AI: Closer look at Microsoft CEO Satya Nadella's AI Strategy. RTZ #905

Last week I went into detail on Microsoft’s ‘Post-OpenAI’ path for AI (#898). Important now that OpenAI is redrawing its relationship with Microsoft. And carving out its own ambitious in this AI Tech Wave . All led by its massively aspirational founder/CEO Sam Altman.

It’s useful to look at Microsoft a little closer through the eyes of its extraordinarily entrepreneurial CEO Satya Nadella. Most tech waves over the last three decades and more are stories of incumbents getting overrun by new tech that disrupt their core products and business models. All while native companies founded around the next wave of technologies apply ‘winner take all’ flywheels to take leadership of the next tech wave.

Not so with incumbent big tech this time around. particularly with Microsoft. It’s a credit to Satya Nadella that did Microsoft swooped in with a billion dollar investment in OpenAI all the way back in 2019, and then follow it up with over ten billion dollars in further investments quickly thereafter to setup the iconic AI partnership in AI Tech Wave. But now that OpenAI is going its way, Microsoft has a very ‘AI Native’ strategy taking this fifty year old company and recasting it for the AI Era ahead.

What CEO Satya Nadella is doing is daunting indeed. Taking a world leading software company and recasting it as a global Cloud based ‘AI Scaffolding’ company that can meaningfully change what tech companies can look like at scale in the era of ‘Accelerated Computing’.

It’s a phrase popularized by Nvidia founder/CEO Jensen Huang, and means essentially rebuilding all software, hardware and related technologies around AI computing built around ever fluid internet infrastructure that can be customized for infinite arrays of AI applications and services. The Holy Grail in the AI Tech Stack Box no. 6 below that I’ve discussed here for over 900 days.

Microsoft, with its unique Azure Cloud business is recasting its role in this new AI ecosystem.

So it’s useful it hear it all in CEO Satya Nadella’s own words, which is possible to do in this podcast hosted by podcaster Dwarkesh Patel, accompanied by Semianalysis founder Dylan Patel.

Both the podcast and the writeup titled “Satya Nadella — How Microsoft is preparing for AGI” are worth watching and reading in full. But here are some key highlights:

“As part of this interview, Satya Nadella gave Dylan Patel (founder of SemiAnalysis) and me an exclusive first-look at their brand-new Fairwater 2 datacenter.

“Microsoft is building multiple Fairwaters, each of which has hundreds of thousands of GB200s & GB300s. Between all these interconnected buildings, they’ll have over 2 GW of total capacity. Just to give a frame of reference, even a single one of these Fairwater buildings is more powerful than any other AI datacenter that currently exists.”

Also note that as of 2025, each Gigawatt of AI data center capacity means $50 billion plus in investments. The industry hopes to get that down to $20 billion per Gigawatt over time with custom GPUs, and more efficient AI Compute technologies.

“Satya then answered a bunch of questions about how Microsoft is preparing for AGI across all layers of the stack.”

“Watch on YouTube; listen on Apple Podcasts or Spotify.”

“Satya Nadella 00:04:17”

“I start with the excitement that I also feel for the idea that maybe after the Industrial Revolution this is the biggest thing. I start with that premise. But at the same time, I’m a little grounded in the fact that this is still early innings. We’ve built some very useful things, we’re seeing some great properties, these scaling laws seem to be working. I’m optimistic that they’ll continue to work. Some of it does require real science breakthroughs, but it’s also a lot of engineering and what have you.”

“That said, I also sort of take the view that even what has been happening in the last 70 years of computing has also been a march that has helped us move. I like one of the things that Raj Reddy has as a metaphor for what AI is. He’s a Turing Award winner at CMU. He had this, even pre-AGI. He had this metaphor for AI, it should either be a guardian angel or a cognitive amplifier. I love that. It’s a simple way to think about what this is. Ultimately, what is its human utility? It is going to be a cognitive amplifier and a guardian angel. If I view it that way, I view it as a tool.”

He then goes on to discuss the differentiating value provided by the model builders like OpenAI, and ‘AI Scaffolding’ companies like Microsoft:

“Satya Nadella 00:21:07”

“That’s a great point. Does all the value migrate just to the model? Or does it get split between the scaffolding and the model? I think that time will tell. But my fundamental point also is that the incentive structure gets clear. Let’s take information work, or take even coding. Already in fact, one of my favorite settings in GitHub Copilot is called auto, which will just optimize. In fact I buy a subscription and the auto one will start picking and optimizing for what I am asking it to do. It could even be fully autonomous. It could arbitrage the tokens available across multiple models to go get a task done.”

“If you take that argument, the commodity there will be models. Especially with open source models, you can pick a checkpoint and you can take a bunch of your data and you’re seeing it. I think all of us will start, whether it’s from Cursor or from Microsoft, seeing some in-house models even. And then you’ll offload most of your tasks to it.”

He then underlines the core of his argument:

“So one argument is if you win the scaffolding—which today is dealing with all the hobbling problems or the jaggedness of these intelligence problems, which you kind of have to—if you win that, then you will vertically integrate yourself into the model just because you will have the liquidity of the data and what have you. There are enough and more checkpoints that are going to be available. That’s the other thing.”

“Structurally, I think there will always be an open source model that will be fairly capable in the world that you could then use, as long as you have something that you can use that with, which is data and a scaffolding. I can make the argument that if you’re a model company, you may have a winner’s curse. You may have done all the hard work, done unbelievable innovation, except it’s one copy away from that being commoditized. Then the person who has the data for grounding and context engineering, and the liquidity of data can then go take that checkpoint and train it. So I think the argument can be made both ways.”

This is a key, subtle and nuanced point that is currently lost in the broader discussions of AI Capex spend and the supply/demand dynamic of the ‘AI Boom’.

The other segment of the discussion is around the ‘bending’ and ‘blending’ of traditional tech software models into AI infrastructure powered businesses that have new margin characteristics short and long term. A topic I’ve discussed in detail here and here.

“Dwarkesh Patel 01:09:35”

“Stepping back, when we were walking back and forth through the factory, one of the things you were talking about is that Microsoft, you can think of it as a software business, but now it’s really becoming an industrial business. There’s all this capex, there’s all this construction. If you just look over the last two years, your capex has sort of tripled. Maybe you extrapolate that forward, it actually just becomes this huge industrial explosion.”

And of course the big financing arrangements by Meta and others:

“Dylan Patel 01:10:01”

“Other hyperscalers are taking loans. Meta has done a $20 billion loan at Louisiana. They’ve done a corporate loan. It seems clear everyone’s free cash flow is going to zero, which I’m sure Amy is going to beat you up if you even try to do that, but what’s happening?”

“Satya Nadella 01:10:19”

“I think the structural change is what you’re referencing, which is massive. I describe it as we are now a capital-intensive business and a knowledge-intensive business. In fact, we have to use our knowledge to increase the ROIC on the capital spend.”

“The hardware guys have done a great job of marketing Moore’s Law, which I think is unbelievable and it’s great. But if you even look at some of the stats I even did in my earnings call, for a given GPT family, the software improvements of really throughput in terms of tokens-per-dollar-per-watt that we’re able to get quarter-over-quarter, year-over-year, it’s massive. It’s 5x, 10x, maybe 40x in some of these cases, just because of how you can optimize. That’s knowledge intensity coming to bring out capital efficiency. That, at some level, is what we have to master.”

“Some people ask me, what is the difference between a classic old-time hoster and a hyperscaler? Software. Yes, it is capital intensive, but as long as you have systems know-how, software capability to optimize by workload, by fleet… That’s why when we say fungibility, there’s so much software in it. It’s not just about the fleet.”

“It’s the ability to evict a workload and then schedule another workload. Can I manage that algorithm of scheduling around? That is the type of stuff that we have to be world-class at. So yes, I think we’ll still remain a software company, but yes, this is a different business and we’re going to manage. At the end of the day, the cash flow that Microsoft has allows us to have both these arms firing well.”

Lastly, it’s worth noting now the Microsoft CEO discussed his company in an increasingly geopolitically charged and polarized world with growing need for ‘Sovereign AIs’:

“01:15:07 – Will the world trust US companies to lead AI?”

“Dylan Patel 01:15:07”

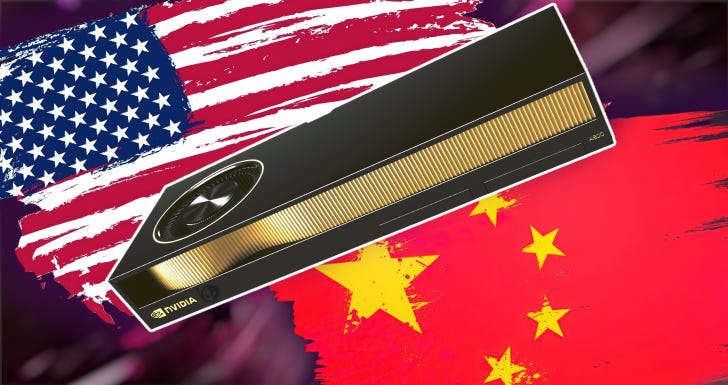

“As we look across the world, America has dominated many tech stacks. The US owns Windows through Microsoft, which is deployed even in China, that’s the main operating system. Of course, there’s Linux, which is open source, but Windows is deployed everywhere in China on personal computers. You look at Word, it’s deployed everywhere. You look at all these various technologies, it’s deployed everywhere. And Microsoft and other companies have grown elsewhere. They’re building data centers in Europe and in India and in all these other places, in Southeast Asia and LatAm and Africa. In all of these different places, you’re building capacity.”

“But this seems quite different. Today, the political aspect of technology, of compute… The US administration didn’t care about the dot-com bubble. It seems like the US administration, as well as every other administration around the world, cares a lot about AI. The question is, we’re sort of in a bipolar world, at least with the US and China, but Europe and India and all these other countries are saying, “No, we’re going to have sovereign AI as well.”

“How does Microsoft navigate the difference to the 90s—where there’s one country in the world that matters, it’s America, and our companies sell everywhere and therefore Microsoft benefits massively—to a world where it is bipolar? Where Microsoft can’t just necessarily have the right to win all of Europe or India or Singapore. There are actually sovereign AI efforts. What is your thought process here and how do you think about this?”

“Satya Nadella 01:16:36”

“It’s a super critical piece. I think that the key, key priority for the US tech sector and the US government is to ensure that we not only do leading innovative work, but that we also collectively build trust around the world on our tech stack. Because I always say the United States is just an unbelievable place. It’s just unique in history. It’s 4% of the world’s population, 25% of the GDP, and 50% of the market cap. I think you should think about those ratios and reflect on it.”

Satya says the key bit above, centered around the US’s historically ‘trusted’ role in the global economy. And then addresses the current environment with maximum care:

“That 50% happens because quite frankly the trust the world has in the United States, whether it’s its capital markets or whether it’s its technology and its stewardship of what matters at any given time in terms of leading sector. If that is broken, then that’s not a good day for the United States. We start with that, which I think President Trump gets, the White House, David Sacks, everyone really, I think, gets it.”

“So therefore I applaud anything that the United States government and the tech sector jointly does to, for example, put our own capital at risk, collectively as an industry, in every part of the world. I would like the USG to take credit for foreign direct investment by American companies all over the world. It’s the least talked about, but the best marketing that the United States should be doing is that it’s not just about all the foreign direct investment coming into the United States, but the most leading sector, which is these AI factories, are all being created all over the world. By whom? By America and American companies.”

Easier said than done, but it needed to be said.

There’s a lot more to absorb on Microsoft’s wide and deep AI strategy going forward, and how Satya Nadella plans to navigate it all in this AI Tech Wave. But the discussion also provides insights into the strategies of his peers at Google, Amazon, Meta and beyond.

The big tech incumbents are going into the AI Tech Wave with eyes wide open. And a sense of institutional flexibility unmatched in prior tech waves when the next new tech emerged.

So they’ve got as much an opportunity to build ‘AI Native’ scaled businesses as any startup. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)