AI: Cranking up OpenAI's Financial Plans. RTZ #837

The Bigger Picture, Sunday, September 7, 2025

As the leading LLM AI company in this AI Tech Wave (along with Nvidia of course), OpenAI’s roadmap always is a key indicator for the industry. After years of relatively opaque projections of billions in AI capex and infrastructure investments, the financial model being cranked up is getting clearer. With building visibility into growing revenues as well as eventual profits. At least until 2029 in their ‘official’ extarnal projections. And that is a Bigger Picture worth unpacking this Sunday.

First up, the company continues to build AI Data Centers at scale with Softbank as its partner in a global infrastructure plan dubbed Stargate. Over the last few months, it has been expanded with big data centers planned in the Middle East, Europe and potentially India.

Also, like its peers Microsoft, Google, Amazon, Meta and others, the company is also diversifying its plans for its own AI GPU chips (aka ASICs), with third party companies like Broadcom. While also being key core customers of chips from Nvidia. A ‘Frenemies’ trend I’ve discussed extensively.

A related trend is the company’s ‘Frenemies’ trend in AI Coding with its own GPT models that partner with key companies like Cursor, while building their own technologies via ‘Build AND Buy’ strategies.

And as I highlighted this week, the company is accelerating its plans for a plethora of AI Applications in the coveted Box #6 of the AI Tech Stack below, led by its ‘CEO of Applications’ Fidji Simo.

The above all being done while the company manages and negotiates its iconic partnership with Microsoft and its Azure Cloud platform. The goal is more independence going forward. Particularly for governance changes that would enable a public IPO sooner than later in the months ahead.

All this means accelerated plans for both AI capex spend, as well as plans for faster growing revenues, cash flow and profits to follow. This concurrent with ongoing fund raising efforts both primary and seondary, while its valuation crossed half a trillion dollars, making it the highest ranked private company to date.

So an update on its projected financials are notable, with all the above in context.

The Information lays out these updated numbers in “OpenAI Says Its Business Will Burn $115 Billion Through 2029”:

“OpenAI recently had both good news and bad news for shareholders. Revenue growth from ChatGPT is accelerating at a more rapid rate than the company projected half a year ago. The bad news? The computing costs to develop artificial intelligence that powers the chatbot, and other data center-related expenses, will rise even faster.”

“As a result, OpenAI projected its cash burn this year through 2029 will rise even higher than previously thought, to a total of $115 billion. That’s about $80 billion higher than the company previously expected.”

“The unprecedented projected cash burn, which would add to the roughly $2 billion it burned in the past two years, helps explain why the company is raising more capital than any private company in history. CEO Sam Altman has previously told employees that their company might be the “most capital intensive” startup of all time.”

Stargate is a key, expanding reason:

“One reason for the huge spending is that OpenAI has become one of the world’s biggest renters of cloud servers. To control those costs, OpenAI is embarking on a long effort to develop its own data center server chips and facilities to power its technology.”

“The daunting cash burn projections increase OpenAI’s risks but haven’t deterred dozens of large investment firms from ploughing capital into the company or buying up shares from employees at ever higher prices. Many of them view OpenAI as a barometer of AI adoption and believe the company can eventually make a lot of money from people who use ChatGPT for free, and from price increases on its products as its technology improves.”

And private investors are leaning in:

“Investors including SoftBank, Thrive Capital and Dragoneer are lining up to purchase OpenAI shares at a price that values it at $500 billion. That’s nearly twice the price they were paying for OpenAI shares about six months ago. It’s also, remarkably, almost one-fifth of the market value of Google, a company which reported $100 billion in net income last year.”

“Because OpenAI’s for-profit business is controlled by a nonprofit, investors currently get stock that entitles them to a share of future profits. The company is trying to convert the shares to traditional equity so its for-profit unit can go public someday, though it faces legal and contractual tussles with the likes of Elon Musk and Microsoft, which could affect the timing and structure of that proposed conversion.”

This transition is a critical one to navigate and negitiate:

“Being publicly traded could make it easier for OpenAI to borrow money and pursue some of its data center ambitions, which could include renting out its servers to other AI developers, according to recent comments from its executives.”

“Cost Breakdown”

“Until then, it has to find ways of paying the almost unfathomable costs of developing its technology and serving it to what it hopes will be billions of customers. At the same time, OpenAI is grappling with increasing competition for talent that has already led to key departures and increased salaries and stock compensation.”

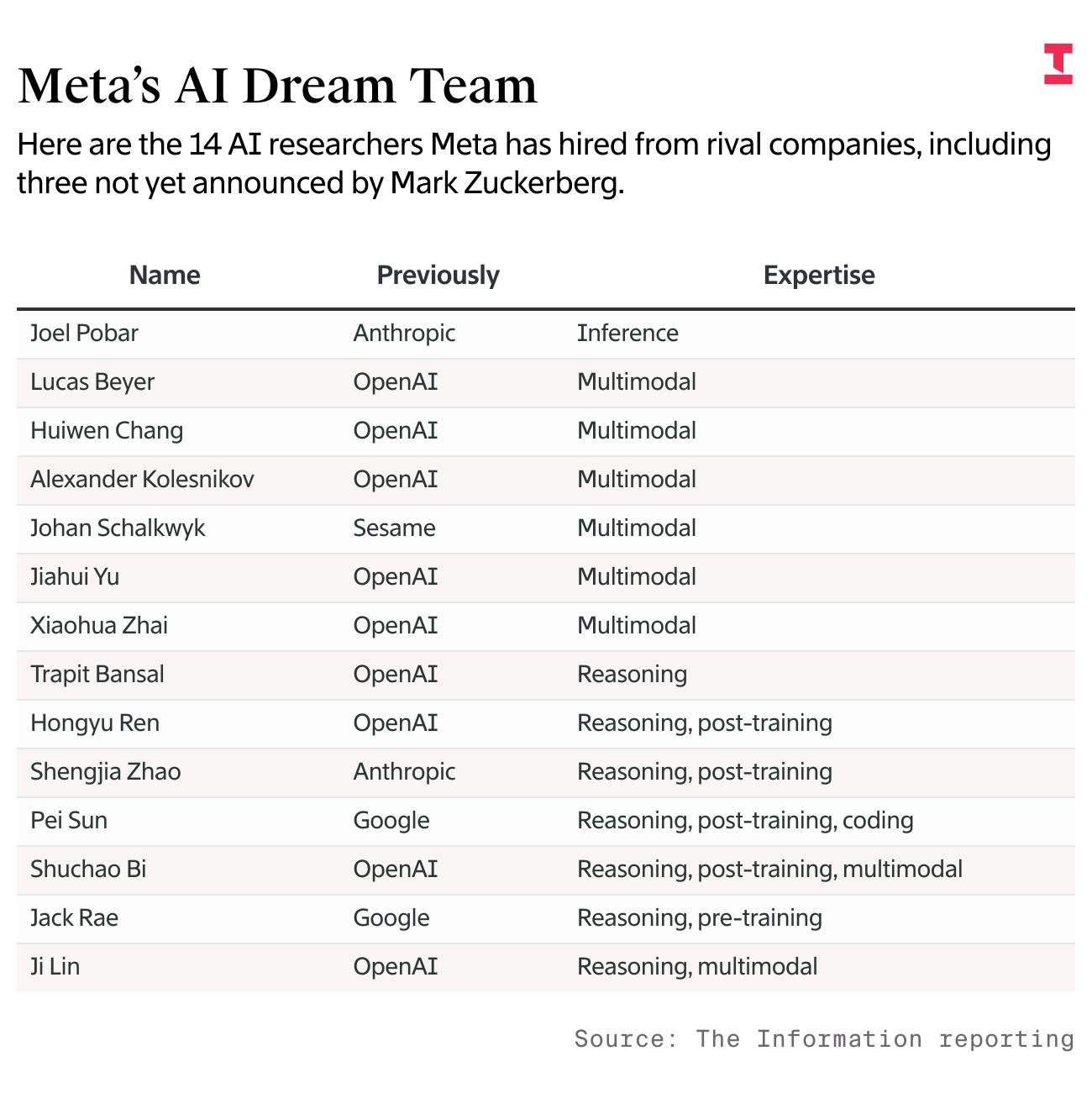

And the AI Talent Wars accelerated by Meta is another factor in the projections:

“For instance, OpenAI has projected about $20 billion in additional stock compensation charges between now and 2030 compared to its earlier projection.”

“But the biggest change emerging from OpenAI’s latest projections was to its cash flows. The company projected it will burn more than $8 billion this year, or roughly $1.5 billion higher than its prior projection from earlier this year. Cash burn will more than double to more than $17 billion next year—$10 billion higher than what the company earlier projected.”

“And in 2027 and 2028, the company projects to burn roughly $35 billion and $45 billion, respectively. In the prior projection, the company said its 2028 cash burn would be $11 billion, meaning the new estimate is more than four times higher.”

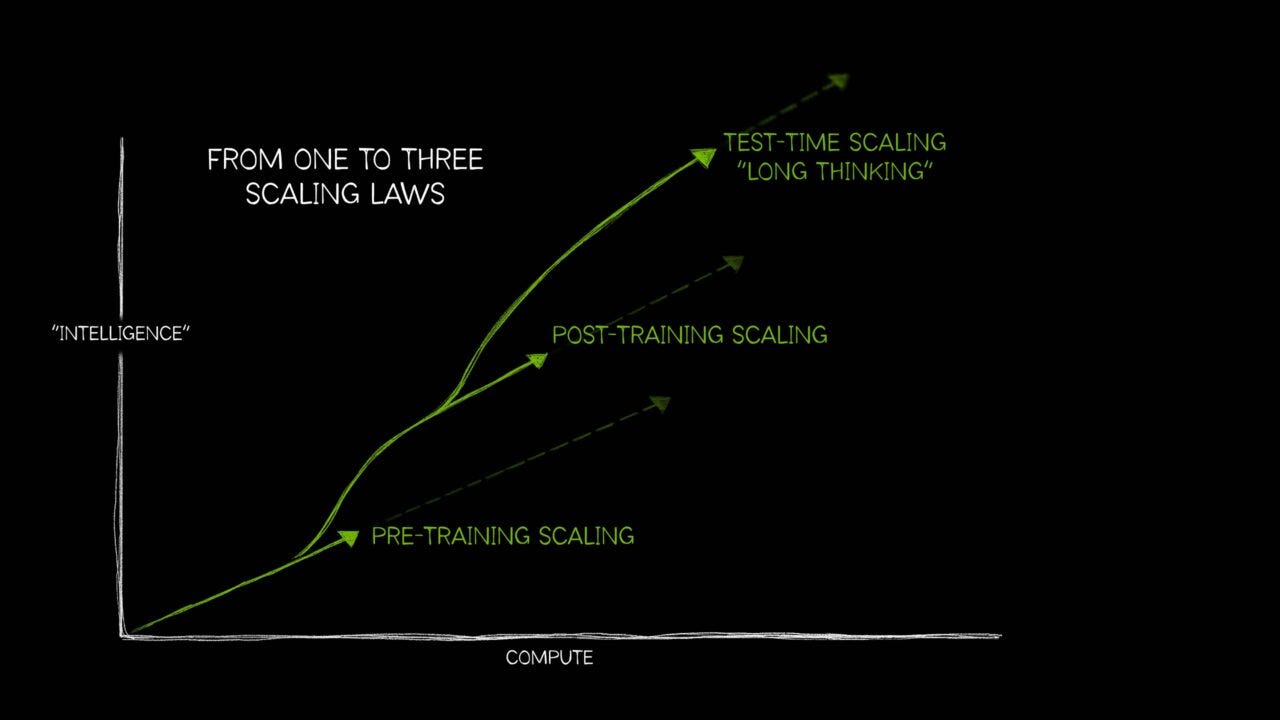

It does come back to AI Data Centers that need massive Scaling, especially given the elasticity of the variable inference costs, and the ‘good news/bad news’ aspect of mainstream rising consumer demand for all tiers of ChatGPT:

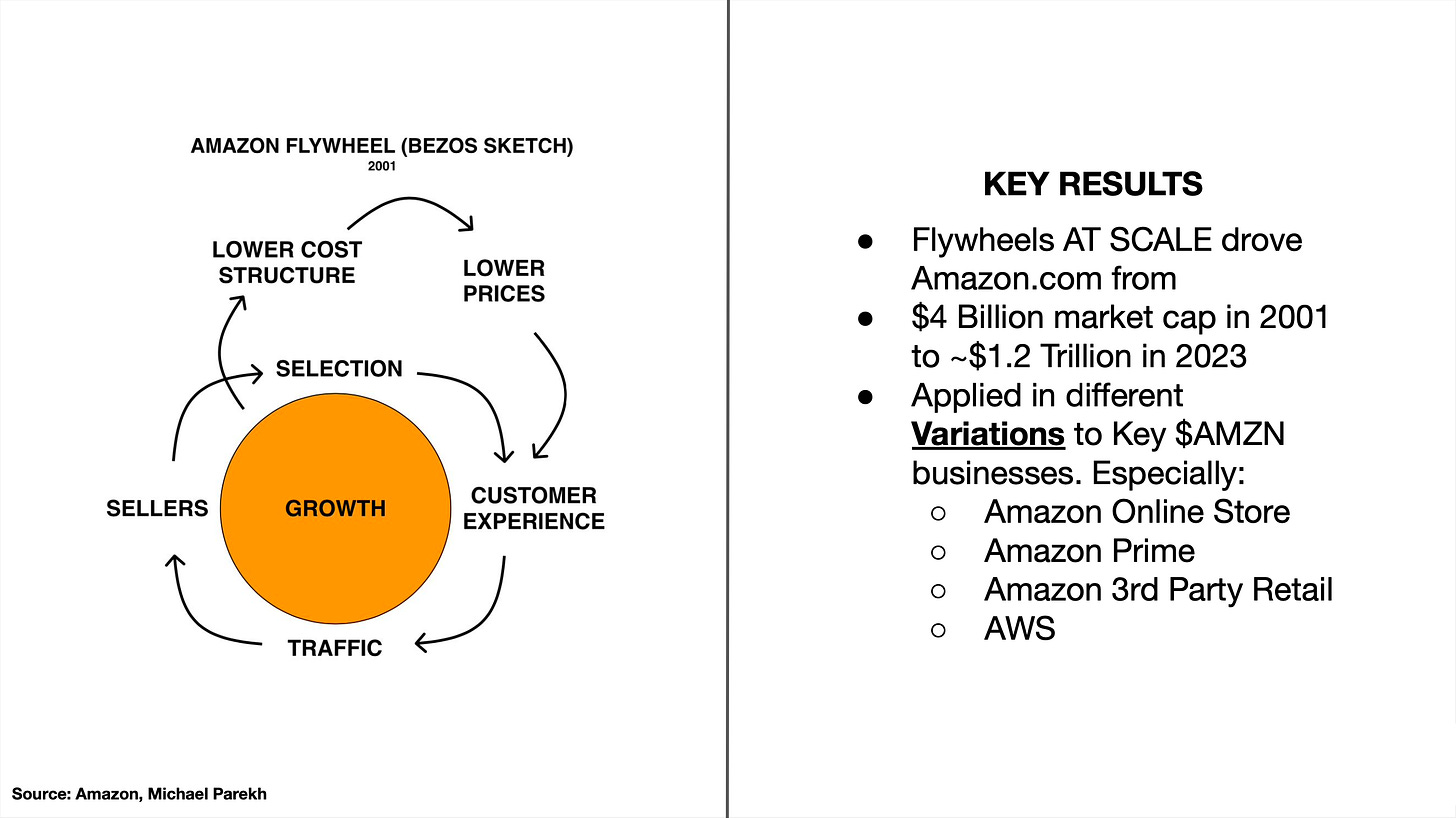

“One factor pushing up the company’s cash burn is its plan to spend nearly $100 billion later this decade on costs related to servers it would control, the new data suggest. CFO Sarah Friar has said OpenAI could offer servers to other companies the way Amazon Web Services does.”

This is a ‘flywheel’ move I’ve discussed for over two years for OpenAI, Meta and others. Leveraging a well known and executed playbook by Amazon with AWS and other core businesses.

“Another large driver of the increased costs is computing costs. While the cost of running its AI models, known as inference compute expenses, is close to what it projected earlier this year, the small differences add up to more than $11 billion in extra spending by the end of the decade. The company expects to spend more than $150 billion on such costs from 2025 through 2030.”

“And its cost to develop AI models, also called training or research compute, is far higher than it previously projected.”

AI Training of course, the original major compute cost of scaling AIs, continues to be a rising variable:

“The company expects to spend more than $9 billion on training costs this year, up about $2 billion from its prior projection, and about $19 billion next year, also more than $2 billion higher than it previously anticipated.”

“The company projected a steady increase in AI training costs through 2030, which suggests this type of expense could grow even after then.”

“The company projected a steady increase in these costs through 2030, which suggests this type of expense could grow even after then. As the company’s struggles to develop GPT-5 this year showed, training AI can yield unpredictable results, including false starts and do-overs that can raise costs.”

Which brings the question to earning it all back:

“Revenue Outlook”

“On the bright side, OpenAI’s revenue outlook is improving somewhat.”

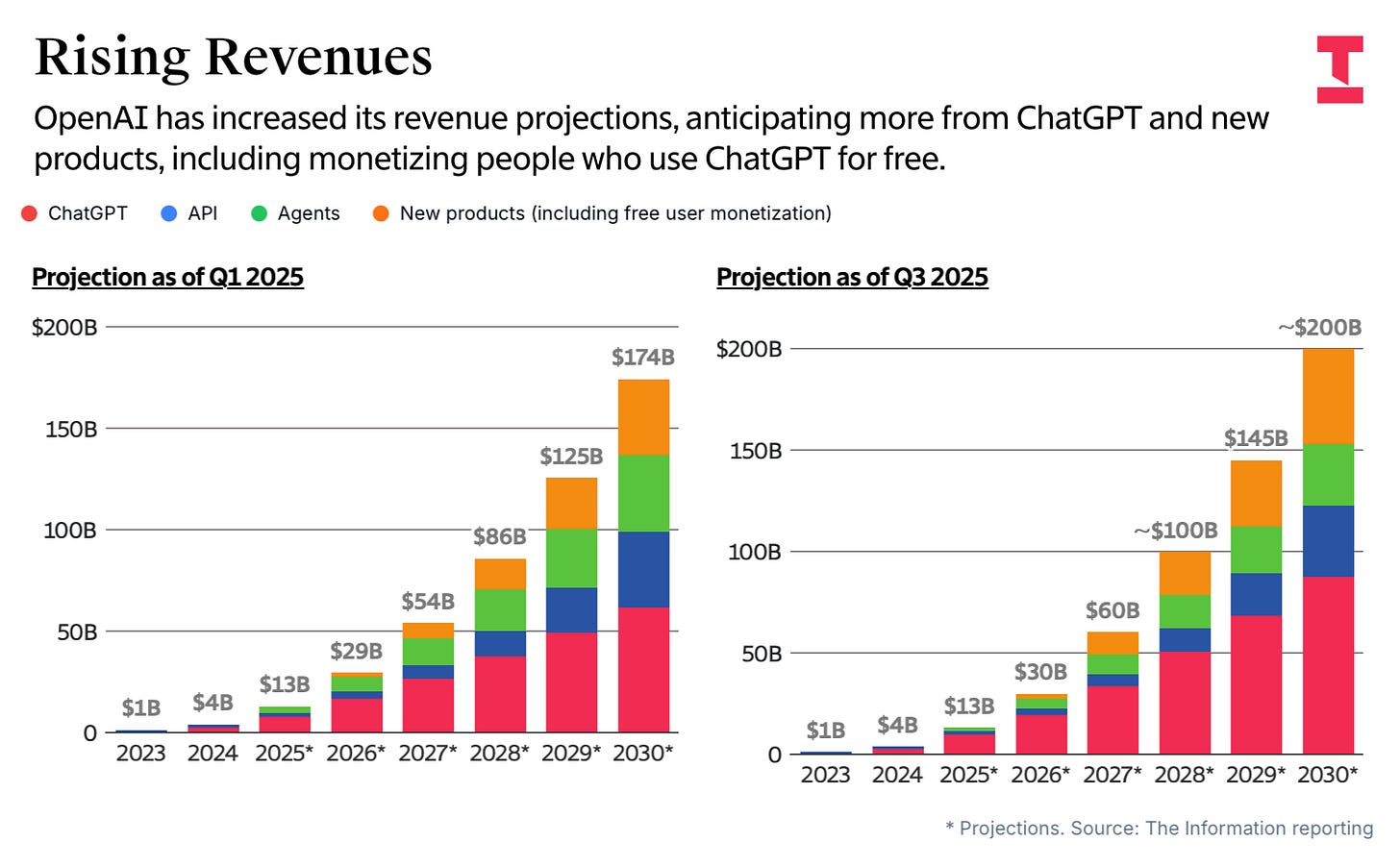

“Overall, the company has projected $13 billion in total revenue this year, up three and a half times from last year and about $300 million higher than its earlier projections for 2025, the new data show. Its revenue projection for 2030 rose about 15% to roughly $200 billion compared to the prior projection.”

“ChatGPT is a large driver of the company’s increased projections. OpenAI expects the chatbot to generate nearly $70 billion in additional revenue over the next six years, compared to earlier projections. Millions of people and thousands of businesses pay subscription fees to use ChatGPT.”

“OpenAI projected nearly $10 billion in revenue from ChatGPT this year, an increase of roughly $2 billion from projections earlier this year, and nearly $90 billion in revenue from the chatbot in 2030, a roughly 40% increase from the earlier projections.”

“OpenAI’s projections also raised expectations for how it will generate revenue from users who don’t pay for ChatGPT. It’s unclear how OpenAI plans to make money off that portion of its user base, although it could include shopping-related services or some form of advertising. The data show the company expects to generate around $110 billion in revenue between 2026 and 2030 from such services.”

“Altman had previously discussed the possibility of charging shopping-related affiliate fees–or a cut of a sale initiated from a user’s search on ChatGPT. Earlier this year, Friar had also discussed the possibility of selling ads but said the company has no active plans to do so.”

And questions on the ultimate margins of the blended business:

“Facebook-Like Margins”

“In its earlier projections, OpenAI projected that the average revenue per user from “free user monetization” products would be $2 per year starting next year and $15 per user per year by the end of the decade, by which time it expected to have two billion weekly active users. OpenAI also told investors these products to have gross profits margins similar to those of Meta Platforms’ Facebook, between 80% and 85%. It isn’t clear if these expectations have changed lately.”

“Notably, OpenAI lowered its projections for generating revenue from its application programming interface, which companies such as Anysphere and Salesforce use to power their AI applications, by $5 billion over the next five years. And it projected about $26 billion less revenue from “agents,” or products that involve AI that handles tasks involving multiple steps. The reasons for that couldn’t be learned, but it’s possible that more such technology will be built into ChatGPT rather than offered as a separate product.”

“In any case, the increase in ChatGPT revenue projections more than made up for those decreases.”

“Microsoft, which is OpenAI’s biggest outside shareholder, is entitled to 20% of OpenAI’s revenue, and the startup’s cash flow projections account for that payout.”

So the the Bigger Picture of OpenAI’s long-term business model becomes a bit clearer, both on the good and ‘bad’ side. And it’s illustrative of the complex set of challenges faced by the AI industry at large in this AI Tech Wave. And I daresay there’ll be more surprises in both directions ahead.

But these turbulent waters will have to be navigated. By OpenAI, and the companies alongside it. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)