AI: Enterprises ramping up AI use cases. RTZ #531

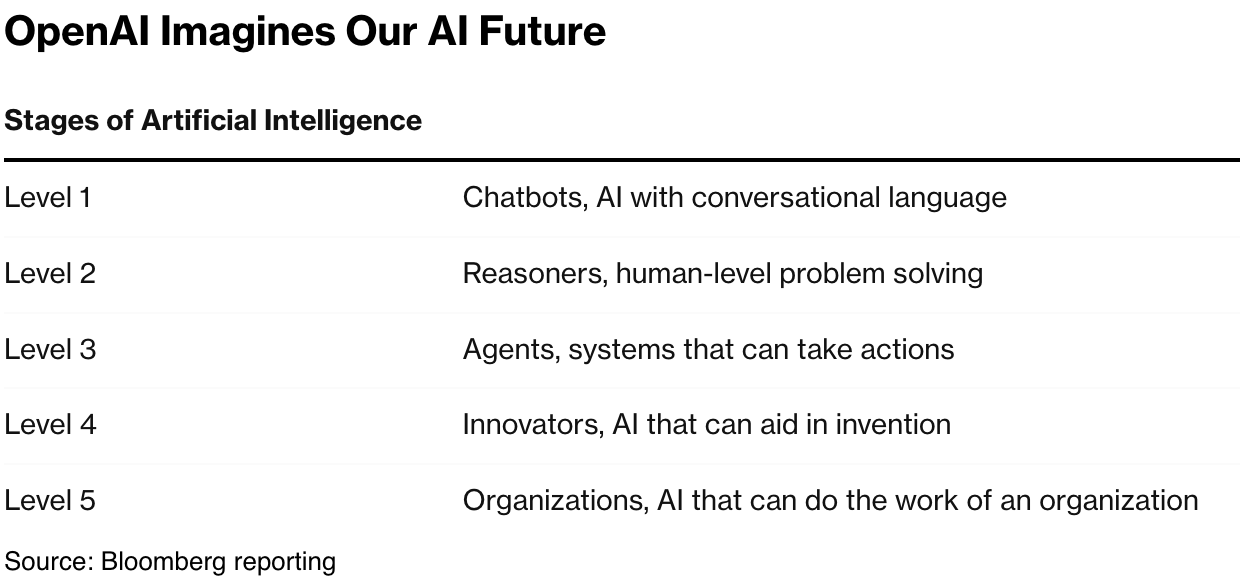

I’ve said for a while that Enterprise sales of AI products and services, be they ‘add ons’ or ‘AI Native offerings, will be a long, ‘work in progress’ slog in this AI Tech Wave. Enterprises, both small and large, are intrigued by LLM/Generative AIs. And they’re experimenting galore with the tech, in their ‘chatbot’ to ‘reasoning’ ‘agent’ forms on the early layers of AI on the OpenAI road to AGI I’ve discussed.

And of course traditional Enterprise Cloud Software will likely see its growth ‘feel’ the AI Wave.

This latest piece by the Information “Corporate Spending on OpenAI Threatens Salesforce, Other Enterprise Apps” provides new context:

“Companies are increasing their spending on generative artificial intelligence without boosting their IT budget, meaning they are cutting other types of cloud software and enterprise apps.”

“Artificial intelligence is supposed to transform the business world and boost the software industry that’s selling it.

But as companies spend more money on chatbots and other conversational AI (see related chart), some say they plan to reduce spending on other types of software, such as expensive enterprise applications and non-AI cloud services. That could limit the upside from AI for providers of cloud services and enterprise software.”

Of course Microsoft and its partner OpenAI are at the forefront of these opportunities, along with Google Cloud, Amazon AWS and others.

Corporate enterprise budgetary habits are shifting:

““AI is becoming a core part of the budgeting process in a way that it wasn’t a few years ago, but [customers] are carving room out in the budget for AI by optimizing other things,” said Shaown Nandi, strategic accounts director at Amazon Web Services, which sells AI to businesses. (In the cloud industry, the word “optimization” is synonymous with spending cuts.)”

“Interviews with IT executives and new data on corporate AI spending show that conversational AI has become a substantial, recurring expense at dozens of large companies, with several of them on track to spend tens of millions of dollars annually. Though that still represents a small amount of companies’ overall IT or cloud budgets, it is evidence they are ironing out some of AI’s notorious kinks while using it to replace older software applications or other types of cloud spending.”

“The trend has shown up in earnings reports from large cloud providers such as Microsoft, which said last week that revenue growth from non-AI cloud services had dipped slightly in the third quarter as AI revenue growth increased slightly. And Amazon Web Services said the sale of AI services has more than doubled over the past year, yet overall cloud revenue in the third quarter grew at the same rate as in the prior quarter.”

Microsoft of course is all in with AI Copilot across their product lines bundled into pricing across their enterprise wares.

OpenAI is also seeing success on this front, as this piece notes:

“T-Mobile agreed to pay OpenAI roughly $100 million over the next three years as part of a deal to use the startup’s technology, The Information reported on Monday. T-Mobile is paying to use OpenAI’s models to develop a new customer service chatbot that will aim to remember customer-specific data and use generative artificial intelligence to answer the bulk of their questions without the need for a human agent. T-Mobile said it plans to release the tool next year.”

“The deal marks one of the largest contracts OpenAI has scored with an enterprise customer so far. Many large companies are planning to increase their budget for generative AI in the coming year, but are simultaneously cutting back on other expenses including legacy IT software, according to interviews with IT executives and company disclosures. OpenAI and T-Mobile announced the deal in September, but the value of the deal has not been previously reported.”

All this of course should give investors some more comfort givent the ever increasing AI capex budgets. That there is growing evidence of AI revenues from these new fangled products and services, as new AI Data Centers get built to deliver the AI ‘Compute’.

As the Information continues to note:

“For companies with the know-how to develop apps, especially software firms like C1, large language models from OpenAI and others are proving useful as coding assistants for software engineers and for powering customer service software.”

“A growing number of companies are also using LLMs to speed up routine internal tasks like compiling data from documents or handling informational requests from employees to human resources and IT departments. Software companies are also using LLMs to automate the work of salespeople who make cold calls or send emails to large numbers of prospective customers.”

“In some cases, the latest forms of AI are helping companies spend less on AI functions they were paying for previously. Kinesso, the tech arm of advertising giant IPG, initially tested ChatGPT for employees, but more recently it built its own chatbot using Google’s AI to help employees quickly search corporate documents and generate images for creative advertising teams.”

The whole piece is worth reading, especially in terms of the charts of enterprise AI applications that companies are allocating growing IT budgets towards.

And AI in the Enterprise is not just for traditional enterprise SaaS focused companies. Palantir’s results this week showed how AI budgets are growing both in the Government/Defense and Commercial sectors, with the latter growing faster this quarter:

“The U.S. business is growing faster than the company as a whole, with its revenue up 44% in the latest quarter relative to a year before. U.S. commercial revenue was up 54%, while U.S. government revenue was up 40%.”

“Palantir’s latest results are, “dare I say, a slap in the face of people who continue to believe that the value of AI is solely in building AI large language models,” Chief Executive Alex Karp told MarketWatch.“

He underlines the key point of course of this piece in whole, that AI chatgpts in the form of ChatGPT, two years old this month, are just the beginning of what’s possible with AI technologies applied in a whole host of old and new ways.

For now in this AI Tech Wave, this is less a story of a ‘zero sum game’ broadly across enterprise software and cloud budgets, despite individual examples of companies shifting their budgets around for AI applications and services.

There is a while to go for AI product innovation and ultimate ‘product-market-fit’. We’re in the early days, and will have to wait for how companies end up using AI at scale. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)