AI: How AI Capex is morphing Big Tech Business Models (part 2). RTZ #804

This us part II of yesterday’s piece on how the AI Tech Wave is for now, changing the business models of big tech Mag 7 companies, as they ramp up AI capex on infrastructure into the hundreds of billions a year.

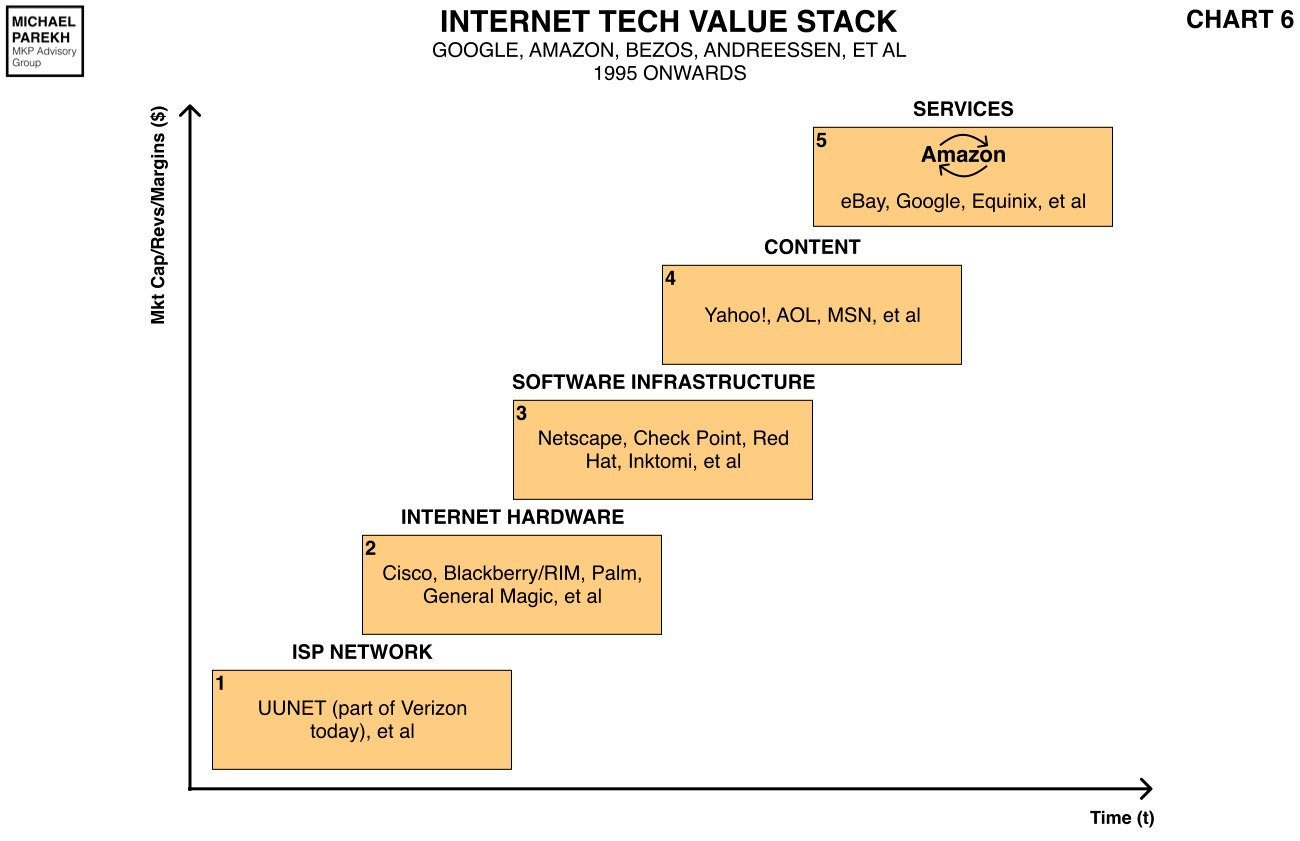

Traditionally, most of them enjoyed higher margins further up the tech stack below (Boxes 5 and 6), with other companies across tech and other industries doing the infrastructure heavy lifting in the lower boxes, with lower relative long-term margins (seen on the Y Axis).

The core message being that unlike the Internet Wave in the nineties, most of the infrastructure spend this time is on the balance sheets of the big tech comnpanies, rather than a separate telecom industry over two decades ago.

This has clear longer-term implications that need to be further emphasized. Specifically on the core margin picture of the underlying big tech companies that have until now been high margin software and ad sales driven companies for decades.

The good news currently is that the revenues seem to be keeping pace with the AI capex for big tech, for now.

As the WSJ goes on to explain in “The AI Boom’s Hidden Risk to the Economy”:

“The build-out of artificial-intelligence infrastructure is costing a fortune, straining companies and capital markets.”

“In the past two weeks one big tech company after another reported blowout earnings amid a wholesale embrace of artificial intelligence.”

“Look a little closer, and a more unsettling side to the AI boom emerges. All the spending on chips, data centers and other AI infrastructure is draining American corporations of cash.”

Of course, most except Nvidia, who is a beneificiary of course of all this spending, along with other big tech infrastructure companies like AMD, Broadcom and many, many others.

And it has a broader impact on the economy and GDP:

“This underscores the hidden risks from the AI boom. No one doubts its potential to raise growth and productivity in the long run. But financing that boom is straining the companies and capital markets.”

“Since the first quarter of 2023, investment in information processing equipment has expanded 23%, after inflation, while total gross domestic product has expanded just 6%. In the first half of the year, information processing investment contributed more than half the sluggish 1.2% overall growth rate. In effect, AI spending propped up the economy while consumer spending stagnated.”

“Much of that investment consists of the graphics-processing units, memory chips, servers, and networking gear to train and run the large language models at the heart of the boom. And all that computing power needs buildings, land and power generation.”

And the key observation to be underlined and noted:

“This is transforming big tech’s business models.”

“For years, investors loved those companies because they were “asset-light.” They earned their profits on intangible assets such as intellectual property, software, and digital platforms with “network effects.” Users flocked to Facebook, Google, the iPhone, and Windows because other users did. Adding revenue required little in the way of more buildings and equipment, making them cash-generating machines.”

“This can be seen in a metric called free cash flow, roughly defined as cash flow from operations minus capital expenditures. It excludes things such as noncash impairment charges that can distort net income. This is arguably the purest measure of a business’s underlying cash-generating potential. Amazon, for example, tells investors: “Our financial focus is on long-term, sustainable growth in free cash flow.”

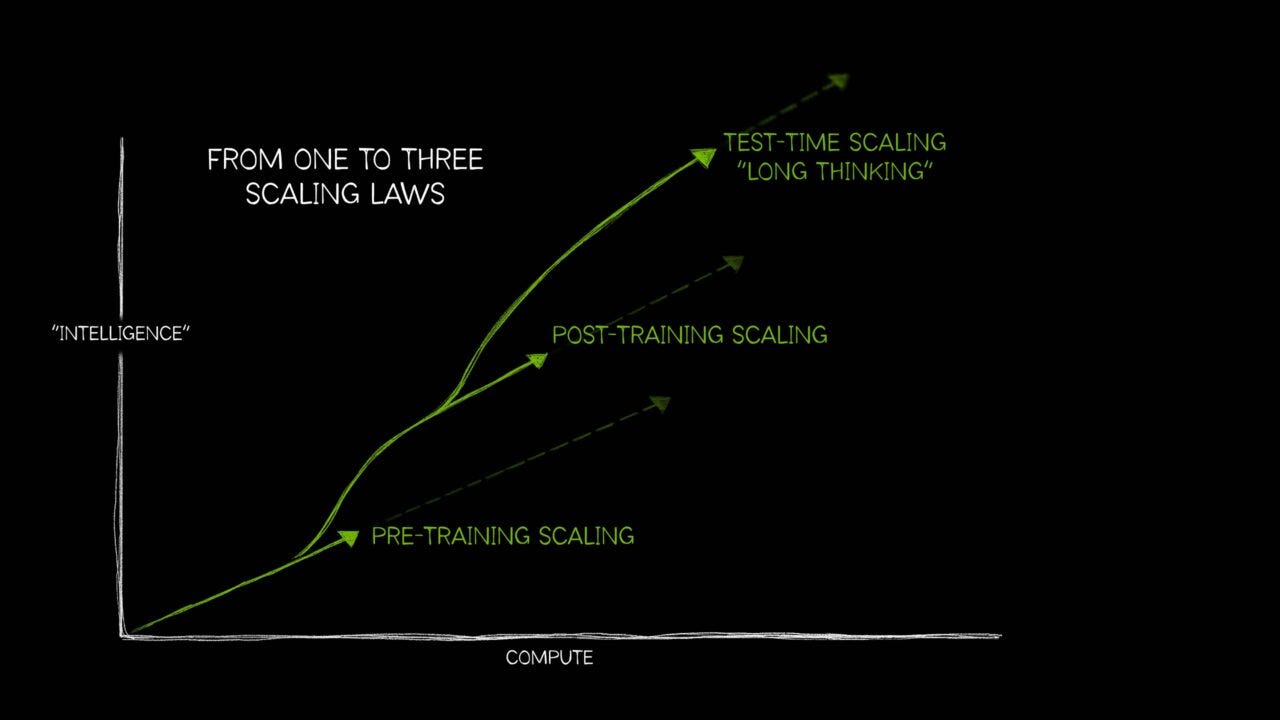

It’s useful of course to track this change over time, as AI is Scaled in many directions:

“From 2016 through 2023, free cash flow and net earnings of Alphabet, Amazon, Meta and Microsoft grew roughly in tandem. But since 2023, the two have diverged. The four companies’ combined net income is up 73%, to $91 billion, in the second quarter from two years earlier, while free cash flow is down 30% to $40 billion, according to FactSet data. Apple, a relative piker on capital spending, has also seen free cash flow lag behind.”

“For all of AI’s obvious economic potential, the financial return remains a question mark. OpenAI and Anthropic, the two leading stand-alone developers of large language models, though growing fast, are losing money.”

And of course the big tech companies are emphasizing the necessity of this spend for long term advantages in AI:

“Much of big tech companies’ latest profits reflect their established franchises: ad spending for Meta and Alphabet, the iPhone for Apple. As to when their AI hardware will pay off, they counsel patience.”

Meta here is of course a great example:

“Meta, parent of Facebook, reported a 36% rise in earnings for the second quarter, but a 22% drop in free cash flow. It said capital expenditure in 2025 would be roughly double last year’s, with “similarly significant” growth in 2026.”

“Meta has said much of its AI-related capital spending supports core businesses, such as ads and content, and is already paying off. The balance goes toward generative AI such as its Llama model. “We are early in the life cycle” of the latter investments, Chief Financial Officer Susan Li told analysts, and “we don’t expect that we are going to be realizing significant revenue from any of those things in the near term.”

Amazon is another one to note, given that it’s the largest Cloud business, with a giant, global ecommerce business strapped to the financials of the parent company as well:

“Amazon began tapering its build-out of fulfillment centers in 2022, allowing free cash flow to turn positive. But in the last year, it has ramped up investment in Amazon Web Services, which hosts data and runs AI models for outside clients, and free cash flow is down by two-thirds from the previous year.”

And as I mentioned above, there are lessons to be noted from previous major tech waves, like the Internet one in particular:

Again, I had a ring side professional seat to these proceedings back in the nineties. So the pattern recognition is vivid.

“Dot-com echoes”

“For now, investors are pricing big tech as if their asset-heavy business will be as profitable as their asset-light models.”

“So far, “we don’t have any evidence of that,” said Jason Thomas, head of research at Carlyle Group. “The variable people miss out on is the time horizon. All this capital spending may prove productive beyond their wildest dreams, but beyond the relevant time horizon for their shareholders,” he added.”

“In the late 1990s and early 2000s, the nascent internet boom had investors throwing cash at startup web companies and broadband telecommunications carriers. They were right the internet would drive a productivity boom, but wrong about the financial payoff. Many of those companies couldn’t earn enough to cover their expenses and went bust. In broadband, excess capacity caused pricing to plunge. The resulting slump in capital spending helped cause a mild recession in 2001.”

Of course it’s important to note the differences in today’s AI tech wave vs the Internet one back then:

“A dot-com-style bust looks far-fetched now. AI’s big spenders are mature and profitable companies, and the demand for computing power exceeds the supply. But if their revenue and profit assumptions prove too optimistic, their current pace of capital spending will be hard to sustain.”

The whole piece is worth reading for additional financial nuances, especially vs the macro economic environment today.

A counter to the above narrative for financial analysts to note is the positive impact for US businesses, and big tech by implication, from the tax breaks of the recent White House Big Bill. The cash flow benefits to big tech is going to be measured in the billions.

The WSJ notes this in a separate piece, “Cash Windfall From Trump’s Tax Law Is Starting to Show Up at Big Companies”:

“Investors are watching boosts to free cash flow as estimates of tax savings trickle out.”

“In short, changes like allowing upfront depreciation of assets and immediate expensing of research-and-development expenses will bring swift windfalls to American corporations but also lasting tailwinds. This in turn has provided incremental fuel to stock markets, a counterweight to risks from tariffs and other policy uncertainty.

The cash savings won’t affect reported earnings, which are calculated using different accounting rules than taxes. It won’t all ultimately end up in free cash flow either, because AT&T plans to reinvest much of the savings in new capital projects. But the change is still a positive for the company’s shareholders and valuation, all other things being equal.”

A good example here are the big tech companies, who of course has been ramping up its AI expenses in infrastructure and talent, driven of late by Meta in particular. Alphabet/Google, Amazon, Microsoft and Meta alone for example, are estimated to see cash tax savings for the current fiscal year from the tax-law changes, of over $17, $15, $12, and $11 plus billion each.

Wall Street will have to calculate these elements into their total financial assessments of the AI opportunity:

“All told, Zion estimates $148 billion in cash tax savings for a sample that covered 369 of the companies in the S&P 500. That is equivalent to 8.5% of the companies’ combined full-year estimates for free cash flow as of June 30, right before Congress passed the tax law, using estimates compiled by S&P Global Market Intelligence.”

“Amazon, Meta, Alphabet and Microsoft together accounted for 38% of the total. Most companies, including those four, haven’t disclosed estimates yet quantifying the impact. Zion used 2025 estimates for companies with calendar fiscal years and 2026 estimates for companies with non-calendar fiscal years.”

Meta’s example is notable in particular:

“At Meta, for instance, Zion estimates $4.6 billion of the $11 billion in savings would come from accelerating expensing of unamortized R&D already on the books, while $3.6 billion would be from upfront expensing of new R&D, and $2.8 billion would be from full expensing of business property.”

The tax policy changes to cash flow is the good news, but it generally applies to public companies at large, so will get discounted into the valuations collectively.

The above discussion of AI Infrastructure investment in data centers and talent, doesn’t even include the coming gargantuan investments for ‘Physical AI’ opportunities, in the form of AI robots, self driving cars, AI gadgets galore and far more.

Each of those will require massive manufacturing investments, that likely won’t be able to be outsourced to China in this geopolitical, ‘Made in America’ tariff environment. And those elements have not yet been factored into the big tech financial projections for AI going forward.

Those implications are for another post, as those investments really ramp up.

But the broader transformation of big tech balance sheets with rising AI infrastructure investments in this AI Tech Wave, is one to monitor closely. And add to the long-term assessment of the AI investment opportunity. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)