AI: Google best positioned for 'Proactive Spinoffs'. RTZ #740

I’ve long discussed in these pages the counter-intuitive merits of the Big Tech (aka Mag 7) pre-emptively pursuing spinoffs of its key assets, to accelerate its long-term opportunities in this AI Tech Wave. Especially for companies like Google, whose every business unit DRIPS with opportunities with AI at Scale. Its Chrome browser alone is a case in point as I discussed yesterday in my piece on AI Browsers ahead.

Proactive Spinoffs are a possible way to get more than two steps ahead, while they may seem to be one step back.

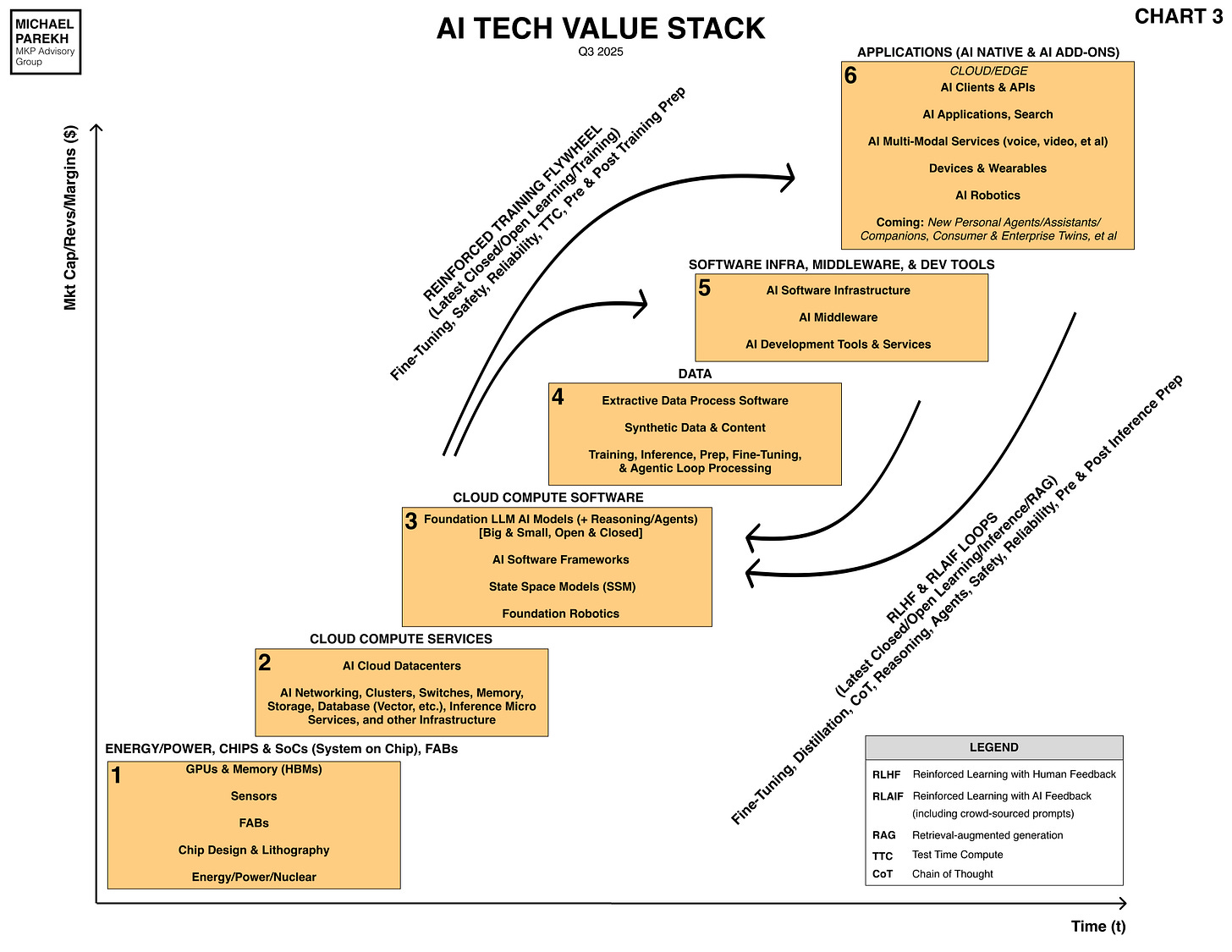

Especially against the relentless ongoing US and EU antitrust and other regulatory initiatives. These spinoffs can be minority positions spun out to public investors, potentially with third party partners that would give investors better ‘pure play’ AI investment options up and down the AI Tech Stack below.

The most likely Mag 7s to benefit from proactive spinoffs in my view would be Google, Meta, and Amazon. The least likely would be Tesla given the reverse logic of Elon Musk needing to consolidate his various ventures into a public company like Tesla, with its meme aspiration driven valuation that’s the highest amongst its peers and the auto industry. Microsoft and Nvidia are further down the list as possible beneficiaries due to the nature of their businesses and AI opportunities. Apple is the least likely inclined due to its core DNA and culture.

So that leaves Google as prime candidate, especially with multiple antitrust actions and a remedies phase underway. Regulators are targeting a separation of its Chrome browser, which is a fundamental funnel into its core Search business. And marketing of Google Search via multi billion dollar annual deals with Apple, Samsung and other hardware/device vendors.

The New York Times picked up on this topic this week in “What if Google Just Broke Itself Up? A Tech Insider Makes the Case”:

“Google has lost two important antitrust cases in the past year. Its search business is threatened, and its stock is stalled. Federal prosecutors are pushing for it to divest various businesses. Unless the company can pull off a few miracles in court, it will be forced to shrink.”

“There’s another possibility. Instead of resisting change, Google could accelerate it. It could spin off huge chunks of itself into independent entities.”

Great minds, as they say:

“That would be a very Silicon Valley power move: Break yourself up before courts can break you up. In an era when Big Tech is under suspicion, a maneuver like this would probably be applauded across the political spectrum. For a company that used to have the motto “Don’t be evil,” such redemption might be irresistible.”

“The Department of Justice wants Google to sell its Chrome browser and its ad network, and maybe its Android mobile business, to fix its monopoly problems. But Gil Luria, a technology analyst with D.A. Davidson & Company, an investment firm based in Montana with $6 billion under management, is thinking bigger. Much bigger.”

The logic laid out is pretty straightforward as articulated, from a fellow Analyst:

“He published a research note on May 12 saying Google had become a conglomerate. This was not a compliment. He meant that Google offered an array of products and services that often have little relationship to one another, including the Waymo self-driving taxi service, YouTube, a cloud storage business, a search firm and an ad network, among other things.”

Note that YouTube is likely the relatively easiest entity for Google to proactively spin off, as earlier discussed.

“Google’s $2 trillion stock market valuation is driven by search advertising, which generates more than half of its revenues. Search is also the part of the company under the most pressure as artificial intelligence begins to answer queries. Google searches in Apple’s Safari browser fell for the first time ever in April. That’s one big reason Google shares are down more than 9 percent this year.”

“Other parts of Google are not getting their due. If Waymo were publicly traded, Mr. Luria argued, investors might give it something closer to Tesla’s $1 trillion valuation, especially since Tesla’s self-driving cab ambitions are little more than a concept at this point. The same goes for YouTube when compared with its rival Netflix, a Wall Street darling.”

“Mr. Luria estimated that all the parts of Google could separately be worth more than $3.7 trillion, or nearly double the company’s valuation now. “Investors want a big-bang breakup, not isolated spinoffs,” he wrote.”

“The benefits would not just be financial, he said. Competition would be stoked. Unleashed engineers might create things as amazing as the original Google search engine, which awed people who first used it a quarter-century ago.”

That last point is particularly key. The biggest unknown benefit from these spinoffs are the creative innovations at scale possible from unleashed assets. Especially at big technology change points like today’s AI Tech Wave.

But ideas like this generally don’t happen in the ‘real world’, generally due to industry inertia and cultural DNA ‘set in its ways’. Thus external legal forces are the usual drivers, in a messy way.

“Mr. Luria knows his proposal is a long shot. “The likelihood of the Google board proceeding in this direction is probably less than 10 percent,” he said in an interview. “But it goes up every day.”

“The analyst’s analysis got a fair amount of traction in the financial press. The moment was right: Google was arguing to Judge Amit Mehta of U.S. District Court in Washington that its punishment for illegally monopolizing online search should be relatively light.”

“The government and Google met in court again on Friday for closing arguments in the penalty phase of the trial. A decision by Judge Mehta might come this summer. Google has said it will then appeal. Barring some sort of a wild card from President Trump, the process could slog on for years.”

“Google’s troubles were compounded by a second antitrust trial. That one, over Google’s advertising technology, resulted in April in another decision against the company. The penalty phase will take place later this year. Google is likely to appeal that case, too.”

“Other asset managers say the logic of a breakup is clear to them.”

“While breakups often promise to unlock shareholder value in theory but fail in practice, this case appears to be an exception, one where real value could be realized,” said Gene Munster, managing partner at Deepwater Asset Management.”

History has shown out that these things actually produce above expected results and returns for customers and investors alike:

“There is a precedent here. In the early 1980s, the national phone company, AT&T, had been fighting off the Justice Department for many years. Worried that it would lose the case, AT&T agreed to voluntarily break itself up. It kept the long-distance lines and shed the seven regional companies that offered local calling. For the next decade, at least, competition reigned.”

Company arguments against these separations are relatively bland as expected:

“Google declined to comment directly on Mr. Luria’s arguments. A spokesman pointed to a blog post that said the Justice Department’s “proposal to split off Chrome and Android — which we built at great cost over many years and make available for free — would break those platforms, hurt businesses built on them, and undermine security.”

Despite theoretical benefits for other stakeholders:

“If a split encourages competition, proponents argue, that will benefit Google’s ad customers, who will see lower prices. Employees might be more challenged working for a smaller company, where it is easier to move higher.”

“The breakup of Google would only hurt people who would otherwise benefit from unlawful market power,” said Barry Barnett, an antitrust lawyer at Susman Godfrey. “These might include Google executives, whose compensation could fall; start-ups, which could get lower buyout offers from Google or none at all; and rivals like Apple, which could see chances to share revenue vanish.” Google currently pays Apple $20 billion annually to be the default search engine on the Safari browser.”

Other historical examples have murkier results:

“Looming over any discussion of a voluntary breakup is the weight of history. Beyond AT&T, there are few examples of a successful company willing to pull itself apart. Companies that are in permanent slumps have regularly done it, however.”

“General Electric, whose roots go back to Thomas Edison in 1892 and was once as iconic as Google, split itself into three companies last year after skittering close to death. Hewlett-Packard, another iconic company suffering a long-term decline, broke itself in two in 2015.”

“Microsoft, an earlier antitrust target, is often cited as a company that may have benefited from either an imposed or voluntary breakup. The government won its monopoly case against the company in 2000, and the judge ordered it to divide in two. That decision was reversed on appeal, and the parties settled. Microsoft took a confrontational approach to the case from the beginning, and in the end, it paid off.”

And the price of inaction and fighting breakups are also historically discernible:

“Google is taking the path now that Microsoft went down 25 years ago, Mr. Luria said.”

“It’s saying, ‘We are not breaking up, and we’ll fight you tooth and nail in court,’” he said. “Microsoft might have won, but the stock was flat for 10 years. They were so focused on fighting the Department of Justice they didn’t notice the rise of mobile devices or cloud computing.”

Often the companies do get distracted, at a time of big tech wave change opportunities:

“After the government sued Microsoft, David Readerman of Endurance Capital Partners said, “Litigation was a major distraction to Microsoft business unit heads: email retrieval, depositions, et al. There were Xerox document copying centers fenced under the buildings for security reasons.”

“Microsoft did not recover its momentum until Satya Nadella became chief executive in 2014.”

“Google’s competitors would presumably be happy with smaller Googles, although maybe not. IBM had a dominant position in computing for years if not decades, probably even greater than that of Google now. The government pursued an antitrust case against it starting in the late 1960s.”

Another issue of course is super majority voting shares, which is now more prevalent than in earlier stock market and tech history:

“Another issue shadowing any talk of a breakup: Owing to Google’s unusual share structure, major changes could never be undertaken without the approval of the two founders, Larry Page and Sergey Brin. And founders tend to be emotionally attached to what they have created.”

And possible optimism:

“But “never say never,” said Mr. Kovacevich, who worked in public policy at Google for many years.”

“Larry and Sergey like bold, unconventional moves,” he added. “Could they decide at some point this would be beneficial to the company? Sure. Any business leader should keep all options on the table.”

These are tough decisions at tough times. Lots of reasons to say no.

Especially in terms of advantages of staying with the status quo. But today’s investors are the most flexible I’ve seen in thirty years of public/private investing, in terms of special terms and arrangements that can allow incumbents to hold onto the advantages of full ownership, while spinning off minority positions. That’s what Bankers are for.

So given the open-ended opportunities at Scale available in this AI Tech Wave. most companies big and not so big, owe it to themselves and stakeholders to give proactive Spinoffs a serious think-through.

Google more than most. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)