AI: Closer look at the Apple/TSMC chip partnership. RTZ #964

I’ve long discussed the criticality of Taiwan Semiconductor (TSMC) for the global tech industry and increasingly the AI Tech Wave through the end of the decade at least. Despite the US/China trade and tariff kerfuffles and Kabuki theater.

At this early point in the AI Tech Wave in 2026, it’s useful to get a snapshot where things stand in terms of TSMC’s global customer profile. Especially vs its historical relationship with Apple over the last few years. And vs its growing concentration of business with Nvidia, Google and other critical AI chip customers in the next few years.

Semianalysis provides a timely snapshot of the bookends in “Apple-TSMC: The Partnership That Built Modern Semiconductors”:

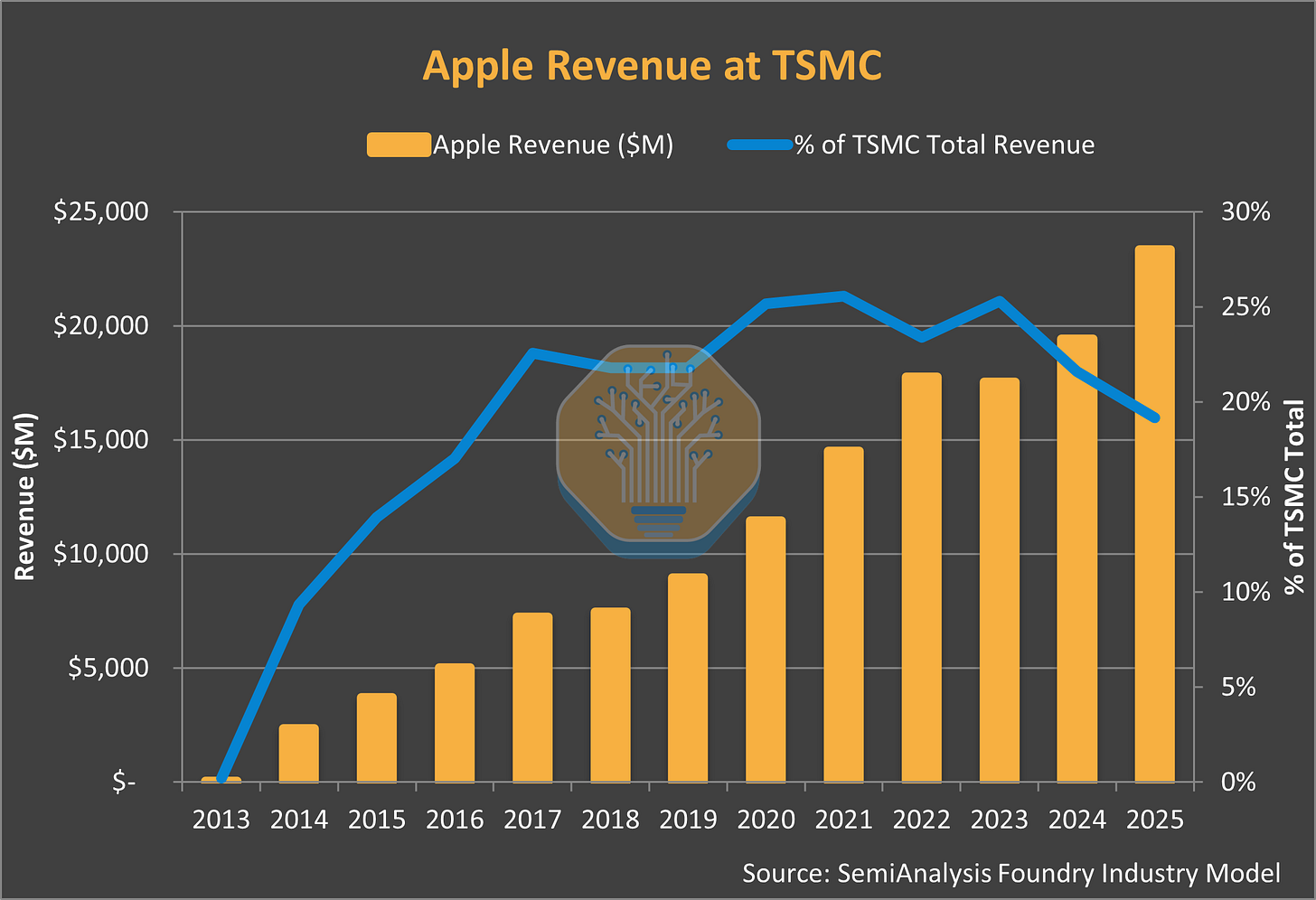

“In 2013, TSMC made a $10 billion bet on a single customer. Morris Chang committed to building 20nm capacity with uncertain economics on the promise that Apple would fill those fabs. “I bet the company, but I didn’t think I would lose,” Chang later said. He was right. Apple’s A8 chip launched in 2014, and TSMC never looked back.”

“Apple’s annual spend at TSMC grew from $2B in 2014 to $24B in 2025. That is 12x in 12 years. Apple went from 9% of TSMC revenue to 25% at its peak and settled to 20% in 2025. More striking is Apple’s dominance at node launches: consistently >50% since 20nm and in some cases near 100%. Apple effectively funded the yield learning curve for every major node transition since 20nm.”

“The foundry model is dominant today. IDMs cannot support process development and fab capex with what is effectively a single customer. But even foundries need a “first and best” customer with large demand and deep pockets to fund their continued advance. Apple has been that customer for the last decade at TSMC. The juggernaut partnership has propelled both companies to new heights, put competitors in the dust, and fueled the chipmaking industry.”

Their report discusses the evolution of this critical relationship that made the Apple we know today possible.

But increasingly imnportant is how Nvidia, Google and other AI Data Center chip customers are going to be an integral part of TSMC’s demand curve at least through the end of the decade:

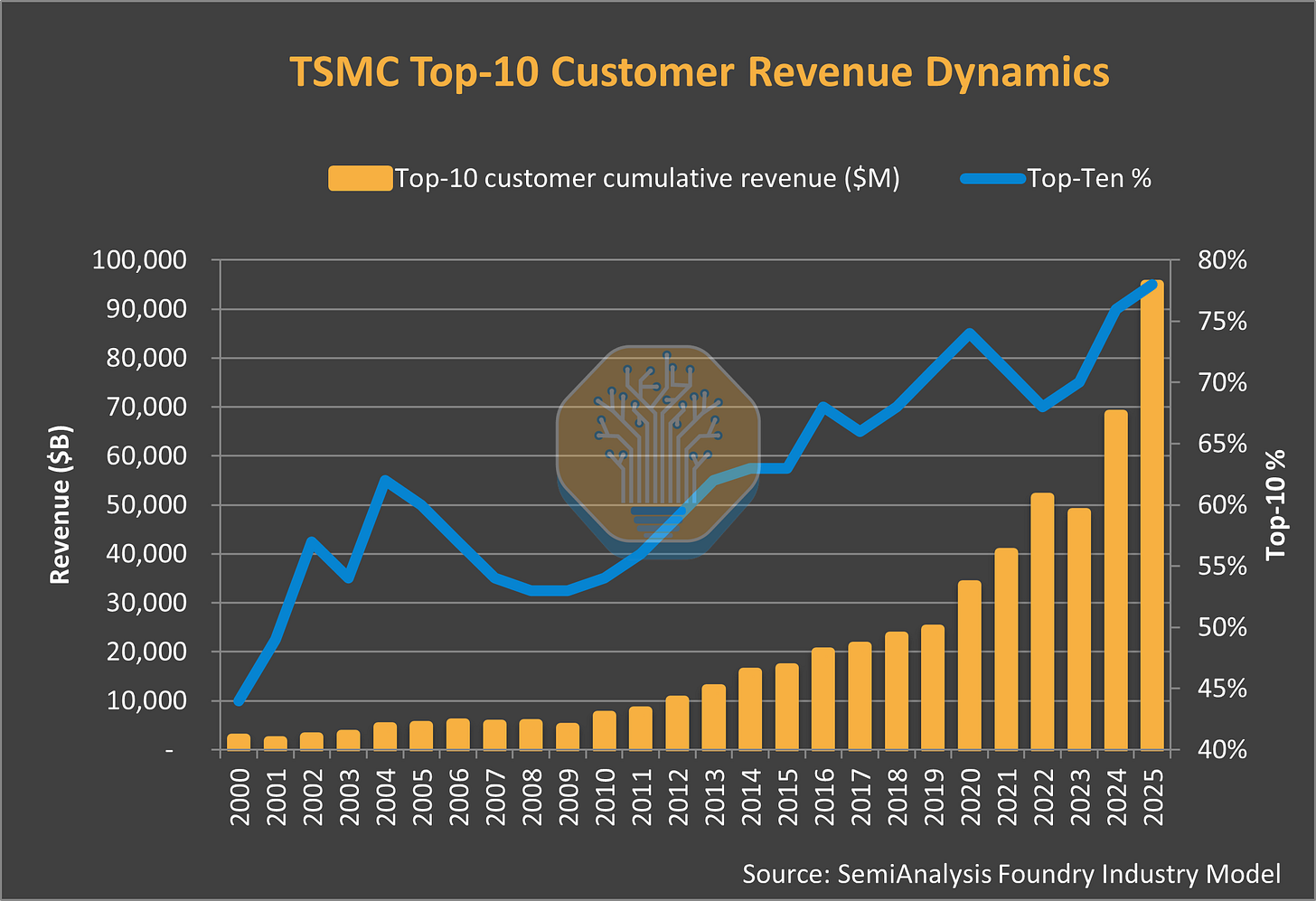

“TSMC’s customer concentration has steadily increased over the past two decades, with the top-10 customers growing from 44% of revenue in 2000 to 78% by 2025. Apple has been a primary driver of this concentration. Before 2014, Apple was a negligible contributor to TSMC’s revenue; by 2025, Apple alone represents roughly a quarter of top-10 customer revenue. For most of the 2014-2022 period, Apple grew faster than the average of the other nine top-10 customers, pulling TSMC’s customer mix increasingly toward Cupertino.”

“That dynamic has now reversed. In 2024 and 2025, non-Apple revenue at TSMC grew at nearly double Apple’s rate, driven by AI accelerator demand from NVIDIA, Broadcom, AMD, and hyperscaler custom silicon. The ex-Apple top-10 cohort, which grew at single-digit rates for much of the 2010s, is now expanding at 40%+ annually. Apple remains TSMC’s largest single customer, but its growth is being outpaced by a coalition of AI-focused buyers who are collectively reshaping the foundry’s revenue base. The customer concentration continues to rise, but the center of gravity is shifting away from smartphones and toward data center silicon.”

This AI Tech Wave has key implications for this relationship going forward, especially given the broader geopolitical issues:

“Concentration is a double-edged sword. With 78% of revenue coming from 10 customers, TSMC is increasingly dependent on a small number of buyers. Apple and NVIDIA alone likely represent 40%+ of total revenue by 2025.”

“TSMC’s N2 node (2025-2026) marks a structural shift. For the first time, Apple faces genuine competition for leading-edge priority.”

“The shift in economics:”

“NVIDIA’s H100/H200/B100 chips sell for $25,000-40,000 each”

“Apple’s A18 Pro sells in iPhones for $1,099-1,199 (implied chip ASP: $100-150)”

“NVIDIA’s revenue per wafer: potentially 3-5x higher than Apple’s”

“TSMC has historically prioritized Apple as the anchor customer for new nodes. But AI margins are extraordinary. Will TSMC allocate N2 capacity to Apple’s predictable-but-lower-margin consumer chips, or to NVIDIA’s volatile-but-higher-margin AI chips?”

“TSMC will thread the needle. Apple gets guaranteed allocation (contractual commitments from the lock-in era). NVIDIA gets incremental capacity from aggressive fab expansion. Both customers are too important to alienate.”

“But the balance of power is shifting. NVIDIA will likely wield more power at TSMC and given Apple’s stagnant volumes it could be even more difficult.”

“We estimate AI accelerator wafers will overtake Apple at TSMC and will outgrow. While Apple will also participate in AI accelerator, it will come under pressure from NVIDIA, Broadcom and others for capacity.”

These TSMC customer dynamics are important to keep in mind as we chart our way through the AI Tech Wave ahead.

While a lot of details may ebb and flow, the core directionality of these trends are relatively locked in. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)