AI: Mag 7 AI Infrastructure Spend bending Business Models. (part 1) RTZ #803

It’s now sunk in that Big Tech companies are spending billions to build AI infrastructure things at Scale. A trend that has no end point for a while. And that’s different vs previous tech waves.

The resulting Big Tech business model impact in this AI Tech Wave likely needs more long-term attention by investors. Especially public ones.

There is a compression of margins long-term as pure software/ services and advertising driven models add big dollops of continuous capex heavy infrastructure spending into the mix. Especially as the Mag 7s rush to spend hundreds of billions a year on AI data center, Power, and AI Talent , indefinitely. Not to mention Nuclear Power plants.

All this of course to build out the vertical capability to process data-driven ‘Intelligence Tokens’ at Scale, on a variable cost basis, so as to faciliate countless, and many unimagined AI applications and services in the coveted AI Tech Stack Box 6 below. Especially as we track the financial metrics and margins on the Y-Axis over time on the X-Axis.

I highlighted this point in yesterday’s post “Questions arise around an ‘AI Bubble’”:

“The other question being raised is the amount of AI Capex this time vs the telecom infrastructure spend of a trillion dollars in the dotcom era. But this time the infrastructure spend is WITHIN the higher margin software companies, not something by a separate industry like Telecoms, in the Internet Wave. “

“That latter industry bore the brunt of the downturn when investor enthusiasm for all things Internet faded at the dawn of the new Century. And that ‘Internet WInter’ lasted almost a decade. It was even longer for the telecom industry underneath it. “

“This integration of infrastructure spend within software/media company models is a new thing in this AI Tech Wave. “

It’s underlined well in the WSJ article I quoted from yesterday, “Silicon Valley’s New Strategy: Move SLow and Build Things”.

The Information expands on this margin compression point well in “Why Big Tech’s Cloud Shift Threatens Microsoft and Google’s Margins”:

“But one element is widely missing from the discussion: how a long-term shift in big tech’s business mix toward cloud services could squeeze profit margins for both Microsoft and Google while improving Amazon’s overall margin.”

“Why? Because for both Microsoft and Google, their cloud businesses are much less profitable than their giant software and advertising businesses, respectively. Microsoft’s productivity and business processes unit—which includes its business software operations—had an operating profit margin of 57.4% in the June quarter. Its “intelligent cloud” unit, which comprises mostly Azure, had a margin of 40.6%. Its overall margin was 45%. A similar scenario holds for Google: Its cloud margin was 20.7% in the June quarter, while its margin in Google services—mostly advertising—was 40% and its overall margin was 32%.”

The attraction for investors in the near-term of course is the faster relative growth on the infrastructure cloud services side, despite the lower relative margins:

“Microsoft and Google already enjoy faster growth in cloud than in their software and ad businesses. In the most recent quarter, Microsoft’s software business expanded 16%, while its cloud business grew 26%. (Azure grew much faster, at 39%—but the cloud business also includes old-fashioned on-premise data center products, which shrank.) Ditto for Google, whose cloud business grew 32% in the quarter, while its services segment grew 12%.”

And this trend is accelerating at Microsoft, Meta and Google at least:

“This trend is likely to be accentuated by the growing demand for AI-cloud services. At the same time, there’s a risk that new AI products will cannibalize Microsoft’s lucrative enterprise software and Google’s search advertising businesses. Of course, both companies are working hard to head off those threats. Microsoft has introduced its own AI software services, including Copilot and AI agents, while Google has enhanced its search with AI features. But they face plenty of competition, as this story and this story make clear.”

Amazon ironically is enjoying the opposite dynamic, due to its world spanning retail e-commerce business:

“Amazon is in a very different position: its bottom line will benefit from a shift to the cloud. Its Amazon Web Services cloud unit’s margin in the June quarter was 33%, far higher than its e-commerce margin of 6.6%, reflecting the razor-thin profits shopping services typically operate on. Indeed, Amazon’s margin has improved as AWS has grown: Between 2017 and 2024, AWS rose as a percentage of Amazon’s total revenue from 9.8% to 17%. In the same period, Amazon’s overall operating margin jumped from 2.3% to 10.7%. (The latter increase likely also reflects the contribution of Amazon’s expanding ad operation, as advertising is typically a very high-margin business.)”

But AWS of course needs to scale up the faster growing AI segment within its market leading Cloud business:

“The focus this week was on AWS’ relatively tepid growth rate of 17% in the second quarter, the same rate as for the previous quarter. That’s still faster than for every other part of Amazon except its advertising business, which is half the size of AWS. Moreover, there’s reason to think AWS’ growth rate will pick up. New Street Research analyst Dan Salmon made that point in a report on Thursday, noting AWS’ 25% expansion in its backlog of business—customer commitments, which offers a picture of future revenue—in the quarter.”

Of course, all the big tech companies are being financially smart in how this infrastructure spend is being financed and funded, with partnerships with external neocloud companies like CoreWeave, Crusoe, and others.

But at these magnitudes, the underlying liabilities do cast a shadow on the parent companies. Despite financial engineering and possible unit spinoffs.

Am not sure for example if investors have digested the infrastructure changes underway at Oracle, another big tech company that is not thought of as a ‘Mag 7’. It’s not just a database software company anymore. It’s busy building the ‘Stargate’ AI infrastructure for OpenAI and Softbank.

In the near term, the new margin trend realities are here to stay, at all the big tech software and media companies involved.

“For all three companies, their cloud profit margins aren’t likely to improve, given how much the humongous levels of capital expenditures cloud requires will raise depreciation expenses. The real issue is that the overall margins for Google and Microsoft could drop closer to their cloud margins over time. The market is well aware of that risk for Google, whose stock has underperformed that of ad rivals like Meta Platforms for a while now. But investors seem to be ignoring the risk for Microsoft, judging by that stock’s premium valuation. At the same time, they may be ignoring Amazon’s potential for growth.”

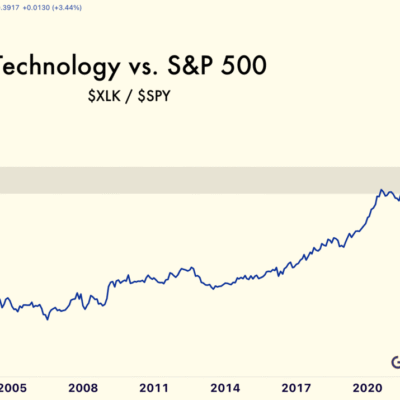

All this is worth discussing because investors over time compare today’s relative valuation of these companies vs in previous years and decades now. And that underlying analysis now needs to take into account the semi-permanent shift in margin architecture of these companies. And of course the relative growth rates.

It’s all less important right at this moment due to the exciting frenzy of very early days in this AI Tech Wave. And the new AI applications and services yet to be developed, deployed and digested at scale by the marketplace. But worth keeping in the back of investor minds nevertheless. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)