AI: Marking OpenAI ChatGPT's 3 Year Anniversary. RTZ #922

How time flies. Still remember OpenAI ChatGPT’s first year when I really got going writing daily about AI matters large and small here at AI: Reset to Zero.

Yesterday, November 30, 2025 marked the third anniversary of ChatGPT launched into the world by OpenAI.

What made AI ‘an overnight success’ after over three decades in its ‘AI WInter’ wilderness. Made this AI Tech Wave, the next bigger tech wave after the PC, the Internet, and the Mobile Phone.

Making Nvidia the ‘overnight’, Denny’s creation 30 years ago, into the core company powering AI today. A $5 trillion+ AI Chip wonder, leveraging prosaic gaming GPUs it toiled over for three decades before AI becoming ‘a thing’.

What made it normal to see OpenAI led $100 billion+ AI Infrastructure investments announced almost every week in 2025. Keeping the GDP going for much of 2025 and beyond.

And made ‘AI’ a ‘Sovereign’ imperative for countries large and small. Not to mention powering an AI ‘Space Race’ between the US and China over perceived geopolitical ‘threats’.

Finally, also making ‘AGI’, or artificial general intelligence, a superintelligence ‘must have’ for the most powerful tech companies in the world. And a lot more other impacts to boot.

Bloomberg summarizes it well in “Three Years of AI Mania: How ChatGPT Reordered the Stock Market”:

“The release of ChatGPT three years ago has driven a bull market in US stocks, with investment in AI being the driving force.”

“The seven most valuable companies in the S&P 500, including Nvidia and Microsoft, are major players in technology and account for nearly half of the benchmark’s gains since ChatGPT’s release.”

“The AI frenzy has created winners, such as Nvidia and electricity providers, but also losers, including companies perceived to be at risk from AI, such as software makers and staffing firms.”

“Three years ago, OpenAI released ChatGPT, setting off a mania on Wall Street for all things artificial intelligence. And the stock market hasn’t been the same since.”

“Bets that the groundbreaking technology will reshape society have minted new market leaders, made an already concentrated S&P 500 Index even more top heavy, and left companies and industries considered at risk of being replaced by AI struggling to keep pace.”

“Yes, there are lingering concerns that the frenzy of spending tied to AI is unsustainable as big payoffs remain elusive. But investment in the technology has been the driving force behind the bull market in US stocks that began less then two months before ChatGPT debuted on Nov. 30, 2022 — and that doesn’t appear to be changing dramatically yet.”

Which is why ChatGPT is a key milestone marker, with a little help from Microsoft:

““Every bull market has a dominant theme, and the dominant theme of this bull market is technology and AI, and it really kicked off in earnest with the launch of ChatGPT,” said Keith Lerner, chief investment officer and chief market strategist at Truist Advisory Services. “If you believe we’re still in a bull market, which we do, you don’t want to give up too early on that leadership.”

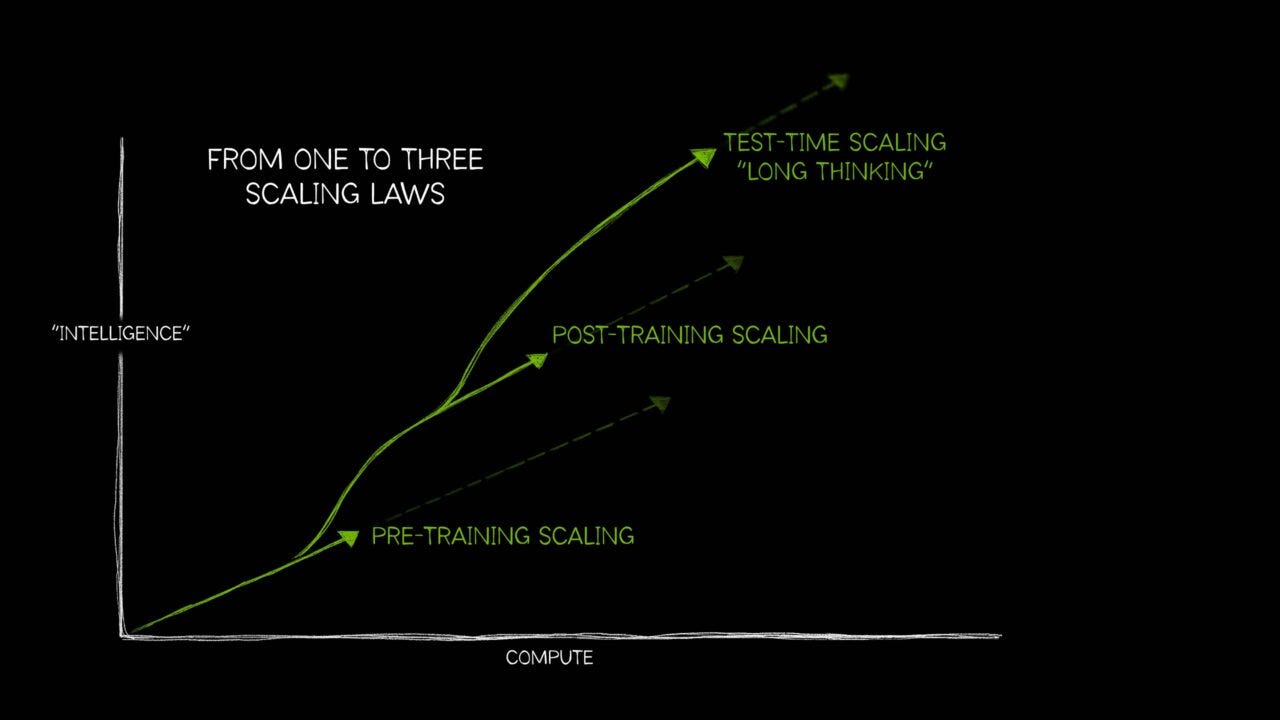

The piece goes onto paint the broad strokes, as the tech world went onto to validate and fund the ‘AI Scaling Laws’, eventually to need trillions in investments:

“Here’s a look at how AI has shaped the current market landscape.”

“Expectations that the world’s largest technology companies would become the dominant players in AI helped revive Big Tech stocks that took a beating in 2022 amid falling profits and rising interest rates.”

“Any time in history AI growth would have driven a lot of these stocks up,” said Michael Bailey, director of research at Fulton Breakefield Broenniman. “But it started at a level of low expectations that has made the AI wave seem even more impressive.”

“The rally sparked by AI enthusiasm has been the chief driving force behind the S&P 500’s 64% jump since the chatbot’s release. The seven most valuable companies in the S&P 500 — Nvidia Corp., Microsoft Corp., Apple Inc., Alphabet Inc., Amazon.com Inc., Meta Platforms Inc. and Broadcom Inc. — are all major players in the technology and account for nearly half of the benchmark’s gains over that time, according to data compiled by Bloomberg.”

And of course as mentioned before, making Nvidia, NVDIA. And Jensen Huang, JENSEN HUANG. The power behind the many thrones:

“No company has benefited from the explosion of investment in AI more than chipmaker Nvidia. With hundreds of billions of dollars being spent annually on computing equipment, its graphics processing units, which dominate the AI market, are experiencing seemingly insatiable demand. The stock is up 979% since the unveiling of ChatGPT, the third best performance in the S&P 500 over that time.”

““If you had to quantify the AI product cycle, it’s all Nvidia, it’s all AI chips,” Bailey said.”

“Nvidia’s revenue is expected to exceed $200 billion this year, up from $27 billion at the end of calendar 2022, according to the average of analyst estimates compiled by Bloomberg. The company’s net income is projected to top $170 billion in the next 12 months, more than the combined anticipated profits of a third of the companies in the S&P 500.”

All leading to a time when the AI Tail is wagging the market dog.

“The Big Tech rally has made an already top-heavy stock market even more beholden to a small number of companies. The seven biggest firms in the S&P 500 now account for about 35% of the weighting in the market capitalization-based index, up from roughly 20% in late 2022.”

The full piece is worth a read, with charts and graphs vividly illustrating the highs and lows of this ‘3 year ChatGPT’ journey.

And it’s fitting market to these earliest of days for AI in all its forms to come in this AI Tech Wave. Far beyond the 2017 Transformers, to the 2022 ChatGPT days.

The glass half full and the not so full.

It’s all just barely gotten started. Stay tuned.

(NOTE: The discussions here are for information purposes only, and not meant as investment advice at any time. Thanks for joining us here)