AI: Exxon to the AI Energy Rescue? RTZ #568

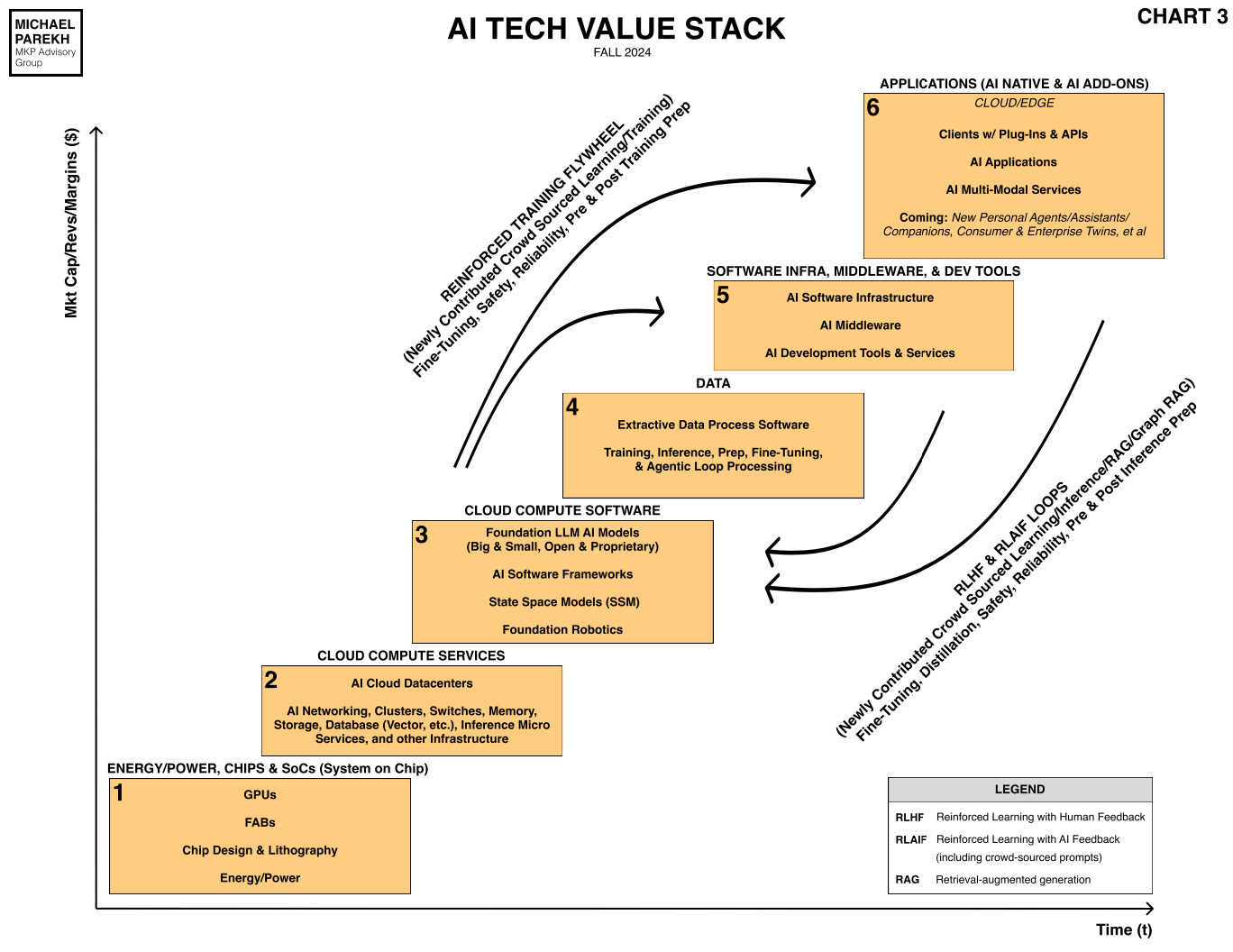

This AI Tech Wave continues to illustrate that ‘necessity is the mother of invention’ ever day. Up and down the AI tech stack below, from the lowest Box 1 for AI power and chips to Box 6 for AI applications and services for billions of mainstream users.

We’re seeing some of that invention in Box 1 with no other than Exxon raising its hand. Throwing down the gauntlet to potentially provide gigawatts of power using natural gas with built in carbon capture, to meet the trillion dollar plus AI data center ramp and their power needs. And help the big tech companies as they rush to nuclear power for their upcoming data center needs.

Bloomberg explains in “Exxon’s AI Power Play Aims to Beat Nuclear”:

“The oil major is betting Big Tech’s need for speed will open up a bigger market for gas-fired plants.”

“To most of us, a power plant is a source of electricity. To Exxon Mobil Corp., it’s a machine that converts natural gas into money. And this is a propitious time for doing that.”

“Exxon announced this week that it is getting into the electricity game — sort of. Data centers, particularly those developing artificial intelligence tools, are projected to need significant amounts of electricity. Preferably, this would be carbon free but, if that isn’t available right now, they will use whatever is. Enter Exxon, which proposes supplying them with electricity from a gas-fired plant but also capturing most of the greenhouse gas emissions pumped out.”

Key attention getter for AI companies is the word ‘Gigawatts’. These are amounts of energy that these 100,000+ AI GPU super clusters ‘AI Table Stakes’ needed. Especially as they ’Super-size’ to hundreds of thousands of GPUs and into millions over the next few years. Most of them from Nvidia of course.

“Exxon boasts that it has already developed 5.5 gigawatts of power generation in house. But these supply power to its own activities; tools for a job like generators on a construction site. By the company’s own admission, it doesn’t “bring a lot of value creation” to power generation per se; it’s an oil major, after all. Rather, it sees itself as a “convener,” a project manager par excellence who can get a plant built on budget, on time, plus supply the fuel and capture the emissions.”

Those gigawatts potentially trump the nuclear gigawatts in size, cost, and time to market.

“The main selling point here, more than the low emissions, is speed.”

The ‘need for speed’ of construction at scale, is the name of the game for the AI Tech Wave currently.

Big Tech wants more power yesterday. There has been a flurry of initiatives from the likes of Alphabet Inc. and Meta Platforms Inc. to encourage new nuclear power plants. The latter are viewed by some as a silver bullet given the large, consistent quantities of carbon-free electricity they could generate. But those bullets are very expensive and a decade or more away. In the meantime, hyperscalers are contracting for gas-fired power, as exemplified by Meta’s recent deal with utility Entergy Corp. in Louisiana.”

Not to mention Microsoft, Google, Amazon and most LLM AI hyperscalers.

“In a sense, Exxon aims to split the difference. It says it can build a gas plant with carbon capture technology relatively quickly, perhaps five years, in part because the plant would be co-located with a data center and, crucially, not connected to the wider grid. Being a standalone plant that doesn’t supply the grid would avoid lengthy regulatory and interconnection delays as well potentially long waits for grid hardware such as transformers, where Big Tech’s growing demand for new generation is tightening an already strained supply chain. (Nuclear plants must have a grid connection, for safety reasons.)”

And it’s natural gas with a cool bonus:

“Moreover, if Exxon can make the plant and emissions capture work, it offers potentially near carbon-free power years ahead of any new nuclear plants. Chief Executive Darren Woods said pointedly during Wednesday’s presentation: “If you’re betting on nuclear and something coming down the road, you got a long road.” He drew out the l-o-o-n-g for effect.”

And Exxon is going where Willy Sutton went to rob banks. It’s where the MONEY is:

“Moreover, Exxon knows Big Tech will pay up for the privilege. Both Amazon.com Inc. and Microsoft.com Inc. have offered to pay significantly above prevailing wholesale prices for electricity from existing nuclear plants. Meanwhile, Entergy’s plants to supply Meta’s data center will cost about $1,400 per kilowatt-hour of capacity to build, or 40% above the typical level, according to Hugh Wynne, an analyst at Sector & Sovereign Research LLC. That’s before factoring in the cost of adding new solar capacity and an investment in carbon capture at an Entergy gas-fired plant that Meta is making to atone for the new plants’ emissions.”

And an additional bonus is that natural gas is abundant in Texas and the Permian basin, where a lot of AI data center projects are already underway:

“Similarly, Exxon could presumably site its co-located data centers in gas-rich Texas, where its booming Permian oil business produces a lot of gas. Natural gas in West Texas often trades at a discount or, as for much of this year, even negative prices. Exxon’s proposal isn’t really about getting into the power business per se. That’s just a means to an end. It’s about capitalizing on Big Tech’s needs to monetize otherwise low-value molecules at a premium.”

The last bonus of course is political, with the coming changes in Washington in January:

“For Exxon, signing up customers for new power projects might help persuade the incoming Trump administration, including a certain AI-invested cost-cutting czar, to protect the Inflation Reduction Act’s expanded carbon capture credits. Those are worth up to $85 per metric ton, equivalent to more than $30 per megawatt-hour for output from a typical new gas-fired plant, which is higher than the production tax credit for nuclear plants. Above all, as with the nuclear startups casting yearning looks toward Silicon Valley, there’s much to be said for having pilot projects underwritten by deep-pocketed customers engaged in an AI arms race.”

Exxon seems to be moving at ‘tech speed’ on this opportunity. And that’s a potential positive for this AI Tech Wave. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)