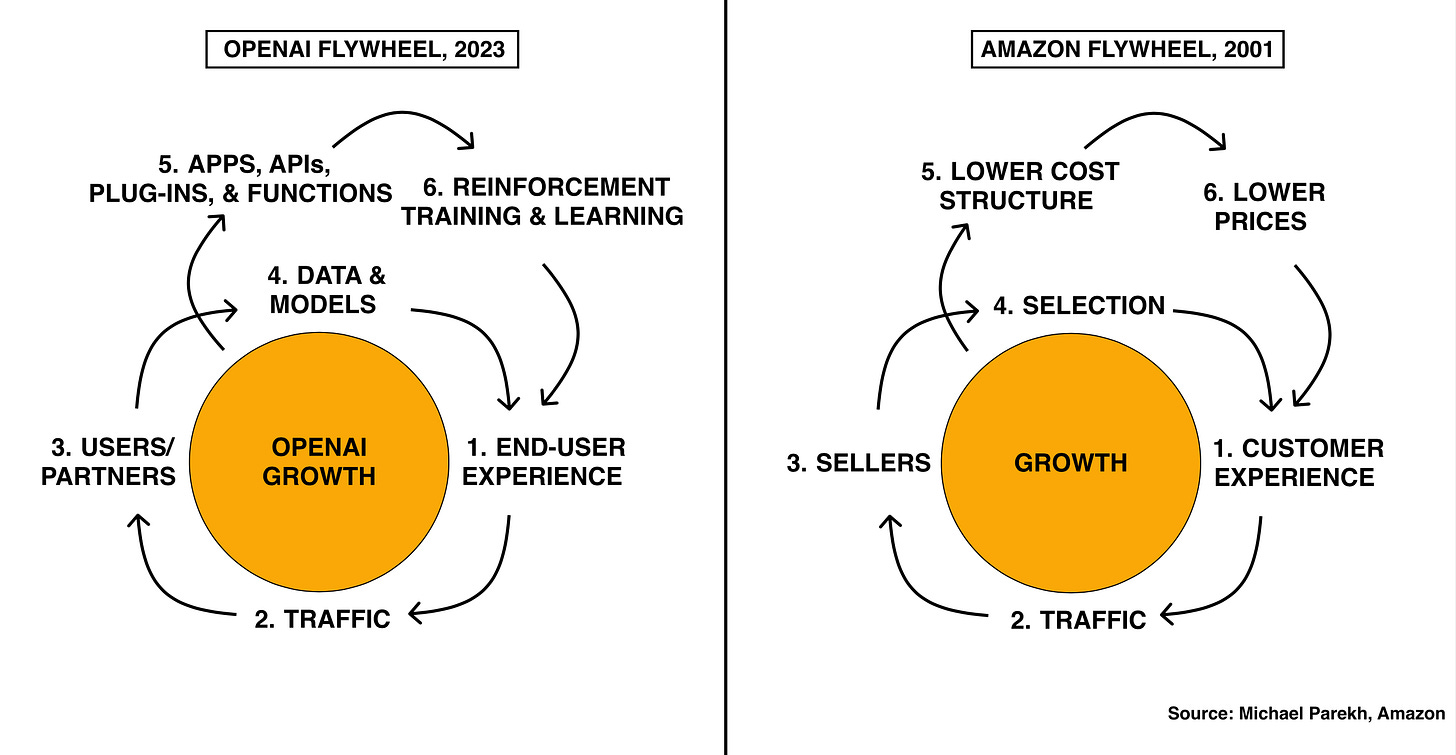

“It’s worth repeating that Google isn’t coasting on the flywheel of their incumbency. They’re hard at work on new stuff, like infusing Generative AI into robots, as I described yesterday. Of overhauling their ubiquitous voice product, Google Assistant, with AI technologies like Bard. The giant who has long considered themselves an “AI First’ company, is indeed thinking of AI first in most things they do, from CEO Sundar Pichai on down.”

“So, for all those reasons and more, in my view, they’re going to win this AI ‘Chat whatever’ round. Just like Microsoft did against Netscape almost a quarter of a century ago.”

And I’d summed up Amazon’s AI prospects two years ago as follows:

“Overall, I think Amazon AWS is an under-appreciated beneficiary of the AI ‘Picks and Shovel’ race currently beyond Nvidia in GPUs. They’re likely one of the best positioned globally, as businesses start to figure out how to implement LLM AI technologies in the years ahead. Be they open or closed, large or small, centralized or at the Edge, in their own networks and devices. For the customer’s own applications, with the needed levels of data control, privacy, and security. “

“So let’s keep a close eye on Amazon as well in the AI race, along with the other usual suspects. And the potential market at the moment is big enough for all.”

So far so good. The under-dog going forward I’d like to highlight amongst the Mag 7s in this AI Tech Wave should be no surprise to regular readers.

It’s of course Apple, about to do it’s AI Thing Different in my view.

The company saw its stock up after its earnings results, particularly due to strength in its new 17 iPhone devices and Services revenues. And of course CEO Tim Cook’s adroit management of the company businesses through the US/China trade and tariff dramas. As the WSJ notes in “How Tim Cook Evaded Disaster at Apple This Year”:

“The CEO was facing risks from Trump’s tariffs, Google litigation and the AI craze. He turned to his playbook and now the iPhone maker is worth $4 trillion.”

“It took two quarters for Tim Cook to save Apple from what was almost a disastrous year.”

“President Trump’s on-again, off-again tariffs risked massively increasing the company’s costs. A pending court ruling imperiled Apple’s lucrative Google contract. Plus, the company was seen as lagging on artificial intelligence.”

“Facing so much uncertainty, Apple tumbled to a market capitalization of $2.6 trillion in April and lost its title as the world’s most valuable company.”

“Six months later, Cook pushed Apple’s market value above $4 trillion for the first time. That’s more than 10 times what the company was worth when Cook took over as chief executive from Steve Jobs 14 years ago.”

In my view, going forward, Apple still remains meaningfully under-appreciated as an AI Story even amongst the most sophisticated public and private market investors.

Watch this recent on stage discussion of AI and big tech companies at a recent JP Morgan/Robinhood investor conference by four of the most prominent institutional investors, Tiger Global’s Chase Coleman, Altimeter’s Brad Gerstner, Maverick Capital’s Andrew Homan, and Lux Capital’s Joah Wolfe. Count the number of times Apple is mentioned (Spoiler: Not Once). Compare that against the number of times Nvidia, Google, Meta and Microsoft are cited. And even Tesla. My views on that one are also well documented.

Apple in my view continues to have the biggest AI opportunities ahead of it. In my view, Apple has not ‘missed the AI train’, which is the current, constant narrative amongst investors and the media.

The AI Tech Wave train is coming for the Apple Station. LLM AI technologies are rapidly improving and evolving to the point that dozens of smaller models ON LOCAL devices.

They are soon going to be able to provide unique bottoms up AI applications and services driven by Small Language Models (SLMs), that are just being invented. And the local devices are becoming more AI capable in GPUs and memory to take more of the ‘mainframe’ AI inference loads from the cloud on to local devices. Supplemented of course by Cloud AI processing as needed.

And that is a world that is uniquely set up for Apple, with its industry leading Apple Silicon chip leadership, driven by its partnerships with ARM, TSMC and many others. And of course its unique ecosystem of hardware and software platforms with common code running across operating systems running desktops, laptops, smartphones and of course wearables. And soon all manner of AI consumer devices to come.

Then consider Apple’s unique capability to globally manufacture and deliver hundreds of millions of devices annually to a dizzying number of countries and in their languages. Especially when these AIs will be able to do voice and video in addition to text.

All that sets up Apple as the leading AI beneficiary in the AI era to come. Yes, even against new wunderkind AI startups like OpenAI. And that is the Bigger Picture early call I’d like to reiterate here at AI: Reset to Zero. We will soon be watching this AI Tech Wave going forward from an Apple perspective. Am calling it here now. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)