AI: Deeper dive into negative Tariff impact on AI/Tech ahead. RTZ #684 (part 2)

The markets are in the throes of the unprecedented near-term volatility driven by the Trump Tariffs. I’ve discussed their implications at a macro level, and for the AI/Tech industry in particular in Part 1 (RTZ # 682), at this early stage of the AI Tech Wave.

But it is easy to get carried away by the muscle memory of near-term volatility in terms of ‘Buying the Dip’, and other tactical market signals. Especially given the intra-day and day to day volatility of the ebbs and flows of the tariff negotiations underway.

Note the intra day volatility when the markets recovered strongly but briefly on the false reports of a ‘90 day pause’ in rolling out tariffs beyond China. That proved false when the administration announced that it was ‘fake news’, and the markets resumed their downward trend.

The point is it’s important to keep the fundamental, bottom up drivers for the tech and AI industries, that are utterly shaken to their core in terms of uncertainties that go FAR beyond specific tariff negotiations. The fundamental tech/AI table is being reset in terms of the global supply chain. And the events have not yet even begun to unfold and be discounted into the public and private markets.

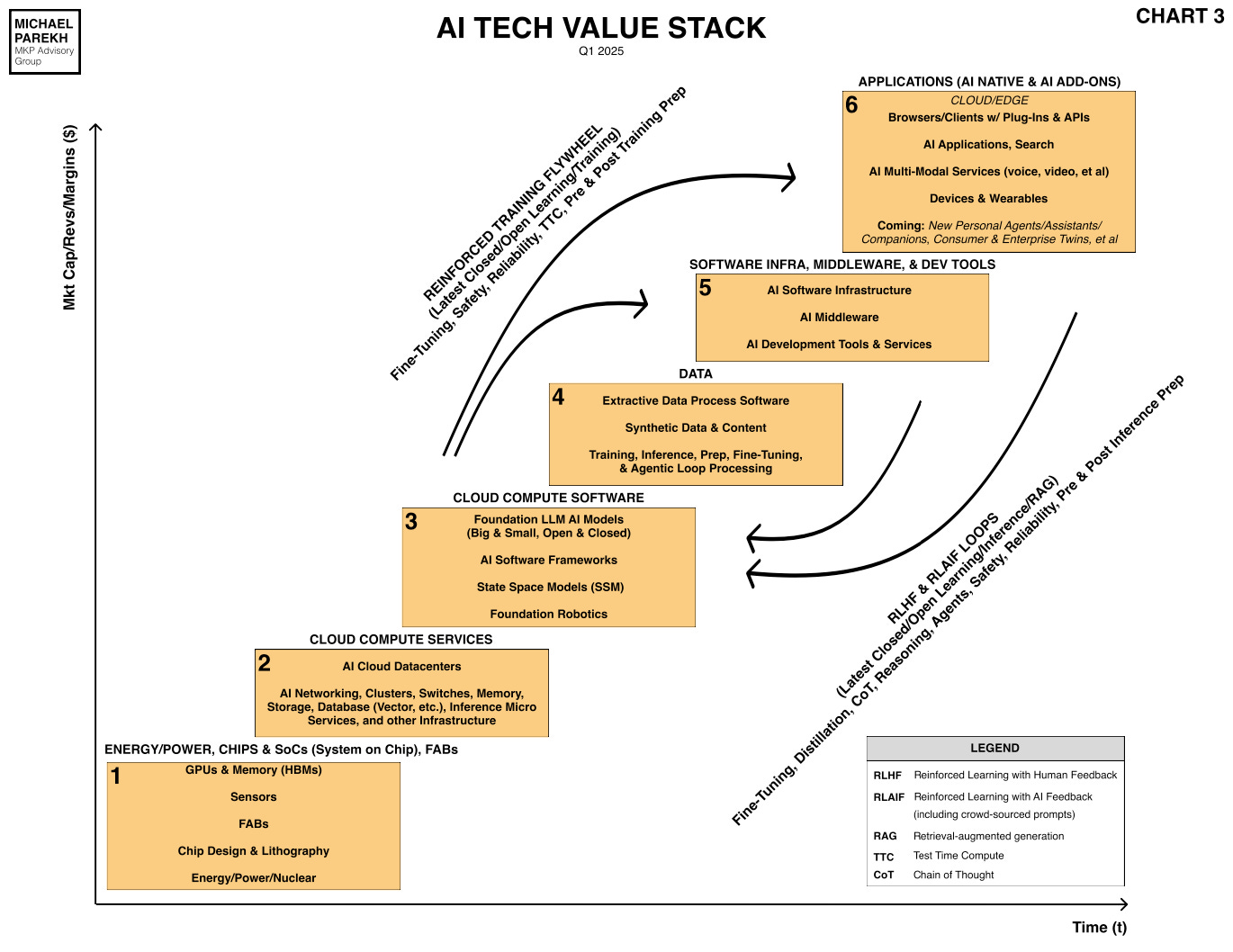

That has to be kept in mind as all stakeholders large and small figure out the AI Tech Wave probabilities up and down the tech stack ahead. So it’s worth revisiting the ‘Tech Trade War’ implications a bit deeper.

The Information lay it out in “Tech’s Biggest Trade War Losers”:

“Trump’s aggressive trade moves mean every U.S. tech company, large and small, now faces threats to its business.”

The ‘Mag 7s’ especially are in very different waters in the months ahead:

“A pullback in e-commerce and ad spending could hammer Amazon and Meta Platforms, and general macroeconomic malaise could hurt cloud computing growth. Less obvious threats, however, are brewing as a global trade war intensifies. EU retaliation aimed at digital services could hurt U.S. tech companies across the board, for instance. Another question is whether China’s counter-tariffs will deal a double whammy to Apple.”

“We’ve taken stock of the biggest tech losers—and some potential winners—emerging amid the fast-moving trade changes.”

Starting with online retail:

“E-Commerce Upheaval”

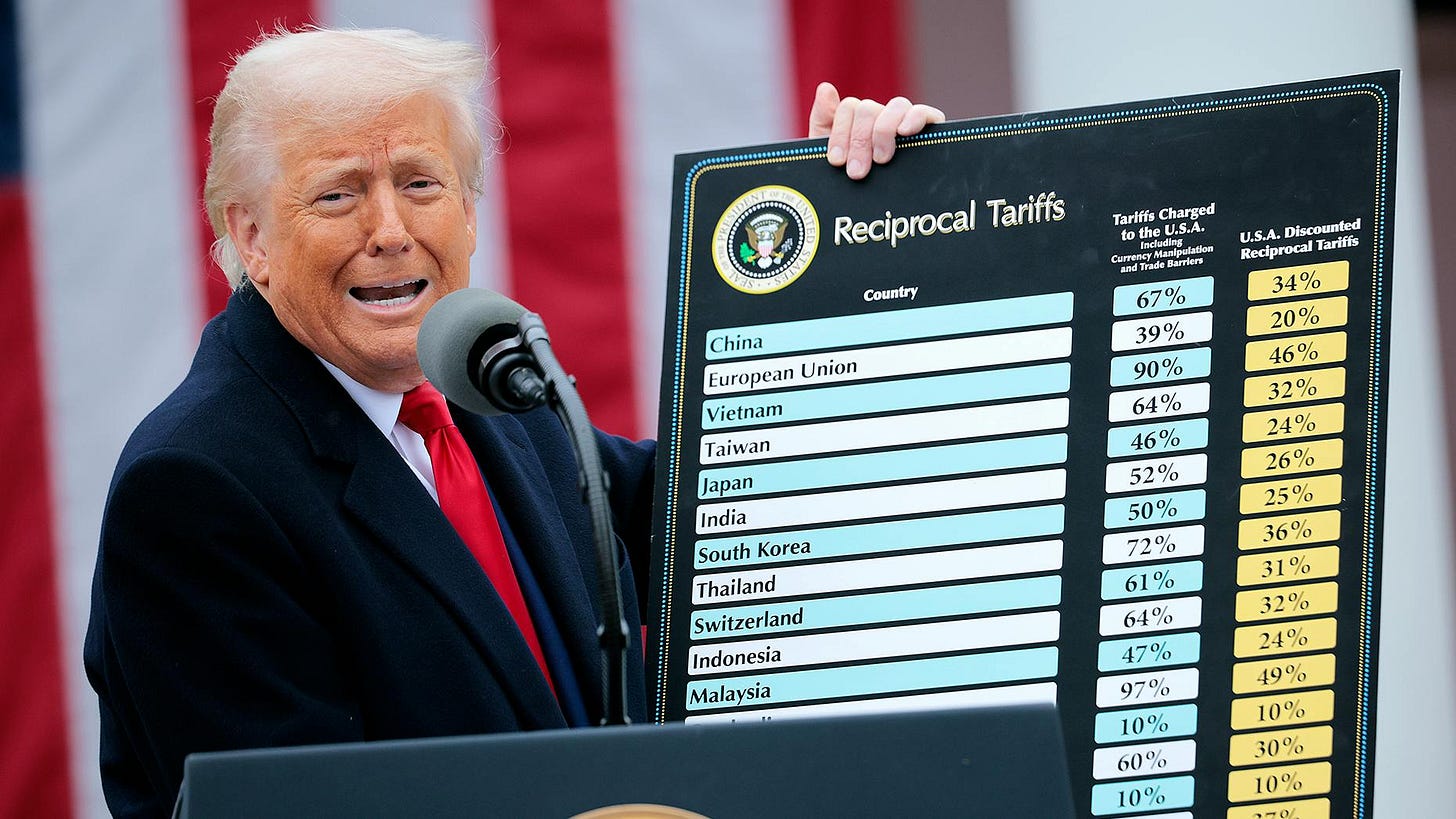

“Merchants that sell imported goods online, particularly items from China, will hike prices or eat some of the tariff costs, hurting sales, margins or both. Blanket 10% tariffs on imports have already gone into effect, while country-specific tariffs, including 34% or more on goods from China, are due to hit on Wednesday.”

“More than 60% of Amazon’s e-commerce sales come from outside sellers, many of which are based in China or manufacture there. Some Amazon sellers have already started hiking their prices for shoppers.”

“After that, e-commerce firms have less than a month before they get hit by another major trade change—the Trump administration last week also announced the end of a provision that allows e-commerce sellers to avoid tariffs on parcels of China goods sent directly to shoppers. The provision, known as de minimis, will end on May 2 for goods from China, and companies that use it will see their tariff rate go from zero to 40% or more.”

And the impact of course will be on both sides of the supply chains:

“That will destroy a prominent way China-founded sellers like PDD Holdings’ Temu and Shein keep their prices low and lure bargain-hunting U.S. shoppers. U.S.-based e-commerce sellers that use de minimis will likely hike prices. Amazon also launched a discount store called Haul last year relying on the same model.”

“Used apparel sellers like ThredUp will escape the pain, however, since items already in the U.S. wouldn’t be subject to tariffs even if they were originally manufactured abroad. Both eBay and Etsy, which sell vintage goods and collectibles in addition to new products, could also be better off than Amazon.”

Then of course it the AI Cloud area, and online Ad impact:

“Cloud, Ad-Spending Pullback”

“U.S. tech giants like Amazon, Microsoft and Google are spared from tariffs on one major front—Trump exempted semiconductors from tariffs on chip manufacturing hubs, including a 32% tariff on Taiwan and 25% on South Korea. That’s a relief for chipmakers like Nvidia as well as their tech customers.”

“But tariffs will still make data center construction more expensive. Oracle, for one, is concerned about higher costs for servers and other materials, The Information reported on Monday.”

“A bigger near-term problem, though, is the likelihood that tech giants’ digital ad revenue and possibly their cloud computing revenue will suffer amid broader uncertainty sparked by tariff announcements. Advertisers tend to pull back in the midst of economic uncertainty, while companies may dial back spending on cloud services.”

And collateral damage beyond:

“E-commerce pain could also spill over into the digital ad market.”

“Meta Platforms is a major destination for online sellers’ ad dollars, and heavy spending by Temu and Shein on Meta ads drove up ad prices in recent years, said e-commerce ad consultant Sue Azari. As Temu’s and Shein’s business suffers, they’re likely to pull back on ad spending. That would in turn hurt TikTok, Pinterest and Reddit, where some e-commerce ad spending had migrated to avoid competition with Shein and Temu.”

“Amazon’s ad business is also closely tied to its e-commerce sales growth. Merchants will likely spend less on boosting their products on its site as their margins come under pressure.”

Retaliation from trading partners can come beyond manufacturing, and hit the US in the far bigger and lucrative Services segment which is over 70% of US GDP vs 10% for Manufacturing, the segment that the tariffs are trying to ‘save’.

It’s the multi-trillion dollar segment vulnerability, while focusing on the trillion plus segment in focus.

Europe is already thinking along these lines:

“Europe Retaliation”

“Trump announced a 20% across-the-board tariff on the EU, as well as specific levies on automobiles and other products. The bloc has proposed targeted counter-tariffs on a range of U.S. goods.”

“But EU officials are also considering striking back by targeting digital services such as cloud computing, software and digital ads sold by U.S. companies. Retaliation could take the form of a tax on their European revenue, something the EU has been discussing for years.”

“Europe spent more than $450 billion on services from the U.S. in 2023, according to EU statistics, including tech and other sectors like banking. Europe is a major market for every major U.S. tech firm—for example, 24% of Apple’s revenue comes from Europe, while 29% of Google’s comes from Europe, the Middle East and Africa.”

“The U.S. is a big exporter of digital services,” said Kay Jebelli, senior director for Europe at the Chamber of Progress, an industry group funded by companies including Amazon and Andreessen Horowitz. “So that’s an obvious target.”

“At the same time, the trade tensions are heightening other tech policy threats.”

“Under the EU’s General Data Protection Regulation privacy rules, tech firms can transfer data about European users to U.S. servers as long as they comply with consumer protection laws, under a provision known as an adequacy decision.”

“The EU could revoke that provision to push back on the U.S. trade moves, Jebelli said, making it much harder for U.S. tech companies to operate in the EU. Over the weekend, France’s economic minister, Eric Lombard, said the EU could “regulate the use of data by certain digital players” as part of a response to tariffs.”

And the deeper impact on global supply chains that could result in $3500+ iPhones, despite Apple trying to expand its iPhone footprint in places like India:

Here’s more on why building iPhones at scale in the US is an impractical aspiration. The White House seems to think it’s possible. But then there’s the practical realities.-

The skilled and unskilled people required, along with the multiple production process steps at scale require millions of workers over years, with high turnover. The US does not turn out those folks in the numbers required. Apple has since 2007 employed over 33 million workers in China of both genders to make iPhones.

By comparison, the total population of Taiwan, coveted by China is 23 million.

The population of the US is around 330 million.

So an expectation of over 10% of the US population, not workforce, would cumulatively make iPhones is a fantasy.

Milton Friedman had it right when he mused how a pencil gets made around the world back in 1980. It’s why even Trump ally Elon Musk tweeted/X’d that video to highlight the merits of global free trade.

One could make a similar video about an iPhone today. Thus the supply chain challenges for Apple today.

“Supply Chain Questions for Apple, Meta”

“Consumer hardware firms had already been retooling their supply chains in recent years to add manufacturing outside China. But new tariffs on imports from countries including India and Vietnam could lessen the benefits of those efforts.”

“Apple has added manufacturing in both India and Vietnam, though it still relies heavily on China. And Meta has been shifting some production of its headsets out of China to Vietnam, The Information reported late last year.”

“Still, there are few straightforward answers right now, and big tech companies are unlikely to make knee-jerk supply chain adjustments. For example, in a Friday Truth Social post, Trump hinted that he might lower tariffs on Vietnam.”

“For some U.S. hardware makers like Apple, China is also a large consumer market in its own right—for instance, China represents just under 20% of Apple’s revenue.”

China of course can use this as a bargaining chip:

“It’s possible that China’s counter-tariffs could even hit goods made within the country for domestic consumption. It’s unclear whether Apple products manufactured in China are exempt from the country’s new 34% tariff on U.S. goods, said Mark Malek, chief investment officer at brokerage Siebert Financial.”

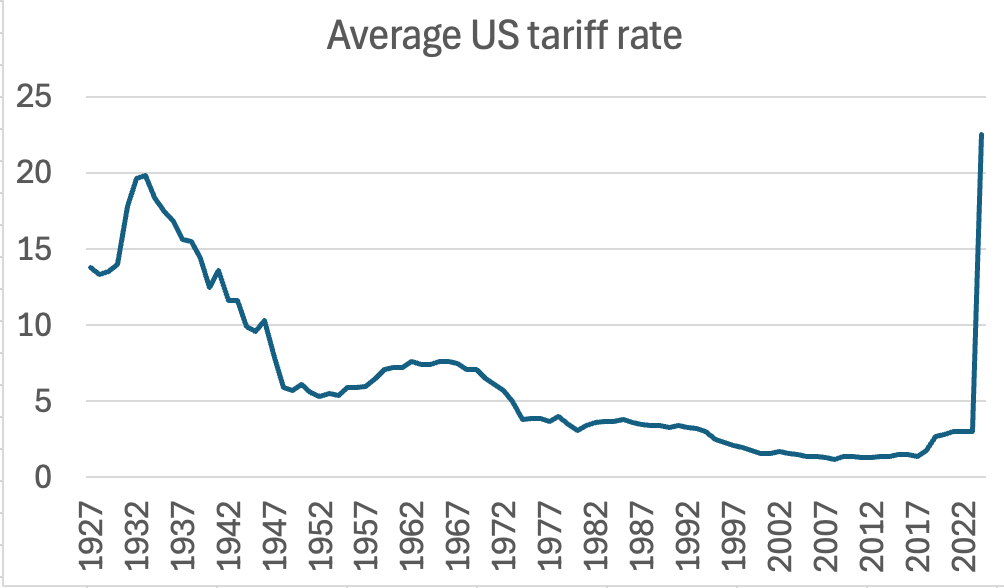

We’ve far surpassed the 1930 Smoot Hawley tariff rates that triggered the Great Depression. Never mind today’s debates over a Recession.

All this is to highlight that the fundamental, secular, bottom up vulnerabilities for US Tech and AI have yet to unfold and be understood. So the risks to this AI Tech Wave are less clear than they were a few weeks ago, as are the potential rewards. So great volatility is more the norm for the near term. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)